Global Aquafeed Additives Market By Ingredients (Feed Acidifiers, Anti-parasitic, Essential Oils and Natural Extracts, Prebiotics, and Palatants), By Form(Dry Form, Wet Form, Moist Form), By Application (Rainbow Trout, Carp, Tilapia, Salmon, Catfish, Crustaceans, Groupers, and Sea Bass), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 70364

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

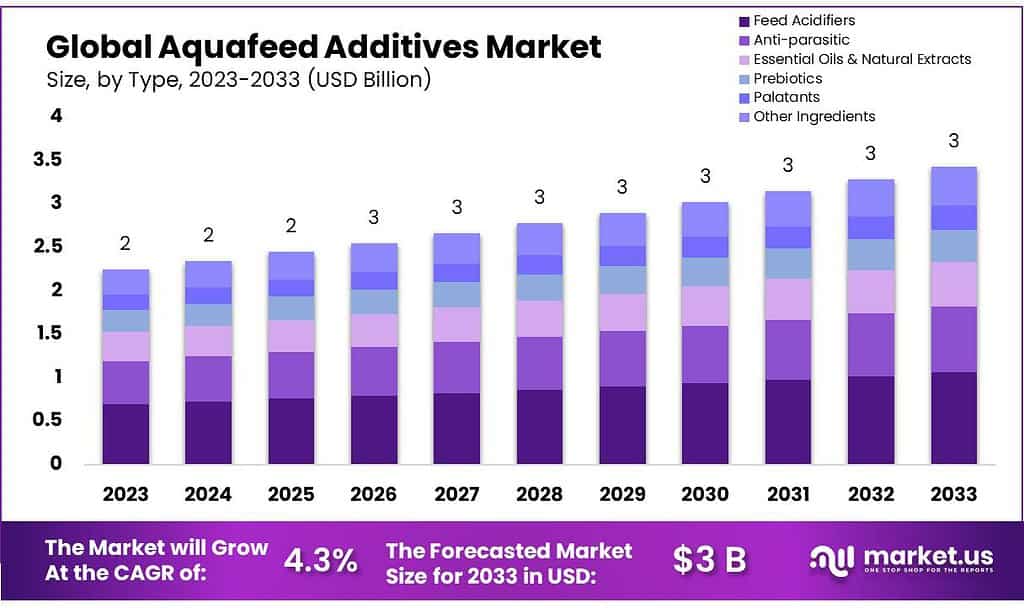

The Aquafeed Additives Market size is expected to be worth around USD 3 billion by 2033, from USD 2 Bn in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

This is due to an increase in the consumption of aqua, dairy, and processed poultry. In the next few years, there will be a growing demand for high-quality meat and its by-products. The concern about the safety and quality of meat has led to an increase in animal diseases.

This will drive the demand for animal feed additives. Vitamins are used extensively in animal feed formulations as additives. Vitamins are already present in animal feeds. However, supplements with vitamins that provide optimal nutrition are often added to feeds for livestock. This drives the demand for vitamins.

Key Takeaways

- Feed Acidifiers Dominate: In 2023, feed acidifiers held 30% market share, crucial for pH balance and parasite control in aquatic animals.

- Form Segmentation: Dry Form, with a 56.3% share, offers ease of handling and longer shelf life. Wet Form is palatable, while the Moist Form combines benefits.

- Catfish Leads Application: Catfish farming commands a 22.9% market share, followed by trout and carp farming, expanding the market scope.

- Challenges: Fluctuating raw material prices and stringent regulations pose challenges. Market competitiveness affects newer businesses.

- Innovation Opportunities: New additives, global aquaculture expansion, and sustainability efforts create growth opportunities.

- Latin America Leading: Latin America, with over 37% revenue share, benefits from local feed availability. North America grows due to increased seafood consumption.

Ingredient Analysis

In 2023, feed acidifiers held a dominant market position, capturing more than a 30% share. Helping Digestion with Acidifiers, Acidifiers are super important in aquafeed. They help keep the right pH levels in the tummies of aquatic animals.

This makes digestion and getting nutrients easier for these animals. Fighting Parasites and anti-parasitic additives are getting popular. They stop parasites from making fish and other water animals sick. Using these additives helps aquatic animals stay healthier and grow better by preventing these infections.

The forecast period will see a rise in awareness by both consumers and producers of the aquaculture sector about sustainable and responsible aquaculture practices. These antiparasitics can be used to prevent parasite-related infections in fish and improve feed quality.

To prevent the spread of parasitic diseases in aquatic species, it is necessary to include anti-parasitic ingredients in aquaculture feed due to the complexity and diversity of parasites such as myxozoans and unicellular organisms. Over the forecast period, this will drive demand for anti-parasitic substances. Aquafeed uses palatants as flavor-enhancing agents. They have been shown to improve the taste and nutritional value of aquafeed. Over the forecast period, there will be an increase in demand for palatants.

By Form

Dry Form Holding a dominant market position, Dry Form captured more than a 56.3% share. This segment’s strength is attributable to its ease of handling, storage efficiency, and longer shelf life, making it a preferred choice in various aquaculture operations. The cost-effectiveness of dry-form additives, coupled with their wide availability, has further bolstered their demand in the market.

Wet Form The Wet Form segment, while smaller in market share compared to Dry Form, offers distinct benefits that drive its demand. These additives are known for their high palatability and nutrient retention, making them an attractive option for specific aquaculture needs. However, the challenges associated with storage and shorter shelf life limit their widespread adoption, positioning them as a niche but essential segment in the Aquafeed Additives market.

Moist Form The Moist Form segment, emerging as a significant player, combines aspects of both dry and wet forms. Offering a balance between ease of handling and nutrient retention, these additives are gaining traction in the market. Their growing popularity is seen as a response to the need for more versatile aquafeed options. However, this segment faces competition from both dry and wet forms, each entrenched in its specific market niches.

Application Analysis

In 2023, catfish stores were leading the market, holding more than a 22.9% share. Catfish Farms Love Aquafeed Additives, Places that raise catfish buy a lot of these special additives. They use these additives to make their catfish healthier and help them grow better.

This shows how important these additives are for making catfish strong and healthy. Helping Rainbow Trout Grow, Trout farms and places that catch rainbow trout also use these special additives. They add these things to the fish food to make it better for rainbow trout. These additives make trout healthier and help them grow faster. This makes trout farming better overall.

Carp eat animal feed such as water insects and insect larvae. They also eat leaves, seeds, and stalks from terrestrial and decayed aquatic plants. Carp is expected to be in demand due to its ability to lower cholesterol. These factors will positively impact the growth of the carp industry. Crustaceans include crabs, lobsters, shrimp, and crayfish. Crustaceans are used in many food products such as soups, fish cakes, stocks, seafood broth, seafood chowder, and processed foods. The market is expected to grow due to an increase in demand for shrimps and prawns in the food sector over the forecast period.

Кеу Маrkеt Ѕеgmеntѕ

By Ingredients

- Feed Acidifiers

- Anti-parasitic

- Essential Oils & Natural Extracts

- Prebiotics

- Palatants

- Hydrolysates

- Yeast Extracts

- Other Ingredients

By Form

- Dry Form

- Wet Form

- Moist Form

By Application

- Rainbow Trout

- Carp

- Tilapia

- Salmon

- Catfish

- Crustaceans

- Groupers

- Sea Bass

- Other Applications

Drivers

The aquafeed additives market is experiencing growth due to several key drivers. Firstly, there’s a rise in fish farming activities not only in specific regions but also globally. This expansion is supported by increased investment in research and development efforts.

These activities are crucial in creating better-compounded meals that maintain the health of aquatic species. Moreover, there’s a growing awareness about the importance of aquafeed additives, contributing to market growth.

Fishing and Farming Fish for Money, Many people are making a living from fishing and farming fish for profit. All around the world, the amount of fish and aquaculture we produce has grown. This is because there are more people, especially in developing countries, and more people living in big cities. Because of this, the need for seafood has increased. People are choosing seafood over regular food because they’re making more money and want more protein.

People Want More Fish, The amount of fish consumed worldwide is rising at an ever faster pace than population growth. This is because people are earning more money and moving to cities. Fishing and fish farms are not just about food anymore.

They’re also important for making money, helping economies, and making life better for people everywhere. This shows how important fishing and fish farming have become for food, and money, and how people live their lives all over the world.

Restraints

The aquafeed additives market could have some problems because the prices of materials might keep changing. This can make it harder to get the important stuff needed for aquafeed additives. Also, the government has strict rules for approving products, which might make it slower for the market to grow. Following these rules and getting approvals can take a lot of time, making it slower for new additives to be used in aquaculture.

This report about aquafeed additives tells a lot about what’s been happening lately, the rules for trading, how much is being brought in and sent out, how it’s made, and how to make it better. It also looks closely at who’s doing well in the market, how much they influence it, and where there might be new chances to make money.

The report also talks about how the rules for the market are changing, how much it’s growing, and what’s becoming more popular in different areas. It covers things like getting permission for new products, launching them, growing to new places, and bringing new technology into the market.

Opportunities

Exploring New Additives, There lies great promise in exploring and formulating new additives for aquafeed. Through innovation and discovering unique ingredients or formulations, discovering breakthrough additives could revolutionize fish farming practices. Expanding Global Aquaculture, With the global expansion of fish farming comes an exciting opportunity for aquafeed additives.

As more fish farms come online, demand for high-quality feed increases significantly – expanding into new global markets provides a wonderful chance to broaden sales of these additives and broaden reach and sales worldwide.

Technology to Improve Feed, The advent of new technologies and methodologies that enhance aquafeed additives presents a huge opportunity. This includes advances in production, preservation, and delivery methods that could greatly increase the efficiency and effectiveness of such products. Sustainability and Environmental Issues, The rising emphasis on sustainability offers businesses an opportunity to develop eco-friendly additives that contribute to a healthier environment. Meeting market demand for such products is becoming increasingly important.

Health-Oriented Products, With consumers becoming more health-minded in their consumption habits, there’s an opportunity to create additives that promote healthier farmed fish. Such innovations could draw customers in while simultaneously expanding the customer base. Additives Tailored to Specific Fish Species, Each fish species has specific dietary needs that make creating additives tailored for specific fish species a viable business opportunity. Tailoring products specifically to meet those of certain fish could win you loyalty from farmers searching for tailored solutions.

Challenges

Raw Material Price Fluctuations, One of the major obstacles facing the aquafeed additives market is unpredictable raw material prices. Such fluctuations can have serious ramifications on costs and availability of essential ingredients used in production processes affecting production costs as well as ultimately undermining market stability.

Navigating Strict Regulatory Approvals, Navigating through stringent government regulations for product approval can be an obstacle. Complying with them and obtaining required approvals may take more time than anticipated and delay the introduction of new additives into the market.

Market Dynamics, The Aquafeed Additives Market Is Highly Competent, There is fierce competition for aquafeed additives market shares among numerous companies that all strive to outsell one another by inventing new things, setting prices, and differentiating their offerings from those of competitors. This makes it hard for smaller or newer businesses to join this race for sales success and sales revenue.

People want something Better for the Environment and Their Health, Now People want products that are good for both the environment and health; making products to meet this growing need is no small task; companies must remain innovative by constantly coming up with fresh concepts for what people want from them.

Regional Analysis

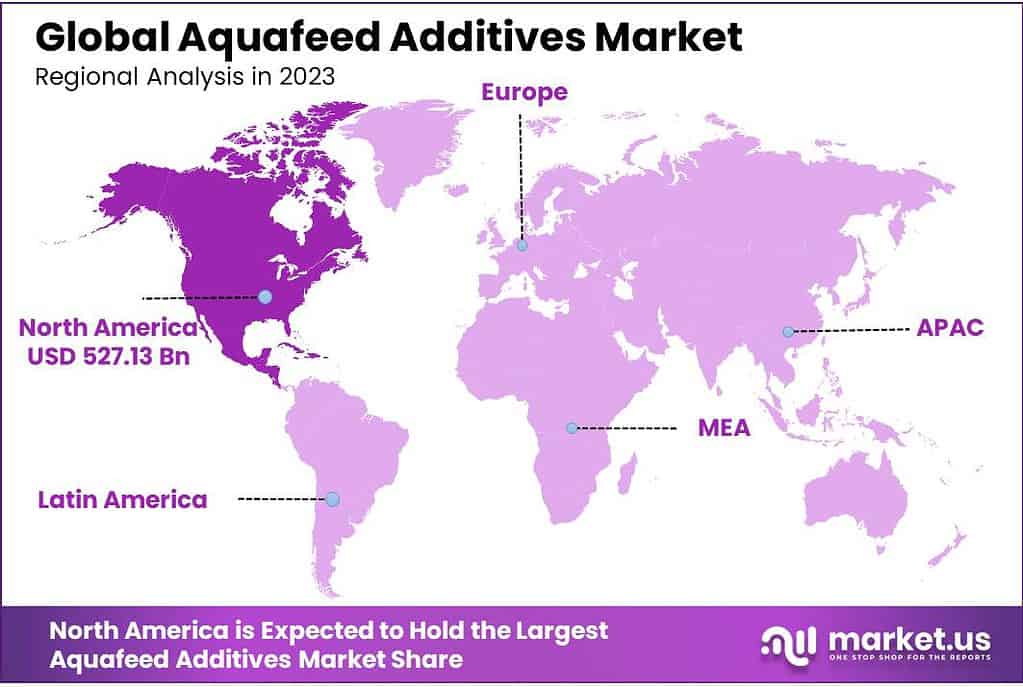

Latin America held the highest revenue share at over 37% in 2023. This is due to the availability of local fish feed, made from basic raw materials such as fish oil or fish meal, and favorable climatic conditions. This region will also see the fastest projected CAGR. North America will experience significant growth due to the growing consumption of seafood in the U.S.A. and Canada.

The growth of the regional market is being driven by the increasing consumption of certain species such as salmonids and other mollusks, hard clams, oysters, and mussels. A decline in the wild fishery and an increase in seafood consumption across the region can explain the rising demand for aquaculture-produced seafood.

The aquaculture industry in Europe is expanding rapidly, particularly in the U.K. France, Italy, and Spain. Market growth has been aided by improved environmental management and an increase in efficiency in feed and nutrient intake. The increasing demand for salmon in the interior has increased the demand for anesthesia and sedation materials for transportation.

This has driven product demand. The substantial growth in the aquaculture industry in the Asia Pacific will result in a steady rate of growth over the forecast period. This is due to the availability and ease of induced conditions for aquaculture as well as the abundance of natural resources.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Market competition is heavily influenced by the product mix, the number of sellers, and geographic location. The R&D of key manufacturers is essential to creating natural and organic feed products. Although online distribution is growing faster than direct sales, direct sales still have a higher market value because of their ease of access.

To increase their presence in the value chain, major players are looking to merge and acquire. They are involved in multiple activities, including production, marketing, and farming. This helps to lower operational costs and produces feed with high nutritional value.

Маrkеt Кеу Рlауеrѕ

- Aker Biomarine

- Nutriad Inc.

- Calanus AS

- Olmix Group

- Norel SA

- Lallemand Inc.

- Alltech

- Kemin Industries

- Nouryon

- DuPont de Nemours Inc

- Biorigin

- Phileo by Lesaffre

- Calanus AS

- Other Key Players

Recent Development

In May 2022, Biomar A/S acquired smart shrimp feeding technology supplier AQ1 Systems.

Report Scope

Report Features Description Market Value (2023) USD 2 Bn Forecast Revenue (2033) USD 3 Bn CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Ingredients (Feed Acidifiers, Anti-parasitic, Essential Oils and Natural Extracts, Prebiotics, and Palatants), By Form(Dry Form, Wet Form, Moist Form), By Application (Rainbow Trout, Carp, Tilapia, Salmon, Catfish, Crustaceans, Groupers, and Sea Bass) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Aker Biomarine, Nutriad Inc., Calanus AS, Olmix Group, Norel SA, Lallemand Inc., Alltech, Kemin Industries, Nouryon, DuPont de Nemours Inc, Biorigin, Phileo by Lesaffre, Calanus AS, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Aquafeed Additives Market?Aquafeed Additives Market size is expected to be worth around USD 3 billion by 2033, from USD 2 Bn in 2023

-

-

- Aker Biomarine

- Nutriad Inc.

- Calanus AS

- Olmix Group

- Norel SA

- Lallemand Inc.

- Alltech

- Kemin Industries

- Nouryon

- DuPont de Nemours Inc

- Biorigin

- Phileo by Lesaffre

- Calanus AS

- Other Key Players