Global Decorative Laminates Market Size, Share, And Business Benefits By Raw Material (Plastic resins, Overlays, Adhesives, Wood substrate), By Type (General Purpose, Postforming, Special Products, Backer), By Application (Cabinets, Furniture, Flooring, Table top, Counter top, Wall panels), By End-Use (Residential, Non-residential, Transportation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148521

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

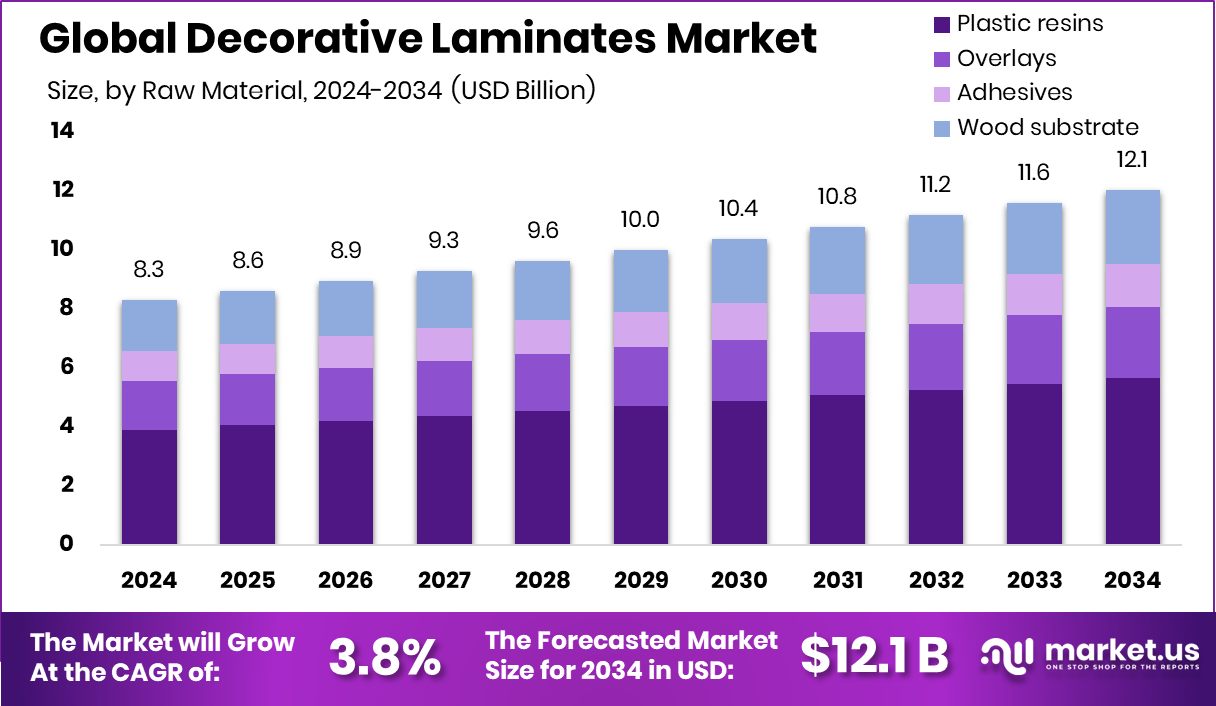

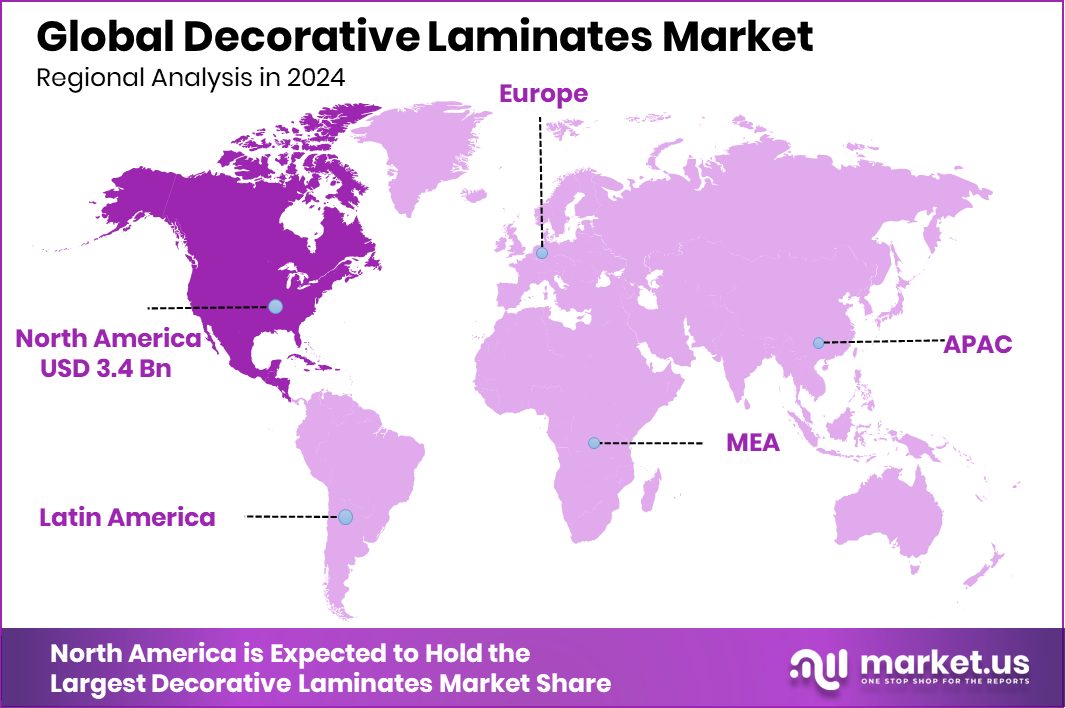

Global Decorative Laminates Market is expected to be worth around USD 12.1 billion by 2034, up from USD 8.3 billion in 2024, and grow at a CAGR of 3.8% from 2025 to 2034. With a 41.7% share, North America’s Decorative Laminates Market reached USD 3.4 billion.

Decorative laminates are surface finishes made by bonding layers of kraft paper with resin under high pressure and heat. These laminates are widely used to enhance the aesthetic appeal of surfaces such as furniture, countertops, walls, and flooring. They come in a variety of textures, colors, and patterns, providing a durable, easy-to-clean surface that mimics the appearance of wood, metal, stone, or other materials.

The decorative laminates market refers to the global trade and consumption of laminate surfaces used for interior applications. It encompasses various types, such as high-pressure laminates (HPL), low-pressure laminates (LPL), and specialty laminates designed for specific applications. The market is driven by rising construction activities, increasing demand for home décor products, and the growing trend of stylish and customizable furniture.

The growth of the decorative laminates market is fueled by rapid urbanization and rising disposable incomes, leading to increased spending on home interiors and office spaces. The trend of modular furniture and modern interior designs has also propelled demand for high-quality, aesthetically pleasing laminate surfaces. Moreover, the surge in commercial infrastructure development, particularly in emerging economies, has created significant opportunities for laminated surfaces in offices, hotels, and retail spaces.

The demand for decorative laminates is on the rise due to the increasing preference for ready-to-install, low-maintenance, and cost-effective surface materials. Consumers are opting for decorative laminates as a sustainable alternative to hardwood and other expensive surface finishes. Furthermore, the rising popularity of compact and multifunctional furniture in urban apartments has driven demand for durable, scratch-resistant, and moisture-proof laminate surfaces.

The growing focus on sustainable construction and eco-friendly materials presents a significant opportunity for the decorative laminates market. Manufacturers are exploring biodegradable and recyclable laminates to meet stringent environmental regulations. Additionally, the rise in home renovation projects and the expansion of the real estate sector provide ample growth prospects for premium and customized laminate designs that cater to evolving consumer preferences.

Key Takeaways

- Global Decorative Laminates Market is expected to be worth around USD 12.1 billion by 2034, up from USD 8.3 billion in 2024, and grow at a CAGR of 3.8% from 2025 to 2034.

- Plastic resins held a dominant position in the Decorative Laminates Market, capturing 47.1% share.

- General Purpose laminates accounted for a substantial 46.2% share in the Decorative Laminates Market segment.

- Cabinets emerged as a significant application in the Decorative Laminates Market, holding a 37.9% share.

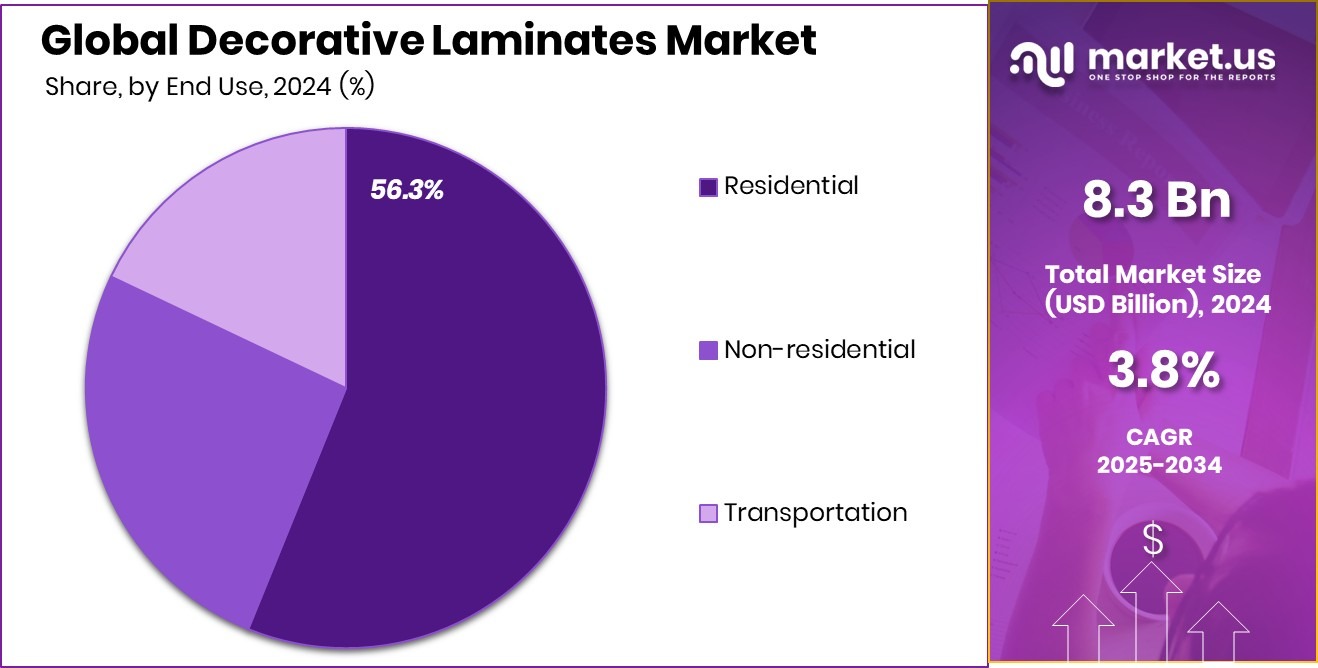

- Residential end-use led the Decorative Laminates Market, representing a commanding 56.3% of the market.

- The Decorative Laminates Market in North America reached USD 3.4 billion, representing 41.7%.

By Raw Material Analysis

Plastic resins accounted for a 47.1% share in the Decorative Laminates Market.

In 2024, Plastic resins held a dominant market position in the By Raw Material segment of the Decorative Laminates Market, with a 47.1% share. The widespread use of plastic resins in manufacturing decorative laminates is primarily driven by their cost-effectiveness, durability, and ease of customization.

Additionally, plastic resins are preferred due to their superior resistance to moisture, heat, and impact, making them ideal for residential and commercial applications. The increasing demand for aesthetically appealing interior décor solutions has further propelled the use of plastic resins in cabinets, countertops, and wall panels.

This trend is particularly prominent in emerging markets where the residential construction sector is expanding rapidly. Furthermore, advancements in resin technology have enabled manufacturers to produce laminates with enhanced surface textures and finishes, aligning with evolving consumer preferences for modern and contemporary designs.

By Type Analysis

General Purpose laminates held a 46.2% share in the Decorative Laminates Market.

In 2024, General Purpose held a dominant market position in the By Type segment of the Decorative Laminates Market, with a 46.2% share. The extensive application of general-purpose decorative laminates in residential and commercial spaces has driven their significant market share. These laminates are favored for their versatility, durability, and affordability, making them ideal for furniture, wall panels, and cabinetry.

Additionally, the rising trend of home renovation and interior customization has further boosted the demand for general-purpose laminates. The expanding middle-class population and increasing disposable incomes in emerging economies have also contributed to the growing preference for affordable yet aesthetically appealing decorative surfaces. Furthermore, advancements in laminate technology have enabled manufacturers to introduce a wide range of patterns, textures, and finishes, enhancing the overall market appeal.

The dominance of the general-purpose segment is also attributed to its widespread availability, cost-effective nature, and easy maintenance, making it a preferred choice for both residential and commercial applications.

By Application Analysis

Cabinets captured a significant 37.9% share in the Decorative Laminates Market applications.

In 2024, Cabinets held a dominant market position in the By Application segment of the Decorative Laminates Market, with a 37.9% share. The extensive utilization of decorative laminates in cabinetry is primarily driven by the rising demand for aesthetically appealing and cost-effective storage solutions in residential and commercial spaces.

The increasing trend of modular kitchens and customized storage units has further propelled the demand for laminated cabinets, as they offer versatility in design, texture, and finish. Additionally, the growing focus on interior décor and home improvement activities has boosted the application of laminates in kitchen cabinets, bathroom vanities, and wardrobe units.

Laminates provide enhanced resistance to scratches, moisture, and stains, making them a preferred choice for cabinetry, especially in high-traffic areas. Furthermore, manufacturers are introducing innovative laminate designs, including wood grain, matte, and high-gloss finishes, catering to evolving consumer preferences for premium and contemporary interiors.

The dominance of the cabinet segment is also supported by the ongoing urbanization trend and the increasing number of residential construction projects worldwide. As consumers seek durable and visually appealing cabinetry solutions, the application of decorative laminates in cabinets is anticipated to maintain its strong market position.

By End-Use Analysis

The residential sector dominated with a 56.3% share in the Decorative Laminates Market.

In 2024, Residential held a dominant market position in the By End-Use segment of the Decorative Laminates Market, with a 56.3% share. The increasing focus on interior aesthetics and home décor has significantly fueled the demand for decorative laminates in residential spaces. Homeowners are opting for cost-effective and durable surfacing solutions, driving the adoption of laminates in areas such as kitchen cabinets, wardrobes, wall panels, and countertops.

The rise in home renovation activities, particularly in urban regions, has further propelled the use of decorative laminates due to their versatility in design and wide range of textures and finishes. Additionally, the growing trend of modular kitchens and customized furniture has enhanced the penetration of laminates in the residential sector.

The availability of diverse laminate patterns, from wood grain to metallic and abstract designs, has also played a crucial role in attracting consumers seeking premium interior finishes. Moreover, the expansion of the middle-class population and the increasing disposable incomes in emerging economies have contributed to the rising demand for affordable yet aesthetically pleasing decorative surfaces.

Key Market Segments

By Raw Material

- Plastic resins

- Overlays

- Adhesives

- Wood substrate

By Type

- General Purpose

- Postforming

- Special Products

- Backer

By Application

- Cabinets

- Furniture

- Flooring

- Table top

- Counter top

- Wall panels

By End-Use

- Residential

- Non-residential

- Transportation

Driving Factors

Growing Demand for Aesthetic Interior Solutions Worldwide

The rising consumer preference for visually appealing interiors has emerged as a major driving factor in the Decorative Laminates Market. Homeowners and commercial property developers increasingly seek cost-effective yet stylish surfacing solutions for cabinets, walls, and furniture.

Decorative laminates provide a versatile range of textures, patterns, and finishes, allowing for customization to match modern and contemporary design themes. Additionally, the increasing popularity of modular kitchens and customized furniture further amplifies the demand for laminates.

As more consumers focus on home renovation and interior décor upgrades, the adoption of decorative laminates is expected to surge. This trend is particularly pronounced in urban areas, where space optimization and stylish interiors are key considerations.

Restraining Factors

Fluctuating Raw Material Prices Impacting Profit Margins

The Decorative Laminates Market faces a significant challenge due to fluctuating raw material prices. Materials like plastic resins and paper, essential for laminate production, are subject to price volatility driven by supply chain disruptions and global economic uncertainties.

Rising costs of petroleum-based resins can particularly impact manufacturing expenses, squeezing profit margins for producers. Additionally, the increasing focus on sustainable materials may further escalate costs, as eco-friendly alternatives are often more expensive.

Smaller manufacturers, in particular, may struggle to absorb these cost variations, leading to potential price increases or reduced profit margins. Consequently, price instability in raw materials remains a critical restraining factor, affecting overall market growth and profitability.

Growth Opportunity

Rising Demand for Customized Interior Design Solutions

The growing preference for personalized home décor is creating significant growth opportunities in the Decorative Laminates Market. Consumers are increasingly seeking unique, tailor-made laminate designs that align with specific interior themes, from contemporary to vintage styles.

This trend is particularly evident in residential spaces, where homeowners want distinct finishes for cabinets, countertops, and wall panels. Manufacturers are responding by offering a diverse range of laminate patterns, colors, and textures, enabling customers to choose customized solutions that enhance aesthetic appeal.

Additionally, the rise of modular furniture and smart homes further supports the demand for bespoke laminates, as they provide cost-effective yet stylish surfacing options. This shift towards customized interiors is anticipated to drive market expansion in the coming years.

Latest Trends

Eco-Friendly Laminates Gaining Popularity Globally

In 2024, a significant trend in the Decorative Laminates Market is the growing preference for eco-friendly laminates. Consumers and manufacturers are increasingly focusing on sustainable materials that minimize environmental impact.

Eco-friendly laminates are produced using recycled or renewable resources and involve manufacturing processes that reduce carbon emissions. These laminates are free from harmful chemicals, making them safer for indoor environments. The demand for such products is driven by heightened environmental awareness and stricter regulations on building materials.

Additionally, eco-friendly laminates offer durability and aesthetic appeal comparable to traditional laminates, making them a viable alternative. As sustainability becomes a key consideration in interior design and construction, the popularity of eco-friendly decorative laminates is expected to continue rising, influencing market offerings and consumer choices.

Regional Analysis

North America captured a 41.7% share in the Decorative Laminates Market, valuing USD 3.4 billion.

In 2024, North America emerged as the dominant region in the Decorative Laminates Market, capturing a substantial 41.7% share valued at USD 3.4 billion. The region’s market growth is driven by the increasing demand for aesthetically appealing and durable surface materials in residential and commercial projects. The rising trend of home renovations and the adoption of modular furniture further bolsters the demand for decorative laminates in the region.

Meanwhile, Europe also maintains a significant market share, with growing applications of laminates in office spaces and retail establishments. The Asia Pacific region exhibits promising growth potential, driven by rapid urbanization and expanding construction activities in countries like China and India. In the Middle East & Africa, the market is witnessing gradual adoption, supported by infrastructural developments and hospitality projects.

Latin America, although a smaller market, is steadily gaining traction as consumer awareness about interior aesthetics rises. North America’s dominance is expected to continue, fueled by technological advancements and increasing consumer spending on home décor solutions. The regional segmentation reflects diverse market dynamics, with each region contributing uniquely to the overall market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Greenlam Industries Limited solidified its position as a prominent player in the global Decorative Laminates Market, leveraging its expansive portfolio and focus on sustainable solutions. The company emphasized the launch of eco-friendly laminates, aligning with the growing demand for sustainable interior solutions in residential and commercial spaces. Greenlam’s strategic investments in advanced manufacturing facilities and new product designs enabled it to capture a significant share in key markets, particularly in the Asia-Pacific region, where demand surged due to urbanization and increasing renovation activities.

OMNOVA North America Inc., a subsidiary of Synthomer, maintained its stronghold in the North American decorative laminates sector by enhancing its product line with high-performance, visually appealing laminates. The company focused on delivering innovative, durable laminates for diverse applications in commercial and residential projects. Its investments in research and development, coupled with a customer-centric approach, allowed OMNOVA to strengthen its market position despite economic challenges in the region.

Abet Laminati SpA, renowned for its high-quality and aesthetically-driven laminate designs, continued to emphasize its premium product range in the European market. The company’s emphasis on distinctive patterns, vibrant colors, and customized laminates caters to the evolving design preferences of architects and interior designers. Abet Laminati leveraged its established distribution network and targeted marketing strategies to maintain its competitive edge, particularly in Western Europe, where demand for premium decorative laminates remained robust throughout 2024.

Top Key Players in the Market

- Greenlam Industries Limited

- OMNOVA North America Inc.

- Abet Laminati SpA

- STYLAM INDUSTRIES LIMITED

- Wilsonart LLC

- Merino Laminates Ltd.

- FunderMax

- Airolam decorative laminates

- Archidply

- Bell Laminates

- Broadview Holding

Recent Developments

- In July 2024, SURTECO announced a significant investment in a new rotogravure printing press. This state-of-the-art equipment is expected to enhance production efficiency and expand the company’s capacity to deliver high-quality, customized decorative laminates.

- In December 2023, Greenlam unveiled a new range of 1mm laminates characterized by bold colors, unique textures, and contemporary designs, targeting modern interior aesthetics.

Report Scope

Report Features Description Market Value (2024) USD 8.3 Billion Forecast Revenue (2034) USD 12.1 Billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Plastic resins, Overlays, Adhesives, Wood substrate), By Type (General Purpose, Postforming, Special Products, Backer), By Application (Cabinets, Furniture, Flooring, Table top, Counter top, Wall panels), By End-Use (Residential, Non-residential, Transportation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Greenlam Industries Limited, OMNOVA North America Inc., Abet Laminati SpA, STYLAM INDUSTRIES LIMITED, Wilsonart LLC, Merino Laminates Ltd., FunderMax, Airolam decorative laminates, Archidply, Bell Laminates, Broadview Holding Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Decorative Laminates MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Decorative Laminates MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Greenlam Industries Limited

- OMNOVA North America Inc.

- Abet Laminati SpA

- STYLAM INDUSTRIES LIMITED

- Wilsonart LLC

- Merino Laminates Ltd.

- FunderMax

- Airolam decorative laminates

- Archidply

- Bell Laminates

- Broadview Holding