Global Enterprise Session Border Controller Market Size, Share Analysis Report By Session Capacity (Up to 200 Sessions, Up to 600 Sessions, Up to 1000 Sessions, Up to 5,000 Sessions, More Than 5,000 Sessions), By Function (Security, Connectivity, Quality of Service, Regulatory, Media Services, Revenue Optimization, Others), By Enterprise Size (Large Enterprises, Small & Medium Enterprise Size), By Industry (Manufacturing, Banking and Financial Services, Transportation, Healthcare, Media and Entertainment, IT and Telecommunication, Other Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152947

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

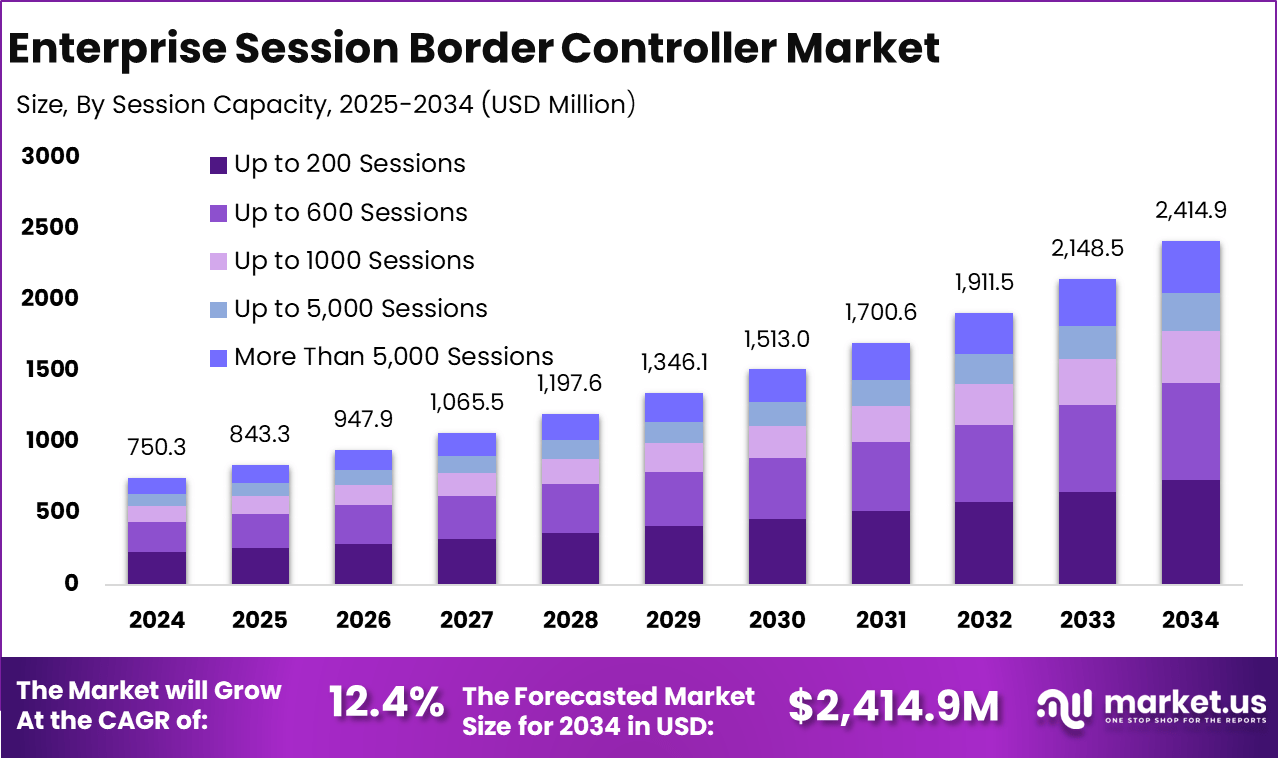

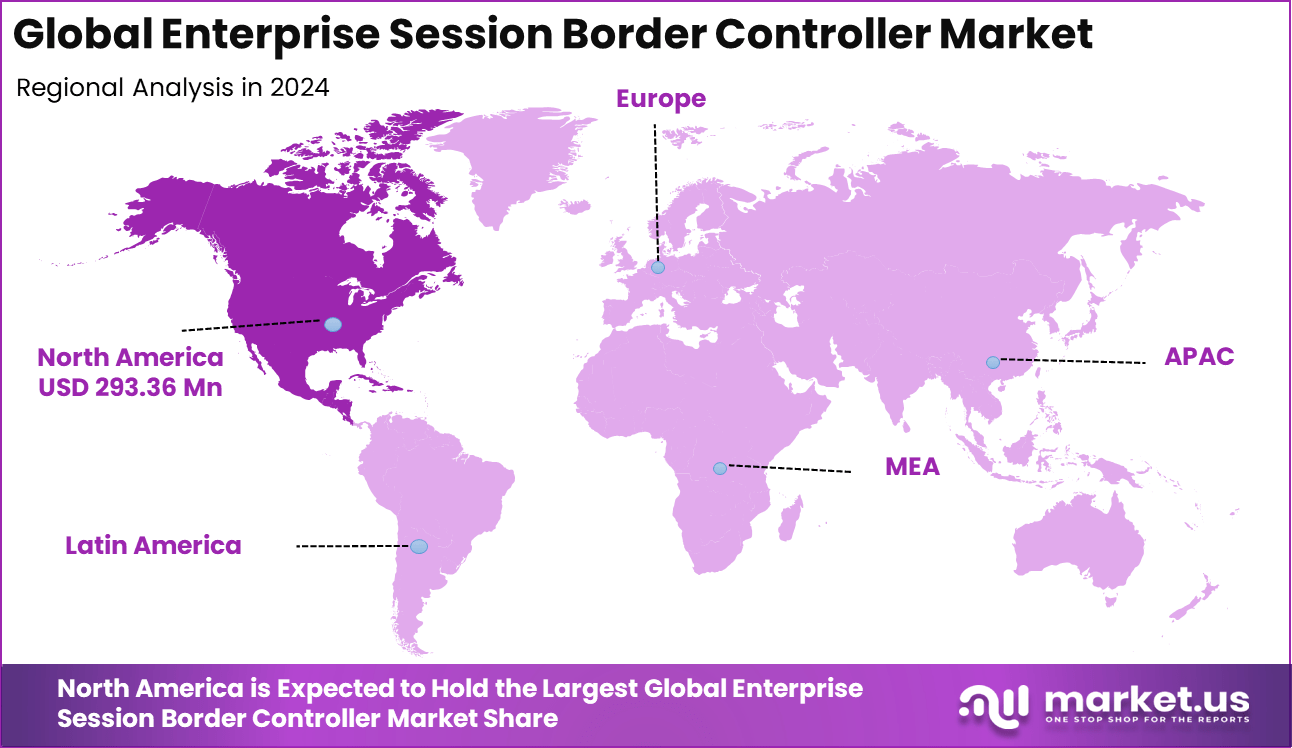

The Global Enterprise Session Border Controller Market size is expected to be worth around USD 2,414.9 million by 2034, from USD 750.3 million in 2024, growing at a CAGR of 12.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.1% share, holding USD 293.36 million in revenue.

The E-SBC market has become essential as businesses navigate the growing complexity of digital communications. E-SBCs are pivotal solutions positioned at the network edge, providing control and security for multimedia data such as voice, video, and messaging between diverse digital environments. As companies increasingly transition to IP-based platforms, these solutions help integrate cloud and on-premise applications securely while safeguarding against security threats in real time.

A major contributor to the growth of the E-SBC market is the expanding adoption of UC and cloud applications. As organizations move away from legacy telephony, the need for uninterrupted service and seamless interoperability increases. Additionally, the rise in both the frequency and sophistication of cyber threats drives organizations to adopt E-SBCs, which provide robust protections like session encryption, intrusion prevention, fraud detection, and secure connection initiation.

Scope and Forecast

Report Features Description Market Value (2024) USD 750.3 Mn Forecast Revenue (2034) USD 2,414 Mn CAGR (2025-2034) 12.4% Largest market in 2024 North America [39.1% market share] For instance, in January 2025, Ribbon Communications unveiled a new version of its Sonus Session Border Controller (SBC) featuring advanced capabilities designed to deliver an improved quality experience and simplified management for enterprise communication systems. The updated SBC solution enhances scalability, security, and performance, addressing the growing demand for seamless, secure communication across cloud and hybrid networks.

Key Takeaway

- The Enterprise Session Border Controller market is projected to reach about USD 2,414.9 million by 2034, growing at a steady 12.4% CAGR from 2025 to 2034, driven by rising adoption of VoIP and unified communication solutions.

- In 2024, North America led the market with a 39.1% share, generating around USD 293.36 million in revenue, supported by advanced network infrastructure and high enterprise adoption.

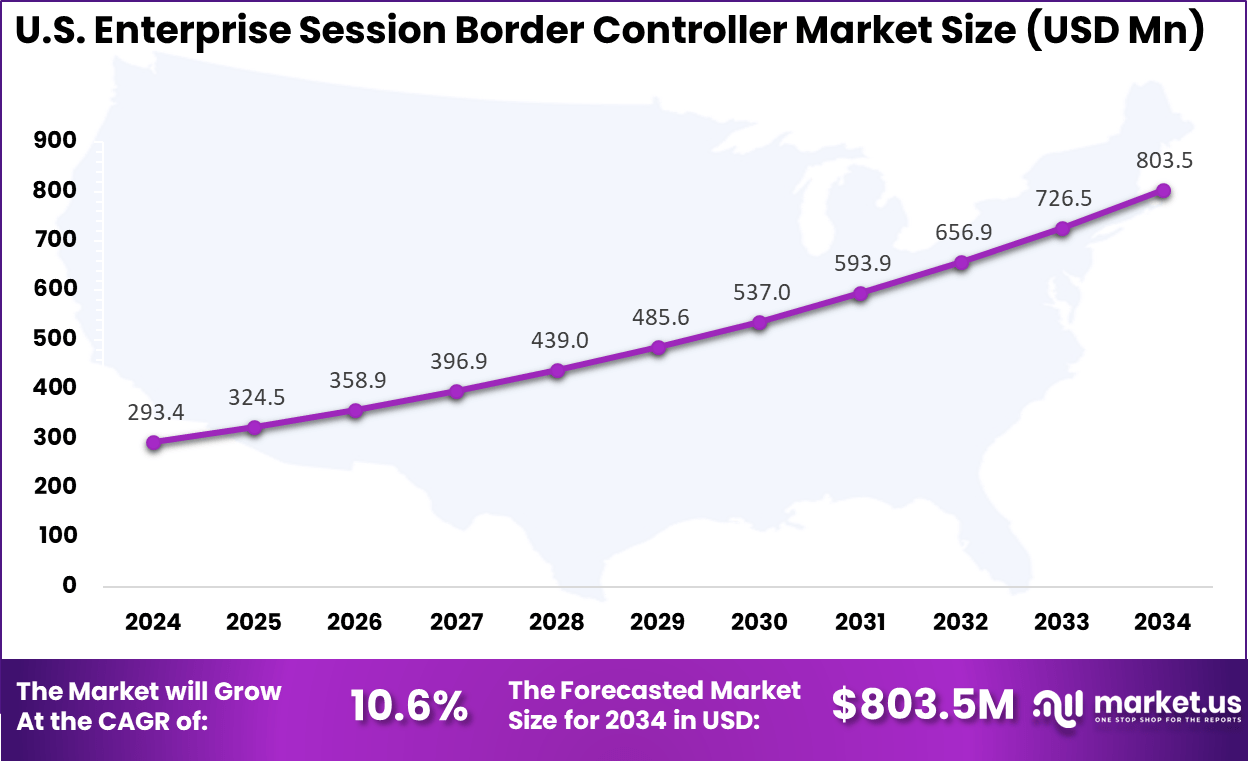

- The United States alone accounted for nearly USD 293.4 million in 2024 and is anticipated to grow at a 10.6% CAGR, reflecting continued investments in secure and reliable communication systems.

- By session capacity, the segment supporting up to 200 sessions dominated, capturing 30.4% share, as it aligns with the needs of small-to-medium sized deployments.

- By function, Security emerged as a key application area, holding a 27.4% share, highlighting enterprises’ focus on safeguarding voice and data traffic.

- By enterprise size, Large Enterprises represented the largest segment, contributing about 64.2% of the market, owing to their complex communication demands and larger workforce.

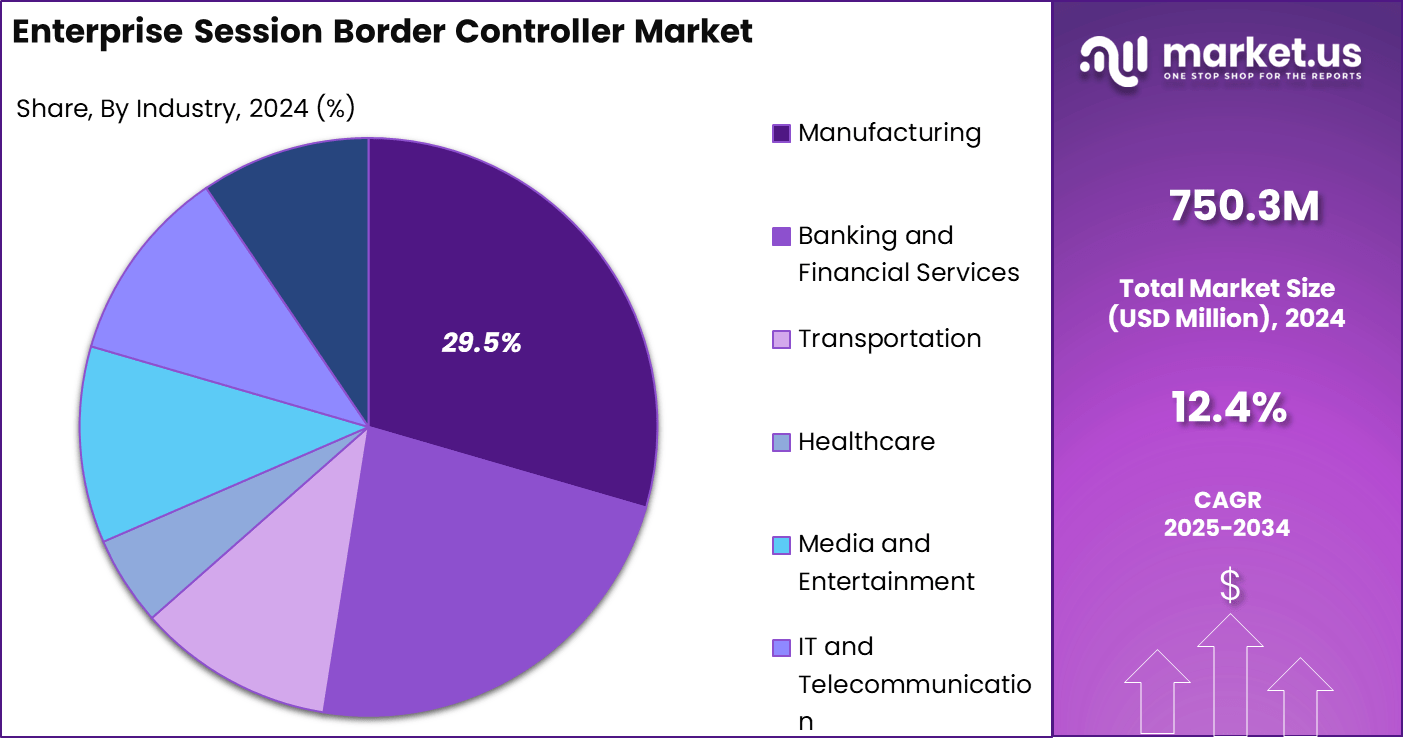

- By industry, Manufacturing accounted for a significant 29.5% share, driven by its increasing use of IP-based communication for operational efficiency and supply chain coordination.

Analysts’ Viewpoint

Emerging technologies rapidly being embraced in the E-SBC sector include cloud-native solutions, artificial intelligence (AI) integration, and virtualization. Cloud-based E-SBCs allow businesses to scale communication capabilities flexibly, reducing reliance on extensive hardware. AI-powered E-SBCs provide real-time threat detection, predictive maintenance, and intelligent session management.

Investment in cloud-native session border controller solutions is particularly promising, especially those equipped with AI-driven analytics and automation. As small and medium enterprises increasingly pursue digital transformation, demand for scalable and subscription-based E-SBCs continues to rise. Fast-growing digital regions with supportive rules attract investment as SMEs seek secure, low-cost communication.

Regulatory requirements for E-SBCs are becoming stricter as governments and industry bodies tighten data privacy regulations. Laws such as GDPR in Europe and new global cybersecurity standards require organizations to secure their communication channels from end to end. E-SBCs support compliance by offering encryption, access controls, and audit trails, essential for finance, healthcare, and telecom sectors.

U.S. E-SBC Market Size

The market for Enterprise Session Border Controller within the U.S. is growing tremendously and is currently valued at USD 293.4 million, the market has a projected CAGR of 10.6%. The widespread adoption of cloud-based communication services, such as UCaaS and CCaaS, is driving the need for robust security solutions to protect sensitive data and ensure regulatory compliance.

The shift to remote and hybrid work models further amplifies the demand for secure and reliable communication networks. Additionally, rising cyber threats and strict regulatory standards are making advanced security features like encryption and access controls essential, particularly for large enterprises in sectors like technology, banking, and healthcare that require scalable and secure communication systems.

For instance, In April 2021, Patton’s SmartNode Session Border Controller (SBC) series was certified for Microsoft Teams Direct Routing, reflecting rising demand for SBCs in the U.S. Businesses are adopting advanced communication solutions to secure and manage VoIP and UC services, reinforcing the U.S. leadership in deploying reliable, scalable, and secure enterprise communication networks.

In 2024, North America held a dominant market position in the Global Enterprise Session Border Controller Market, capturing more than a 39.1% share, holding USD 293.36 million in revenue. The region benefits from widespread adoption of cloud-based communication and VoIP solutions, which require secure, seamless integration – functions provided by E-SBCs.

Additionally, the growth of internet users, strong IT infrastructure, and the presence of major telecom operators drive demand. Rising cybersecurity threats and stringent data protection regulations also push organizations to invest in advanced E-SBCs to safeguard communication networks and ensure compliance, particularly among large enterprises managing complex systems.

For instance, In January 2025, GlobalMeet enhanced its operational efficiency by adopting Cataleya’s next-generation SBC solution, highlighting the rising use of advanced E-SBCs in North America. The region continues to lead in demand for secure, scalable communication networks as enterprises in technology, finance, and healthcare increasingly embrace cloud-based solutions.

Session Capacity Analysis

In 2024, The Up to 200 Sessions segment held a dominant market position, capturing a 30.4% share of the Global Enterprise Session Border Controller Market. This dominance is due to the growing adoption of cloud-based communication solutions by small to mid-sized enterprises (SMEs) that typically require lower session capacities.

These organizations seek cost-effective, scalable solutions for their communication needs, making E-SBCs with up to 200 sessions a practical choice. With the shift to IP-based and cloud platforms, SMEs with limited budgets and infrastructure increasingly prefer lower-capacity E-SBCs. Additionally, the rise in remote work and distributed teams further boosts demand for secure, flexible communication systems that don’t require high-capacity investments.

For Instance, in May 2021, Sangoma provided an Enterprise Session Border Controller (E-SBC) designed to support up to 200 sessions. This solution is tailored for small to mid-sized enterprises seeking a cost-effective and secure communication platform, enabling seamless integration with VoIP and UC solutions while ensuring robust security and traffic management capabilities.

Function Analysis

In 2024, the Security segment held a dominant market position, capturing a 27.4% share of the Global Enterprise Session Border Controller Market. The surge in cyber threats, including DDoS attacks, ransomware, and various weaknesses in communication networks, has been the main driving force behind the demand for this area.

As companies prioritize the protection of sensitive data and maintain the integrity of their communication systems, E-SBCs equipped with advanced security features like encryption keys, traffic monitoring, and threat detection have become indispensable for addressing evolving cybersecurity challenges and complying with regulations.

For instance, In April 2025, Oracle issued a critical patch for its Communications SBC solutions to address security vulnerabilities. This update reinforces its commitment to protecting enterprise networks from cyber threats, with improved safeguards against unauthorized access and data breaches to help organizations secure VoIP and UC platforms and ensure compliance.

Enterprise Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 64.2% share of the Global Enterprise Session Border Controller Market. This dominance is due to the complex and high-volume communication needs of large organizations, which require advanced solutions to manage, secure, and optimize their communication networks.

With multiple locations, distributed teams, and large-scale cloud and VoIP deployments, these enterprises prioritize robust, scalable E-SBCs to ensure security, compliance, and high-quality communication. Their larger budgets and greater infrastructure requirements further drive the demand for sophisticated, high-capacity E-SBC solutions.

For Instance, In January 2025, TelcoBridges rolled out major updates to its ProSBC Session Border Controller system, designed for large enterprises. The enhancements improve scalability, security, and flexibility, enabling organizations to handle high communication traffic securely and efficiently across distributed networks.

Industry Analysis

In 2024, The Manufacturing segment held a dominant market position, capturing a 29.5% share of the Global Enterprise Session Border Controller Market. This dominance is due to the increasing reliance of manufacturing companies on connected devices, IoT, and real-time communication systems for operations, supply chain management, and remote monitoring.

As manufacturing processes become more digitized and interconnected, there is a growing need for secure, reliable communication solutions to protect sensitive data and ensure seamless collaboration across global teams. E-SBCs play a critical role in safeguarding communication networks and supporting the scalability required by the manufacturing industry.

For Instance, in January 2025, Oracle’s acquisition of Acme Packet for $1.7 billion reinforced the growing importance of advanced Enterprise Session Border Controllers (E-SBCs) in industries like manufacturing. As manufacturers increasingly adopt cloud-based and IoT-enabled solutions, the need for secure, reliable communication systems becomes more critical.

Key Market Segments

By Session Capacity

- Up to 200 Sessions

- Up to 600 Sessions

- Up to 1000 Sessions

- Up to 5,000 Sessions

- More Than 5,000 Sessions

By Function

- Security

- Connectivity

- Quality of Service

- Regulatory

- Media Services

- Revenue Optimization

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprise Size

By Industry

- Manufacturing

- Banking and Financial Services

- Transportation

- Healthcare

- Media and Entertainment

- IT and Telecommunication

- Other Industries

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Embracing Cloud-Native and AI-Enhanced Security

One of the most remarkable current trends in the enterprise session border controller (E-SBC) market is the adoption of cloud-native solutions along with the integration of artificial intelligence. Cloud-native E-SBCs are enabling organizations to secure their expanding network perimeters with far more agility and efficiency, especially as businesses distribute their communication infrastructure across hybrid and multi-cloud environments.

Alongside this, AI-powered features are helping E-SBCs perform advanced threat detection, automate session management, and optimize user experience in real time. These upgrades are empowering companies to handle evolving communication patterns smoothly, keeping security and productivity at the forefront as digital operations grow.

Key Driver

Heightened Focus on Secure and Compliant Communication

Businesses today are more concerned than ever about the security and privacy of their communication systems. With cyber threats constantly evolving and data privacy regulations getting stricter, E-SBCs have become essential in protecting sensitive voice, video, and messaging data.

They do this by encrypting traffic, managing access controls, and ensuring that communication policies adhere to global compliance standards. This emphasis on safety and regulation is why organizations are placing greater reliance on E-SBCs as the backbone of their secure communications strategy.

Main Restraint

High Implementation Costs and Integration Complexities

While the advantages of E-SBCs are clear, the process of deploying these solutions remains costly and complex, particularly for smaller enterprises. Integrating E-SBCs with existing legacy communication infrastructure often involves technical hurdles, specialized expertise, and unexpected operational delays.

The associated expenses, including training IT staff and ongoing maintenance, make it difficult for many organizations to invest confidently in E-SBC solutions, especially if budgets are tight or technical resources are limited.

Emerging Opportunity

Expanding Role in Cloud Communication Platforms

An exciting opportunity lies ahead as more companies transition to cloud-based communication services. The move to unified communication platforms and remote workspaces offers E-SBC vendors a growing chance to deliver flexible, virtualized session control and security.

Organizations are seeking scalable solutions that can consistently operate across multiple platforms, regardless of whether they’re on-premise or cloud-based. The compatibility of E-SBCs with cutting-edge network technologies is becoming a pivotal selling point, allowing businesses to easily scale and adapt their communication ecosystems to meet rising demand and new collaboration needs.

Key Challenge

Addressing Interoperability and Vendor Compatibility

A real-world challenge emerges from the need to ensure seamless interoperability between diverse communication systems and vendors. Many organizations operate hybrid environments that mix old PBX systems with modern cloud-based platforms, and making all these pieces work harmoniously is not trivial.

Differences in standards, protocols, and network architectures can cause integration headaches, slow deployments, and even impact communication reliability. Overcoming this challenge often requires not just technical solutions but strong cooperation among multiple technology providers, sometimes slowing down deployment cycles and limiting flexibility for end users.

Key Players Analysis

Audiocodes, Sonus Networks, and Oracle lead the enterprise session border controller market with secure, high-performance solutions for VoIP and unified communications. Cisco and Edgewater strengthen their positions by offering scalable, feature-rich products suited for large enterprises and service providers, backed by continuous innovation and standard compliance.

Avaya and Adtran focus on affordable, easy-to-deploy SBCs for small and medium businesses, while Patton Electronics and Ingate Systems serve niche markets with customizable, regulatory-compliant solutions. These players expand market diversity by meeting specific operational needs.

Genband enhances competition with advanced session management and security capabilities. Other regional and emerging vendors contribute localized support and specialized features, keeping the market dynamic and fostering wider adoption across industries.

Top Key Players in the Market

- Audiocodes Ltd.

- Sonus Networks, Inc.

- Oracle Corporation

- Cisco Systems, Inc.

- Edgewater Networks Inc.

- Avaya Inc.

- Adtran, Inc.

- Patton Electronics Co.

- Ingate Systems AB

- Genband, Inc.

- Others

Recent Developments

- In June 2025, AudioCodes announced the launch of its new session border controller (SBC) solution, designed to enhance the security and scalability of enterprise communications. This advanced SBC solution aims to address the growing demand for secure, high-quality voice and video services, particularly in the context of increased cloud adoption and remote work.

- In June 2025, Edgewater Wireless captured significant industry attention at the Silicon Catalyst Portfolio Update in Silicon Valley. The company showcased its latest innovations in wireless technology, complementing its session border controller (SBC) solutions to offer secure, high-performance communication systems.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Session Capacity (Up to 200 Sessions, Up to 600 Sessions, Up to 1000 Sessions, Up to 5,000 Sessions, More Than 5,000 Sessions), By Function (Security, Connectivity, Quality of Service, Regulatory, Media Services, Revenue Optimization, Others), By Enterprise Size (Large Enterprises, Small & Medium Enterprise Size), By Industry (Manufacturing, Banking and Financial Services, Transportation, Healthcare, Media and Entertainment, IT and Telecommunication, Other Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Audiocodes Ltd., Sonus Networks, Inc., Oracle Corporation, Cisco Systems, Inc., Edgewater Networks Inc., Avaya Inc., Adtran, Inc., Patton Electronics Co., Ingate Systems AB, Genband, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enterprise Session Border Controller MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Enterprise Session Border Controller MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Audiocodes Ltd.

- Sonus Networks, Inc.

- Oracle Corporation

- Cisco Systems, Inc.

- Edgewater Networks Inc.

- Avaya Inc.

- Adtran, Inc.

- Patton Electronics Co.

- Ingate Systems AB

- Genband, Inc.

- Others