Global Building Insulation Market Size, Share, And Enhanced Productivity By Material Type (Fiberglass, Mineral Wool, Cellulose, Polyurethane/Polyisocyanurate Foams (PUR/PIR), Polystyrene, Others), By Application (Roof, Wall, Floor and Basement, Ceiling and Attic, Acoustic Partition and HVAC Duct, Others), By End-User (Residential, Non-Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173044

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

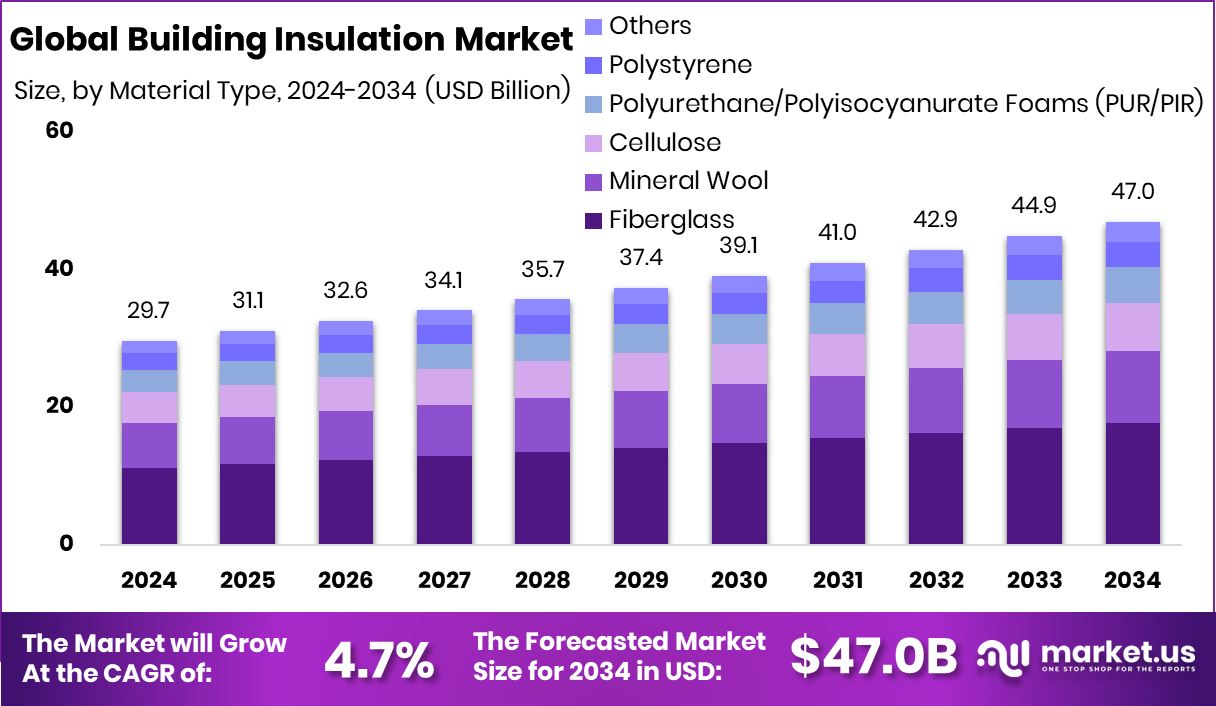

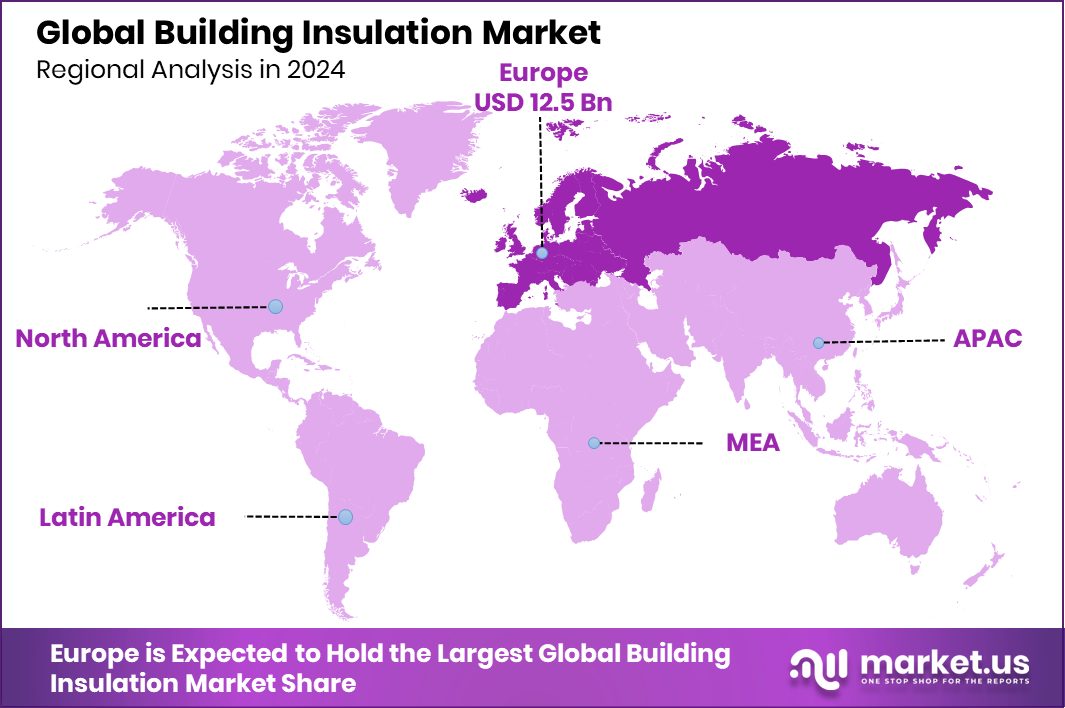

The Global Building Insulation Market is expected to be worth around USD 47.0 billion by 2034, up from USD 29.7 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034. The European Building Insulation Market achieved 42.30% share, supported by energy efficiency demand worth USD 12.5 Bn.

Building insulation refers to materials and systems installed in walls, roofs, floors, and ceilings to reduce heat transfer between indoor and outdoor environments. Its main purpose is to keep buildings warm in colder conditions and cool in warmer ones, improving comfort while lowering energy use. Effective insulation also helps control moisture, reduce noise, and protect building structures over time, making it a basic requirement in modern construction.

The Building Insulation Market includes the production, supply, and use of these insulation materials across residential, commercial, and industrial buildings. The market exists because buildings are among the largest consumers of energy worldwide. Insulation directly improves energy efficiency, reduces heating and cooling demand, and supports long-term cost savings for building owners and occupants.

One major growth factor is the shift toward sustainable and low-carbon construction. Funding such as the €20 M loan from the European Investment Bank to Aisti for bio-based tiles highlights how public finance is encouraging greener building materials that work alongside insulation systems. These efforts support wider adoption of environmentally friendly insulation solutions.

Demand for building insulation is rising as governments and homeowners focus on energy efficiency and resilience. The £300,000 secured by Wull Technologies to advance sustainable insulation technology reflects growing interest in innovative insulation that delivers better performance with lower environmental impact. Similarly, the $100 million capital raise by UT Financial Services supports large-scale commercial development, where insulation is essential for long-term operating efficiency.

The opportunity lies in new materials and circular construction approaches. The €2.6 M raised by Fiber Elements, including funding to scale sustainable basalt fiber manufacturing, shows how advanced fibers can improve structural and insulation performance together. Broader initiatives, such as Canada’s C$2 bn Critical Minerals Sovereign Fund and the U.S. DOE’s $20 million funding to improve recycling technologies, create future pathways for durable, recyclable insulation materials that align with next-generation construction needs.

Key Takeaways

- The Global Building Insulation Market is expected to be worth around USD 47.0 billion by 2034, up from USD 29.7 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- In the Building Insulation Market, fiberglass dominates material types with a 37.8% share globally.

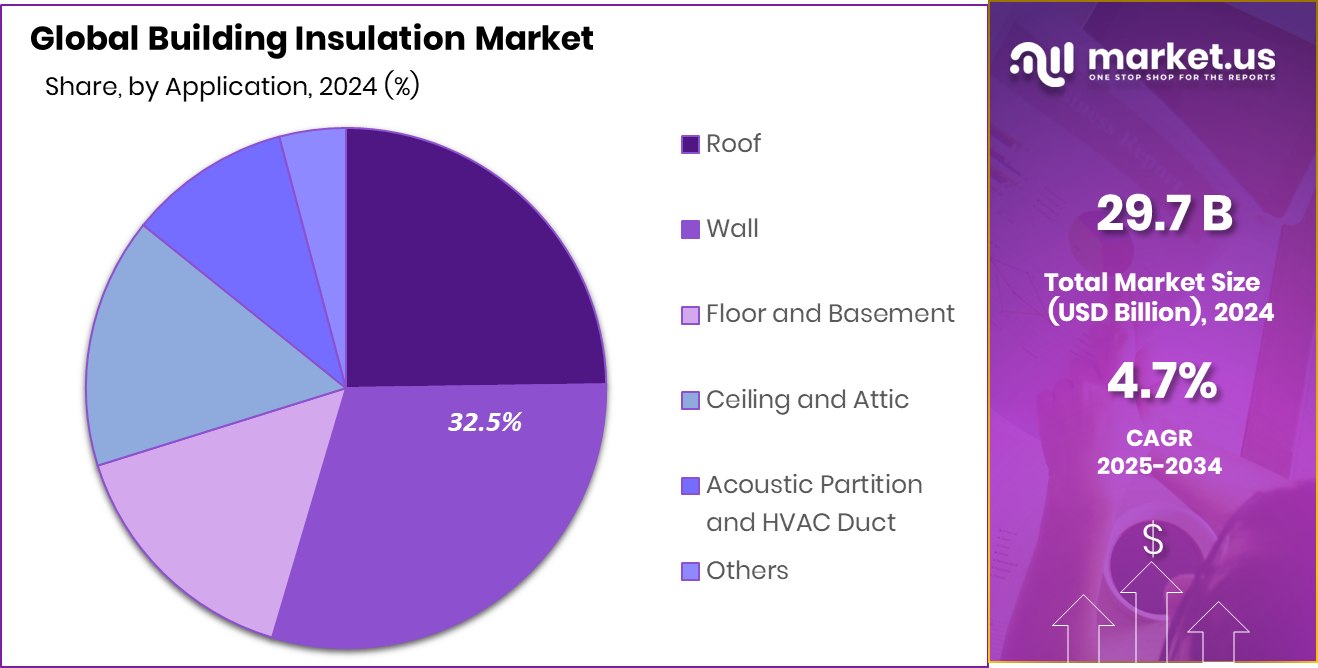

- Within the Building Insulation Market, wall applications lead demand, accounting for a 32.5% share.

- The Building Insulation Market sees residential end users leading consumption, holding a dominant 61.2%.

- Europe’s Building Insulation Market dominance at 42.30% reflects strong regulations and USD 12.5 Bn valuation.

By Material Type Analysis

Fiberglass dominates Building Insulation Market with 37.8% share due to affordability.

In 2024, the fiberglass segment held a 37.8% share of the Building Insulation Market, reflecting its strong position as a cost-effective and reliable insulation material. Fiberglass continues to be widely used because it delivers balanced thermal and acoustic performance while remaining lightweight and easy to install. Its non-combustible nature and resistance to moisture make it suitable for diverse climates and building codes.

Residential and light commercial builders prefer fiberglass due to its availability in batts, rolls, and loose-fill forms, which supports flexible installation across new construction and retrofit projects. Ongoing improvements in recycled glass content and low-binder formulations have also strengthened fiberglass adoption, aligning the material with sustainability goals and stricter indoor air-quality requirements in modern buildings.

By Application Analysis

Wall applications lead the Building Insulation Market, holding 32.5% driven by demand.

In 2024, the wall application segment accounted for 32.5% of the Building Insulation Market, making it one of the most critical areas for energy efficiency improvement. Walls are a primary pathway for heat loss and gain, especially in residential and mixed-use buildings, which drives consistent insulation demand. Builders increasingly focus on cavity wall insulation and external wall systems to meet tightening energy codes and reduce long-term heating and cooling costs.

Wall insulation also supports better indoor comfort by minimizing temperature fluctuations and external noise. The growing use of layered wall assemblies, combined with improved vapor barriers and air-sealing practices, has increased insulation thickness and performance requirements, reinforcing the importance of this application across both new construction and renovation activities.

By End-User Analysis

Residential end-users dominate the Building Insulation Market with 61.2% from housing growth.

In 2024, the residential end-user segment dominated the Building Insulation Market with a 61.2% share, supported by steady housing development and renovation activity. Rising energy prices and awareness of thermal comfort have encouraged homeowners to invest in better insulation solutions. Residential buildings, particularly single-family homes and low-rise apartments, rely heavily on insulation to achieve energy savings and meet local building efficiency standards.

Government incentives for energy-efficient homes and retrofitting programs have further boosted residential insulation demand. Additionally, urbanization and population growth continue to expand housing needs, especially in emerging regions. As homeowners prioritize lower utility bills and improved living conditions, residential insulation remains the strongest demand driver within the overall market.

Key Market Segments

By Material Type

- Fiberglass

- Mineral Wool

- Cellulose

- Polyurethane/Polyisocyanurate Foams (PUR/PIR)

- Polystyrene

- Others

By Application

- Roof

- Wall

- Floor and Basement

- Ceiling and Attic

- Acoustic Partition and HVAC Duct

- Others

By End-User

- Residential

- Non-Residential

Driving Factors

Shift Toward Plastic-Free, Bio-Based Building Materials

One major driving factor for the Building Insulation Market is the growing move away from plastic-based materials toward safer, bio-based alternatives. Buildings increasingly require insulation that avoids microplastics, improves indoor air quality, and meets environmental expectations. This shift is strongly supported by innovation funding. Bioweg landing $19 million in Series A funding shows rising confidence in bio-based materials that can replace microplastics in everyday applications, including construction-related products.

At the same time, Eden Materials uses farm waste to create affordable bioplastics highlights how agricultural by-products can reduce dependence on traditional plastics used around insulation systems. Adding to this momentum, Cellugy securing €8.1 million in EU funding supports scaling microplastic alternatives suitable for industrial use. Together, these developments push insulation markets toward cleaner materials, supporting long-term demand for sustainable, non-toxic, and regulation-ready insulation solutions across residential and commercial buildings.

Restraining Factors

High Costs And Slow Scaling Of Alternatives

One key restraining factor in the Building Insulation Market is the high cost and slow scaling of next-generation sustainable materials. While innovation is strong, many new solutions are still at an early stage and are not yet cost-competitive for large construction projects. Cellugy securing €4.9M seed funding to scale EcoFLEXY production shows that eco-friendly materials require significant investment before reaching commercial volumes.

Similarly, Flint raising $2M in seed funding for sustainable paper battery technology highlights how early-stage technologies often face long development timelines before market readiness. In addition, Denmark’s Cellugy receiving €8M in EU funding for fossil-free materials confirms that public support is essential, but scaling remains gradual. Until production costs fall and supply becomes stable, builders may delay adoption, limiting the faster growth of advanced insulation materials.

Growth Opportunity

Scaling Bio-Based Materials For Next-Generation Insulation

A major growth opportunity in the Building Insulation Market lies in scaling bio-based and cellulose-driven materials that reduce plastic use and improve sustainability. Rubi securing a $1 million SBIR Phase II grant highlights government-backed support for advancing clean material technologies from research to real-world applications, opening pathways for insulation innovation.

At the same time, BIOWEG raising €16 million to scale biotech solutions targeting microplastic pollution shows strong investor confidence in alternatives that can be integrated into construction materials, including insulation components.

Adding to this momentum, Ukrainian start-up Releaf Paper receiving €2.5 million in EU funding to build a pilot line for cellulose extraction, creates opportunities for using plant-based fibers in insulation systems. Together, these developments support affordable, scalable, and low-impact insulation materials, expanding future market potential across residential and commercial construction.

Latest Trends

Recycling And Bio-Replacement Of Foam Insulation

One of the latest trends in the Building Insulation Market is the rapid shift toward recycling existing foam materials and replacing them with natural alternatives. Polystyvert securing $16M for polystyrene recycling shows a growing focus on recovering insulation-grade plastics instead of sending them to landfills. At the same time, innovation is moving beyond recycling.

Mushroom Material’s $8.5m raise, along with another fungi-based styrofoam start-up securing $8.5m, highlights how mycelium materials are being developed to directly replace traditional foam insulation.

Adding scale to this trend, TemperPack is closing a $22.5m Series B, which reflects rising confidence in sustainable foam alternatives that can be produced at commercial volumes. Together, these developments signal a clear move toward circular and bio-based insulation solutions that reduce waste, emissions, and long-term environmental impact.

Regional Analysis

In 2024, Europe led the Building Insulation Market with 42.30% share, reaching USD 12.5 Bn.

In 2024, Europe emerged as the dominating region in the Building Insulation Market, holding a leading 42.30% share and reaching a total value of USD 12.5 Bn. This strong position reflects the region’s long-standing focus on energy efficiency, strict building performance standards, and widespread adoption of thermal insulation across both new construction and renovation activities.

Europe’s market leadership is reinforced by high insulation penetration in residential and commercial buildings, driven by the need to reduce heat loss and improve indoor comfort. North America represents a mature and stable market, supported by consistent demand from residential housing upgrades and commercial construction, where insulation is viewed as a core component of energy-efficient building design.

Asia Pacific continues to show steady expansion, fueled by urban growth, rising construction activity, and increasing awareness of thermal comfort in densely populated areas. The Middle East & Africa market is shaped by climate-driven insulation needs, particularly for temperature control in extreme conditions, while Latin America demonstrates gradual adoption as building standards improve and construction activity stabilizes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Aspen Aerogels Inc. stands out for its focus on high-performance insulation solutions designed for space-constrained and high-efficiency building applications. The company’s aerogel-based materials address demanding thermal requirements where traditional insulation struggles, making them relevant for premium residential, commercial, and industrial buildings. Aspen’s strength lies in material science expertise and its ability to deliver thin yet highly effective insulation, aligning well with modern building designs that prioritize energy efficiency without sacrificing usable space.

Atlas Roofing Corporation plays a critical role in the Building Insulation Market through its integrated approach to roofing systems and insulation products. The company benefits from strong positioning in building envelopes, where insulation performance directly impacts roof durability and indoor energy control. Atlas Roofing’s product portfolio supports both new construction and renovation projects, giving it resilience across construction cycles. Its focus on system compatibility and installation efficiency enhances its appeal among contractors and builders.

BASF SE brings scale, chemistry expertise, and innovation depth to the insulation landscape. BASF’s insulation solutions benefit from advanced polymer science and long-standing relationships with the construction sector. The company’s strength lies in developing materials that balance thermal performance, durability, and regulatory compliance, reinforcing its influence across global building insulation value chains in 2024.

Top Key Players in the Market

- Aspen Aerogels Inc.

- Atlas Roofing Corporation

- BASF SE

- Beijing New Building Materials Public Limited Company

- Cellofoam North America Inc.

- Covestro AG

- Dow

- DuPont

- GAF Materials LLC

- Holcim

Recent Developments

- In September 2025, Dow partnered with Gruppo Fiori to create a new process for recycling polyurethane foam from end-of-life vehicles without disassembly. While focused on automotive PU, this development supports Dow’s broader Renuva™ sustainability platform, which aims to recycle and reuse polyols and other raw materials used in insulation foams, reinforcing Dow’s circular strategy for materials, including those used in building insulation.

- In March 2024, BNBM released its Annual Report for 2023, outlining its business strategy and performance. The report highlights the company’s ongoing focus on expanding its building materials portfolio, which includes thermal insulation materials used in construction.

Report Scope

Report Features Description Market Value (2024) USD 29.7 Billion Forecast Revenue (2034) USD 47.0 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Fiberglass, Mineral Wool, Cellulose, Polyurethane/Polyisocyanurate Foams (PUR/PIR), Polystyrene, Others), By Application (Roof, Wall, Floor and Basement, Ceiling and Attic, Acoustic Partition and HVAC Duct, Others), By End-User (Residential, Non-Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aspen Aerogels Inc., Atlas Roofing Corporation, BASF SE, Beijing New Building Materials Public Limited Company, Cellofoam North America Inc., Covestro AG, Dow, DuPont, GAF Materials LLC, Holcim Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Building Insulation MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Building Insulation MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Aspen Aerogels Inc.

- Atlas Roofing Corporation

- BASF SE

- Beijing New Building Materials Public Limited Company

- Cellofoam North America Inc.

- Covestro AG

- Dow

- DuPont

- GAF Materials LLC

- Holcim