Global Distillation Systems Market Size, Share, And Business Benefits By Type (Column Still, Pot Still), By Technology (Fractional, Steam, Vacuum, Multiple-effect), By Component (Column Shells, Plates and Packings, Condenser), By Method (Continuous, Batch), By End-user (Petroleum and Biorefinery, Food and Beverages, Pharmaceuticals, Water Treatment), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165443

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

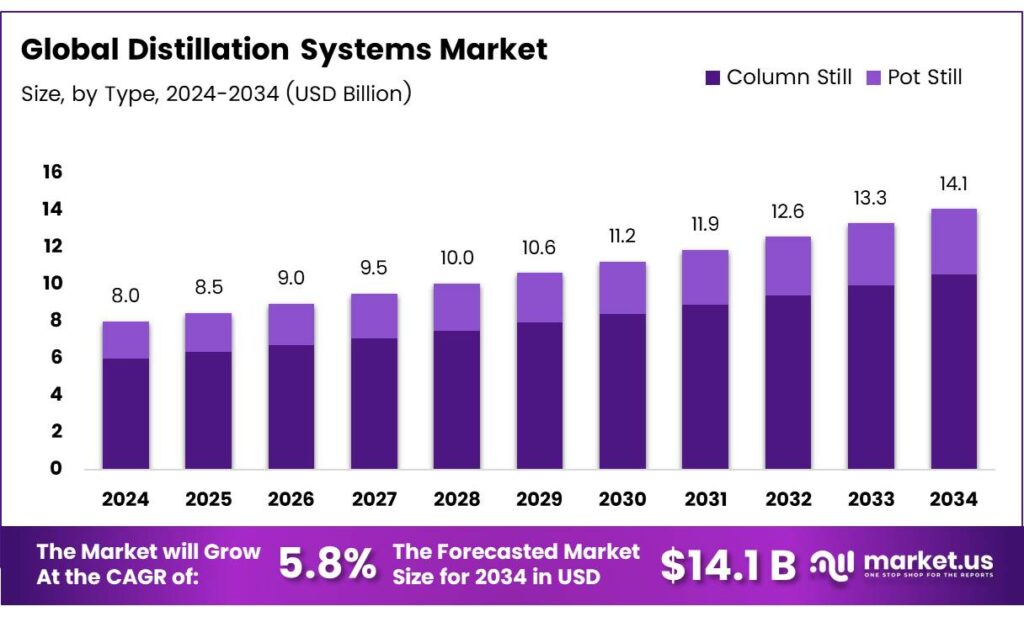

The Global Distillation Systems Market size is expected to be worth around USD 14.1 billion by 2034, from USD 8.0 billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

Distillation is a fundamental separation process that exploits differences in volatility to isolate components, playing a vital role in extracting essential oils from medicinal and aromatic plants through various hydrodistillation techniques designed to maximize yield and efficiency. In the food industry, it serves as a key separation technique for capturing volatile components and essential oils, with applications spanning the production of ethanol and alcoholic beverages from fermented liquids.

The fractionation and concentration of volatile aromas, the recovery of organic solvents during desolventation in edible oil production via solvent extraction, and the elimination of undesirable odorous substances from cream, oils, and fats. The process can be conducted either as a batch operation or continuously, with adjustments to pressure and temperature being critical for achieving efficient separation based on the relative volatilities of the components.

Several distillation methods are employed, including steam distillation, batch distillation, and continuous distillation with fractional columns, each tailored to specific needs in food and beverage production, such as whisky manufacturing. Vapor-liquid equilibrium data are indispensable for designing effective distillation systems; in ideal mixtures, these conditions follow Raoult’s law, though the water-ethanol system deviates from ideality and forms an azeotrope.

Common processes include batch distillation, continuous flash distillation, and fractional distillation, all illustrated through practical examples. Steam distillation stands out as a primary method for recovering essential oils and fragrances. Additionally, pervaporation integrates membrane permeation with evaporation as an alternative separation process; its basic principles are outlined alongside an analysis of its diverse applications.

- Ethanol, the alcohol in wines, has a boiling point of 78.37°C. Since wine is mostly water, the mixture must not be allowed to reach 100°C, or the water will evaporate along with the alcohol. To maximize separation, the temperature should be carefully maintained at the precise boiling point of the target distillate. Once the vapor is collected, it must be cooled to room temperature to condense back into liquid form. The initial distillate is not 100% pure and may retain traces of impurities, especially the original solvent.

Key Takeaways

- The Global Distillation Systems Market is expected to grow from USD 8.0 billion in 2024 to USD 14.1 billion by 2034 at a 5.8% CAGR.

- Column still dominates By Type with a 74.9% share in 2024 due to high-purity separation and scalability.

- Fractional leads By Technology with a 38.5% share in 2024 for fine separations and heat-sensitive materials.

- Column Shells hold top By Component position with 33.4% share in 2024 as durable, customizable core housing.

- Continuous method commands By Method with a 67.3% share in 2024, for high volumes and energy savings.

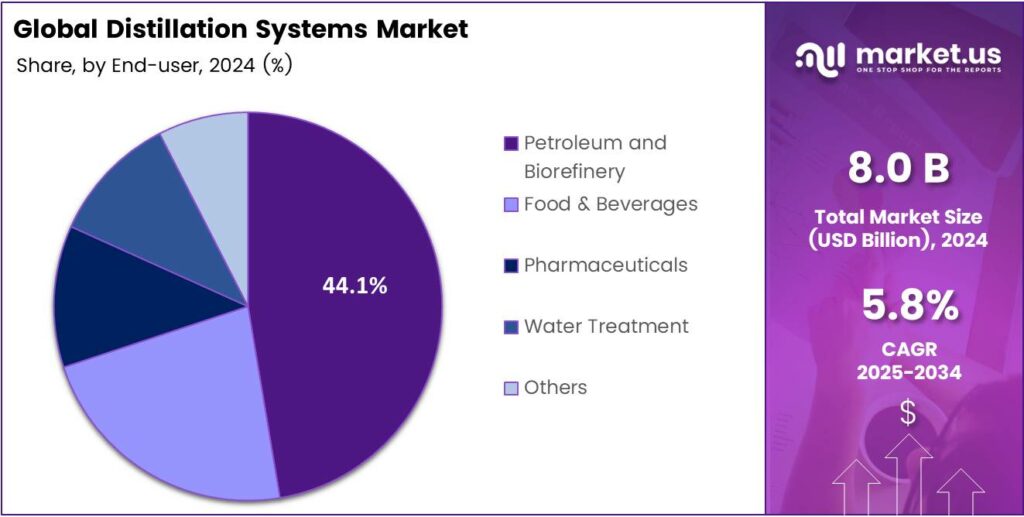

- Petroleum and Biorefinery is leading By End-user with 44.1% share in 202,4, driven by crude separation needs.

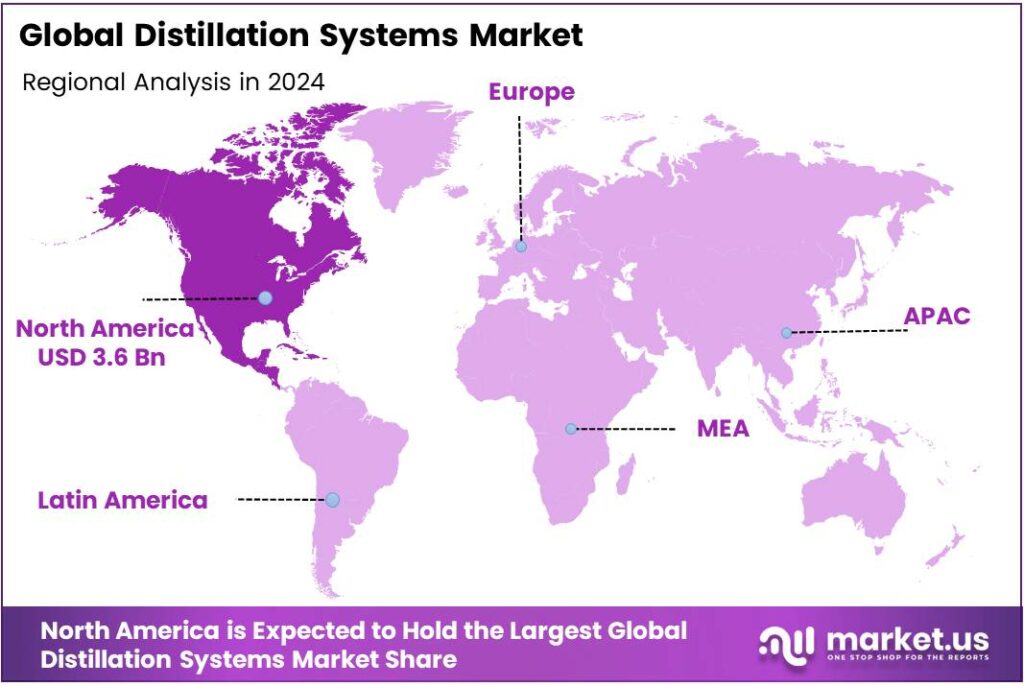

- North America dominates regionally with a 45.8% share of USD 3.6 billion in 2024 via an advanced industrial base.

By Type Analysis

Column still dominates with 74.9% due to its efficiency in large-scale continuous operations.

In 2024, Column Still held a dominant market position in the By Type Analysis segment of the Distillation Systems Market, with a 74.9% share. This sub-segment thrives because it enables high-purity separation in industrial settings. Moreover, its scalability supports massive production volumes.

Additionally, energy-efficient designs reduce operational costs. Pot still follows as a traditional option for smaller batches. It excels in crafting artisanal spirits with unique flavors. However, lower throughput limits its market share. Yet, demand grows in craft distilleries. Consequently, it appeals to niche producers seeking authenticity.

By Technology Analysis

Fractional dominates with 38.5% due to its precision in separating complex mixtures.

In 2024, Fractional held a dominant market position in the By Technology Analysis segment of the Distillation Systems Market, with a 38.5% share. This technology shines in achieving fine separations. Furthermore, it handles heat-sensitive materials effectively. Besides, versatility across industries boosts adoption. Therefore, it leads to sophisticated applications.

Steam technology relies on direct steam injection for heating. It simplifies processes in food processing. Moreover, it offers cost savings. However, energy intensity varies. Thus, it suits specific evaporation needs. Vacuum operates under reduced pressure to lower boiling points. This protects delicate compounds. Additionally, it enhances purity in pharmaceuticals. Consequently, adoption rises for sensitive products.

Multiple-effect (MED) maximizes energy reuse across stages. It cuts utility costs significantly. Furthermore, it fits desalination plants. Hence, sustainability drives its use. Others include emerging or hybrid methods. They address unique challenges. Yet, limited standardization curbs growth. Still, innovation potential remains.

By Component Analysis

Column Shells dominate with 33.4% due to their critical role in system structure.

In 2024, Column Shells held a dominant market position in the By Component Analysis segment of the Distillation Systems Market, with a 33.4% share. These shells provide the core housing for distillation. Moreover, durable materials ensure longevity. Additionally, customization meets varied pressures. Thus, they form the backbone of setups.

Plates and Packings facilitate vapor-liquid contact inside columns. They improve separation efficiency. Furthermore, designs like trays enhance throughput. Consequently, upgrades focus here on performance. Reboilers and Heaters supply essential heat energy. They drive the boiling process. Besides, integration optimizes thermal management. Hence, reliability is key in operations.

By Method Analysis

Continuous dominates with 67.3% due to its efficiency in large-scale operations and uninterrupted processing.

In 2024, Continuous held a dominant market position in the By Method Analysis segment of the Distillation Systems Market, with a 67.3% share. This method excels in handling high volumes seamlessly. Moreover, it reduces downtime significantly. Additionally, energy savings boost its appeal. Thus, industries prefer it for consistent output.

Meanwhile, Batch serves smaller production needs effectively. It offers flexibility in processing varied mixtures. However, it involves more manual intervention. Consequently, operational costs may rise. Yet, it remains vital for custom distillations where precision matters over speed.

By End-user Analysis

Petroleum and Biorefinery dominate with 44.1% due to their critical role in fuel production and refining processes.

In 2024, Petroleum and Biorefinery held a dominant market position in the By End-user Analysis segment of the Distillation Systems Market, with a 44.1% share. This sector demands robust systems for crude separation. Furthermore, it ensures high purity levels. Besides, scalability supports massive outputs. Hence, investments continue to grow here.

Conversely, the Food and Beverage Industry utilizes distillation for flavor extraction and purification. It maintains product quality strictly. Moreover, hygiene standards drive adoption. Additionally, it aids in alcohol production. Therefore, it supports diverse culinary applications efficiently.

Similarly, Pharmaceuticals relies on precise distillation for solvent recovery and drug isolation. It guarantees sterility and accuracy. Furthermore, regulatory compliance is key. Besides, it enhances yield purity. Thus, it plays a crucial role in the manufacturing of medicines.

Key Market Segments

By Type

- Column Still

- Pot Still

By Technology

- Fractional

- Steam

- Vacuum

- Multiple-effect (MED)

- Others

By Component

- Column Shells

- Plates and Packings

- Reboilers and Heaters

- Condenser

- Others

By Method

- Continuous

- Batch

By End-User

- Petroleum and Biorefinery

- Food and Beverages

- Pharmaceuticals

- Water Treatment

- Others

Emerging Trends

Renewable, Energy-Smart Distillation in Food Processing

A big shift in distillation systems is the move toward energy-smart, renewable-powered plants. FAO estimates that agrifood systems already use about 30% of the world’s available energy and are responsible for roughly 30% of global greenhouse gas emissions, largely because they still rely on fossil fuels. That pressure makes every steam column, reboiler, and evaporator in a distillery worth re-thinking.

New designs in beverage, flavor, and edible oil distillation now pair high-efficiency heat exchangers, vapour recompression, and better insulation with solar thermal or green electricity, so the same alcohol, aroma, or ingredient is produced with far less fuel. FAO’s work on renewable energy in agrifood systems highlights that cleaner heat and power can strengthen food security while cutting emissions, especially for energy-hungry unit operations like evaporation and distillation.

In parallel, UNIDO’s energy-system optimization programmes show food factories how to redesign steam networks and process integration rather than just upgrade single boilers. Distillation lines are often at the centre of those studies because they run continuously and touch many utility streams. Policy is nudging this trend along. FAO’s recent focus on green food processing and innovation calls out energy efficiency and low-emission heat as core levers for sustainable value chains.

Drivers

Cutting Food Losses with Cleaner, Tighter Distillation

- One strong driver for better distillation systems is the push to reduce food loss between farm and retail. FAO’s SDG 12.3 monitoring shows that about 13.2% of global food output is lost before it even reaches retail shelves. When you add in losses at retail and households, a widely cited FAO estimate suggests that roughly 30% of food produced worldwide never reaches the human stomach.

A fair share of that waste comes from poor processing, unstable ingredients, and product quality issues that can be traced back to how heat and separation steps are managed. In fruit juice, beer, spirits, dairy ingredients, and edible oils, distillation and evaporation steps decide whether flavour, colour, and stability are within spec.

Modern systems with precise temperature control, better vacuum handling, and automated cleaning can keep aroma compounds, remove unwanted volatiles, and achieve microbiological safety more reliably. That translates to fewer rejected batches and longer shelf life. A stable distilled flavour fraction can be blended into many recipes, reducing the risk that a heat-damaged note will spoil a whole production run.

Restraints

High Energy Intensity and Costly Thermal Infrastructure

The biggest restraint on adopting advanced distillation systems is their heavy dependence on thermal energy and steam infrastructure. Process-heat analyses from the US Department of Energy show that just five sectors, among them food and beverages, use over 80% of U.S. manufacturing thermal process energy.

UNIDO has long pointed out that industrial motor and steam systems consume huge amounts of energy and often remain inefficient at the system level, even when individual components such as boilers or pumps are modern. For a food company that lives on thin margins, tying an investment decision to a complex steam-system revamp, new heat-recovery loops, and advanced controls can feel risky.

Regulatory pressure on emissions can paradoxically slow decisions as well. When a country tightens fuel standards or carbon pricing, executives may postpone new distillation lines until they are certain about long-term energy policy and gas or electricity prices. Smaller processors in emerging markets struggle even more because concessional finance and technical support reach them slowly.

Opportunity

Distillation for Safe Water and High-Purity Ingredients

- A powerful growth opportunity for distillation systems lies at the intersection of food-grade processing and safe water. UNICEF’s 2025 update on drinking-water access notes that 2.1 billion people still lack safely managed drinking water services, even though around 961 million gained, lifting global coverage from 68% to 74%.

For beverage producers, bottlers, and ingredient suppliers, this gap underscores how valuable robust purification steps are, especially in regions where raw water is inconsistent. Distillation, whether in classic distillers, multi-effect evaporators, or membrane-hybrid systems, offers a way to produce very clean process water, alcohols, and solvents that meet strict food-safety standards.

That same plant may also supply high-purity water to nearby communities or contract bottlers under public–private partnerships shaped by national WASH and food-safety strategies. WHO and UNICEF’s joint monitoring work has pushed many governments to strengthen regulations around safe water and hygienic processing, which in turn encourages investments in reliable purification trains.

Regional Analysis

North America leads with a 45.8% share and a USD 3.6 Billion market value.

North America continues to dominate the global Distillation Systems Market, holding a strong 45.8% share valued at USD 3.6 billion in 2024. The region’s leadership is shaped by its mature industrial base, advanced chemical processing facilities, and strong adoption of energy-efficient distillation technologies.

The United States remains the central driver, supported by its large petrochemical, oil refining, food processing, and pharmaceutical production clusters. Refineries across the U.S. Gulf Coast are upgrading distillation columns to enhance throughput and reduce operational energy use, aligning with Department of Energy (DOE) efficiency guidelines.

North American manufacturers are early adopters of automation-enabled systems, integrating smart sensors, real-time monitoring, and advanced process control tools to cut downtime and reduce energy losses. This shift is reinforced by strong environmental regulations, which push industries to adopt cleaner, low-emission distillation setups.

The food and beverage sector—especially breweries, dairy processors, and distillers continues to invest in modern fractional and steam distillation systems to ensure product quality and consistency. Pharmaceutical manufacturers in the U.S. and Canada also rely heavily on premium distillation solutions for solvent recovery and ingredient purification.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

GEA is a technology leader specializing in sophisticated engineering and process solutions. In the distillation systems market, the company excels by providing high-performance, energy-efficient plants for demanding sectors like chemicals, pharmaceuticals, and food & beverage. Their strength lies in offering integrated, customized systems that optimize separation processes, reduce operational costs, and ensure maximum product purity.

Veolia leverages its global expertise in water, waste, and energy management to serve the distillation systems market, particularly in environmental applications. The company focuses on designing and implementing systems for solvent recovery, wastewater treatment, and resource purification. Their strength is providing circular economy solutions, helping clients reclaim valuable materials and reduce environmental impact.

SUEZ is a prominent force in water and waste solutions, applying this expertise to distillation for purification and recovery purposes. The company provides advanced systems primarily for treating industrial wastewater, recovering solvents, and desalination. Their strategic focus is on helping industries comply with environmental regulations, minimize their ecological footprint, and achieve water security.

Top Key Players in the Market

- GEA Group Aktiengesellschaft

- Veolia Environnement S.A.

- SUEZ S.A.

- Alfa Laval AB

- SPX FLOW, Inc.

- Sulzer Ltd

- Koch-Glitsch, LP

- Aquatech International LLC

- Pfaudler, Inc.

- HRS Heat Exchangers Ltd

Recent Developments

- In 2025, GEA opened its New Food Application and Technology Center (ATC) in Janesville, Wisconsin, USA, to advance innovations in food processing technologies, including potential applications for distillation-related separation in dairy and beverages. Source: GEA Group via ZoomInfo.

- In 2024, SUEZ secured a design-build-operate contract seawater RO desalination plant in Taiwan, enhancing water supply through efficient filtration akin to distillation processes. The company partnered with Maynilad Water Services, Inc., to deploy Cyclor Turbo technology in a wastewater treatment project.

Report Scope

Report Features Description Market Value (2024) USD 8.0 Billion Forecast Revenue (2034) USD 14.1 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Column Still, Pot Still), By Technology (Fractional, Steam, Vacuum, Multiple-effect (MED), Others), By Component (Column Shells, Plates and Packings, Reboilers and Heaters, Condenser, Others), By Method (Continuous, Batch), By End-user (Petroleum and Biorefinery, Food and Beverages, Pharmaceuticals, Water Treatment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape GEA Group Aktiengesellschaft, Veolia Environnement S.A., SUEZ S.A., Alfa Laval AB, SPX FLOW, Inc., Sulzer Ltd, Koch-Glitsch, LP, Aquatech International LLC, Pfaudler, Inc., HRS Heat Exchangers Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Distillation Systems MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Distillation Systems MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GEA Group Aktiengesellschaft

- Veolia Environnement S.A.

- SUEZ S.A.

- Alfa Laval AB

- SPX FLOW, Inc.

- Sulzer Ltd

- Koch-Glitsch, LP

- Aquatech International LLC

- Pfaudler, Inc.

- HRS Heat Exchangers Ltd