Global Cell Line Development Market By Product (Cell Culture Media & Reagents, Equipment, Services and Kits & Assay Tools), By Cell Line Type (Recombinant Cell Lines, Hybridomas, Continuous Cell Lines and Primary Cell Lines), By Source (Mammalian Cell Lines and Non-Mammalian Cell Lines) By Application (Biopharmaceutical Production, Drug Discovery & Preclinical Research, Regenerative Medicine & Disease Modeling, Toxicity Testing and Others), By End-User (Biopharmaceutical & Biotechnology Companies, Contract Development & Manufacturing Organizations (CDMOs), Academic & Research Institutes and Diagnostic & Clinical Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171832

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

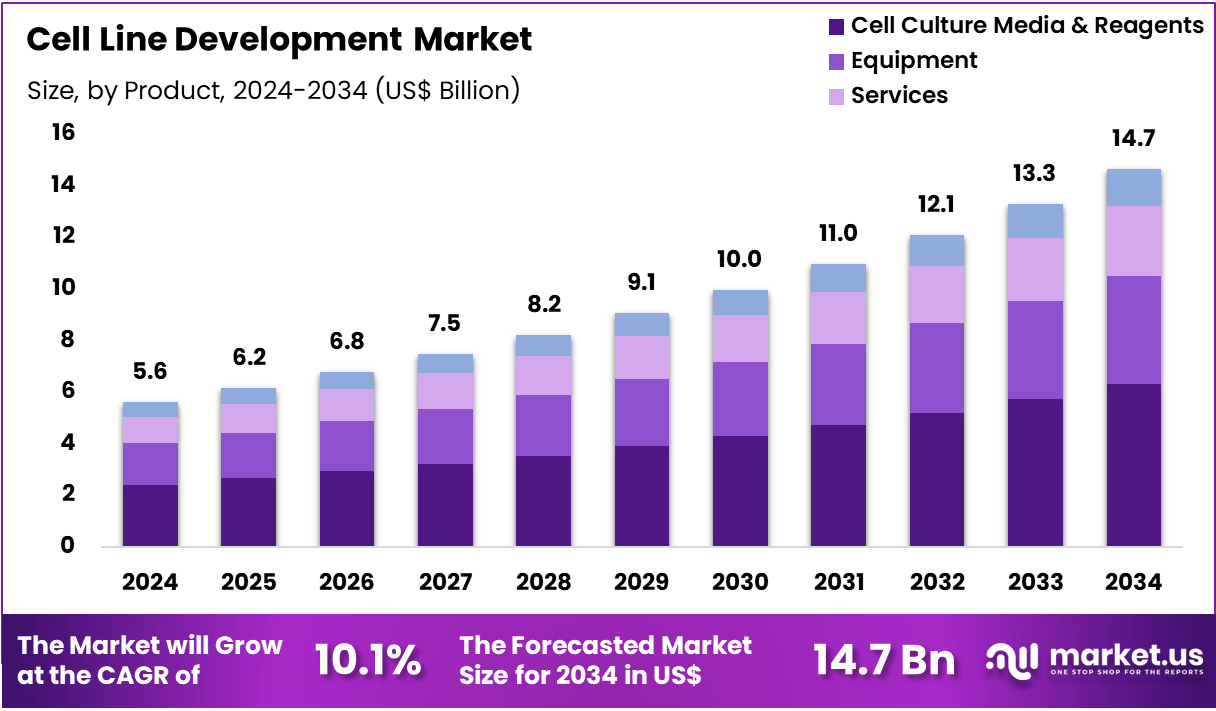

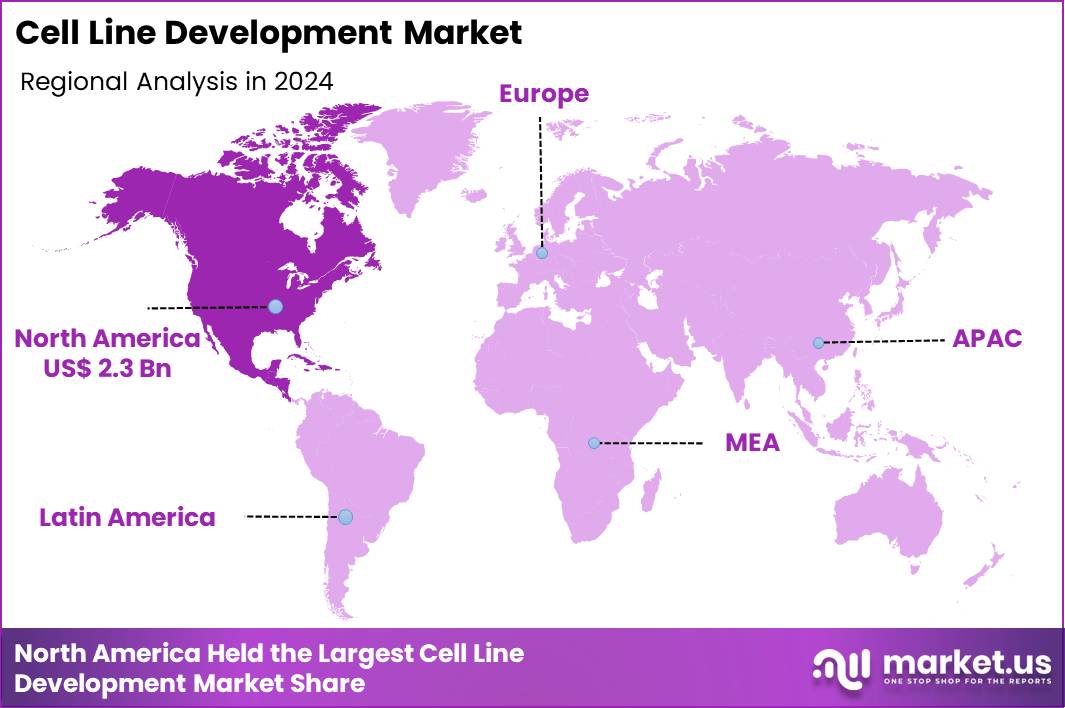

The Global Cell Line Development Market size is expected to be worth around US$ 14.7 Billion by 2034 from US$ 5.6 Billion in 2024, growing at a CAGR of 10.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.2% share with a revenue of US$ 2.3 Billion.

Growing demand for advanced therapies accelerates the adoption of engineered cell lines that enable efficient production of complex biologics and viral vectors. Biopharmaceutical developers increasingly rely on stable mammalian hosts, such as CHO and HEK293 systems, to express high yields of monoclonal antibodies for oncology and autoimmune treatments. These cell lines support recombinant protein manufacturing by incorporating gene amplification techniques that enhance titer and consistency.

Developers also utilize customized platforms for biosimilar development, ensuring comparable glycosylation profiles and bioactivity to originator molecules. Cell line engineering facilitates vaccine production through optimized expression of antigens in scalable suspension cultures.

In May 2025, Switzerland based NewBiologix granted ReciBioPharm rights to use its engineered HEK293 cell line technology across Europe and the US to support large scale viral vector manufacturing. This development strengthens the cell line development market by emphasizing the growing need for purpose built human cell lines in cell and gene therapy production.

As viral vector demand increases, manufacturers seek cell line systems that enable higher productivity and consistent performance at scale. Licensing models such as this accelerate global technology transfer and expand commercial opportunities for advanced cell line development solutions beyond traditional biologics manufacturing.

Biotechnology companies pursue opportunities to engineer suspension-adapted cell lines that streamline transition from research to commercial-scale bioreactors in gene therapy applications. Developers integrate site-specific integration tools to create producer lines for lentiviral and AAV vectors, improving transduction efficiency and payload capacity. These platforms open avenues for CAR-T cell manufacturing by generating master cell banks that maintain genomic stability during ex vivo expansion.

Opportunities expand in regenerative medicine, where induced pluripotent stem cell-derived lines provide renewable sources for tissue engineering and organoid models. Firms explore non-mammalian alternatives for rapid prototyping of enzymes and cytokines in drug discovery pipelines. Companies capitalize on hybrid systems combining human and rodent hosts to balance expression speed with post-translational modification fidelity.

Market innovators deploy CRISPR-based editing to generate knockout cell lines that eliminate unwanted glycosyltransferases, refining product quality attributes in antibody therapeutics. Developers incorporate high-throughput screening workflows to select clones with superior growth characteristics and reduced aggregation in viral vector production.

Industry participants advance glutamine synthetase selection systems that eliminate antibiotic resistance markers for safer therapeutic outputs. Researchers refine transposase-mediated integration for faster stable pool generation in bispecific antibody development. Companies prioritize serum-free media adaptations that enhance viability during high-density perfusion cultures for vaccine antigens. Ongoing advancements focus on automation-driven clonality assurance, ensuring regulatory compliance in stem cell-derived therapy platforms.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.6 billion, with a CAGR of 10.1%, and is expected to reach US$ 14.7 billion by the year 2034.

- The product segment is divided into cell culture media & reagents, equipment, services and kits & assay tools, with cell culture media & reagents taking the lead in 2024 with a market share of 43.0%.

- Considering cell line type, the market is divided into recombinant cell lines, hybridomas, continuous cell lines and primary cell lines. Among these, recombinant cell lines held a significant share of 32.3%.

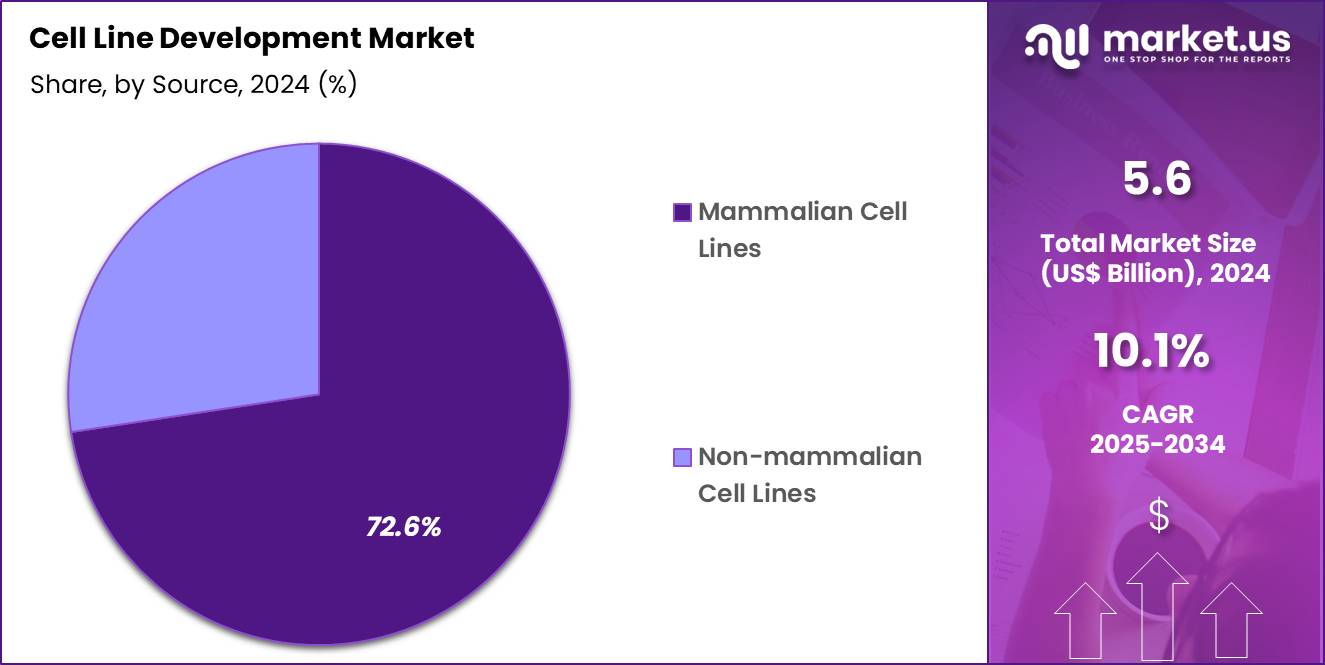

- Furthermore, concerning the source segment, the market is segregated into mammalian cell lines and non-mammalian cell lines. The mammalian cell lines sector stands out as the dominant player, holding the largest revenue share of 72.6% in the market.

- The application segment is segregated into biopharmaceutical production, drug discovery & preclinical research, regenerative medicine & disease modeling, toxicity testing and others, with the biopharmaceutical production segment leading the market, holding a revenue share of 44.8%.

- The end-user segment is segregated into biopharmaceutical & biotechnology companies, contract development & manufacturing organizations (CDMOs), academic & research institutes and diagnostic & clinical laboratories, with the biopharmaceutical & biotechnology companies segment leading the market, holding a revenue share of 47. 5%.

- North America led the market by securing a market share of 41.2% in 2024.

Product Analysis

Cell culture media and reagents, holding 43.0%, are expected to dominate because consistent cell growth, productivity, and stability depend directly on optimized media formulations. Biopharmaceutical developers increasingly customize media to enhance protein expression, reduce impurities, and shorten development timelines. Rising production of monoclonal antibodies, vaccines, and recombinant proteins strengthens continuous demand for high-performance reagents.

Advances in serum-free and chemically defined media improve reproducibility and regulatory compliance. Companies prioritize scalable media solutions to support transition from research to commercial manufacturing. Continuous process optimization requires repeated media refinement, increasing consumption volumes. Supplier innovation focuses on yield enhancement and cost efficiency, further driving adoption. These factors keep cell culture media and reagents anticipated to remain the largest product segment in the cell line development market.

Cell Line Type Analysis

Recombinant cell lines, holding 32.3%, are projected to dominate because they enable stable and high-yield expression of complex therapeutic proteins. Biopharmaceutical pipelines increasingly rely on genetically engineered cell lines to produce biologics with precise molecular characteristics. Demand for biosimilars and next-generation biologics accelerates recombinant cell line development activities.

Advances in gene editing technologies improve transfection efficiency and clone selection speed. Developers favor recombinant systems to meet stringent quality, consistency, and scalability requirements. Regulatory expectations encourage the use of well-characterized recombinant lines with documented genetic stability. These drivers keep recombinant cell lines expected to remain a core focus area within cell line development.

Source Analysis

Mammalian cell lines, holding 72.6%, are expected to dominate because they provide post-translational modifications essential for the safety and efficacy of many biologic drugs. Therapeutic antibodies and complex proteins require human-like glycosylation patterns that mammalian systems deliver reliably. CHO and HEK cell lines continue to serve as industry standards across global manufacturing facilities.

Increasing approvals of mammalian-derived biologics reinforce long-term reliance on these platforms. Continuous improvements in cell engineering enhance productivity and robustness. Developers prioritize mammalian systems to reduce immunogenicity risks in patients. These factors keep mammalian cell lines anticipated to remain the dominant source segment.

Application Analysis

Biopharmaceutical production, holding 44.8%, is projected to dominate because commercial-scale manufacturing drives the highest demand for robust and scalable cell lines. Growing global consumption of biologics increases pressure to accelerate development and improve yields. Cell line optimization directly impacts production cost, process efficiency, and supply reliability.

Manufacturers invest heavily in early-stage cell line development to secure long-term commercial success. Expansion of manufacturing capacity across multiple regions strengthens development activity. Regulatory scrutiny around consistency reinforces the importance of optimized production-ready cell lines. These trends keep biopharmaceutical production expected to remain the leading application area.

End-User Analysis

Biopharmaceutical and biotechnology companies, holding 47.5%, are expected to dominate because they lead innovation, development, and commercialization of biologic therapies. These companies maintain internal cell line development capabilities to protect intellectual property and control timelines. Expanding pipelines in oncology, immunology, and rare diseases increase development workloads.

Strategic investments in advanced cell engineering platforms strengthen in-house expertise. Competitive pressure to reach market faster drives continuous optimization efforts. Partnerships with CDMOs still require strong internal oversight of cell line quality. These dynamics keep biopharmaceutical and biotechnology companies anticipated to remain the dominant end users in the cell line development market.

Key Market Segments

By Product

- Cell Culture Media & Reagents

- Equipment

- Bioreactors & Culture Systems

- Incubators

- Centrifuges & Separation Systems

- Cryopreservation & Cell Banking Equipment

- Automated Cell Culture & Colony Screening Systems

- Microscopy & Imaging Systems

- Transfection & Electroporation Systems

- Others

- Services

- Kits & Assay Tools

By Cell Line Type

- Recombinant cell lines

- Hybridomas

- Continuous cell lines

- Primary cell lines

By Source

- Mammalian Cell Lines

- CHO

- HEK-293

- Vero

- BHK-21

- Others

- Non-mammalian Cell Lines

- Insect

- Microbial

- Yeast & Fungal

- Plants

- Others

By Application

- Biopharmaceutical Production

- Drug Discovery & Preclinical Research

- Regenerative Medicine & Disease Modeling

- Toxicity testing

- Others

By End-User

- Biopharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Academic & Research Institutes

- Diagnostic & Clinical Laboratories

Drivers

Advancements in gene editing technologies are driving the market

The cell line development market is experiencing robust growth propelled by rapid advancements in gene editing technologies, particularly CRISPR-Cas9 systems, which enable precise and efficient genetic modifications in host cells. These tools facilitate the creation of stable, high-expressing cell lines essential for biopharmaceutical production. Enhanced accuracy in targeting specific genes reduces off-target effects and improves overall yield consistency.

Integration with next-generation sequencing allows for detailed genomic characterization during development. Pharmaceutical companies leverage these innovations to accelerate timelines from construct design to stable pool generation. Regulatory bodies support such technologies through streamlined pathways for genetically engineered products. Collaboration among academia, biotech firms, and equipment providers fosters continuous refinement of editing platforms.

Emerging applications in complex protein expression further expand utility. Global investments in biotechnology infrastructure bolster adoption rates. These advancements collectively position gene editing as a cornerstone driver for market expansion, ensuring alignment with evolving therapeutic demands. Ongoing research promises even greater precision and scalability in future iterations.

Restraints

Regulatory complexities and compliance requirements are restraining the market

The cell line development market encounters significant hurdles stemming from intricate regulatory frameworks and stringent compliance mandates imposed by authorities worldwide. Navigating good manufacturing practice guidelines demands extensive documentation and validation at every stage. Variability in international standards complicates global operations for multinational entities.

Prolonged review periods for genetically modified cell lines delay commercialization efforts. Intellectual property disputes surrounding proprietary editing tools add legal uncertainties. High costs associated with achieving regulatory approval deter smaller organizations from entering the field. Frequent updates to guidelines necessitate ongoing adaptations in processes and facilities.

Risk of non-compliance leading to product recalls or market withdrawal poses substantial financial threats. Limited harmonization between regions creates additional operational challenges. These factors collectively impede swift market growth and innovation deployment, requiring careful strategic planning to mitigate impacts.

Opportunities

Expansion in biosimilar and biobetter development is creating growth opportunities

The cell line development market is poised for substantial opportunities arising from the escalating focus on biosimilar and biobetter therapeutics, which demand optimized cell lines for cost-effective and improved production. Biosimilars address patent expirations of originator biologics, offering affordable alternatives in oncology and immunology.

Biobetters enhance efficacy or safety profiles through engineered modifications in expression systems. Regulatory pathways for biosimilars encourage investment in comparable cell line platforms. Increasing healthcare expenditure in emerging economies drives demand for accessible treatments. Partnerships between originator companies and generic manufacturers facilitate technology transfer.

Advancements in analytical comparability studies support robust development. Contract service providers expand capacity to meet rising outsourcing needs. Intellectual property strategies enable differentiation in competitive landscapes. These opportunities diversify applications beyond novel biologics, fostering sustained market evolution and broader therapeutic access.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics invigorate the cell line development market as robust biopharmaceutical investments and surging demand for biologics worldwide encourage biotech firms to scale up stable cell lines for efficient drug production and personalized therapies. Executives at prominent companies strategically deploy automated platforms and CRISPR-editing tools, harnessing global trends in oncology and gene therapy to capture expanding opportunities across mature and emerging regions.

Lingering inflation and economic uncertainties, however, inflate costs for media, reagents, and R&D infrastructure, prompting smaller developers to streamline operations and delay expansions in volatile funding environments. Geopolitical frictions, especially U.S.-China biotech rivalries and supply chain vulnerabilities from regional conflicts, routinely disrupt access to critical plasmids and expression vectors, fostering delays and heightened risks for manufacturers with international dependencies.

Current U.S. tariffs, featuring a 10% baseline on most imported medical devices alongside up to 25 percent duties on Chinese-origin biotechnology equipment, amplify procurement expenses for American providers and erode competitive edges in domestic channels. These tariffs also provoke counter-measures from trading partners that constrain U.S. exports of advanced cell line technologies and slow multinational collaborative efforts.

Still, the tariff pressures galvanize substantial commitments to North American biomanufacturing hubs and onshoring initiatives, cultivating fortified supply architectures that will accelerate technological breakthroughs and secure enduring market vitality for the long term.

Latest Trends

Adoption of artificial intelligence and machine learning platforms is a recent trend

In 2025, the cell line development market has embraced a notable trend involving the widespread adoption of artificial intelligence and machine learning platforms to optimize predictive modeling and process efficiency. These technologies analyze vast datasets from historical clonings to forecast productivity and stability outcomes.

Integration with high-throughput screening accelerates clone selection by identifying superior performers early. AI-driven design of experiments minimizes resource consumption while maximizing insights. Machine learning algorithms enhance media formulation and feeding strategies for improved yields. Collaborative platforms enable real-time data sharing among multidisciplinary teams. Regulatory acceptance of in silico models supports reduced animal testing requirements.

Industry leaders incorporate these tools into proprietary workflows for competitive advantage. Emerging startups specialize in AI-enabled ecosystems tailored for bioprocessing. This trend transforms traditional empirical approaches into data-centric paradigms, promoting faster and more reliable development cycles. Continued evolution promises deeper integration across the entire biomanufacturing value chain.

Regional Analysis

North America is leading the Cell Line Development Market

In 2024, North America captured a 41.2% share of the global cell line development market, propelled by intensive advancements in biopharmaceutical manufacturing and supportive regulatory ecosystems. Leading biotechnology firms refine Chinese hamster ovary platforms through targeted genome editing, achieving higher titers and improved glycosylation patterns for next-generation monoclonal antibodies.

Academic research centers pioneer inducible expression systems, facilitating precise control over therapeutic protein production in preclinical models. Contract manufacturing organizations expand automation capabilities for rapid clonal selection, addressing bottlenecks in scalability for orphan drug candidates. Surge in adoptive cell therapies demands specialized immortalized lines for consistent viral vector yields, aligning with personalized medicine paradigms.

Federal agencies streamline guidance on comparability assessments, enabling seamless process transfers across multi-site operations. These integrated efforts enhance productivity and regulatory compliance, solidifying regional dominance in biologic innovation. The U.S. Food and Drug Administration approved 55 novel drugs in 2023, many requiring sophisticated cell line platforms for efficient commercial-scale production.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders anticipate vigorous expansion in cell line engineering throughout Asia Pacific over the forecast period, as nations fortify indigenous capabilities in biologic therapeutics. Authorities establish specialized incubation clusters, nurturing proprietary HEK293-derived systems optimized for cost-efficient biosimilar expression of insulin analogs and fusion proteins.

Enterprises deploy single-cell printing technologies, accelerating stable pool generation for erythropoietin variants suited to regional patient genetics. Joint ventures integrate perfusion bioreactors, customizing glutamine synthetase selection markers to withstand variable raw material supplies. Escalating autoimmune disorder incidences spur investments in hybridoma alternatives, yielding high-affinity antibodies against endemic pathogens.

Regulatory alignments expedite master cell bank characterizations, attracting multinational partnerships for technology localization. These strategic pursuits equip the region to deliver accessible, high-quality biologics amid rising healthcare demands. The International Diabetes Federation documented 537 million adults worldwide living with diabetes in 2021, with the largest concentrations in Asia-Pacific nations driving biologic production needs.Expert

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Cell Line Development market drive growth by investing in high-expression, stable mammalian cell platforms that shorten timelines for biologics and biosimilar production. Companies active in the Cell Line Development market expand capabilities through proprietary host cell lines, gene-editing technologies, and clone-screening automation that improve yield and consistency.

Strategic collaborations with biopharma firms and CDMOs allow participants in the Cell Line Development market to embed early in drug pipelines and secure long-term development contracts. Market leaders emphasize scalability, regulatory-ready documentation, and process robustness to support smooth transition from preclinical stages to commercial manufacturing.

Geographic expansion into Asia and Europe supports demand from emerging biologics hubs seeking faster and cost-efficient development services. Lonza Group exemplifies leadership in the Cell Line Development market through its GS gene expression system, global manufacturing and development infrastructure, and deep integration across biopharmaceutical research, development, and commercial production.

Top Key Players

- Advanced Instruments

- Aragen Life Sciences

- ASIMOV

- Berkeley Lights

- Corning Inc.

- Creative BioLabs

- Danaher

- Fyonibio

- Genscript Biotech

- Lonza

- Merck KGaA

- ProBioGen

- PromoCell

- Sartorius AG

- Thermo Fisher Scientific Inc.

- WuXi PharmaTech

Recent Developments

- In May 2025, ProBioGen formed a strategic collaboration with Poland based Polpharma Biologics focused on deploying its CHO.RiGHT cell line technology to support multiple biosimilar development programs. This agreement contributes to the growth of the cell line development market by reinforcing the shift toward specialized, high expression host systems that improve development efficiency and manufacturing reliability. As biosimilar portfolios expand, developers increasingly rely on advanced cell line platforms to achieve consistent quality attributes and competitive production economics. Such collaborations highlight the rising value of outsourced cell line engineering expertise, driving broader adoption of proprietary CHO systems across the biosimilar landscape.

- In April 2025, Thermo Fisher Scientific introduced an upgraded integrated development platform incorporating a high productivity CHO K 1 cell line that significantly shortened early development timelines while enhancing process robustness. This advancement supports expansion of the cell line development market by illustrating how optimized host cell systems can reduce time to clinical entry and lower overall development risk. Shorter development cycles encourage biopharmaceutical companies to adopt standardized, ready to use cell line solutions, increasing demand for scalable platforms that combine speed, stability, and yield in a single offering.

Report Scope

Report Features Description Market Value (2024) US$ 5.6 Billion Forecast Revenue (2034) US$ 14.7 Billion CAGR (2025-2034) 10.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Cell Culture Media & Reagents, Equipment (Bioreactors & Culture Systems, Incubators, Centrifuges & Separation Systems, Cryopreservation & Cell Banking Equipment, Automated Cell Culture & Colony Screening Systems, Microscopy & Imaging Systems, Transfection & Electroporation Systems and Others), Services and Kits & Assay Tools), By Cell Line Type (Recombinant Cell Lines, Hybridomas, Continuous Cell Lines and Primary Cell Lines), By Source (Mammalian Cell Lines (CHO, HEK-293, Vero, BHK-21 and Others) and Non-Mammalian Cell Lines (Insect, Microbial, Yeast & Fungal, Plants and Others)), By Application (Biopharmaceutical Production, Drug Discovery & Preclinical Research, Regenerative Medicine & Disease Modeling, Toxicity Testing and Others), By End-User (Biopharmaceutical & Biotechnology Companies, Contract Development & Manufacturing Organizations (CDMOs), Academic & Research Institutes and Diagnostic & Clinical Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Sartorius AG, Merck KGaA, Danaher, Corning Inc., Creative BioLabs, Lonza, WuXi PharmaTech, Advanced Instruments, Berkeley Lights, Aragen Life Sciences, ASIMOV, ProBioGen, Genscript Biotech, Fyonibio, PromoCell Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cell Line Development MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Cell Line Development MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Advanced Instruments

- Aragen Life Sciences

- ASIMOV

- Berkeley Lights

- Corning Inc.

- Creative BioLabs

- Danaher

- Fyonibio

- Genscript Biotech

- Lonza

- Merck KGaA

- ProBioGen

- PromoCell

- Sartorius AG

- Thermo Fisher Scientific Inc.

- WuXi PharmaTech