Global Coconut Oil Market Size, Share, And Business Benefit By Nature (Conventional, Organic), By Source (Dry Coconut, Wet Coconut), By Product Type (RBD, Virgin, Crude), By Application (Food and Beverages (Snacks and Cereals, Beverages, Nutritional products , Bakery and Confectionery, Others), Pharmaceuticals, Cosmetics and Personal Care Products, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166598

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

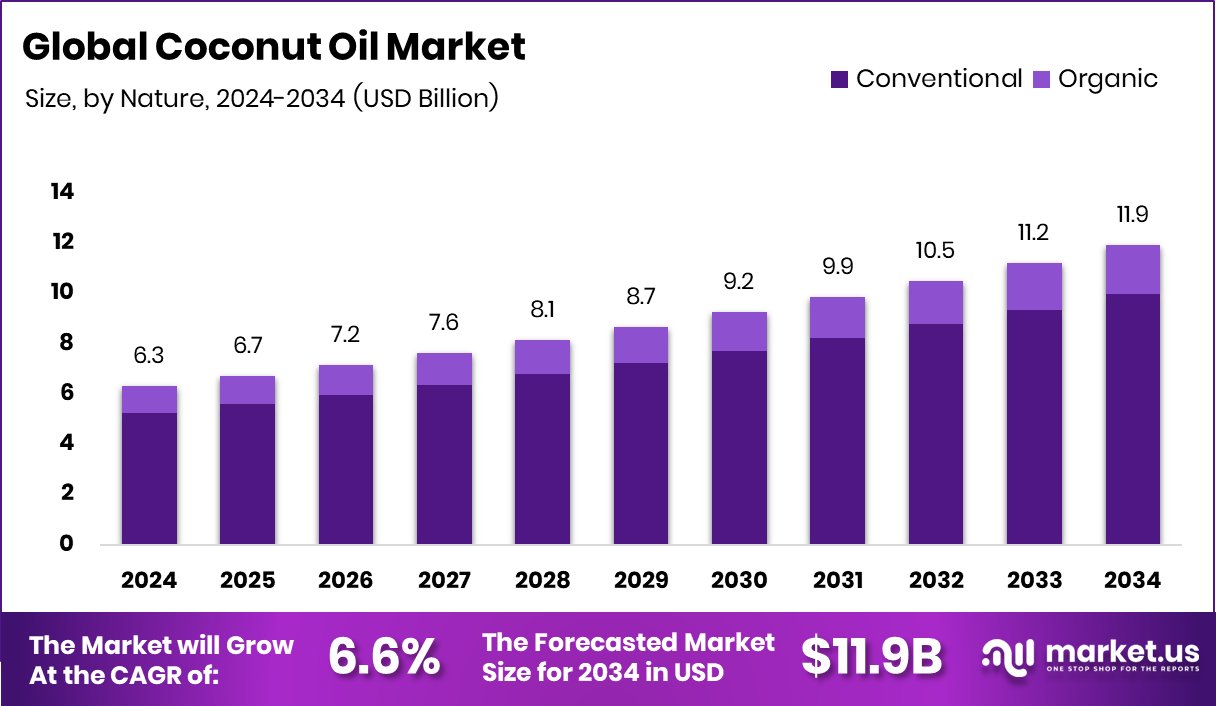

The Global Coconut Oil Market is expected to be worth around USD 11.9 billion by 2034, up from USD 6.3 billion in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034. Asia-Pacific maintains growth due to abundant coconut production, supporting its 45.90% dominance.

Coconut oil is a natural edible oil extracted from mature coconuts, valued for its rich fatty acid profile and its use in cooking, beauty care, wellness, soaps, and nutraceuticals. It is known for its stable shelf life, mild aroma, and versatility across home care, food processing, and personal-care applications.

The coconut oil market represents the global trade and consumption of coconut-derived oils used in food, cosmetics, pharmaceuticals, and industrial products. Demand continues to rise as consumers shift toward plant-based fats, clean-label ingredients, and traditional wellness practices. The market also benefits from expanding coconut cultivation and growing interest in tropical oils across Asia-Pacific, Europe, and North America.

Growth is supported by the rising popularity of natural and minimally processed oils in everyday diets and skincare routines. New capital is flowing into healthier snacking and plant-based categories, highlighted by Daily Crunch’s $4 million, Troo Good’s $9 million, and Eat Better’s $2 million funding rounds—signals that consumer interest in clean, functional ingredients like coconut oil remains strong.

Demand is further fueled by the expansion of value-added coconut products such as coconut-based yoghurt, beverages, and energy snacks. Investments such as Beyond Snack’s USD 8.3 million, Adukale’s Rs 11 crore, and The Coconut Collab’s £1.5M reflect a rising shift toward natural ingredients, indirectly boosting the use of coconut oil across food innovation.

Opportunity grows as companies explore sustainable, alternative fat sources. The market is also shaped by larger strategic moves such as Ferrero’s $3.1B WK Kellogg deal, KLF Nirmal Industries’ Rs 75 crore backing, and innovative solutions like ÄIO’s €1M to develop fermentation-based oils. These trends expand the scope of coconut oil applications while encouraging cleaner, more responsible production pathways.

Key Takeaways

- The Global Coconut Oil Market is expected to be worth around USD 11.9 billion by 2034, up from USD 6.3 billion in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034.

- In the Coconut Oil Market, conventional products dominate with 83.4%, driven by wide availability and affordability.

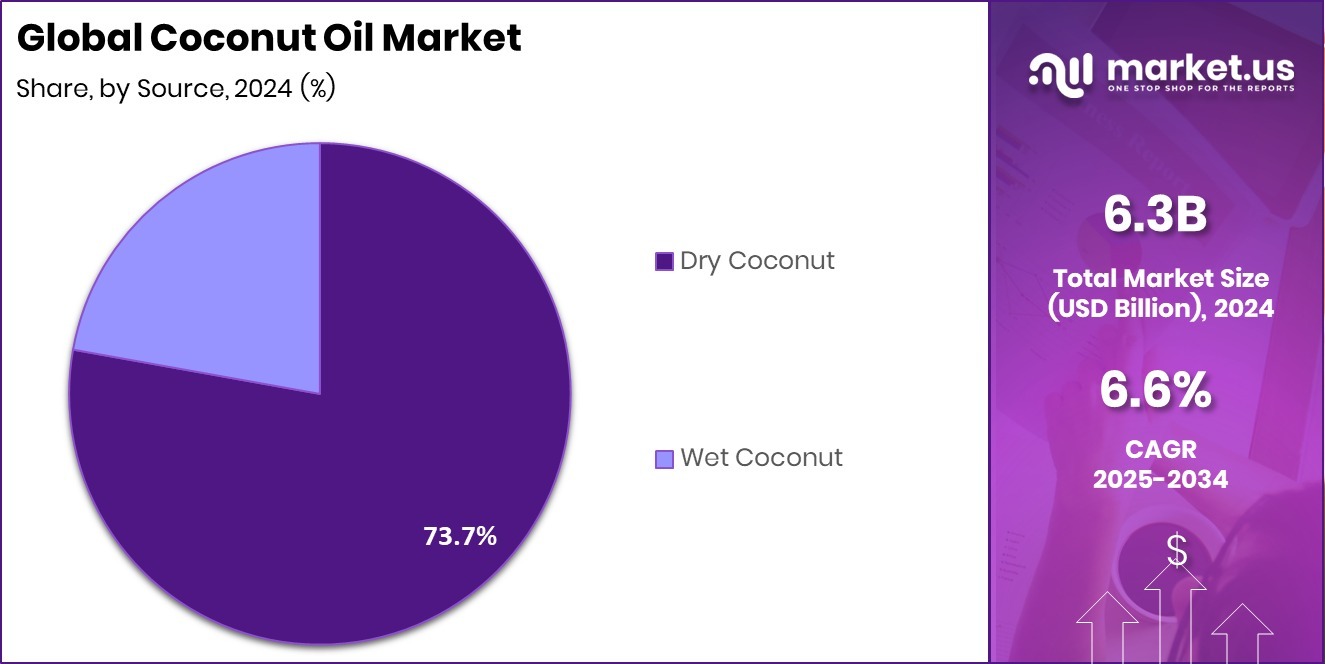

- The Coconut Oil Market is led by dry coconut sourcing at 73.7%, ensuring a stable raw material supply.

- Within the Coconut Oil Market, RBD coconut oil holds a strong 59.3% share due to its versatile applications.

- The Coconut Oil Market sees food and beverages emerging as the top application with 41.1% share.

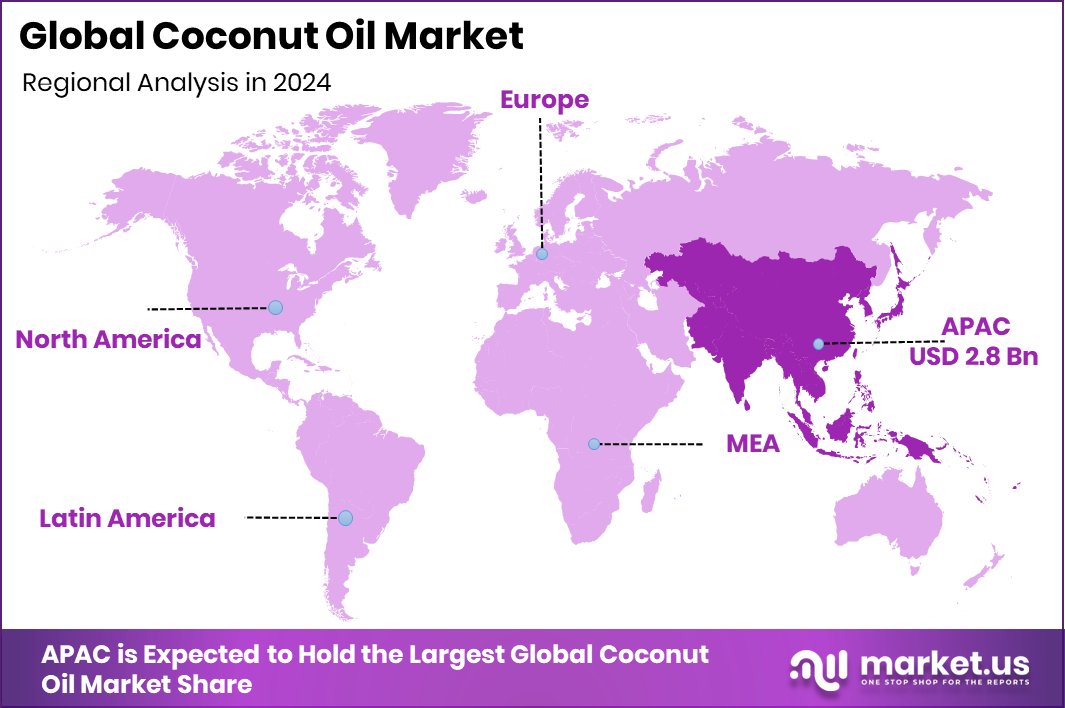

- The Asia-Pacific records a strong market value of USD 2.8 Bn overall.

By Nature Analysis

In the Coconut Oil Market, Conventional forms hold 83.4%, showing strong consumer trust.

In 2024, Conventional held a dominant market position in the By Nature segment of the Coconut Oil Market, with an 83.4% share. This strong lead reflects its wide availability, stable pricing, and deep presence across food, personal care, and household applications.

Conventional coconut oil continues to be the preferred choice for large-volume users such as food processors, soap and cosmetic makers, and wellness brands that rely on a consistent supply.

Its dominance is also supported by established farming networks, traditional extraction practices, and strong distribution in both domestic and export markets. The segment benefits from steady demand in cooking oils, packaged foods, and value-added coconut products, reinforcing its long-term market strength and consumer acceptance.

By Source Analysis

The Coconut Oil Market thrives as Dry Coconut accounts for 73.7% of total sourcing.

In 2024, Dry Coconut held a dominant market position in the By Source segment of the Coconut Oil Market, with a 73.7% share. This strong lead comes from its widespread use in traditional oil extraction, reliable shelf stability, and suitability for large-scale processing.

Dry coconut offers higher oil yield, predictable quality, and easier transport, making it the preferred raw material for food-grade, cosmetic-grade, and industrial coconut oil production. It’s established supply chains across major coconut-producing regions further support consistent output and cost efficiency.

With its deep integration into conventional processing systems, dry coconut remains the backbone of the sector, enabling a steady supply for refined, virgin, and value-added coconut oil applications.

By Product Type Analysis

The Coconut Oil Market expands steadily, with RBD oil capturing 59.3% share.

In 2024, RBD held a dominant market position in the By Product Type segment of the Coconut Oil Market, with a 59.3% share. This leadership is driven by its neutral flavour, clear appearance, and high stability, making it suitable for packaged foods, frying applications, bakery products, and personal-care formulations.

RBD coconut oil is widely preferred by large manufacturers because it offers consistent quality and meets standardised processing requirements for both domestic and export markets.

Its longer shelf life and versatility across foodservice, cosmetics, and industrial uses further strengthen its position. With strong consumer acceptance and broad commercial demand, RBD remains the most widely adopted product type across global coconut oil supply chains.

By Application Analysis

Demand strengthens in the Coconut Oil Market, where Food and Beverages hold 41.1%.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Coconut Oil Market, with a 41.1% share. This leadership comes from the strong use of coconut oil in cooking oils, baked goods, snacks, confectionery, and processed foods, where its stability and clean flavour are highly valued.

The segment also benefits from rising interest in plant-based and minimally processed ingredients, pushing coconut oil into everyday household use and commercial food manufacturing.

Its suitability for frying, seasoning blends, and ready-to-eat products strengthens its relevance across modern food categories. With steady demand from both retail and large-scale food processors, Food and Beverages continues to anchor the overall market’s growth.

Key Market Segments

By Nature

- Conventional

- Organic

By Source

- Dry Coconut

- Wet Coconut

By Product Type

- RBD

- Virgin

- Crude

By Application

- Food and Beverages

- Snacks and Cereals

- Beverages

- Nutritional products

- Bakery and Confectionery

- Others

- Pharmaceuticals

- Cosmetics and Personal Care Products

- Others

Driving Factors

Growing Shift Toward Healthy Natural Oils

A major driver for the Coconut Oil Market is the strong global movement toward healthier, natural, and minimally processed oils. Consumers are choosing coconut oil for everyday cooking, skincare, and wellness because it feels familiar, clean, and plant-based. This shift is strengthened by rising investment in healthier snacking and natural ingredient brands.

Wonderland Foods raising Rs 140 crore and Farmley securing $42 million in Series C funding clearly show how investors are supporting clean-label, nut-based, and coconut-linked products. These funds help brands expand sourcing, build better supply chains, and launch new natural food items, which in turn increases demand for coconut oil. As more companies adopt coconut-derived ingredients in snacks, mixes, and nutrition foods, the overall market continues to grow steadily.

Restraining Factors

Rising Cost Pressures Across Coconut Supply Chains

A key restraining factor for the Coconut Oil Market is the rising cost pressure across sourcing, processing, and distribution. Coconut production depends heavily on climate, ageing plantations, and labour-intensive harvesting, which often makes raw coconuts more expensive and less predictable than other vegetable oil sources. These challenges impact oil processors, food brands, and wellness companies that rely on stable input prices.

At the same time, financial activity in the snacking sector—like Eat Better securing INR 17 crore and Beyond Snack raising $8.3 million—shows strong investor interest in value-added snacks but also pushes demand for premium ingredients. This higher demand can tighten supplies further, increasing price volatility. As costs rise, manufacturers face margin pressure, limiting the wider usage of coconut oil in price-sensitive markets.

Growth Opportunity

Expanding Use in Healthy Snack Innovations

A major growth opportunity for the Coconut Oil Market comes from its rising use in healthy, natural, and premium snack products. More brands are choosing coconut oil for roasting, baking, flavouring, and clean-label formulations because it offers a mild taste and is perceived as a better alternative to refined seed oils. This momentum is strengthened by new investments in India’s fast-growing healthy snacking space.

Phab’s $2 million seed funding and Farmley’s $6.7 million pre-series round show how investors are supporting nutritious, ingredient-focused snack brands. As these companies scale production and introduce coconut-based bars, roasted mixes, and functional snack formats, demand for coconut oil rises sharply. This creates steady room for innovation, premium product launches, and deeper market expansion across global food categories.

Latest Trends

Rising Shift Toward Clean-Label Food Formulations

One of the latest trends in the Coconut Oil Market is the rapid shift toward clean-label, high-protein, and minimally processed packaged foods. Coconut oil is increasingly used in cereals, instant meals, and ready-to-eat snacks because it offers a natural fat source that fits modern wellness expectations. This trend is growing stronger as major food brands expand into healthier product lines, supported by fresh investment activity.

Magic Spoon securing $85 million after gaining shelf space at Target highlights how clean-ingredient cereals are moving into mainstream retail. Similarly, Yu raising INR 55 crore in Series B funding reflects the growing demand for natural, preservative-free instant foods. As these companies scale up, the use of coconut oil in clean-label recipes continues to rise, shaping innovation across global food categories.

Regional Analysis

Asia-Pacific leads the Coconut Oil Market with a 45.90% share in 2024.

Asia-Pacific dominated the Coconut Oil Market with a 45.90% share and a market value of USD 2.8 billion, supported by abundant coconut cultivation across key producing countries and strong demand from food, cosmetic, and wellness sectors. The region benefits from large processing capacities, steady domestic consumption, and a well-established export network, keeping it at the centre of global supply.

North America shows consistent growth as consumers shift toward natural oils in cooking, clean-label snacks, and personal-care products. The region’s demand is supported by a rising preference for plant-based alternatives and growing adoption of coconut-derived ingredients in premium food categories.

Europe continues to expand due to its strong cosmetic, skincare, and speciality food industries, where coconut oil is valued for its purity, versatility, and alignment with natural product trends. Increasing usage in organic and vegan formulations supports steady market uptake.

The Middle East & Africa market grows gradually, driven by rising urbanisation, expanding retail channels, and increasing use of coconut oil in personal-care routines.

Latin America also shows moderate progress, supported by demand from bakery, confectionery, and household applications. Emerging wellness consumption patterns continue to gradually strengthen the region’s adoption of coconut oil.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill Incorporated maintained a strong presence through its extensive supply-chain capabilities and diversified food-ingredient portfolio. The company benefits from deep relationships with growers, processors, and end-use manufacturers, allowing it to support consistent coconut-oil sourcing across food, personal-care, and industrial applications. Its focus on quality control and processing efficiencies helps strengthen reliability for global buyers.

ADM continued to contribute to the market through its broad agricultural-processing network and experience in plant-based oils. The company’s established infrastructure in refining, blending, and distributing edible oils positions it well to support customers seeking a stable coconut oil supply. Its engagement in food innovation and nutrition-driven product development also supports coconut oil’s use in clean-label foods and wellness-oriented categories.

Bunge Limited plays an important role due to its integrated operations across oilseed processing, ingredients, and global logistics. The company’s expertise in handling edible oils and maintaining large-scale distribution networks enables steady participation in coconut-oil flows for food manufacturers, bakeries, and packaged-goods producers. Its broad geographic footprint and ability to align with evolving consumer preferences allow it to remain a relevant participant in the coconut-oil ecosystem.

Top Key Players in the Market

- Cargill Incorporated

- ADM

- Bunge Limited

- Mangga Dua

- Greenville Agro Corporation

- Royce Food Corporation

- Novel Nutrients Pvt. Ltd.

- Aromaax International

- Connoils LLC

- Tantuco Enterprises, Inc.

- Celebes Coconut Corporation

Recent Developments

- In June 2024, Cargill launched the CocoGrow project to revitalise coconut-tree cultivation in Sarangani Province. The initiative aims to support local farmers, improve yields and strengthen the coconut industry in the region.

Report Scope

Report Features Description Market Value (2024) USD 6.3 Billion Forecast Revenue (2034) USD 11.9 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Conventional, Organic), By Source (Dry Coconut, Wet Coconut), By Product Type (RBD, Virgin, Crude), By Application (Food and Beverages (Snacks and Cereals, Beverages, Nutritional products, Bakery and Confectionery, Others), Pharmaceuticals, Cosmetics and Personal Care Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill Incorporated, ADM, Bunge Limited, Mangga Dua, Greenville Agro Corporation, Royce Food Corporation, Novel Nutrients Pvt. Ltd., Aromaax International, Connoils LLC, Tantuco Enterprises, Inc., Celebes Coconut Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill Incorporated

- ADM

- Bunge Limited

- Mangga Dua

- Greenville Agro Corporation

- Royce Food Corporation

- Novel Nutrients Pvt. Ltd.

- Aromaax International

- Connoils LLC

- Tantuco Enterprises, Inc.

- Celebes Coconut Corporation