Global Desiccated Coconut Market Size, Share, And Business Benefits By Nature (Conventional, Organic), By Form (Powder, Granular, Flakes, Chips, Shreds), By Application (Bakery and Confectionery, Dairy, Health Foods and Supplements, Culinary, Others), By End Use (Households, Food and Beverage Industry, Food Services Industry), By Distribution Channel (Supermarkets and Hypermarkets, Online, Convenience Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152132

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

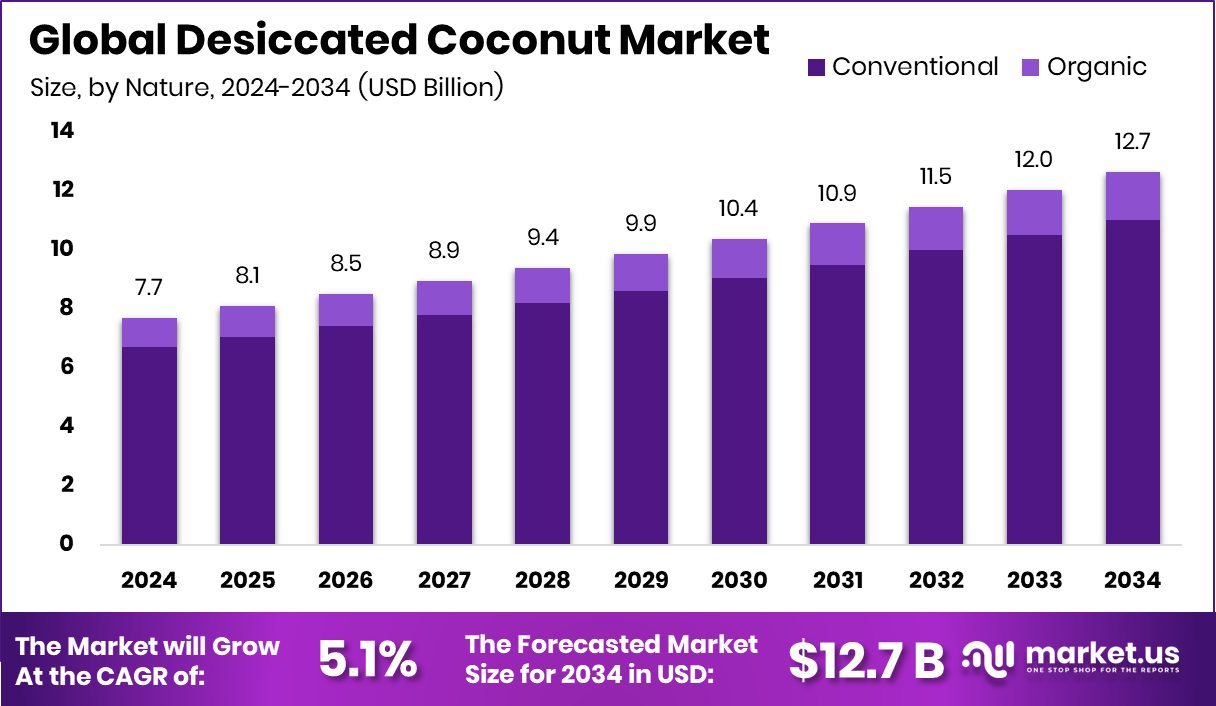

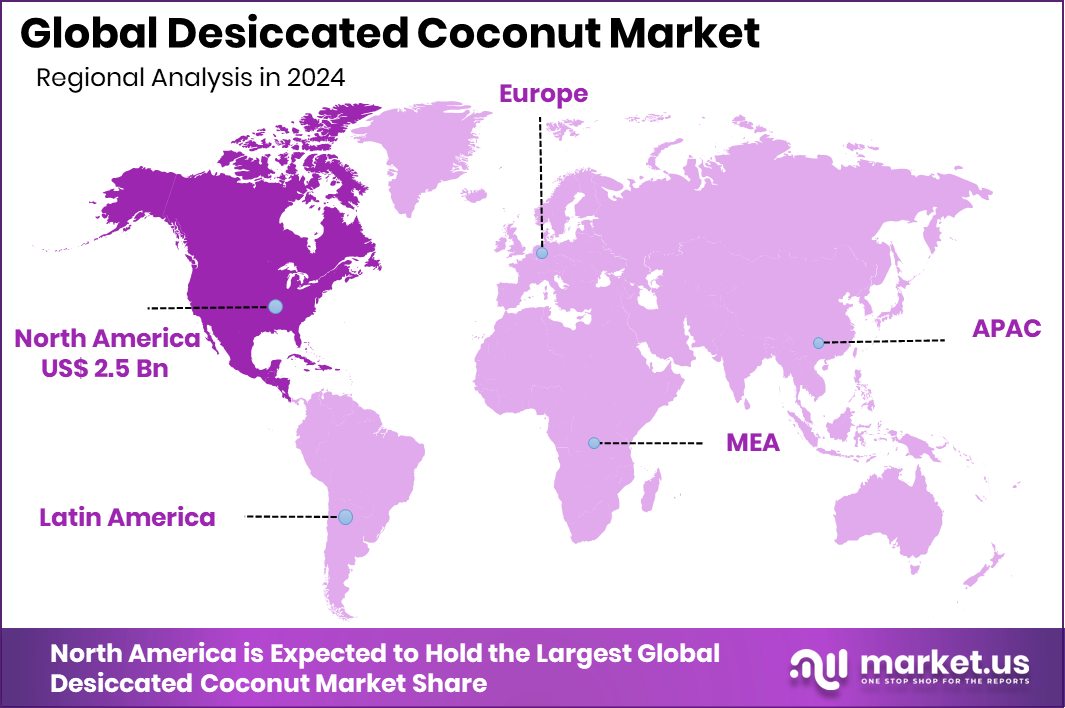

Global Desiccated Coconut Market is expected to be worth around USD 12.7 billion by 2034, up from USD 7.7 billion in 2024, and grow at a CAGR of 5.1% from 2025 to 2034. Strong demand from food industries boosted North America’s USD 2.5 billion market share.

Desiccated coconut is finely grated, dried, and unsweetened coconut flesh that is primarily used in the food and beverage industry. It is made by removing the moisture content from fresh coconut meat and grinding it into various grades, including fine, medium, and coarse. It retains the natural flavor and aroma of coconut, making it a popular ingredient in baked goods, confectionery, cereals, snack bars, and savory dishes.

The desiccated coconut market comprises the global trade and consumption of this processed coconut product across various industries. It serves a wide range of applications, particularly in the food processing sector, as a key ingredient in packaged and ready-to-eat products. The market is driven by demand from the bakery, confectionery, and health food segments. It also includes supply-side dynamics, such as the availability of raw coconuts, regional production capabilities, and global export trends, especially from coconut-producing countries in Asia and the Pacific.

The growth of the desiccated coconut market can be attributed to the rising demand for natural, plant-based ingredients in processed foods. With increasing health consciousness, consumers are seeking alternatives to synthetic additives and artificial flavors, favoring desiccated coconut for its clean-label and functional properties. David, a functional snack brand focused on building muscle and reducing fat, has secured $75 million in Series A funding, led by Greenoaks with additional backing from Valor Equity Partners.

Rising consumption of baked goods and confectionery items globally is one of the primary drivers of demand. The inclusion of desiccated coconut in granola bars, cookies, pastries, and chocolates continues to gain traction due to its distinct flavor and nutritional content. According to an industry report, Harmless Harvest, a refrigerated coconut water company headquartered in San Francisco, California, has raised $30 million in growth capital.

Key Takeaways

- Global Desiccated Coconut Market is expected to be worth around USD 12.7 billion by 2034, up from USD 7.7 billion in 2024, and grow at a CAGR of 5.1% from 2025 to 2034.

- In 2024, conventional desiccated coconut dominated the market, accounting for a significant 87.2% share.

- Powdered desiccated coconut held a 32.1% market share due to its versatility in food applications.

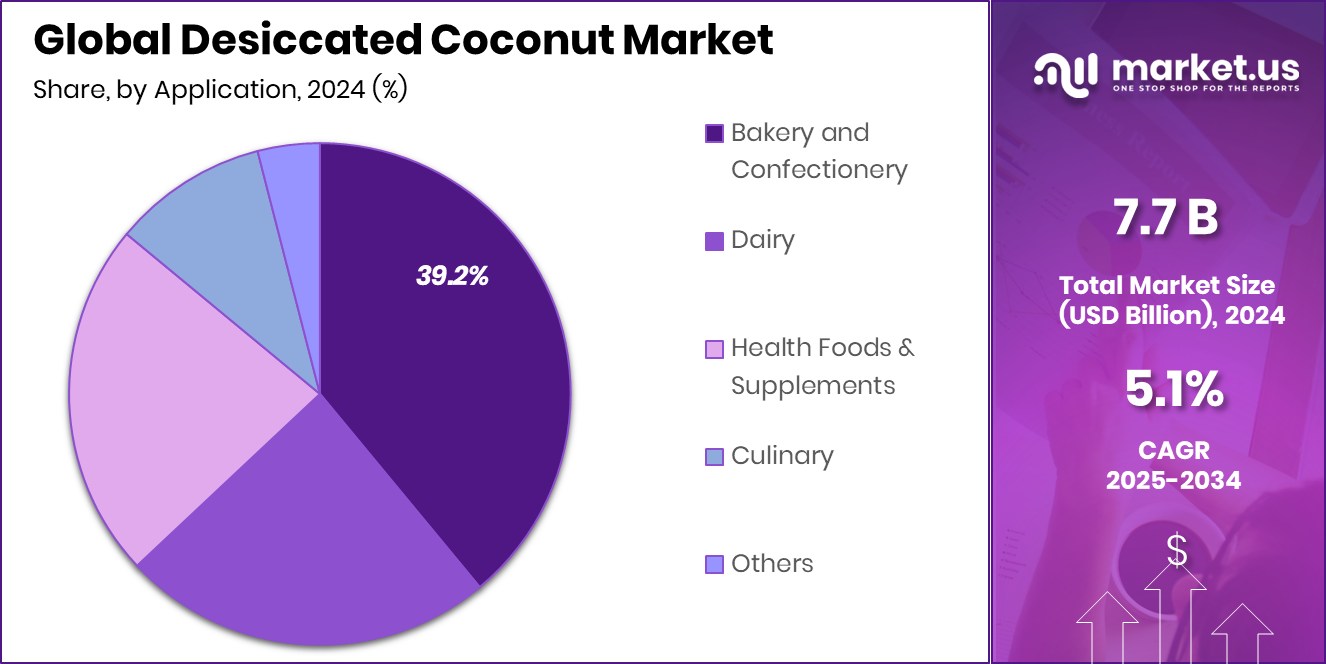

- Bakery and confectionery applications led demand, capturing 39.2% of the desiccated coconut market in 2024.

- The food and beverage industry remained the primary consumer, holding 56.8% market share in 2024.

- Supermarkets and hypermarkets dominated distribution channels, accounting for 36.6% of global desiccated coconut sales.

- The market in North America reached a value of USD 2.5 billion in 2024.

By Nature Analysis

Conventional desiccated coconut dominates with 87.2% market share globally.

In 2024, Conventional held a dominant market position in the By Nature segment of the Desiccated Coconut Market, with an 87.2% share. This significant market share can be attributed to the widespread availability, cost-effectiveness, and established supply chains supporting conventional coconut farming practices. The preference for conventional desiccated coconut remains high among food processors, confectionery manufacturers, and commercial bakeries due to its consistent quality, year-round supply, and competitive pricing.

The large-scale production of conventional coconuts across major producing countries has ensured a stable and scalable source of raw material, allowing manufacturers to meet the growing global demand without disruption. Additionally, conventional desiccated coconut is favored in high-volume applications where organic certification is not a primary requirement, such as in large-scale food production, packaged foods, and exports to developing markets.

Despite the rising awareness about organic products, conventional desiccated coconut continues to dominate as the preferred choice for many businesses, particularly in price-sensitive segments. The strong position of the conventional category is also supported by favorable processing infrastructure and reduced certification costs, further reinforcing its market leadership in 2024.

By Form Analysis

The powder form of desiccated coconut holds 32.1% market share.

In 2024, Powder held a dominant market position in the By Form segment of the Desiccated Coconut Market, with a 32.1% share. This strong market presence is primarily due to its versatile usage across a wide range of food applications, including bakery items, snacks, desserts, and instant food products. The powdered form of desiccated coconut offers ease of blending, uniform texture, and longer shelf life, making it highly suitable for industrial-scale food processing and packaged food formulations.

Food manufacturers prefer powdered desiccated coconut for its ability to integrate seamlessly into both dry and semi-moist formulations without altering consistency or requiring additional processing. It also enhances product texture and imparts a natural coconut flavor, which adds value to various end products. Furthermore, its lightweight and compact form reduces packaging and transportation costs, contributing to operational efficiencies across the supply chain.

The dominance of the powder form is further supported by its suitability for high-speed production environments, where uniformity and flowability are essential. As a result, its demand remains strong from commercial bakeries, confectionery producers, and instant meal manufacturers. In 2024, the preference for powdered desiccated coconut continues to grow, driven by functional benefits and compatibility with modern food manufacturing processes.

By Application Analysis

Bakery and confectionery lead application with 39.2% market dominance.

In 2024, Bakery and Confectionery held a dominant market position in the By Application segment of the Desiccated Coconut Market, with a 39.2% share. This leading position is driven by the widespread use of desiccated coconut as a key ingredient in cakes, cookies, pastries, sweets, and chocolate-based products. Its ability to enhance flavor, texture, and moisture retention makes it highly valuable to both artisanal and commercial baking operations.

The rising global consumption of baked goods and confectionery, particularly in urban regions, has contributed significantly to the segment’s growth. Desiccated coconut in bakery and confectionery applications not only adds a unique tropical taste but also provides visual appeal and improved mouthfeel, which are essential for consumer satisfaction. Its use is especially prominent in product categories that emphasize natural and plant-based ingredients.

Moreover, the long shelf life and easy incorporation of desiccated coconut powder or shreds into various recipes support high-volume, consistent production in commercial food environments. This consistency, along with its cost efficiency and ease of handling, has reinforced its preference among manufacturers. As a result, bakery and confectionery applications continue to anchor the desiccated coconut market, maintaining a clear dominance with a 39.2% share in 2024.

By End Use Analysis

The food and beverage industry uses 56.8% of desiccated coconut.

In 2024, the Food and Beverage Industry held a dominant market position in the By End Use segment of the Desiccated Coconut Market, with a 56.8% share. This substantial share reflects the increasing incorporation of desiccated coconut in a wide range of processed and packaged food items, including bakery goods, confectionery, ready-to-eat meals, cereals, and desserts. The food and beverage industry values desiccated coconut for its rich flavor, versatility, and ability to improve texture and visual appeal across various products.

Manufacturers in this segment rely on desiccated coconut for its long shelf life and ease of use in large-scale production. It offers consistent quality and is available in different grades, such as fine, medium, or powdered forms, allowing for flexible applications depending on the product requirements. Its plant-based nature also aligns with the industry’s growing interest in natural and clean-label ingredients.

The dominance of the food and beverage sector is further supported by consumer demand for tropical and ethnic flavors, where coconut is a key ingredient. As global consumption patterns shift toward flavorful, plant-based, and convenient food options, desiccated coconut continues to be a preferred choice in the industry’s ingredient portfolio, securing its leading 56.8% share in 2024.

By Distribution Channel Analysis

Supermarkets and hypermarkets distribute 36.6% of the total market volume.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the distribution Channel segment of the Desiccated Coconut Market, with a 36.6% share. This strong foothold is attributed to their wide consumer reach, extensive shelf space, and ability to offer a diverse range of food products under one roof. These large-format retail outlets provide consumers with convenient access to both domestic and imported brands of desiccated coconut in various forms and packaging sizes.

The organized retail structure of supermarkets and hypermarkets supports effective in-store promotion, better visibility, and product placement, which collectively enhance consumer buying behavior. Shoppers often prefer these stores for the assurance of product quality, easy comparison of brands, and availability of value packs suited for both household and commercial use.

In addition, supermarkets and hypermarkets often serve as the first point of purchase for new product launches, helping brands gain faster traction among a wider audience. Their ability to handle bulk procurement and maintain regular stock further strengthens their position in the supply chain.

Key Market Segments

By Nature

- Conventional

- Organic

By Form

- Powder

- Granular

- Flakes

- Chips

- Shreds

By Application

- Bakery and Confectionery

- Dairy

- Health Foods and Supplements

- Culinary

- Others

By End Use

- Households

- Food and Beverage Industry

- Food Services Industry.

By Distribution Channel

- Supermarkets and Hypermarkets

- Online

- Convenience Stores

- Others

Driving Factors

Rising Use in Processed Food and Snacks

One of the main driving factors for the desiccated coconut market is its increasing use in processed foods and snacks. As more people choose ready-to-eat meals, bakery items, cereals, and snack bars, the demand for ingredients like desiccated coconut has grown steadily. Its natural taste, long shelf life, and easy storage make it a perfect choice for food manufacturers.

It also adds texture, flavor, and visual appeal to many packaged products. In today’s market, consumers are more focused on plant-based and clean-label ingredients, and desiccated coconut fits this demand well. Its wide application across sweet and savory food products continues to push its usage forward, especially in urban and health-conscious markets.

Restraining Factors

Price Fluctuations Due to Raw Coconut Supply

A major restraining factor for the desiccated coconut market is the frequent price fluctuations caused by the unstable supply of raw coconuts. Coconut production is heavily dependent on weather conditions and seasonal cycles. Natural events like droughts, floods, or cyclones can damage coconut plantations and reduce yield, leading to sudden shortages.

When the supply of raw coconuts drops, the cost of production increases, which directly affects the pricing of desiccated coconut in the market. These unpredictable variations in cost make it difficult for manufacturers to plan and maintain stable pricing. Inconsistent availability also disrupts global trade and creates supply chain challenges, especially for companies dependent on steady imports from coconut-producing regions.

Growth Opportunity

Growing Demand for Plant-Based Food Ingredients Globally

A key growth opportunity in the desiccated coconut market lies in the rising global demand for plant-based food ingredients. As more consumers shift towards vegetarian, vegan, and dairy-free diets, the use of coconut-based products is increasing in food and beverage items. Desiccated coconut, being natural and plant-derived, fits perfectly into this trend. It is used in dairy alternatives, vegan desserts, energy bars, and health-focused snacks.

Health-conscious consumers prefer clean-label products with fewer artificial ingredients, and desiccated coconut offers both taste and nutritional value. This shift in eating habits, especially in developed countries, is opening new markets for coconut-based ingredients. As awareness of plant-based lifestyles grows, demand for desiccated coconut is expected to rise steadily.

Latest Trends

Rise of Organic and Clean‐Label Coconut Products

One of the latest trends in the desiccated coconut market is the rise of organic and clean‐label coconut products. Consumers are becoming more aware of what goes into their food and prefer natural, unprocessed ingredients. Organic desiccated coconut is free from pesticides, chemicals, and preservatives, which appeals to health‐conscious buyers.

Clean‐label packaging highlights minimal processing, clear ingredient lists, and no artificial additives—qualities that many shoppers now seek. This trend is especially strong in premium food segments like health bars, granola mixes, and specialty baking goods. Brands are responding by offering certified organic and minimally processed desiccated coconut in eco‐friendly packaging.

Regional Analysis

In 2024, North America held a 32.9% share of the desiccated coconut market.

In 2024, North America emerged as the dominant region in the desiccated coconut market, accounting for a substantial 32.9% share and reaching a market value of USD 2.5 billion. The strong foothold of this region is primarily driven by the high consumption of packaged and processed foods, particularly in the United States and Canada. Desiccated coconut is widely used in the production of bakery products, cereals, snack bars, and confectionery items across the region, supported by consumer preferences for plant-based and tropical ingredients.

In Europe, steady demand continues due to the popularity of ethnic cuisines and growing interest in natural food components, though it remains behind North America in overall market share. The Asia Pacific region, while not leading, benefits from being a major supplier of raw coconuts and processed coconut products, which supports domestic use and exports.

Meanwhile, markets in the Middle East & Africa and Latin America are gradually expanding, supported by rising urbanization and evolving food habits. However, these regions currently maintain a smaller share compared to North America. Overall, North America’s dominance reflects both high consumption patterns and a mature food processing industry, positioning it at the forefront of the global desiccated coconut market in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bake King has continued to leverage its established presence in the bakery ingredients space. Its dedicated focus on ensuring consistent quality, coupled with strong relationships with food manufacturers, has enabled seamless integration of its desiccated coconut into bakery and confectionery formulations. By maintaining rigorous quality protocols and supply chain efficiency, Bake King has enhanced its reliability as a preferred supplier, particularly in markets seeking standardized ingredient performance.

CBL Natural Foods remains committed to the production of clean-label, naturally processed coconut products. The company’s emphasis on traceability and minimal additive use aligns with growing consumer demand for transparency. Its investment in certified processing facilities ensures that its desiccated coconut meets the requirements of premium and health-oriented segments.

Celebes Coconut Corporation, based in Southeast Asia, benefits from proximity to raw material sources. This geographic advantage allows the company to consolidate supply and maintain competitive pricing. By optimizing logistics and leveraging regional production capacity, Celebes has strengthened its export footprint. Its strategic sourcing model also supports supply chain resilience amid seasonal fluctuations, reinforcing customer confidence.

Ken Taste Products Limited has focused on diversification, offering multiple product grades and packaging formats catering to both industrial and retail channels. Their ability to supply fine, medium, and coarse grades of desiccated coconut enhances their responsiveness to varying application needs, from confectionery to savory applications. This flexibility, backed by scalable manufacturing, supports growth across different end‑use segments.

Top Key Players in the Market

- Bake King

- CBL Natural Foods

- Celebes Coconut Corporation

- Ken Taste Products Limited

- Cocomi

- Coloma Bio Organic

- Fiesta

- Holland & Barrett

- Ken Taste Products Limited

- Pacific Eastern Coconut Utama

- Primex Coco Products Inc.

- S & P industries

- VIET DELTA Corporation

- WV Industries

- Highlands Desiccated Coconut Produce (M) Sdn Bhd

Recent Developments

- In November 2024, CBL Global Foods—a core part of CBL Natural Foods—hosted a delegation from the International Coconut Community at their facilities. This event highlights the company’s active engagement with global coconut organizations and its recognized leadership within the international coconut industry.

- In April 2024, Celebes Coconut Corporation showcased its organic desiccated coconut and other coconut-based offerings—such as virgin coconut oil, coconut milk, and coconut water—at the Natural Products Expo West trade show, held in Anaheim, California. This event reinforced the company’s position in the health‑food and organic ingredient sectors, allowing it to engage directly with buyers, distributors, and health‑oriented brands.

Report Scope

Report Features Description Market Value (2024) USD 7.7 Billion Forecast Revenue (2034) USD 12.7 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Conventional, Organic), By Form (Powder, Granular, Flakes, Chips, Shreds), By Application (Bakery and Confectionery, Dairy, Health Foods and Supplements, Culinary, Others), By End Use (Households, Food and Beverage Industry, Food Services Industry), By Distribution Channel (Supermarkets and Hypermarkets, Online, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bake King, CBL Natural Foods, Celebes Coconut Corporation, Ken Taste Products Limited, Cocomi, Coloma Bio Organic, Fiesta, Holland & Barrett, Ken Taste Products Limited, Pacific Eastern Coconut Utama, Primex Coco Products Inc., S & P industries, VIET DELTA Corporation, WV Industries, Highlands Desiccated Coconut Produce (M) Sdn Bhd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bake King

- CBL Natural Foods

- Celebes Coconut Corporation

- Ken Taste Products Limited

- Cocomi

- Coloma Bio Organic

- Fiesta

- Holland & Barrett

- Ken Taste Products Limited

- Pacific Eastern Coconut Utama

- Primex Coco Products Inc.

- S & P industries

- VIET DELTA Corporation

- WV Industries

- Highlands Desiccated Coconut Produce (M) Sdn Bhd