Global Cross Arm Composite Insulators Market Size, Share, And Industry Analysis Report By Voltage Rating (Low Voltage, Medium Voltage, High Voltage), By Material Type (Silicone Rubber, EPDM, Others), By Application (Transmission Lines, Distribution Lines, Substations), By End-User (Utilities, Industrial, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170369

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

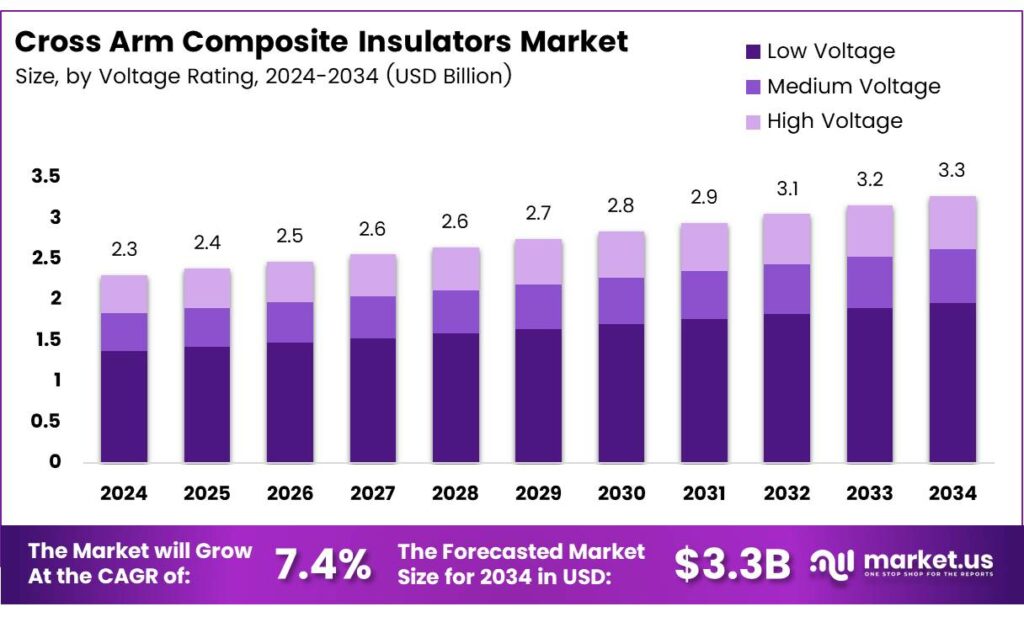

The Global Cross Arm Composite Insulators Market size is expected to be worth around USD 3.3 billion by 2034, from USD 2.3 billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

The Cross Arm Composite Insulators Market covers advanced insulation solutions used on overhead distribution and transmission lines. These insulators replace traditional wooden or steel cross arms while supporting conductors safely. As grid reliability becomes critical, utilities increasingly adopt composite cross-arm insulators for durability, lighter weight, and reduced maintenance requirements.

Cross-arm composite insulators represent a structural and electrical upgrade for modern power networks. They combine load-bearing capability with insulation performance, simplifying tower design. As utilities modernize aging lines, composite cross arms improve safety margins, reduce outage risks, and support compact line configurations efficiently. Demand is steadily rising due to grid expansion and refurbishment programs.

- Composite insulators are designed for rated voltages from 10 kV to 220 kV, with a creepage distance of at least 25 mm/kV, supporting heavy pollution zones. They deliver mechanical load capacity between 70 kN and 160 kN, suitable for demanding cross-arm applications. These insulators withstand power frequency voltage of 42 kV for 1 minute and lightning impulse voltage from 110 kV to 195 kV. They operate reliably between -40°C and +60°C, while silicone hydrophobicity reduces leakage current, improving long-term safety.

Renewable energy integration and cross-border transmission lines. Power utilities prioritize solutions that lower lifecycle costs and installation time. Consequently, the Cross Arm Composite Insulators Market aligns strongly with transmission upgrades, smart grid deployment, and long-distance overhead line reinforcement projects. Composite cross-arm insulators gain preference where corrosion resistance, pollution performance, and mechanical strength are decisive procurement criteria for utilities.

Key Takeaways

- The Global Cross Arm Composite Insulators Market is projected to grow from USD 2.3 billion in 2024 to USD 3.3 billion by 2034, registering a CAGR of 7.4% during 2025–2034.

- Medium Voltage dominates the market with a share of 48.2%, driven by widespread use in transmission and distribution upgrades.

- Silicone Rubber leads with a market share of 66.3%, supported by superior hydrophobicity and long-term performance.

- Transmission Lines hold the largest share at 52.7%, reflecting rising investments in grid expansion and capacity enhancement.

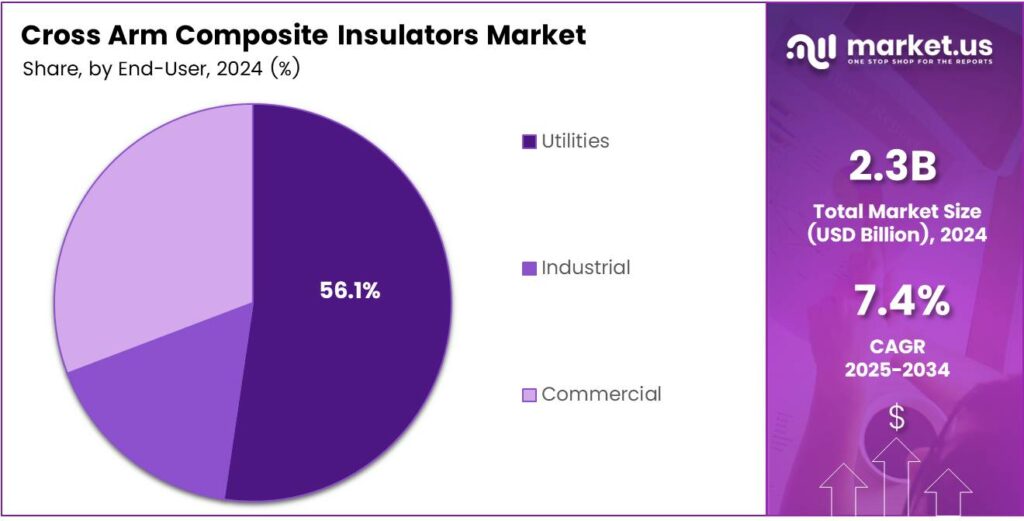

- Utilities account for the highest share of 56.1%, backed by large-scale grid modernization and replacement programs.

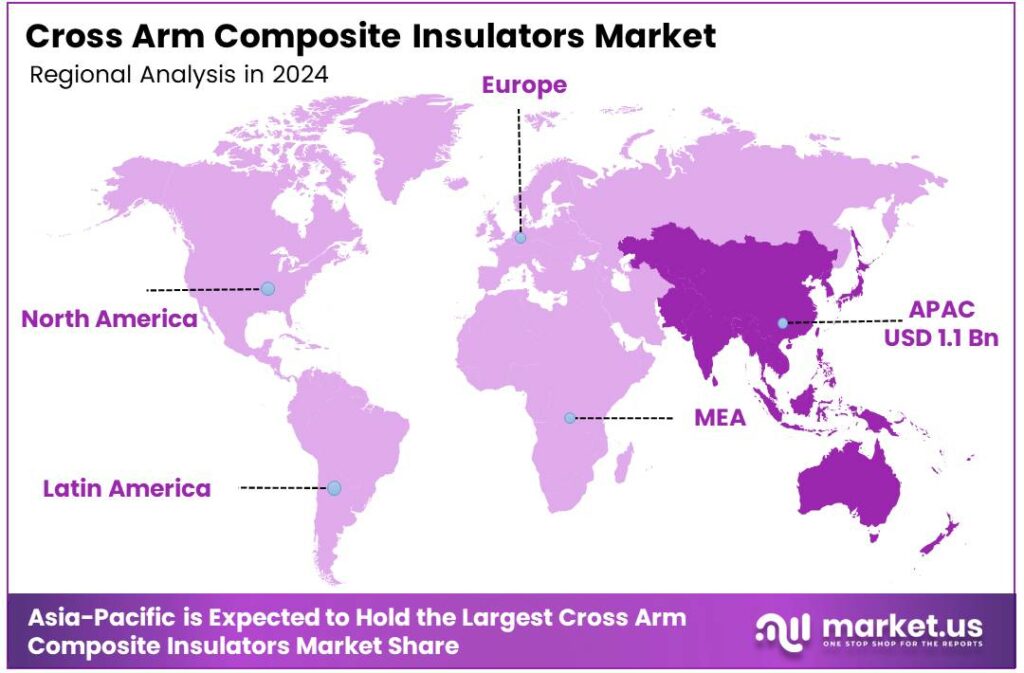

- Asia Pacific dominates the market with a share of 48.9%, valued at USD 1.1 billion, due to rapid power infrastructure development.

By Voltage Rating Analysis

Medium Voltage dominates with 48.2% due to its wide adoption across regional transmission and distribution upgrades.

In 2024, Medium Voltage held a dominant market position in the By Voltage Rating analysis segment of the Cross Arm Composite Insulators Market, with a 48.2% share. Medium voltage cross-arm composite insulators are widely used in urban and semi-urban grids, offering a balance between insulation strength, weight reduction, and cost efficiency.

Low-voltage cross-arm composite insulators continue to support smaller distribution networks and rural electrification projects. These insulators are preferred where mechanical load requirements are lower, and installation simplicity is critical. Their lightweight design improves handling, while composite materials help extend service life in humid and polluted environments.

High Voltage cross-arm composite insulators serve long-distance transmission corridors and critical grid infrastructure. Although volumes are lower, demand remains steady due to grid modernization and the replacement of aging ceramic systems. Their high mechanical strength and resistance to electrical stress support reliability in extreme weather and high-load conditions.

By Material Type Analysis

Silicone Rubber dominates with 66.3% due to superior hydrophobicity and long-term performance reliability.

In 2024, Silicone Rubber held a dominant market position in the By Material Type analysis segment of the cross-arm composite Insulators Market, with a 66.3% share. Silicone rubber materials provide excellent hydrophobic properties, reducing leakage currents and maintenance needs, especially in polluted and coastal environments.

EPDM composite insulators are gaining traction in cost-sensitive applications where moderate weather resistance and flexibility are required. EPDM materials offer good aging resistance and mechanical stability, making them suitable for distribution-level installations and regions with controlled environmental exposure.

Others include hybrid polymer blends and emerging composite materials designed for niche applications. These materials focus on improving mechanical endurance and thermal resistance. While adoption remains limited, ongoing material innovation may expand their role in specialized grid projects and customized installations.

By Application Analysis

Transmission Lines dominate with 52.7% driven by expanding grid networks and capacity upgrades.

In 2024, Transmission Lines held a dominant market position in the By Application analysis segment of the Cross Arm Composite Insulators Market, with a 52.7% share. These insulators are critical for supporting higher mechanical loads and ensuring electrical reliability across long-span transmission infrastructure.

Distribution Lines represent a steady application area, particularly in urban expansion and rural electrification programs. Composite insulators are increasingly replacing traditional materials due to their lighter weight, easier installation, and lower risk of breakage during handling and operation.

Substations use cross-arm composite insulators to ensure compact layouts and enhanced safety. Their resistance to contamination and electrical stress supports stable substation performance. Adoption is gradual but consistent, especially in modern substations designed for higher efficiency and reduced maintenance cycles.

By End-User Analysis

Utilities dominate with 56.1% supported by large-scale grid investments and replacement programs.

In 2024, Utilities held a dominant market position in the By End-User analysis segment of the Cross Arm Composite Insulators Market, with a 56.1% share. Utilities prioritize composite insulators to improve grid reliability, reduce outages, and lower long-term maintenance costs across transmission and distribution assets.

Industrial end-users adopt cross-arm composite insulators within captive power networks and industrial substations. These users value durability and electrical safety, especially in environments exposed to chemicals, dust, and temperature variations that can affect conventional insulation systems.

Commercial applications remain smaller but stable, supporting private power distribution systems, commercial complexes, and infrastructure projects. Composite insulators offer space efficiency and reduced servicing needs, making them suitable for modern commercial power installations focused on reliability and operational continuity.

Key Market Segments

By Voltage Rating

- Low Voltage

- Medium Voltage

- High Voltage

By Material Type

- Silicone Rubber

- EPDM

- Others

By Application

- Transmission Lines

- Distribution Lines

- Substations

By End-User

- Utilities

- Industrial

- Commercial

Emerging Trends

Shift Toward Lightweight and Low-Maintenance Materials Shapes Market Trends

A major trend in the Cross Arm Composite Insulators Market is the shift toward lightweight and low-maintenance materials. Utilities are increasingly choosing composite insulators to reduce tower weight and simplify installation, especially in difficult terrains and long-span transmission lines.

- The growing use of composite insulators in high-pollution and coastal areas. Their superior resistance to salt, dust, and industrial pollution makes them more reliable than traditional insulators, reducing cleaning and replacement frequency. In 2024, global energy demand rose by about 2.2%, with electricity consumption jumping nearly 4.3%, much faster than overall economic growth.

Sustainability is also shaping market trends. Composite insulators support longer service life and lower maintenance, which helps utilities reduce material usage and operational impact over time. This aligns well with the broader goals of efficient and sustainable power infrastructure.

Drivers

Rising Investment in Power Transmission Infrastructure Drives Market Growth

The Cross Arm Composite Insulators Market is mainly driven by the growing need to strengthen power transmission and distribution networks. Many countries are investing in new transmission lines to meet rising electricity demand from cities, industries, and renewable energy projects.

- Composite cross-arm insulators are preferred because they are lightweight and easy to install, which reduces tower load and construction time. India’s Ministry of Power has launched the National Electricity Plan to build transmission capacity capable of handling 500 GW of renewable energy by 2030.

The expansion of renewable energy, especially wind and solar farms, is also supporting market growth. These projects require reliable and durable insulation systems for long-distance power evacuation. Composite cross-arm insulators help maintain line stability and safety under varying weather conditions.

Restraints

High Initial Costs Compared to Conventional Insulators Limit Adoption

One of the major restraints in the Cross Arm Composite Insulators Market is the higher upfront cost compared to traditional porcelain or glass insulators. For small utilities or projects with limited budgets, this cost difference can slow adoption, even though composite insulators offer long-term benefits.

- India’s central government recently unveiled a USD 2.65 billion Transmission Plan to link renewable-rich states with high-demand regions as part of its renewable energy expansion strategy. This plan aims to connect and transmit over 200 GW of new renewable capacity, facilitating solar and wind generation integration into the main grid.

Limited awareness in developing regions also acts as a restraint. Some utilities still rely on conventional materials due to familiarity and established supply chains. The lack of technical training for handling and installing composite insulators further adds to hesitation among grid operators.

Growth Factors

Grid Modernization and Smart Power Networks Create New Opportunities

The growing focus on grid modernization presents strong growth opportunities for the Cross Arm Composite Insulators Market. Governments and utilities are upgrading power networks to support smart grids, digital monitoring, and efficient power flow. Composite insulators fit well into modern grid designs due to their flexibility and lightweight structure.

Rapid electrification in developing countries is another major opportunity. Rural electrification programs and new transmission projects require reliable and easy-to-install insulation solutions. Composite cross-arm insulators reduce installation time and transportation costs, making them attractive for remote areas.

Urban expansion and industrial development are also creating demand for compact and high-performance transmission structures. Composite materials allow for optimized tower designs and improved line spacing, helping utilities manage space constraints.

There is also a growing demand for renewable energy integration. Long-distance transmission lines connecting solar parks, wind farms, and hydro projects need durable insulation systems. Composite insulators help reduce maintenance needs and improve operational reliability.

Regional Analysis

Asia Pacific Dominates the Cross Arm Composite Insulators Market with a Market Share of 48.9%, Valued at USD 1.1 billion

Asia Pacific leads the Cross Arm Composite Insulators Market due to rapid grid expansion, rising electricity demand, and large-scale renewable energy integration. Utilities are increasingly upgrading aging transmission and distribution networks using composite insulators for better performance in polluted and humid environments. The region accounted for a dominant 48.9% share, with a market value of USD 1.1 billion, supported by strong investments in power infrastructure across emerging and developed economies.

North America shows steady demand driven by grid modernization programs and the replacement of conventional ceramic insulators with lightweight composite alternatives. Utilities in this region focus on improving reliability, reducing maintenance costs, and strengthening networks against extreme weather events. Increasing investments in transmission upgrades and renewable power evacuation corridors continue to support market growth across both urban and rural networks.

Europe’s market growth is supported by strict grid reliability standards and a strong focus on energy transition goals. The region emphasizes modern transmission infrastructure to support offshore wind, cross-border interconnections, and decentralized power generation. Composite insulators are increasingly preferred due to their long service life, resistance to pollution, and suitability for compact line designs in densely populated areas.

The U.S. market benefits from ongoing investments in grid resilience and in replacing aging infrastructure. Utilities are increasingly adopting composite insulators to improve system reliability and reduce outage risks from storms and environmental stressors. Federal and state-level initiatives aimed at modernizing transmission and distribution networks continue to create consistent demand for advanced insulator solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, ABB Ltd. stands out for bringing strong grid-domain know-how into composite insulation applications used on transmission and distribution structures. Its strength is less about “one product” and more about systems thinking—aligning insulator performance with line reliability, digital monitoring, and utility maintenance priorities. From an analyst lens, ABB’s advantage is credibility with utilities that are modernizing networks and tightening outage and safety targets.

For Siemens AG, the key story is grid modernization at scale. Utilities are upgrading substations, adding renewable interconnections, and reinforcing overhead corridors where composite solutions can improve contamination resistance and reduce weight. Siemens’ broader portfolio helps it influence specifications and standards conversations, which can indirectly support the adoption of advanced insulation materials across high-stress environments.

With General Electric, the market impact comes from deep experience across transmission hardware, grid equipment, and utility projects where qualification cycles are strict. GE typically benefits when customers prioritize proven performance, documentation, and lifecycle support important in regions facing severe weather, aging lines, and higher fault-duty conditions.

Meanwhile, Hubbell Power Systems is often seen as highly execution-focused, winning where fast availability, field-friendly designs, and utility-approved configurations matter most. Analysts typically associate Hubbell with practical line hardware integration helpful when composite cross-arm solutions must work smoothly with fittings, installation practices, and crew safety procedures.

Top Key Players in the Market

- ABB Ltd.

- Siemens AG

- General Electric

- Hubbell Power Systems

- TE Connectivity

- Lapp Insulators GmbH

- MacLean Power Systems

- Aditya Birla Insulators

- NGK Insulators Ltd.

- Bharat Heavy Electricals Limited (BHEL)

Recent Developments

- In 2024, ABB acquired a weather routing business to expand its marine software portfolio, indirectly supporting power transmission reliability through integrated digital solutions for grid operations.

- In 2024, Siemens continues to be listed as a key contributor in transmission insulator ecosystems, with ongoing R&D in composite materials for high-voltage applications exceeding 69 kV, focusing on pollution resistance and mechanical support.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 3.3 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Voltage Rating (Low Voltage, Medium Voltage, High Voltage), By Material Type (Silicone Rubber, EPDM, Others), By Application (Transmission Lines, Distribution Lines, Substations), By End-User (Utilities, Industrial, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABB Ltd., Siemens AG, General Electric, Hubbell Power Systems, TE Connectivity, Lapp Insulators GmbH, MacLean Power Systems, Aditya Birla Insulators, NGK Insulators Ltd., Bharat Heavy Electricals Limited (BHEL) Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Cross Arm Composite Insulators MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Cross Arm Composite Insulators MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Siemens AG

- General Electric

- Hubbell Power Systems

- TE Connectivity

- Lapp Insulators GmbH

- MacLean Power Systems

- Aditya Birla Insulators

- NGK Insulators Ltd.

- Bharat Heavy Electricals Limited (BHEL)