Global Anti-obesity Drugs Market By Drug Type (Prescription Drugs, OTC Drugs), By Mechanism of Action (Centrally Acting Drugs, Peripherally Acting Drugs, Gut-Hormone Incretins- GLP-1 Agonists, Dual Agonists/GIP Agonists), By Route of Administration (Oral, Injectable), By Patient Type (Adults, Pediatrics), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151652

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Drug Type Analysis

- Mechanism of Action Analysis

- Route of Administration Analysis

- Patient Type Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

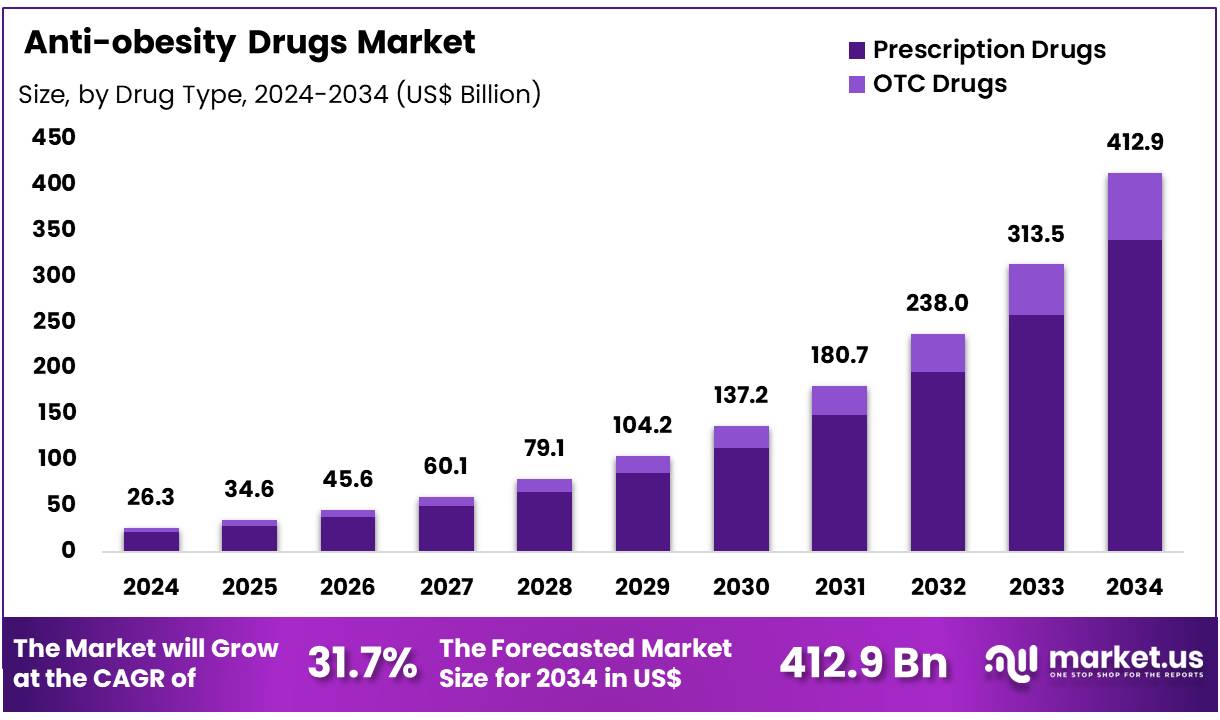

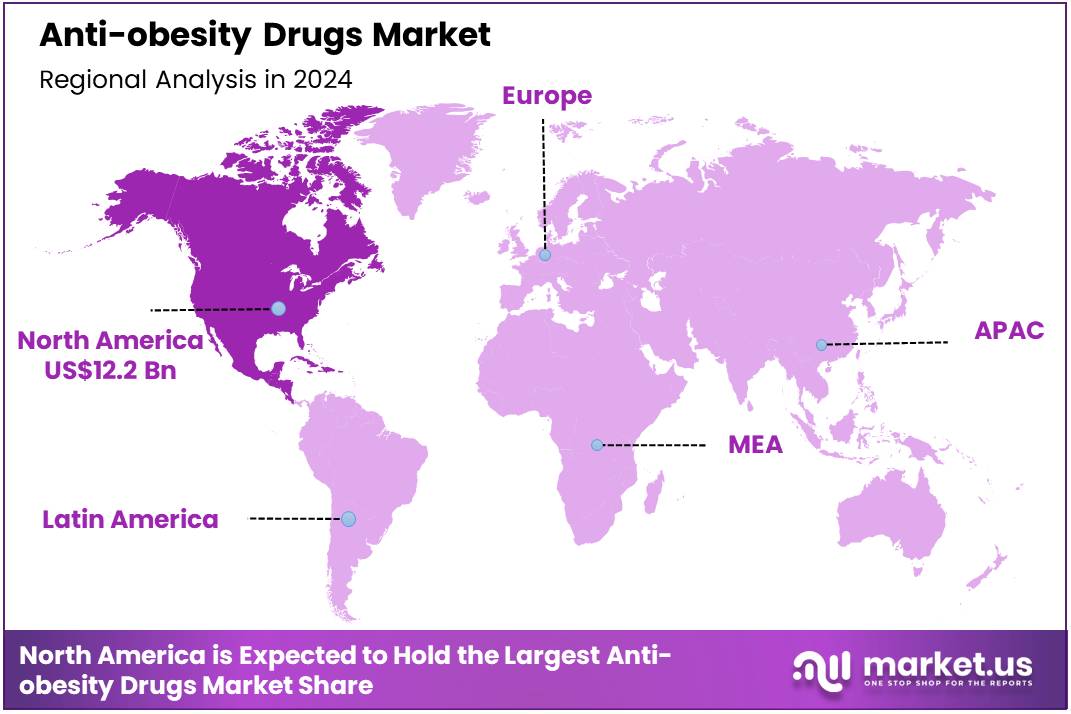

Global Anti-obesity Drugs Market size is forecasted to be valued at US$ 412.9 Billion by 2034 from US$ 26.3 Billion in 2024, growing at a CAGR of 31.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 46.40% share with a revenue of US$ 12.2 Billion.

The anti-obesity drugs market has experienced remarkable growth in recent years, driven by the escalating global prevalence of obesity and the increasing demand for effective weight management solutions. This surge is largely attributed to the success of glucagon-like peptide-1 (GLP-1) receptor agonists, such as semaglutide (Wegovy) and tirzepatide (Mounjaro), which have demonstrated significant efficacy in weight reduction and related health improvements.

Semaglutide, developed by Novo Nordisk, has been a cornerstone in obesity treatment, with sales more than doubling in the fourth quarter of 2024. For instance, Novo Nordisk launched Wegovy in the most populous country, China, which will create competition for Eli Lilly’s Mounjaro, set to enter the Indian market in March 2025. Similarly, Eli Lilly’s tirzepatide has shown impressive results, with studies indicating a 94% reduction in the risk of developing type 2 diabetes among patients with obesity.

These drugs not only aid in weight loss but also offer benefits in managing comorbid conditions such as cardiovascular diseases and type 2 diabetes. The market dynamics are further influenced by the introduction of oral formulations. Eli Lilly’s orforglipron, an oral GLP-1 receptor agonist, has demonstrated comparable efficacy to injectable versions, offering a more convenient option for patients. This development is expected to broaden patient access and adherence to obesity treatments.

Despite the promising outlook, challenges remain. Issues such as high treatment costs, insurance coverage limitations, and potential side effects continue to impact market penetration. Additionally, the rapid growth has led to supply chain constraints, with companies like Novo Nordisk and Eli Lilly working to scale production to meet demand.

Using these medications for a year could result in losing between 3% to 12% more body weight compared to lifestyle changes alone. While this may seem modest, losing 5% to 10% of body weight and maintaining it can provide significant health benefits, such as reducing blood pressure, blood sugar, and triglyceride levels.

Key Takeaways

- In 2024, the market for anti-obesity drugs generated a revenue of US$ 26.3 billion, with a CAGR of 31.7%, and is expected to reach US$ 412.9 billion by the year 2034.

- Among the drug type segment, prescription drugs dominated the market with 82.3% share in 2024.

- By Mechanism of Action, Peripherally Acting Drugs contributed to the largest revenue share of 58.5% in 2024.

- Injectable segment was the maximum revenue generating route of administration holding 75.9% share in 2024.

- By Patient Type, Adults captured the majority of the market share with 95.3% in 2024.

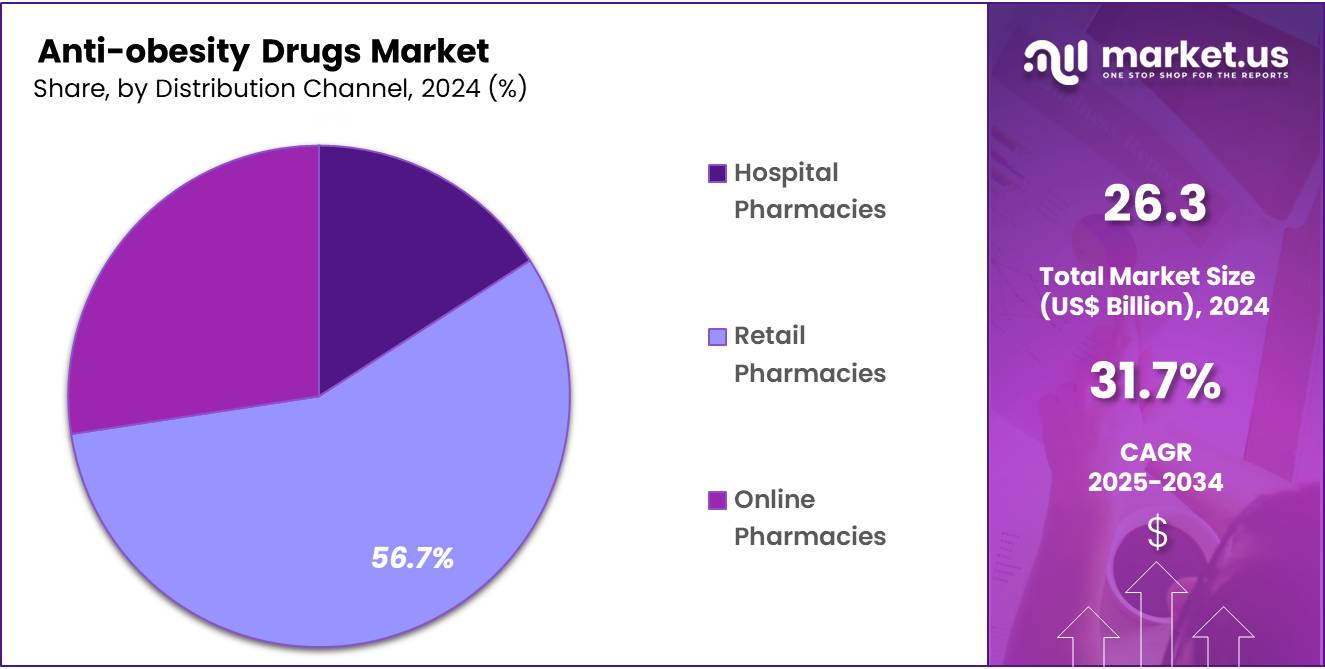

- Among the distribution channel segment, Retail Pharmacies held the largest segment accounting for 56.70% in 2024.

- North America held the maximum share of 46.40% in 2024 in the global market.

Drug Type Analysis

The prescription drugs segment held the largest share in the anti-obesity drugs market with 82.3% share in 2024, primarily driven by the increasing demand for clinically proven weight management solutions. Prescription drugs, particularly those that target specific biological pathways involved in obesity, such as GLP-1 receptor agonists, have gained significant attention for their proven effectiveness.

Medications like semaglutide (Wegovy) and liraglutide (Saxenda) are among the leading prescription drugs that help patients achieve significant weight loss. Semaglutide, in particular, has garnered widespread use due to its remarkable results, helping patients lose an average of 15-20% of their body weight in clinical trials.

The success of these prescription medications has been driven by the increasing recognition of obesity as a chronic disease that requires long-term management, much like other conditions such as hypertension or diabetes. As a result, many healthcare providers now prescribe these drugs as part of a comprehensive treatment plan for obesity, particularly for patients with comorbidities such as type 2 diabetes, heart disease, and hypertension. Weight loss medication eligibility is typically determined by BMI. Most medications are prescribed to individuals with a BMI of 30 or above, or 27 or above if, they have weight-related health issues.

Mechanism of Action Analysis

Peripherally acting anti-obesity drugs have become a significant segment in the global anti-obesity market holding 58.5% share in 2024, primarily due to their targeted mechanisms and favorable safety profiles. Unlike centrally acting drugs that influence the brain’s appetite centers, peripherally acting agents work locally within the gastrointestinal system to reduce fat absorption or alter metabolic processes.

This localized action often results in a lower incidence of central nervous system-related side effects, making them appealing to a broader patient demographic. Orlistat, a well-known peripherally acting drug, exemplifies this class. By inhibiting pancreatic and gastric lipases, orlistat reduces the absorption of dietary fats, leading to weight loss.

It has been widely used for years and remains a cornerstone in obesity management. The drug’s safety profile is generally favorable, with gastrointestinal side effects being the most common, typically related to its fat-blocking action. Orlistat should be taken with meals containing 10% to 30% fat, with side effects that may include oily fecal spotting and fecal urgency.

Route of Administration Analysis

Injectable anti-obesity drugs was the leading segment with 75.9% revenue share in 2024, primarily due to their superior efficacy and sustained weight loss results compared to other administration routes. This dominance is largely attributed to the widespread use of glucagon-like peptide-1 (GLP-1) receptor agonists, such as semaglutide (Wegovy) and tirzepatide (Zepbound), which have shown significant effectiveness in weight management.

In India, the launch of Wegovy in June 2025 underscores the growing demand for injectable anti-obesity treatments. Novo Nordisk aims to achieve $1 billion in sales in India within five to seven years, highlighting the country’s potential as a key market for these therapies. Similarly, Eli Lilly’s Mounjaro has seen a positive response in India, with over 81,570 units sold by May 2025, reflecting a 60% surge in sales between April and May.

The preference for injectable formulations is further supported by their ability to provide consistent drug levels, reducing the frequency of administration and enhancing patient compliance. While oral alternatives are being developed, injectable medications currently lead the market in terms of efficacy and patient outcomes. As the global anti-obesity drug market continues to expand, injectable therapies are poised to remain at the forefront of treatment options, offering effective solutions for weight management and related health conditions.

Patient Type Analysis

The anti-obesity drugs market is predominantly driven by adult patients contributing 95.3% share in 2024, reflecting the high prevalence of obesity in this demographic. In the United States, for instance, approximately 42% of adults are classified as obese, a statistic that underscores the substantial patient base for anti-obesity medications. This trend is mirrored in other regions, including Europe and Asia-Pacific, where rising obesity rates among adults are contributing to the market’s expansion. Many adults with obesity also suffer from other chronic diseases. In the U.S., 58% of obese adults have high blood pressure, a risk factor for heart disease, and approximately 23% have diabetes.

Furthermore, the expansion of the targeted treatments into broader health concerns, such as reducing the risk of dementia, has broadened their appeal. A study led by Professor Rong Xu at Case Western Reserve School of Medicine found that adults with type 2 diabetes taking semaglutide had a notably lower incidence of dementia compared to those on other antidiabetic medications, particularly among women and older adults.

Distribution Channel Analysis

The retail pharmacy segment was the largest distribution channel in the global anti-obesity drugs market, commanding a significant share of over 56.7% in 2024. This dominance is attributed to the widespread accessibility and convenience offered by retail pharmacies, which include national chains, independent outlets, and supermarket-based pharmacies. These establishments serve as primary points of contact for patients seeking both prescription and over-the-counter weight-loss medications.

The preference for retail pharmacies is further bolstered by their ability to provide personalized services, including medication counseling, refill reminders, and patient education. Such services enhance patient adherence to prescribed regimens and foster trust in the treatment process. Additionally, the integration of digital platforms by many retail pharmacies has facilitated easier access to medications, allowing patients to order prescriptions online for home delivery, thereby accommodating the growing demand for convenient healthcare solutions.

Key Market Segments

By Drug Type

- Prescription Drugs

- OTC Drugs

By Mechanism of Action

- Centrally Acting Drugs

- Peripherally Acting Drugs

- Gut-Hormone Incretins

- GLP-1 Agonists

- Dual Agonists/GIP Agonists

By Route of Administration

- Oral

- Injectable

By Patient Type

- Adults

- Pediatrics

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Rising burden of obesity

The escalating global prevalence of obesity is a primary driver propelling the anti-obesity drugs market. According to the World Obesity Federation’s 2025 Atlas, the number of adults living with obesity is expected to more than double from 524 million in 2010 to 1.13 billion by 2030. This surge is not confined to high-income nations; low- and middle-income countries are experiencing rapid increases in obesity rates, with projections indicating that by 2035, 79% of adults with overweight and obesity will reside in these regions.

The National Family Health Survey (NFHS-5) reveals that nearly 24% of women and 22.9% of men are classified as overweight or obese, reflecting a sharp increase from 2015-16. This upward trend is attributed to urbanization, sedentary lifestyles, and dietary changes, leading to increased demand for effective weight management solutions. The Indian market is becoming a focal point for anti-obesity drug manufacturers, with companies like Novo Nordisk and Eli Lilly launching their products Wegovy and Mounjaro, respectively aiming to tap into this growing market.

The rising obesity rates are closely linked to an increase in obesity-related comorbidities, including type 2 diabetes, hypertension, cardiovascular diseases, and certain cancers. These health complications not only diminish quality of life but also impose substantial economic burdens on healthcare systems globally. Consequently, there is an urgent need for effective pharmacological interventions to address obesity and its associated health risks.

One of the key factors fueling the anti-obesity drug market is the increased recognition of obesity as a chronic disease, rather than a lifestyle choice. Medical associations, including the American Medical Association (AMA), have officially classified obesity as a disease, leading to greater acceptance of drug-based interventions. This shift has encouraged healthcare providers to prescribe anti-obesity medications more readily, particularly for patients with obesity-related comorbidities.

Another major driver is the growing awareness and destigmatization of obesity treatments. High-profile endorsements and public discussions about weight-loss medications have reduced the social stigma surrounding their use. Celebrities and influencers openly discussing their experiences with drugs like Ozempic and Wegovy have contributed to a surge in demand, even leading to shortages in supply.

Restraints

High treatment costs and Limited reimbursements

The escalating costs of anti-obesity medications, coupled with limited insurance reimbursements, present significant barriers to access for many patients. Wegovy by Novo Nordisk is priced at $1,349 in the U.S., and Eli Lilly’s Zepbound is priced at $1,060 for a 28-day supply, making these drugs unaffordable for a large portion of the population. Despite their proven efficacy in promoting weight loss and improving obesity-related comorbidities, these medications remain largely inaccessible due to their high price tags.

Insurance coverage for these treatments is inconsistent and often restrictive. As of 2024, only about half of private employer-sponsored plans in the U.S. cover GLP-1 medications for weight loss, and even fewer state Medicaid programs provide coverage for anti-obesity drugs. Additionally, Medicare Part D explicitly excludes coverage for anti-obesity medications, leaving a significant portion of the population without financial assistance for these treatments. In fact, a 2024 analysis revealed that only 13 state Medicaid programs covered GLP-1s for obesity treatment, and many of these plans imposed stringent criteria such as prior authorization and BMI thresholds.

The lack of reimbursement has led to disparities in access to care. For instance, in West Virginia, a pilot program that provided weight-loss drugs to public employees was halted due to the high monthly cost of $1.4 million, despite the program’s initial success in improving patient outcomes. Similarly, insurers like Blue Cross Blue Shield of Michigan have announced plans to drop coverage for popular weight-loss drugs starting in 2025, citing escalating costs as a primary concern.

However, in March 2025, Novo Nordisk reduced the price of Wegovy by 23% for uninsured patients, lowering it from $650 to $499 per month. Eli Lilly followed suit by lowering Zepbound’s starter dose to $349 and higher doses to $499 through its self-pay program, Lilly Direct. These discounted doses require patients to manually draw the medication from a vial, which adds a step compared to prefilled injector pens.

Opportunities

Innovative Next‑Gen Drug Candidates

The anti-obesity drugs market is poised for a transformative shift, driven by the emergence of next-generation drug candidates that offer enhanced efficacy, improved safety profiles, and greater patient convenience. As clinical trials progress and regulatory approvals are sought, these therapies have the potential to redefine obesity management and improve patient outcomes worldwide.

Among the most promising developments is Amycretin, a dual-acting GLP-1 and amylin receptor agonist developed by Novo Nordisk. Amycretin, currently in early-stage trials, shows superior weight loss results, with participants losing an average of 24.3% of their body weight at the highest dose, surpassing current leaders like Wegovy and Mounjaro. It has completed phase 1b/2a trials as of January 2025. Additionally, an oral formulation of Amycretin showed a 13.1% weight loss, indicating its potential as a convenient alternative to injectable treatments.

Another significant advancement is MariTide, developed by Amgen. This investigational drug targets both GLP-1 and GIP receptors, resulting in up to 20% weight loss over 52 weeks. MariTide also demonstrated improvements in cardiometabolic risk factors, including reductions in blood pressure and lipid levels. The drug’s long-acting formulation, with monthly or bi-monthly dosing, could enhance patient adherence and long-term weight management.

CagriSema, a combination therapy of semaglutide and cagrilintide, is currently in Phase 3 trials. Early results from the REDEFINE-4 trial showed that participants lost an average of 22.7% of their body weight, making it a potential competitor to existing treatments. However, some patients reported reduced appetite and gastrointestinal discomfort, which may impact tolerability.

For patients seeking oral alternatives, Orforglipron offers a promising option. ACHIEVE-1 is the first of seven Phase 3 studies investigating orforglipron, an investigational oral drug for people with diabetes and obesity. At its highest dose, it helped participants lose an average of 16.0 lbs (7.9%) in a key secondary endpoint.

Efficacy Estimated Results Orforglipron 3 mg Orforglipron 12 mg Orforglipron 36 mg Placebo Primary Endpoint A1C reduction from baseline of 8.0% 1.30% 1.60% 1.50% 0.10% Key Secondary Endpoints Percent weight reduction from baseline of 90.2 kg (198.9 lbs) 4.70% 6.10% 7.90% 1.60% Weight reduction from baseline of 90.2 kg (198.9 lbs) 4.4 kg (9.7 lbs) 5.5 kg (12.2 lbs) 7.3 kg (16.0 lbs) 1.3 kg (2.9 lbs) Impact of Macroeconomic / Geopolitical Factors

The impact of macroeconomic and geopolitical factors plays a crucial role in shaping the healthcare landscape, especially in the context of rising prescription drug expenditures driven by the growing demand for anti-obesity medications. Anti-obesity medications, notably semaglutide and tirzepatide, have significantly influenced the trajectory of prescription drug expenditures.

In 2023, these drugs accounted for the majority of the growth in endocrine drug spending. This surge is projected to continue into 2024, with overall prescription drug spending expected to rise by 10% to 12%, and clinic-based expenditures increasing by 11% to 13%. Conversely, hospital drug spending is anticipated to remain relatively stable, with a slight increase of 0% to 2%.

The primary factors contributing to this rise include higher utilization rates, the introduction of new medications, and price adjustments. In clinics, the 15% growth in drug spending was predominantly driven by a 12.7% increase in the volume of drug use, with injectable medications comprising 77.8% of the spending.

Notably, branded products experienced the most significant spending increases, with injectable drugs rising by 15.9% and noninjectable drugs by 16.5%. Despite efforts to control prescription drug costs, the anticipated lack of new generic drug approvals in 2024 is expected to maintain high spending levels. The limited pipeline for new generics suggests that the financial impact of anti-obesity medications will persist, influencing both healthcare budgets and policy discussions regarding the affordability and accessibility of these treatments.

Latest Trends

Emergence of Generics and Biosimilars

The anti-obesity drugs market is undergoing a significant transformation with the emergence of generics and biosimilars, poised to enhance accessibility and affordability for patients worldwide. As patents for leading anti-obesity medications approach expiration, pharmaceutical companies are preparing to introduce cost-effective alternatives, potentially revolutionizing the treatment landscape.

Semaglutide, the active ingredient in Novo Nordisk’s Wegovy and Eli Lilly’s Mounjaro, is expected to become available in generic form in Canada as early as 2026, with other markets following suit. Companies like Sandoz and Apotex are already preparing to launch generic versions, which could reduce treatment costs by 80–85% compared to branded versions. Similarly, in India, where obesity rates are rising, generic versions of semaglutide are anticipated to enter the market post-2026, offering more affordable options to the population.

In addition to generics, biosimilars biologically similar products to branded biologics—are gaining traction. For instance, Chinese and Indian pharmaceutical companies are developing biosimilars of GLP-1 receptor agonists, aiming to introduce them to markets after 2026. These biosimilars are expected to provide similar efficacy and safety profiles as their branded counterparts, further driving down costs and increasing treatment accessibility.

Regional Analysis

North America is leading the Anti-obesity Drugs Market

In 2024, North America accounted for a 46.4% share of the anti-obesity drugs market, driven by high obesity prevalence, advanced healthcare infrastructure, and substantial healthcare expenditure. The United States, in particular, has seen an increased adoption of GLP-1 receptor agonists like semaglutide and tirzepatide, contributing to a robust market presence.

For instance, according to the latest KFF Health Tracking Poll, approximately 12% of adults report having ever used a GLP-1 agonist, a growing class of prescription medications used for weight loss, diabetes treatment, or to help prevent heart attacks and strokes in adults with heart disease. Among these, 6% are currently using such a drug.

The prevalence of GLP-1 agonist use is notably higher, reaching 43% among adults diagnosed with diabetes, 25% among those with heart disease, and 22% among those recently diagnosed as overweight or obese in the past five years. Public awareness of GLP-1 drugs has also risen, with 32% of adults saying they have heard “a lot” about these medications, a significant increase from 19% in July 2023.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is witnessing rapid growth in the anti-obesity drugs market, with projections indicating a the highest CAGR during the forecast period. Countries such as India, China, and Japan are experiencing rising obesity rates, prompting increased awareness and demand for effective weight management solutions.

According to a report from clinical research organization Novotech, China has become the second-most-popular country for obesity trials after the U.S., despite only 6% of the population being classified as obese, compared to 31% in Australia and 40% in the U.S. The recent launch of Novo Nordisk’s Wegovy in India reflects the growing market potential in the region. Additionally, the anticipated availability of generic versions of semaglutide post-2026 is expected to further drive market expansion by improving accessibility and affordability.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The anti-obesity drugs market is currently dominated by two pharmaceutical giants: Novo Nordisk and Eli Lilly. Novo Nordisk’s semaglutide-based treatments, Wegovy and Ozempic, have established a strong market presence. However, recent developments indicate a shift in the competitive landscape. Eli Lilly’s tirzepatide-based drugs, Mounjaro and Zepbound, have demonstrated superior efficacy in clinical trials, with Zepbound showing more significant weight loss compared to Wegovy. This has led to projections that Eli Lilly’s drugs may surpass Novo Nordisk’s in sales by 2026, despite Novo’s efforts to expand its offerings, including the potential launch of an oral version of semaglutide.

In India, the competition is intensifying with the introduction of Wegovy, shortly after Mounjaro’s debut in March 2025. Both drugs are targeting the country’s rapidly escalating obesity and type 2 diabetes rates, signaling a significant shift in the healthcare landscape. The competition is expected to drive innovation and access to effective weight-loss treatments, potentially transforming long-term strategies for managing chronic metabolic disorders.

Top Key Players

- Novo Nordisk A/S

- Eli Lilly and Company

- Hoffmann-La Roche AG

- Pfizer Inc.

- GSK plc

- Currax Pharmaceuticals LLC

- Boehringer Ingelheim International GmbH

- Amgen Inc.

- AstraZeneca plc

- Merck & Co., Inc.

- Zealand Pharma

- Takeda Pharmaceutical Co. Ltd

- Rhythm Pharmaceuticals, Inc.

- Vivus LLC

- Zydus Lifesciences Ltd.

- Gelesis Holdings Inc.

- Teva Pharmaceuticals Company Limited

- Hanmi Pharm.Co.,Ltd.

- Verdiva

- HK inno.N Corp.

- Reddy’s Laboratories

Recent Developments

- In April 2025, Pfizer Inc. announced it would discontinue developing danuglipron, an oral GLP-1 receptor agonist for chronic weight management.

- In March 2025, Roche entered an exclusive partnership with Zealand Pharma to co-develop and market petrelintide, an amylin analog, as both a standalone treatment and in combination with Roche’s incretin asset CT-388.

- In February 2025, Mankind Pharma announced that it is developing an oral anti-obesity drug, which could become the first small-molecule treatment for obesity globally if successful.

Report Scope

Report Features Description Market Value (2024) US$ 26.3 billion Forecast Revenue (2034) US$ 412.9 billion CAGR (2025-2034) 31.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Type (Prescription Drugs, OTC Drugs), By Mechanism of Action (Centrally Acting Drugs, Peripherally Acting Drugs, Gut-Hormone Incretins- GLP-1 Agonists, Dual Agonists/GIP Agonists), By Route of Administration (Oral, Injectable), By Patient Type (Adults, Pediatrics), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novo Nordisk A/S, Eli Lilly and Company, F. Hoffmann-La Roche AG, Pfizer Inc., GSK plc, Currax Pharmaceuticals LLC, Boehringer Ingelheim International GmbH, Amgen Inc., AstraZeneca plc, Merck & Co., Inc., Zealand Pharma, Takeda Pharmaceutical Co. Ltd, Rhythm Pharmaceuticals, Inc., Vivus LLC, Zydus Lifesciences Ltd., Gelesis Holdings Inc., Teva Pharmaceuticals Company Limited, Hanmi Pharm.Co.,Ltd., Verdiva, HK inno.N Corp., Dr. Reddy’s Laboratories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Novo Nordisk A/S

- Eli Lilly and Company

- Hoffmann-La Roche AG

- Pfizer Inc.

- GSK plc

- Currax Pharmaceuticals LLC

- Boehringer Ingelheim International GmbH

- Amgen Inc.

- AstraZeneca plc

- Merck & Co., Inc.

- Zealand Pharma

- Takeda Pharmaceutical Co. Ltd

- Rhythm Pharmaceuticals, Inc.

- Vivus LLC

- Zydus Lifesciences Ltd.

- Gelesis Holdings Inc.

- Teva Pharmaceuticals Company Limited

- Hanmi Pharm.Co.,Ltd.

- Verdiva

- HK inno.N Corp.

- Reddy’s Laboratories