Global Deep Learning Market Size, Share, Industry Analysis Report By Solution (Hardware (Central Processing Unit (CPU), Graphics Processing Unit (GPU), Field Programmable Gate Array (FPGA), Application-Specific Integration Circuit (ASIC)), Software, Services (Installation Services, Integration Services, Maintenance & Support Services), By Application (Image Recognition, Voice Recognition, Video Surveillance & Diagnostics, Data Mining), By End-use (Automotive, Aerospace & Defense, Healthcare, Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156138

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- U.S. Deep Learning Market Size

- Solution Analysis

- Application Analysis

- End-use Outlook Analysis

- Emerging Trends

- Top Use Cases

- Key Market Segments

- By End-use Outlook

- Top Impacting Factors on Growth

- Customer Insights

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

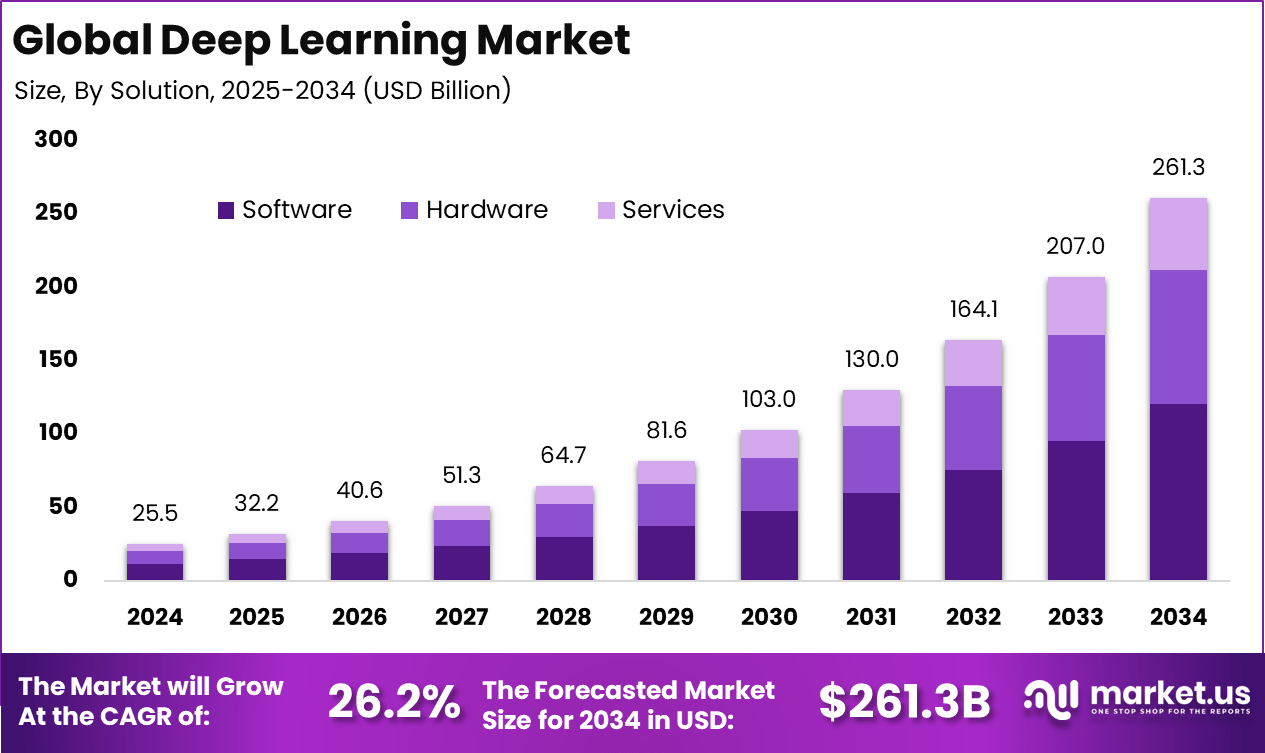

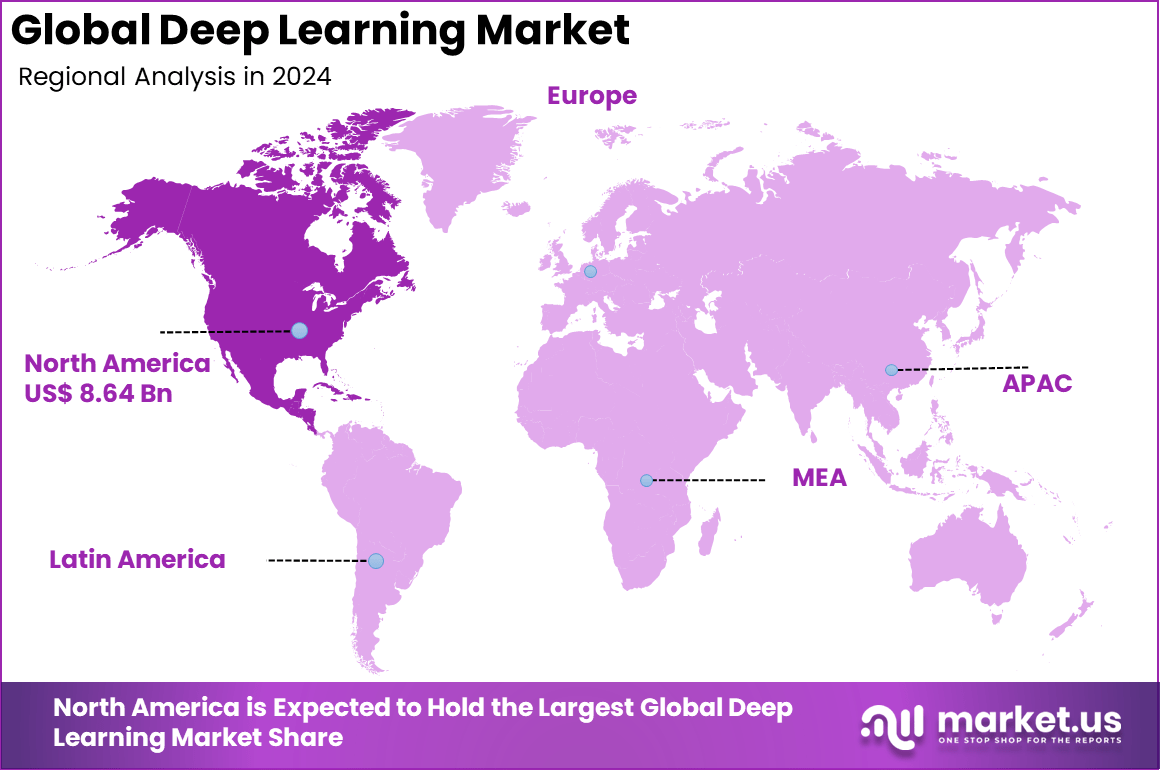

The Global Deep Learning Market size is expected to be worth around USD 261.3 billion by 2034, from USD 25.5 billion in 2024, growing at a CAGR of 26.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 33.9% share, holding USD 8.64 billion in revenue.

The Deep Learning Market focuses on advanced artificial intelligence techniques that use layered neural networks to analyze vast amounts of data and deliver intelligent decision-making, automation, and pattern recognition across industries. Deep learning is widely deployed in areas like healthcare, finance, automotive, retail, and manufacturing for applications such as image and speech recognition, predictive analytics, fraud detection, autonomous vehicles, and digital assistants.

One of the top driving factors for growth in the deep learning market is the explosive rise in data generated by IoT devices, digital platforms, and enterprise business systems. As organizations look to make sense of this information, the need for technologies that efficiently analyze and interpret such data has become critical. The field has greatly benefited from the ongoing development of hardware accelerators like GPUs and AI-specific chips, as these advancements have made it feasible to train and deploy deep learning models.

Based on data from wifitalents, Deep learning has brought major progress to AI projects, with over 85% reporting better performance, as per wifitalents. Convolutional neural networks (CNNs) have led the growth in image recognition, improving accuracy by over 20% between 2012 and 2020. However, such progress comes with high energy use. Training one GPT-3 model consumes around 1,287 MWh of electricity, equal to what 100 U.S. households use in a year.

In language tasks, transformer models like BERT now achieve up to 94% accuracy, replacing older RNNs. Deep learning is also helping healthcare, improving cancer detection accuracy by up to 15%. By 2025, it is expected that 60% of digital interactions will be handled by AI and deep learning systems. GPT-4, with over 170 billion parameters, stands as the largest neural model yet, showing the scale this technology has reached.

For instance, In October 2024, deep learning was applied to 3D medical imaging to predict disease risk, marking an important step in healthcare analytics. By using advanced algorithms, this technology can identify early signs of conditions such as cancer and neurological disorders with higher accuracy. The ability to detect diseases at earlier stages supports more effective treatment strategies and improves patient outcomes.

Key Takeaway

- By Solution, Software led with 46.1% share, reflecting strong demand for AI platforms and frameworks.

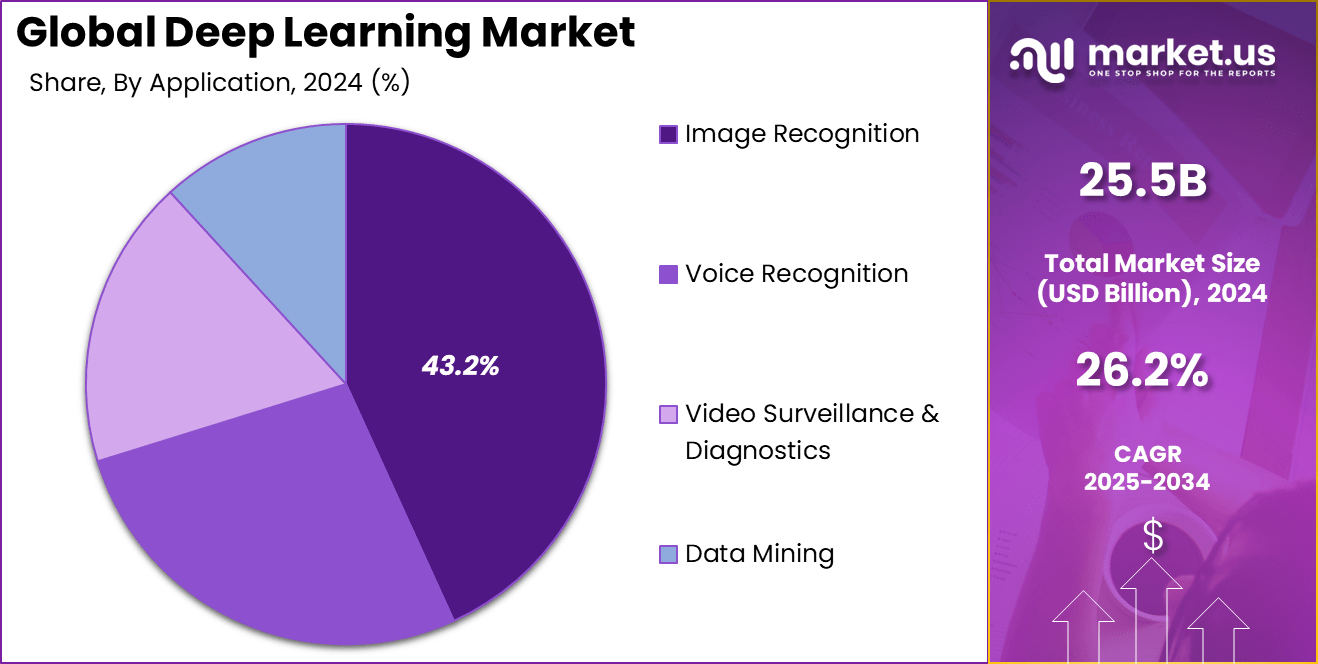

- By Application, Image Recognition dominated with 43.2% share, driven by adoption in healthcare, security, and retail.

- By End-use, Automotive held 39.6% share, supported by autonomous driving and ADAS technologies.

- By Region, North America captured 33.9% share of the global market.

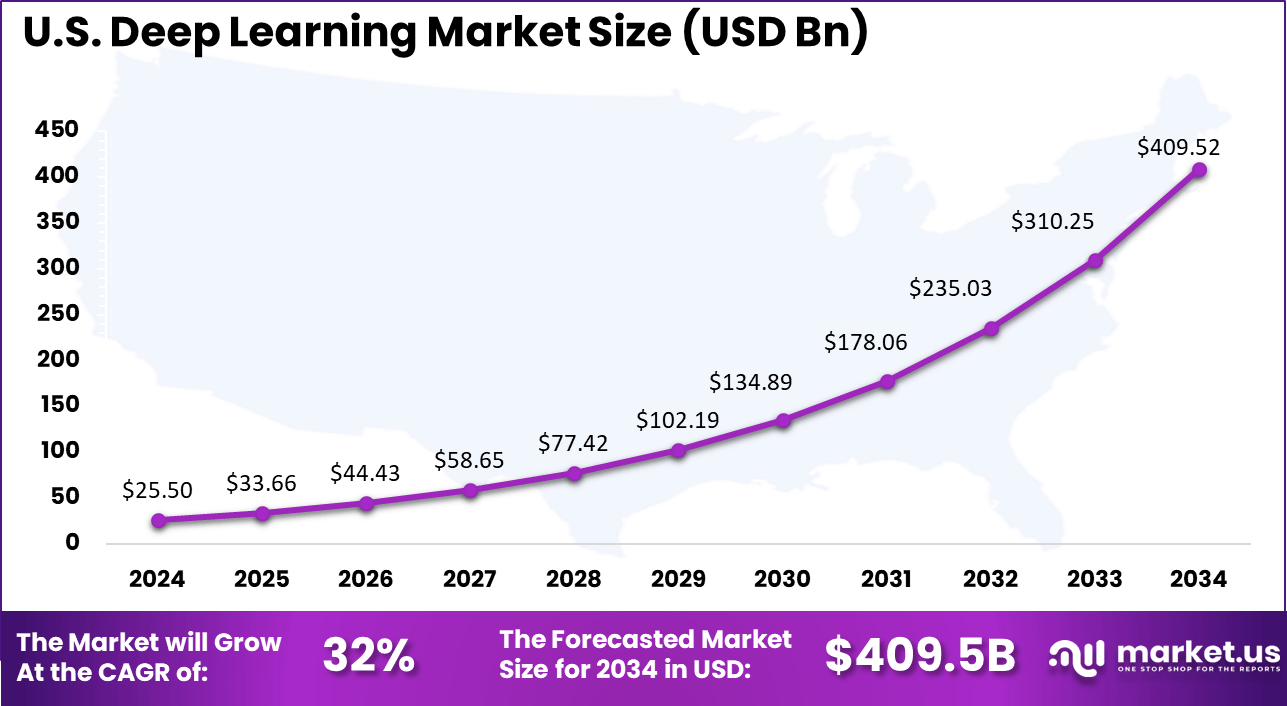

- U.S. Market, valued at USD 25.50 Billion in 2024, is projected to grow at a CAGR of 32%, highlighting rapid enterprise adoption and AI integration.

U.S. Deep Learning Market Size

The market for Deep Learning within the U.S. is growing tremendously and is currently valued at USD 25.50 billion, the market has a projected CAGR of 32%. The market is growing tremendously due to a combination of factors such as advancements in AI research, increased availability of large datasets, and the rise of powerful computing infrastructure.

The U.S. is home to leading tech companies and research institutions driving innovations in deep learning applications across sectors like healthcare, finance, and autonomous vehicles. Additionally, significant investments from both the government and private sectors are accelerating the adoption of deep learning technologies for commercial and industrial use.

For instance, in September 2024, NVIDIA announced its partnership in a U.S. government initiative aimed at fostering globally inclusive AI, further cementing the country’s dominance in deep learning. The collaboration emphasizes the U.S.’s leadership in AI innovation, leveraging powerful technologies to drive advancements in sectors like healthcare, defense, and education.

In 2024, North America held a dominant market position in the Global Deep Learning Market, capturing more than a 33.9% share, holding USD 8.64 billion in revenue. This dominance is due to its robust technological infrastructure, substantial investments, and the presence of leading tech companies like NVIDIA, Google, and Microsoft, along with top research institutions.

The region’s advanced computing power, especially in AI-driven sectors like healthcare, automotive, and finance, has accelerated the adoption of deep learning. Additionally, progress in autonomous systems and deep learning frameworks further boosted the market’s expansion, establishing North America as a key player in AI innovation.

For instance, in November 2023, North America reinforced its dominance in deep learning with significant advancements in medical imaging at the RSNA conference. Innovations in AI-driven technologies, particularly for disease detection and diagnosis, highlighted the region’s leadership in healthcare applications of deep learning.

Solution Analysis

In 2024, Software holds the largest share in the deep learning market solution segment, accounting for 46.1%. Deep learning software frameworks, libraries, and development tools are at the core of modern artificial intelligence research and commercial deployments. These software platforms provide the infrastructure required to design, train, and deploy complex neural network models across various industries.

The flexibility, scalability, and continuous updates of deep learning software solutions make them a preferred choice for organizations aiming to implement or scale AI applications. As the adoption of AI expands, the need for robust and user-friendly software solutions continues to fuel this segment’s growth.

For Instance, in December 2023, Neurocle released an updated version of its deep learning software for inspection applications, enhancing its capabilities in industrial automation. The updated software integrates advanced deep learning algorithms to improve accuracy and speed in visual inspections, enabling real-time defect detection and quality control.

Application Analysis

In 2024, Image recognition is a leading application area within the deep learning market, holding a 43.2% share. Deep learning-powered image recognition is widely used in facial recognition, digital imaging, automated quality inspection, and medical diagnostics. Its ability to process and analyze vast volumes of visual data with high accuracy is revolutionizing industries like security, healthcare, retail, and manufacturing.

Advances in convolutional neural networks (CNNs) and the availability of large annotated datasets enable image recognition solutions to deliver high precision and reliability. Organizations across sectors rely on this technology for both operational efficiency and competitive advantage in visual data processing.

For instance, in April 2024, the introduction of MONET, a new AI tool, enhanced medical imaging through the integration of deep learning and text analysis. This innovative tool combines advanced image processing techniques with natural language processing to extract and interpret both visual and textual data from medical records.

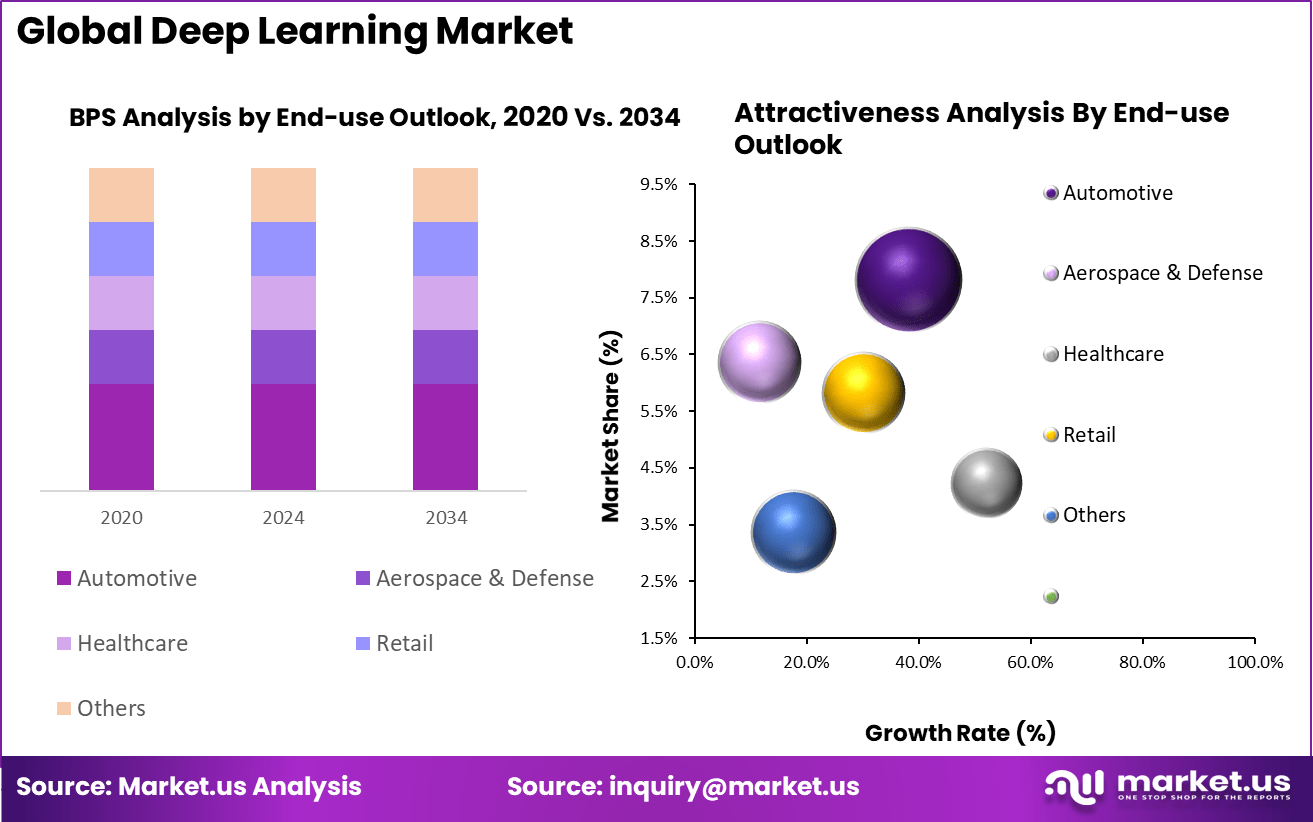

End-use Outlook Analysis

The automotive industry commands a 39.6% share of the deep learning market by end-use outlook, reflecting the sector’s rapid integration of AI technologies. Deep learning is fundamental to enabling advanced driver-assistance systems (ADAS), autonomous vehicles, in-vehicle virtual assistants, and predictive maintenance solutions. Manufacturers are leveraging deep learning to enhance vehicle safety, navigation, and user experience.

The focus on connected and autonomous cars is driving investment in deep learning applications within automotive, as these systems rely on robust AI models for real-time decision-making and environmental perception. This trend is expected to accelerate further as regulatory and consumer demand for intelligent vehicle technologies rises.

For Instance, in August 2025, deep learning technology was leveraged to enhance automated weld seam inspection in automotive production. The integration of deep learning algorithms into inspection systems allows for high-precision detection of weld defects, improving quality control and reducing production errors.

Emerging Trends

Trend Details Explainable AI (XAI) Focus on transparency, interpretability, trust, and bias mitigation Federated Learning Training decentralized models preserving data privacy Self-Supervised Learning Reduces labeled data dependency by using pseudo-labeling Quantum Deep Learning Uses quantum computing to accelerate training and inferencing Interoperability Improved cross-platform neural network collaboration (e.g., ONNX) Top Use Cases

Use Case Details Image Recognition & Classification Facial recognition, medical imaging, object detection Natural Language Processing (NLP) Virtual assistants, chatbots, language translation, sentiment analysis Fraud Detection in Finance Anomaly detection, transaction monitoring Recommendation Systems Personalized content for Netflix, Spotify, e-commerce Autonomous Driving Vehicle navigation, obstacle detection Predictive Maintenance Equipment failure prediction in automotive and manufacturing Customer Relationship Management Personalized services and financial advice Key Market Segments

By Solution

- Hardware

- Central Processing Unit (CPU)

- Graphics Processing Unit (GPU)

- Field Programmable Gate Array (FPGA)

- Application-Specific Integration Circuit (ASIC)

- Software

- Services

- Installation Services

- Integration Services

- Maintenance & Support Services

By Application

- Image Recognition

- Voice Recognition

- Video Surveillance & Diagnostics

- Data Mining

By End-use Outlook

- Automotive

- Aerospace & Defense

- Healthcare

- Retail

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Top Impacting Factors on Growth

Factors Details Rapid AI Adoption Across Sectors Healthcare, automotive, finance, retail Increase in Big Data & Quality Labeled Datasets Enables training of accurate models Improvements in Hardware & Processing Power GPUs, AI-specific chips, cloud infrastructure Rise of Automation & Predictive Analytics Enhances operational efficiency Government Policies & Regulatory Support AI-friendly regulations and funding Growing Talent Pool & Research Investments Skilled workforce and continuous innovation Challenges: Data Privacy, High Initial Costs, Ethical Concerns These may hinder growth but also inspire more transparency efforts Customer Insights

Insights Details Enhanced Customer Understanding Analyzes unstructured data for satisfaction and preference trends Predictive Analytics Forecasts customer behavior to anticipate needs Personalization Tailors content, product recommendations, and services Conversational AI & Speech Recognition Improves virtual assistant and chatbot effectiveness Call Center Analytics Enhances understanding of customer interactions and service quality Business Benefits Increased engagement, loyalty, and real-time insights for growth Drivers

Increased Adoption Across Industries

Deep learning technologies are increasingly being adopted across sectors like healthcare, automotive, finance, retail, manufacturing, and entertainment. These industries leverage deep learning to improve operational efficiency, enhance customer experiences, and optimize decision-making processes.

For example, in healthcare, AI models assist in diagnostics, while in automotive, deep learning powers self-driving cars. This widespread adoption is a key driver of deep learning market growth, as businesses realize its potential to improve productivity and reduce costs.

For instance, in July 2025, Sensormatic Solutions introduced advanced deep learning AI capabilities to enhance retail traffic analytics through its Re-ID technology. This innovation leverages deep learning to track and analyze customer behavior more accurately, providing retailers with valuable insights into shopper patterns and store performance.

Restraint

High Computational Costs

Training deep learning models is computationally expensive, requiring powerful hardware such as GPUs and significant energy resources. This high cost can limit the accessibility of deep learning, particularly for smaller organizations that may not have the resources to invest in such infrastructure.

The financial barrier associated with purchasing and maintaining high-end equipment, along with the associated energy consumption, slows down the widespread adoption of deep learning, especially in cost-sensitive industries or smaller businesses.

For instance, in July 2021, Google Research unveiled efforts to reduce the high computational costs associated with deep reinforcement learning (DRL). By introducing new techniques to optimize training processes and improve efficiency, Google aims to make DRL more accessible to a broader range of researchers and developers.

Opportunities

Expansion of Industry-Specific Deep Learning Applications

An expanding array of sector-specific applications creates significant growth opportunities. In healthcare, deep learning models are enabling predictive diagnostics, patient risk assessment, and drug discovery acceleration.

The automotive sector is leveraging deep neural networks for perception and control in autonomous vehicles. Financial services deploy deep learning for fraud detection, risk modeling, and personalized customer insights. Emerging areas – such as precision agriculture, smart manufacturing, and digital marketing – offer high-potential, untapped opportunities as domain data and regulatory clarity mature.

For instance, in August 2025, EdgeAI computing startup EdgeHax secured ₹1.39 crores in seed funding, marking a significant step forward for Edge AI and deep learning technologies. The startup’s focus on enabling real-time data processing on edge devices, such as smartphones and IoT sensors, aligns with the growing demand for low-latency, efficient AI solutions.

Challenges

Competition and Fragmentation

The deep learning market faces intense competition, with numerous startups and established companies vying for dominance. This fragmented landscape requires companies to innovate continuously to stay ahead.

Startups often disrupt traditional business models, while large incumbents leverage their resources to scale quickly. This constant pressure to innovate and differentiate products poses a challenge for companies looking to carve out a niche in the market, making it difficult to maintain a competitive edge over time.

For instance, in June 2025, Microsoft advanced the field of computational chemistry using deep learning techniques to improve accuracy in molecular simulations. This breakthrough exemplifies the ongoing competition and fragmentation within the deep learning space, where companies and research institutions are striving to lead in specialized fields.

Key Players Analysis

In the deep learning market, global technology leaders such as NVIDIA Corporation, Intel Corporation, and Advanced Micro Devices, Inc. play a decisive role. Their innovations in GPUs, processors, and hardware accelerators provide the backbone for large-scale AI model training. These companies continue to invest in chip designs that improve speed, reduce energy consumption, and enable real-time processing.

One of the leading players in the market, in March 2025, AMD completed its $4.9 billion acquisition of ZT Systems, a leading provider of AI and general-purpose compute infrastructure. This strategic move enhances AMD’s capabilities in delivering end-to-end AI solutions, combining its CPU, GPU, and networking technologies with ZT’s systems expertise.

Another group of key players includes Google, Inc., Microsoft Corporation, and IBM Corporation. These companies dominate the software and cloud-based ecosystem that powers deep learning. Their platforms offer scalable infrastructure, advanced algorithms, and AI frameworks that accelerate adoption by enterprises.

Specialized players such as Clarifai, Inc., HyperVerge, Entilic, and ARM Ltd. bring targeted innovations to the market. Clarifai and HyperVerge are advancing image recognition and computer vision, while Entilic is using deep learning in medical diagnostics. ARM contributes with efficient chip architectures that support mobile and edge AI.

Top Key Players in the Market

- Advanced Micro Devices, Inc.

- ARM Ltd.

- Clarifai, Inc.

- Entilic

- Google, Inc.

- HyperVerge

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- NVIDIA Corporation

Recent Developments

- In June 2025, BrainScope expanded its board and launched an advanced deep learning platform aimed at enhancing brain health insights. The new platform leverages cutting-edge AI and deep learning technologies to analyze brain activity and provide more accurate diagnostics for conditions like traumatic brain injury (TBI) and concussions.

- In June 2024, Hewlett Packard Enterprise and NVIDIA introduced NVIDIA AI Computing by HPE, a jointly developed suite of AI solutions. This collaboration focuses on accelerating enterprise adoption of generative AI technologies through integrated infrastructure and coordinated go-to-market efforts. The solutions are designed to support large-scale model training and deployment, helping organizations embed generative capabilities into core business functions.

- In March 2024, Google Cloud revealed key advancements in generative AI tailored for healthcare and life sciences during the HIMSS24 conference in Orlando. A major highlight was the launch of Vertex AI Search for Healthcare, a tool that enhances clinical workflows by enabling fast, accurate access to medical data.

Report Scope

Report Features Description Market Value (2024) USD 25.5 Bn Forecast Revenue (2034) USD 261.3 Bn CAGR(2025-2034) 26.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Hardware, Software, Services), By Application (Image Recognition, Voice Recognition, Video Surveillance & Diagnostics, Data Mining), By End-use Outlook (Automotive, Aerospace & Defense, Healthcare, Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Advanced Micro Devices, Inc., ARM Ltd., Clarifai, Inc., Entilic, Google, Inc., HyperVerge, IBM Corporation, Intel Corporation, Microsoft Corporation, NVIDIA Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Advanced Micro Devices, Inc.

- ARM Ltd.

- Clarifai, Inc.

- Entilic

- Google, Inc.

- HyperVerge

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- NVIDIA Corporation