Global Autonomous Mining Drones By Component (Hardware, Software, Services), By Automation Level (Remotely Operated, Semi-Autonomous, Fully Autonomous) By Application (Surveying and Mapping, Stockpile Management, Blast Hole Inspection, Others), By Mining Type (Surface Mining, Underground Mining) By End-User (Metal Mining, Mineral Mining, Coal Mining) By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165461

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

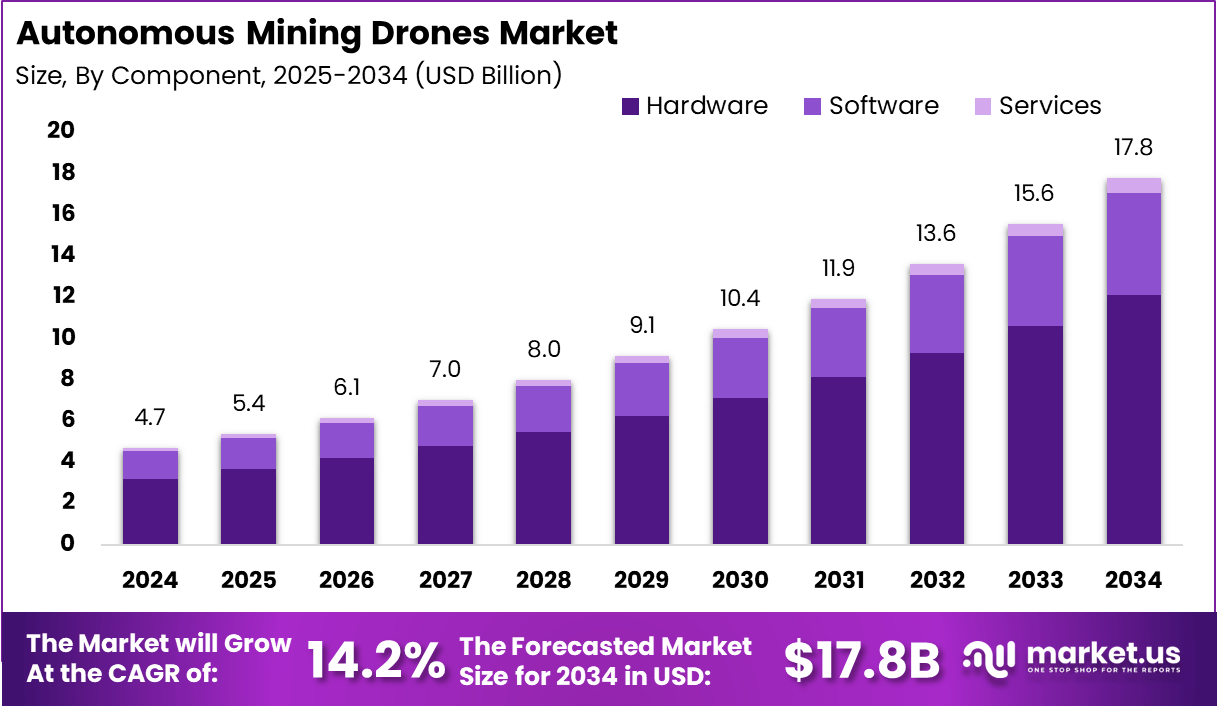

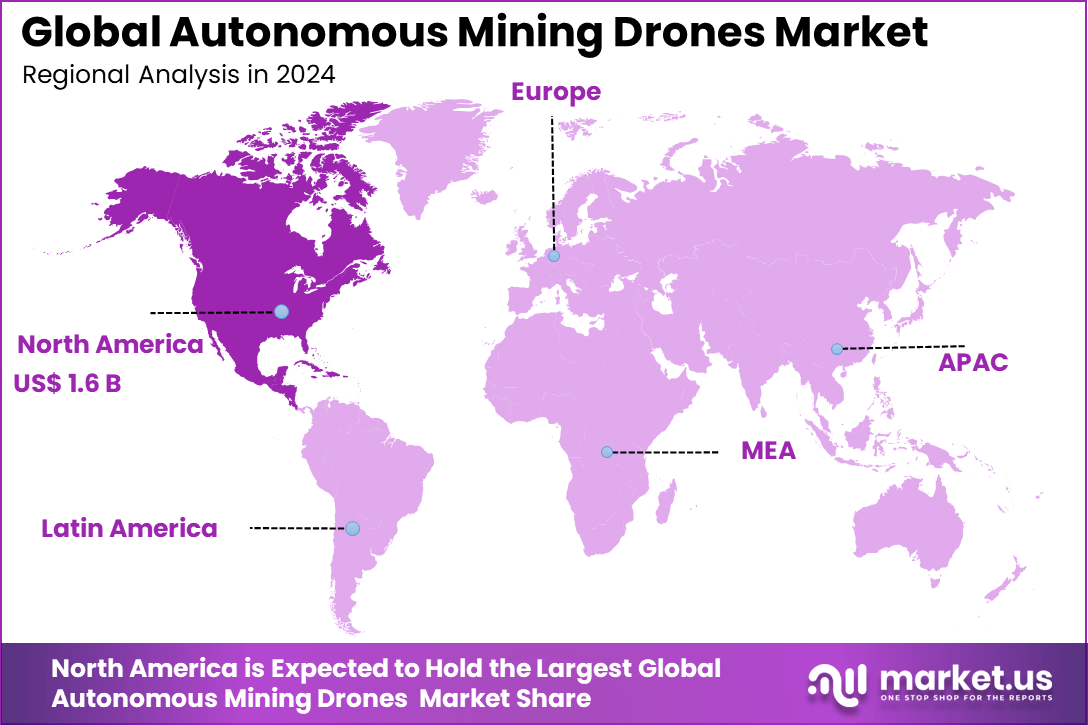

The Global Autonomous Mining Drones Market generated USD 4.7 billion in 2024 and is predicted to register growth from USD 5.4 billion in 2025 to about USD 17.8 billion by 2034, recording a CAGR of 14.2% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 34.1% share, holding USD 1.6 Billion revenue.

The autonomous mining drones market has been expanding as mining operators adopt automated aerial systems to improve efficiency, safety and visibility across large mining sites. These drones are increasingly used for tasks that previously required manual labour, including inspection, mapping and monitoring. Growth reflects the broader shift toward digital mining operations where real time data collection and autonomous systems support faster decision making.

The growth of the market can be attributed to rising demand for safer mining operations, the need to reduce worker exposure in high risk areas and the growing use of precision mapping for mine planning. Increased investments in digital transformation programs inside mining companies are also strengthening adoption. Availability of better batteries, advanced navigation systems and long endurance platforms is accelerating the transition toward autonomous aerial tools.

According to Market.us research report, The global Drone market is projected to reach USD 95.4 billion by 2034, rising from USD 36.4 billion in 2024 at a 10.1% CAGR from 2025 to 2034. In 2024, APAC led the market with more than 40.2% share, generating about USD 14.63 billion in revenue.

Demand is rising across both surface and underground mining activities. Large mines require continuous monitoring of stockpiles, blast zones and haul roads, which creates strong interest in automated drones that can operate without manual piloting. Companies using remote or difficult terrains rely on these systems to maintain visibility and reduce operational delays. Demand is also supported by the need to lower survey time and improve measurement accuracy.

Key Takeaway

- Hardware forms 68.1% of the autonomous mining drones market. Durable drones and sensors are essential for tough mining conditions.

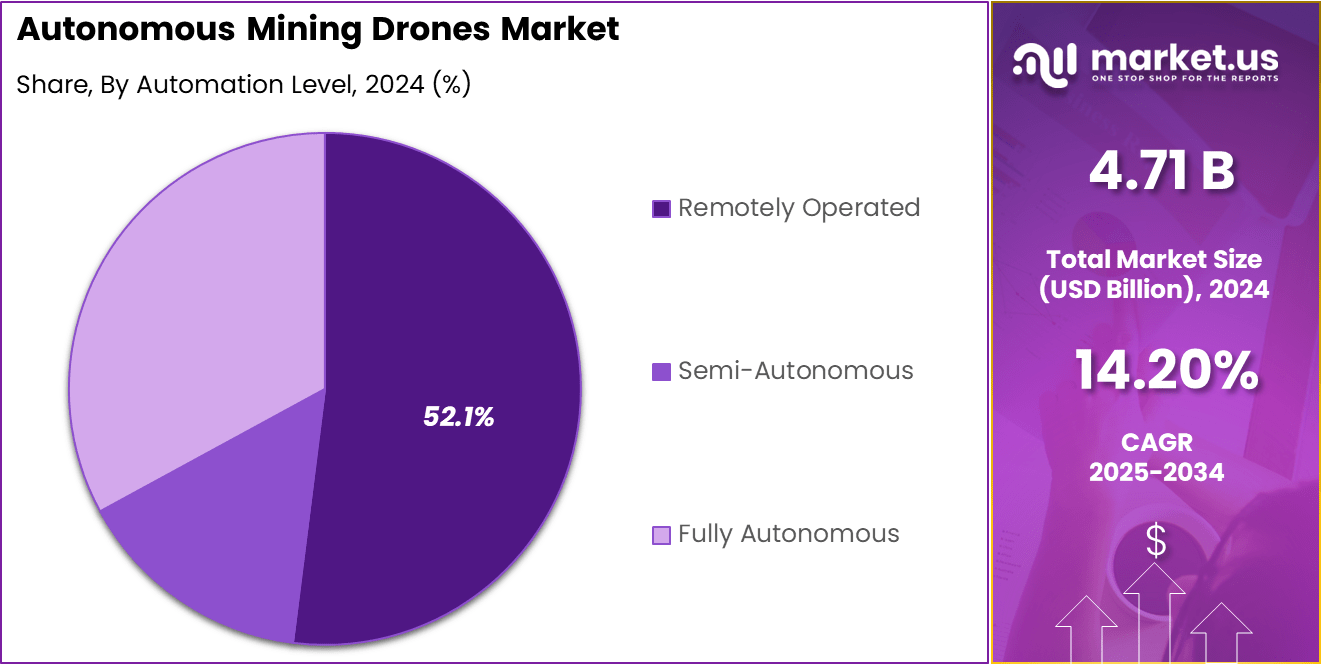

- Remotely operated drones hold 52.1% of automation. Balances human control and automation for safety and flexibility.

- Surveying and mapping make up 41.6% of use cases. These drones produce precise maps and 3D models quickly.

- Surface mining represents 72.6% of adoption. Open sites benefit most from drone coverage and monitoring.

- Mineral mining accounts for 51.8% of end-users. Drones help improve safety and data accuracy in mineral extraction.

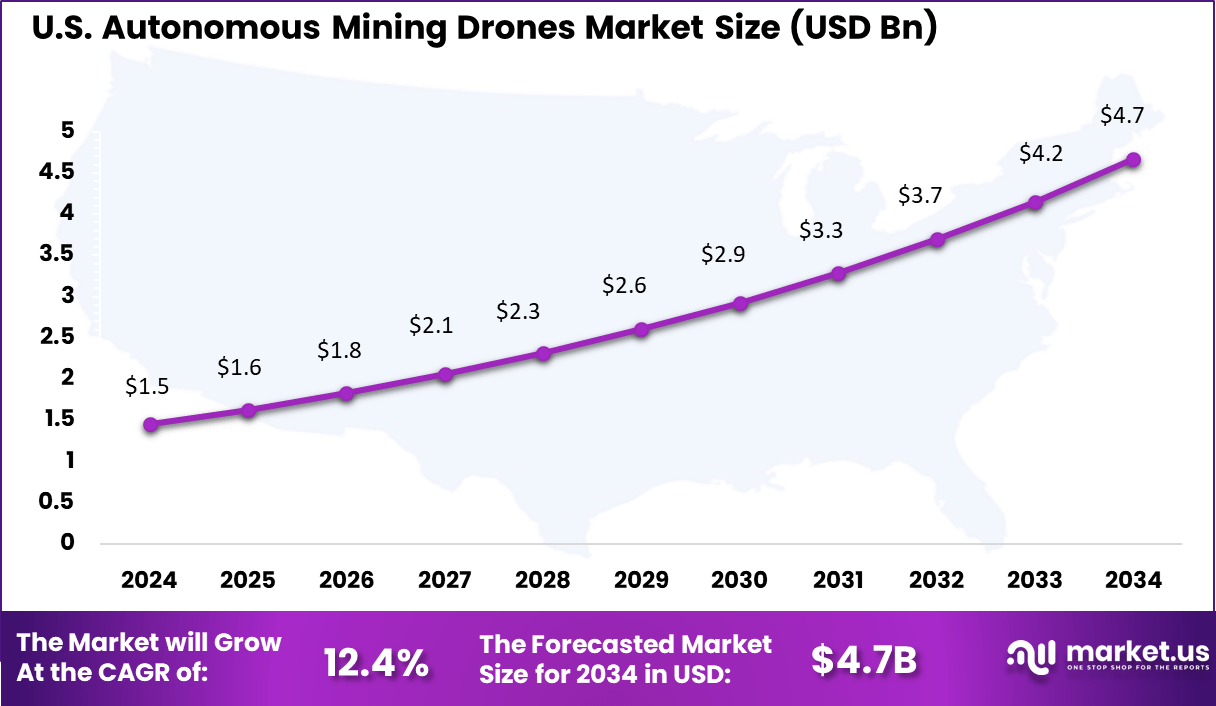

- North America accounted for 34.1% of the market, with the US generating about USD 1.45 billion and recording a 12.4% CAGR.

Adoption and Efficiency Statistics

Increased Adoption

- Global mining operations recorded a 67% increase in drone adoption over a three-year period.

- Autonomous systems represent the fastest-growing category within mining technology investments.

- By 2025, more than 60% of new mining equipment purchases are expected to include autonomous or automated capabilities.

Efficiency Gains

- AI-powered mining vehicles can improve operational efficiency by up to 20% compared with conventional machinery.

- Drones can cut surveying data acquisition time by as much as 90%, supporting faster and more accurate site assessments.

- One case study reported that a single autonomous drone flight covered an area equal to nine football stadiums representing 16 million cubic meters of surface mapping.

Safety and Operational Benefits

Accident Reduction

- Automated mining vehicles can reduce workplace accidents by up to 30% by keeping workers away from high-risk zones.

Environmental Monitoring

- Drones are frequently used to monitor noise, dust, land stability, and the structural integrity of tailings dams, improving compliance across environmental regulations.

Key Users

- Large mining firms are driving adoption at scale.

- BHP conducts more than 600 drone flights per month across six operational sites.

- Rio Tinto operates the world’s largest autonomous drilling fleet, reinforcing its leadership in automation.

U.S. Market Size

The United States is the largest contributor within North America, with a market value of USD 1.45 billion and a compound annual growth rate (CAGR) of 12.4%. This growth is fueled by ongoing investments in smart mining technologies, digital transformation, and the need for safer, more efficient mining practices. The U.S. market continues to expand as more companies integrate autonomous drones into their daily operations, setting a benchmark for the rest of the world.

North America holds a 34.1% share of the global autonomous mining drones market, making it one of the leading regions for adoption and investment. The region’s strong infrastructure, advanced technology adoption, and supportive regulatory environment have helped drive rapid growth in the sector. Mining companies in North America are increasingly using drones for surveying, mapping, and monitoring, which boosts efficiency and safety across operations.

Component Analysis

In 2024, Hardware makes up 68.1% of the autonomous mining drones market, showing that physical drone systems are the main investment for mining companies. Most of the spending goes toward drones equipped with advanced sensors, cameras, and navigation systems that can operate in tough environments. These hardware components are essential for tasks like mapping, surveying, and monitoring mine sites, where reliability and durability are critical.

The focus on hardware also reflects the need for robust, weather-resistant drones that can handle dust, heat, and rough terrain. As mining operations expand into more remote and challenging locations, the demand for high-performance hardware continues to grow. This segment is expected to remain dominant as new technologies like LiDAR and multispectral imaging become standard in mining drones.

Automation Level

In 2024, Remotely operated drones account for 52.1% of the market, highlighting the industry’s preference for systems that can be controlled from a distance. This approach allows operators to manage drones from safe, centralized locations, reducing the need for on-site personnel in hazardous areas. Remotely operated drones are widely used for surveying, inspection, and monitoring tasks, where real-time control is important.

The shift toward remote operation is driven by safety and efficiency. Mining companies can cover large areas quickly and respond to changing conditions without exposing workers to risks. As communication networks improve, remote operation is becoming more reliable and accessible, making it a preferred choice for many mining operations.

By Application

In 2024, Surveying and mapping is the leading application for autonomous mining drones, representing 41.6% of the market. Drones equipped with LiDAR and multispectral cameras are used to create detailed 3D maps and topographic models of mine sites. This helps mining companies track progress, plan new excavations, and manage resources more efficiently.

The speed and accuracy of drone-based surveying have made it a standard practice in modern mining. Compared to traditional ground surveys, drones can cover large areas in less time and with fewer errors. This application is especially valuable for monitoring stockpiles, assessing terrain, and supporting exploration activities

Mining Type

In 2024, Surface mining is the most common type of mining where autonomous drones are used, making up 72.6% of the market. Open-pit mines and other surface operations benefit from drones that can monitor large, exposed areas for safety, progress, and resource management. Drones help track excavation, map terrain, and inspect infrastructure without the need for manual surveys.

The use of drones in surface mining is growing as companies look for ways to improve efficiency and reduce costs. Drones can quickly identify changes in the landscape, monitor stockpiles, and support planning for new operations. This segment is expected to remain dominant as surface mining continues to expand globally.

End-User Segment

In 2024, Mineral mining is the largest end-user segment for autonomous mining drones, accounting for 51.8% of the market. Drones are used by mineral mining companies to support exploration, mapping, and monitoring activities. These systems help locate valuable resources, assess site conditions, and ensure safe and efficient operations.

The adoption of drones in mineral mining is driven by the need for accurate data and improved safety. Drones can access remote or hazardous areas, providing valuable insights without putting workers at risk. As demand for minerals grows, mining companies are investing more in drone technology to stay competitive and sustainable.

Key Segments

By Component

- Hardware

- Software

- Services

By Automation Level

- Remotely Operated

- Semi-Autonomous

- Fully Autonomous

By Application

- Surveying and Mapping

- Stockpile Management

- Blast Hole Inspection

- Others

By Mining Type

- Surface Mining

- Underground Mining

By End-User

- Metal Mining

- Mineral Mining

- Coal Mining

Driver

Enhanced Safety and EfficiencyAutonomous mining drones are making a big difference by improving safety in hazardous mining environments. These drones can fly into unstable or dangerous areas where sending workers would be risky. With advanced sensors and AI, they detect hazards like loose rocks or gas leaks before they become serious problems, helping mining companies take action early and prevent accidents.

Another major benefit is the boost in operational efficiency. Drones can survey large mining sites and monitor equipment much faster than traditional methods, cutting inspection time from days to hours. This means mines can respond quickly to maintenance needs, reduce downtime, and optimize their workflow. By automating routine tasks, mining operations become safer, more productive, and less dependent on manual labor.

Restraint

High Initial Investment and Regulatory BarriersThe upfront cost of autonomous mining drones is a significant barrier for many companies. Advanced drones with AI, LiDAR, and robust software can cost between $50,000 and $200,000 per unit, making them a big investment. Smaller mining firms may struggle to afford this technology, which slows down adoption and limits access to its benefits.

Regulatory requirements also pose a challenge. Many countries have strict rules for drone use in mining, including permits, flight restrictions, and compliance checks. These regulations add extra costs and delays, making it harder for companies to deploy drones quickly and efficiently. As a result, regulatory hurdles can stall innovation and slow the spread of autonomous drone technology in the mining sector.

Opportunity

Expansion in Remote and Challenging TerrainsAutonomous mining drones are opening new opportunities in remote and difficult-to-access areas. Traditional surveying methods often struggle in rugged landscapes, dense forests, or underground mines. Drones with VTOL capabilities can fly into these locations, providing accurate data for exploration and site management without risking human lives.

Outsourcing drone services is another growing trend. Mining companies can now access advanced drone capabilities without buying expensive equipment. This allows even small firms to benefit from drone technology and creates a market for specialized drone service providers. As demand increases, this ecosystem will continue to expand and support more innovative solutions for challenging terrains.

Challenge

Integration with Legacy Systems and Workforce AdaptationIntegrating autonomous drones with older mining systems is a major challenge. Many mines still rely on legacy equipment and outdated IT infrastructure, making it difficult to connect new drone technology. This lack of compatibility can lead to inefficiencies and delays, slowing down the adoption of autonomous solutions.

Workforce adaptation is another hurdle. Employees need training to use and manage autonomous drones, and there can be resistance to change, especially if automation leads to job displacement. Ensuring that staff are comfortable with new technology and that cybersecurity is strong is essential for successful implementation. Overcoming these challenges requires investment in training, communication, and ongoing support.

Key Players Analysis

DJI, FLIR Systems, and senseFly (AgEagle) hold a strong presence in the autonomous mining drones market. Their focus remains on delivering high-precision mapping, improved safety monitoring, and reliable autonomous flight systems. These companies invest in advanced sensors, thermal imaging, and long-range navigation capabilities. Their technologies support faster site assessments and reduced manual inspection requirements.

Delair, Skycatch, Kespry, Autel Robotics, and PrecisionHawk contribute to market expansion through specialized survey-grade drone platforms. Their solutions focus on accurate volumetric analysis, terrain modeling, and automated data workflows. These companies prioritize ease of deployment to support daily mine-site operations. Better integration with cloud-based analytics enables faster decision-making for pit planning and resource tracking.

Airobotics, Flyability, Microdrones, 3DR, Parrot, Hovermap, Volatus Aerospace, and others add diversity with niche capabilities such as confined-space inspection, high-endurance flight, and autonomous launch stations. Their systems are used for underground mapping, structural monitoring, and safety compliance checks. Strong demand for minimizing worker exposure in hazardous zones supports their adoption.

Top Key Players in the Market

- DJI

- FLIR Systems

- senseFly (AgEagle)

- Delair

- Skycatch

- Kespry

- Autel Robotics

- PrecisionHawk

- Airobotics

- Flyability

- Microdrones

- 3DR

- Parrot

- Hovermap

- Volatus Aerospace

- Others

Recent Development

- November, 2025, DJI launched the Neo 2, its lightest and most compact drone yet, featuring omnidirectional obstacle sensing and gesture control. While not exclusively for mining, the Neo 2’s safety and imaging upgrades are expected to benefit inspection and surveying tasks in complex mining sites.

- June, 2025, Delair unveiled the DT61 at the Paris Air Show, a new long-distance observation drone with vertical takeoff and increased payload capacity. The DT61 is designed for multi-mission use, including large-scale mining inspections. Delair expects commercialization by the end of 2025, with plans to expand its drone fleet for both civilian and military applications.

Report Scope

Report Features Description Market Value (2024) USD 4.71 Bn Forecast Revenue (2034) USD 17.8 Bn CAGR(2025-2034) 14.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Automation Level (Remotely Operated, Semi-Autonomous, Fully Autonomous) By Application (Surveying and Mapping, Stockpile Management, Blast Hole Inspection, Others), By Mining Type (Surface Mining, Underground Mining) By End-User (Metal Mining, Mineral Mining, Coal Mining), Autonomous Mining Drones Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DJI, FLIR Systems, senseFly (AgEagle), Delair, Skycatch, Kespry, Autel Robotics, PrecisionHawk, Airobotics, Flyability, Microdrones, 3DR, Parrot, Hovermap, Volatus Aerospace, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autonomous Mining Drones MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Autonomous Mining Drones MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

DJI FLIR Systems senseFly (AgEagle) Delair Skycatch Kespry Autel Robotics PrecisionHawk Airobotics Flyability Microdrones 3DR Parrot Hovermap Volatus Aerospace Others