Global Banana Flakes Market By Nature (Organic, Conventional), By End Use (Food Processing Industry, Nutraceutical, Retail/Household, Foodservice Industry, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Specialty Store, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148371

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

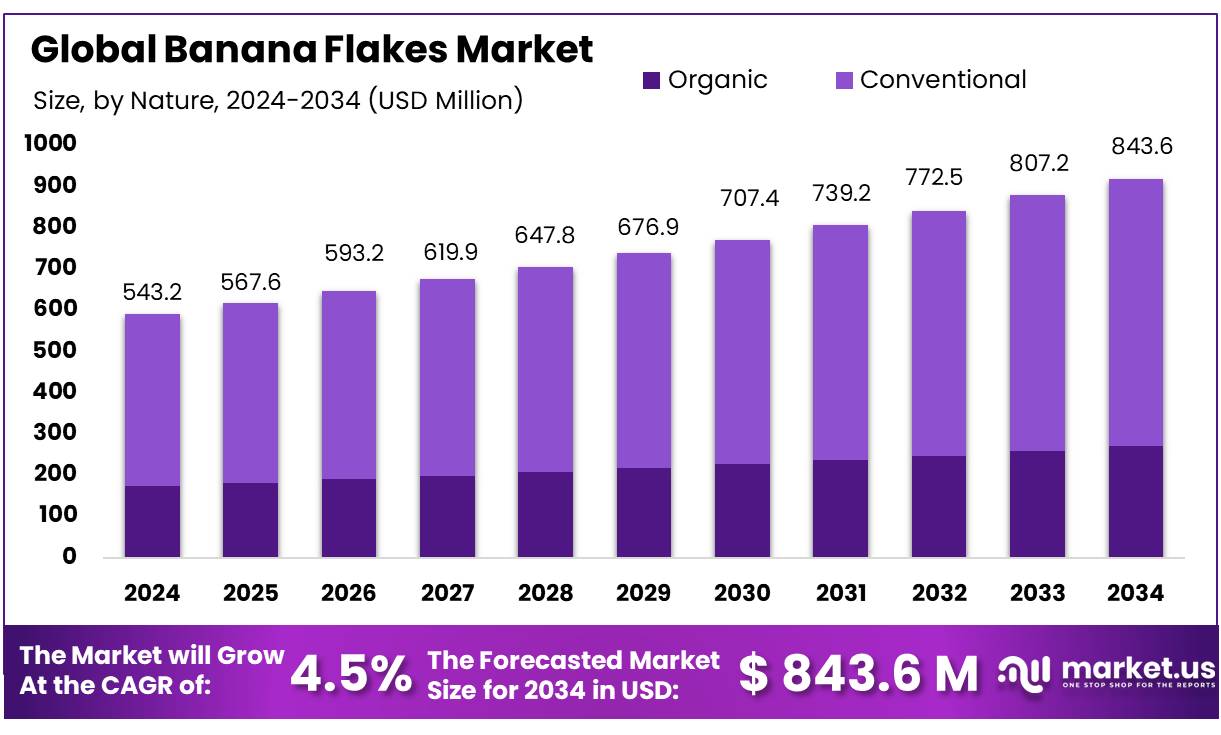

The Global Banana Flakes Market size is expected to be worth around USD 843.6 Million by 2034, from USD 543.2 Million in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The banana flakes industry is witnessing robust growth, propelled by increasing consumer demand for nutritious, convenient, and gluten-free food options. Banana flakes, produced through the dehydration of ripe bananas, retain essential nutrients such as potassium, magnesium, and vitamins A, B6, and C, making them a favored ingredient in cereals, infant foods, bakery products, and health supplements. Their extended shelf life and ease of incorporation into various food products further enhance their appeal in the food processing sector.

Government initiatives and policies also play a crucial role in shaping the banana flakes industry. In India, for instance, the National Horticulture Board reports that the country leads the world in banana production, with an annual output of about 14.2 million tonnes. This abundant supply provides a strong foundation for the banana processing industry, including the production of banana flakes. Moreover, programs like “Make in India” and various export subsidies have significantly promoted the banana processing sector, enhancing the country’s position as a leading exporter of banana-based products.

Technological advancements have also played a pivotal role in the production of high-quality banana flakes. Modern processing facilities employ techniques that ensure minimal nutrient loss and maintain the natural flavor and color of the fruit. For instance, companies like Tropical Food Machinery have developed specialized equipment for banana processing, ensuring efficiency and product quality. Their banana processing lines are designed to handle capacities ranging from 3,000 to 15,000 kg/h, catering to both small-scale and large-scale operations.

Key Takeaways

- Banana Flakes Market size is expected to be worth around USD 843.6 Million by 2034, from USD 543.2 Million in 2024, growing at a CAGR of 4.5%.

- Conventional held a dominant market position, capturing more than a 77.7% share in the global Banana Flakes Market.

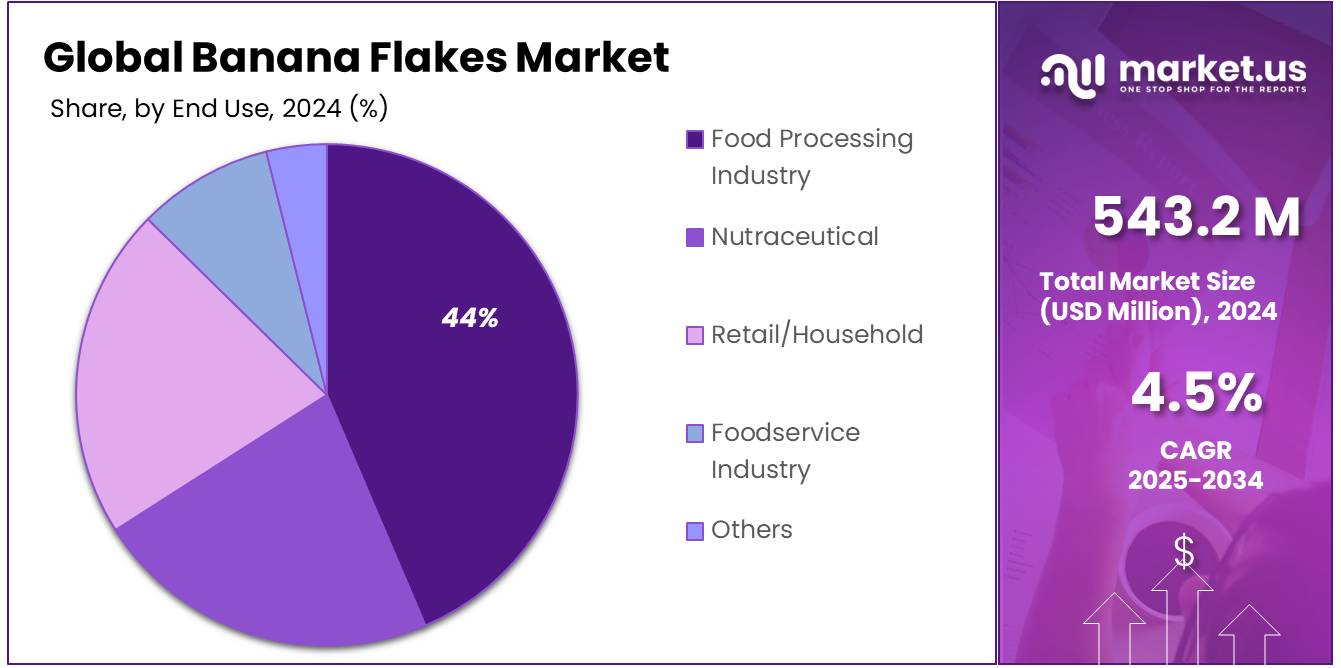

- Food Processing Industry held a dominant market position, capturing more than a 44.8% share in the Banana Flakes Market.

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 38.9% share in the Banana Flakes Market.

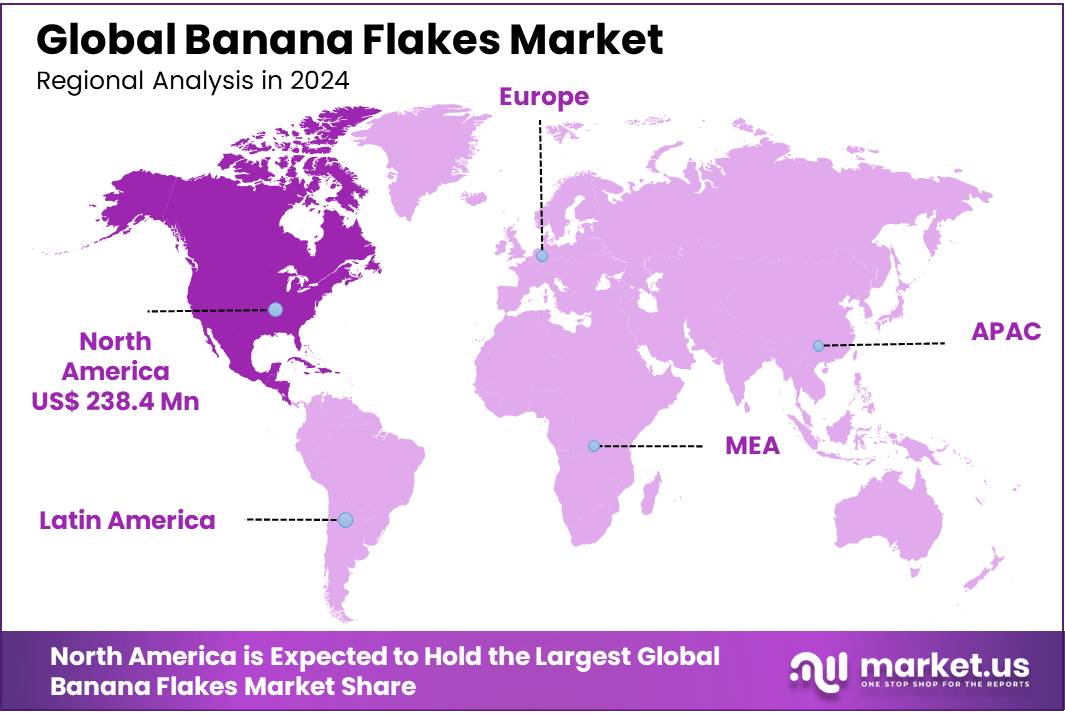

- North America emerged as the leading region in the global banana flakes market, commanding a substantial 43.9% share, equivalent to a market value of approximately USD 238.4 million.

By Nature

Conventional Banana Flakes dominate with 77.7% share, driven by affordability and accessibility.

In 2024, Conventional held a dominant market position, capturing more than a 77.7% share in the global Banana Flakes Market. The segment’s leadership can be attributed to its widespread availability and cost-effectiveness, making it a preferred choice among food manufacturers and consumers. Conventional banana flakes are widely utilized in bakery products, snacks, and breakfast cereals, as they offer a consistent flavor profile and longer shelf life. Additionally, their lower cost compared to organic alternatives enhances their demand in price-sensitive markets, particularly in regions such as Asia Pacific and Latin America. The segment is expected to maintain its stronghold in 2025 as the demand for affordable, nutrient-dense food products continues to rise globally.

By End Use

Food Processing Industry leads with 44.8% share, driven by growing demand for banana-based ingredients.

In 2024, the Food Processing Industry held a dominant market position, capturing more than a 44.8% share in the Banana Flakes Market. The segment’s strong performance is driven by the increasing use of banana flakes as a natural ingredient in bakery products, snacks, and infant nutrition. The food processing sector leverages banana flakes for their high nutritional content, consistent texture, and extended shelf life, making them a cost-effective alternative to fresh bananas. In 2025, the segment is expected to maintain its market leadership as manufacturers increasingly incorporate banana flakes in health-centric product formulations, catering to the rising consumer demand for nutrient-dense, natural food products.

By Distribution Channel

Hypermarkets/Supermarkets lead with 38.9% share, fueled by extensive retail networks and consumer reach.

In 2024, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 38.9% share in the Banana Flakes Market. The segment’s prominence is attributed to the widespread availability of banana flakes through well-established retail chains, providing consumers with easy access to packaged and processed banana products. Hypermarkets and supermarkets continue to serve as primary distribution channels for banana flakes, attracting health-conscious shoppers seeking nutritious, ready-to-use food ingredients. The convenience of bulk purchasing and promotional offers further propels sales through these retail outlets. In 2025, the segment is expected to sustain its lead, as major retailers expand their health food sections, offering a wider assortment of banana flake-based products.

Key Market Segments

By Nature

- Organic

- Conventional

By End Use

- Food Processing Industry

- Infant Nutrition

- Cereals & Snacks

- Bakery & Confectionery

- Dairy & Desserts

- Others

- Nutraceutical

- Retail/Household

- Foodservice Industry

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Store

- Online Retail

- Others

Drivers

Abundant Banana Production Fuels Growth in the Banana Flakes Market

One of the major driving factors for the banana flakes market is the abundant global production of bananas. According to the Food and Agriculture Organization (FAO), the world produced approximately 135 million tonnes of bananas in 2022, excluding plantains . This substantial production provides a steady and cost-effective supply of raw materials for banana flakes manufacturers.

India, being the largest producer, contributed about 34.5 million tonnes in 2022 . This high yield not only supports domestic consumption but also facilitates exports, bolstering the banana processing industry. The consistent availability of bananas ensures that manufacturers can meet the growing demand for banana flakes without significant supply constraints.

The surplus in banana production has encouraged investments in processing facilities, especially in countries like India and the Philippines. These facilities convert fresh bananas into flakes, extending shelf life and reducing post-harvest losses. This not only adds value to the raw produce but also opens up new markets for processed banana products.

Government initiatives have also played a role in this growth. In India, schemes like the Pradhan Mantri Kisan Sampada Yojana (PMKSY) aim to modernize food processing and reduce agricultural waste. Such programs provide financial assistance for setting up processing units, including those for banana products, thereby supporting the banana flakes market.

Restraints

Limited Processing Infrastructure Challenges Banana Flakes Market Expansion

A significant hurdle for the banana flakes market is the limited processing infrastructure in major banana-producing regions. While countries like India and the Philippines are top producers of bananas, they often lack adequate facilities to process these bananas into flakes. This gap leads to underutilization of the banana harvest and restricts the availability of banana flakes in the market.

According to the Food and Agriculture Organization (FAO), post-harvest losses for bananas can reach up to 20% in some developing countries due to inadequate processing and storage facilities. This loss not only affects the income of farmers but also limits the raw material available for banana flake production. Without sufficient processing units, surplus bananas cannot be efficiently converted into flakes, leading to missed opportunities in meeting the growing demand for healthy snack alternatives.

Efforts are being made to address this issue. For instance, the Indian government has launched initiatives like the Pradhan Mantri Kisan SAMPADA Yojana (PMKSY) to modernize food processing infrastructure. Under this scheme, financial assistance is provided for setting up processing units, including those for banana products. However, the implementation of such programs is still in progress, and many regions continue to face challenges in establishing the necessary infrastructure.

Opportunity

Rising Demand for Organic and Gluten-Free Foods Opens New Avenues for Banana Flakes Market

One of the significant growth opportunities for the banana flakes market lies in the increasing global demand for organic and gluten-free food products. As consumers become more health-conscious, there’s a noticeable shift towards foods that are perceived as natural and free from synthetic additives. Banana flakes, being naturally gluten-free and rich in essential nutrients like potassium and dietary fiber, align well with these consumer preferences.

According to the Food and Agriculture Organization (FAO), global banana production reached approximately 119 million tonnes in 2021, with India being the largest producer, contributing about 26% to the total output. This abundant production provides a steady supply of raw materials for banana flake manufacturers, facilitating the expansion of organic product lines.

In India, government initiatives like the National Programme for Organic Production (NPOP) have been instrumental in promoting organic farming practices. The NPOP provides certification for organic products, ensuring their authenticity and quality. Such programs not only support farmers in transitioning to organic farming but also boost consumer confidence in organic products, including banana flakes.

Trends

Rising Demand for Natural and Healthy Snacks Boosts Banana Flakes Market

In recent years, there has been a noticeable shift in consumer preferences towards natural and healthy snack options. Banana flakes, known for their nutritional benefits and versatility, have gained significant popularity among health-conscious individuals. This trend is particularly evident in the increasing demand for banana-based products in various regions.

According to the Food and Agriculture Organization (FAO), global banana production reached approximately 119 million tonnes in 2023, reflecting a steady increase over the past decade. This growth in banana production has provided ample raw material for the banana flakes industry, facilitating its expansion. The FAO’s data underscores the importance of bananas as a staple fruit, not only for direct consumption but also for processed products like banana flakes.

In India, the Ministry of Food Processing Industries (MoFPI) has initiated several schemes to promote the processing of fruits, including bananas. The Pradhan Mantri Kisan SAMPADA Yojana (PMKSY) aims to create modern infrastructure with efficient supply chain management from farm gate to retail outlet. Under this scheme, financial assistance is provided for setting up food processing units, which has encouraged entrepreneurs to venture into banana processing, including the production of banana flakes. Such government initiatives have played a crucial role in boosting the banana flakes market in India.

Furthermore, the increasing awareness of the health benefits associated with banana consumption has led to a surge in demand for banana-based snacks. Banana flakes are rich in essential nutrients like potassium, dietary fiber, and natural sugars, making them an attractive option for health-conscious consumers. The versatility of banana flakes allows them to be used in various applications, including breakfast cereals, bakery products, and infant foods, further driving their demand.

Regional Analysis

In 2024, North America emerged as the leading region in the global banana flakes market, commanding a substantial 43.9% share, equivalent to a market value of approximately USD 238.4 million. This dominance is largely attributed to the region’s advanced food processing industry, coupled with a growing consumer inclination towards healthy and convenient food options. Banana flakes, known for their nutritional benefits and versatility, have found increasing applications in breakfast cereals, snack bars, and infant nutrition products across the United States and Canada.

The United States, in particular, has seen a surge in demand for banana flakes, driven by the rising popularity of plant-based and gluten-free diets. According to the U.S. Department of Agriculture (USDA), the organic food sector has been experiencing consistent growth, with organic food sales reaching over USD 60 billion in 2022. This trend has positively impacted the banana flakes market, as consumers seek out organic and minimally processed food ingredients. Moreover, the presence of key market players and established distribution channels in North America has facilitated the widespread availability of banana flakes in both retail and online platforms.

Government initiatives promoting healthy eating habits have also played a role in boosting the banana flakes market. For instance, the U.S. Food and Drug Administration (FDA) has been advocating for clearer nutritional labeling, encouraging consumers to make informed food choices. Such measures have heightened awareness about the benefits of nutrient-rich foods like banana flakes. Additionally, collaborations between food manufacturers and research institutions have led to product innovations, enhancing the appeal of banana flakes in various culinary applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Diana Group, a part of Symrise AG, operates a significant banana processing facility in Ecuador. This site focuses on producing high-quality banana flakes, powders, and pieces, emphasizing sustainability and traceability. Their products cater to various applications, including baby food, cereals, and snacks. Diana Group’s integration into Symrise’s value chain enhances its global reach and innovation capabilities.

Futurcorp S.A., headquartered in Ecuador, is known for its expertise in banana processing and export. The company offers a range of banana-derived products, including flakes, catering to international markets. Futurcorp’s strategic location allows access to high-quality raw materials, ensuring product consistency and reliability. Their commitment to quality control and customer satisfaction has solidified their presence in the global banana flakes market.

Based in Hamburg, Germany, Johs. Thoms GmbH & Co. KG has over four decades of experience in the fruit processing industry. The company offers a diverse portfolio of fruit products, including banana flakes, catering to various sectors such as bakery, confectionery, and dairy. Their emphasis on quality, sustainability, and customer service has established them as a trusted supplier in the European market.

Top Key Players in the Market

- Dermasal

- Diana Group

- Futurcorp S.A.

- Johs. Thoms GmbH & Co. KG

- Nutritional Designs, Inc.

- Orkla Group

- P&G Food Industries

- Rabeler Fruchtchips GmbH

- Symrise

- Van Drunen Farms

- Z Natural Foods

Recent Developments

In 2024, Futurcorp S.A., based in Ecuador, solidified its position as a key player in the banana flakes market by exporting over 100,000 kilograms of banana flakes to the United States, with major clients including Van Drunen Farms and Newtown Foods USA .

In 2024, Diana Group, operating under the diana food™ brand and as part of Symrise AG, strengthened its position in the banana flakes market through its facility in Ecuador.

Report Scope

Report Features Description Market Value (2024) USD 543.2 Mn Forecast Revenue (2034) USD 843.6 Mn CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By End Use (Food Processing Industry, Nutraceutical, Retail/Household, Foodservice Industry, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Specialty Store, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dermasal, Diana Group, Futurcorp S.A., Johs. Thoms GmbH & Co. KG, Nutritional Designs, Inc., Orkla Group, P&G Food Industries, Rabeler Fruchtchips GmbH, Symrise, Van Drunen Farms, Z Natural Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dermasal

- Diana Group

- Futurcorp S.A.

- Johs. Thoms GmbH & Co. KG

- Nutritional Designs, Inc.

- Orkla Group

- P&G Food Industries

- Rabeler Fruchtchips GmbH

- Symrise

- Van Drunen Farms

- Z Natural Foods