Global Ceramic Insulators Market Size, Share, And Industry Analysis Report By Type (Ceramic Pin Insulator, Ceramic Strain Insulator, Ceramic Bushing Insulator), By Application (Rail, Transformer, Cables), By End User (Electrical Industry, Heater Industry), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169246

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

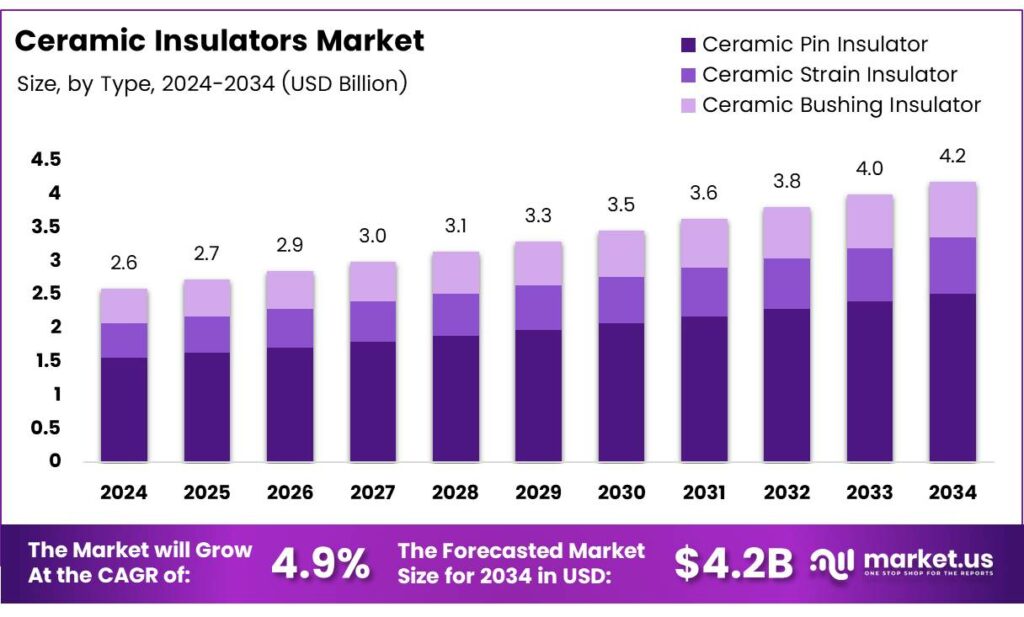

The Global Ceramic Insulators Market size is expected to be worth around USD 4.2 billion by 2034, from USD 2.6 billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The ceramic insulators market refers to the global trade and application ecosystem for porcelain-based electrical insulation components. These products ensure electrical isolation, mechanical strength, and long service life across transmission, distribution, railways, and industrial power systems. Market demand is closely tied to grid expansion, infrastructure upgrades, and rising power reliability expectations.

Ceramic insulators remain critical due to their proven durability under extreme electrical and climatic conditions. As utilities modernise ageing networks, ceramic materials continue gaining preference for long-distance transmission. Consequently, demand growth aligns with renewable integration, higher grid voltages, and replacement cycles in mature power markets.

- In substations and distribution systems, ceramic support insulators manage very high mechanical and electrical stresses. According to global utility engineering standards, they operate at voltages up to 500 kV, with basic insulation levels ranging from 95 kV to 1,675 kV. Wall bushings are typically rated up to 72 kV and 3,150 A, enabling safe enclosure penetration.

Beyond grid infrastructure, ceramic insulating sleeve washers serve precision electrical and electronic applications. These components withstand temperatures up to 3000 °F and resist corrosive gases, including hydrochloric and nitric acid. Such properties ensure electrical isolation, corrosion prevention, and dimensional stability in sensitive assemblies.

The market also benefits from diversified product availability supporting medium- and high-voltage networks. According to Indian power equipment certification norms, offerings include 11 kV, 15 kV, and 33 kV ceramic configurations across pin, strain, shackle, and arrester applications. This breadth supports scalable adoption across utilities, industries, and infrastructure-led growth initiatives.

Key Takeaways

- The Global Ceramic Insulators Market is projected to reach USD 4.2 billion by 2034, growing from USD 2.6 billion in 2024 at a 4.9% CAGR.

- Ceramic Pin Insulators led the market by type, accounting for a dominant share of 49.6% in 2024.

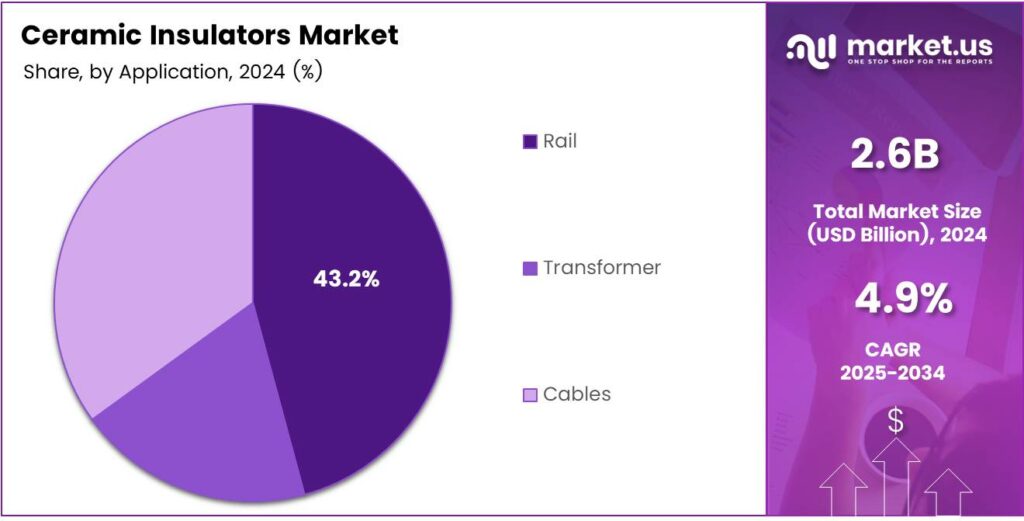

- Rail Applications emerged as the largest segment, holding a market share of 43.2% in 2024.

- The Electrical Industry was the primary end user, contributing a substantial 92.4% share of total market demand.

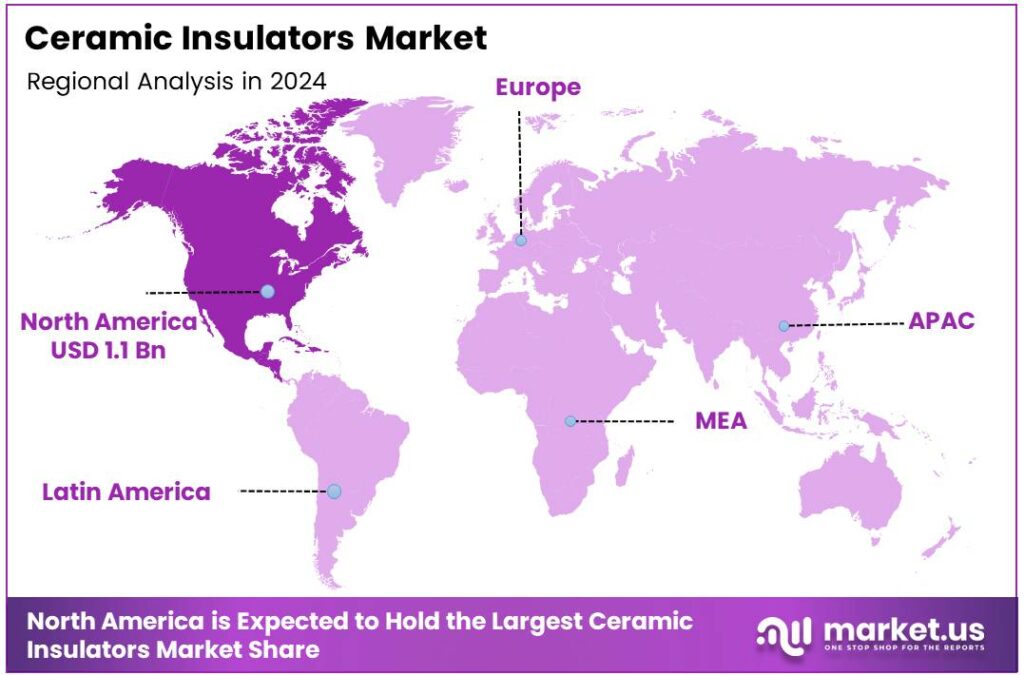

- North America dominated the global market with a 43.8% share, valued at approximately USD 1.1 billion in 2024.

By Type Analysis

Ceramic Pin Insulator dominates with 49.6% due to its long-standing use in overhead distribution networks and stable mechanical performance.

In 2024, Ceramic Pin Insulator held a dominant market position in the By Type Analysis segment of the Ceramic Insulators Market, with a 49.6% share. It continues to be preferred for low- and medium-voltage lines, driven by simple design, ease of installation, and dependable insulation under varied environmental conditions.

Ceramic Strain Insulators play a critical supporting role where conductors experience high tensile stress. They are commonly used at dead ends, sharp turns, and long-span lines. Their demand remains steady as grids expand and transmission routes become more complex across both urban and remote regions.

Ceramic Bushing Insulators are essential for enabling safe conductor passage through grounded barriers in electrical equipment. Their relevance grows with the rising installation in substations and transformers. These insulators ensure electrical isolation, operational safety, and long-term reliability under high thermal and electrical stress.

By Application Analysis

Rail dominates with 43.2% due to extensive electrified rail networks and continuous upgrades in rail infrastructure.

In 2024, Rail held a dominant market position in the By Application Analysis segment of the Ceramic Insulators Market, with a 43.2% share. The segment benefits from continuous railway electrification, growing metro projects, and the need for durable insulation able to withstand vibration, pollution, and weather exposure.

Transformer applications rely on ceramic insulators to provide electrical separation and mechanical stability within high-voltage environments. Their role remains essential in ensuring safe energy transfer, minimising leakage risks, and supporting long operating life as transformer installations expand across transmission and distribution networks.

Cable-related applications depend on ceramic insulators for supporting overhead cable systems and maintaining insulation integrity. With ongoing grid expansion and refurbishment, these insulators contribute to reliable power flow, especially in areas where cables are exposed to mechanical loads and environmental stress.

By End User Analysis

Electrical Industry dominates with 92.4% owing to its extensive reliance on ceramic insulators across generation, transmission, and distribution systems.

In 2024, the Electrical Industry held a dominant market position in the By End User Analysis segment of the Ceramic Insulators Market, with a 92.4% share. The sector consistently demands ceramic insulators for substations, transmission lines, and distribution networks, driven by safety standards, grid expansion, and long asset life.

The Heater Industry forms a smaller yet stable end-user segment supported by the insulating and heat-resistant properties of ceramic materials. These insulators are used to ensure electrical separation and thermal stability in heating equipment, where operational safety and durability remain critical performance requirements.

Key Market Segments

By Type

- Ceramic Pin Insulator

- Ceramic Strain Insulator

- Ceramic Bushing Insulator

By Application

- Rail

- Transformer

- Cables

By End User

- Electrical Industry

- Heater Industry

Emerging Trends

Shift Toward High-Voltage Applications Shaping Market Trends

A key trend in the ceramic insulators market is the growing use in high-voltage and ultra-high-voltage applications. As transmission distances increase, utilities are adopting higher voltage systems to reduce power losses. Ceramic insulators are well-suited for such demanding environments.

- Producers are focusing on better glazing, higher purity raw materials, and advanced firing processes. These improvements enhance mechanical strength and resistance to environmental pollution. The transmission network has now reached 4,85,544 circuit-kilometres (ckm) of transmission lines, with a transformation capacity of 12,51,080 MVA

Utilities now prefer application-specific insulators based on voltage level, climate, and pollution conditions. Ceramic insulators are being tailored to meet these precise operational needs. Sustainability considerations are influencing the market. Ceramic insulators are made from natural raw materials and have long service lives.

Restraints

High Installation Costs and Material Alternatives Limiting Market Growth

One major restraint in the ceramic insulators market is the high initial installation cost. Ceramic insulators are heavier and require careful handling during transport and installation. This increases labour costs, especially for large transmission projects in remote areas. Another challenge is the availability of alternative materials such as polymer and composite insulators.

These alternatives are lighter in weight and easier to install, making them attractive for some utility operators. In certain applications, utilities prefer polymer insulators due to lower upfront costs. Fragility is also a limiting factor for ceramic insulators. While they perform well electrically, they can crack or break under severe mechanical stress or improper handling.

This creates concerns during installation and transportation. Slow replacement cycles can restrict market growth. Ceramic insulators have a long operational life, which reduces the frequency of repeat purchases. For manufacturers, this means slower demand growth compared to short-life electrical components.

Drivers

Rising Power Transmission and Grid Expansion Driving Ceramic Insulators Demand

The ceramic insulators market is strongly driven by the growing need for reliable power transmission. As electricity consumption increases across residential, industrial, and commercial sectors, utilities are expanding transmission and distribution networks. Ceramic insulators are widely used in power lines and substations because they can handle high voltage and harsh weather conditions.

- One of the biggest forces pushing ceramic insulator demand is the strong rise in electricity demand — both overall and peak — coupled with the push to integrate more renewable energy. In India, peak electricity demand rose by 13% to 243 GW in FY 2024. Ceramic insulators help ensure safe and continuous power flow, making them essential in large infrastructure projects.

The growth of renewable energy projects also supports market demand. Wind and solar power installations need strong grid connectivity, where ceramic insulators play a critical role. Their long service life and low maintenance needs make them a preferred choice for outdoor electrical applications.

Growth Factors

Smart Grid Projects Creating New Growth Opportunities

The expansion of smart grid projects presents strong growth opportunities for the ceramic insulators market. Governments and utilities are investing in modern grid systems to improve power reliability, monitoring, and fault management. Ceramic insulators remain important components in upgraded substations and high-voltage lines.

Growing investments in renewable energy integration also open new opportunities. As more wind, solar, and hybrid energy projects come online, stable grid connections are required. Ceramic insulators support these connections by providing consistent insulation performance in outdoor and high-load conditions.

Electrification of railways is another opportunity area. High-speed and metro rail projects depend on safe electrical infrastructure. Ceramic insulators are widely used in overhead lines and traction substations due to their durability and thermal stability.

Regional Analysis

North America Dominates the Ceramic Insulators Market with a Market Share of 43.8%, Valued at USD 1.1 Billion

North America leads the ceramic insulators market, benefiting from strong investments in grid modernisation, rail electrification, and power infrastructure upgrades. The region accounted for a 43.8% share, with market value reaching USD 1.1 billion, driven by the replacement of aging transmission systems. High-voltage applications in substations and utilities continue to support steady regional demand.

Europe shows stable growth supported by renewable energy integration and the expansion of cross-border transmission networks. Increasing focus on grid reliability and safety standards encourages the use of ceramic insulators in substations and rail networks. Ongoing investments in wind and solar-linked transmission projects also support market expansion.

Asia Pacific is witnessing strong demand due to rapid urbanisation, rising electricity consumption, and large-scale power transmission projects. Government-led electrification programs and railway network expansion drive consistent adoption of ceramic insulators. Growing investments in high-voltage infrastructure strengthen long-term market prospects.

The Middle East and Africa market is supported by investments in power generation and transmission to meet rising population needs. Grid expansion in developing economies and upgrades in oil- and gas-linked power systems increase demand. Harsh climatic conditions also favour ceramic insulators for durability and reliability.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Shandong Zibo Insulators Co., Ltd remains a critical supplier in the global ceramic insulators market in 2024, supported by its large-scale manufacturing base and consistent product quality. The company’s strength lies in meeting utility-grade requirements for transmission and distribution networks, particularly in price-sensitive and high-volume markets where durability and standardised performance are essential.

Technical Ceramic Australia is positioned as a specialist-driven player, focusing on advanced technical ceramics and high-reliability insulator solutions. In 2024, its market relevance is driven by demand from industrial, rail, and niche energy applications, where precision engineering, thermal stability, and long service life are valued over mass-volume production.

ElsewedyElectric leverages its integrated power infrastructure ecosystem to strengthen its ceramic insulators portfolio. The company benefits from close alignment with grid, substation, and transmission projects, allowing ceramic insulators to be bundled into broader turnkey electrical solutions. This integrated approach improves project execution efficiency and long-term utility partnerships.

Suraj Ceramics Industries continues to build its analyst appeal in 2024 through steady domestic demand and selective export penetration. Its focus on porcelain insulators for utilities, railways, and industrial applications supports stable volumes, while cost control and compliance with electrical standards help the company remain competitive amid pricing pressure.

Top Key Players in the Market

- Shandong Zibo Insulators Co., Ltd

- Technical Ceramic Australia

- ElsewedyElectric

- Suraj Ceramics Industries

- CJI Porcelain Pvt. Ltd

- Bikaner Porcelain Private Limited

- Isolantite Manufacturing Company, Inc

- Aditya Birla Insulators

- Bhatinda Ceramics Pvt. Ltd

- ANDI ENGINEERS

Recent Developments

- In 2025, Shandong Zibo Insulators Co., Ltd, a Chinese manufacturer specialising in porcelain and ceramic insulators for electrical applications, has focused on sustainability reporting in recent years. The company highlights operational transparency, environmental impacts, and compliance with industry standards in the ceramic insulators sector.

- In 2025, Technical Ceramic Australia, an Australian firm producing advanced technical ceramics, including porcelain insulators for electrical and industrial uses, shows limited publicly available updates on recent developments. The company emphasises its role as a key domestic manufacturer of alumina ceramics and insulators.

Report Scope

Report Features Description Market Value (2024) USD 2.6 billion Forecast Revenue (2034) USD 4.2 billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ceramic Pin Insulator, Ceramic Strain Insulator, Ceramic Bushing Insulator), By Application (Rail, Transformer, Cables), By End User (Electrical Industry, Heater Industry) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Shandong Zibo Insulators Co., Ltd, Technical Ceramic Australia, ElsewedyElectric, Suraj Ceramics Industries, CJI Porcelain Pvt. Ltd, Bikaner Porcelain Private Limited, Isolantite Manufacturing Company, Inc, Aditya Birla Insulators, Bhatinda Ceramics Pvt. Ltd, ANDI ENGINEERS Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Ceramic Insulators MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Ceramic Insulators MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Shandong Zibo Insulators Co., Ltd

- Technical Ceramic Australia

- ElsewedyElectric

- Suraj Ceramics Industries

- CJI Porcelain Pvt. Ltd

- Bikaner Porcelain Private Limited

- Isolantite Manufacturing Company, Inc

- Aditya Birla Insulators

- Bhatinda Ceramics Pvt. Ltd

- ANDI ENGINEERS