Global Babassu Oil Market Size, Share, And Business Benefits Ву Туре (Conventional, Organic), By Form (Liquid, Powder), By Application (Cosmetics, Food and Beverage, Pharmaceutical, Others), By Distribution Channel (Supermarkets and Hypermarkets, Online Retail, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157106

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

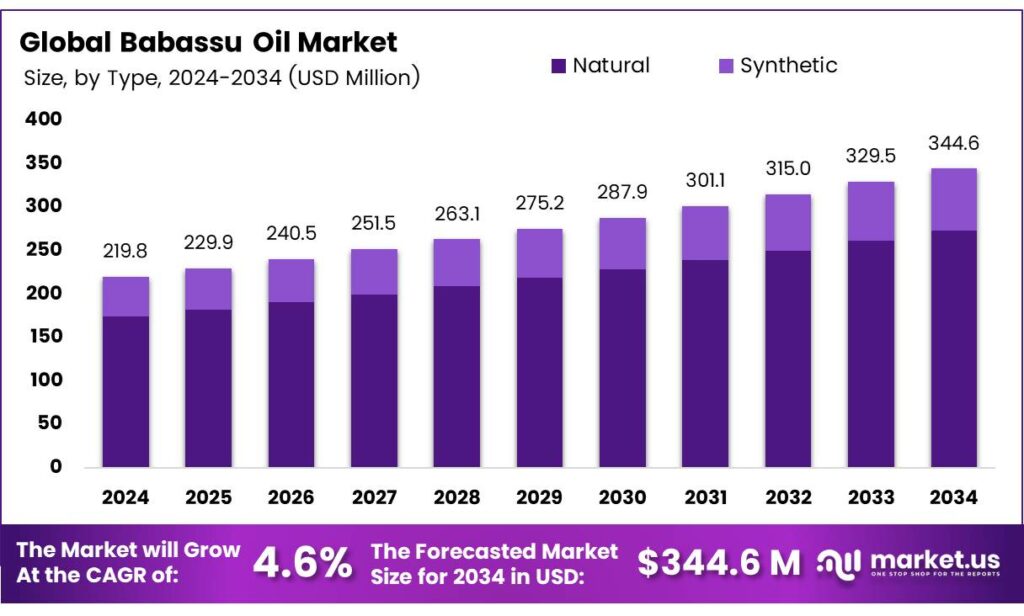

The Global Babassu Oil Market size is expected to be worth around USD 344.6 Million by 2034, from USD 219.8 Million in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

Babassu oil is a key raw material in the pharmaceutical and biofuel industries, yet its physicochemical and thermal properties are underexplored in existing literature. This study characterizes these properties to promote their use in the food industry. Two types of babassu oil, extra-virgin and virgin, were analyzed for their physicochemical properties, lipid profile, triacylglycerol composition, and thermal characteristics.

Babassu oil, characterized by a high content of saturated fatty acids 80–91%, primarily includes lauric, myristic, palmitic, capric, caprylic, and stearic acids, with the remaining 9–20% consisting of unsaturated fatty acids such as oleic and linoleic acids. This lipid profile closely resembles that of palm kernel and coconut oils, which are among the most widely produced and consumed vegetable oils globally.

The similarity in composition positions babassu oil as a viable alternative for applications in industries where these oils are prevalent, particularly in food production due to its edible nature and ease of production. The anti-inflammatory properties of babassu oil and its primary component, lauric acid, have been demonstrated in studies involving mouse ear edema, where they effectively inhibited the eicosanoid pathway and bioactive amines.

A formulated microemulsion containing 39% babassu oil, 12.2% oil phase, and 48.8% surfactant was identified as a bicontinuous to oil-in-water transition microemulsion with a Newtonian flow profile. This microemulsion significantly enhanced the topical anti-inflammatory activity of babassu oil, and a novel delivery system utilizing microemulsion droplet clusters was developed to improve the therapeutic efficacy of the oil, expanding its potential in pharmaceutical applications.

The extraction method influences the fatty acid quantities in extra-virgin babassu oil (EVBO) and virgin babassu oil (VBO), but it does not alter the types of fatty acids present in either. Despite variations in their physicochemical and thermal properties, they are suitable for food industry applications. These attributes, combined with their compositional similarity to widely used vegetable oils, underscore the potential of babassu oil as a versatile and valuable raw material in both food and pharmaceutical sectors.

Key Takeaways

- The Global Babassu Oil Market is projected to grow from USD 219.8 million in 2024 to USD 344.6 million by 2034, with a CAGR of 4.6%.

- Conventional babassu oil held a 79.4% market share in 2024 due to its cost-effectiveness and wide use in cosmetics, soaps, and food processing.

- Liquid babassu oil captured an 89.2% market share in 2024, favored for its versatility in cosmetics, skincare, and food applications.

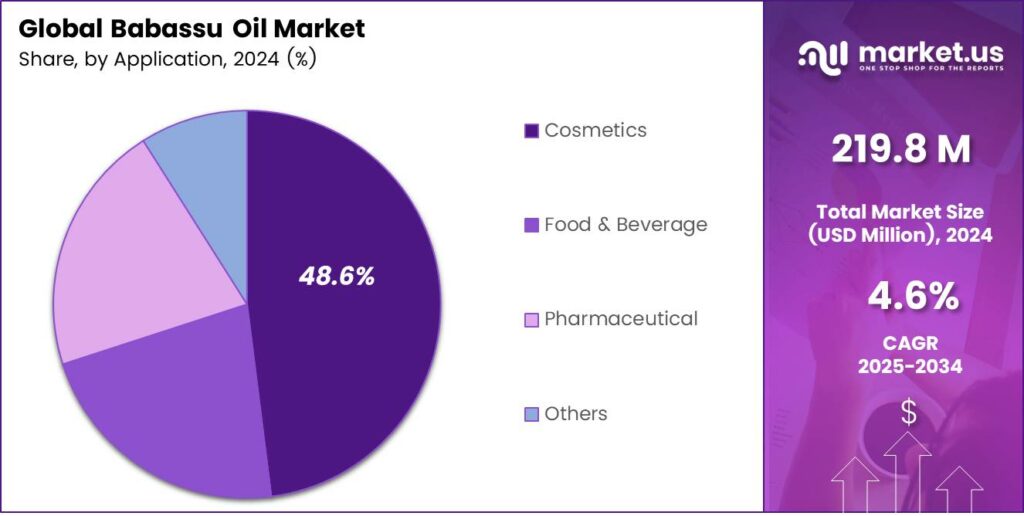

- The cosmetics segment accounted for 48.6% of the market in 2024, driven by demand for natural, moisturizing ingredients.

- Supermarkets and Hypermarkets led distribution with a 31.7% share in 2024, offering a wide product variety and consumer convenience.

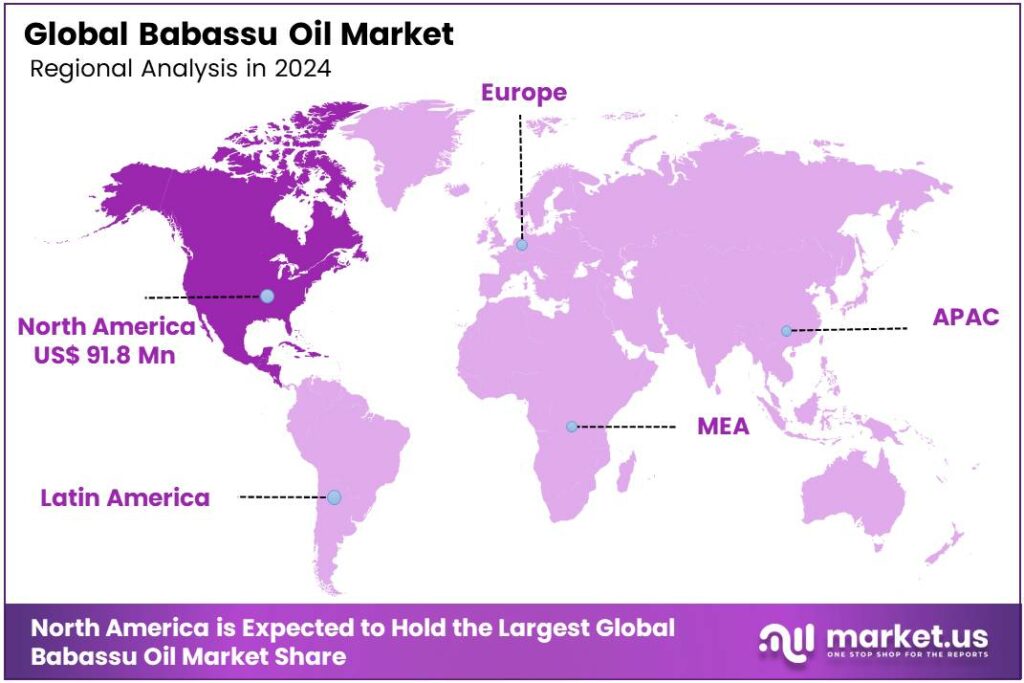

- North America held a 41.8% market share in 2024, generating USD 91.8 million, driven by demand in personal care and household products.

Analyst Viewpoint

Investing in babassu oil presents a compelling opportunity, driven by the global shift toward natural and sustainable products. The oil, derived from the babassu palm in South America, is gaining traction in cosmetics, food, and industrial applications due to its moisturizing properties, high lauric acid content, and eco-friendly profile.

Its sustainable harvesting supports local communities in Brazil, aligning with the growing demand for socially responsible investments. The rising popularity of plant-based products and the push for biodegradable alternatives in industries like lubricants create a promising growth trajectory, especially in regions like North America and Asia-Pacific, where demand for organic products is surging.

The babassu oil market faces challenges from volatile raw material prices and limited supply, as production is largely concentrated in Brazil’s Amazon region. This geographic dependency could lead to supply chain disruptions, especially with increasing environmental regulations aimed at protecting the Amazon. Consumer awareness of babassu oil’s benefits remains low compared to more established oils like coconut or palm, which could slow market penetration in developing regions.

Ву Туре

Conventional Segment Leads with 79.4% Share

In 2024, Conventional held a dominant market position, capturing more than a 79.4% share in the global Babassu Oil market. This strong preference is mainly because conventional babassu oil is widely available and cost-effective compared to organic alternatives. Its extensive use in cosmetics, soaps, hair care products, and food processing has strengthened its market dominance.

Demand for conventional babassu oil is expected to remain steady, driven by its affordability and established supply chains. Consumers in emerging markets especially favor this type due to lower price sensitivity. While organic options are slowly growing in popularity, the conventional segment continues to be the backbone of the industry, ensuring accessibility across both industrial and retail applications.

By Form

Liquid Form Dominates with 89.2% Share

In 2024, Liquid held a dominant market position, capturing more than 89.2% share in the global Babassu Oil market. The liquid form is highly preferred due to its versatility, making it easy to incorporate into cosmetics, personal care products, and food applications. Its smooth texture and quick absorption have boosted demand from the skincare and haircare industries, where natural oils are increasingly valued.

The liquid segment is expected to retain its leadership, supported by rising use in premium formulations and household consumption. The segment’s convenience, stability during processing, and broad commercial applications ensure it continues to be the most widely used form, outpacing other forms by a significant margin.

By Application

Cosmetics Application Leads with 48.6% Share

In 2024, Cosmetics held a dominant market position, capturing more than a 48.6% share in the global Babassu Oil market. The growth of this segment is strongly tied to the rising demand for natural and plant-based ingredients in skincare and haircare products. Babassu oil’s lightweight texture, moisturizing ability, and non-greasy finish make it a preferred alternative to synthetic oils.

The cosmetics segment is expected to maintain its strong presence, supported by increasing consumer awareness of clean beauty and sustainable sourcing. From lotions and creams to shampoos and conditioners, babassu oil continues to be widely used, reinforcing its role as a core ingredient in modern personal care formulations.

By Distribution Channel

Supermarkets and Hypermarkets Lead with 31.7% Share

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 31.7% share in the global Babassu Oil market. This strong presence is mainly due to the wide product variety, convenient access, and the ability for consumers to compare brands directly on shelves.

These outlets serve as key distribution points, especially in urban areas where consumer preference leans toward one-stop shopping. This channel is expected to maintain steady growth as supermarkets expand their natural and organic product ranges, providing greater visibility to babassu oil-based items. The trust, accessibility, and promotional offers available in these stores continue to make them the preferred choice for household buyers.

Key Market Segments

Ву Туре

- Conventional

- Organic

By Form

- Liquid

- Powder

By Application

- Cosmetics

- Food and Beverage

- Pharmaceutical

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Online Retail

- Specialty Stores

- Others

Drivers

A Gentle Push Toward a Greener Choice

First off, babassu oil has earned favor not just for its functional qualities in food and personal care, but for the way it’s produced. It’s often harvested using traditional methods by communities in Brazil, especially by the babassu breaker women, who collect and process the nuts by hand. This practice not only helps protect local biodiversity but also provides a vital source of income and empowerment for these women.

Meanwhile, environmental concerns around palm oil have nudged manufacturers and consumers alike toward more ethically sourced substitutes. Babassu oil, with its lower environmental footprint, is increasingly being highlighted in marketing (and by regulators and NGOs) as a cleaner, more sustainable alternative. It’s nourishing or good for the skin; they’re choosing it because they feel it comes from a place that respects nature and communities.

Restraints

Supply Chain Vulnerability: Fragmented and Declining Babassu Production

One major challenge for babassu oil production is the limited access to babassu groves, which restricts the raw material supply. However, increasing land privatization and the conversion of babassu forests into monocultures like cattle pasture and soybean fields have encroached upon these forests. This has made it harder for the breakers to access the palms, directly threatening their livelihoods and the supply of babassu nuts for oil production

Communities have also organized through the Interstate Movement of Babassu Coconut Breakers, forming cooperatives and pushing Free Babaçu bills in municipalities. These initiatives aim to secure land access, improve bargaining power, and ensure that local people, not just large landowners, benefit from babassu oil’s value chain.

NGOs, or governments, support these cooperatives, or when laws secure access to forests, they’re not just securing raw materials. They’re protecting a way of life. These women hold knowledge, tradition, and resilience. Let’s not forget: behind every ton of oil is a woman, deeply rooted in her land, counting on access to continue her work.

Opportunity

Rising Demand for Natural and Sustainable Products

Across the world, more people are choosing what’s simple, gentle, and kind for their skin, bodies, and the planet. That rising preference for natural and sustainably sourced ingredients has become a powerful growth engine for babassu oil, especially in the cosmetics, personal care, and food sectors.

Babassu oil is often compared to coconut oil, but it has a lighter, creamier feel, melts at body temperature, and leaves just a whisper of a soothing, cool sensation. This makes it a favorite in lotions, creams, and beauty products that consumers love to massage into their skin. At the same time, its stable and mild nature lends itself well to cooking products that value both health and flavor.

Trends

Supporting Traditional Women-Led Economies and Biodiversity-Friendly Practices

In the Brazilian states of Maranhao, Tocantins, Para, and Piaui, an estimated 1 million women babassu breakers (called quebradeiras de coco babacu) make their living by collecting and processing babassu fruit. This practice is more than work; it is a deep expression of community wisdom and ecological care.

Brazil has taken steps to formally protect this vital tradition. Maranhão’s constitution now explicitly guarantees the protection of babassu palm groves as a source of income for rural workers, even granting access to public lands in support of family and community economies. These are known as the Free Babassu laws, first passed in Lago do Junco.

The collecting babassu sustainably, they preserve the land and their own way of life hands-on, communal, and deeply respectful of nature. Not only is the oil a livelihood, it’s a legacy. Unlike monocultures linked with palm oil controversies, babassu groves integrate well with other species of orchards, pasture, and even small-scale farming. This creates living, multi-use landscapes full of life, not lifeless plantations.

Regional Analysis

North America leads with a 41.8% share and a USD 91.8 Million market value.

In 2024, North America dominated the babassu oil market, capturing 41.8% of global revenue, about USD 91.8 Million, underpinned by resilient demand from personal care, soaps, and household cleaners that favor lauric-rich oils for mild foaming and conditioning.

The U.S. Food & Drug Administration’s MoCRA requirements pushed brands toward clearer ingredient stewardship, which supports the adoption of plant-derived inputs like babassu alongside coconut and palm kernel oils. The United States’ vegetable oil balance tightened, reinforcing reliance on imported oils and fats.

Lauric oil trade flows notably coconut and palm kernel showed continued volatility in U.S. lauric oil, before stabilizing through 2024, which encouraged formulators to diversify lauric sources, including babassu, to manage cost and supply risk. Retailers’ premium private labels and indie brands are expected to keep.

North American usage steady in rinse-off and leave-on products, while home care blenders leverage babassu’s low-temperature fluidity and biodegradability to meet internal sustainability scorecards. Coupled with robust e-commerce penetration and MoCRA-driven transparency.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mielle Organics leverages babassu oil as a premium ingredient in its acclaimed hair care products. The company drives market growth by targeting conscious consumers seeking natural, multifunctional oils for hydration and scalp health. Its strong brand loyalty and effective digital marketing strategies significantly influence retail and e-commerce segments, making it an influential niche brand that promotes the oil’s versatile benefits beyond traditional applications.

Cargill is a major force in the babassu oil supply chain, leveraging its vast network for sourcing and processing. The company supplies large volumes of high-quality, sustainable oil to the food, cosmetic, and industrial sectors. Its focus on responsible sourcing and ability to meet bulk demand from multinational manufacturers solidifies its position as a critical B2B supplier, shaping market availability and pricing on an international scale.

Sheabutter Cottage specializes in handcrafted, natural personal care products, featuring babassu oil as a star ingredient in soaps, lotions, and balms. The brand captures a dedicated audience valuing artisanal quality, transparency, and ethical sourcing directly from small communities. This approach promotes babassu oil’s pure, skin-nourishing properties, strengthening its presence in the premium.

Top Key Players in the Market

- Mielle Organics

- Cargill

- Sheabutter Cottage

- Dr. Adorable Inc.

- ANITA GRANT

- Atomm Botanicals

- Atina

- Citróleo

- Hallstar

- Pioma Chemicals

Recent Developments

- In 2024, Mielle Organics joined P&G Beauty, pending regulatory approval, to expand access to healthy hair products for Black women globally. The partnership aims to enhance innovation, community investment, and product reach, with Mielle operating as an independent subsidiary led by co-founders Monique and Melvin Rodriguez.

- In 2024, Cargill, a major player in the global edible oils industry, continues to prioritize sustainability in its sourcing of raw materials, including palm, soybean, and canola oils. While babassu oil is not explicitly mentioned, Cargill’s focus on sustainable agricultural practices and traceable supply chains for natural oils is relevant to the babassu oil sector.

Report Scope

Report Features Description Market Value (2024) USD 219.8 Million Forecast Revenue (2034) USD 344.6 Million CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Ву Туре (Conventional, Organic), By Form (Liquid, Powder), By Application (Cosmetics, Food and Beverage, Pharmaceutical, Others), By Distribution Channel (Supermarkets and Hypermarkets, Online Retail, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mielle Organics, Cargill, Sheabutter Cottage, Dr. Adorable Inc., ANITA GRANT, Atomm Botanicals, Atina, Citróleo, Hallstar, Pioma Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Mielle Organics

- Cargill

- Sheabutter Cottage

- Dr. Adorable Inc.

- ANITA GRANT

- Atomm Botanicals

- Atina

- Citróleo

- Hallstar

- Pioma Chemicals