Global Baby Diapers Market Size, Share, Growth Analysis By Product (Disposable Diapers, Non-Disposable Diapers), By Type (Open Diapers (Taped), Closed Diapers (Pull-Up or Pants)), By Size (Large, Extra Large, New Born, Medium, Small), By Distribution Channel (Supermarkets & Hypermarkets, Online, Specialty Stores, Pharmacies & Drugstores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154500

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

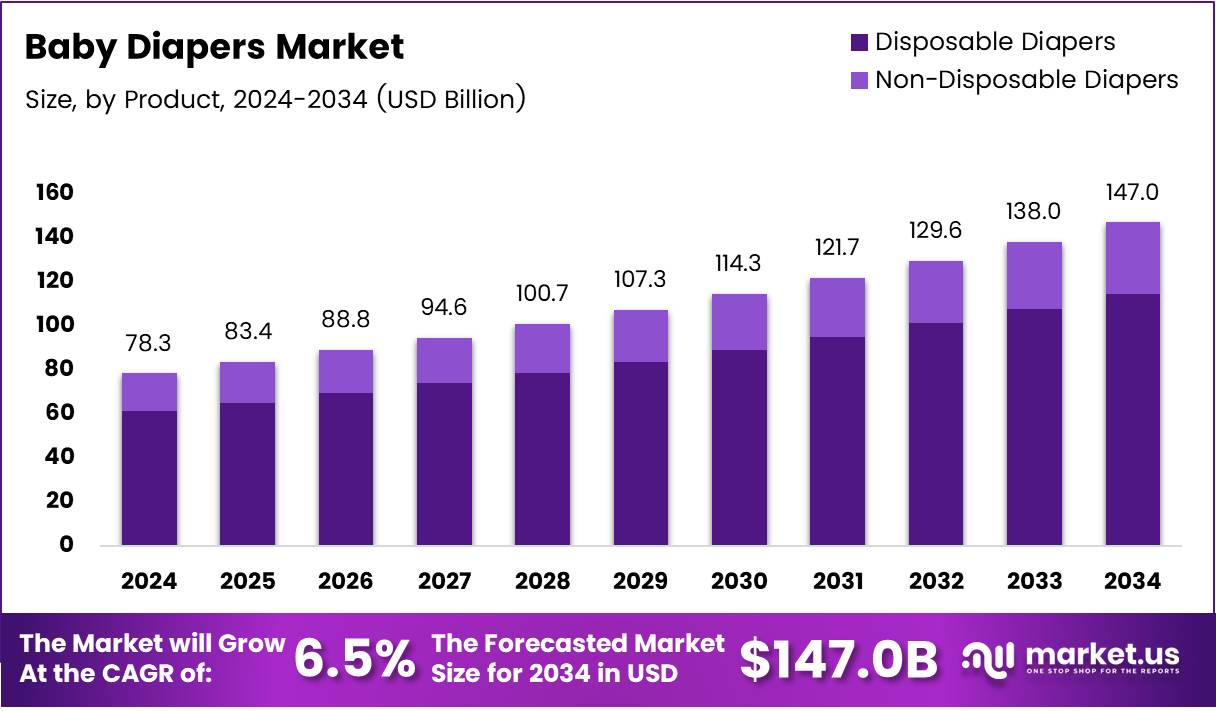

The Global Baby Diapers Market size is expected to be worth around USD 147.0 Billion by 2034, from USD 78.3 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

The baby diapers market refers to the global production, distribution, and consumption of disposable and cloth diapers for infants. It includes manufacturers, retailers, suppliers, and end users. Driven by rising hygiene awareness, changing lifestyles, and higher birth rates in emerging economies, this market remains competitive and innovation-focused.

Shifting parental preferences and growing awareness around child hygiene are fueling market expansion. Many parents now seek premium, eco-friendly, and ultra-absorbent products, driving brands to innovate. Moreover, working parents are willing to pay more for convenience and performance, thus increasing demand for disposable baby diapers across urban centers.

Emerging markets present strong growth potential due to increasing disposable income and urbanization. As birth rates decline in developed countries, manufacturers shift focus toward Asia-Pacific and Africa. The growing e-commerce sector further boosts availability and accessibility, particularly in semi-urban and rural regions where physical stores are limited.

Manufacturers are also leveraging plant-based and biodegradable materials to align with sustainability goals. Biodegradable diaper offerings help brands meet the rising demand for eco-conscious baby care products. This shift opens new opportunities for startups and niche players to compete against established global brands.

Government initiatives and public health policies in emerging countries are promoting hygiene product accessibility. In countries like India and Brazil, awareness campaigns on baby hygiene have increased adoption. However, import duties and strict environmental disposal regulations can pose barriers for market penetration and growth.

Technological advances in superabsorbent polymers and breathable fabrics are improving product comfort and performance. Companies continue to invest in R&D to enhance leak protection and skin-friendliness. Additionally, smart diapers—featuring moisture sensors—are creating opportunities in the premium segment for tech-savvy consumers.

According to journals, in low- and middle-income countries, consumption ranges from 2 to 6 diapers per child per day, totaling over 4,000 diapers per child over the diapering period. This highlights a substantial recurring demand base in developing regions, where population growth remains high.

Moreover, as per adinaaba, around 250 million single-use diapers are discarded daily worldwide, underscoring growing environmental concerns and the need for sustainable disposal solutions. These figures indicate both the size of the market and the urgency for innovation in waste management and eco-friendly diapering alternatives.

Key Takeaways

- The Global Baby Diapers Market is projected to reach USD 147.0 Billion by 2034, up from USD 78.3 Billion in 2024, growing at a CAGR of 6.5%.

- Disposable Diapers dominated the product segment in 2024 with a 78.9% market share, driven by convenience and hygiene.

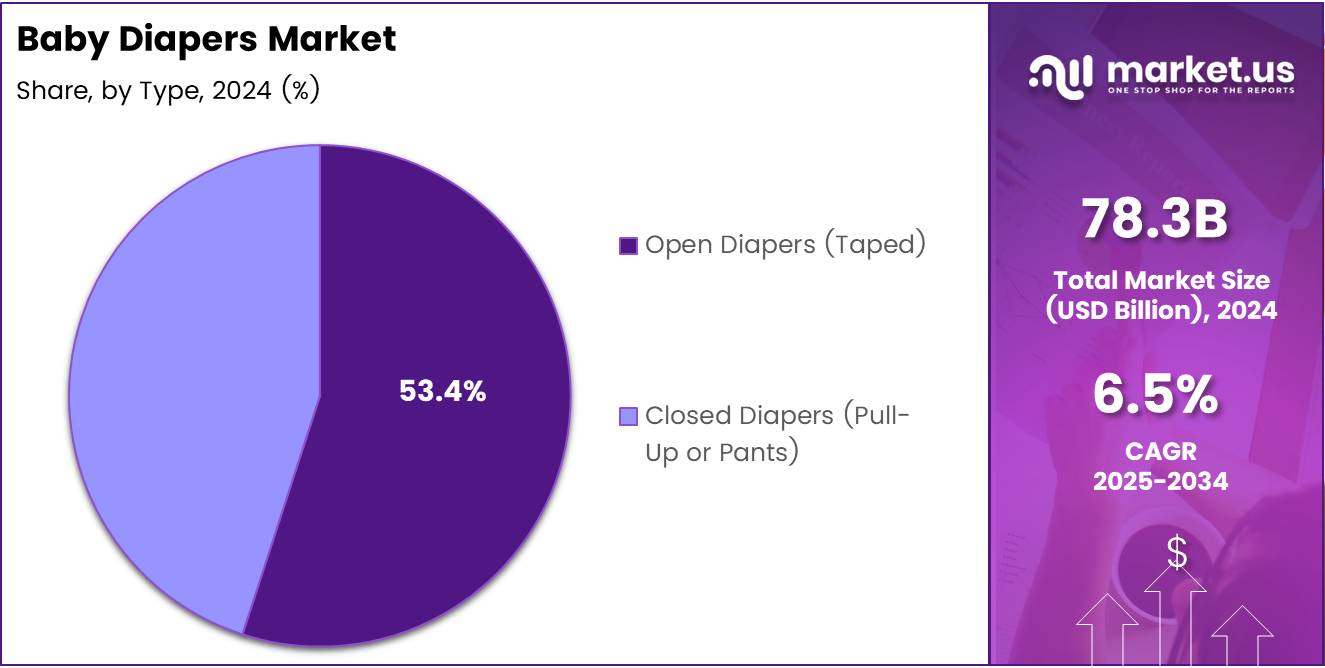

- Open Diapers (Taped) led the type segment with a 53.4% share in 2024, favored for their adjustability and suitability for newborns.

- Large-sized diapers accounted for the largest size segment with a 40.5% share in 2024, catering to growing babies and toddlers.

- Supermarkets & Hypermarkets dominated distribution channels with a 36.2% share in 2024, due to variety, accessibility, and promotions.

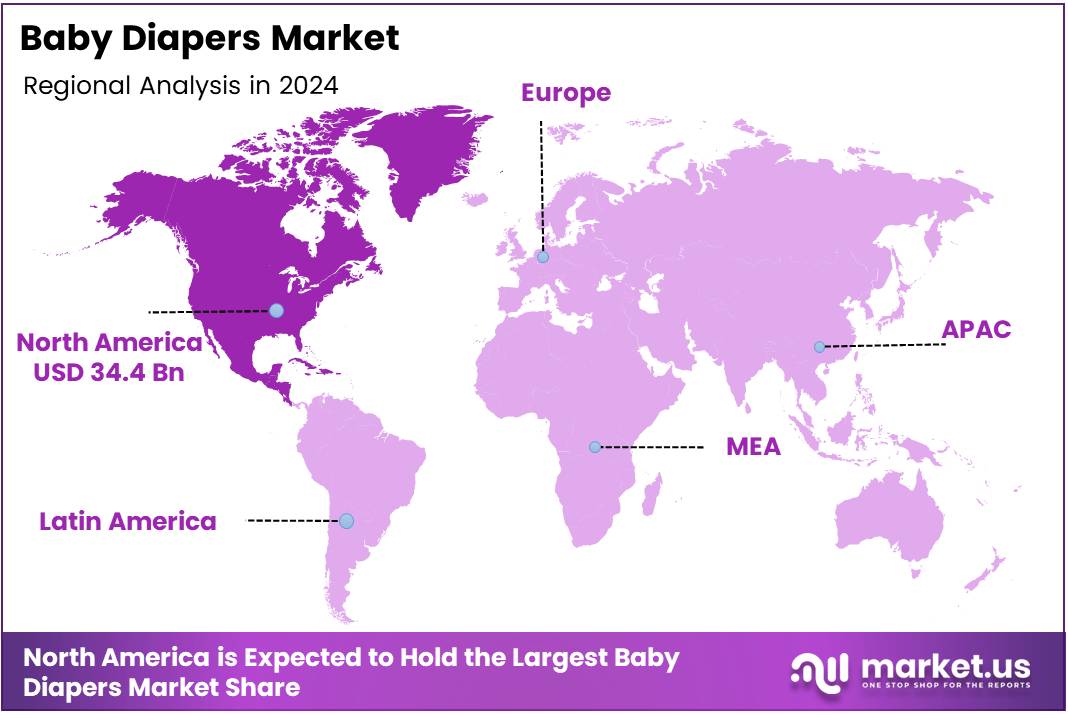

- North America led the regional market with a 44.8% share and a value of USD 34.4 Billion, supported by high consumer awareness and premium product adoption.

Product Analysis

Disposable Diapers lead the category with 78.9% market share in 2024, favored for their convenience and hygiene.

In 2024, Disposable Diapers held a dominant market position in the By Product Analysis segment of the Baby Diapers Market, accounting for a substantial 78.9% share. This strong performance is primarily attributed to the convenience they offer to parents and caregivers, coupled with growing urbanization and fast-paced lifestyles. The disposable nature of these products ensures hygienic use and easy disposal, which resonates well with modern consumer preferences.

On the other hand, Non-Disposable Diapers remained a niche segment within the market. Although they appeal to environmentally conscious consumers, their adoption is comparatively limited due to the frequent need for washing and the perceived inconvenience in handling. Despite their sustainability benefits, they held a much smaller market share, lacking the widespread commercial acceptance of their disposable counterparts.

Manufacturers continue to invest in advanced materials and technologies for disposable diapers to enhance absorbency and skin-friendliness, further strengthening the segment’s position. While sustainability remains a concern, the dominant presence of disposable options indicates a clear consumer tilt toward practicality and ease of use.

Type Analysis

Open Diapers (Taped) dominate with 53.4% share in 2024, preferred for their adjustability and newborn-friendly design.

In 2024, Open Diapers (Taped) emerged as the leading segment in the By Type Analysis of the Baby Diapers Market, securing a notable 53.4% market share. This dominance is driven by their adjustable fit and suitability for younger babies, especially newborns who require frequent diaper changes. The taped design allows for easy removal and reapplication, providing both comfort for the infant and convenience for the caregiver.

Closed Diapers (Pull-Up or Pants), although growing in popularity, primarily cater to older infants and toddlers transitioning into potty training. These pants-style diapers are often favored for their ease of wear and flexibility during movement. However, their adoption remains slightly behind due to limited use during the early stages of infancy.

The consumer preference for Open Diapers highlights the market’s responsiveness to usability and baby comfort during the early months. This segment continues to benefit from product innovation focused on skin sensitivity, leak protection, and breathability.

Size Analysis

Large size leads with 40.5% share in 2024 due to high demand among growing infants and toddlers.

In 2024, Large-sized baby diapers held a leading position in the By Size Analysis segment of the Baby Diapers Market, capturing a significant 40.5% share. This dominance is closely tied to the demographic distribution, with a high number of babies and toddlers falling into this size bracket as they grow. The large size offers a balanced combination of coverage, absorbency, and comfort for active infants.

Extra Large diapers followed, catering primarily to older toddlers who require added capacity and mobility. Meanwhile, Medium-sized diapers captured a fair portion of the market, serving infants transitioning from newborn to larger sizes.

New Born and Small sizes, while critical in early infancy, represented a comparatively smaller share due to the limited time babies spend in these size ranges. Nonetheless, these segments are vital for providing specialized comfort and fit for newborns.

The demand trend clearly emphasizes the need for larger-sized diapers as infants grow, reinforcing the importance of comfort and durability in product design and selection.

Distribution Channel Analysis

Supermarkets & Hypermarkets lead with 36.2% share in 2024, driven by product variety and immediate availability.

In 2024, Supermarkets & Hypermarkets held a dominant position in the By Distribution Channel Analysis segment of the Baby Diapers Market, accounting for 36.2% of total sales. The leading share is a result of consumers’ preference for physical shopping formats that offer wide product variety, immediate access, and frequent promotional offers.

These retail outlets also provide a tactile shopping experience where customers can compare brands, examine packaging, and benefit from bundle deals, which are crucial in the baby care segment. This channel’s dominance is especially evident in urban regions with dense retail infrastructure.

Online channels, while expanding rapidly due to convenience and subscription models, still lag slightly behind in market share. Specialty Stores and Pharmacies & Drugstores cater to niche and premium consumers, often emphasizing quality and brand trust. The ‘Others’ category remained relatively minor in its contribution.

The market dynamics underscore a hybrid purchasing pattern, though brick-and-mortar stores—particularly large-format retailers—continue to command the most trust among consumers for baby essentials like diapers.

Key Market Segments

By Product

- Disposable Diapers

- Non-Disposable Diapers

By Type

- Open Diapers (Taped)

- Closed Diapers (Pull-Up or Pants)

By Size

- Large

- Extra Large

- New Born

- Medium

- Small

By Distribution Channel

- Supermarkets & Hypermarkets

- Online

- Specialty Stores

- Pharmacies & Drugstores

- Others

Drivers

Expansion of E‑commerce Channels for Diaper Distribution Drives Market Growth

Online shopping is changing how parents buy diapers. E‑commerce offers 24/7 access, wide assortments, and fast delivery, reducing stock‑out risk. Price comparison tools and bundled offers make diapers more affordable, lifting basket sizes and repeat orders.

Digital platforms also improve brand discovery. Marketplaces highlight new SKUs, eco lines, and trial packs, helping parents switch or trade up. Ratings and reviews shrink perceived risk, speeding adoption of premium and specialty diapers.

Subscription features stabilize demand. Auto‑replenishment, flexible pause/skip options, and tiered discounts lock in customer lifetime value. Predictive reminders based on age and usage lower churn and raise adherence to preferred brands.

Logistics advancements support this shift. Last‑mile networks, dark stores, and quick‑commerce promise same‑day delivery in dense cities. This convenience is critical for time‑pressed parents and boosts willingness to pay for express services.

Urbanization and more dual‑income households reinforce the online channel. Busy schedules favor doorstep delivery over store trips. As platforms expand into tier‑2/3 cities with localized UX and cash‑on‑delivery, the online share of diaper sales is set to climb further.

Restraints

Environmental Concerns Regarding Disposable Diaper Waste Constrain Market Expansion

Disposable diapers generate significant solid waste, drawing scrutiny from regulators and communities. Landfill pressure and plastic reduction targets can increase compliance costs, push extended producer responsibility, and slow category growth.

Rising eco awareness changes purchase behavior. Some parents shift to cloth or hybrid systems to reduce waste. This substitution risk caps volume growth, especially in markets with strong sustainability norms.

Material debates add uncertainty. Concerns about microplastics, fragrances, and lotions invite tighter standards and labeling demands. Manufacturers may face reformulation expenses and longer time‑to‑market for new lines.

Affordability barriers persist in rural and low‑income regions. Limited retail reach, smaller pack availability, and low disposable incomes keep usage occasional rather than daily. Without education and micro‑pack innovations, penetration remains shallow.

Skin sensitivity issues amplify hesitation. Reports of rashes or allergies—whether due to fit, moisture, or additives—can drive brand switching or reduced usage. Firms must invest in dermatological testing, breathable materials, and transparent claims to rebuild trust.

Growth Factors

Subscription‑Based Diaper Delivery Models Unlock Scalable Growth

Subscriptions convert episodic purchases into predictable revenue. Auto‑refills aligned to infant growth stages reduce stockouts and improve household planning, strengthening brand loyalty and lifetime value.

Bundled economics add margin. Pairing diapers with wipes, creams, and training pants raises average order value. Tiered discounts and rewards encourage longer subscription durations and lower acquisition costs over time.

Data insights are a core edge. Usage patterns, size changes, and churn signals enable precise demand forecasting and targeted promotions. Personalization—such as sending the next size proactively—improves satisfaction and reduces returns.

Emerging markets widen the canvas. As payments digitize in Africa and Asia, lightweight subscription models using mobile wallets and flexible billing can scale. Localized logistics partnerships solve last‑mile and cash‑on‑delivery needs.

Smart diaper innovation complements the model. Health‑monitoring add‑ons (moisture/temperature sensors) can justify premium plans. Education content, pediatric tips, and community features increase stickiness, turning a commodity into a service relationship.

Emerging Trends

Increasing Popularity of Biodegradable and Organic Diapers Shapes Purchasing Trends

Parents are seeking gentler, greener options. Biodegradable cores, plant‑based topsheets, and chlorine‑free processing appeal to eco‑conscious buyers, especially in urban and premium segments.

Transparency drives trust. Clear sourcing, third‑party certifications, and recyclability guidance reduce confusion and support price premiums. Brands that communicate material science in simple terms win consideration.

Customization is rising. Flexible sizing, better stretch zones, and gender‑neutral designs improve fit and comfort, lowering leak risk. Build‑your‑own bundles and on‑site fit quizzes make selection easier and decrease returns.

Digital voices matter. Collaborations with parenting bloggers and micro‑influencers bring authentic reviews and how‑to content. Trial codes and referral programs turn social proof into measurable conversions.

Iteration speed is a differentiator. Fast feedback loops from online reviews and subscriber data help brands refine absorbency, wetness indicators, and skin‑friendly additives. Continuous improvement keeps products aligned with evolving parent expectations.

Regional Analysis

North America Dominates the Baby Diapers Market with a Market Share of 44.8%, Valued at USD 34.4 Billion

North America holds the leading position in the global baby diapers market, accounting for a substantial 44.8% market share and reaching a value of USD 34.4 Billion. The region benefits from high consumer awareness, strong purchasing power, and widespread adoption of premium hygiene products. Moreover, consistent product innovation and the presence of advanced distribution channels further fuel market expansion.

Europe Baby Diapers Market Outlook

Europe represents a significant share in the global baby diapers market, supported by rising concerns around infant hygiene and growing demand for eco-friendly and biodegradable diaper options. Increasing birth rates in certain parts of Eastern Europe and steady product innovation across Western Europe are contributing to consistent market growth in the region.

Asia Pacific Baby Diapers Market Trends

The Asia Pacific baby diapers market is witnessing rapid expansion, driven by a large and growing infant population, rising urbanization, and improving disposable incomes. Countries such as China and India are emerging as major markets due to increasing awareness of hygiene and a gradual shift towards disposable diaper products over traditional alternatives.

Middle East and Africa Baby Diapers Market Analysis

The baby diapers market in the Middle East and Africa is growing steadily, supported by improving economic conditions and a growing young population. Urbanization, increased access to retail products, and a gradual rise in consumer awareness around hygiene are aiding market development, particularly in Gulf countries and parts of North Africa.

Latin America Baby Diapers Market Overview

Latin America shows moderate growth in the baby diapers market, underpinned by rising health and hygiene awareness among consumers. While economic disparities remain a challenge, growing urban centers and expanding retail networks are contributing to gradual market penetration, especially in countries like Brazil and Mexico.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Baby Diapers Company Insights

In 2024, the global baby diapers market is being actively shaped by a mix of established leaders and emerging innovators.

First Quality Enterprises continues to demonstrate steady growth with its strong private-label offerings and emphasis on cost-effective solutions, particularly in North America. Their commitment to advanced manufacturing and hygiene standards bolsters their market position.

The Honest Company, Inc. maintains its niche by focusing on eco-friendly and hypoallergenic products that appeal to health-conscious and environmentally aware consumers. Its branding strategy and online presence help sustain its competitive edge despite rising market saturation.

Kimberly-Clark Corporation remains a dominant force globally, driven by its trusted Huggies brand. The company benefits from robust supply chains and global market penetration, enabling it to adapt to regional preferences and regulatory dynamics effectively.

Hengan International, a key player in the Asia-Pacific region, continues to expand its footprint through product innovation and affordability. Its extensive distribution network and strong domestic brand recognition help it maintain resilience amid growing local competition.

These companies collectively influence trends around sustainability, product innovation, and brand loyalty, shaping the broader trajectory of the baby diapers market in 2024.

Top Key Players in the Market

- First Quality Enterprises

- The Honest Company, Inc.

- Kimberly-Clark Corporation

- Hengan International

- The Hain Celestial Group, Inc.

- Procter & Gamble Company (P&G)

- Unicharm Corporation

- Ontex Group

- Essity AB

- Johnson & Johnson

Recent Developments

- In May 2025, Nobel Hygiene raised Rs 170 crore from Neo Asset Management to support its business expansion and strengthen its market presence in the hygiene products sector. The funding reflects growing investor interest in India’s consumer health and wellness space.

- In September 2024, DOMS acquired a 51.77% stake in Uniclan Healthcare, marking its strategic entry into the healthcare segment. The acquisition aims to diversify DOMS’s portfolio and capitalize on synergies in health-focused product lines.

Report Scope

Report Features Description Market Value (2024) USD 78.3 Billion Forecast Revenue (2034) USD 147.0 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Disposable Diapers, Non-Disposable Diapers), By Type (Open Diapers (Taped), Closed Diapers (Pull-Up or Pants)), By Size (Large, Extra Large, New Born, Medium, Small), By Distribution Channel (Supermarkets & Hypermarkets, Online, Specialty Stores, Pharmacies & Drugstores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape First Quality Enterprises, The Honest Company, Inc., Kimberly-Clark Corporation, Hengan International, The Hain Celestial Group, Inc., Procter & Gamble Company (P&G), Unicharm Corporation, Ontex Group, Essity AB, Johnson & Johnson Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- First Quality Enterprises

- The Honest Company, Inc.

- Kimberly-Clark Corporation

- Hengan International

- The Hain Celestial Group, Inc.

- Procter & Gamble Company (P&G)

- Unicharm Corporation

- Ontex Group

- Essity AB

- Johnson & Johnson