Global Flavoured Milk Market Size, Share Report By Type (Dairy Based, Plant Based), By Flavor (Chocolate, Fruit, Vanilla, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, Online Retail Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154194

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

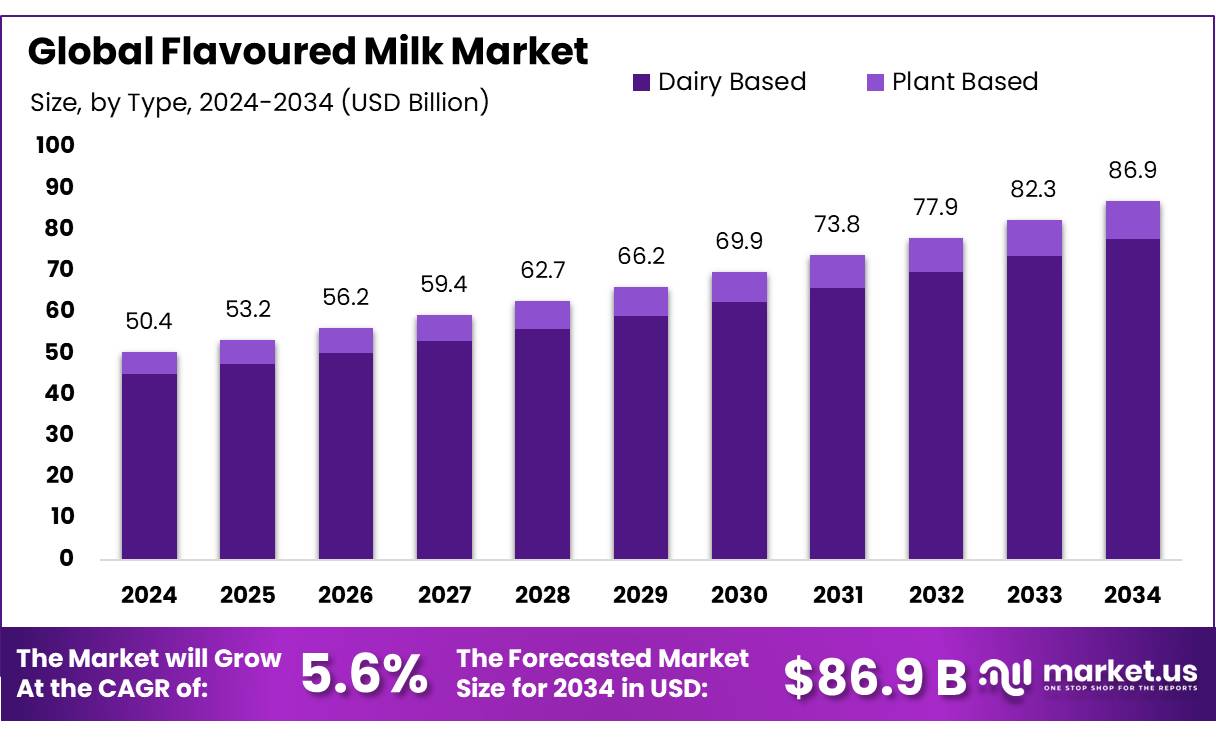

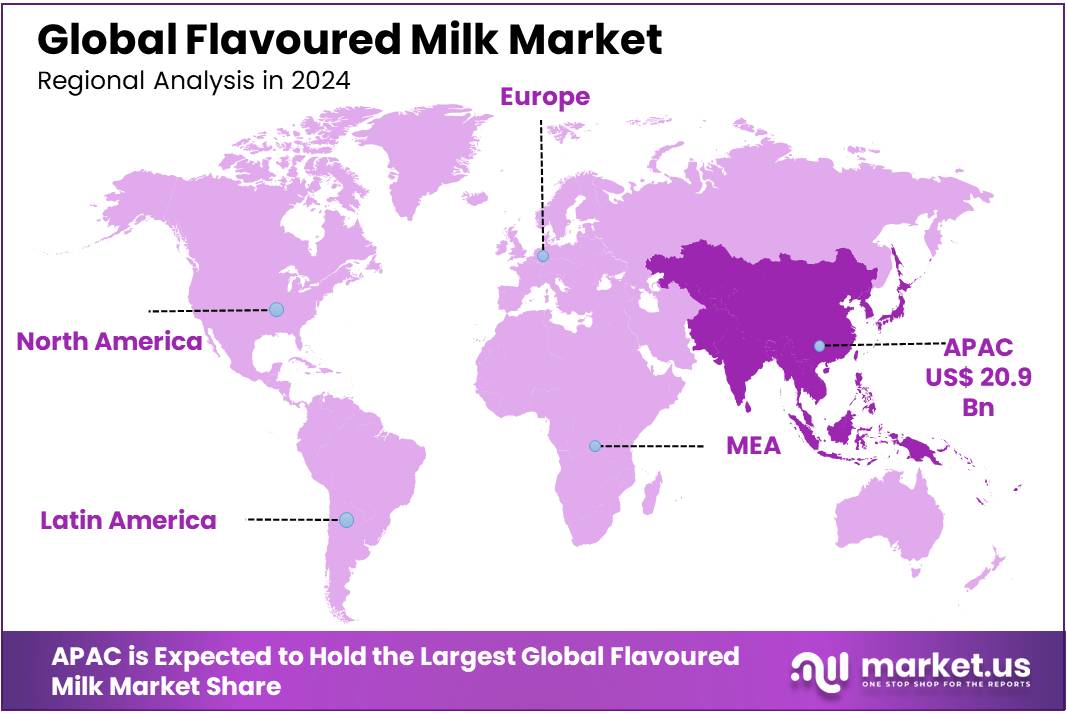

The Global Flavoured Milk Market size is expected to be worth around USD 86.9 Billion by 2034, from USD 50.4 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 41.60% share, holding USD 20.9 Billion in revenue.

Flavoured milk concentrates represent a category of value‑added dairy ingredients produced by concentrating milk—often through evaporation or ultrafiltration—then blending with sugars, flavours (such as chocolate, strawberry or vanilla), and stabilisers. These concentrates are utilised in beverage production, foodservice, school nutrition programs, and convenience food products. The concentrates extend shelf‑life, reduce transportation costs, and permit flexible flavour profiling before final reconstitution.

The industrial scenario is characterized by a shift towards organized dairy processing. While the unorganized sector still dominates, there is a noticeable transition towards modern processing units that adhere to quality standards and efficient production practices. This transformation is evident in states like Bihar, where the government has sanctioned ₹316 crore for setting up dairy equipment and processing plants under the Bihar State Milk Co-operative Federation (COMFED), aiming to enhance milk processing capabilities and product diversification.

Government initiatives play a pivotal role in supporting the dairy sector’s growth. The National Dairy Plan aims to enhance milk production and strengthen dairy infrastructure across the country. Programs like the Dairy Entrepreneurship Development Scheme (DEDS) provide financial assistance to entrepreneurs for establishing dairy units, thereby fostering the development of value-added dairy products, including flavoured milk concentrates. Furthermore, the Animal Husbandry Infrastructure Development Fund (AHIDF), with an allocation of ₹15,000 crore, encourages private sector investment in dairy infrastructure, facilitating the establishment of modern processing facilities.

Regional governments have also introduced targeted schemes to bolster the dairy sector. For instance, the Odisha government, under the Mukhyamantri Kamadhenu Yojana, plans to distribute 10,000 high-yielding cows to farmers, enhancing milk production and supporting rural livelihoods. Similarly, Assam has implemented a ₹5 per litre milk subsidy and expanded milk processing capacities to strengthen its dairy industry.

In the United States, the Dairy Promotion Program (“check-off”) has supported flavoured milk consumption through school nutrition programs and marketing campaigns since 1983, funded via a mandated 15¢/cwt. levy on fluid milk production. This initiative contributed to milk consumption rising from 122.4 billion pounds in 1983 to 176.3 billion pounds by 2004, including growth in flavoured products in schools

Key Takeaways

- Flavoured Milk Market size is expected to be worth around USD 86.9 Billion by 2034, from USD 50.4 Billion in 2024, growing at a CAGR of 5.6%.

- Dairy Based held a dominant market position, capturing more than an 89.4% share in the global flavoured milk market.

- Chocolate held a dominant market position, capturing more than a 44.9% share in the global flavoured milk market.

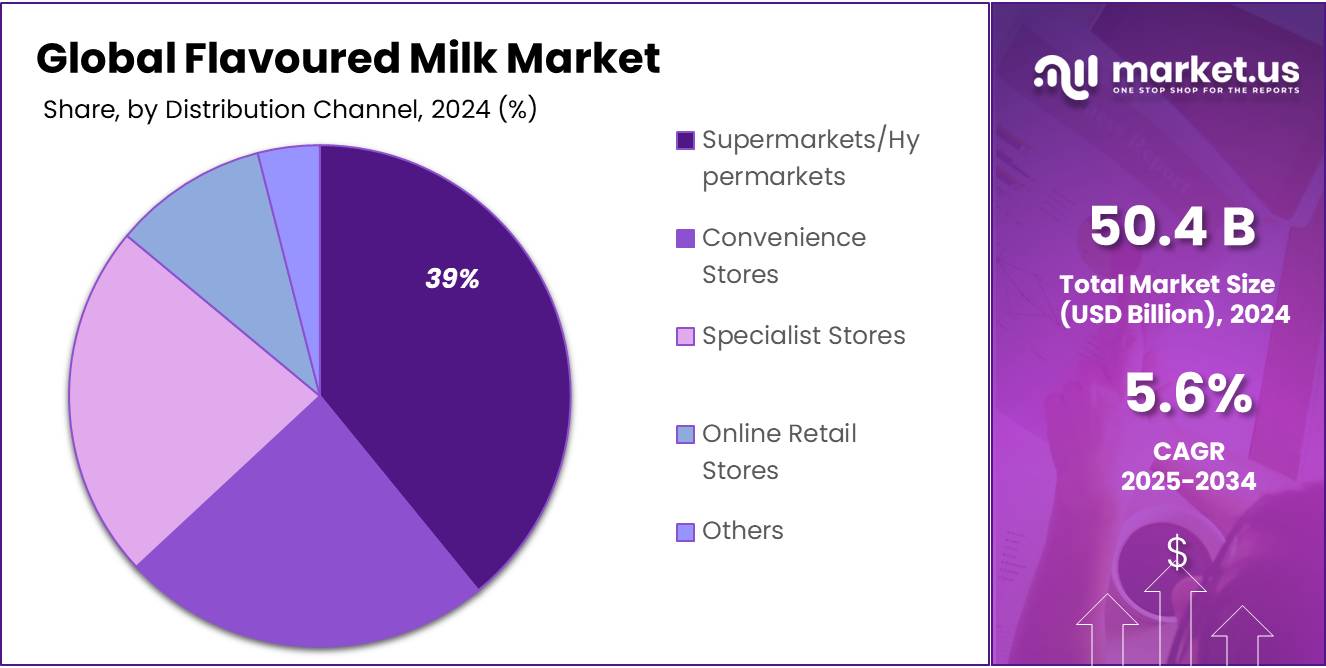

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 39.2% share in the global flavoured milk market

- Asia Pacific emerged as the leading region in the global flavoured milk market, accounting for 41.60% of the total market share with a valuation of USD 20.9 billion.

By Type Analysis

Dairy-Based Flavoured Milk dominates with 89.4% share due to its natural taste and nutrition.

In 2024, Dairy Based held a dominant market position, capturing more than an 89.4% share in the global flavoured milk market by type. This strong preference is mainly driven by consumers’ trust in traditional milk sources for their natural nutrients such as calcium, protein, and vitamins. Dairy-based flavoured milk is widely consumed across both developed and emerging markets due to its familiarity, taste, and availability through schools, retail, and foodservice.

By 2025, the demand for dairy-based flavoured milk is expected to remain high, especially in regions like Asia Pacific, where milk consumption continues to rise with population growth. Flavours such as chocolate, vanilla, and banana remain popular in this segment, and producers are also offering fortified options to appeal to health-conscious buyers. The wide distribution network and strong shelf presence of dairy-based products further strengthen their dominance in the flavoured milk industry.

By Flavor Analysis

Chocolate Flavoured Milk leads with 44.9% share owing to its universal taste appeal.

In 2024, Chocolate held a dominant market position, capturing more than a 44.9% share in the global flavoured milk market by flavor. Its widespread popularity among all age groups, especially children and young adults, has made it the most consumed flavor in both home and institutional settings. The rich and sweet taste of chocolate blends well with milk, making it a preferred choice for school milk programs, retail shelves, and ready-to-drink formats.

By 2025, chocolate flavoured milk is expected to retain its top position due to growing demand for indulgent yet nutritious beverages. Innovations such as reduced sugar versions and the addition of functional ingredients like protein and vitamins are also contributing to sustained consumer interest. As global dairy processors continue to invest in expanding their chocolate product lines, the flavor’s market share is projected to remain strong in the near term.

By Distribution Channel Analysis

Supermarkets/Hypermarkets dominate with 39.2% share due to strong retail visibility and access.

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 39.2% share in the global flavoured milk market by distribution channel. These retail formats offer consumers a wide variety of branded and private-label flavoured milk options under one roof, making them a convenient and preferred choice for bulk and routine purchases. The presence of chilled storage sections and attractive in-store promotions further enhance customer engagement and product visibility.

Looking ahead to 2025, supermarkets and hypermarkets are expected to maintain their lead, supported by expanding urban retail infrastructure and increasing consumer footfall. Their ability to stock different packaging formats—from single-serve to family packs—caters to diverse consumer needs. Moreover, rising middle-class income and preference for organized retail in emerging economies are likely to reinforce the segment’s dominance in the coming year.

Key Market Segments

By Type

- Dairy Based

- Plant Based

By Flavor

- Chocolate

- Fruit

- Vanilla

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialist Stores

- Online Retail Stores

- Others

Emerging Trends

Innovative Flavours and Functional Offerings

The flavoured milk market in India is witnessing a surge in demand, driven by evolving consumer preferences for innovative flavours and functional beverages. Traditional flavours like chocolate and strawberry remain popular; however, there is a noticeable shift towards more exotic and regionally inspired options. For instance, in September 2024, Purabi Dairy launched long shelf-life flavoured milk in Mango, Strawberry, and Kesar variants, produced at a modern facility, expanding market reach and boosting farmer opportunities.

This trend towards innovation is further exemplified by the introduction of unique flavours such as Thandai, Gulkand Paan, and Strawberry by Keva Flavours in 2024, blending traditional and modern tastes to offer consumers a unique and indulgent dairy beverage experience.

The government’s support plays a pivotal role in fostering this innovation. Under the Mukhyamantri Kamadhenu Yojana, the Odisha government plans to distribute 10,000 high-yielding cows to farmers, aiming to increase daily milk production from 72 lakh litres to 165 lakh litres by 2036 and 274 lakh litres by 2047. This initiative not only boosts milk production but also encourages the development of value-added dairy products like flavoured milk, creating new income avenues for youth.

Moreover, the Pradhan Mantri Poshan Shakti Nirman (PM Poshan) Scheme in Haryana has approved a ₹665.65 crore budget for the 2025–26 financial year to enhance nutrition for over 1.5 million school children. As part of this initiative, the state government plans to serve 200 ml of skimmed flavoured milk six days a week to students, aiming to improve their nutritional status and educational outcomes.

Drivers

Increasing Consumer Demand for Healthy and Convenient Beverages

Flavoured milk concentrates are experiencing significant growth, driven by the increasing consumer demand for convenient, nutritious, and tasty beverage options. This shift in consumer behavior is largely influenced by the growing awareness of health and wellness, especially among younger populations who seek nutritious alternatives to sugary sodas and carbonated drinks. The increasing preference for ready-to-drink beverages that offer both taste and health benefits has further amplified the demand for flavoured milk.

This growth is a direct result of the rising health consciousness among consumers, who are increasingly opting for beverages that offer functional benefits, such as protein and calcium. Additionally, flavoured milk is seen as an excellent source of essential vitamins and minerals, which has made it a popular choice for parents looking to provide a healthy drink option for their children.

Government initiatives have also played a crucial role in supporting the dairy industry, which includes flavoured milk production. The National Dairy Development Board (NDDB) has been instrumental in the development of dairy infrastructure, while state-specific initiatives such as the Assam government’s subsidy of INR 5 per litre of milk have provided further incentives for local milk production.

Moreover, the Animal Husbandry Infrastructure Development Fund (AHIDF), with a corpus of INR 15,000 crore, is further enhancing the dairy sector’s ability to meet growing consumer demand by improving processing and storage facilities.

Restraints

Rising Raw Material Costs Affecting Profit Margins

One of the major factors restraining the growth of the flavoured milk concentrate market is the rising cost of raw materials, particularly milk and dairy ingredients. As demand for dairy products continues to grow globally, the pressure on milk supply chains has intensified, leading to higher prices for milk and other dairy ingredients like cream, whey powder, and milk solids. This increase in raw material costs directly affects the profitability of flavoured milk producers, as they are unable to pass on the entire cost increase to consumers without affecting demand.

In India, milk prices saw a rise of approximately 7% in 2023 due to the increasing demand from both domestic and international markets. According to the Department of Animal Husbandry and Dairying, India’s milk production was estimated at 210 million tonnes in 2024, but the growing demand coupled with challenges in production and logistics is pushing prices up. This price hike impacts the flavoured milk concentrate market by increasing production costs for manufacturers.

Additionally, the cost of packaging materials such as cartons, plastic bottles, and caps is also rising due to global supply chain disruptions and inflationary pressures. For example, plastic and paperboard prices surged by up to 10% in 2023 due to increased production costs for packaging manufacturers.

While the government has been offering subsidies and support to dairy farmers, such as the Animal Husbandry Infrastructure Development Fund (AHIDF), which aims to improve milk production and processing infrastructure, these measures are not sufficient to counterbalance the sharp increase in raw material and packaging costs. As a result, flavoured milk producers are facing the challenge of maintaining profit margins while meeting the growing consumer demand.

Opportunity

Government Support and Infrastructure Development

One of the most promising growth opportunities for the flavoured milk concentrate industry lies in the robust support provided by the Indian government to enhance dairy infrastructure and promote value-added dairy products. This support is evident through various schemes and initiatives aimed at improving milk production, processing capabilities, and market access.

- The government’s commitment to the dairy sector is reflected in the allocation of substantial funds for infrastructure development. For instance, the Bihar state cabinet approved over ₹2,000 crore for development projects, including ₹316 crore for setting up dairy equipment across five districts under Comfed. This funding will facilitate the establishment of milk processing plants and milk powder units, thereby enhancing the state’s dairy processing capacity.

Similarly, the Assam government introduced a ₹5 per litre milk subsidy to support dairy farmers, coupled with the expansion of a milk processing plant to increase capacity and improve infrastructure. These initiatives aim to empower rural communities, boost agricultural productivity, and enhance self-reliance in milk production.

Furthermore, the Department of Animal Husbandry and Dairying (DAHD) has launched several schemes to support dairy infrastructure projects. The Dairy Entrepreneurship Development Scheme (DEDS) offers back-ended capital subsidies of 25% for the general category and 33% for SC/ST category farmers, with an additional 10% contribution from the entrepreneur. This scheme encourages the establishment of dairy units and value-added dairy products like flavoured milk.

These government initiatives not only provide financial support but also create a conducive environment for the growth of the flavoured milk concentrate industry. By improving infrastructure, enhancing processing capabilities, and supporting dairy farmers, the government is paving the way for increased production and consumption of value-added dairy products, including flavoured milk concentrates.

Regional Insights

Asia Pacific dominates the global flavoured milk market with 41.60% share, valued at USD 20.9 billion.

In 2024, Asia Pacific emerged as the leading region in the global flavoured milk market, accounting for 41.60% of the total market share with a valuation of USD 20.9 billion. The region’s dominance can be attributed to rising population, increasing urbanization, and a strong cultural preference for dairy-based beverages across countries such as India, China, Indonesia, and Vietnam. High milk production in these countries ensures consistent raw material supply, enabling large-scale flavoured milk manufacturing.

- According to the Department of Animal Husbandry & Dairying (DAHD), India produced over 230 million tonnes of milk in 2022–2023, supported by government schemes such as the National Programme for Dairy Development. Similarly, China is witnessing growing consumption of dairy beverages among young consumers and urban populations due to rising health consciousness and demand for convenient nutrition.

In 2025, the Asia Pacific flavoured milk market is expected to witness sustained growth, supported by increasing disposable incomes and expansion of modern retail chains. Multinational and regional dairy players are introducing localized flavours such as saffron, cardamom, matcha, and mango to cater to cultural preferences, which is expected to boost consumption further.

Additionally, government-backed school milk initiatives and dairy development programs are contributing to the market’s expansion, especially in semi-urban and rural areas. With a strong distribution network and continuous product innovation, Asia Pacific is likely to retain its leadership in the global flavoured milk sector.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nestlé S.A. remains a global leader in the flavoured milk market, offering popular products under brands like Nesquik and Milo. The company focuses on nutritional enhancement, including reduced sugar and added vitamins, to meet evolving consumer demands. With a strong global distribution network and product innovation, Nestlé continues to expand in both developed and emerging markets. In 2024, the company strengthened its position in Asia and Latin America through localized flavours and fortified milk drink variants tailored to regional preferences.

Meiji Holdings Co. Ltd., a prominent Japanese dairy and food conglomerate, holds a significant presence in the flavoured milk sector across Asia. Known for its quality dairy products, the company focuses on functional flavoured milk beverages enriched with calcium, probiotics, and vitamins. In 2024, Meiji expanded its ready-to-drink portfolio by launching new chocolate and banana flavours targeting school-aged consumers in Japan and Southeast Asia. The company’s commitment to innovation and health-driven formulations supports its competitive edge.

The Hershey Company, primarily known for its confectionery products, has strategically diversified into flavoured milk through its brand extensions. Its chocolate milk offerings, especially in the U.S. market, have gained traction among children and families. In 2024, Hershey continued to invest in shelf-stable flavoured milk products with a focus on packaging innovations and retail partnerships. The company’s brand equity in chocolate products gives it a strong positioning in the flavoured milk category, especially in North America.

Top Key Players Outlook

- Nestle SA

- Meiji Holdings Co. Ltd.

- The Hershey Company

- The Coca Cola Company

- The Farmer’s Cow

- Danone SA

- Hiland Dairy

- Dana Dairy Group

- Saputo Inc

- Godrej Group

- Parle Agro Private Limited

Recent Industry Developments

In 2024, Meiji Holdings Co. Ltd. achieved consolidated net sales of JPY 1,154.0 billion and operating profit of JPY 84.7 billion, reflecting a 4.4% and 0.5% year‑on‑year increase respectively.

In 2024, Nestlé S.A. generated total group sales of CHF 91,354 million, with the Milk products and Ice cream segment achieving CHF 10,397 million in sales. Overall group organic growth stood at 2.2%, and real internal growth (RIG) contributed 0.8% of that increase.

Report Scope

Report Features Description Market Value (2024) USD 50.4 Bn Forecast Revenue (2034) USD 86.9 Bn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Dairy Based, Plant Based), By Flavor (Chocolate, Fruit, Vanilla, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestle SA, Meiji Holdings Co. Ltd., The Hershey Company, The Coca Cola Company, The Farmer’s Cow, Danone SA, Hiland Dairy, Dana Dairy Group, Saputo Inc, Godrej Group, Parle Agro Private Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nestle SA

- Meiji Holdings Co. Ltd.

- The Hershey Company

- The Coca Cola Company

- The Farmer's Cow

- Danone SA

- Hiland Dairy

- Dana Dairy Group

- Saputo Inc

- Godrej Group

- Parle Agro Private Limited