Blood Lancet Market By Product Type (Safety Lancets and Standard Lancets), By Application (Blood Glucose Testing, Hemoglobin Testing, Cholesterol Testing, Coagulation Testing, Infectious Disease Testing, and Others), By End-use (Hospitals & Clinics, Homecare Settings, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133041

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

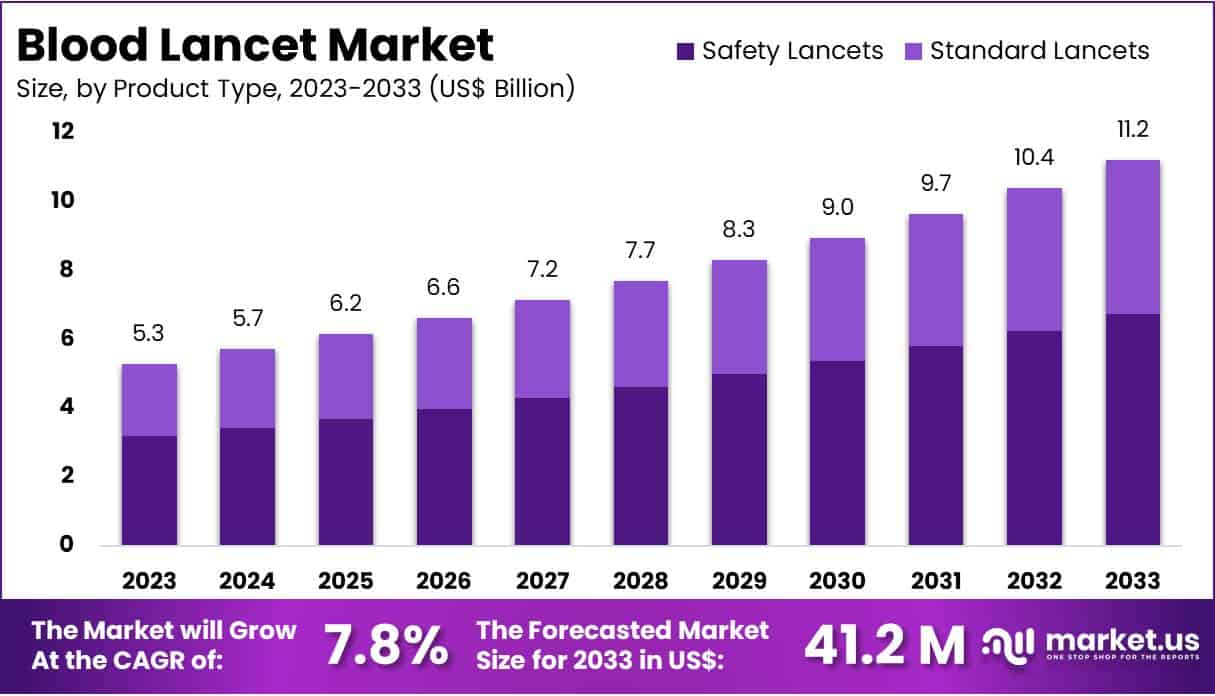

The Global Blood Lancet Market size is expected to be worth around US$ 11.2 Billion by 2033, from US$ 5.3 Billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2024 to 2033.

Growing prevalence of diabetes and other chronic conditions requiring regular blood monitoring drives the blood lancet market, as patients and healthcare providers seek reliable tools for safe and efficient blood sampling. Blood lancets play a crucial role in glucose monitoring, coagulation tests, and other diagnostic procedures, offering minimal discomfort and precision in capillary blood collection.

According to the CDC, over 34 million Americans, or nearly 11% of the U.S. population, had diabetes in 2020, with 1.5 million new cases diagnosed annually, highlighting the demand for self-monitoring solutions like lancets. Additionally, healthcare settings face an average of 385,000 needlestick injuries annually, underscoring the importance of safety-engineered lancets that reduce the risk of accidental injuries.

Recent trends in the market include the development of customizable, single-use lancets with adjustable penetration depths, improving patient comfort and ensuring optimal blood sample quality. Opportunities also emerge from the increasing adoption of lancets in home-based diagnostics and telemedicine, supporting remote patient care and chronic disease management. The market continues to benefit from advancements in materials and ergonomic designs, catering to diverse patient needs and enhancing usability.

Key Takeaways

- In 2023, the market for blood lancet generated a revenue of US$ 5.3 billion, with a CAGR of 7.8%, and is expected to reach US$ 11.2 billion by the year 2033.

- The product type segment is divided into safety lancets and standard lancets, with safety lancets taking the lead in 2023 with a market share of 62.5%.

- Considering application, the market is divided into blood glucose testing, hemoglobin testing, cholesterol testing, coagulation testing, infectious disease testing, and others. Among these, blood glucose testing held a significant share of 38.4%.

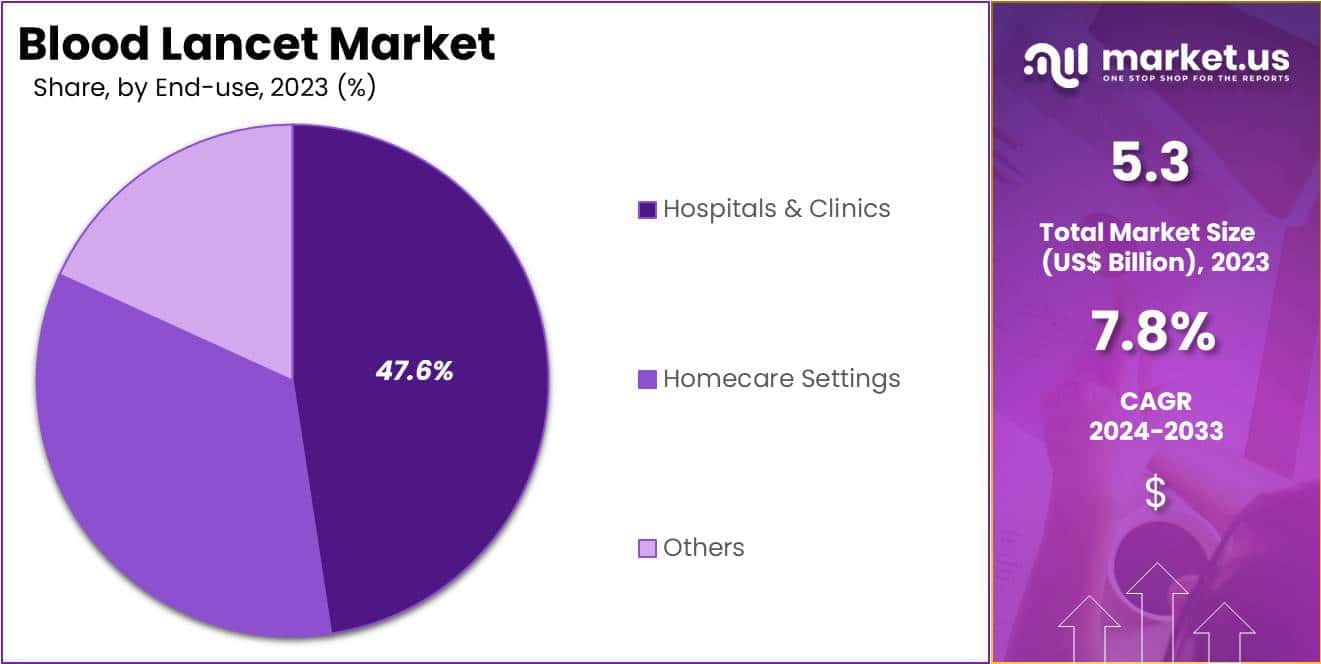

- Furthermore, concerning the end-use segment, the market is segregated into hospitals & clinics, homecare settings, and others. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 47.6% in the blood lancet market.

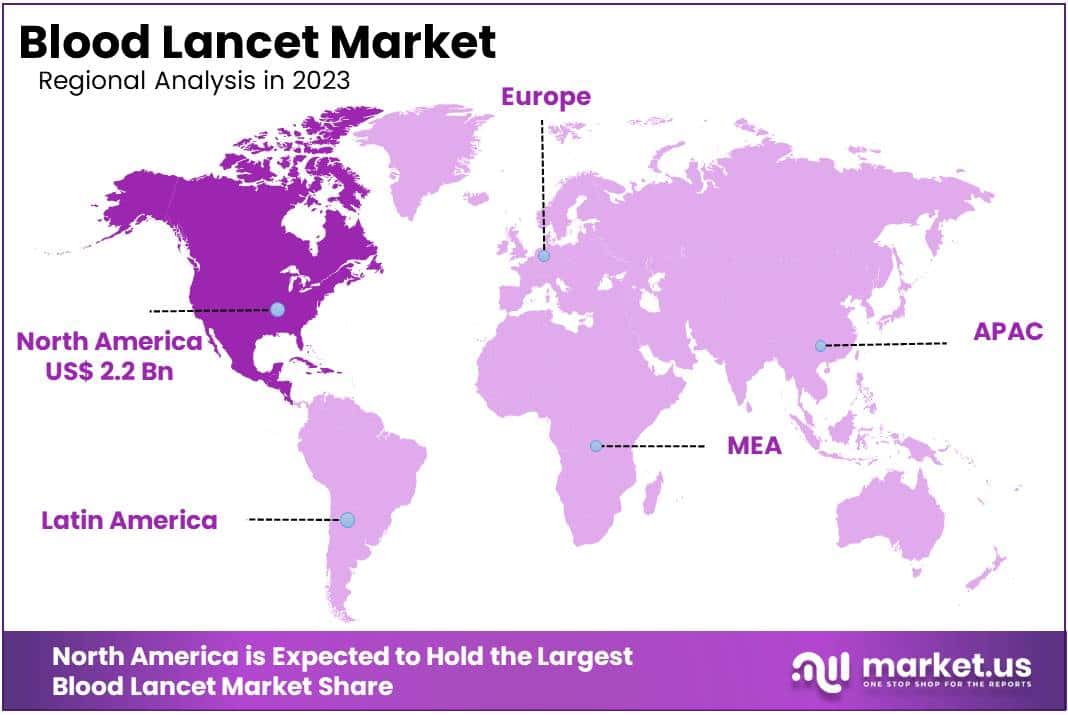

- North America led the market by securing a market share of 41.3% in 2023.

Product Type Analysis

The safety lancets segment led in 2023, claiming a market share of 62.5% owing to the increasing focus on patient safety and the need to reduce the risk of accidental needle-stick injuries. Safety lancets, equipped with retractable mechanisms, provide a safer alternative by preventing reuse and ensuring precise blood collection.

The demand for these lancets has risen due to stringent regulatory guidelines and growing awareness about infection control in healthcare settings. Additionally, their ease of use and minimal pain during sampling make them popular in both professional and homecare environments.

The rising prevalence of chronic diseases such as diabetes further boosts demand for frequent and safe blood sampling. As healthcare providers prioritize patient safety, the safety lancets segment is expected to expand steadily in the blood lancet market.

Application Analysis

The blood glucose testing held a significant share of 38.4% due to the rising global prevalence of diabetes, which necessitates frequent blood glucose monitoring. Patients with diabetes rely heavily on blood glucose testing to manage their condition, increasing the demand for accurate and convenient blood sampling tools like lancets.

Healthcare providers recommend regular monitoring to prevent complications, further supporting the growth of this segment. Technological advancements in glucometers, which require minimal blood samples, enhance the usability of lancets for glucose testing.

Additionally, public health initiatives promoting diabetes awareness and self-monitoring contribute to the segment’s expansion. With the growing emphasis on preventive healthcare, the blood glucose testing segment is anticipated to experience robust growth.

End-use Analysis

The hospitals and clinics segment exhibited a significant growth rate, capturing a revenue share of 47.6%. This growth is attributed to the extensive range of diagnostic procedures conducted within these facilities. Blood lancets, crucial for various tests, see heightened demand due to the comprehensive care provided, covering both routine and specialized blood tests. This segment benefits from the structured environment where these devices are employed.

In hospitals and clinics, the presence of trained professionals ensures that blood lancets are used correctly, thereby enhancing the accuracy of test results. Accurate testing is critical in diagnosing and managing conditions, ensuring patient care remains at a high standard. The professional handling of these devices contributes to reliable diagnostics, reinforcing the segment’s growth.

The rising prevalence of chronic and infectious diseases necessitates frequent blood testing, which in turn supports the sustained demand for blood lancets in hospitals and clinics. As healthcare infrastructure continues to expand, especially in emerging markets, the reliance on effective and safe blood sampling devices is expected to persist. This expansion underscores the ongoing dominance of the hospitals and clinics segment in the blood lancet market.

Key Market Segments

By Product Type

- Safety Lancets

- Standard Lancets

By Application

- Blood Glucose Testing

- Hemoglobin Testing

- Cholesterol Testing

- Coagulation Testing

- Infectious Disease Testing

- Others

By End-use

- Hospitals and Clinics

- Homecare Settings

- Others

Drivers

Growing Prevalence of Diabetes

The increasing prevalence of diabetes significantly drives the demand for blood lancets as regular blood glucose monitoring becomes essential for disease management. According to the International Diabetes Federation (IDF) Diabetes Atlas, around 537 million people aged 20-79 had diabetes in 2021.

This number is anticipated to rise to 643 million by 2030 and 783 million by 2045, with over 75% of these individuals residing in low- and middle-income countries. Diabetes remains a leading cause of death, accounting for 6.7 million fatalities in 2021, equivalent to one death every five seconds. As more individuals are diagnosed with diabetes, the need for convenient and accurate blood glucose testing tools, including lancets, grows.

Blood lancets enable painless and efficient self-monitoring, improving patient compliance and aiding in better glycemic control. The rising diabetes burden globally underlines the critical role of lancets in disease management, especially as healthcare systems prioritize preventive and home-based care solutions.

Restraints

Rising Risk of Infection

The risk of infection associated with improper use or reuse of blood lancets significantly hampers the market, particularly in resource-limited settings. Inadequate sterilization or sharing of lancets increases the likelihood of transmitting bloodborne pathogens, including hepatitis B, hepatitis C, and HIV. This concern raises alarm among healthcare professionals and regulatory bodies, prompting stricter usage guidelines.

However, in regions with limited healthcare infrastructure or poor awareness, adherence to safe practices remains a challenge. The fear of infection discourages some individuals from performing routine blood tests, impacting the demand for lancets. Rising infection risks are anticipated to impede the market by emphasizing the need for safer alternatives or enhanced education about proper usage. Addressing these concerns through single-use lancets and educational campaigns will be critical for ensuring the sustained adoption of these devices.

Opportunities

High Risk of Needlestick Injuries

The high risk of needlestick injuries presents a significant opportunity for innovation and growth in the blood lancet market. According to the American Medical Association, approximately 600,000 to 800,000 needlestick injuries occur annually in the United States, putting 5.6 million healthcare workers at risk of exposure to bloodborne pathogens. This occupational hazard drives demand for safer lancet designs that minimize the risk of accidental injuries.

Manufacturers are developing advanced lancets with retractable needles and safety locks to address this critical issue. Rising awareness of workplace safety and stricter regulatory requirements further boost the adoption of safety-engineered lancets. These innovations improve user confidence and promote widespread usage in both clinical and home settings. The focus on reducing needlestick injuries aligns with broader efforts to enhance occupational safety, creating growth opportunities for the lancet market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the blood lancet market. Economic growth in developed regions increases healthcare spending, boosting demand for diagnostic tools like blood lancets. Conversely, economic instability and inflation in emerging markets limit healthcare budgets, reducing access to essential medical devices.

Geopolitical tensions and trade restrictions disrupt global supply chains, causing shortages and increased costs of raw materials necessary for lancet production. Additionally, varying regulatory environments across regions pose compliance challenges, affecting market entry and product availability.

However, rising prevalence of chronic diseases such as diabetes drives consistent demand for blood lancets. Supportive government initiatives and expanding healthcare infrastructure in developing countries present opportunities for market growth, encouraging innovation and investment in this sector.

Trends

Impact of Rising Innovation on the Blood Lancet Market

Rising innovation is anticipated to drive growth in the blood lancet market. In July 2021, BD announced a significant advancement in patient care with its “One-Stick Hospital Stay” initiative, building on its history of innovation in blood collection and vascular access solutions. This approach aims to reduce the number of needlesticks patients experience during hospital stays, enhancing comfort and safety.

High demand for minimally invasive and user-friendly devices has led manufacturers to develop lancets with features like adjustable depth settings and improved safety mechanisms. Growing adoption of home-based diagnostic testing further propels innovation, as consumers seek convenient and painless blood sampling methods. Companies investing in research and development to create advanced lancet designs are likely to gain a competitive edge.

As technological advancements continue, the blood lancet market is expected to experience sustained growth, offering improved solutions for both healthcare providers and patients.

Regional Analysis

North America is leading the Blood Lancet Market

North America dominated the market with the highest revenue share of 41.3% owing to the increasing prevalence of diabetes and the expanding elderly population. The U.S. Census Bureau reported that the population aged 65 and over reached 55.8 million in 2020, accounting for 16.8% of the total population, marking a 38.6% increase from 2010.

This demographic shift has led to a higher incidence of chronic conditions like diabetes, necessitating regular blood glucose monitoring and, consequently, a greater demand for blood lancets. Advancements in lancet technology, focusing on minimizing pain and enhancing user convenience, have further propelled market growth.

Additionally, the rise of home-based healthcare and self-monitoring practices has increased the adoption of lancets among patients managing chronic diseases. Healthcare providers’ emphasis on preventive care and early diagnosis has also contributed to the sustained demand for blood lancets in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the rising prevalence of diabetes and increased healthcare awareness. In March 2023, Astellas Pharma entered into an agreement with Roche Diabetes Care Japan to develop and commercialize the Accu-Chek Guide Me blood glucose monitoring system combined with BlueStar, an FDA-cleared digital health solution for diabetes patients.

This collaboration aims to enhance diabetes management, thereby increasing the demand for blood lancets. Rapid urbanization, changing lifestyles, and dietary habits have contributed to a surge in diabetes cases, necessitating regular blood glucose monitoring.

Government initiatives focusing on improving healthcare infrastructure and access, along with growing health consciousness among the population, are anticipated to further drive the adoption of blood lancets. The expansion of e-commerce platforms and the availability of cost-effective lancet options are also expected to contribute to market growth in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The blood lancet market is witnessing significant advancements driven by key players focusing on product innovation. These companies are dedicated to improving patient comfort through the development of safety and ultra-thin lancets, which ensure precise blood sampling. Their efforts are concentrated on enhancing the design features to meet the specific requirements of various user groups, including pediatric and diabetic patients.

To broaden their market reach, these players are investing heavily in research and development. This strategic investment enables them to tailor products to specific medical needs, enhancing their offerings for targeted populations. Additionally, partnerships with healthcare facilities and retail pharmacies are being forged to expand distribution channels, ensuring that innovative lancets are accessible to a wider audience.

The expansion into emerging markets is a strategic move by industry leaders, driven by the increasing access to healthcare in these regions. This expansion is supported by educational campaigns targeted at healthcare professionals and patients. These initiatives are crucial for raising awareness about the benefits of new lancet technologies and driving product adoption. As a result, these companies are not only enhancing their competitive edge but are also playing a pivotal role in improving diagnostic tools globally.

Top Key Players in the Blood Lancet Market

- Terumo Medical Corporation

- Roche Diagnostics

- Owen Mumford

- MTD Medical Technology and Devices

- Medline Industries

- Greiner Bio-One

- EQT AB

- Braun SE

- Astellas Pharma Inc.

Recent Developments

- In March 2023: Astellas Pharma Inc. formed strategic partnership with Roche Diabetes Care Japan to make and sell the Accu-Chek Guide Me system for monitoring blood glucose, which combines high accuracy with BlueStar*1 technology. This collaboration emphasizes the growing demand for accurate and user-friendly blood sampling devices, indirectly boosting the blood lancet market as an integral component of blood glucose monitoring.

- In June 2021: Greiner Bio-One introduced the MiniCollect PIXIE Heel Incision Safety Lancet. This new product is specifically designed for heel incisions in neonatal and pediatric care. Its launch addresses the crucial need for safe and efficient blood collection. By focusing on this specialized area, Greiner Bio-One contributes to the expansion of the blood lancet market. This development is significant for healthcare providers requiring reliable tools for sensitive procedures.

Report Scope

Report Features Description Market Value (2023) US$ 5.3 billion Forecast Revenue (2033) US$ 11.2 billion CAGR (2024-2033) 7.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Safety Lancets and Standard Lancets), By Application (Blood Glucose Testing, Hemoglobin Testing, Cholesterol Testing, Coagulation Testing, Infectious Disease Testing, and Others), By End-use (Hospitals & Clinics, Homecare Settings, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Terumo Medical Corporation, Roche Diagnostics, Owen Mumford, MTD Medical Technology and Devices, Medline Industries, Greiner Bio-One , EQT AB, B. Braun SE, and Astellas Pharma Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Terumo Medical Corporation

- Roche Diagnostics

- Owen Mumford

- MTD Medical Technology and Devices

- Medline Industries

- Greiner Bio-One

- EQT AB

- Braun SE

- Astellas Pharma Inc.