Global Acrylate Market Size, Share, And Business Benefits By Chemistry (Butyl Acrylate, Ethyl Acrylate, 2-Ethyl Hexyl Acrylate, Methyl Acrylate, Others), By Application (Paints, Coatings, and Printing Inks, Plastics, Adhesives and Sealants, Fabrics, Others), By End-use (Building and Construction, Packaging, Consumer Goods Automotive Textiles, Bio-medical, Cosmetic and Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151128

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

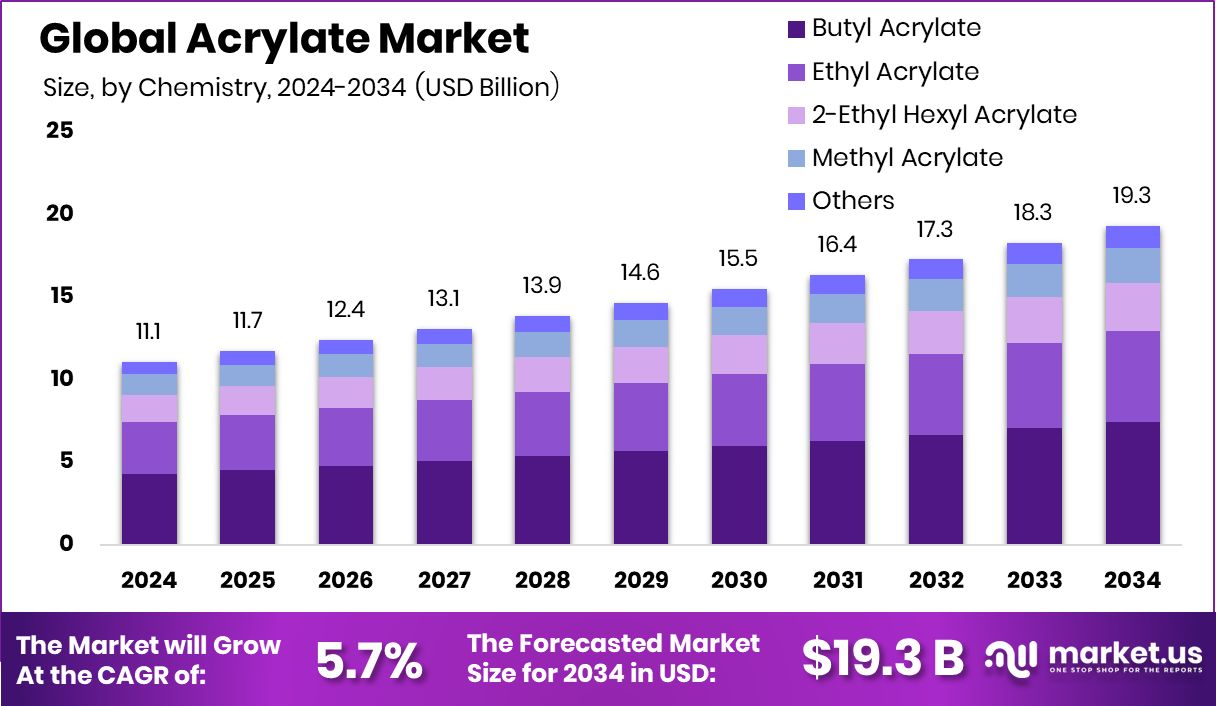

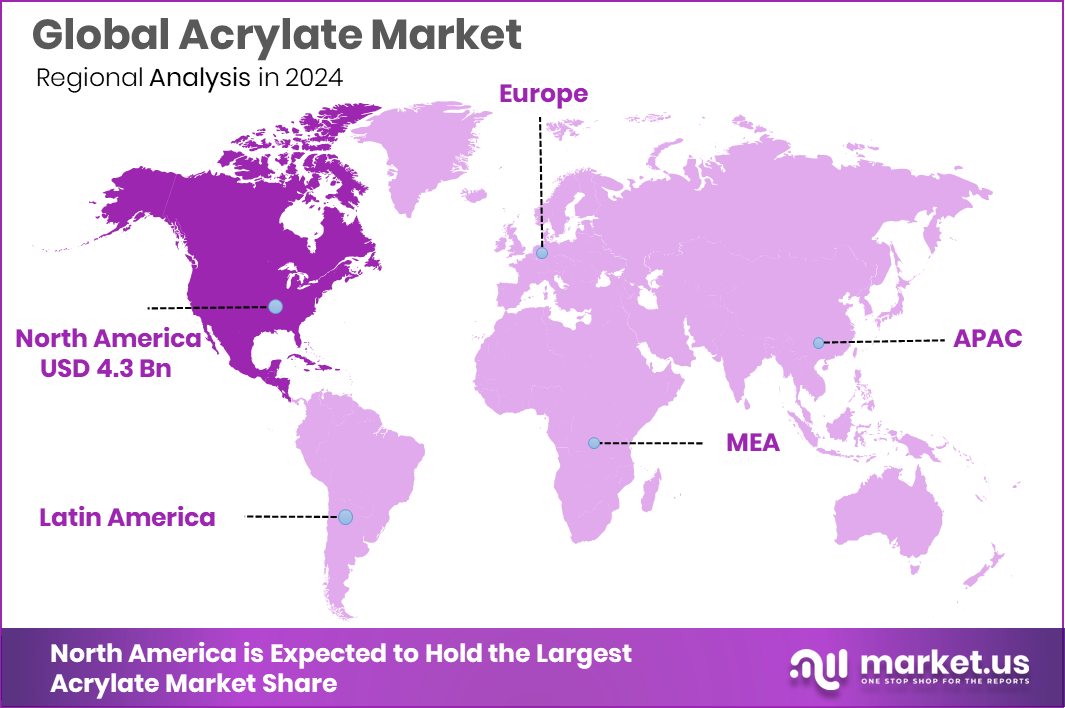

Global Acrylate Market is expected to be worth around USD 19.3 billion by 2034, up from USD 11.1 billion in 2024, and grow at a CAGR of 5.7% from 2025 to 2034. Strong demand from the construction and coatings industries supported North America’s USD 4.3 billion position.

Acrylate refers to a group of chemical compounds derived from acrylic acid or its esters and salts. These compounds are known for their fast-drying properties, flexibility, and durability, making them highly useful in the production of paints, coatings, adhesives, textiles, and sealants. Acrylates can be tailored to provide various functional properties like UV resistance, water resistance, and elasticity, which makes them suitable for a wide range of industrial and consumer applications.

The acrylate market encompasses the global production, distribution, and consumption of acrylate-based products across different industries. It includes a wide variety of products ranging from adhesives, coatings, and sealants to superabsorbent polymers used in personal care items. The market is shaped by both supply-side dynamics, such as raw material availability, and demand-side factors, such as industrial growth and consumer preferences for high-performance materials.

The rising demand for water-based and environmentally friendly coatings is one of the major growth drivers for acrylates. As industries shift towards sustainable solutions, acrylates offer low-VOC formulations without compromising performance. Rapid urbanization and infrastructure development also contribute to increased use of acrylate-based paints and adhesives. According to an industry report, Living Ink, a leader in sustainable colorant technology, has secured $3 million in a successful funding round to advance its bio-based pigment innovations.

Consumer goods, automotive, and construction sectors are generating consistent demand due to the versatile applications of acrylates. In particular, personal care items like diapers and hygiene products rely on superabsorbent acrylate polymers, adding to the everyday demand across global markets. According to an industry report, Meanwhile, Pittsburgh-based Liquid X has raised $2.5 million in new funding, which will support team expansion and future growth.

Key Takeaways

- Global Acrylate Market is expected to be worth around USD 19.3 billion by 2034, up from USD 11.1 billion in 2024, and grow at a CAGR of 5.7% from 2025 to 2034.

- Butyl acrylate dominates the acrylate market, holding a 38.6% share due to its wide industrial usage.

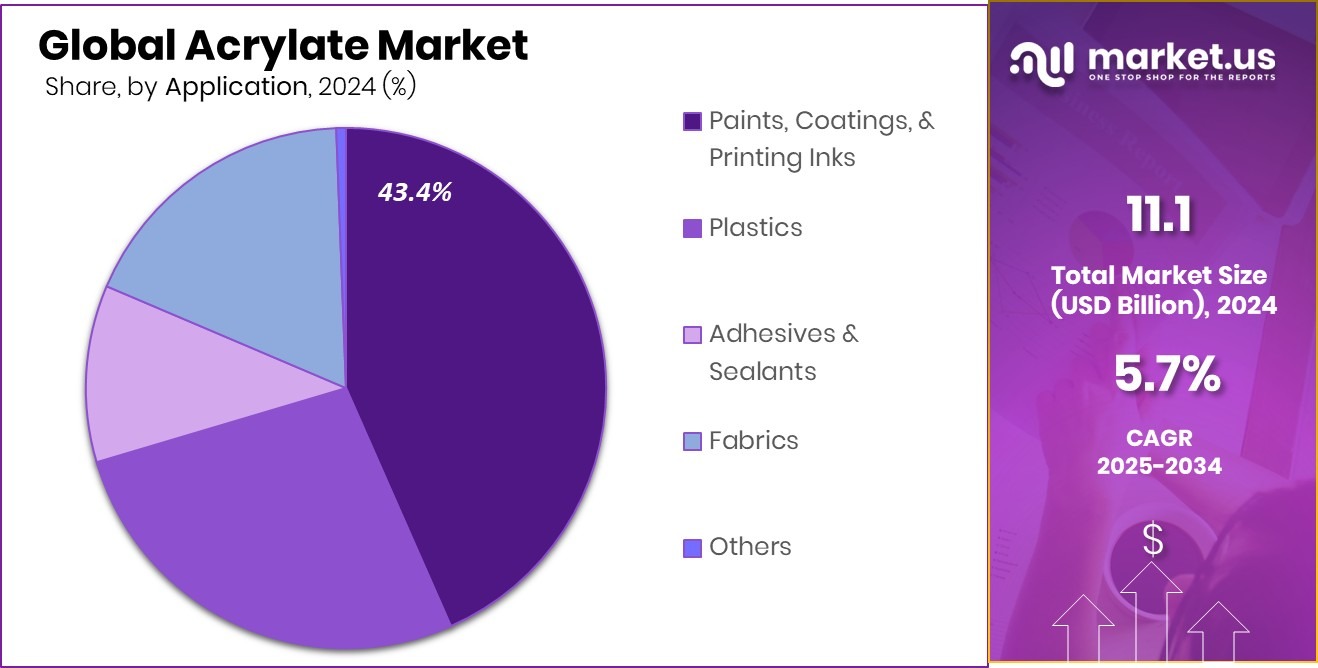

- Paints, coatings, and printing inks lead the acrylate market with a 43.4% application share.

- Building and construction contribute 29.9% to the acrylate market demand, driven by infrastructure growth worldwide.

- North America recorded a market value of USD 4.3 billion that year.

By Chemistry Analysis

By Chemistry, Butyl Acrylate leads the Acrylate Market, accounting for a 38.6% share.

In 2024, Butyl Acrylate held a dominant market position in the By Chemistry segment of the Acrylate Market, with a 38.6% share. This strong market presence can be attributed to its widespread use in a variety of industrial applications, particularly in paints, coatings, and adhesives.

Butyl Acrylate offers a balance of flexibility, durability, and resistance to environmental factors, making it a preferred choice for formulations requiring long-term performance. Its compatibility with other acrylic monomers also enhances its versatility, further supporting its dominance in the chemistry segment.

The continued expansion in the construction and automotive sectors has contributed to sustained demand for Butyl Acrylate, particularly in the production of high-performance coatings. Additionally, growing emphasis on low-VOC and water-based formulations has increased the adoption of Butyl Acrylate in environmentally conscious product lines.

Manufacturers benefit from its consistent performance characteristics, ease of formulation, and broad compatibility with other raw materials. These factors collectively solidify its leading share in the market.

By Application Analysis

Paints, Coatings, and Printing Inks dominate the Acrylate Market applications with a 43.4% share.

In 2024, Paints, Coatings, and Printing Inks held a dominant market position in the By Application segment of the Acrylate Market, with a 43.4% share. This leadership is primarily driven by the extensive use of acrylate compounds in formulating high-performance paints and coatings that demand durability, weather resistance, and fast drying times. Industries such as construction, automotive, and general manufacturing rely heavily on these applications, boosting the segment’s market share.

The preference for water-based and low-VOC coatings has further increased the reliance on acrylates in this segment, as they offer excellent film-forming properties without compromising environmental compliance. In printing inks, acrylates contribute to improved adhesion, flexibility, and color retention, making them a favored choice for both commercial and industrial printing needs.

The consistent demand from infrastructure projects and refurbishment activities continues to support the growth of this segment. Additionally, the versatility of acrylates in meeting diverse formulation requirements allows manufacturers to develop customized solutions tailored to specific end-user demands.

By End-use Analysis

Building and Construction drives the Acrylate Market end-use, contributing 29.9% to total demand.

In 2024, Building and Construction held a dominant market position in the end-use segment of the Acrylate Market, with a 29.9% share. This leading position is largely supported by the sector’s growing need for durable, weather-resistant, and flexible materials used in applications such as sealants, adhesives, paints, and coatings. Acrylates provide essential performance benefits like UV stability, water resistance, and long-term adhesion—qualities that are vital in modern construction practices.

The increasing global focus on infrastructure development, urban housing projects, and renovation activities has driven steady demand for acrylate-based products in this segment. In particular, the use of acrylate polymers in construction materials helps enhance longevity and performance under varying environmental conditions.

Additionally, the shift towards sustainable construction materials aligns with the low-VOC and water-based nature of many acrylate formulations, further reinforcing their role in the sector. With ongoing investment in infrastructure and a growing emphasis on building efficiency and durability, the Building and Construction segment continues to be a primary driver of acrylate consumption, solidifying its top share in the 2024 market.

Key Market Segments

By Chemistry

- Butyl Acrylate

- Ethyl Acrylate

- 2-Ethylhexyl Acrylate

- Methyl Acrylate

- Others

By Application

- Paints, Coatings, and Printing Inks

- Plastics

- Adhesives and Sealants

- Fabrics

- Others

By End-use

- Building and Construction

- Packaging

- Consumer Goods, Automotive, Textiles

- Bio-medical

- Cosmetic and Personal Care

- Others

Driving Factors

Growing Demand for Water-Based Coatings Solutions

One of the top driving factors in the acrylate market is the rising demand for water-based coatings. These coatings are gaining popularity because they are safer for the environment and healthier for people. Unlike solvent-based coatings, water-based ones release fewer harmful fumes (VOCs), making them ideal for indoor use and areas with strict environmental rules.

Acrylates are a key ingredient in these coatings because they help provide a smooth finish, strong adhesion, and durability. As more industries, including construction and automotive, move toward eco-friendly practices, the need for water-based coatings continues to grow.

Restraining Factors

Fluctuating Raw Material Prices Affecting Production Costs

A major restraining factor in the acrylate market is the unstable pricing of raw materials used in its production. Acrylates are made from petrochemical-based inputs, and the prices of these chemicals often change due to factors like oil price volatility, supply chain issues, or geopolitical tensions. When raw material prices go up, the overall cost of producing acrylates also increases.

This puts pressure on manufacturers and may lead to higher product prices or reduced profit margins. For smaller companies or price-sensitive industries, this can limit the use of acrylate-based products. Such cost uncertainties make it harder for businesses to plan and may slow down market growth in the short term.

Growth Opportunity

Expansion of Bio-Based and Green Acrylate Alternatives

A significant growth opportunity in the acrylate market lies in the shift towards bio-based and green acrylate alternatives. These eco-friendly variants are made using renewable feedstocks instead of traditional petrochemicals, making them more sustainable and appealing to environmentally conscious consumers and industries.

With increasing regulations on carbon emissions and a global push for greener materials, manufacturers can benefit by developing and offering bio-derived acrylates that match the performance of conventional types. These alternatives help reduce environmental impact without sacrificing quality.

Latest Trends

Rise of UV‑Curable Acrylates for Fast Applications

A prominent recent trend in the acrylate market is the growing use of UV‑curable acrylates. These special acrylate formulations are activated by ultraviolet light, allowing coatings, inks, adhesives, and sealants to cure almost instantly. This fast-drying method saves time and energy compared to traditional heat-based curing processes.

Industries such as electronics, automotive, packaging, and 3D printing are increasingly adopting UV-curable solutions for their speed and precision. As technology advances and UV-curing systems become more affordable and accessible, more manufacturers are expected to integrate UV‑curable acrylates into their operations, making this a key emerging trend in the acrylate market.

Regional Analysis

In 2024, North America held a 39.3% share of the Acrylate Market.

In 2024, the Acrylate Market showed varied performance across regions, with North America emerging as the dominating region, holding a 39.3% market share valued at USD 4.3 billion. The region’s strong industrial base, coupled with growing demand from construction, automotive, and consumer goods sectors, continues to support its leading position. The presence of advanced manufacturing capabilities and increasing adoption of environmentally friendly coatings further fuel market growth in North America.

Europe followed closely, driven by regulatory focus on sustainable materials and the rising demand for water-based and low-VOC products. In Asia Pacific, rapid industrialization, urban infrastructure projects, and a growing population have led to a steady rise in acrylate consumption, particularly in developing economies. Meanwhile, the Middle East & Africa region is witnessing moderate growth, supported by construction and packaging demand, though overall contribution remains smaller.

Latin America is gradually expanding, with increased focus on domestic manufacturing and the application of acrylates in local industries. While North America leads in market share and value, Asia Pacific is viewed as a key region for future growth due to expanding industrial activities. Each region reflects a unique pace of development, influenced by its economic structure and sector-specific demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as Evonik, Formosa Plastics, and Hexion played significant roles in shaping the global acrylate market. These companies, with their strong product portfolios and manufacturing capabilities, contributed notably to innovation, supply consistency, and performance-driven applications in the acrylate segment.

Evonik maintained a steady position through its focus on specialty chemicals and functional acrylates that serve high-performance needs in coatings, adhesives, and sealants. The company’s emphasis on sustainable and high-purity solutions supported demand from industries seeking environmentally friendly materials without compromising performance.

Formosa Plastics demonstrated strength in production scale and integration, offering competitive pricing and volume supply across regions. With a broad chemical manufacturing base, Formosa’s acrylate products continued to meet the needs of mass-market applications, particularly in the construction and consumer goods sectors. The company’s ability to scale production in response to demand shifts added resilience to its market presence.

Hexion leveraged its expertise in thermoset resins and tailored chemical solutions to offer specialty acrylate formulations used in coatings, composites, and industrial adhesives. Its ability to innovate and deliver performance-driven formulations allowed it to serve niche market needs and applications where precision and durability are critical.

Top Key Players in the Market

- Alpha Chemika

- Arkema S.A.

- BASF SE

- Dow

- Evonik

- Formosa Plastics

- Hexion

- KH Chemical

- KURARAY

- LG Chem

- Mitsubishi Chemical Group

- Nippon Shokubai Co., Ltd.

- Sasol

- SIBUR

- Sumitomo Chemical

- Wanhua Chemical Group Co. Ltd.

Recent Developments

- In June 2025, BASF announced that its Rheovis® additive range (used in coatings) now incorporates up to 35% bio-based Ethyl Acrylate, verified through ¹⁴C analysis (ASTM D6866‑18). This change maintains product performance while cutting the overall carbon footprint by around 30% compared to fossil-based alternatives.

- In October 2024, Arkema introduced a new ethyl acrylate made entirely from bio‑ethanol at its Carling, France, facility. This product features 40% bio‑carbon content and cuts the product carbon footprint (PCF) by up to 30%. Sourced from biomass, this sustainable option targets coating applications and aligns with Arkema’s plans to decarbonize its acrylic offerings.

Report Scope

Report Features Description Market Value (2024) USD 11.1 Billion Forecast Revenue (2034) USD 19.3 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Chemistry (Butyl Acrylate, Ethyl Acrylate, 2-Ethyl Hexyl Acrylate, Methyl Acrylate, Others), By Application (Paints, Coatings, and Printing Inks, Plastics, Adhesives and Sealants, Fabrics, Others), By End-use (Building and Construction, Packaging, Consumer Goods Automotive Textiles, Bio-medical, Cosmetic and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alpha Chemika, Arkema S.A., BASF SE, Dow, Evonik, Formosa Plastics, Hexion, KH Chemical, KURARAY, LG Chem, Mitsubishi Chemical Group, Nippon Shokubai Co., Ltd., Sasol, SIBUR, Sumitomo Chemical, Wanhua Chemical Group Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alpha Chemika

- Arkema S.A.

- BASF SE

- Dow

- Evonik

- Formosa Plastics

- Hexion

- KH Chemical

- KURARAY

- LG Chem

- Mitsubishi Chemical Group

- Nippon Shokubai Co., Ltd.

- Sasol

- SIBUR

- Sumitomo Chemical

- Wanhua Chemical Group Co. Ltd.