Global Central Venous Catheter Market By Product Type (Non-Tunneled Catheters, Tunneled Catheters, Implantable Ports) By Property (Antimicrobial Catheters, Non-Antimicrobial Catheters) By Design (Single Lumen, Double Lumen, Multiple Lumens) By Material (Polyurethane, Teflon, Silicone Rubber) By End-User (Hospitals, Ambulatory Surgical Centers, Cancer Treatment Centers, Dialysis Centers, Others) and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160301

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

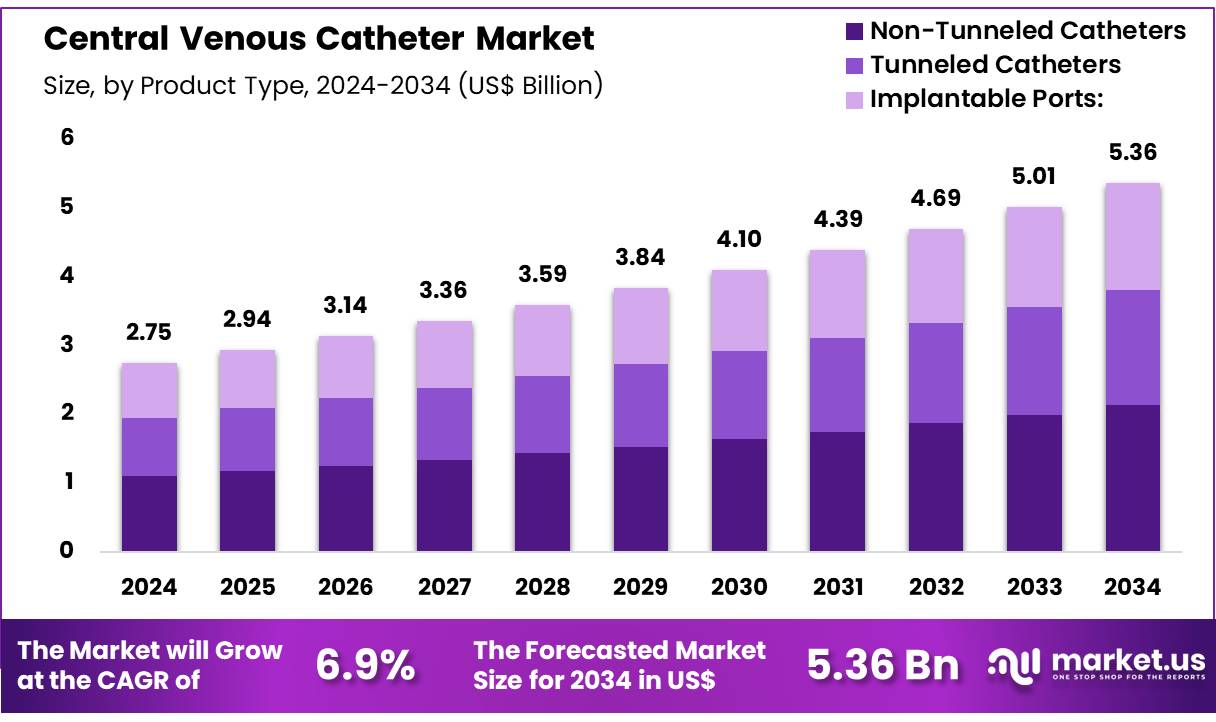

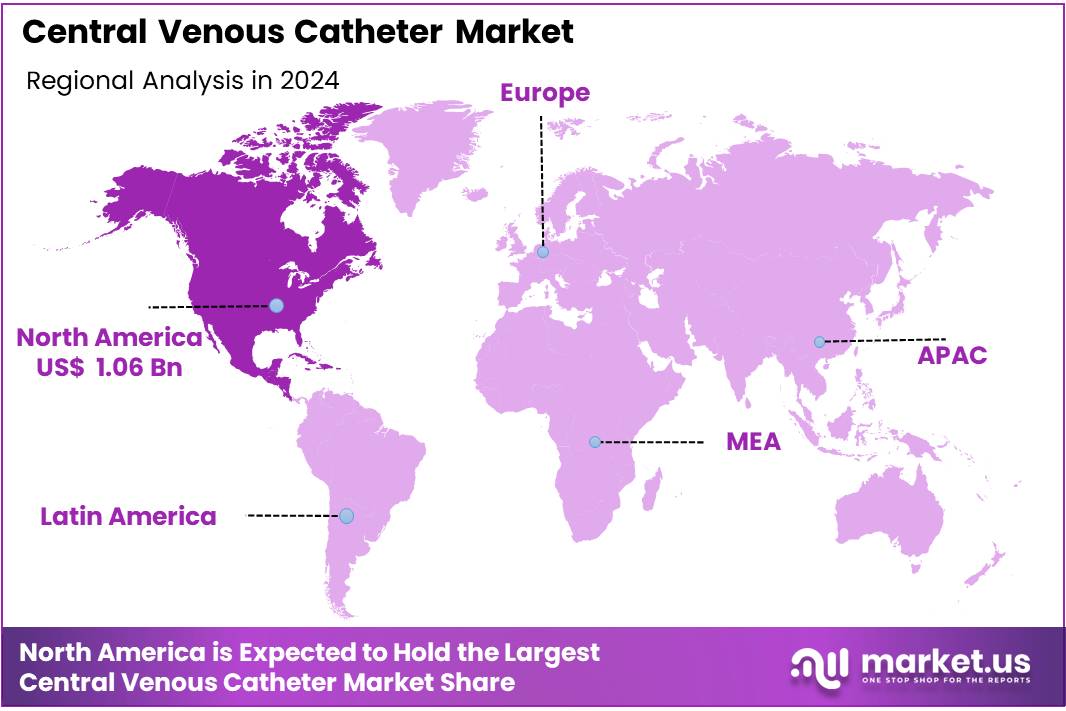

Global Central Venous Catheter Market size is expected to be worth around US$ 5.36 Billion by 2034 from US$ 2.75 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 38.5% share with a revenue of US$ 1.06 Billion.

Growth in the central venous catheter (CVC) sector is underpinned by the increasing demand for complex care worldwide. Rising incidence of cancer, renal disease, critical illness, and surgical interventions continues to expand the patient base requiring reliable central access. In 2020, global cancer incidence was estimated at 19.3 million new cases, a burden that supports consistent procedural volumes for CVC placement in oncology care pathways.

Chronic kidney disease represents another major driver. Global estimates suggest that 9–10% of adults approximately 800 million individuals are affected. Advanced stages frequently require vascular access for hemodialysis or catheter-based therapies when fistulas are not viable, sustaining demand for tunneled catheters and specialized dialysis devices.

Similarly, critical care infrastructure contributes to stable growth. In 2021, OECD countries reported an average of 16.9 intensive care beds per 100,000 population, reflecting a substantial installed base where CVCs are routine for vasoactive drug delivery, advanced monitoring, and fluid therapy. Post-pandemic investment in resilient intensive care capacity further strengthens this structural driver.

Surgical expansion globally also plays a pivotal role. The Global Surgery agenda emphasizes access to safe, affordable surgical and anesthesia services. As procedure volumes rise in both high- and low-income settings, perioperative CVC use for hemodynamic support, parenteral nutrition, and transfusions expands correspondingly. Infection prevention remains a key focus shaping product adoption.

Central line–associated bloodstream infections (CLABSIs) continue to impose high costs and mortality risk. With strong national guidelines, hospitals are encouraged to implement bundles, training, and adopt antimicrobial or power-injectable catheters, accelerating the premium segment of the market.

Regulatory approvals further reinforce innovation cycles. For instance, the U.S. FDA has cleared antimicrobial-coated and antibiotic-impregnated CVCs, enabling hospitals to standardize higher-performance devices aimed at reducing CLABSI incidence and improving workflow efficiency. Demographic aging adds a long-term layer of growth, as the population aged 65 and over is projected to more than double in coming decades. This cohort experiences elevated rates of cancer, renal disease, and surgical intervention, thereby ensuring sustained baseline demand for central access.

Sepsis care contributes further momentum. WHO estimated 48.9 million sepsis cases and 11 million deaths globally in 2017, with central access remaining integral for fluid resuscitation, vasopressors, and monitoring in severe cases.

Key Takeaways

- Market Size: Global Central Venous Catheter Market size is expected to be worth around US$ 5.36 Billion by 2034 from US$ 2.75 Billion in 2024.

- Market Growth: The market growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

- Product Type Analysis: Non-Tunneled Catheters account for the largest share, representing 39.8% of the market in 2024.

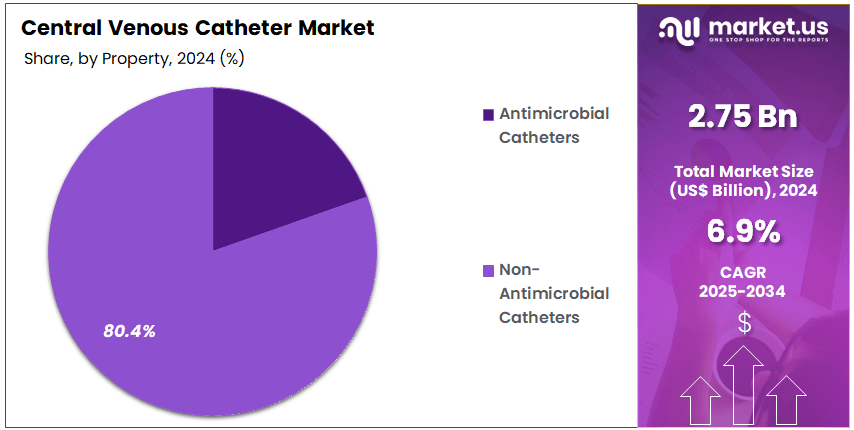

- Property Analysis: Non-Antimicrobial Catheters dominate the market in 2024, accounting for 80.4% of the overall market share.

- Design Analysis: The multiple lumen segment dominates the global market in 2024, accounting for 39.8% of the total share.

- Material Analysis: Polyurethane dominates the market, accounting for 46.8% share in 2024.

- End-Use Analysis: Hospitals dominate the market with 59.9% share, reflecting their position as the primary healthcare setting for critical care, surgeries, and long-term patient management.

- Regional Analysis: In 2024, North America held a dominant market position, capturing more than a 38.5% share and holding US$ 1.06 billion market value for the year.

Product Type Analysis

The Central Venous Catheter (CVC) market is segmented by product type into Non-Tunneled Catheters, Tunneled Catheters, and Implantable Ports. Among these, Non-Tunneled Catheters account for the largest share, representing 39.8% of the market in 2024. The dominance of this segment can be attributed to their widespread use in critical care and emergency settings, where immediate vascular access is required. Their relatively lower cost, ease of insertion, and suitability for short-term use further strengthen their demand across hospitals and intensive care units.

Tunneled Catheters represent a significant share as well, supported by their clinical advantage in reducing infection risks during long-term use. These catheters are commonly preferred in oncology, dialysis, and chronic illness management, where patients require frequent and sustained access to central veins. The rising prevalence of cancer and renal disorders has contributed to steady demand in this category.

Implantable Ports occupy a smaller but steadily growing portion of the market. These devices are typically employed in long-term treatments, particularly chemotherapy, due to their convenience and lower infection risk over extended periods. The growth of this segment is supported by advancements in minimally invasive implantation techniques and increasing patient preference for devices that improve quality of life during prolonged therapies.

Overall, product adoption trends reflect a balance between short-term critical care needs driving Non-Tunneled Catheter demand and chronic disease management fueling the uptake of Tunneled Catheters and Implantable Ports. This segmentation highlights how varying clinical requirements continue to shape the growth trajectory of the Central Venous Catheter market.

Property Analysis

Segment on the basis of product properties into Non-Antimicrobial Catheters and Antimicrobial Catheters. Among these, Non-Antimicrobial Catheters dominate the market in 2024, accounting for 80.4% of the overall market share. This strong dominance can be attributed to their widespread use in routine clinical practices, cost-effectiveness, and higher adoption across healthcare facilities where standard infection control practices are sufficient. The ease of availability and lower procurement costs further strengthen the preference for non-antimicrobial variants, particularly in resource-constrained settings.

In contrast, Antimicrobial Catheters represent a smaller but growing segment. Although their current share is limited, antimicrobial CVCs are expected to witness a steady rise in demand due to increasing emphasis on infection prevention and the reduction of catheter-related bloodstream infections (CRBSIs).

Hospitals and intensive care units in developed economies are progressively adopting these products in high-risk patient populations, where infection control is a priority. Moreover, continuous innovation in antimicrobial coating technologies and favorable clinical outcomes are expected to support their market growth over the forecast period.

Overall, while Non-Antimicrobial Catheters remain the predominant choice in 2024, the gradual shift toward antimicrobial solutions indicates a long-term trend favoring advanced products. This transition is anticipated to be driven by growing awareness of healthcare-associated infections, regulatory support for infection control measures, and rising healthcare expenditure globally.

Design Analysis

The Central Venous Catheter (CVC) market is segmented based on design into single lumen, double lumen, and multiple lumen catheters. Among these, the multiple lumen segment dominates the global market in 2024, accounting for 39.8% of the total share. The dominance of this category is largely driven by the rising demand for advanced devices capable of supporting multiple simultaneous infusions, blood sampling, and hemodynamic monitoring in critically ill patients.

Multiple lumen catheters are preferred in intensive care units (ICUs) and oncology treatments due to their ability to reduce the need for repeated venipuncture, thereby minimizing patient discomfort and infection risks. Their higher adoption in complex medical procedures is expected to sustain this segment’s leadership over the forecast period.

The double lumen segment holds a significant market share owing to its utility in patients requiring dual access for therapies such as total parenteral nutrition (TPN) and concurrent medication administration. Its cost-effectiveness and wider application in general hospital care settings continue to support demand growth.

The single lumen segment, although smaller in share, remains relevant due to its use in simpler clinical procedures such as drug administration, hydration, and blood transfusion. The lower cost and ease of use make it suitable for short-term applications and emergency care. However, its adoption is relatively limited compared to multi-lumen designs as healthcare providers increasingly prioritize devices offering multifunctionality and infection control.

Material Analysis

Material segment included polyurethane, Teflon, and silicone rubber. Among these, polyurethane dominates the market, accounting for 46.8% share in 2024. The dominance of polyurethane can be attributed to its superior biocompatibility, durability, and flexibility, which allow for long-term catheterization and reduced risks of kinking and breakage. Additionally, polyurethane-based catheters demonstrate enhanced chemical resistance, supporting their use in complex therapies involving multiple medications.

Teflon represents another significant material segment. Its value lies in its low-friction surface and chemical inertness, which reduces the risk of clot formation and ensures patient safety. However, its relatively rigid nature compared to polyurethane limits usage in long-term placements, restricting its share primarily to short-term and acute care applications.

Silicone rubber holds a smaller market proportion but plays a vital role in specialized cases. Its exceptional biocompatibility and flexibility make it suitable for patients requiring prolonged catheterization. Silicone is often preferred in oncology and critical care, although its comparatively lower tensile strength and higher cost hinder broader adoption.

Overall, polyurethane continues to lead the market due to its balanced performance in terms of strength, safety, and cost-effectiveness. The segmentation highlights a clear preference toward materials offering durability and patient comfort, with Teflon and silicone catering to niche therapeutic needs. The trend suggests ongoing preference for polyurethane, while silicone is likely to gain momentum in chronic care applications.

End-User Analysis

The end-users segmented into hospitals, ambulatory surgical centers, cancer treatment centers, dialysis centers, and others. In 2024, hospitals dominate the market with 59.9% share, reflecting their position as the primary healthcare setting for critical care, surgeries, and long-term patient management.

The high share is driven by the large volume of admissions, complex procedures, and the availability of advanced infrastructure for catheter insertion and monitoring. Furthermore, hospitals often serve as referral centers for severe cases, strengthening their role in central venous catheter usage.

Ambulatory surgical centers (ASCs) account for a smaller but steadily growing segment. Their growth is supported by the rising demand for minimally invasive procedures, cost-effectiveness, and shorter recovery times, which encourage adoption of CVCs for specific outpatient treatments.

Cancer treatment centers represent a key application area, as central venous catheters are extensively utilized in chemotherapy, targeted drug delivery, and supportive therapies. The increasing global cancer burden supports the demand in this segment. Dialysis centers form another significant category, as central venous catheters are frequently used for hemodialysis initiation and as vascular access solutions for patients awaiting permanent fistula creation.

The others segment, comprising specialty clinics and home healthcare providers, reflects emerging opportunities. Although smaller in scale, this segment is expanding due to growing interest in home-based infusion therapies and chronic disease management.

Key Market Segments

By Product Type

- Non-Tunneled Catheters

- Tunneled Catheters

- Implantable Ports

By Property

- Antimicrobial Catheters

- Non-Antimicrobial Catheters

By Design

- Single Lumen

- Double Lumen

- Multiple Lumens

By Material

- Polyurethane

- Teflon

- Silicone Rubber

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Cancer Treatment Centers

- Dialysis Centers

- Others

Driving Factors

One principal driver of the central venous catheter (CVC) market is the increasing burden of chronic diseases requiring long-term intravenous therapy, such as cancer, renal failure, and cardiovascular disorders. The aging population also amplifies this demand, as older patients more often require complex interventions and extended vascular access. Further, the expansion of intensive care services globally pushes the use of central venous access devices in critical care settings.

In addition, heightened awareness of catheter-associated bloodstream infections (CLABSIs) has spurred adoption of advanced devices (e.g. antimicrobial-coated, biocompatible polymers) that reduce complications and thus encourage use. Implementation of evidence-based infection prevention guidelines, such as those by CDC for intravascular catheter–related infection, supports safer use of CVCs and underpins market growth.

Trending Factors

A leading trend in the CVC market is the shift toward “smart” or sensor-enabled catheters that allow real-time monitoring of pressure, flow, temperature, or early biofilm formation. Integration with digital platforms and alert systems is gaining traction. Another trend is the increased adoption of antimicrobial or antiseptic-coated CVCs designed to reduce CLABSI risk.

Meanwhile, ultrasound guidance has become standard for many CVC insertions (for example in internal jugular access) to reduce complications and improve first-pass success, replacing blind techniques. Also observed is a shift to less invasive settings: ambulatory or home infusion services are promoting use of long-term catheters (e.g., tunneled, PICC) in outpatient care.

Restraining Factors

A major restraint is the risk and cost burden of catheter-related bloodstream infections (CLABSIs). Hospitals face increased morbidity, extended stays, and regulatory penalties, making them cautious in adoption and use. According to CDC reporting, CLABSIs are preventable yet remain a significant challenge.

Another restraint is cost sensitivity advanced CVC designs (e.g. antimicrobial coatings, sensor integration) incur higher manufacturing and acquisition cost, limiting uptake in low-resource settings. Regulatory and approval hurdles for novel catheter technologies also slow market entry. In addition, clinician training and standardization of insertion & maintenance protocols become barriers in settings with limited clinical expertise.

Opportunity

There is strong opportunity in emerging markets and low- and middle-income countries, where healthcare infrastructure is expanding and demand for intravenous access is rising. Adoption of safer, advanced CVC technologies in these regions is relatively low, representing a growth frontier. Another opportunity lies in developing next-generation coatings or materials (e.g. novel antimicrobials, anti-thrombogenic surfaces) that further reduce complications.

Also, leveraging telemedicine and remote monitoring of catheter status offers potential value in outpatient and home care settings. Finally, stronger alignment with global initiatives on infection prevention (such as forthcoming WHO guidelines for catheter-associated bloodstream infections) could encourage procurement and subsidy of safer CVC technologies.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 38.5% share and holding US$ 1.06 billion market value for the year. The region’s leadership can be attributed to the high prevalence of chronic diseases and a growing number of hospital admissions requiring central venous access. The presence of well-established healthcare infrastructure has further supported market expansion.

The increasing demand for advanced catheter technologies has also fueled growth. High adoption rates of minimally invasive procedures in the United States and Canada have significantly influenced the regional market. In addition, favorable reimbursement policies and strong regulatory frameworks have accelerated the uptake of central venous catheters.

North America benefits from continuous investments in healthcare innovation. Strong research and development activities in vascular access devices have strengthened the product pipeline. Furthermore, the growing elderly population, coupled with rising cases of cancer and kidney disorders, has led to increased utilization of central venous catheters.

The region also shows high acceptance of antimicrobial-coated catheters. This trend is driven by strict infection control guidelines and rising awareness of hospital-acquired infections. These factors have collectively enhanced the market position of North America in the global central venous catheter market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The central venous catheter market is characterized by the presence of a limited number of global players alongside several regional manufacturers. Competition is driven by technological advancements, product innovation, and adherence to stringent regulatory standards. Market participants are focusing on expanding their product portfolios with antimicrobial and antimicrobial-coated catheters to reduce infection risks, which remain a critical concern in clinical use.

Strategic initiatives such as mergers, acquisitions, and partnerships are being adopted to strengthen distribution networks and enhance global reach. Furthermore, heavy investment in research and development is aimed at improving material quality, device safety, and procedural efficiency.

Strong brand positioning, long-term contracts with healthcare institutions, and collaborations with hospitals play a significant role in maintaining market share. Players are also emphasizing geographical expansion into emerging economies, where rising healthcare expenditure and growing adoption of advanced medical devices provide significant growth opportunities.

Market Key Players

- Teleflex Incorporated

- Becton, Dickinson and Company (BD)

- B. Braun Melsungen AG

- ICU Medical, Inc.

- Medtronic plc

- Cook Medical Inc.

- AngioDynamics, Inc.

- Asahi Kasei Corporation

- Vygon Ltd.

- Rex Medical, LLC

- Poly Medicure Ltd.

- Lepu Medical Technology Co., Ltd.

- Guangdong Baihe Medical Technology Co., Ltd.

- CorMedix Inc.

- Other key players

Recent Developments

- Teleflex Incorporated: July 2025 – Teleflex completed its acquisition of BIOTRONIK’s Vascular Intervention business for approximately €760 million, expanding its product portfolio into drug-coated balloons, covered stents, and balloon catheters, thus extending its reach into interventional vascular devices.

- Becton, Dickinson and Company (BD): BD issued an early alert regarding material fatigue and cracks in certain PowerPICC/intravascular catheters, following observed transverse cracks in the catheter body. This has potential implications for safety and regulatory scrutiny in vascular access devices

- AngioDynamics, Inc.: AngioDynamics settled a multi-year patent dispute with Becton Dickinson/C.R. Bard. Under the agreement, BD granted AngioDynamics a license on certain port device patents, and AngioDynamics reciprocated on catheter patents; a one-time payment of US $7 million is to be followed by six annual payments of US $2.5 million.

Report Scope

Report Features Description Market Value (2024) US$ 2.75 Billion Forecast Revenue (2034) US$ 5.36 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Non-Tunneled Catheters, Tunneled Catheters, Implantable Ports) By Property (Antimicrobial Catheters, Non-Antimicrobial Catheters) By Design (Single Lumen, Double Lumen, Multiple Lumens) By Material (Polyurethane, Teflon, Silicone Rubber) By End-User (Hospitals, Ambulatory Surgical Centers, Cancer Treatment Centers, Dialysis Centers, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Teleflex Incorporated, Becton, Dickinson and Company (BD), B. Braun Melsungen AG, ICU Medical, Inc., Medtronic plc, Cook Medical Inc., AngioDynamics, Inc., Asahi Kasei Corporation, Vygon Ltd., Rex Medical, LLC, Poly Medicure Ltd., Lepu Medical Technology Co., Ltd., Guangdong Baihe Medical Technology Co., Ltd., CorMedix Inc., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Central Venous Catheter MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Central Venous Catheter MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Teleflex Incorporated

- Becton, Dickinson and Company (BD)

- B. Braun Melsungen AG

- ICU Medical, Inc.

- Medtronic plc

- Cook Medical Inc.

- AngioDynamics, Inc.

- Asahi Kasei Corporation

- Vygon Ltd.

- Rex Medical, LLC

- Poly Medicure Ltd.

- Lepu Medical Technology Co., Ltd.

- Guangdong Baihe Medical Technology Co., Ltd.

- CorMedix Inc.

- Other key players