Global Exterior Paint Market Size, Share, And Enhanced Productivity By Resin Type (Acrylic, Epoxy, Silicone, Polyurethane), By Product Type (Water-based, Oil-based), By Application (Commercial, Industrial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174327

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

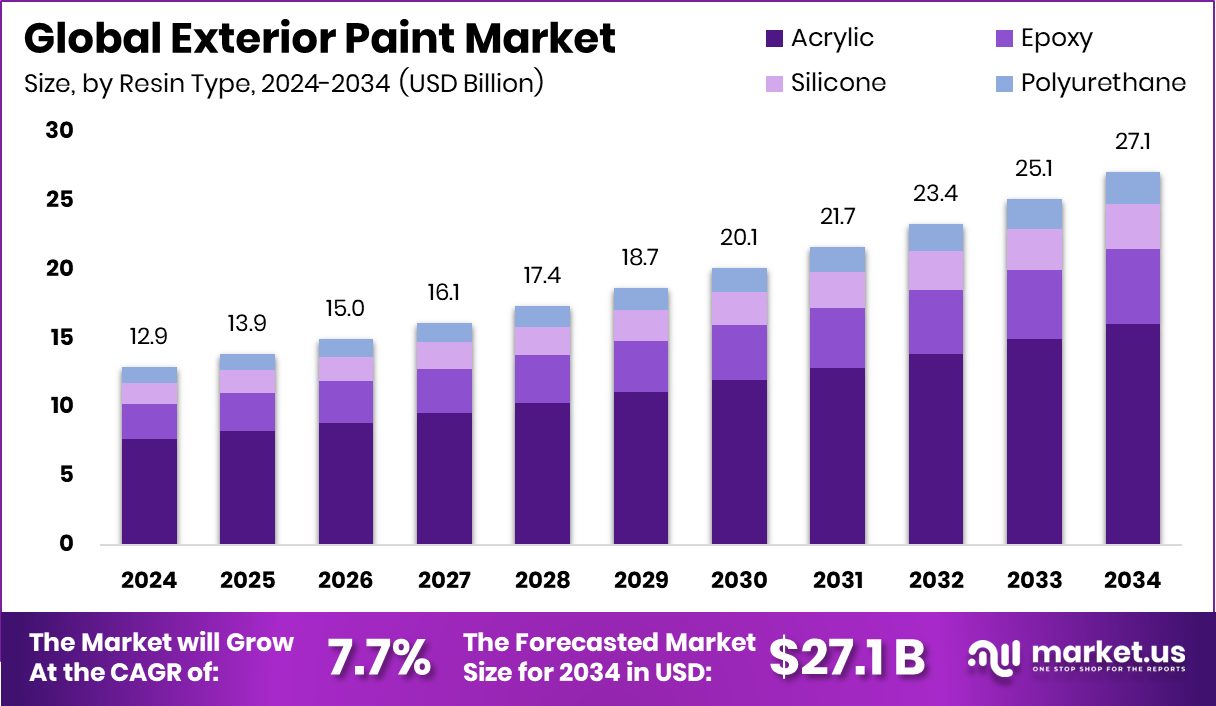

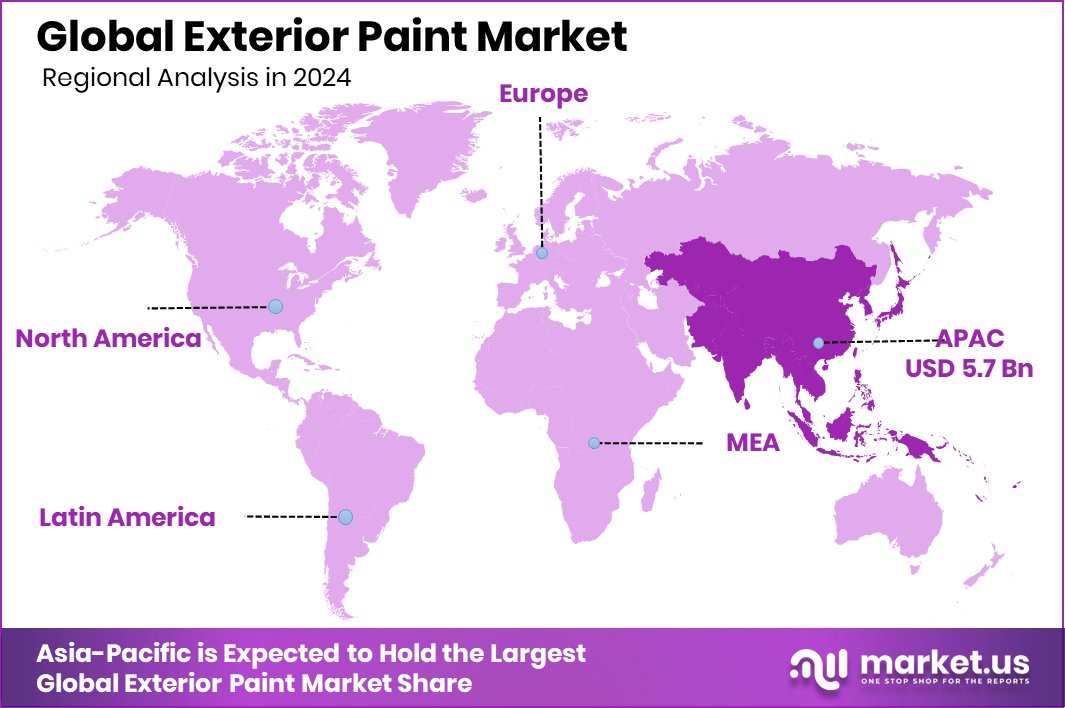

The Global Exterior Paint Market is expected to be worth around USD 27.1 billion by 2034, up from USD 12.9 billion in 2024, and is projected to grow at a CAGR of 7.7% from 2025 to 2034. The Asia Pacific Exterior Paint Market achieved 44.2% dominance, generating revenues of USD 5.7 Bn.

Exterior paint is a protective and decorative coating applied to the outside surfaces of buildings, such as walls, facades, and exterior fixtures. Its main role is to shield structures from weather conditions like rain, sunlight, heat, humidity, and pollution while also improving visual appeal. Exterior paints are designed to resist cracking, fading, moisture penetration, and surface damage over long exposure periods.

The exterior paint market represents the overall demand and supply of these coatings across residential, commercial, and public infrastructure projects. This market is closely linked to housing activity, renovation cycles, and government-supported building maintenance programs. Exterior paint demand grows steadily as buildings require regular repainting to maintain durability, safety, and appearance.

Growth factors for exterior paint are strongly supported by public and private spending on housing upkeep. In the United States, housing grants in Euclid allow homeowners to apply for up to USD 7,500 under Community Development Block Grant funding for property improvements, including exterior repainting. In another example, lawmakers highlighted a request of USD 50,000 for an emergency paint job tied to military family housing, showing how public housing maintenance directly drives paint usage.

Demand for exterior paint remains strong due to continuous renovation and asset management. Large capital flows, such as Broad Creek Capital’s USD 150 million fund, reflect rising investments in property-focused projects that include exterior upgrades. These investments increase repainting activity across residential and mixed-use developments.

Opportunities are expanding through industry funding aimed at innovation and scale. Ecoat secured €21 million to develop more sustainable paint solutions, supporting future exterior applications. Additionally, major transactions like a planned ₹9,000 crore buyout, funded through structured financing and promoter stake pledges, indicate strong long-term confidence in the paint sector’s growth potential.

Key Takeaways

- The Global Exterior Paint Market is expected to be worth around USD 27.1 billion by 2034, up from USD 12.9 billion in 2024, and is projected to grow at a CAGR of 7.7% from 2025 to 2034.

- In 2024, acrylic resins dominated the Exterior Paint Market with 59.4% share, ensuring durability performance.

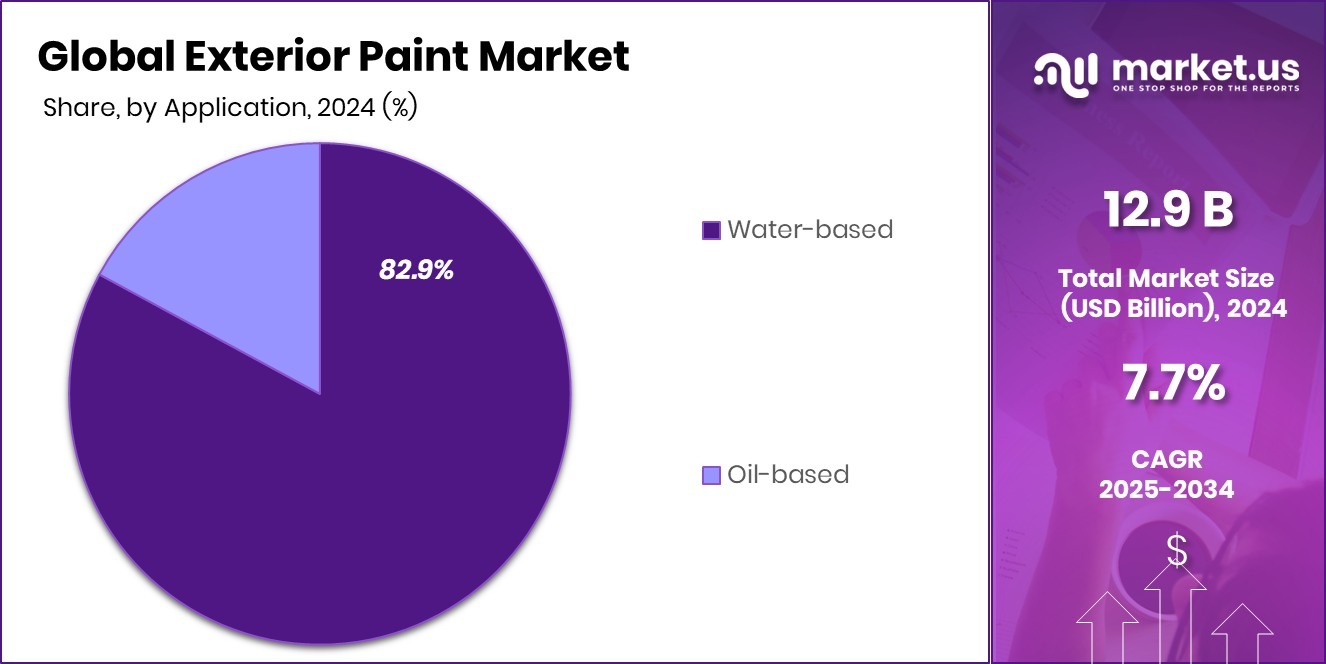

- Water-based products led the Exterior Paint Market at 82.9%, driven by regulations, safety, and sustainability demand.

- Residential applications captured 65.3% of the Exterior Paint Market, supported by housing growth worldwide trends.

- In the Asia Pacific, rapid urbanization and housing demand supported 44.2% market share, reaching USD 5.7 Bn.

By Resin Type Analysis

In 2024, acrylic resins dominated the Exterior Paint Market with 59.4% share.

In 2024, the Exterior Paint Market by resin type was led by acrylic, which accounted for 59.4% of total demand. Acrylic resins are widely preferred because they offer strong adhesion, excellent color retention, and high resistance to UV radiation and moisture. These properties make acrylic-based exterior paints suitable for varied climatic conditions, including high heat, rainfall, and humidity.

In residential and commercial buildings, acrylic paints help maintain surface appearance for longer periods, reducing repainting frequency. In 2024, rising construction activity and renovation spending supported the continued use of acrylic resins, especially on concrete, masonry, and exterior walls, where durability and flexibility are critical performance requirements.

By Product Type Analysis

Water-based products led the Exterior Paint Market, accounting for 82.9% demand globally.

In 2024, the Exterior Paint Market by product type was dominated by water-based paints, holding a significant 82.9% share. Water-based exterior paints gained strong acceptance due to low volatile organic compound (VOC) emissions, easy application, and faster drying times. These products are widely aligned with environmental regulations and green building standards, encouraging adoption across both developed and emerging regions.

In 2024, homeowners and contractors increasingly favored water-based exterior coatings for their minimal odor, ease of cleanup, and long-term performance. Continuous improvements in formulation also enhanced weather resistance and color stability, allowing water-based paints to outperform traditional solvent-based alternatives in most exterior applications.

By Application Analysis

Residential applications drove the Exterior Paint Market, capturing 65.3% overall consumption share.

In 2024, the Exterior Paint Market by application was largely driven by the residential sector, which captured 65.3% of overall consumption. Residential demand remained strong due to steady housing construction, home improvement projects, and repainting cycles. Exterior paints are essential for protecting homes from environmental exposure while enhancing curb appeal.

In 2024, growing urbanization, rising disposable income, and increased awareness of home maintenance supported residential paint usage. Homeowners increasingly selected exterior paints with longer lifespans, better moisture resistance, and heat-reflective properties. This shift toward performance-oriented coatings reinforced the residential segment’s leading position within the global exterior paint landscape.

Key Market Segments

By Resin Type

- Acrylic

- Epoxy

- Silicone

- Polyurethane

By Product Type

- Water-based

- Oil-based

By Application

- Commercial

- Industrial

- Residential

Driving Factors

Sustainable Materials Driving Exterior Paint Market Growth

One major driving factor for the exterior paint market is the shift toward safer and cleaner materials. Builders and homeowners now prefer paints that reduce environmental harm while maintaining durability. This change is supported by Bioweg securing USD 19 million in Series A funding to replace microplastics with bio-based alternatives used in everyday products, including coatings.

Such innovation encourages paint makers to reformulate exterior paints with biodegradable and safer ingredients. At the same time, BISTOOL’s Pre-Series A funding to expand its premium silicone product line shows how material science investments are accelerating surface performance improvements. These developments help exterior paints last longer, resist cracking, and meet stricter environmental expectations, driving steady market growth.

Restraining Factors

Rising Innovation Costs Restraining the Exterior Paint Market

A key restraining factor in the exterior paint market is the rising cost of research, compliance, and advanced raw materials. While innovation is essential, it increases production expenses and final product pricing. BIOWEG raising €16 million in Series A funding highlights the capital required to develop next-generation bio-based inputs, which may not be immediately affordable for all paint producers.

Similarly, €5 million in ERC Advanced Grants secured by two UCD researchers reflects the high cost of scientific research linked to sustainable materials. These financial pressures can slow adoption, limit small-scale production, and restrain short-term market expansion despite long-term benefits.

Growth Opportunity

Advanced Raw Materials Creating Exterior Paint Opportunities

The exterior paint market is seeing strong growth opportunities through advanced raw material investments. Acrylic raising a debut USD 55 million solo GP fund reflects growing interest in next-generation material platforms, which can influence coating durability and formulation efficiency.

Additionally, ASP securing USD 140 million financing for a silicon metal complex supports the supply of key inputs used in high-performance coatings. These funding activities improve access to stronger, weather-resistant components for exterior paints. As material availability improves, paint manufacturers can develop longer-lasting products with better heat and moisture resistance, opening new opportunities across residential and infrastructure repainting projects.

Latest Trends

Bio-Based Innovation Shaping Exterior Paint Market Trends

One of the latest trends in the exterior paint market is the adoption of bio-based and high-performance resin systems. A Renton-based company becoming a finalist in a USD 3 million global competition for bio-epoxy resins shows growing recognition of sustainable coating technologies. These resins support improved adhesion and durability in exterior environments.

At the same time, delays such as the pending ₹49-crore grant promised to Panjab University highlight how institutional funding timelines can affect research translation. Together, these developments show a trend toward greener paint solutions, balanced by funding execution challenges influencing innovation speed.

Regional Analysis

Asia Pacific led the Exterior Paint Market with a 44.2% share, valued at USD 5.7 Bn.

The Asia Pacific region dominated the Exterior Paint Market, accounting for 44.2% of total demand and reaching a value of USD 5.7 Bn. This leadership position was mainly supported by strong residential construction activity, rapid urban expansion, and consistent repainting demand across major economies. Growing housing stock, climate-driven maintenance needs, and rising preference for durable exterior coatings continued to reinforce the region’s dominance in overall market consumption.

North America represented a mature but stable exterior paint market, supported by steady renovation cycles and regular maintenance of existing residential buildings. Demand in this region remained closely linked to repainting activities rather than new construction, with homeowners prioritizing weather resistance, longevity, and surface protection. The focus on maintaining housing quality sustained consistent market demand without sharp volume fluctuations.

Europe showed balanced growth, driven by the refurbishment of older housing infrastructure and strict quality expectations for exterior coatings. Climatic diversity across the region increased the need for paints offering moisture resistance and long-term surface protection, keeping repainting demand active across residential applications.

The Middle East & Africa market was supported by housing development and surface protection requirements in extreme climatic conditions. Exterior paints in this region are primarily used to withstand heat, sunlight, and dust exposure.

Latin America maintained moderate demand, largely driven by residential construction and repainting needs. Urban population growth and housing maintenance remained key factors shaping exterior paint usage across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Asian Paints continued to demonstrate strong strategic positioning in the global Exterior Paint Market during 2024. The company’s emphasis on product durability, climate-specific formulations, and aesthetic consistency aligned well with demand from residential and urban infrastructure segments. Asian Paints benefited from its deep distribution reach and close engagement with contractors and homeowners, enabling faster adoption of advanced exterior coatings. Its steady focus on innovation in weather resistance and surface protection reinforced brand loyalty and repeat demand, particularly in regions with high repainting cycles and harsh environmental exposure.

Sherwin-Williams maintained a leadership stance in 2024 by leveraging its broad exterior paint portfolio and strong professional contractor network. The company’s exterior coatings were positioned around long service life, surface protection, and consistent finish quality. Its vertically integrated retail model supported close customer interaction, helping refine product offerings based on real-world application needs. From an analyst viewpoint, Sherwin-Williams’ disciplined operational approach and focus on premium exterior solutions strengthened its competitive edge across residential and commercial repainting activities.

Meanwhile, AkzoNobel played a critical role in shaping exterior paint standards through performance-driven formulations and sustainability-oriented design. In 2024, the company emphasized durability, color retention, and surface protection across varied climates. Its balanced global footprint allowed it to respond effectively to regional housing maintenance needs. Analysts view AkzoNobel’s consistent product quality and long-term innovation strategy as key contributors to its stable presence in the exterior paint landscape.

Top Key Players in the Market

- Asian Paints

- Sherwin-Williams

- AkzoNobel

- Valspar

- Kansai Paint

- PPG Industries

- Nippon Paint

- Behr

- Berger Paints

- Benjamin Moore

Recent Developments

- In October 2024, Valspar announced Epic Adventure V073-6 as its 2025 Color of the Year, a deep blue tone intended to inspire design choices for both interior and exterior surfaces. This highlights Valspar’s ongoing trend-setting role in paint color planning for consumers and professionals.

- In February 2024, Kansai Paint partnered with Mitsui to invest in Kansai Helios, a European coatings manufacturer. This development supports the company’s broader coatings and paint business by strengthening European operations and boosting product reach in industrial and architectural coatings markets.

Report Scope

Report Features Description Market Value (2024) USD 12.9 Billion Forecast Revenue (2034) USD 27.1 Billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Resin Type (Acrylic, Epoxy, Silicone, Polyurethane), By Product Type (Water-based, Oil-based), By Application (Commercial, Industrial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Asian Paints, Sherwin-Williams, AkzoNobel, Valspar, Kansai Paint, PPG Industries, Nippon Paint, Behr, Berger Paints, Benjamin Moore Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Asian Paints

- Sherwin-Williams

- AkzoNobel

- Valspar

- Kansai Paint

- PPG Industries

- Nippon Paint

- Behr

- Berger Paints

- Benjamin Moore