Global Carboxylic Acid Market Size, Share, And Business Benefits By Product (Acetic Acid, Ascorbic Acid, Azelaic Acid, Formic Acid, Valeric Acid, Citric Acid, Others), By End-Use (Food and Beverages, Animal Feed, Building and Construction, Pharmaceuticals, Agrochemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151246

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

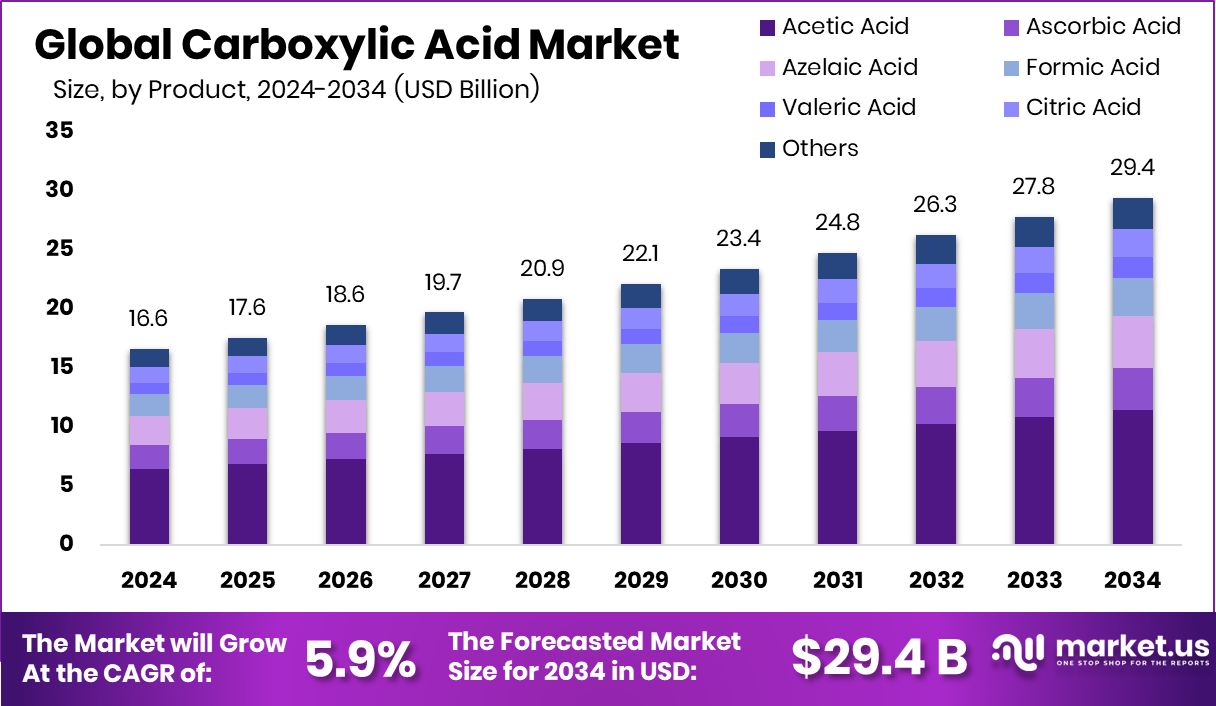

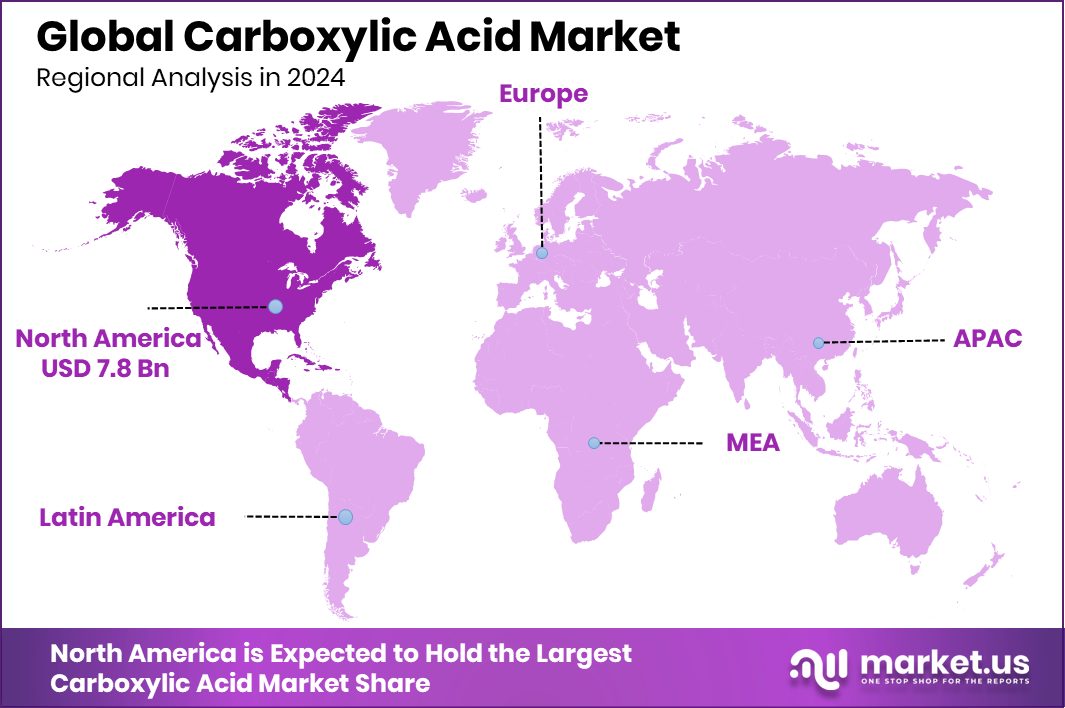

Global Carboxylic Acid Market is expected to be worth around USD 29.4 billion by 2034, up from USD 16.6 billion in 2024, and grow at a CAGR of 5.9% from 2025 to 2034. Strong demand in the food and chemical sectors supported North America’s USD 7.8 billion market.

Carboxylic acid is an organic compound that contains a carboxyl group (-COOH). These acids are widely found in nature and are important in biological and industrial processes. They can range from simple molecules like acetic acid to complex fatty acids. Carboxylic acids are typically known for their sour taste and are often used in food preservation, pharmaceuticals, and as raw materials for polymers and solvents.

The carboxylic acid market refers to the global trade, production, and application of carboxylic acid-based products. This market spans various industries such as agriculture, pharmaceuticals, food processing, textiles, and chemicals. Demand is driven by the compound’s versatility and its ability to be used in both high-volume industrial applications and specialized chemical processes.

One of the key growth factors for this market is the increasing use of carboxylic acids in sustainable and biodegradable materials. As industries shift toward eco-friendly practices, bio-based carboxylic acids are gaining preference, particularly in packaging and agricultural products. This transition supports both environmental goals and market expansion.

The rising demand for processed and packaged food is also fueling growth, as carboxylic acids are commonly used as preservatives and flavor enhancers. Additionally, their use in personal care items, such as creams and lotions, is increasing with the rise of health-conscious consumers.

Key Takeaways

- Global Carboxylic Acid Market is expected to be worth around USD 29.4 billion by 2034, up from USD 16.6 billion in 2024, and grow at a CAGR of 5.9% from 2025 to 2034.

- Acetic acid holds a 38.9% share in the Carboxylic Acid Market due to widespread industrial applications.

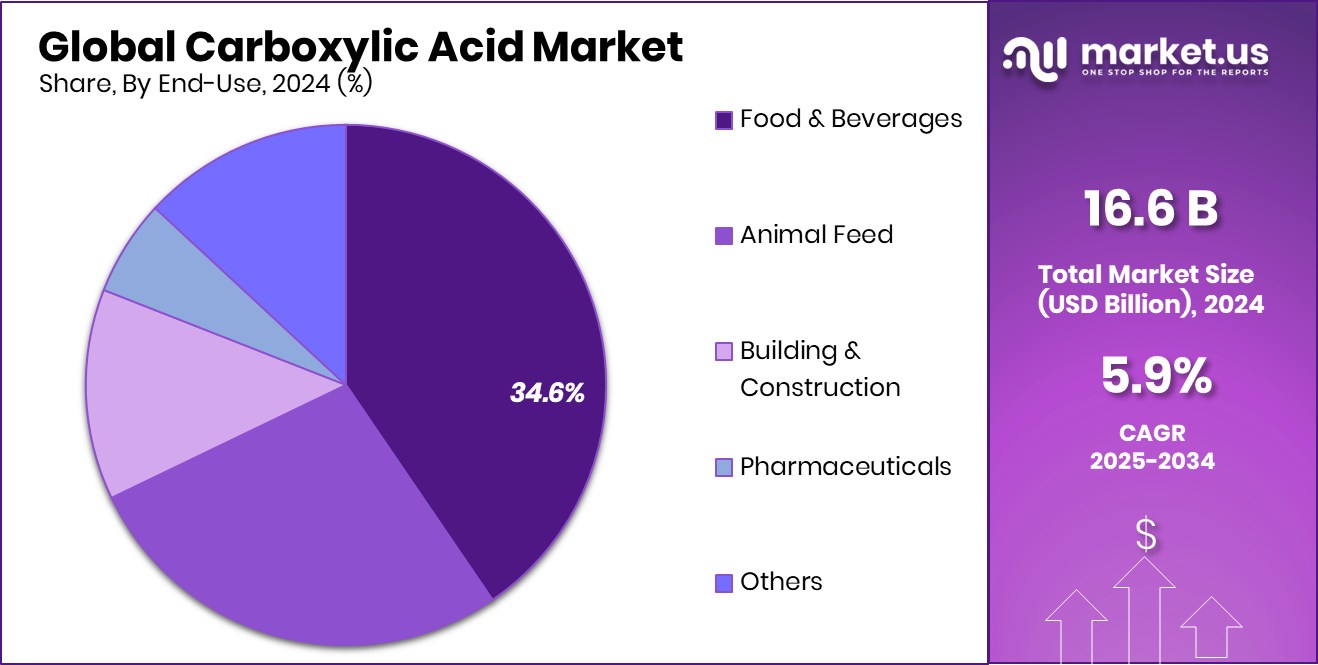

- The food and beverages segment accounts for 34.6% of the Carboxylic Acid Market, driven by preservation needs.

- North America recorded a market value of USD 7.8 billion that year.

By Product Analysis

Acetic acid dominates the Carboxylic Acid Market with a 38.9% share.

In 2024, Acetic Acid held a dominant market position in the By Product segment of the Carboxylic Acid Market, with a 38.9% share. This significant share underscores the widespread application and importance of acetic acid across various industries.

Acetic acid is a vital chemical intermediate used in the production of a broad range of products such as vinyl acetate monomer, acetic anhydride, and ester solvents. Its strong demand is largely driven by its role in the manufacture of synthetic fibers, plastics, and food preservatives.

The food and beverage industry contributes to its prominence through its use as an acidity regulator and preservative, helping extend shelf life and enhance flavor. Additionally, its utility in the production of adhesives, paints, and coatings further strengthens its market hold. The steady demand from both industrial and consumer-facing applications continues to support its leading position.

As industries increasingly prioritize efficiency and sustainability, acetic acid’s relatively simple production process and versatility make it a preferred choice. The 38.9% share in 2024 reflects both consistent consumption patterns and the product’s critical role across multiple sectors, ensuring its continued relevance and market dominance in the coming years.

By End-Use Analysis

Food and beverages drive 34.6% of the Carboxylic Acid Market demand.

In 2024, Food and Beverages held a dominant market position in the By End-Use segment of the Carboxylic Acid Market, with a 34.6% share. This leading share highlights the essential role of carboxylic acids in food preservation, flavor enhancement, and acidity regulation.

Products such as acetic acid and citric acid are widely used in this sector to maintain product freshness, improve taste profiles, and ensure food safety. The strong demand for packaged and processed food items continues to drive the need for effective preservatives and stabilizers, where carboxylic acids are commonly applied.

The growth in urban populations and shifting dietary patterns have led to increased consumption of ready-to-eat and convenience foods, directly influencing the demand within the food and beverage industry. Carboxylic acids are also favored due to their compatibility with food safety regulations and their ability to extend shelf life without compromising quality.

The 34.6% market share in 2024 reflects the industry’s reliance on these compounds for product formulation and stability. With health and hygiene becoming key consumer concerns, the use of carboxylic acids in maintaining food quality remains a central factor in their sustained dominance within this end-use segment.

Key Market Segments

By Product

- Acetic Acid

- Ascorbic Acid

- Azelaic Acid

- Formic Acid

- Valeric Acid

- Citric Acid

- Others

By End-Use

- Food and Beverages

- Animal Feed

- Building and Construction

- Pharmaceuticals

- Agrochemicals

- Others

Driving Factors

Rising Demand for Processed and Packaged Foods

One of the main factors driving the carboxylic acid market is the growing demand for processed and packaged foods. As people lead busier lives, they prefer ready-to-eat meals and convenient food options. Carboxylic acids, especially acetic and citric acids, are widely used in these food products as preservatives, flavor enhancers, and acidity regulators. They help improve shelf life and maintain the taste and quality of food.

This trend is especially strong in urban areas, where fast-paced lifestyles are common. As more consumers choose packaged food, the need for safe and effective food ingredients continues to rise. This increasing demand directly supports the growth of the carboxylic acid market across different regions and food categories.

Restraining Factors

Environmental Concerns Over Chemical-Based Production Methods

A major factor that may hold back the growth of the carboxylic acid market is the environmental impact linked to its chemical-based production. Many carboxylic acids are made through processes that release harmful gases or create chemical waste, which can affect air and water quality. As environmental regulations become stricter, manufacturers may face more rules, higher costs, or limits on how much they can produce.

There is also growing pressure from consumers and governments to shift toward greener, more eco-friendly solutions. This creates challenges for companies still relying on traditional production methods. Unless cleaner and sustainable alternatives are widely developed, these environmental concerns could slow down the market’s expansion and make operations more expensive for producers.

Growth Opportunity

Growing Use in Eco-Friendly Packaging Solutions

A major growth opportunity for the carboxylic acid market lies in its increasing use in eco-friendly and biodegradable packaging. As more companies and consumers look for sustainable options, the demand for green packaging materials is rising quickly. Carboxylic acids are used to make bioplastics and other biodegradable materials that can replace traditional plastics. These materials break down more easily and have less impact on the environment.

This shift is being supported by government policies encouraging the use of natural and renewable resources. With industries like food, retail, and personal care moving toward sustainable packaging, the need for carboxylic acid-based solutions is expected to grow. This trend opens up new markets and long-term opportunities for manufacturers and suppliers.

Latest Trends

Shift Toward Bio-Based Carboxylic Acids Production

A notable recent trend in the carboxylic acid market is the growing shift toward bio-based production methods. Instead of relying on traditional processes that use petroleum-derived raw materials, manufacturers are increasingly turning to renewable sources, such as plant-based sugars and agricultural byproducts.

This eco-friendlier approach reduces carbon emissions and supports environmental goals, making products more attractive to sustainability-focused consumers and brands. Companies are investing in fermentation and enzymatic methods to produce popular acids like lactic, citric, and acetic acid. These techniques offer lower energy consumption and less chemical waste.

Regional Analysis

North America led the Carboxylic Acid Market in 2024 with a 47.2% share.

In 2024, North America emerged as the dominating region in the global Carboxylic Acid Market, accounting for 47.2% of the total share and reaching a market value of USD 7.8 billion. This leadership position is primarily attributed to strong demand from the food, beverage, and chemical sectors, coupled with advanced manufacturing capabilities and supportive regulatory frameworks.

Europe also maintained a significant presence in the market due to its well-established industrial base and increased focus on sustainable and bio-based chemical production. The Asia Pacific region continued to grow steadily, driven by rising consumption in food preservation, packaging, and pharmaceuticals across developing economies such as India and Southeast Asian nations.

The Middle East & Africa and Latin America held smaller shares but showed gradual development, supported by emerging industrial activities and increasing demand for processed foods and consumer goods. While North America held the largest share, other regions are also showing signs of steady growth, supported by rising urbanization, improved living standards, and expansion in end-use industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as BASF SE, Eastman Chemical Company, and Dow maintained a strong foothold in the global Carboxylic Acid Market by leveraging innovation, manufacturing efficiency, and diversified product offerings.

BASF SE continued to strengthen its position by focusing on sustainability and bio-based alternatives. The company’s integrated production networks and global supply chain capabilities allowed it to cater to rising demand, particularly in food preservation, personal care, and industrial applications. Its focus on circular economy principles also aligned well with the global push for green chemistry.

Eastman Chemical Company emphasized specialty chemicals and customized solutions, enabling it to serve niche markets more effectively. Its experience in organic synthesis and material science supported the development of tailored carboxylic acid products suited for high-performance coatings, adhesives, and food-grade applications. Eastman’s regional adaptability and strong customer relationships helped it navigate fluctuating raw material costs and environmental compliance challenges.

Dow, known for its broad chemical portfolio, played a key role in addressing volume demand across large-scale applications. Its ability to scale operations and its investment in R&D contributed to consistent product quality and performance. Dow also emphasized digital transformation in its production lines, improving efficiency and lowering operational costs.

Top Key Players in the Market

- BASF SE

- Eastman Chemical Company

- Dow

- FINETECH INDUSTRY LIMITED

- Celanese Corporation

- Perstorp

- OXEA GmbH

- Hydrite Chemical

Recent Developments

- In October 2024, BASF announced it had shifted its entire ethyl acrylate production in Ludwigshafen to a bio‑based version. This new product features 40% bio-content, offers approximately 30% lower carbon footprint compared to its fossil-based counterpart, and serves as a drop-in replacement in existing applications like coatings and adhesives.

- In March 2024, Dow announced plans to invest in a large-scale production facility on the U.S. Gulf Coast. This new plant will produce carbonate solvents, which are frequently used in carboxylic‑derived applications such as electrolytes for lithium‑ion batteries. The project also aims to capture a significant portion of CO₂ emissions from its operations, reinforcing Dow’s move toward more sustainable practices.

Report Scope

Report Features Description Market Value (2024) USD 16.6 Billion Forecast Revenue (2034) USD 29.4 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Acetic Acid, Ascorbic Acid, Azelaic Acid, Formic Acid, Valeric Acid, Citric Acid, Others), By End-Use (Food and Beverages, Animal Feed, Building and Construction, Pharmaceuticals, Agrochemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Eastman Chemical Company, Dow, FINETECH INDUSTRY LIMITED, Celanese Corporation, Perstorp, OXEA GmbH, Hydrite Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Eastman Chemical Company

- Dow

- FINETECH INDUSTRY LIMITED

- Celanese Corporation

- Perstorp

- OXEA GmbH

- Hydrite Chemical