Global Cardiovascular Ultrasound Market By Product Type (Transthoracic Echocardiography, Stress Echocardiography, Transesophageal Echocardiography and Others), By Technology (2D Ultrasound, Doppler Imaging, Color Flow Imaging and 3D/4D Ultrasound), By Display (Color Display and Monochrome Display), By End-User (Hospitals, Ambulatory Surgical Centers, Diagnostic Centers and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174204

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

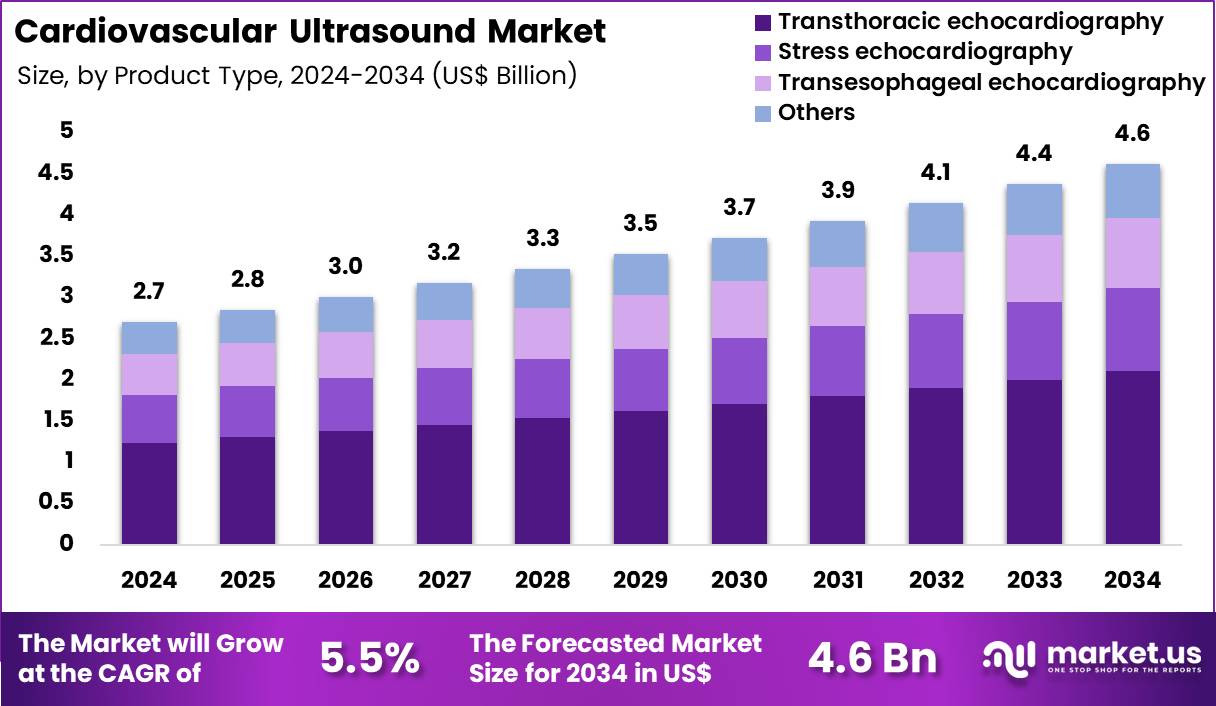

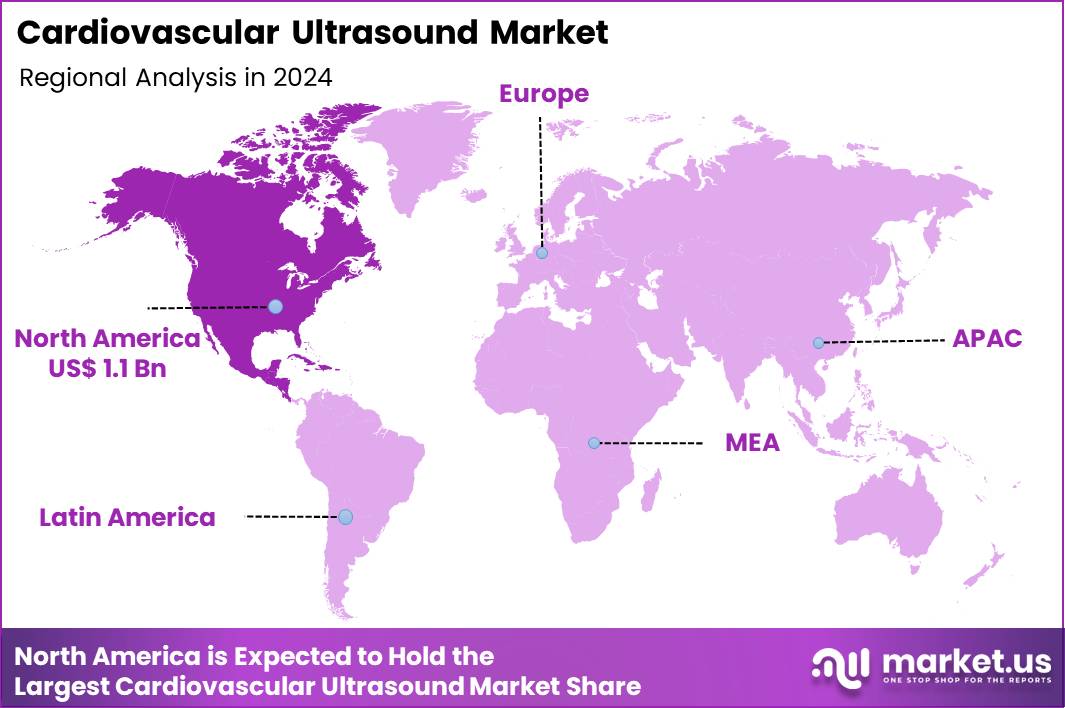

The Global Cardiovascular Ultrasound Market size is expected to be worth around US$ 4.6 Billion by 2034 from US$ 2.7 Billion in 2024, growing at a CAGR of 5.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.9% share with a revenue of US$ 1.1 Billion.

Rising prevalence of advanced heart failure drives cardiologists to increasingly rely on cardiac assist devices that deliver mechanical circulatory support for patients with refractory symptoms despite optimal medical therapy. Surgeons implant left ventricular assist devices as destination therapy in individuals ineligible for heart transplantation, restoring adequate cardiac output and enhancing functional capacity.

These systems also function as a bridge to transplantation, stabilizing hemodynamics and preventing end-organ damage in patients awaiting donor organs. Clinicians deploy right ventricular assist devices for isolated right heart failure in postcardiotomy shock or severe pulmonary hypertension, while biventricular configurations address combined systolic dysfunction in acute cardiogenic shock following massive myocardial infarction.

In March 2025, Berlin Heart received US FDA approval for its EXCOR Apex Cannulae, expanding design specifications and broadening applicability in pediatric and complex heart failure cases. Manufacturers develop fully implantable continuous-flow systems to eliminate external drivelines, reducing infection risks and improving quality of life in long-term therapy.

Developers advance miniaturized pediatric devices and hybrid configurations integrating transcatheter valve therapies, while wireless power transmission and remote monitoring platforms enhance safety and outcomes. Ongoing refinements in pump design, biocompatible coatings, and multidisciplinary care models sustain incremental innovation and reinforce the expanding role of cardiac assist devices in comprehensive heart failure management.

Key Takeaways

- In 2024, the market generated a revenue of US$ 7 Billion, with a CAGR of 5.5%, and is expected to reach US$ 4.6 Billion by the year 2034.

- The product type segment is divided into transthoracic echocardiography, stress echocardiography, transesophageal echocardiography and others, with transthoracic echocardiography taking the lead in 2024 with a market share of 45.8%.

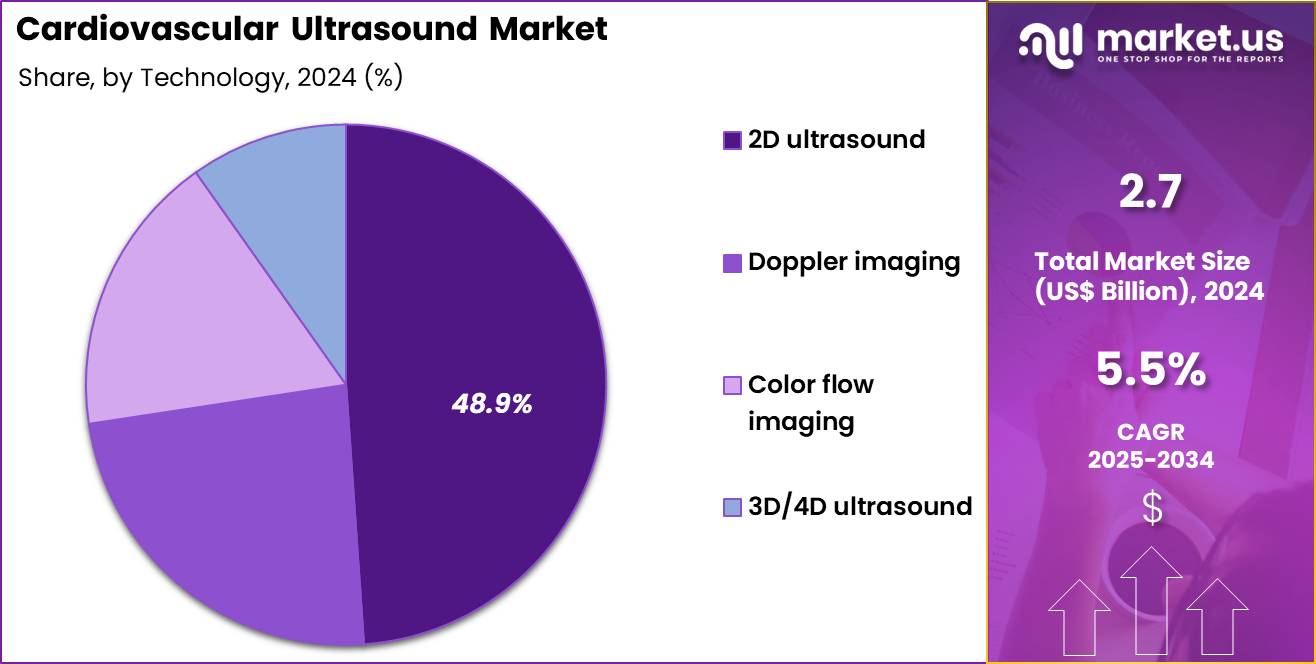

- Considering technology, the market is divided into 2D ultrasound, doppler imaging, color flow imaging and 3D/4D ultrasound. Among these, 2D ultrasound held a significant share of 48.9%.

- Furthermore, concerning the display segment, the market is segregated into color display and monochrome display. The color display sector stands out as the dominant player, holding the largest revenue share of 62.4% in the market.

- The end-user segment is segregated into hospitals, ambulatory surgical centers, diagnostic centers and others, with the hospitals segment leading the market, holding a revenue share of 58.7%.

- North America led the market by securing a market share of 39.9% in 2024.

Product Type Analysis

Transthoracic echocardiography accounted for 45.8% of growth within the product type category and represents the most widely used modality in the Cardiovascular Ultrasound market. Clinicians rely on transthoracic echocardiography as a first-line diagnostic tool for cardiac assessment. Non-invasive imaging supports broad patient acceptance across age groups. Rapid bedside applicability strengthens usage in acute and chronic care settings.

High diagnostic yield supports evaluation of cardiac structure and function. Growing prevalence of cardiovascular diseases increases routine screening volumes. Transthoracic procedures support repeated follow-up without procedural risk. Emergency departments frequently use this modality for rapid cardiac evaluation. Portability of systems enhances point-of-care deployment.

Training familiarity among cardiologists sustains preference. Cost-effectiveness supports widespread adoption in resource-constrained settings. Hospitals integrate transthoracic echocardiography into standard cardiac workflows. Early diagnosis improves treatment planning efficiency. Technological improvements enhance image clarity and diagnostic confidence.

Increased outpatient cardiac visits drive procedural volumes. Minimal patient preparation supports workflow efficiency. Clinical guidelines recommend transthoracic echocardiography as an initial assessment. Broad clinical indications sustain continuous demand. The segment is projected to remain dominant due to accessibility and diagnostic versatility.

Technology Analysis

2D ultrasound represented 48.9% of growth within the technology category and serves as the foundational imaging technique in the Cardiovascular Ultrasound market. Clinicians prefer 2D ultrasound for real-time visualization of cardiac anatomy. Simplicity and reliability support routine clinical use. Lower equipment complexity improves affordability and maintenance. Training curricula emphasize 2D imaging proficiency. Most cardiovascular assessments rely on 2D measurements for diagnosis.

Compatibility with Doppler and color flow upgrades enhances utility. Faster acquisition times support high patient throughput. Emergency and critical care settings favor 2D ultrasound for rapid assessment. Consistent image interpretation improves diagnostic standardization. Widespread installed base sustains replacement demand. Rural and secondary care centers rely heavily on 2D systems.

Technological refinements continue to improve resolution. Integration with portable devices expands usage scenarios. Clinical workflows prioritize 2D imaging as the initial step. Reduced learning curve supports adoption among new practitioners. Cost containment strategies favor 2D technology. Cardiovascular screening programs increase utilization. The segment is anticipated to retain leadership due to foundational clinical reliance.

Display Analysis

Color display accounted for 62.4% of growth within the display category and dominates the Cardiovascular Ultrasound market. Color visualization improves differentiation of cardiac structures. Enhanced contrast supports accurate interpretation of blood flow patterns. Clinicians prefer color displays for improved diagnostic confidence. Color imaging integrates seamlessly with Doppler and flow analysis.

Complex cardiac pathologies require detailed visual representation. Teaching hospitals emphasize color displays for training purposes. Improved user interface enhances workflow efficiency. Patient communication improves with visually intuitive displays. Advancements in display technology enhance brightness and resolution. Reduced eye strain supports prolonged diagnostic sessions.

Color displays support advanced imaging applications. Portable ultrasound systems increasingly feature color displays. Procurement decisions favor systems with modern display capabilities. Improved visualization reduces diagnostic ambiguity.

Color displays align with digital imaging standards. Multi-parameter visualization enhances clinical decision-making. Cardiology departments prioritize comprehensive imaging solutions. The segment is projected to sustain dominance due to visualization advantages and user preference.

End-User Analysis

Hospitals represented 58.7% of growth within the end-user category and remain the primary setting for cardiovascular ultrasound utilization. Hospitals manage high volumes of cardiac patients across care stages. Emergency and inpatient services drive continuous imaging demand. Availability of trained cardiologists supports extensive ultrasound use. Hospitals integrate ultrasound into diagnostic and interventional pathways.

Advanced imaging infrastructure supports complex evaluations. Referral networks concentrate cardiovascular diagnostics within hospitals. Teaching hospitals expand procedural volumes through training programs. Intensive care units require frequent cardiac monitoring. Multidisciplinary teams rely on ultrasound for treatment planning.

Hospitals prioritize early diagnosis to reduce cardiac complications. Procurement budgets support acquisition of advanced systems. Standardized protocols reinforce routine ultrasound usage. Postoperative monitoring increases repeat imaging. Hospitals manage patients with multiple comorbidities effectively.

Reimbursement frameworks favor hospital-based diagnostics. Expansion of cardiac specialty centers strengthens demand. Integration with electronic health records improves workflow. Hospitals remain central to cardiovascular care delivery. The segment is expected to maintain dominance due to infrastructure scale and patient concentration.

Key Market Segments

By Product Type

- Transthoracic echocardiography

- Stress echocardiography

- Transesophageal echocardiography

- Others

By Technology

- 2D ultrasound

- Doppler imaging

- Color flow imaging

- 3D/4D ultrasound

By Display

- Color display

- Monochrome display

By End-User

- Hospitals

- Ambulatory surgical centers

- Diagnostic centers

- Others

Drivers

Rising prevalence of cardiovascular diseases is driving the market

The cardiovascular ultrasound market is driven by the rising prevalence of cardiovascular diseases, which necessitates non-invasive diagnostic tools for early detection and monitoring of conditions such as heart failure and coronary artery disease. Healthcare providers rely on ultrasound systems to assess cardiac structure and function, enabling timely intervention in high-risk populations. Regulatory agencies emphasize screening programs that incorporate ultrasound to address the growing burden on healthcare systems.

Pharmaceutical companies support ultrasound use in clinical trials for cardiovascular therapies, sustaining market demand. Clinical protocols integrate ultrasound for routine evaluations in primary care and specialty settings. Global health organizations track disease trends to inform policy on diagnostic equipment accessibility. Academic research validates ultrasound efficacy in reducing mortality through accurate diagnosis. Patient care improves with portable ultrasound options for point-of-care assessments.

Economic impacts from untreated diseases further justify investment in ultrasound technologies. According to the World Health Organization, an estimated 19.8 million people died from cardiovascular diseases in 2022, representing 32% of all global deaths. This mortality figure underscores the urgent need for advanced imaging. Ultrasound adoption aligns with efforts to manage chronic conditions like hypertension.

Providers favor echocardiography for its safety and cost-effectiveness over invasive methods. Market players respond with systems optimized for high-volume screening. Research highlights ultrasound’s role in preventing complications like stroke. Patient awareness campaigns promote regular cardiac checks using ultrasound. Economic analyses show cost savings from early detection via imaging.

Overall, this driver maintains momentum in diagnostic innovation. The Centers for Disease Control and Prevention reported 919,032 deaths from cardiovascular disease in the United States in 2023.

Restraints

High costs of advanced ultrasound systems are restraining the market

The cardiovascular ultrasound market is restrained by the high costs of advanced systems, which include premium pricing for features like 3D imaging and AI integration, limiting adoption in budget-constrained facilities. Manufacturers incur substantial R&D expenses for compliance with safety standards, passing these onto buyers. Regulatory requirements for validation add to financial burdens, deterring upgrades in smaller clinics.

Healthcare systems in developing regions struggle with funding for high-end equipment, reducing market penetration. Clinical practices may opt for basic models, compromising diagnostic accuracy. Global disparities in reimbursement exacerbate affordability issues for ultrasound technologies. Academic analyses highlight the impact on equity in cardiac care. Patient access is limited in areas with inadequate insurance coverage for diagnostic tools.

Economic models project slower growth without cost reduction strategies. From GE HealthCare’s 2024 annual report, the Ultrasound segment (renamed Advanced Visualization Solutions) reported revenues of $5,131 million, reflecting modest 0.7% growth amid pricing pressures. This figure illustrates the challenge of maintaining profitability. Providers face ongoing maintenance costs for sophisticated systems.

Market players respond with financing options to mitigate restraints. Research emphasizes value-based pricing to balance costs and benefits. Patient outcomes may suffer from delayed adoption due to financial barriers. Economic analyses show higher upfront costs offset by long-term savings in care. Overall, this restraint limits broader deployment in resource-limited settings. Regulatory scrutiny on cost-effectiveness adds to market challenges.

Opportunities

Advancements in AI-integrated ultrasound systems is creating growth opportunities

The cardiovascular ultrasound market offers growth opportunities through advancements in AI-integrated systems, which enhance diagnostic precision and workflow efficiency for conditions like valvular heart disease. Developers can innovate platforms with AI for automated measurements, expanding applications in point-of-care settings. Regulatory pathways for AI-enabled devices facilitate faster market entry, encouraging investment.

Healthcare providers gain tools for real-time analysis, improving outcomes in high-volume cardiology practices. Pharmaceutical partnerships focus on AI ultrasound for clinical trials in heart failure. Clinical research explores AI in telemedicine for remote cardiac assessments. Global adoption in emerging markets aligns with infrastructure development for digital health.

Academic collaborations refine AI algorithms to ensure accuracy in diverse populations. Patient therapies benefit from AI facilitating early detection with reduced operator dependency. From Philips’ 2024 annual report, the Ultrasound segment (part of Diagnosis & Treatment, sales of €8,790 million) emphasized AI tools for cardiovascular diagnosis, contributing to 1% comparable growth. This data highlights AI’s role in segment performance.

Providers favor AI for standardizing exams across skill levels. Market players respond with cloud-based AI for data sharing. Research emphasizes AI in reducing diagnostic errors. Patient care advances with AI enabling personalized risk stratification. Economic models project returns from efficiency gains in imaging. Overall, this opportunity diversifies applications in preventive cardiology. Regulatory support for AI drives sustained innovation.

Impact of Macroeconomic / Geopolitical Factors

Global economic upturns direct ample funding toward cardiac diagnostics, energizing the cardiovascular ultrasound market via broader access to echocardiography systems in expanding healthcare networks. Firms exploit favorable borrowing conditions to upgrade portable ultrasound tech, addressing surging needs from lifestyle-related heart conditions in urban centers.

Regrettably, escalating worldwide inflation compounds equipment and maintenance fees, curtailing deployment speeds for providers in economically strained locales. Aggravated trade blockades stemming from U.S.-China frictions and European conflicts sever critical semiconductor supplies, inflating delays for transducer assemblies among reliant vendors.

Operators neutralize such vulnerabilities through adaptive contract manufacturing shifts to allied countries, which refines cost controls and sparks fresh tech transfer deals. Current US tariffs, setting a 10% floor on imported medical imaging gear with spikes to 50% for designated origins, magnify expenses for foreign exporters targeting American buyers.

Stateside enterprises respond by fortifying assembly operations domestically, which catalyzes engineering breakthroughs and shields profit streams. Sophisticated AI-enhanced imaging protocols invariably uplift the sector’s resilience, unlocking superior diagnostic precision and steady revenue climbs internationally.

Latest Trends

Integration of artificial intelligence in cardiovascular ultrasound is a recent trend

In 2024, the cardiovascular ultrasound market has demonstrated a prominent trend toward the integration of artificial intelligence, which automates image analysis and enhances diagnostic accuracy for conditions like echocardiography assessments. Manufacturers are focusing on AI algorithms to reduce exam times and improve workflow in busy cardiology departments. Healthcare professionals are adopting AI-enabled systems for real-time guidance during scans, supporting precise measurements of cardiac function.

Regulatory approvals highlight AI’s role in standardizing ultrasound interpretations across operators. Clinical trials are evaluating AI in detecting abnormalities like valve defects with higher sensitivity. Academic studies are exploring AI integration with wearable devices for continuous monitoring. Global networks are advancing AI to ensure compatibility with diverse ultrasound platforms. Patient therapies benefit from AI facilitating faster diagnosis and personalized treatment plans.

Ethical protocols are ensuring data privacy in AI applications. From Siemens Healthineers’ 2024 annual report, the Ultrasound segment contributed to strong performance in Imaging and Ultrasound, with AI advancements in procedural guidance. This trend reflects company-wide emphasis on digital solutions. Providers favor AI for reducing variability in readings.

Market players respond with cloud-based AI for remote consultations. Research emphasizes AI in predicting cardiovascular events. Patient care advances with AI enabling early intervention. Economic models project cost savings from efficiency gains. Overall, this trend strengthens ultrasound’s role in precision medicine. Regulatory support for AI drives sustained adoption.

Regional Analysis

North America is leading the Cardiovascular Ultrasound Market

In 2024, North America held a 39.9% share of the global cardiovascular ultrasound market, propelled by the increasing adoption of echocardiography for non-invasive monitoring of heart conditions, particularly in outpatient settings where portable and 3D imaging systems enable precise assessment of valvular diseases and cardiomyopathies amid rising obesity rates.

Cardiologists expanded utilization of Doppler-enhanced devices for real-time evaluation of cardiac function in high-risk patients with atrial fibrillation, supported by updated protocols that prioritize early intervention to prevent strokes. Innovations in contrast agents and strain imaging improved diagnostic accuracy for ischemic heart disease, aligning with reimbursement expansions for preventive screenings in managed care networks.

Demographic shifts toward older populations amplified procedural volumes for aortic stenosis evaluations, prompting integrated models with telemedicine for follow-up. Pharmaceutical collaborations validated ultrasound-guided therapies for heart failure management, bridging gaps in rural access.

Supply chain fortification ensured equipment with high-resolution transducers compliant with biosafety norms in high-volume clinics. Collaborative quality metrics tracked procedural outcomes, fostering confidence in pediatric congenital assessments. Coronary heart disease killed 371,506 people in 2022.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders anticipate vigorous progression in cardiovascular ultrasound technologies across Asia Pacific throughout the forecast period, as healthcare modernizations confront escalating heart disease burdens from dietary changes and pollution exposure. Specialists deploy portable echocardiographs in community screenings, optimizing detection of rheumatic heart valve issues in adolescent groups.

National authorities invest in 3D imaging upgrades for tertiary centers, equipping them to manage congenital anomalies amid youthful demographics. Biotech innovators customize Doppler systems with enhanced portability, suiting remote monitoring for hypertensive complications in rural enclaves. Cross-national research groups evaluate strain analysis through studies, enhancing precision for ischemic evaluations in diabetic populations.

Pharmaceutical firms adapt contrast-enhanced variants through local manufacturing, ensuring affordability for valvular assessments. Policy initiatives promote technician training on real-time applications, extending coverage to peripheral facilities facing resource constraints. In 2021, Asia accounted for 11.8 million deaths from cardiovascular diseases.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Cardiovascular Ultrasound market drive growth by advancing image clarity, real-time analytics, and AI-assisted quantification that improve diagnostic confidence in cardiac and vascular assessments. Companies expand adoption by tailoring systems for point-of-care, outpatient, and high-volume hospital settings, enabling broader clinical access beyond tertiary centers.

Commercial strategies focus on long-term equipment upgrades, software subscriptions, and service contracts that generate recurring revenue and strengthen customer retention. Innovation priorities include portable platforms, automation of measurements, and seamless integration with electronic health records to streamline clinician workflows.

Market expansion targets regions experiencing rising cardiovascular disease prevalence and increased investment in non-invasive diagnostics. GE HealthCare operates as a leading participant through its comprehensive ultrasound portfolio, global service infrastructure, and continuous investment in cardiovascular imaging technologies that support scalable and reliable clinical deployment.

Recent Developments

- In August 2024, UltraSight secured US FDA authorization for its artificial intelligence enabled cardiac ultrasound guidance software. The platform delivers real time visual and procedural prompts that assist non sonographers in acquiring diagnostically useful cardiac ultrasound views at the bedside. By lowering skill barriers, the technology expands cardiac imaging access across emergency, primary care, and remote clinical environments, supporting earlier detection of cardiovascular abnormalities.

- In February 2024, FUJIFILM India rolled out the ALOKA ARIETTA 850 ultrasound system nationwide, marking its entry with an initial deployment at Fortis Hospital in Bengaluru. The system enhances advanced diagnostic imaging capabilities for cardiology and general applications, reinforcing the adoption of high end ultrasound solutions within India’s expanding hospital infrastructure.

Top Key Players

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Canon Medical Systems Corporation

- Hitachi Medical Systems

- Samsung Medison

- Mindray Medical International

- Fujifilm Healthcare

- Shenzhen Mindray Bio-Medical Electronics

- Esaote S.p.A.

Report Scope

Report Features Description Market Value (2024) US$ 2.7 Billion Forecast Revenue (2034) US$ 4.6 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Transthoracic Echocardiography, Stress Echocardiography, Transesophageal Echocardiography and Others), By Technology (2D Ultrasound, Doppler Imaging, Color Flow Imaging and 3D/4D Ultrasound), By Display (Color Display and Monochrome Display), By End-User (Hospitals, Ambulatory Surgical Centers, Diagnostic Centers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GE Healthcare, Koninklijke Philips N.V., Siemens Healthineers, Canon Medical Systems Corporation, Hitachi Medical Systems, Samsung Medison, Mindray Medical International, Fujifilm Healthcare, Shenzhen Mindray Bio-Medical Electronics, Esaote S.p.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cardiovascular Ultrasound MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Cardiovascular Ultrasound MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Canon Medical Systems Corporation

- Hitachi Medical Systems

- Samsung Medison

- Mindray Medical International

- Fujifilm Healthcare

- Shenzhen Mindray Bio-Medical Electronics

- Esaote S.p.A.