Global Cocoa Chocolate Market Size, Share Analysis Report By Type (Cocoa Ingredients, Chocolate), By Application (Food And Beverage, Cosmetics, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162975

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

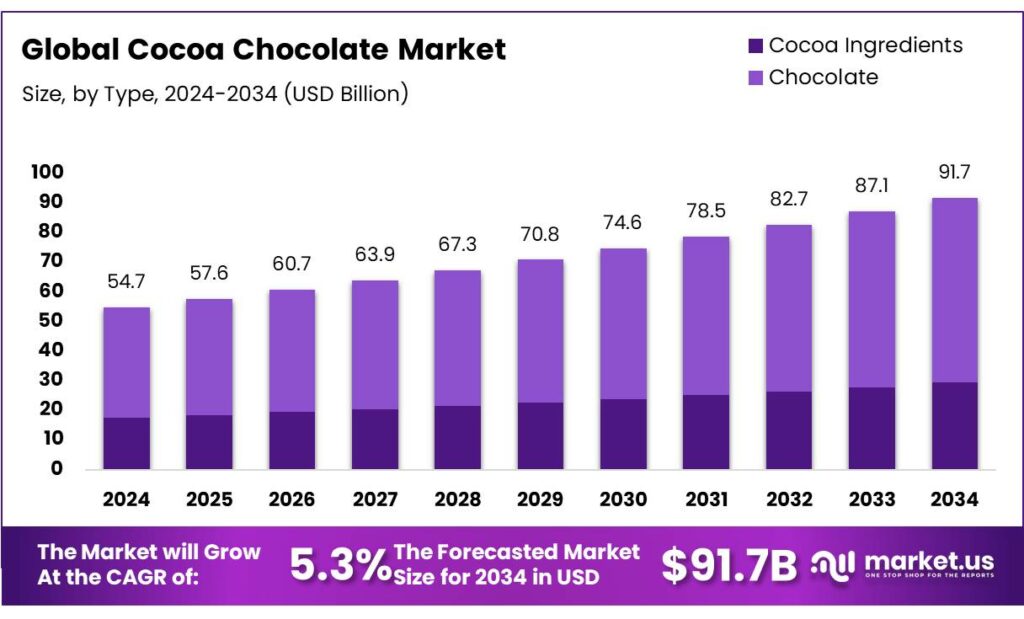

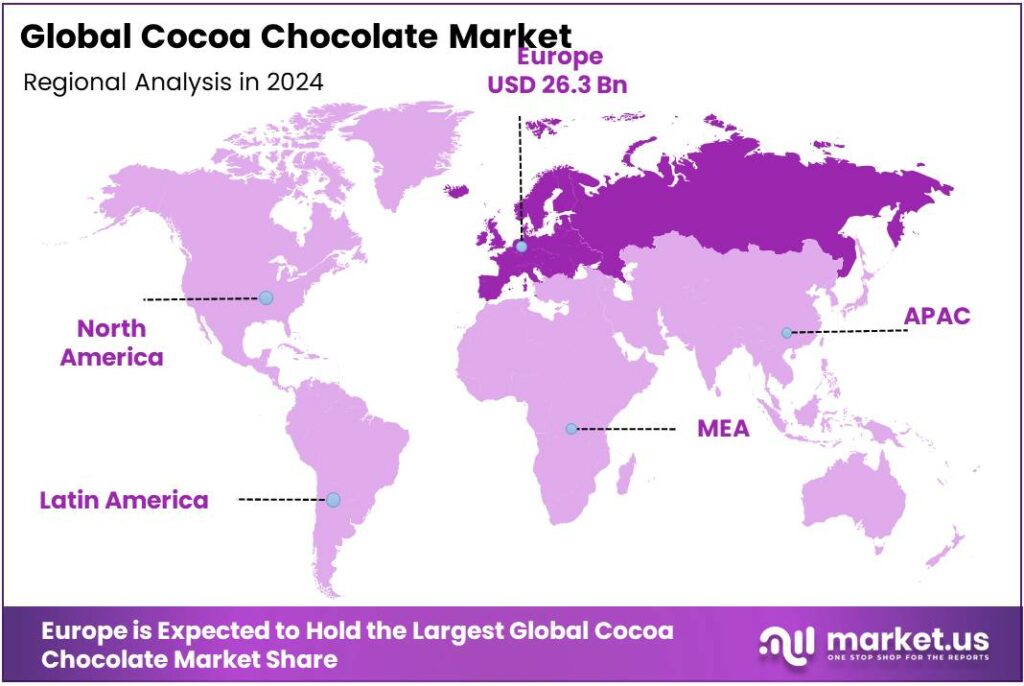

The Global Cocoa Chocolate Market size is expected to be worth around USD 91.7 Billion by 2034, from USD 54.7 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 48.2% share, holding USD 26.3 Billion in revenue.

Cocoa–chocolate sits at the intersection of volatile agricultural supply and increasingly energy-exposed food manufacturing, with fundamentals reshaped by record price swings and compliance demands. After a severe West African shortfall, the International Cocoa Organization reported global grindings at 4.816 million tonnes for 2023/24, evidencing demand resilience despite bean scarcity. Cocoa prices mirrored tightness: the World Bank’s beverage index rose 18% in December 2024 and stood ~91% higher year-over-year, with cocoa up 58% in 2024 before a projected 9% decline in 2025 as supply recovers.

The IEA notes industry consumed 37% of global energy in 2022, underscoring why energy shocks quickly squeeze chocolate margins. In the EU, industry accounted for 24.6% of final energy use in 2023, while policy moves since 2023 target an overall 42.5% renewables share by 2030, creating incentives for processors to electrify and source green power. Historical benchmarking shows food manufacturing’s energy footprint is material: the U.S. EIA estimated food, beverage, and tobacco manufacturing at ~4% of delivered industrial energy in OECD economies, a useful proxy for chocolate factory exposure to fuel and electricity volatility.

Price transmission along the chain is visible in farmgate moves designed to protect growers. Ghana’s COCOBOD set a USD 3,100/tonne producer price for 2024/25, while Côte d’Ivoire lifted the 2025/26 farmgate to CFA 2,500/kg ,both historic steps that support farmer incomes yet pressure processors’ input costs. High prices also curbed demand in key import markets USDA notes U.S. cocoa bean import volumes fell 22% in 2023 and a further 26% in 2024 amid the price spike that peaked at USD 10,412/tonne in December 2024. On the regulatory front, the EU Deforestation Regulation will require due diligence and segregation of compliant cocoa, materially affecting sourcing, traceability systems, and logistics for EU-bound chocolate.

Key demand drivers include premiumization, strong seasonal gifting, and expanding cocoa use in biscuits, beverages, and dairy mixes. Yet the dominant medium-term driver is supply normalization: ICCO projects global supply to rise ~7.8% to ~4.84 million tonnes in 2024/25, while demand is expected to edge ~4.8% lower to ~4.65 million tonnes, a path that could ease extreme price volatility if realized. Policy is another driver: EUDR-aligned traceability, living-income pricing pilots, and Ghana/Côte d’Ivoire pricing reforms aim to stabilize farmer economics and reduce smuggling that exceeded ~350,000 tonnes in 2023/24 across the region, according to recent reporting.

Key Takeaways

- Cocoa Chocolate Market size is expected to be worth around USD 91.7 Billion by 2034, from USD 54.7 Billion in 2024, growing at a CAGR of 5.3%.

- Chocolate held a dominant market position, capturing more than a 68.3% share of the global cocoa chocolate market.

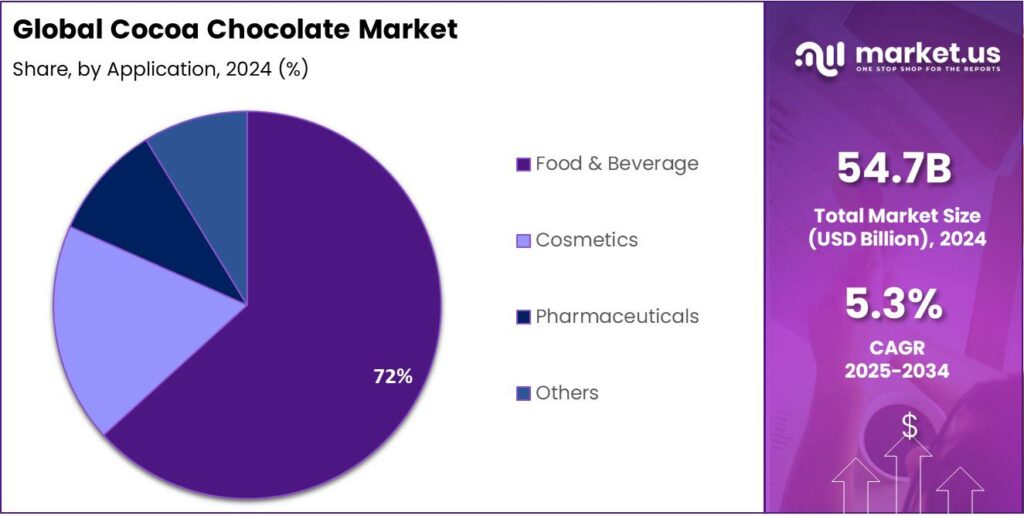

- Food And Beverage held a dominant market position, capturing more than a 72.4% share of the global cocoa chocolate market.

- Europe held a dominant position in the global cocoa chocolate market, accounting for more than 48.20% of the total market share and generating revenues of approximately USD 26.3 billion.

By Type Analysis

Chocolate dominates with 68.3% share due to strong global demand and premiumization trends

In 2024, Chocolate held a dominant market position, capturing more than a 68.3% share of the global cocoa chocolate market. The segment’s leadership was primarily driven by rising consumer demand for indulgent and premium-quality chocolate products across both developed and emerging economies. Increasing awareness of ethically sourced cocoa and the growing preference for dark and organic chocolate further reinforced this trend. Global manufacturers have been expanding their product portfolios, introducing innovative flavors and sustainable packaging to attract environmentally conscious consumers.

The chocolate segment benefited from strong retail and e-commerce sales, especially during festive and seasonal periods, which contributed to steady year-on-year growth through 2024. Rising disposable income levels and urbanization in countries such as India, China, and Brazil supported consumption expansion, while established markets like Europe and North America continued to show resilience in premium and artisanal chocolate demand.

By Application Analysis

Food & Beverage dominates with 72.4% share driven by strong demand in confectionery and bakery industries

In 2024, Food & Beverage held a dominant market position, capturing more than a 72.4% share of the global cocoa chocolate market. This dominance was primarily supported by the widespread use of cocoa chocolate in confectionery, bakery, dairy, and ready-to-drink beverage products. The increasing demand for indulgent and flavor-rich food items, along with the rising popularity of chocolate-infused products such as desserts, ice creams, and beverages, contributed significantly to the segment’s expansion. The segment also benefited from continuous product innovation, where manufacturers introduced new chocolate flavors and textures to enhance consumer experience and maintain market interest.

The year 2024 witnessed a notable rise in chocolate applications across premium bakery and snack products, supported by urbanization and changing eating habits. Foodservice chains and cafes increasingly incorporated chocolate-based offerings, which further fueled segmental growth. In developing regions, expanding middle-class populations and improved retail access also played an essential role in boosting chocolate-based food product sales.

Key Market Segments

By Type

- Cocoa Ingredients

- Cocoa Butter

- Cocoa Liquor

- Cocoa Powder

- Chocolate

- Dark

- Milk

- White

- Filled

By Application

- Food & Beverage

- Confectionery

- Dairy

- Bakery

- Others

- Cosmetics

- Pharmaceuticals

- Others

Emerging Trends

Traceable, origin-led chocolate shaped by EUDR and price shocks

Price dynamics are amplifying this trend. After two poor crops, the International Cocoa Organization projected 2024/25 global cocoa supply at 4.840 million tonnes and demand at 4.650 million tonnes, showing how rationing and reformulation followed the 2024 price spike. The World Bank’s beverage index rose 58% in 2024, then is projected to fall 9% in 2025 and 3% in 2026 as output recovers—creating margin room to fund traceability and to launch higher-cocoa, origin-specific lines without over-tightening price points. On the processing side, Europe’s grind in Q3-2025 fell 4.8% year-over-year to 337,353 t, but markets rallied because the drop was smaller than feared—evidence of an industry flexing volumes while protecting value.

Consumer pull for “credible quality” is the other half of the trend. In the United States, confectionery sales reached $54 billion in 2024, with the National Confectioners Association expecting the category to exceed $70 billion by 2029—a powerful base to absorb traceability and origin upgrades. Within that, chocolate led at $28.1 billion in 2024, keeping premium spaces resilient despite inflation. In practice, this means smaller portion sizes with better cocoa credentials, seasonal collections tied to certified or mapped origins, and retail assortments that reward verified provenance.

Origin diversification is accelerating too—another visible trend aligned with EUDR. Ecuador is on track to become the world’s No. 2 cocoa producer, with industry leadership projecting output above 650,000 t by 2026/27 as agroforestry and farm-gate price transmission lift yields. This creates new supply options for European buyers building deforestation-free portfolios and gives brands more levers for origin-led ranges. In parallel, debate around the EUDR’s timelines continues—some stakeholders argued for more time—but the Commission’s phased approach still orients the industry toward December 2025 for larger firms, keeping momentum behind traceability infrastructure.

Drivers

Resilient chocolate demand as an “affordable treat”

The single strongest engine behind cocoa-chocolate is steady consumer demand for small, affordable indulgences—even in years of extreme raw-material volatility. In the United States, confectionery sales reached $54.0 billion in 2024, underscoring consumers’ willingness to keep treating themselves despite cost pressures. Within that, chocolate remained the anchor category: NCA reports $28.1 billion in chocolate sales in 2024 across measured retail channels, outpacing gum and approaching parity with rapidly growing non-chocolate items. The emotional pull is clear: an NCA consumer study found 65% of shoppers explicitly turn to chocolate as an “affordable treat,” reinforcing why value, portion-control formats, and seasonal gifting keep baskets sticky even when budgets are tight.

Importantly, this consumer backbone holds even when supply shocks force temporary rationing. The International Cocoa Organization (ICCO) recorded a sharp supply-side squeeze, with 2023/24 world production down ~13% year over year to ~4.37–4.38 million tonnes, triggering price spikes and near-term grind adjustments.

In the United States, USDA’s Economic Research Service noted U.S. cocoa-bean import volumes fell 22% in 2023 and 26% in 2024 as prices surged, with an all-time high of $10,412/ton in December 2024—yet demand for finished chocolate continued to generate record dollar sales at retail. In Europe, where price sensitivity is more visible in industrial data, the European Cocoa Association reported Q3-2025 grindings down 4.8% year over year to 337,353 tonnes—a cyclical dip that reflects temporary affordability pressures rather than a structural retreat from chocolate.

Policy also buttresses this demand-led engine by improving supply reliability and trust—two prerequisites for sustained category growth. Côte d’Ivoire and Ghana’s $400/ton Living Income Differential (LID), implemented to stabilize farmer earnings, helps keep growers engaged and quality consistent, ultimately supporting the volume and taste profiles consumers expect. On the buying-market side, the EU Deforestation Regulation will apply from 30 December 2025 for large and medium companies, pushing rapid adoption of traceability and deforestation-free sourcing for cocoa.

Restraints

Price shocks, disease, and new compliance costs squeeze the category

Cocoa-chocolate’s biggest restraint today is the collision of extreme input-cost volatility with origin-level disease and fast-tightening regulatory requirements. After two weak harvests, the International Cocoa Organization estimated 2023/24 global cocoa production at 4.382 million tonnes, below demand, creating a deep supply-demand gap that pushed futures to historic levels.

USDA’s Economic Research Service reports cocoa prices peaked at $10,412/ton in Dec-2024, with U.S. cocoa-bean import volumes falling 22% in 2023 and 26% in 2024 as buyers retrenched. Those spikes transmit directly into chocolate manufacturer costs and retail pricing, risking trading-down and recipe changes that can erode brand equity. In Europe—home to some of the world’s largest processors—the European Cocoa Association recorded Q3-2025 grindings down 4.8% year over year to 337,353 t, a clear signal that high raw-material prices are curbing throughput and margins.

At origin, agronomic shocks deepen the constraint. Ghana and Côte d’Ivoire together supply over 60% of global cocoa, concentrating risk in two West African systems that have faced aging trees, weather stress, and disease. In July-2024, ICCO data cited by Reuters indicated 81% of Ghana’s Western North region was affected by cocoa swollen shoot virus, with ~500,000 ha of Ghana’s cocoa land impacted nationwide—implying multi-year replanting cycles and suppressed yields.

- ICCO’s market reports warned that hot, dry conditions and Harmattan winds could continue to weigh on 2024/25 supplies, keeping prices elevated. Even as ICCO later projected a 7.8% supply rebound to 4.840 million tonnes for 2024/25, it also forecast demand down 4.8% to 4.650 million tonnes, reflecting rationing and affordability pressures rather than structural health.

Layered on top are mounting compliance costs. The EU Deforestation Regulation (EUDR) adds traceability, geolocation, and due-diligence obligations that many smallholders and mid-tier processors must rapidly stand up to retain access to the EU’s premium market. Following a one-year phase-in, the law applies from 30 Dec 2025 for large/medium companies and from 30 Jun 2026 for micro/small enterprises—deadlines that accelerate investment needs in mapping, data systems, and segregation.

Opportunity

Compliance-ready, value-added cocoa as the next growth lane

On the supply side, normalization from 2024’s extreme tightness creates room to reinvest. The International Cocoa Organization projects global 2024/25 cocoa supply at 4.840 million tonnes versus demand at 4.650 million tonnes, a configuration that eases the most acute rationing and gives manufacturers oxygen to fund traceability, reformulation, and origin programs. Added tailwind: the World Bank estimates its beverage price index rose 58% in 2024, but is projected to fall 9% in 2025 and 3% in 2026 as production recovers—creating margin headroom to launch EUDR-compliant, origin-specific, or higher-cocoa lines without shocking consumers on price.

Demand remains a sturdy base for premiumization. In the United States, confectionery dollar sales reached $54 billion in 2024, and the National Confectioners Association expects the category to surpass $70 billion by 2029 across outlets. Even within a year of price spikes, chocolate accounted for $28.1 billion in 2024—a signal that consumers will keep trading up for credible quality cues. These dollars can be directly channeled into origin programs and compliant supply that unlock EU access and retailer preference.

In September 2025, the African Development Bank approved €100 million to strengthen Côte d’Ivoire’s cocoa value chain—another signal that concessional and development capital will co-finance compliance, agroforestry, and youth employment at scale.

Origin diversification is a parallel opportunity that reduces compliance and climate risk. Ecuador, for example, is rapidly scaling compliant, agroforestry-based cocoa; industry leaders expect output to exceed 650,000 t by 2026/27, potentially elevating the country to No. 2 globally as yields approach ~800 kg/ha in shaded systems. For buyers, this means more choice of high-quality beans with strong traceability building blocks—ideal for EUDR dossiers and premium dark chocolate portfolios.

Regional Insights

Europe leads the global market with 48.20% share valued at USD 26.3 billion, supported by strong consumer demand and premiumization trends

In 2024, Europe held a dominant position in the global cocoa chocolate market, accounting for more than 48.20% of the total market share and generating revenues of approximately USD 26.3 billion. The region’s leadership is primarily attributed to its established chocolate culture, advanced processing capabilities, and strong presence of leading confectionery manufacturers across Germany, Switzerland, Belgium, France, and the United Kingdom. European consumers have shown a long-standing preference for high-quality chocolate products, particularly in the premium and artisanal categories, which continues to drive substantial market growth.

The European cocoa chocolate sector benefits from well-developed supply chains and a high level of innovation in flavor, packaging, and sustainability. Major companies in the region have increased their focus on ethical sourcing and traceability, complying with the European Union’s deforestation-free regulation (Regulation 2023/1115), which aims to ensure that all cocoa imports meet strict environmental standards. Consumption of dark and organic chocolate products has grown steadily, supported by a health-conscious consumer base. Additionally, Germany and Switzerland remain among the highest per capita chocolate consumers globally, reflecting the maturity and strength of the regional market.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Olam International (Olam Cocoa): Singapore-based Olam is a major integrated agri-business covering origination, trading and processing of cocoa beans. It says it serves over 20,900 customers globally and is a top supplier of cocoa beans and products (liquor, butter, powder) with operations in major origin countries.

Cocoa Processing Company Limited (Ghana): Founded in 1965 and publicly listed since 2003, Ghana’s CPC processes premium Ghana cocoa beans (without blending) into semi-finished cocoa liquor, butter, powder and its own “Golden Tree” branded chocolate & confectionery. Its cocoa-factory throughput is about 64,500 metric tonnes annually.

Touton S.A.: French agro-industrial trader founded in 1848, Touton is a long-standing specialist in cocoa, coffee, vanilla and spices with over 700 employees across 14 subsidiaries and seven processing/packaging sites. It emphasises sustainable sourcing and tropical ingredient supply chains.

Top Key Players Outlook

- Barry Callebaut, AG

- Cargill, Inc.

- Olam International

- Fuji Oil Company Ltd.

- Cocoa Processing Co. Ltd.

- Touton S.A.

- PLOT Enterprise Ghana Limited

- Others

Recent Industry Developments

In 2024, OFI achieved an earnings before interest and tax (EBIT) of S$1,071 million, reflecting an 11.5 % increase year-on-year, and the business recorded volume growth of 2.1 % to approximately 3.4 million metric tonnes.

Fuji Oil Company Ltd. plays a strategic role in the cocoa-chocolate sector by focusing on ingredient innovation, plant-based solutions and sustainable sourcing. In the fiscal year ended March 31, 2025, Fuji Oil reported net sales of ¥671,211 million and an operating profit of ¥9,895 million as higher cocoa bean procurement costs weighed on margins.

Report Scope

Report Features Description Market Value (2024) USD 54.7 Bn Forecast Revenue (2034) USD 91.7 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Cocoa Ingredients, Chocolate), By Application (Food And Beverage, Cosmetics, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Barry Callebaut, AG, Cargill, Inc., Olam International, Fuji Oil Company Ltd., Cocoa Processing Co. Ltd., Touton S.A., PLOT Enterprise Ghana Limited, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Barry Callebaut, AG

- Cargill, Inc.

- Olam International

- Fuji Oil Company Ltd.

- Cocoa Processing Co. Ltd.

- Touton S.A.

- PLOT Enterprise Ghana Limited

- Others