Global Cardiovascular Needle Market By Product Type (Round bodied needles and Cutting needles), By Usage (Single-use and Multiple-use), By Application (Open-heart surgery, Coronary artery bypass graft (CABG) surgery, Cardiac valve procedures, Heart transplant and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169451

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

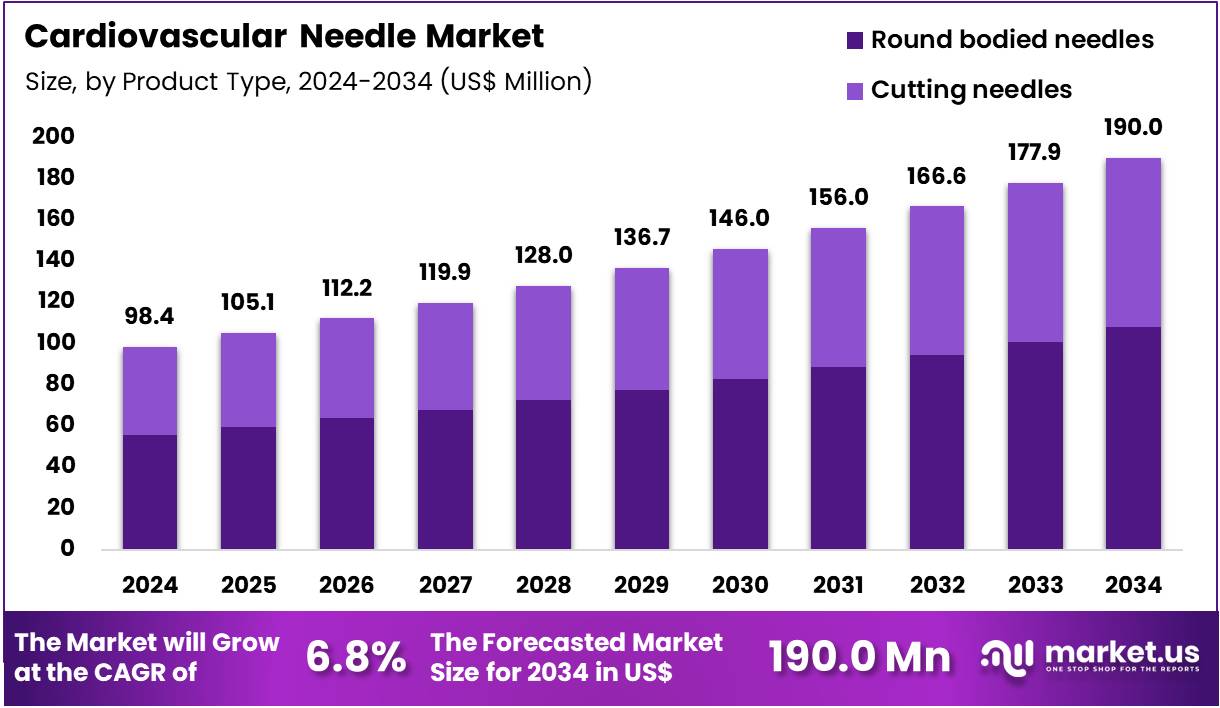

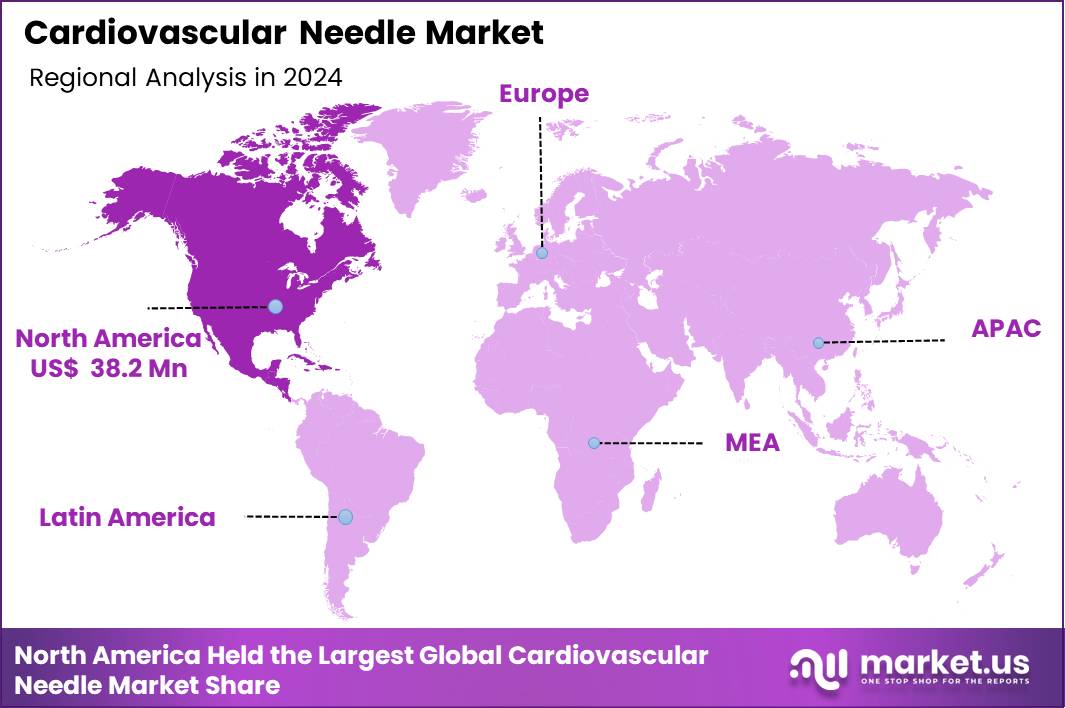

The Global Cardiovascular Needle Market size is expected to be worth around US$ 190.0 Million by 2034 from US$ 98.4 Million in 2024, growing at a CAGR of 6.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.8% share with a revenue of US$ 38.2 Million.

The Cardiovascular Needle Market is expected to experience steady expansion as surgical volumes rise across cardiac care units globally. Growing incidences of coronary artery disease, valve disorders, congenital heart defects, and heart failure continue increasing the need for open-heart surgeries, CABG procedures, valve replacements, and heart transplants, all of which depend on precision-engineered needles for suturing delicate cardiovascular tissues.

Hospitals and specialty cardiac centers increasingly prefer high-grade stainless-steel and alloy-based needles that provide improved bending resistance, sharper penetration, and reduced tissue trauma, supporting better post-operative outcomes and shorter recovery times.

Moreover, advancements in minimally invasive cardiac interventions and robotic-assisted procedures are anticipated to support product innovation, prompting manufacturers to offer micro-precision needles with enhanced curvature stability and higher tensile strength.

According to NCBI, minimally invasive cardiac surgery (MICS) demonstrates notably reduced complication rates and shorter hospital stays compared with conventional open-heart procedures. Studies indicate success rates exceeding 95% among suitable candidates, with 30-day mortality typically around 1–2%. Five-year survival rates generally range from 75% to more than 90%, depending on the specific intervention. Recovery is also faster, with many patients resuming normal activities within 2–4 weeks, compared with the 6–12-week recovery period associated with traditional surgery.

Rising healthcare expenditure, adoption of advanced surgical tools, and higher availability of trained cardiothoracic surgeons further strengthen demand. Regulatory emphasis on surgical safety and infection control also accelerates the shift toward sterile, single-use cardiovascular needles in high-volume cardiac surgery centers. In addition, the expanding aging population more prone to cardiac complications supports long-term market stability. Collectively, these factors position the Cardiovascular Needle Market for sustained growth through continuous innovation, increased procedural load, and rising global cardiac disease burden.

Key Takeaways

- In 2024, the market generated a revenue of US$ 98.4 Million, with a CAGR of 6.8%, and is expected to reach US$ 190.0 Million by the year 2034.

- The Product Type segment is divided into Round bodied needles, and Cutting needles, with Round bodied needles taking the lead in 2024 with a market share of 56.8%

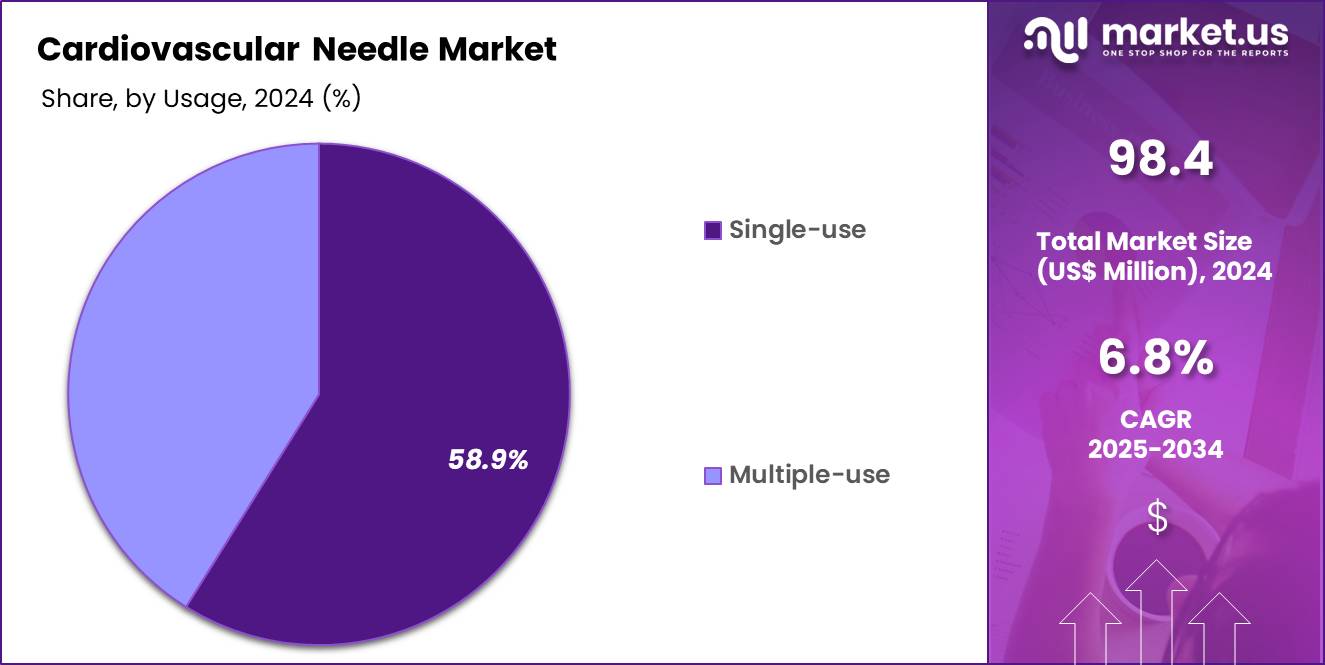

- The Usage segment is divided into Single-use, and Multiple-use, with Single-use taking the lead in 2024 with a market share of 58.9%

- The Application segment is divided into Open-heart surgery, Coronary artery bypass graft (CABG) surgery, Cardiac valve procedures, Heart transplant, and Others, with Coronary artery bypass graft (CABG) surgery taking the lead in 2024 with a market share of 41.2%

- North America led the market by securing a market share of 38.8% in 2024.

Product Type Analysis

Round-bodied needles hold an estimated 56.8% share of the Cardiovascular Needle Market, driven by their extensive use in delicate cardiovascular tissue suturing where minimal trauma is required. These needles penetrate smoothly through myocardium, vessel walls, and graft materials, making them the preferred choice in valve repair, cardiac defect closure, and anastomosis suturing. Hospitals performing high-volume CABG and valve surgeries routinely favor taper-point round-bodied variants due to their precision, reduced bleeding risk, and compatibility with modern monofilament sutures.

Their dominance is strengthened by procedural statistics. Globally, more than 2 million open-heart procedures occur annually, and round-bodied needles are involved in a majority of these interventions due to their atraumatic profile. Round-bodied needles are also routinely included in cardiovascular suturing kits supplied by manufacturers, enabling high usage consistency across surgical centers.

Usage Analysis

Single-use needles account for approximately 58.9% of the market, reflecting global hospital policies favoring sterility, infection control, and elimination of cross-contamination risk. Major cardiovascular centers follow strict single-use guidelines aligned with WHO and surgical infection-prevention standards, which strongly accelerate consumption volume.

Increasing procedural acuity such as in CABG, valve replacement, and heart-failure corrective surgeries requires sterile, uncompromised instruments. Single-use cardiovascular needles also support consistent performance by ensuring optimal sharpness and structural integrity for each procedure. Rising hospital accreditation requirements and widespread adoption of disposable surgical kits further reinforce the dominance of the single-use segment.

Application Analysis

CABG holds the largest share at 41.2%, reflecting its global procedural volume. With cardiovascular disease remaining the world’s leading cause of death, CABG demand continues to rise, generating sustained consumption of high-precision cardiovascular needles. Suturing multiple grafts such as LIMA-to-LAD or saphenous vein grafts requires dependable round-bodied needles for anastomoses. Growth is reinforced by an aging population and high prevalence of multi-vessel coronary disease.

According to NCBI, Coronary Artery Bypass Graft (CABG) remains one of the most frequently performed cardiac surgeries in the U.S., with an estimated 370,000–400,000 procedures conducted each year. Isolated CABG represents more than 70% of all cardiac surgeries, underscoring its clinical significance. Long-term survival rates commonly exceed 90%, although patient outcomes vary depending on age, overall health, and comorbidities. The procedure carries higher risks of complications such as stroke or myocardial infarction in older or medically complex patients, even as overall success rates remain strong.

Open-heart surgery is also a major application which represents 25.0% of total application share. Procedures including septal defect repair, aneurysm correction, and tumor excision heavily rely on atraumatic needles to ensure minimal myocardial disruption. As complex congenital heart surgeries increase in pediatric and adult populations, demand for specialized cardiovascular needles rises across tertiary care hospitals.

Key Market Segments

By Product Type

- Round bodied needles

- Cutting needles

By Usage

- Single-use

- Multiple-use

By Application

- Open-heart surgery

- Coronary artery bypass graft (CABG) surgery

- Cardiac valve procedures

- Heart transplant

- Others

Drivers

Rising global incidence of cardiovascular diseases

Rising global incidence of cardiovascular diseases is one of the leading factors driving the market, as more patients require interventions such as CABG, valve repair, and congenital defect correction. According to WHO, cardiovascular diseases (CVDs) remain the foremost cause of death worldwide. In 2022, they were responsible for an estimated 19.8 million deaths, accounting for roughly 32% of all global mortality, with heart attacks and strokes contributing to about 85% of these cases.

More than three-quarters of CVD-related deaths occur in low- and middle-income countries, highlighting significant disparities in healthcare access and prevention. Among the 18 million premature deaths from noncommunicable diseases in 2021, approximately 38% were attributed to CVDs, underscoring their substantial burden on global health.

Moreover, the CDC reports that approximately 805,000 people in the United States experience a heart attack each year. Of these cases, about 605,000 represent a first-time heart attack, while roughly 200,000 occur in individuals who have previously suffered one.

Increasing surgical volumes in both developed and emerging regions result in consistent and predictable demand for cardiovascular needles. Additionally, the expansion of minimally invasive and robotic cardiothoracic surgery has heightened the need for specialized needle geometries that provide enhanced maneuverability and penetration precision during restricted-access procedures.

Hospitals are also adopting single-use needles at a faster pace due to their infection-control benefits and compliance with updated sterility guidelines, further supporting growth. Investment in cardiac care infrastructure, expansion of tertiary surgical centers, and growing government-supported heart-disease management programs reinforce long-term market momentum.

Restraints

Increasing availability of alternative surgical technologies

A major restraint in the cardiovascular needle market is the increasing availability of alternative surgical technologies, such as sutureless anastomosis devices, tissue adhesives, and transcatheter interventions that reduce the need for suturing altogether. Additionally, the complexity of cardiovascular surgeries requires precise needle handling, and improper needle performance can increase risk of tissue trauma, bleeding, or vessel damage raising barriers for low-quality or low-cost manufacturers.

Cost constraints in developing regions also affect adoption of premium single-use needles, encouraging continued use of multiple-use options despite sterilization challenges. Rising regulatory scrutiny surrounding surgical instrument quality and sterility further increases compliance burden for manufacturers.

Opportunities

Expanding demand for minimally invasive cardiac procedures

Expanding demand for minimally invasive cardiac procedures offers strong opportunities for specialized cardiovascular needles with enhanced rigidity, smaller diameters, and precision-engineered tips. Growing cardiac surgery volumes in Asia Pacific, particularly in India, China, and Southeast Asia, present a substantial pathway for geographic expansion.

Customized suturing kits integrated with cardiovascular needles are seeing increasing adoption among cardiac centers seeking workflow efficiency. There is also opportunity in designing needles optimized for robotic-assisted coronary and valve procedures, where maneuverability and precision requirements are significantly higher. Training institutions and academic surgical centers represent an additional growth channel as global demand for cardiac surgeons continues rising..

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors influence the Cardiovascular Needle Market by shaping consumer spending, supply chain stability, and access to diagnostic materials. Periods of economic slowdown typically shift household spending toward essential healthcare, which benefits at-home testing because it offers a lower-cost alternative to clinical diagnostics.

However, inflation-driven increases in raw material and logistics costs can raise kit prices, affecting affordability in price-sensitive markets. Geopolitical tensions also impact the sourcing of assay components, microfluidic cartridges, reagents, and lateral-flow materials, which are often manufactured across multiple countries. Disruptions in global trade routes or restrictions on chemical exports may slow production timelines and limit inventory availability for online and retail channels.

Public health policy changes in response to geopolitical events further influence demand. For example, global energy and food supply uncertainties increase consumer awareness of immunity, fatigue, and nutritional well-being, contributing to higher self-monitoring behavior. Shifts in labor markets, such as the rise of remote work, encourage more people to adopt home diagnostics rather than visiting clinics. At the same time, increased government scrutiny over cross-border data transfers and digital health privacy may affect how testing companies store and process user data.

Latest Trends

Transition toward single-use, pre-sterilized cardiovascular needles

A key trend shaping the market is the transition toward single-use, pre-sterilized cardiovascular needles included within procedural kits designed for CABG and valve surgeries. Another trend is the introduction of needles optimized for hybrid surgical–interventional procedures that combine open surgery with catheter-based techniques. In advanced cardiac centers, surgeons increasingly prefer ultra-sharp taper-point needles to reduce myocardial tissue stress and improve postoperative recovery.

Robotic devices are influencing needle innovation through demand for greater tip durability and reduced bending during manipulation. Regionally, large hospitals are standardizing cardiovascular suturing tools to ensure consistent surgical quality, promoting adoption of premium-grade, surgeon-preferred needle designs.

Regional Analysis

North America is leading the Cardiovascular Needle Market

North America represents the largest share of the Cardiovascular Needle Market securing a market share of 38.8% in 2024., supported by its extensive cardiac surgery infrastructure, high procedural volumes, and strong adoption of advanced cardiovascular suturing technologies. The region performs a significant portion of the world’s CABG and valve surgeries annually, driven by high prevalence of coronary artery disease, aging demographics, and widespread cardiac specialty centers. Hospitals in the US follow stringent infection-prevention standards, creating strong demand for single-use needles integrated into sterile surgical kits.

Additionally, high adoption of minimally invasive and robotic cardiac surgery continues to increase consumption of premium cardiovascular needles with enhanced maneuverability and atraumatic profiles. Consistent investment in cardiac care, strong reimbursement frameworks, and rapid integration of new surgical innovations reinforce North America’s leading position.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing regional market due to rapid expansion of cardiac care networks, increasing accessibility of complex cardiovascular procedures, and rising disease burden across major countries. Large populations in China and India exhibit high incidence of cardiac disorders, creating strong need for CABG, valve repair, and congenital heart surgeries.

Government investments in tertiary cardiac hospitals and better insurance coverage are improving patient access to surgical treatments, driving higher usage of cardiovascular needles. The region is also witnessing increasing adoption of minimally invasive cardiac surgery, which requires specialized needle designs. As clinical training improves and more surgeons adopt advanced suturing techniques, cardiovascular needle consumption is expected to accelerate significantly across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include BD (Becton, Dickinson and Company), B. Braun Melsungen AG, CP Medical, Inc., Ethicon US LLC, KLS Martin Group, Barber of Sheffield Ltd., MANI Inc., FSSB Surgical Needles GmbH, Teleflex Incorporated, Sklar Surgical Instruments, Medline Industries, Inc., Quality Needles Pvt. Ltd., Surtex Instruments Ltd., Symmetry Surgical Inc., Scanlan International

BD (Becton, Dickinson and Company) maintains a strong presence in the cardiovascular needle space through its high-precision surgical needles engineered for consistent penetration and reduced tissue trauma. The company’s portfolio supports CABG, valve repair, and vascular suturing procedures, benefiting from BD’s broad surgical instrumentation ecosystem. B. Braun Melsungen AG provides cardiovascular needles integrated within its comprehensive cardiac suturing and surgical solutions.

Its focus on high-grade stainless-steel construction, ergonomic handling, and controlled sharpness aligns with surgeon preferences in open-heart and graft-related procedures. CP Medical, Inc. specializes in surgical sutures and associated needles tailored for cardiovascular and vascular surgeries. Its cardiovascular needle designs emphasize exceptional strength, predictable curvature, and compatibility with specialty cardiac sutures used in bypass and valve procedures.

Top Key Players

- BD (Becton, Dickinson and Company)

- Braun Melsungen AG

- Ethicon US LLC (Johnson & Johnson)

- Teleflex Incorporated

- KLS Martin Group

- MANI, Inc.

- FSSB Surgical Needles GmbH

- CP Medical, Inc.

- Medline Industries, Inc.

- Scanlan International

- Symmetry Surgical Inc.

- Surtex Instruments Ltd.

- Sklar Surgical Instruments

- Quality Needles Pvt. Ltd.

- Other key players

Recent Developments

- In June 2025, Olympus Corporation announced the introduction of SecureFlex, a single-use fine needle biopsy device, across the EMEA region. Engineered for compatibility with ultrasound endoscopes, SecureFlex enables endoscopic ultrasound-guided fine needle biopsy (EUS-FNB) of submucosal and extramural lesions within the gastrointestinal tract, enhancing precision in minimally invasive diagnostic procedures.

- In August 2023, Healthium Medtech, a global leader in medical technology solutions, announced the launch of TRUMAS™, a new range of sutures engineered to overcome key challenges encountered during suturing in minimal access surgeries. Marking India’s 77th Independence year, the company strengthened its commitment to advancing the country’s medtech ecosystem by introducing this innovative solution aimed at transforming suturing efficiency and precision in minimally invasive procedures.

Report Scope

Report Features Description Market Value (2024) US$ 98.4 Million Forecast Revenue (2034) US$ 190.0 Million CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Round bodied needles and Cutting needles), By Usage (Single-use and Multiple-use), By Application (Open-heart surgery, Coronary artery bypass graft (CABG) surgery, Cardiac valve procedures, Heart transplant and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BD (Becton, Dickinson and Company), B. Braun Melsungen AG, CP Medical, Inc., Ethicon US LLC, KLS Martin Group, Barber of Sheffield Ltd., MANI Inc., FSSB Surgical Needles GmbH, Teleflex Incorporated, Sklar Surgical Instruments, Medline Industries, Inc., Quality Needles Pvt. Ltd., Surtex Instruments Ltd., Symmetry Surgical Inc., Scanlan International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cardiovascular Needle MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Cardiovascular Needle MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BD (Becton, Dickinson and Company)

- Braun Melsungen AG

- Ethicon US LLC (Johnson & Johnson)

- Teleflex Incorporated

- KLS Martin Group

- MANI, Inc.

- FSSB Surgical Needles GmbH

- CP Medical, Inc.

- Medline Industries, Inc.

- Scanlan International

- Symmetry Surgical Inc.

- Surtex Instruments Ltd.

- Sklar Surgical Instruments

- Quality Needles Pvt. Ltd.

- Other key players