Global Automotive Telematics Market Size, Share, Growth Analysis By Technology Type (Embedded, Tethered, Integrated), By Solution (Component, Service), By Vehicle Type (Passenger, Commercial), By Application (Information & Navigation, Safety & Security, Fleet Management, Insurance Telematics, Others), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169394

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

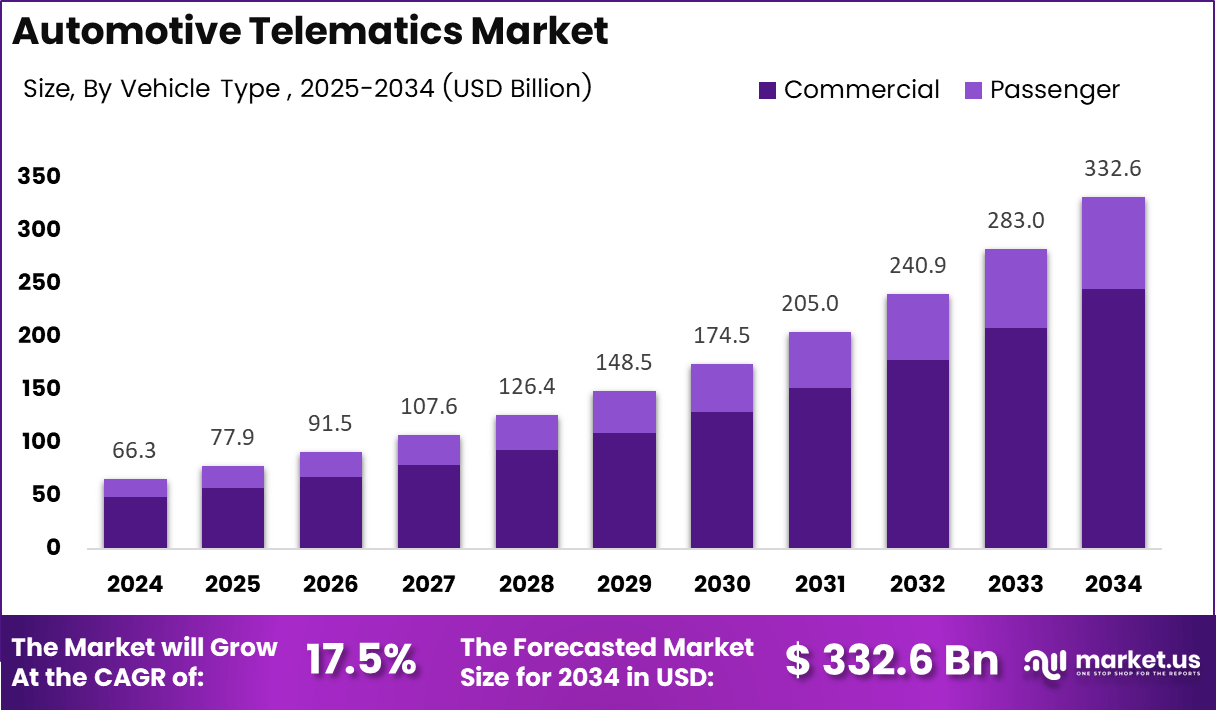

The Global Automotive Telematics Market size is expected to be worth around USD 332.6 billion by 2034, from USD 66.3 billion in 2024, growing at a CAGR of 17.5% during the forecast period from 2025 to 2034.

The Automotive Telematics Market represents a connected-vehicle ecosystem enabling real-time monitoring, navigation, predictive maintenance, and wireless communication. It integrates telecom technologies, onboard diagnostics, cloud platforms, and smart mobility systems that support safer driving, fleet optimization, and regulatory compliance across passenger and commercial vehicles.

The market advances steadily as automakers adopt integrated telematics units to enhance operational visibility and customer engagement. Growing emphasis on vehicle safety, intelligent routing, and remote diagnostics accelerates demand. Meanwhile, rising consumer expectations for connected-car features encourage broader deployment of in-vehicle connectivity modules and cloud-enabled telematics services.

The sector gains momentum as governments strengthen investments in ITS infrastructure, data standardization, and Automotive vehicle-to-everything communication frameworks. Regulatory authorities increasingly mandate telematics-enabled emergency response systems, emission reporting, and automated safety features, stimulating higher adoption among OEMs. These interventions also promote standardized architectures supporting interoperability across diverse vehicle platforms.

Telematics adoption expands as emerging opportunities materialize across fleet automation, usage-based insurance, predictive maintenance, and EV ecosystem management. Increasing penetration of electric vehicles creates an additional need for battery performance tracking and route efficiency analytics. Growth in mobility-as-a-service platforms further amplifies application potential across logistics, leasing, and subscription-based mobility operators.

Technology evolution transforms market dynamics as edge computing, AI-enabled diagnostics, cloud analytics, and cybersecurity frameworks mature. Advancements improve real-time decision-making, reduce operating downtime, and enhance vehicle lifecycle management. Additionally, rising smart-city investments stimulate integration of telematics with traffic systems, environmental monitoring, and automated enforcement networks.

The role of standardized vehicle data becomes increasingly critical to market scalability. According to the Car Survey, a 2015 gas-powered vehicle generates different data formats compared with a 2023 electric vehicle, prompting businesses to use Smartcar APIs to standardize data across 40+ brands through consistent endpoints that simplify connectivity and integration.

Connectivity adoption rises further as 5G accelerates high-bandwidth vehicle communication. According to global telecom assessments, 9 out of 10 new vehicles are shipped with built-in internet connectivity, enabling faster telematics data exchange and supporting advanced features such as autonomous navigation, V2X communication, and real-time fleet intelligence that strengthen telematics market growth.

Key Takeaways

- The global Automotive Telematics Market reached USD 66.3 billion in 2024 and is expected to exceed USD 332.6 billion by 2034.

- The market is projected to expand at a strong 17.5% CAGR from 2025 to 2034.

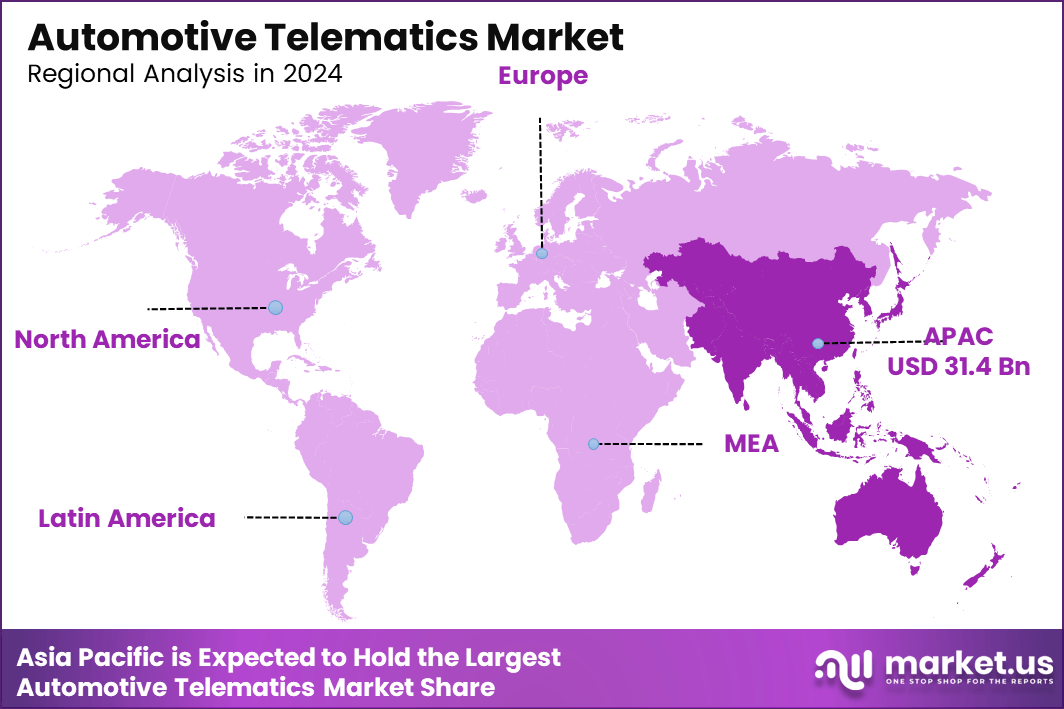

- Asia Pacific dominated the market with a 47.4% share, generating USD 31.4 billion in telematics revenue.

- Embedded technology led the technology segment with a 49.6% share in 2024.

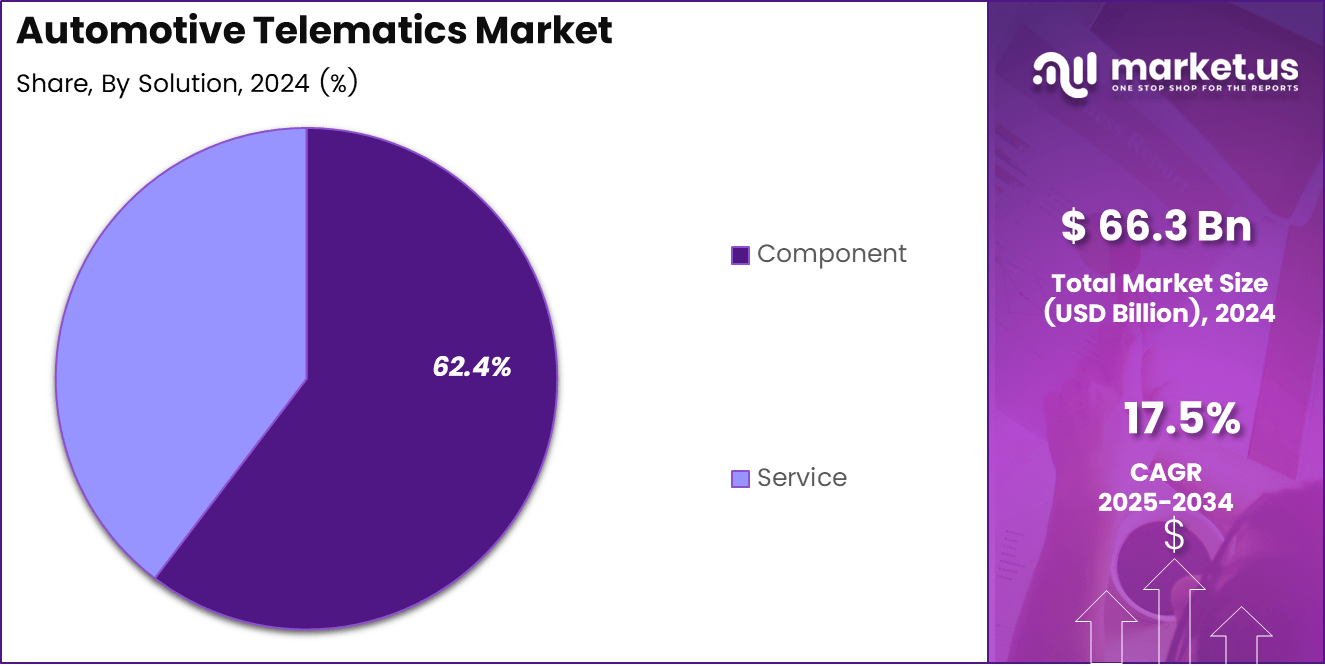

- The Component category held the highest solution share at 62.4%, driven by hardware and sensor integration.

- Passenger vehicles represented the largest vehicle segment with a 73.8% market share.

- Information and Navigation emerged as the leading application area with a 34.9% share in 2024.

Technology Type Analysis

Embedded dominates with 49.6% due to deeper integration, faster data access, and higher OEM adoption.

In 2024, Embedded held a dominant market position in the By Technology Type Analysis segment of the Automotive Telematics Market, with a 49.6% share. Embedded systems continue accelerating usage as automakers integrate advanced connectivity, diagnostics, and performance monitoring directly into vehicle architecture, improving reliability and remote management features across modern fleets.

Tethered systems remained relevant because they bridge older connectivity models with modern telematics needs. These systems support drivers transitioning from legacy architectures, enabling cost-efficient upgrades while maintaining access to navigation, maintenance alerts, and communication functions through paired smartphones. This segment remains significant for value-focused markets and retrofitted vehicle ecosystems seeking flexible extensions.

Integrated systems advanced steadily as manufacturers invest in unified digital ecosystems. Integrated telematics combine embedded processing with cloud-based applications, enhancing user experiences through coordinated communication, infotainment, and predictive analytics. Growing demand for seamless digital dashboards pushes adoption among connected vehicle programs focusing on efficiency, personalization, and intelligent driving environments across passenger and commercial segments.

Solution Analysis

Component dominates with 62.4% due to rising demand for sensors, modules, and control units.

In 2024, Component held a dominant market position in the By Solution Analysis segment of the Automotive Telematics Market, with a 62.4% share. Growth stems from increasing integration of hardware modules enabling diagnostics, GPS tracking, data capture, and seamless connectivity, driven by OEM mandates and rapid electrification trends across global markets.

Service solutions continued expanding as telematics providers deliver subscription-based offerings, including fleet insights, real-time monitoring, remote updates, and predictive analytics. These services strengthen operational efficiency for fleet owners and help OEMs build recurring revenue models. Rising adoption of software-defined vehicles accelerates service-centric enhancements across connected mobility ecosystems.

Vehicle Type Analysis

Passenger dominates with 73.8% supported by strong consumer demand for safety, smart mobility, and infotainment features.

In 2024, Passenger vehicles held a dominant market position in the By Vehicle Type Analysis segment of the Automotive Telematics Market, with a 73.8% share. Expanding EV adoption, integrated safety systems, and digital cockpit preferences strengthened telematics uptake, especially among tech-savvy urban buyers valuing connectivity and enhanced vehicle intelligence.

Commercial vehicles advanced as operators prioritized telematics for optimizing fleet efficiency, fuel tracking, driver performance, and compliance management. Businesses embraced data-driven operations to reduce downtime, streamline logistics, and improve routing accuracy. Growing regulatory pressure for vehicle monitoring and safety encourages broader adoption of telematics across commercial fleets of varying sizes.

Application Analysis

Information & Navigation dominates with 34.9% due to high usage of routing, mapping, and driving-assistance tools.

In 2024, Information & Navigation held a dominant market position in the By Application Analysis segment of the Automotive Telematics Market, with a 34.9% share. Rising adoption of real-time traffic data, predictive routing, and integrated mapping platforms strengthened this segment across connected passenger and commercial vehicles in global markets.

Safety & Security applications expanded steadily as telematics enabled emergency alerts, crash detection, remote immobilization, and theft-prevention capabilities. Growing consumer interest in proactive safety features and regulatory focus on advanced driver assistance contributed significantly to this segment’s continued adoption across various vehicle categories worldwide.

Fleet Management gained traction as logistics operators prioritized vehicle tracking, fuel monitoring, automated reporting, and compliance tools. Large and mid-scale fleets increasingly leverage telematics platforms to reduce operational costs, optimize asset utilization, and enhance on-road performance, strengthening competitiveness in transportation, delivery, and mobility services.

Insurance Telematics progressed as usage-based insurance models accelerated adoption. Real-time driving-behavior analytics, mileage data, and risk scoring helped insurers develop personalized products. Consumers and fleet owners embraced telematics-driven insurance for cost transparency, safer driving incentives, and improved claims accuracy, enhancing engagement across mobility ecosystems.

Others included emerging applications supporting diagnostics, infotainment, and vehicle-to-cloud services. These evolving features enrich vehicle connectivity and provide enhanced user experiences.

Key Market Segments

By Technology Type

- Embedded

- Tethered

- Integrated

By Solution

- Component

- Service

By Vehicle Type

- Passenger

- Commercial

By Application

- Information & Navigation

- Safety & Security

- Fleet Management

- Insurance Telematics

- Others

By Sales Channel

- OEM

- Aftermarket

Drivers

Expansion of software-defined vehicle architectures enabling real-time connectivity

Automotive telematics is growing as software-defined vehicle designs support faster updates and continuous connectivity. Automakers use these architectures to manage features remotely, improve navigation accuracy, and push real-time data to onboard systems. This shift strengthens reliability and helps vehicles stay updated without physical servicing needs.

The rising integration of AI-based telematics is also accelerating market expansion. AI analytics help understand driving behavior, detect risky patterns, and support personalized safety recommendations. These intelligent insights improve insurance assessment, fleet planning, and overall road performance, creating stronger adoption across consumer and commercial segments.

OEMs increasingly prioritize predictive maintenance and remote diagnostics, driving demand for telematics solutions. These tools help identify component health issues early, reduce downtime, and avoid expensive repairs. As more vehicles incorporate connected sensors, predictive diagnostics become essential for efficient ownership and fleet management.

Cloud-based telematics platforms are being adopted widely across both passenger and commercial fleets. Cloud systems store large volumes of data securely while enabling real-time monitoring, route optimization, and performance tracking. These platforms also support over-the-air updates, making them critical for next-generation connected mobility strategies.

Restraints

High upfront installation costs are limiting adoption among cost-sensitive buyers

Automotive telematics growth faces constraints as high installation costs discourage smaller fleets and budget buyers. Hardware components, data plans, and integration fees create financial challenges, slowing adoption in developing markets. Cost sensitivity makes these customers depend on basic solutions rather than advanced connected features.

Limited interoperability between older vehicle systems and modern telematics infrastructures also restrains market growth. Legacy vehicles often lack compatible hardware, making integration difficult. Fleet operators with mixed vehicle ages struggle to unify platforms, leading to inefficiencies and inconsistent data quality across operations.

Data privacy remains a major concern for both consumers and regulators. Location tracking, behavioral data, and continuous vehicle monitoring require strong compliance measures. Privacy concerns reduce trust and slow telematics adoption, especially in regions with stricter data regulations and evolving cybersecurity guidelines.

Uncertainty around data usage and ownership further complicates adoption decisions. Drivers and fleet owners often question how collected data is stored, shared, or monetized. Without transparent policies, users hesitate to embrace fully connected systems, affecting market momentum across several application areas.

Growth Factors

Emerging demand for insurer-backed usage-based telematics models

Automotive telematics offers strong opportunities as insurers expand usage-based models. These solutions reward safe driving, personalize premiums, and improve risk evaluation accuracy. Growing acceptance among young drivers and commercial fleets strengthens demand for telematics-enabled insurance programs globally.

Investments in vehicle-to-everything communication technologies continue to create new growth avenues. V2X supports safer roads by enabling communication between vehicles, infrastructure, and pedestrians. This ecosystem improves alert systems, traffic efficiency, and long-distance fleet coordination, making it a major opportunity area for telematics providers.

Expanding EV adoption presents another opportunity, as electric vehicles rely heavily on connected systems for battery monitoring, routing, and charging insights. Telematics helps optimize EV performance and supports energy-efficient mobility planning, encouraging manufacturers to deepen integration across upcoming vehicle models.

Rising digital transformation in transportation encourages governments and industries to adopt smart mobility frameworks. These programs promote connected fleets, intelligent transportation systems, and cloud-managed logistics solutions. Telematics providers benefit from these policy shifts as digital mobility ecosystems continue expanding globally.

Emerging Trends

Shift toward subscription-based telematics service models

Automotive telematics is experiencing a shift toward subscription-based service models, improving affordability and flexibility for users. Monthly service plans allow access to real-time tracking, diagnostics, and navigation without high upfront costs. This model boosts recurring revenue for providers and increases long-term engagement.

The integration of biometrics into telematics dashboards is becoming a key trend. Driver wellness monitoring uses heart rate, fatigue detection, and posture insights to improve safety. Fleet operators use these metrics to reduce accidents and enhance driver performance, supporting safer transportation operations.

Cybersecurity-focused telematics solutions are gaining traction as connected vehicles face increasing digital threats. Encrypted data pipelines and secure communication frameworks help safeguard critical information. Manufacturers and fleets prioritize cybersecurity investments to protect telematics systems from unauthorized access and disruptions.

Advanced sensor fusion and cloud analytics are also shaping telematics trends. These technologies enhance situational awareness, support automated driving features, and improve decision-making. As vehicles evolve into intelligent digital platforms, telematics continues playing a central role in enhancing future mobility experiences.

Regional Analysis

Asia Pacific Leads the Automotive Telematics Market with a Market Share of 47.4%, Valued at USD 31.4 Billion

The Asia Pacific region dominates the automotive telematics market, holding a strong 47.4% share and generating USD 31.4 billion, driven by rapid connected-vehicle adoption and electrification programs. Rising deployment of embedded telematics across China, Japan, and South Korea strengthens regional leadership. Government investments in smart mobility, 5G rollout, and intelligent transport systems further accelerate telematics penetration in both passenger and commercial fleets.

North America Automotive Telematics Market Trends

North America experiences steady growth driven by advanced regulatory frameworks around vehicle safety, data compliance, and telematics-enabled insurance models. The region benefits from strong OEM integration of connectivity platforms, expanding 5G networks, and rising fleet digitization across logistics. Increasing consumer interest in remote diagnostics and real-time vehicle monitoring continues to enhance adoption momentum.

Europe Automotive Telematics Market Trends

Europe’s telematics market expands due to strict EU safety mandates, eCall compliance, and growing electrification initiatives supporting connected-EV ecosystems. Major economies focus on vehicle cybersecurity and data harmonization to support seamless cross-border telematics functionalities. Fleet operators increasingly adopt AI-based telematics to optimize routing, reduce emissions, and improve operational transparency.

Middle East and Africa Automotive Telematics Market Trends

The Middle East and Africa region witnesses rising adoption supported by government smart-city programs and commercial fleet modernization efforts. Telematics solutions gain traction in logistics, oil and gas transport, and security-sensitive operations requiring real-time tracking. Gradual expansion of 4G/5G networks improves connectivity capabilities, enabling higher telematics deployment in emerging urban hubs.

Latin America Automotive Telematics Market Trends

Latin America shows growing telematics uptake as OEMs integrate connected features across mid-range vehicles and fleet operators adopt tracking solutions to reduce theft and enhance route efficiency. Economic digitalization and expanding cloud infrastructure support market growth. Despite varying regulatory maturity, demand for safety, navigation, and driver-behavior monitoring continues to rise across major economies.

United States Automotive Telematics Market Trends

The United States demonstrates strong adoption supported by early telematics integration, expanding EV sales, and widespread 5G availability. Increasing use of telematics in usage-based insurance, fleet automation, and predictive maintenance strengthens market advancement. Federal and state initiatives promoting connected and autonomous mobility further accelerate the country’s leadership within North America.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Telematics Company Insights

The global automotive telematics market in 2024 reflects rapid digital transformation, and Ford Motor Company continues to strengthen its ecosystem through advanced connected-vehicle platforms. The company increasingly integrates telematics into mainstream models, supporting remote diagnostics, enhanced driver insights, and predictive maintenance functionalities that align with growing consumer demand for real-time vehicle intelligence.

Toyota Motor Corporation advances its telematics strategy by embedding intelligent communication systems across its hybrid and electric portfolios. Its focus on safety-driven data services, automated assistance, and remote monitoring enhances user engagement, while its large global fleet accelerates data-driven mobility innovation and supports long-term connected-car scalability.

Mercedes-Benz AG demonstrates strong leadership in premium telematics adoption, leveraging its luxury positioning to drive high-value digital services. Its connected ecosystem offers seamless in-vehicle experiences, advanced navigation intelligence, and personalized mobility features, strengthening customer loyalty and reinforcing the company’s transition toward software-centric vehicle architectures.

Volkswagen AG continues expanding its telematics capabilities through unified software platforms that improve fleet connectivity, real-time diagnostics, and digital service delivery. With growing emphasis on electrification and cloud-based mobility services, the company enhances operational efficiency, vehicle performance visibility, and long-term service revenue potential.

Collectively, these leading companies influence market direction by prioritizing integrated connectivity, cloud telematics, data analytics, and over-the-air software updates. Their strategic investments accelerate the adoption of intelligent transportation systems, shaping the competitive landscape and setting performance benchmarks for the future of connected mobility.

Top Key Players in the Market

- Ford Motor Company

- Toyota Motor Corporation

- Mercedes-Benz AG

- Volkswagen AG

- General Motors Company

- BMW Motors

- AB Volvo

- Hyundai Motor Company

- Tata Motors

- Nissan Motor Co., Ltd.

Recent Developments

- In Oct 2025, Teletrac Navman, a Vontier company and leading connected mobility platform, was named “Vehicle Telematics Solution of the Year” at the 6th annual AutoTech Breakthrough Awards.The recognition highlights Teletrac Navman’s leadership in automotive and transportation technology, honoring innovation across global telematics solutions.

- In Dec 2025, shares of Blue Cloud Softech Solutions rose by 3% to ₹25.20 following the announcement of a strategic MoU with ConnectM Technology Solutions.The collaboration focuses on jointly developing a semiconductor based EdgeAI System on Chip (SoC) for advanced automotive cybersecurity applications.

Report Scope

Report Features Description Market Value (2024) USD 66.3 billion Forecast Revenue (2034) USD 332.6 billion CAGR (2025-2034) 17.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology Type (Embedded, Tethered, Integrated), By Solution (Component, Service), By Vehicle Type (Passenger, Commercial), By Application (Information & Navigation, Safety & Security, Fleet Management, Insurance Telematics, Others), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ford Motor Company, Toyota Motor Corporation, Mercedes-Benz AG, Volkswagen AG, General Motors Company, BMW Motors, AB Volvo, Hyundai Motor Company, Tata Motors, Nissan Motor Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Telematics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Telematics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ford Motor Company

- Toyota Motor Corporation

- Mercedes-Benz AG

- Volkswagen AG

- General Motors Company

- BMW Motors

- AB Volvo

- Hyundai Motor Company

- Tata Motors

- Nissan Motor Co., Ltd.