Global Blackcurrant Seed Oil Market Size, Share, And Business Benefits By Type (Conventional, Organic), By Form (Liquid, Gel Capsules), By Application (Cosmetics and Personal Care, Food and Beverages, Pharmaceuticals, Others), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 156844

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

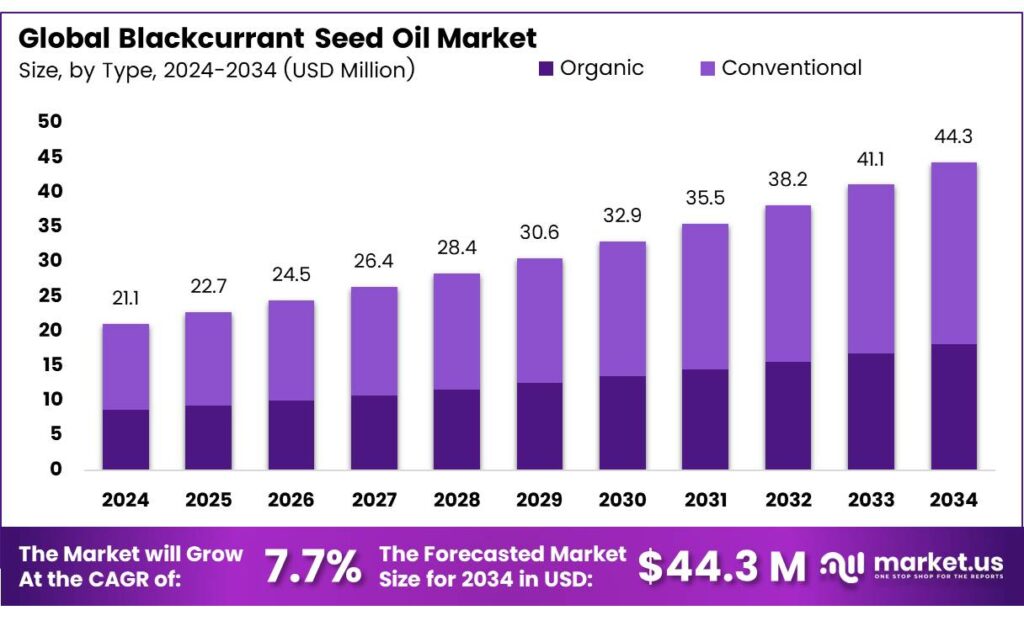

The Global Blackcurrant Seed Oil Market size is expected to be worth around USD 44.3 Million by 2034, from USD 21.1 Million in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034.

Black currant seed oil, extracted from Ribes nigrum seeds, has been cherished in Europe and Asia for centuries due to its diverse health benefits. Rich in essential fatty acids like gamma-linolenic acid (GLA) and alpha-linolenic acid (ALA), this potent oil is a valuable natural remedy. Here’s how to integrate it into your daily routine for health and cosmetic benefits. Black currant seed oil is an excellent source of GLA, a key omega-6 fatty acid known for its lipid-modifying properties and support for healthy inflammatory pathways.

Several reports have indicated that γ-linolenic acid has anti-inflammatory and immunomodulating effects. γ-Linolenic acid is present in small amounts in the oils commonly used in Western diets but is found in high concentrations in certain other plant oils such as borage oil (23%), BCSO (18%), and evening primrose oil (9%). It can also be generated in the body through the desaturation of linoleic acid (18:2n−6) by the action of the rate-limiting enzyme linoleoyl-CoA desaturase.

Blackcurrant seed oil (BCSO) and soybean oil (SBO) capsules share a similar base structure, each containing 750 mg of oil per capsule. However, slight variations exist in their excipient composition. BCSO capsules contain 195 mg of gelatin, 71 mg of glycerol, and 34 mg of water, whereas SBO capsules include 210 mg of gelatin, 77 mg of glycerol, and 33 mg of water. These minor differences contribute to capsule stability and texture.

The fatty acid composition reveals a striking contrast between the two oils. In BCSO, palmitic acid (16:0) accounts for 6.2% (279 mg), while SBO has a higher proportion at 9.8% (441 mg). Similarly, stearic acid (18:0) is lower in BCSO at 1.6% (72 mg) compared to 3.9% (176 mg) in SBO. BCSO contains 12.7% (572 mg) oleic acid (18:1n-9), which is less than SBO’s 26.2% (1179 mg). The blackcurrant seed oil market is well-positioned for long-term growth, supported by rising health awareness, consumer preference for natural products, and expanding industrial applications.

Key Takeaways

- The Global Blackcurrant Seed Oil Market is expected to reach USD 44.3 Million by 2034 from USD 21.1 Million in 2024, with a CAGR of 7.7%.

- The Conventional segment led in 2024, holding a 59.3% market share due to availability and lower costs.

- Liquid form dominated in 2024 with a 68.5% share, favored for its versatility in supplements and skincare.

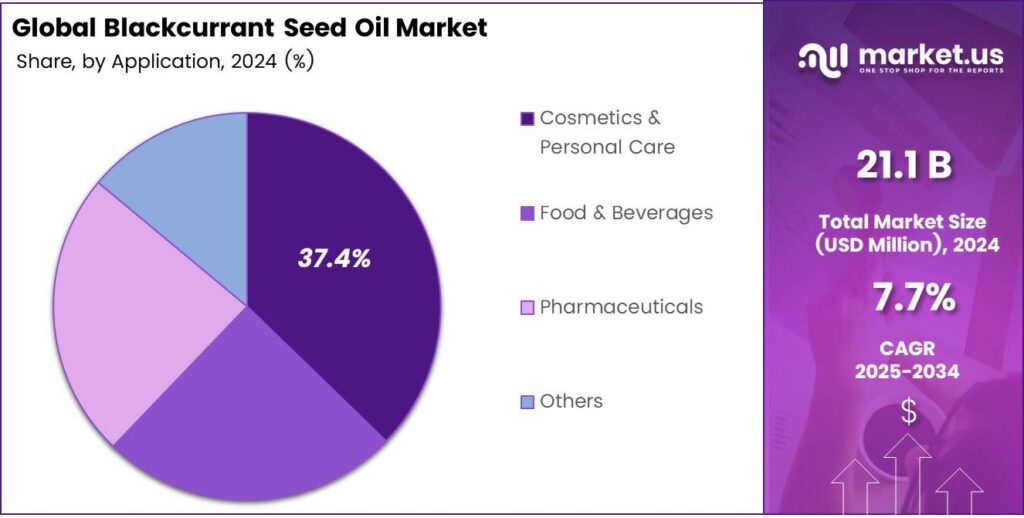

- The Cosmetics and Personal Care sector captured 37.4% of the market in 2024, driven by oil’s skin benefits.

- Offline channels held a 72.6% share in 2024, preferred for trust and product verification.

- North America led with a 37.5% share in 2024, generating USD 7.9 million in revenue.

Analyst Viewpoint

The Blackcurrant Seed Oil Market is gaining traction as a promising investment due to rising consumer demand for natural, health-focused products. Its rich content of gamma-linolenic acid (GLA) and alpha-linolenic acid (ALA) makes it a sought-after ingredient in cosmetics, nutraceuticals, and functional foods, appealing to health-conscious millennials and Gen Z.

Consumers are increasingly drawn to blackcurrant seed oil for its anti-inflammatory and antioxidant properties, particularly in skincare for conditions like eczema and in supplements for joint and heart health. Social media influencers and wellness trends are amplifying demand, especially among younger demographics prioritizing clean-label and plant-based products.

The regulatory landscape for blackcurrant seed oil is stringent, particularly in cosmetics and food applications. In Europe, compliance with EU cosmetic safety standards demands rigorous testing, which can raise costs but ensures consumer trust. In the U.S., the FDA’s GRAS status for blackcurrant seed oil facilitates its use in supplements, but labeling and health claim regulations remain strict.

By Type

Conventional Segment Leading with 59.3% Share

In 2024, Conventional held a dominant market position, capturing more than a 59.3% share of the global blackcurrant seed oil market. The segment’s strength is largely driven by its wide availability, lower production cost, and established consumer trust.

Conventional blackcurrant seed oil is commonly used in dietary supplements, cosmetics, and functional foods, as it provides gamma-linolenic acid (GLA), omega-3, and omega-6 fatty acids, which support skin health and immune function. Consumers seeking affordable options continue to favor conventional varieties over premium-priced organic alternatives.

The demand for conventional blackcurrant seed oil is expected to remain steady, as manufacturers scale up production to cater to the food and personal care industries. The segment benefits from long-standing supply chains, particularly across Europe and Asia-Pacific, where blackcurrant cultivation is widespread.

By Form

Liquid Form Leading with 68.5% Share

In 2024, Liquid held a dominant market position, capturing more than a 68.5% share in the blackcurrant seed oil market. The preference for liquid form is linked to its versatility and ease of use across dietary supplements, skincare formulations, and aromatherapy.

Consumers and manufacturers alike value the liquid format because it preserves the natural profile of fatty acids such as omega-3, omega-6, and gamma-linolenic acid, making it suitable for both direct consumption and blending into finished products. The liquid form is also favored in the cosmetic industry, where it is directly added to creams, serums, and oils to improve skin hydration and elasticity.

The liquid segment is expected to see continued adoption, particularly as health-conscious consumers seek natural oils for everyday wellness routines. Its adaptability in both household and industrial applications strengthens its role as the primary delivery form in the market.

By Application

Cosmetics and Personal Care Leading with 37.4% Share

In 2024, Cosmetics and Personal Care held a dominant market position, capturing more than a 37.4% share of the blackcurrant seed oil market. This strong presence is driven by the oil’s rich composition of omega fatty acids and antioxidants, which are widely recognized for improving skin elasticity, reducing inflammation, and promoting a youthful appearance.

Skincare brands increasingly incorporate blackcurrant seed oil into facial serums, moisturizers, and hair care products, responding to rising consumer demand for natural and plant-based beauty solutions. The oil’s ability to soothe sensitive skin and support hydration has made it a preferred ingredient in premium cosmetic formulations.

The cosmetics and personal care segment is expected to strengthen further as clean beauty trends and consumer awareness around natural ingredients continue to grow. With the global shift toward eco-friendly and sustainable products, blackcurrant seed oil stands out as a high-value ingredient aligned with these preferences.

By Distribution Channel

Offline Distribution Leading with 72.6% Share

In 2024, Offline held a dominant market position, capturing more than a 72.6% share of the blackcurrant seed oil market. Pharmacies, health stores, supermarkets, and specialty retailers continue to be the preferred purchasing points for consumers, as they provide trust, product verification, and the opportunity to physically examine items before buying.

Many consumers, especially in developing markets, still rely on offline channels for wellness and beauty products, valuing face-to-face interactions and immediate product availability. The segment benefits from established retail networks and strong brand visibility through in-store promotions and shelf presence.

The offline channel is expected to maintain its lead, supported by growing consumer awareness of natural oils and supplements. While online channels are expanding, offline outlets remain crucial for premium oils like blackcurrant seed oil, as buyers often seek expert advice from pharmacists or store consultants before making a purchase.

Key Market Segments

By Type

- Conventional

- Organic

By Form

- Liquid

- Gel Capsules

By Application

- Cosmetics and Personal Care

- Food and Beverages

- Pharmaceuticals

- Others

By Distribution Channel

- Online

- Offline

Drivers

A key health-boosting component: Gamma-Linolenic Acid (GLA) in Blackcurrant Seed Oil

One major driving force behind the growing attention to blackcurrant seed oil is its notably high gamma‑linolenic acid (GLA) content, an essential omega‑6 fatty acid revered for its gentle role in supporting inflammation balance and skin health. GLA isn’t your everyday fatty acid. It’s special because our bodies can convert linoleic acid into GLA, but this process becomes less efficient with aging or under stress.

That’s why getting GLA directly from foods like blackcurrant seed oil is helpful; it bypasses that bottleneck. Blackcurrant seed oil shines because of its high GLA content, ranging between 15–20% of its fatty acid makeup. This isn’t a random stat; it’s from credible biochemical literature such as the Gamma‑Linolenic Acid monograph and detailed oil composition studies.

Restraints

Capsules Too Large and High Daily Intake

When people try to take blackcurrant seed oil for health (like easing joint stiffness), a big hurdle can be how much they have to swallow. In a clinical study, folks were asked to take 10.5 grams of this oil per day. That translated to a staggering 15 capsules a day, and many simply couldn’t keep up.

In fact, only 50% of participants stayed through the whole 24‑week study. Two main reasons stood out: the sheer number and size of the capsules, and people feeling it wasn’t helping enough to justify the effort. Imagine needing to swallow dozens of capsules every day just to keep going.

For most of us, that’s more than inconvenient—it’s discouraging. For people already juggling health issues, losing motivation halfway isn’t surprising. This dosage inconvenience turns a potentially helpful oil into something a lot of folks drop out of, even before noticing any benefit.

Opportunity

Rising Popularity in Natural Skincare and Dietary Wellness

This rising demand isn’t just about numbers; it’s about what we value. When sunlight dries our skin, or inflammation whispers discomfort in our joints, it’s comforting to seek out that purple-hued seed that packs anti‑inflammatory omega fatty acids and antioxidants. People aren’t just buying products; they’re hoping for healing, a little glow, a sense of calm.

That human desire for wellness is giving the market real momentum. While we don’t have a government program focused solely on blackcurrant seed oil (it’s still a niche crop), broader initiatives supporting natural, sustainable oils and healthier food systems are indirectly helping. For example, as more governments promote plant-based wellness and skincare safety, products like BCSO come into greater focus.

Trends

The Rise of Sustainable and High-Purity Blackcurrant Seed Oil

Imagine someone who cares about what they put on their skin and into their body, someone who reads labels, values clean ingredients, and worries about the planet. That desire for pure, ethical, and traceable nature is shaping the future of blackcurrant seed oil. Lately, consumers have become more selective, not just looking for natural ingredients, but for ones grown kindly and processed transparently.

Government and trusted organizations are also nudging this shift. While there isn’t a specific program targeting blackcurrant seed oil, broader agricultural and sustainability policies help. In various countries, USDA and EU initiatives promote organic farming, sustainable agriculture, and traceability in supply chains, all of which benefit specialty oils like blackcurrant seed. This creates a foundation for producers to adopt better practices and for consumers to trust what’s on the label.

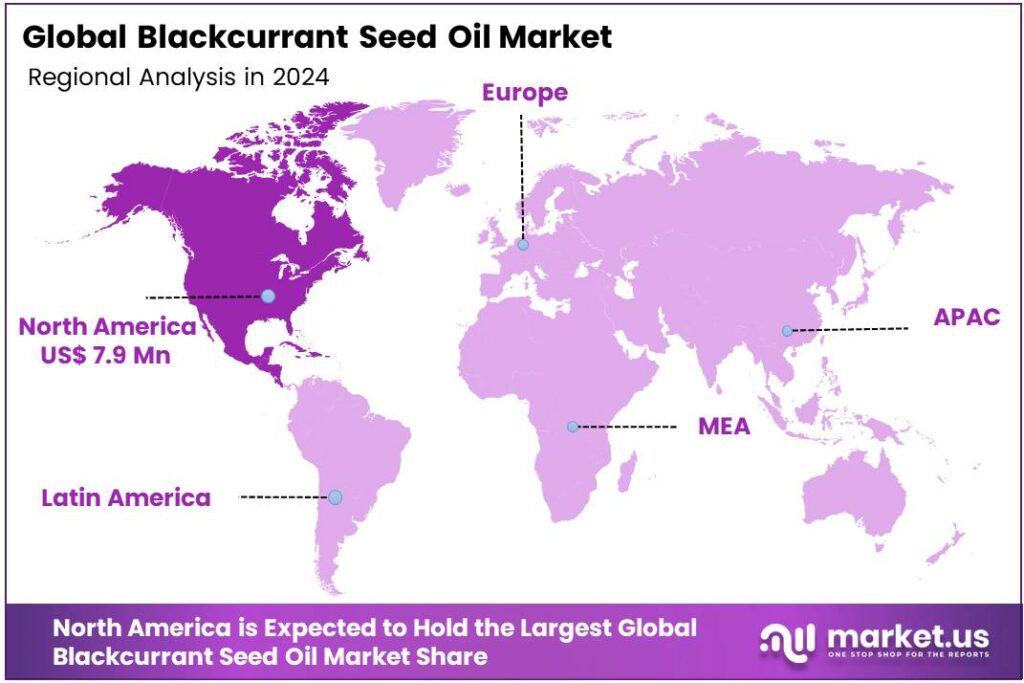

Regional Analysis

North America Dominates with 37.5%, USD 7.9 Million Market Share

North America stands out as the dominant region in the global Blackcurrant Seed Oil market, commanding an impressive 37.5% share and accounting for approximately USD 7.9 million in revenue. This strong leadership reflects the region’s established industries in supplements and cosmetics, where demand for omega-rich, natural oils continues to rise steadily.

Driving this regional prominence is North America’s growing consumer preference for therapeutic and sustainable wellness solutions. Blackcurrant seed oil, known for its high gamma-linolenic acid (GLA) and omega-3 and omega-6 content, is increasingly embraced in skincare, dietary supplements, and nutraceutical applications.

The prevalence of well-developed distribution networks, combined with robust awareness of plant-based health ingredients, supports this market strength. Complementing this, the broader North American wellness sector is characterized by a sophisticated regulatory environment, premium product positioning, and higher consumer spending power, all catalyzing the adoption of such oils

Other regions, such as Europe and the Asia-Pacific, are emerging but have yet to rival North America’s volume and value. Europe, while also a major contributor due to its strong manufacturing base and consumer interest in natural personal care products, typically trails behind North America in terms of market share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Connoils LLC specializes in high-quality, organic oils. A key player in blackcurrant seed oil, they focus on purity and efficacy, supplying bulk ingredients to the nutraceutical, cosmetic, and food industries. Their competitive edge lies in rigorous quality control, cold-press extraction, and a strong B2B distribution network, catering to clients seeking premium, bioactive-rich oils for functional applications.

- NOW FOODS offers blackcurrant seed oil primarily in softgel form, targeting retail consumers. Leveraging its vast distribution and trusted brand reputation, it makes this niche oil accessible for its nutritional benefits, particularly GLA content. Their strength is in marketing affordable, quality-tested supplements directly to health-conscious individuals through widespread retail and online channels.

- Vando Natural is a global supplier of plant-based oils and natural ingredients. They provide blackcurrant seed oil in bulk quantities, emphasizing competitive pricing and large-scale production capacity. Their focus is on serving cosmetic, pharmaceutical, and nutritional manufacturers worldwide, offering both standard and customized formulations to meet specific industrial requirements.

Top Key Players in the Market

- Connoils LLC

- NOW FOODS

- Vando Natural

- Dève Herbes

- NutriONN

- PARAS PERFUMERS

- Cibaria International

- GoodLife ProVision

- Botanical Beauty

Recent Developments

- In 2024, Connoils LLC, a Wisconsin-based company specializing in powder delivery systems and specialty oil distribution, including blackcurrant seed oil, was acquired by CoreFX Ingredients. This acquisition enhances CoreFX’s portfolio by integrating Connoils’ novel encapsulation technology.

- In 2024, NOW Foods, a prominent player in the natural products industry, offers blackcurrant seed oil in capsule and liquid forms for health and wellness applications, particularly for its omega-3 and omega-6 fatty acid content. While no specific 2024–2025 developments tie directly to blackcurrant seed oil.

Report Scope

Report Features Description Market Value (2024) USD 21.1 Million Forecast Revenue (2034) USD 44.3 Million CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Conventional, Organic), By Form (Liquid, Gel Capsules), By Application (Cosmetics and Personal Care, Food and Beverages, Pharmaceuticals, Others), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Connoils LLC, NOW FOODS, Vando Natural, Dève Herbes, NutriONN, PARAS PERFUMERS, Cibaria International, GoodLife ProVision, Botanical Beauty Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Blackcurrant Seed Oil MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Blackcurrant Seed Oil MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Connoils LLC

- NOW FOODS

- Vando Natural

- Dève Herbes

- NutriONN

- PARAS PERFUMERS

- Cibaria International

- GoodLife ProVision

- Botanical Beauty