Global AI in Insurance Claims Processing Market Size, Share, Statistics Analysis Report By Offering (Software, Services), By Deployment Model (On-premise, Cloud), By Technology (Machine Learning, Natural Language Processing, Computer Vision, Others), By Enterprise Size (Large Enterprises, SMEs), By End-user (Life and Health Insurance, Property and Casualty Insurance), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143058

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- U.S. Market Growth

- Offering Analysis

- Deployment Model Analysis

- Technology Analysis

- Enterprise Size Analysis

- End-user Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

The AI in insurance claims processing Market size is expected to be worth around USD 2,761 Million By 2034, from USD 514.3 Million in 2024, growing at a CAGR of 18.30% during the forecast period from 2025 to 2034. In 2024, North America held a leading market position in the AI in insurance claims processing sector, capturing more than 37.3% of the share, generating revenues of USD 191.8 million.

The market for AI in insurance claims processing is evolving rapidly, driven by the need for greater efficiency and accuracy in the insurance sector. Insurers are increasingly adopting AI to automate claims reporting, damage assessment, and fraud detection, leading to faster, more reliable, and cost-efficient operations.

The integration of AI is not only enhancing the customer experience by providing quicker resolutions but also helping insurers manage costs and maintain competitive pricing. The technology’s adoption is expected to grow, influenced by the rising demand for streamlined operations and the continuous evolution of AI capabilities.

The primary drivers of AI adoption in insurance claims processing include the need for enhanced accuracy in claims handling, cost efficiency through automation, and improved customer satisfaction levels. AI’s capability to reduce human error, accelerate claims resolution, and detect fraud early are significant factors pushing insurers towards these technological solutions.

The demand for AI in claims processing is increasing as insurers seek to overcome the challenges associated with traditional, manual handling of claims, which is often slow and error-prone. This demand is bolstered by the positive impact of AI on operational efficiency and customer loyalty, with insurers experiencing enhanced trust and retention rates among policyholders.

The business benefits of employing AI in claims processing are manifold. They include higher accuracy and efficiency, cost reductions, better risk management through predictive analytics, and enhanced customer service capabilities. These benefits collectively help insurance companies to improve their overall profitability and market competitiveness.

Key Takeaways

- The Global AI in insurance claims processing Market size is expected to reach USD 2,761 Million by 2034, up from USD 514.3 Million in 2024, with a CAGR of 18.30% during the forecast period from 2025 to 2034.

- In 2024, the Software segment dominated the AI in insurance claims processing market, holding more than 78.6% of the market share.

- The Cloud segment held a dominant position in the AI in insurance claims processing market in 2024, capturing more than 59.3% of the market share.

- In 2024, the Machine Learning segment was the dominant force in the AI in insurance claims processing industry, accounting for more than 43.8% of the market share.

- The Large Enterprises segment held a dominant market position in 2024, with more than 82.7% of the share in the AI in insurance claims processing market.

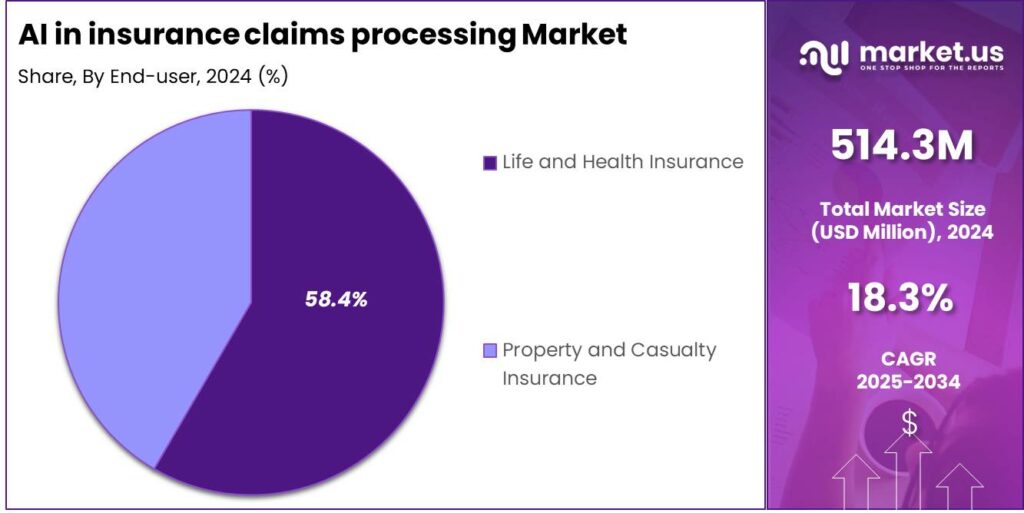

- The Life and Health Insurance segment dominated the AI in insurance claims processing market in 2024, capturing more than 58.4% of the market share.

- In 2024, North America held a leading market position in the AI in insurance claims processing sector, capturing more than 37.3% of the share, generating revenues of USD 191.8 million.

- The U.S. market for AI in insurance claims processing was estimated to be worth USD 172.65 million in 2024, with a projected CAGR of 17.7%.

Analysts’ Viewpoint

Investment in AI technology for claims processing is seen as highly strategic, providing significant returns through cost savings on manual processing, reduced claim payout times, and minimized fraud losses. The ongoing advancements in AI technologies offer substantial opportunities for insurers to innovate and stay ahead in a competitive market.

Recent technological advancements in AI, such as improved ML algorithms and advanced data analytics, have significantly boosted the capabilities of claims processing systems. These technologies enable more accurate damage assessments, quicker fraud detection, and more personalized customer interactions, thus advancing the overall efficiency of the claims handling process.

The regulatory environment for AI in insurance claims processing is evolving, with increased scrutiny on data privacy, security, and the ethical use of AI. Insurers are required to ensure their AI systems comply with these regulations to avoid legal repercussions and maintain customer trust.

U.S. Market Growth

The U.S. market for AI in insurance claims processing was estimated to be worth $172.65 million in 2024. It is projected to grow at a compound annual growth rate (CAGR) of 17.7%.

The integration of artificial intelligence (AI) within the insurance sector is primarily aimed at enhancing the efficiency and accuracy of claims processing. AI technologies, including machine learning and natural language processing, are employed to automate the evaluation of claims, detect fraudulent activities, and facilitate quicker service delivery.

Moreover, the adoption of AI in insurance claims processing is expected to transform traditional business models by providing deeper insights into claims data. These insights can lead to improved risk assessment, pricing strategies, and overall customer experience. As insurance companies continue to face pressure to increase efficiency and reduce costs, AI’s role in the industry is set to expand, driving significant growth in the market through the forecast period and beyond.

In 2024, North America held a dominant market position in the AI in insurance claims processing sector, capturing more than a 37.3% share with revenues amounting to USD 191.8 million. This leadership can be attributed to several factors that uniquely position North America at the forefront of this technological advance.

The region’s AI adoption is driven by strong tech infrastructure and a competitive insurance market that rapidly integrates new technologies to improve efficiency and customer service. U.S. insurers are leaders in using AI for claims processing, fraud reduction, and enhancing the customer experience. Collaboration with tech giants and startups further fuels significant growth in this sector.

Regulatory support in the U.S. and Canada has created a favorable environment for AI adoption in insurance. Government policies promoting digital transformation in financial services, coupled with a skilled workforce in AI and data analytics, accelerate the development and implementation of AI solutions in claims processing.

The high level of digital literacy among consumers in North America also plays a critical role. There is a greater willingness among policyholders to use digital and automated solutions for managing insurance matters, including claims. This consumer behavior drives insurers to adopt advanced AI solutions to meet expectations and enhance customer engagement.

Offering Analysis

In 2024, the Software segment held a dominant position in the AI in insurance claims processing market, capturing more than a 78.6% share. This market share is mostly due to the essential role that software plays in the operational deployment of AI technologies.

Software solutions are the backbone of AI implementation, encompassing algorithms that automate the processing, analysis, and management of claims data. As insurers increasingly adopt digital methods to enhance efficiency and customer satisfaction, the demand for robust software solutions that can integrate seamlessly into existing systems and offer reliable AI functionalities continues to surge.

The predominance of the Software segment can also be attributed to its direct impact on reducing claim processing times and improving accuracy. AI-powered software tools are capable of analyzing large sets of data quickly and with a high degree of precision, which traditional manual processes cannot match.

Moreover, advancements in AI and machine learning technologies have made these software solutions more accessible and affordable to a broader range of insurance providers, including small and mid-sized firms. The continuous innovation in AI software for claims processing, such as natural language processing and predictive analytics, has further driven the adoption of these technologies.

Deployment Model Analysis

In 2024, the Cloud segment held a dominant market position in the AI in insurance claims processing market, capturing more than a 59.3% share. This substantial market share is attributable to several intrinsic advantages of cloud computing, including scalability, flexibility, and cost-efficiency, which are particularly valuable in the dynamic field of insurance.

Cloud-based AI solutions in insurance claims processing provide unmatched scalability, allowing insurers to adjust computing resources based on demand without heavy investment in physical infrastructure. This flexibility helps manage claim volumes more efficiently, particularly during peak periods like post-disaster scenarios.

Furthermore, the cloud deployment model reduces the upfront costs associated with implementing AI technologies. By leveraging cloud services, insurance companies can utilize state-of-the-art computational capabilities and storage solutions on a subscription basis, eliminating the need for large initial investments in hardware.

Cloud-based AI systems in insurance claims processing improve collaboration and data accessibility. With data stored in the cloud, stakeholders can access information in real time, enhancing decision-making and service delivery. This is especially valuable in today’s globalized market, where remote work and digital interactions are increasingly common.

Technology Analysis

In 2024, the Machine Learning segment held a dominant market position in the AI in insurance claims processing industry, capturing more than a 43.8% share. This prominence is largely due to machine learning’s ability to drastically enhance the accuracy and efficiency of claims processing systems.

Machine learning algorithms excel at analyzing large volumes of data to identify patterns and anomalies which might indicate fraudulent claims, a critical issue in the insurance industry. By automating the detection of potentially fraudulent activities, insurers can significantly reduce losses and streamline the claims approval process.

Furthermore, machine learning contributes to improving customer experiences by enabling personalized claims handling processes based on individual customer data. This personalization can lead to higher customer satisfaction rates and increased loyalty, as policyholders receive services that are tailored to their specific needs and circumstances.

Machine learning in insurance claims processing offers strategic insights into operational risks and efficiency, optimizing processes and resource allocation. This data-driven approach enhances decision-making, supports sustainable practices, and drives long-term growth, cementing machine learning’s key role in AI-driven insurance transformation.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position in the AI in insurance claims processing market, capturing more than an 82.7% share. This substantial market share can be attributed to the significant resources that large enterprises possess, enabling them to invest in advanced AI technologies.

These organizations typically have the financial capability to integrate sophisticated AI systems that streamline and automate complex claims processes. Consequently, the adoption of AI solutions in large enterprises not only enhances operational efficiencies but also improves the accuracy and speed of claims handling.

Large enterprises often benefit from economies of scale which allow for the broader implementation of AI technologies across various departments. This widespread deployment contributes to a more comprehensive data gathering process, facilitating deeper insights and more accurate predictive analytics in claims processing.

The ability to leverage vast amounts of data effectively reduces fraudulent claims and identifies patterns that smaller entities might not discern. Thus, large enterprises are better positioned to maximize the potential of AI, driving efficiency in handling large volumes of claims while ensuring compliance with regulatory standards.

End-user Analysis

In 2024, the Life and Health Insurance segment held a dominant market position in the AI in insurance claims processing market, capturing more than a 58.4% share. This leadership can be primarily attributed to the complexity and volume of claims in the life and health insurance sectors, which necessitate enhanced processing efficiency that AI technologies can provide.

The demand for AI in life and health insurance is driven by the need for precision and compliance in claims adjudication. AI aids insurers in meeting regulatory requirements by using advanced algorithms to detect anomalies and patterns of fraud, ensuring accurate, compliant claims processing and reducing overpayments.

Moreover, AI technology supports personalized customer experiences in the life and health insurance segment. Through data analytics, insurers are able to offer customized insurance products and dynamically adjust premiums based on individual risk assessments. This personalized approach not only enhances customer engagement but also optimizes risk management strategies for insurers.

AI adoption in life and health insurance reflects the broader digital transformation trend, driven by consumer preference for digital channels. AI enhances claims processing efficiency, reinforcing the segment’s market dominance. As insurers embrace AI’s operational benefits, growth and innovation in the sector are expected to continue.

Key Market Segments

By Offering

- Software

- Services

By Deployment Model

- On-premise

- Cloud

By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Others

By Enterprise Size

- Large Enterprises

- SMEs

By End-user

- Life and Health Insurance

- Property and Casualty Insurance

Driver

Enhanced Efficiency and Cost Reduction

The integration of artificial intelligence (AI) into insurance claims processing significantly enhances operational efficiency and reduces costs. AI automates routine tasks such as data entry and analysis, which traditionally require substantial manual effort and are prone to errors.

By streamlining these processes, insurers can handle claims faster and with greater accuracy, leading to lower operational costs and improved customer satisfaction. For instance, AI’s ability to collect, organize, and analyze claims data swiftly enables insurers to process claims in a fraction of the time it would take human adjusters.

This acceleration reduces administrative costs, speeds up claim resolutions, and improves the customer experience. AI’s predictive analytics enhance risk assessment and fraud detection, further minimizing financial losses. These efficiencies make AI essential for modernizing insurance practices and driving widespread adoption.

Restraint

Regulatory and Compliance Challenges

The deployment of AI in insurance claims processing encounters significant restraints due to stringent regulatory and compliance issues. Insurers must navigate a complex landscape of laws and regulations that vary by region and are often not fully adapted to emerging AI technologies.

For example, issues related to data privacy, ethical AI use, and transparency in AI-driven decisions pose substantial challenges. Ensuring that AI systems comply with all legal requirements can be both expensive and time-consuming, potentially slowing down the adoption of AI technologies.

Non-compliance can result in severe penalties, making regulatory adherence a critical concern for insurers implementing AI solutions.As AI regulations and laws change, insurers must invest in ongoing audits, legal consultations, and system adjustments to maintain compliance.

Opportunity

Personalization of Insurance Products

AI offers a significant opportunity in the personalization of insurance products and services. By analyzing vast amounts of data on individual behavior and preferences, AI enables insurers to tailor products that more closely fit the needs and risk profiles of their customers.

This capability allows insurers to differentiate themselves in a competitive market by offering customized policies, such as usage-based car insurance or personalized health plans. Personalization enhances customer satisfaction, loyalty, and generates new revenue streams by offering solutions beyond traditional one-size-fits-all policies.

Leveraging AI for personalized insurance improves risk assessment and pricing models, allowing insurers to better understand individual customer needs and behaviors, leading to more accurate risk profiling.

Challenge

Integration with Legacy Systems

A major challenge in adopting AI within the insurance industry is the integration of AI technologies with existing legacy systems. Many insurers operate on outdated platforms that are not designed to support the seamless integration of AI and the handling of large data volumes required for AI processes.

Upgrading these systems can be costly and disruptive to current operations.Furthermore, there is often a significant skills gap within the existing workforce, with a shortage of professionals trained in AI and data science, complicating the effective implementation and management of AI solutions. This integration challenge is a critical barrier that insurers must overcome to fully leverage the benefits of AI in their operations.

Emerging Trends

One prominent trend is the automation of routine tasks. AI systems quickly extract relevant information from both structured and unstructured data, like policy documents and medical records, reducing manual data entry and document review. This automation speeds up the claims process and lets claims handlers focus on more complex tasks.

Another significant development is the integration of AI-driven chatbots. Advanced AI systems, like chatbots, handle tasks such as the first notice of loss, updating claim details, and tracking support. This improves customer service, reduces processing times, and boosts operational efficiency for insurers.

Predictive analytics, powered by machine learning, is also gaining traction. These tools analyze patterns in claims data to detect potential fraud, assess risks more accurately, and anticipate future claims trends. This proactive approach enables insurers to make informed decisions, mitigate risks, and allocate resources more effectively.

Furthermore, the rise of usage-based insurance (UBI) is noteworthy. By leveraging AI to analyze real-time data from telematics devices, insurers can offer personalized policies based on individual driving behaviors. This trend not only aligns premiums more closely with actual risk but also encourages safer driving habits among policyholders.

Business Benefits

The adoption of AI in claims processing offers several business advantages. AI enhances operational efficiency. By automating repetitive tasks, insurers can process a higher volume of claims in a shorter time, leading to significant cost savings and increased productivity.

AI improves accuracy and consistency in claims assessments. Machine learning algorithms analyze data without human biases, reducing errors and ensuring fair evaluations. This leads to more accurate payouts and higher customer satisfaction.

AI boosts fraud detection by identifying patterns and anomalies in claims data, minimizing financial losses. It also improves risk management through predictive analytics, allowing insurers to anticipate risks and refine underwriting and pricing models.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Progressive Corporation, one of the largest auto insurance companies in the U.S., has been a leader in utilizing AI for claims processing. Their AI-powered systems are used to streamline claim assessments and improve customer interactions. Progressive’s claims system uses AI to help adjusters determine claim severity, detect fraudulent activities, and offer quick settlement options.

GEICO, known for its innovative approach to insurance, uses AI to enhance claims processing and reduce the time it takes to handle claims. GEICO uses AI, including machine learning and computer vision, to assess vehicle damage and simplify the claims process. Their AI-driven customer service offers self-service tools for filing claims, tracking status, and receiving real-time assistance.

Ping An Insurance, a global leader in the insurance industry based in China, has adopted AI technologies to redefine insurance claims processing. Ping An’s AI platform automates tasks like damage assessment and fraud detection with image recognition and data analytics. It also uses AI for claim prediction, helping to accurately estimate costs and reduce fraud.

Top Key Players in the Market

- Progressive Corporation

- GEICO

- Ping An Insurance Company of China Ltd

- Microsoft Corporation

- CCC Information Services Inc.

- Claim Genius

- Nauto Inc.

- Shift Technology

- Tracable

- SAS Institute Inc.

- Insurify Inc.

- Amazon Web Services (AWS)

- Google LLC

- Other Key Players

Top Opportunities Awaiting for Players

- Intelligent Automation Platforms: The future of AI in insurance claims processing emphasizes the shift from basic robotic process automation to more sophisticated, intelligent platforms. These systems combine AI with deep insurance expertise to improve decision-making and optimize processes. Early adopters are seeing significant ROI, highlighting the potential for industry-wide transformation.

- Enhanced Customer Experience through Hyper-Personalization: AI is enabling insurers to offer hyper-personalized customer experiences. This is achieved through advanced data analytics and generative AI, which allow for tailored policy management and claims processes based on individual customer data.

- Automation of Claims Handling: AI-driven automation in claims handling is poised to significantly reduce processing times and costs while improving accuracy. Full automation extends from the initial assessment of claims to final settlements, helping insurers manage claims leakage and fraud more effectively. Such capabilities can lead to substantial cost savings and higher operational efficiency.

- Climate Resilience: As climate-related risks intensify, there’s a growing need for insurance models that prioritize climate resilience. AI can aid in developing new coverage options for extreme weather and improve the assessment of risk exposure using data-driven solutions. This approach helps insurers manage risks more effectively while maintaining customer trust by proactively addressing emerging challenges.

- Data Management and Analytics: The integration of AI in claims processing is heavily reliant on the quality and management of data. Insurers are urged to enhance data governance by using data lakehouses, which merge data lakes and warehouses. This technology improves data management, enabling advanced analytics for better decision-making and operational efficiency.

Recent Developments

- In May 2024, Sedgwick launched an AI-powered application to assist in claims management. This proprietary model utilizes modern AI, machine learning, and natural language processing to swiftly review unstructured data, such as claim notes and medical bills, thereby enhancing the efficiency of claims professionals.

- In October 2024, Prudential partnered with Google Cloud to employ MedLM, Google’s family of language models fine-tuned for healthcare industry use cases, to improve the accuracy and efficiency of medical insurance claim decisions. This initiative aims to expedite claims processing by leveraging advanced AI capabilities.

- In December 2024, CCC Intelligent Solutions Inc., a leading cloud platform provider for the property and casualty insurance sector, announced a definitive agreement to acquire EvolutionIQ, an AI-driven platform specializing in disability and injury claims management.

Report Scope

Report Features Description Market Value (2024) USD 514.3 Mn

Forecast Revenue (2034) USD 2,761 Mn CAGR (2025-2034) 18.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Offering (Software, Services), By Deployment Model (On-premise, Cloud), By Technology (Machine Learning, Natural Language Processing, Computer Vision, Others), By Enterprise Size (Large Enterprises, SMEs), By End-user (Life and Health Insurance, Property and Casualty Insurance) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Progressive Corporation, GEICO, Ping An Insurance Company of China Ltd, Microsoft Corporation, CCC Information Services Inc., Claim Genius, Nauto Inc., Shift Technology, Tracable, SAS Institute Inc., Insurify Inc., Amazon Web Services (AWS), Google LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI in Insurance Claims Processing MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

AI in Insurance Claims Processing MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Progressive Corporation

- GEICO

- Ping An Insurance Company of China Ltd

- Microsoft Corporation

- CCC Information Services Inc.

- Claim Genius

- Nauto Inc.

- Shift Technology

- Tracable

- SAS Institute Inc.

- Insurify Inc.

- Amazon Web Services (AWS)

- Google LLC

- Other Key Players