Global Ethanolamines Market Size, Share Analysis Report By Product (Monoethanolamines, Diethanolamines, Triethanolamines), By Grade (Food Grade, Industrial Grade, Pharmaceutical Grade), By Application (Surfactants, Chemical Intermediates, Herbicides, Gas Treatment, Cement, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152205

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

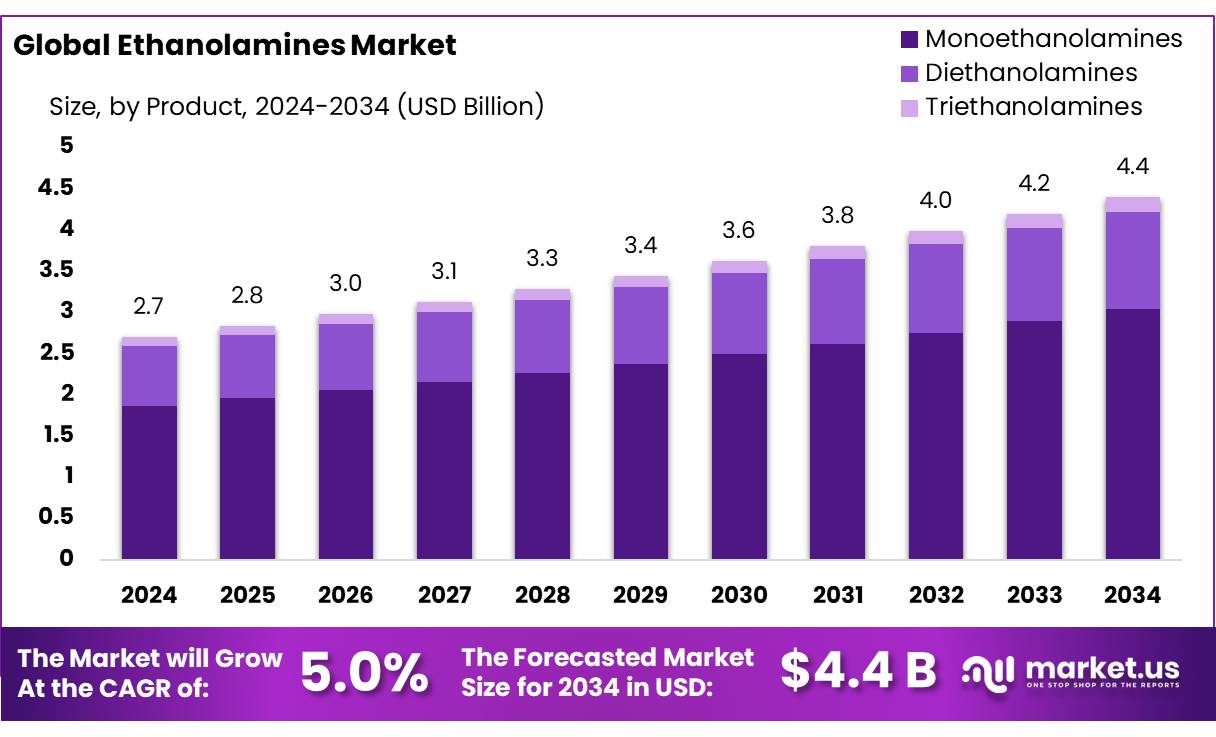

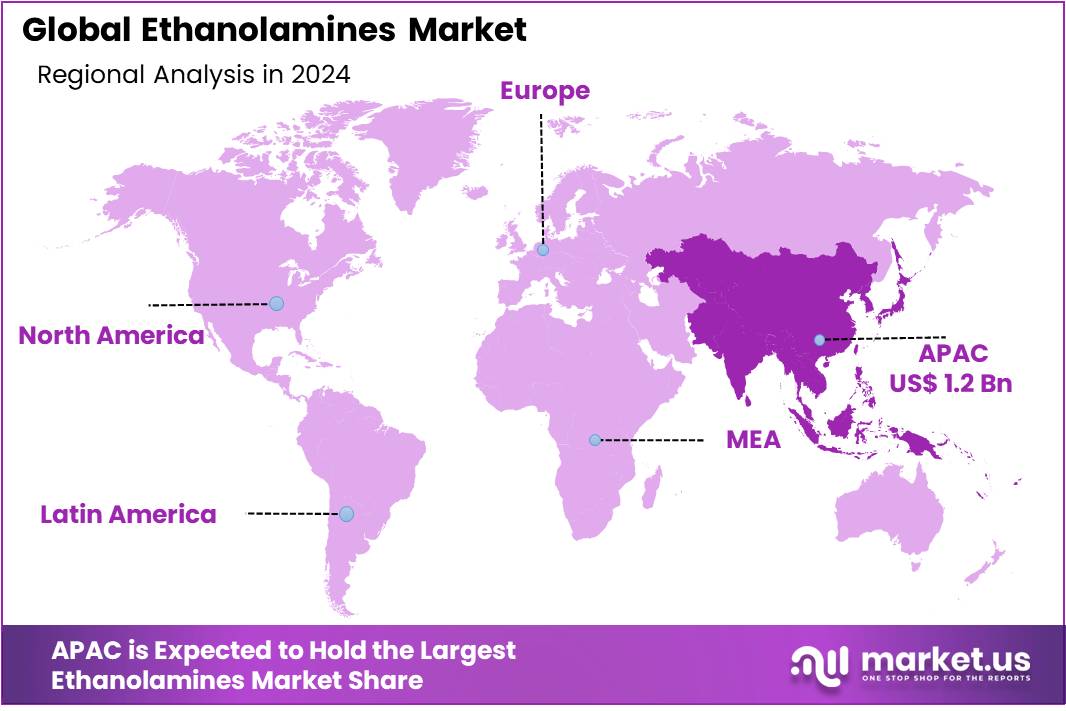

The Global Ethanolamines Market size is expected to be worth around USD 4.4 Billion by 2034, from USD 2.7 Billion in 2024, growing at a CAGR of 5.0% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 47.1% share, holding USD 1.2 billion revenue.

Ethanolamines are a class of bifunctional chemicals—including monoethanolamine (MEA), diethanolamine (DEA), and triethanolamine (TEA)—manufactured via the reaction of ethylene oxide with ammonia. These compounds serve as surfactants, pH regulators, emulsifiers, corrosion inhibitors, and gas scrubbing agents across diverse sectors, notably agriculture, personal care, detergents, construction, and oil and gas.

Demand is being propelled by several converging forces. First, expansion in agricultural applications, particularly ethanolamine-based herbicides such as glyphosate salts, is substantial: global herbicide-linked agricultural production must increase by approximately 70% by 2050 to meet food demand, directly enhancing ethanolamine usage.

Government initiatives play a significant role in shaping the ethanolamine industry. In India, the Ethanol Blending Program (EBP) aims to achieve 20% ethanol blending in petrol by 2025, advancing the initial target set for 2030. This policy is expected to bolster the demand for ethanol, indirectly influencing the production and consumption of ethanolamines. Furthermore, the National Action Plan for Climate Change (NAPCC) emphasizes sustainable agricultural practices and energy efficiency, aligning with the increased utilization of ethanolamines in various sectors.

In India, the government’s initiatives to promote biofuels have further bolstered the ethanolamine market. The Ministry of Petroleum and Natural Gas has been actively supporting the blending of ethanol with gasoline, aiming to increase the ethanol blending percentage to 20% by 2025. This policy is expected to enhance the demand for ethanolamines, which are integral in the formulation of biofuels.

Key Takeaways

- Ethanolamines Market size is expected to be worth around USD 4.4 Billion by 2034, from USD 2.7 Billion in 2024, growing at a CAGR of 5.0%.

- Monoethanolamines held a dominant market position, capturing more than a 49.2% share of the global ethanolamines market.

- Chemical Synthesis held a dominant market position, capturing more than a 72.3% share of the ethanolamines market.

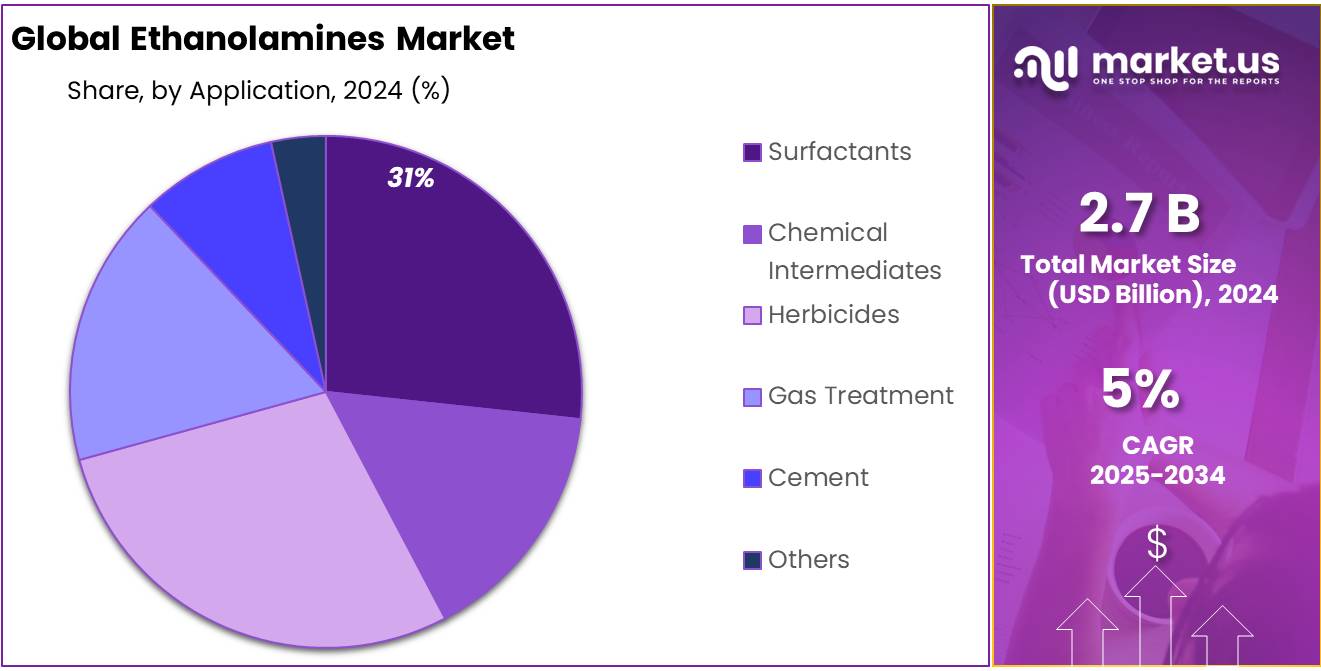

- Surfactants held a dominant market position, capturing more than a 31.8% share of the global ethanolamines market.

- Asia-Pacific (APAC) region held a dominant position in the global ethanolamines market, accounting for 47.1% of the total market share and reaching a valuation of approximately USD 1.2 billion.

By Product Analysis

Monoethanolamines leads with 49.2% share in 2024 due to high demand in gas treatment and surfactants.

In 2024, Monoethanolamines held a dominant market position, capturing more than a 49.2% share of the global ethanolamines market. This strong performance is mainly driven by its wide usage across key industries such as natural gas treatment, cement additives, and surfactant production.

The chemical’s ability to absorb acidic gases like carbon dioxide and hydrogen sulfide makes it essential in refining and petrochemical operations. Its role in the production of emulsifiers and detergents also supports steady demand from the cleaning and personal care sectors. As industrial activities continue to expand in regions such as Asia-Pacific and North America, especially in oil and gas processing, the consumption of Monoethanolamines remains firm.

By Grade Analysis

Chemical Synthesis leads with 72.3% share in 2024 driven by its large-scale use across core industries.

In 2024, Chemical Synthesis held a dominant market position, capturing more than a 72.3% share of the ethanolamines market by grade. This strong share is primarily due to its extensive use in industrial manufacturing processes, including the production of chemicals for pharmaceuticals, agrochemicals, and personal care products.

Ethanolamines, particularly in chemical synthesis grade, are vital intermediates in making emulsifiers, corrosion inhibitors, and dispersing agents. Their ability to react with acids and fatty substances makes them useful in a wide variety of formulations. The demand remains strong from countries with large-scale industrial infrastructure, especially across Asia-Pacific and parts of Europe.

By Application Analysis

Surfactants dominate with 31.8% share in 2024 due to strong demand in cleaning and personal care products.

In 2024, Surfactants held a dominant market position, capturing more than a 31.8% share of the global ethanolamines market by application. This leading share is largely due to the increasing use of ethanolamines in producing surfactants used in household cleaners, shampoos, detergents, and industrial formulations.

The compound’s ability to reduce surface tension and improve the effectiveness of cleaning agents makes it an essential ingredient in daily-use products. Rising awareness around hygiene and the growing consumption of personal care items across both developed and emerging regions have kept the demand strong.

Key Market Segments

By Product

- Monoethanolamines

- Diethanolamines

- Triethanolamines

By Grade

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

By Application

- Surfactants

- Chemical Intermediates

- Herbicides

- Gas Treatment

- Cement

- Others

Emerging Trends

Advancements in Bioethanol Production from Agro-Waste

A significant trend shaping the ethanolamine industry is the increasing utilization of agro-waste for bioethanol production. This approach aligns with India’s sustainability goals and offers a renewable source for producing ethanolamines, which are vital in various industrial applications.

The Indian government has been actively promoting the use of surplus agricultural residues, such as rice straw, bagasse, and other biomass, for bioethanol production. This initiative is part of the broader National Biofuels Policy, which encourages the use of non-food feedstocks to produce ethanol, thereby reducing dependence on edible crops and enhancing energy security.

In 2024, India allocated 5.2 million tonnes of subsidized rice from the Food Corporation of India (FCI) for ethanol production. This strategic move aims to achieve the target of 20% ethanol blending in petrol by 2025-26, as outlined in the Ethanol Blended Petrol (EBP) Programme. The anticipated requirement for ethanol to meet this target is approximately 1,350 crore litres, necessitating a substantial increase in production capacity.

Drivers

Growing Demand for Eco-Friendly Chemicals Drives Ethanolamines Market Growth

One of the key driving factors for the ethanolamines market is the increasing demand for eco-friendly and sustainable chemicals, particularly in the production of detergents, surfactants, and agrochemicals. As global awareness of environmental issues continues to grow, industries are shifting towards green and biodegradable alternatives. Ethanolamines, being an essential component in many of these applications, are benefiting from this shift.

Ethanolamines, especially monoethanolamine (MEA), are used in a wide range of products, including cleaning agents, personal care items, and agricultural chemicals. Their role in the production of surfactants and detergents, which are integral to consumer goods, makes them a staple in the everyday lives of consumers. The push towards sustainability has driven manufacturers to seek out ingredients that are biodegradable and have a minimal environmental impact. Ethanolamines meet these criteria, making them a preferred choice in various sectors.

In India, the government’s initiatives have further accelerated the demand for ethanolamines. The Ethanol Blended Petrol (EBP) Programme, which aims to increase ethanol blending in petrol to 20% by 2025, reflects a broader commitment to sustainability. This initiative encourages the use of ethanol-based products, which directly benefits the ethanolamine sector.

The government’s focus on reducing carbon emissions and promoting cleaner energy sources has created a favorable environment for the growth of ethanolamine applications. By 2024, India’s ethanolamine market is expected to reach 18.61 thousand metric tonnes, and it is projected to grow at a rate of 4.63% annually, reflecting the growing demand driven by these policies.

Restraints

High Raw Material Costs Limit Ethanolamines Production

A major restraining factor for the ethanolamines market is the high cost of raw materials, which can hinder production and limit the affordability of end-products. Ethanolamines are primarily produced from ethylene oxide, a chemical derived from petrochemical feedstocks. The fluctuation in the prices of crude oil and natural gas directly impacts the cost of these raw materials, causing instability in production costs. This unpredictability makes it difficult for manufacturers to plan effectively, resulting in higher costs for ethanolamines and related products.

For instance, in 2023, the price of crude oil saw significant fluctuations due to geopolitical tensions and market instability. As crude oil prices rose, the cost of ethylene oxide, and consequently ethanolamines, also increased. These price hikes are then passed down the supply chain, affecting industries that rely on ethanolamines, including detergents, agrochemicals, and personal care products. This increase in production costs can make ethanolamines less competitive compared to alternative chemicals, which may limit their adoption in price-sensitive markets.

In India, where the ethanolamine market is growing rapidly, government initiatives like the Ethanol Blended Petrol (EBP) Programme are driving up demand. However, the cost of ethanol remains high due to limited domestic production. As a result, the government is focusing on boosting the domestic supply of ethanol through various policies, but high production costs still pose a challenge. By 2024, India’s ethanolamine market is expected to grow at a rate of 4.63%, but this growth is still tied to how effectively raw material prices can be managed.

Opportunity

Growth Opportunities in Ethanolamine Production from Agro-Waste

A promising growth avenue for the ethanolamine industry lies in utilizing agro-waste materials, such as agricultural residues and dairy byproducts, to produce bioethanol. This approach not only addresses the increasing demand for sustainable chemicals but also supports the Indian government’s initiatives to promote renewable energy sources.

In Gujarat, Amul has pioneered the production of bioethanol from whey, a byproduct of dairy processing. Following a successful trial, Amul plans to invest ₹70 crore in a bioethanol plant with a capacity of 50,000 liters per day. This initiative is expected to generate an additional ₹700 crore in income for dairy farmers. Similarly, other companies in Gujarat are investing in ethanol production, with plans to establish plants totaling a capacity of 2,800 kiloliters per day, amounting to an investment of ₹3,300 crore. These developments align with the government’s Ethanol Blended Petrol (EBP) Programme, which aims to achieve 20% ethanol blending in petrol by 2025.

The National Biofuels Policy further supports this growth by encouraging the production of ethanol from various feedstocks, including agricultural residues. This policy framework provides a conducive environment for the expansion of bioethanol production, thereby creating a steady supply of ethanolamine.

Regional Insights

Asia-Pacific dominates the ethanolamines market with 47.1% share, valued at USD 1.2 billion in 2024.

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global ethanolamines market, accounting for 47.1% of the total market share and reaching a valuation of approximately USD 1.2 billion. This significant regional dominance is largely driven by robust demand from key end-use sectors such as agrochemicals, personal care, textiles, and oil and gas. Countries like China, India, South Korea, and Japan are at the forefront of this growth due to their expanding manufacturing capabilities and rising consumption across diverse industrial applications.

China remains the leading contributor within the region, supported by its strong presence in the production of herbicides and surfactants. India’s demand is rapidly increasing due to large-scale agricultural activity and a growing consumer base for personal care products. The rising focus on industrial expansion, urbanization, and infrastructure development across emerging economies has further bolstered the consumption of ethanolamines in the production of cement additives, detergents, and gas treatment chemicals.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Oriental Union Chemical Corporation (OUCC), based in Taiwan, is a key producer of ethanolamines, primarily catering to markets in Asia. The company focuses on monoethanolamine (MEA), diethanolamine (DEA), and triethanolamine (TEA) production, serving sectors like gas treatment, surfactants, and agrochemicals. OUCC benefits from strong regional demand and strategic integration with upstream ethylene oxide supply. With expanding production capacity and a focus on industrial applications, OUCC continues to play a vital role in the Asia-Pacific ethanolamines market.

Akzo Nobel N.V., headquartered in the Netherlands, operates in the ethanolamines market through its performance chemicals division. The company supplies ethanolamines mainly for use in paints, coatings, personal care, and cleaning products. Its focus on sustainable chemistry and product innovation supports growing demand in Europe and North America. Akzo Nobel emphasizes circularity and eco-friendly surfactant systems, positioning its ethanolamine-based solutions for environmentally conscious markets. Its strong regional presence strengthens its role as a key supplier in this segment.

BASF SE, a global chemical giant based in Germany, is one of the leading manufacturers of ethanolamines, including MEA, DEA, and TEA. The company supports applications across personal care, agriculture, gas treatment, and cement additives. With production sites in Europe, Asia, and North America, BASF ensures a reliable supply network and product consistency. The company’s investment in sustainable production, such as its ISCC PLUS-certified plants, highlights its commitment to green chemistry and innovation in ethanolamine derivatives.

Top Key Players Outlook

- OUCC

- Akzo Nobel N.V.

- BASF SE

- DOW

- Huntsman Corporation LLC

- Indorama Ventures Public Company Limited

- INEOS

- Jay Dinesh Chemicals

- Jiaxing Jinyan Chemical Co Ltd.

- Kanto Kagaku

- Nouryon

- SABIC

- Sintez OKA Group of Companies

Recent Industry Developments

In 2024, OUCC produced approximately 100,000 MT of ethanolamines annually, with its Kaohsiung facility alone contributing 60,000 MT and its Yangzhou plant adding 40,000 MT.

In 2024, Akzo Nobel N.V. reported approximately €10.7 billion in revenue, with a net income of €488 million, marking a stable year-on-year performance.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Bn Forecast Revenue (2034) USD 4.4 Bn CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Monoethanolamines, Diethanolamines, Triethanolamines), By Grade (Food Grade, Industrial Grade, Pharmaceutical Grade), By Application (Surfactants, Chemical Intermediates, Herbicides, Gas Treatment, Cement, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape OUCC, Akzo Nobel N.V., BASF SE, DOW, Huntsman Corporation LLC, Indorama Ventures Public Company Limited, INEOS, Jay Dinesh Chemicals, Jiaxing Jinyan Chemical Co Ltd., Kanto Kagaku, Nouryon, SABIC, Sintez OKA Group of Companies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- OUCC

- Akzo Nobel N.V.

- BASF SE

- DOW

- Huntsman Corporation LLC

- Indorama Ventures Public Company Limited

- INEOS

- Jay Dinesh Chemicals

- Jiaxing Jinyan Chemical Co Ltd.

- Kanto Kagaku

- Nouryon

- SABIC

- Sintez OKA Group of Companies