Global Anti Aging Market Analysis By Product Type (Moisturizers, Anti-Wrinkle Creams, Serums, Anti-Aging Shampoos, Hair Oils & Serums, Injectables, Devices), By Treatment Type (Topical Treatments, Injectables, Laser Treatments, Surgical Procedures, Others), By Gender (Women, Men), By Distribution Channel (Retail, E-commerce, Pharmacies/Drugstores, Spas & Dermatology Clinics, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152748

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

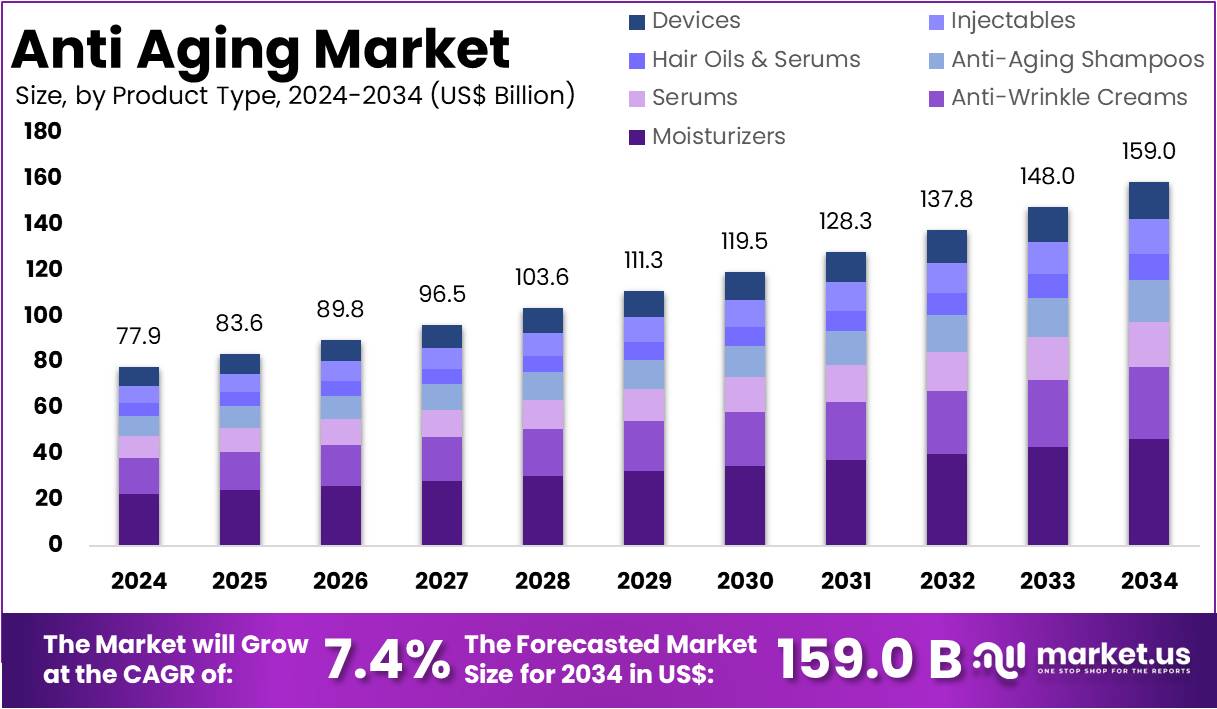

The Global Anti Aging Market size is expected to be worth around US$ 159 Billion by 2034, from US$ 77.9 Billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

Anti-aging refers to the process of delaying, preventing, or reversing the visible and biological effects of aging, especially on the skin. This includes a wide range of interventions such as skincare products, cosmetic procedures, dietary supplements, and lifestyle changes. Anti-aging treatments focus on addressing common issues such as wrinkles, fine lines, sagging skin, and pigmentation. In recent years, internal therapies such as hormone treatments and regenerative medicine have also been explored to support overall health and longevity.

The global rise in the aging population is a key driver for the anti-aging market. According to the World Health Organization, the population aged 60 and above continues to grow rapidly. For instance, China alone had 330 million people aged 60+ in 2024, contributing to a domestic market worth US$15 billion. This growth is supported by longer lifespans, declining birth rates, and increased awareness of healthy aging. Similarly, countries like Japan and Italy are experiencing demographic shifts that further accelerate the demand for anti-aging solutions.

Medical and scientific advancements have introduced new approaches in the anti-aging space. Study findings confirm that treatments using recombinant human epidermal growth factor (rhEGF) can stimulate skin repair and slow epithelial aging. Likewise, low-dose human growth hormone has been shown to improve muscle mass, bone density, and immunity in older adults. These innovations are supported by biotechnology and are forming the foundation for more effective anti-aging therapies.

Preventive health measures also play a vital role in the anti-aging sector. According to WHO data, lifestyle interventions such as the Mediterranean diet and consistent physical activity are associated with reduced mortality and slower biological aging. These public health recommendations support consumer behavior and product uptake. Governments are responding as well. For example, the U.S. has launched a Strategic Framework for Aging, while states like Vermont have implemented 10-year strategies to promote aging well.

The adoption of digital technologies is transforming how consumers approach anti-aging care. For instance, in 2024, Olay’s AI-powered Skin Advisor tool attracted approximately 487,000 monthly visits. Major brands like L’Oréal (ModiFace), Neutrogena (Skin360), and Perfect Corp have embraced AI-driven skin analysis for personalized treatment. Advanced platforms such as SkinGPT‑4 achieved 93% accuracy in identifying skin issues. Emerging tools now use real-time imaging and digital twins to predict aging patterns and optimize skincare regimens.

New market opportunities are also emerging in niche areas. Post-menopausal skincare is gaining focus, addressing concerns such as dryness and elasticity loss. Similarly, anti-aging for men’s grooming has expanded with tailored serums and eye creams. Biohacking programs now integrate genetic testing and biometric monitoring to extend healthspan. Post-treatment skincare products, designed to support recovery after procedures like chemical peels or laser therapy, are also becoming more common. This expanding variety reflects growing personalization and health-tech integration in the global anti-aging market.

Key Takeaways

- By 2034, the global anti-aging market is projected to reach approximately US$ 159 Billion, growing from US$ 77.9 Billion in 2024 at a 7.4% CAGR.

- In 2024, moisturizers led the product type segment in the anti-aging market, accounting for over 29.2% of the total market share.

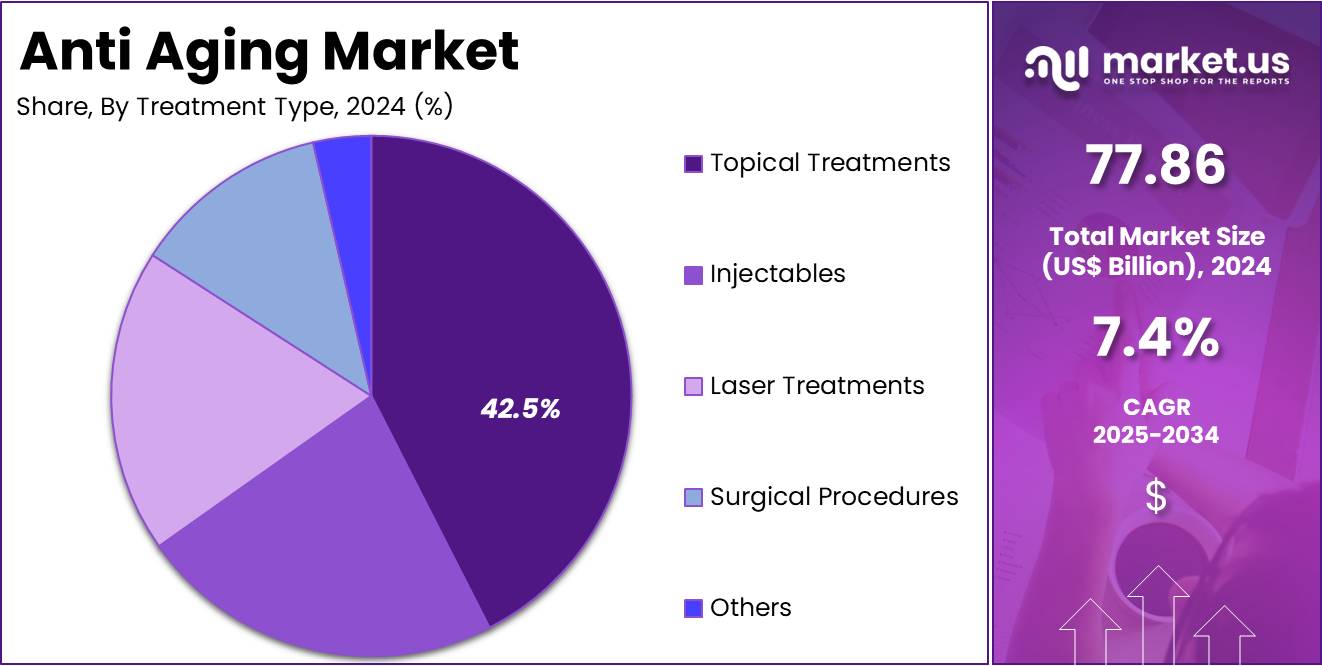

- Topical treatments emerged as the leading treatment type in 2024, securing a dominant share of more than 42.5% in the global anti-aging market.

- Women represented the largest consumer group in 2024, capturing over 68.9% share within the gender segment of the anti-aging market.

- The retail distribution channel held the leading position in 2024, contributing to more than 36.5% of anti-aging product sales globally.

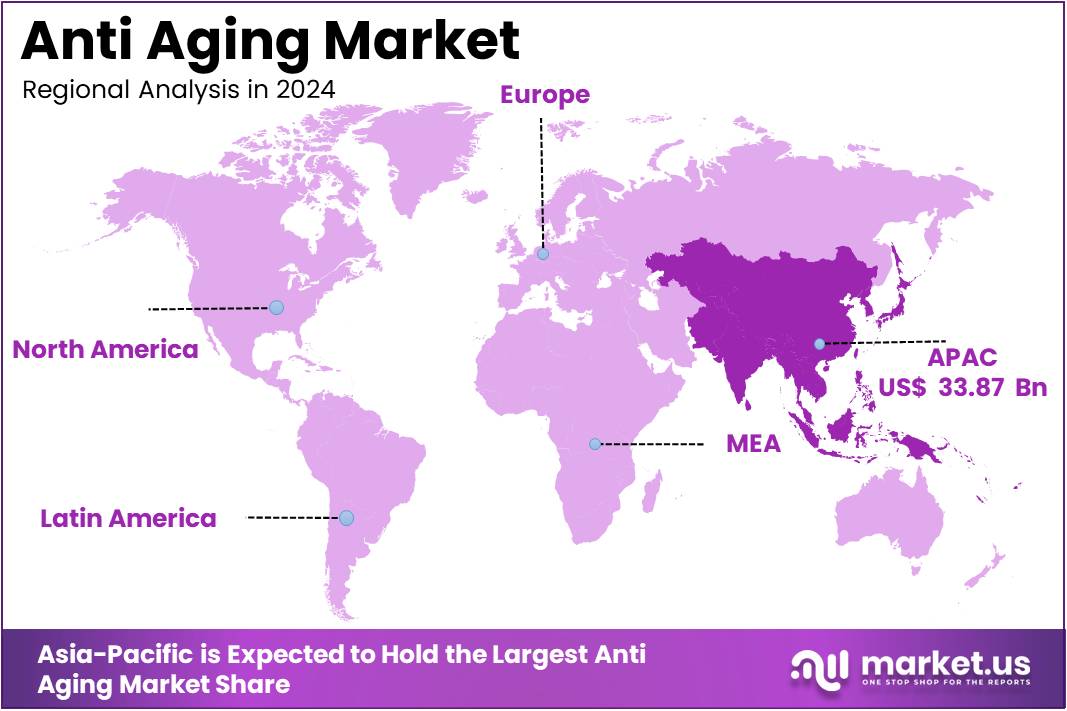

- Asia Pacific dominated the global landscape in 2024, accounting for over 43.5% market share and generating US$ 33.87 Billion in revenue.

Product Type Analysis

In 2024, the Moisturizers section held a dominant market position in the Product Type segment of the Anti-Aging Market, and captured more than a 29.2% share. This growth was mainly driven by the high consumer demand for products that hydrate and repair the skin. Moisturizers offering visible rejuvenation were widely adopted. Their easy availability across online and offline stores also supported this trend. Daily use and broad appeal helped moisturizers remain the preferred choice among consumers of various age groups.

Anti-wrinkle creams held the second-largest share in the anti-aging product market. Their growing use is linked to benefits such as reduced fine lines and improved skin firmness. These creams often boost collagen levels, which enhances skin texture. Rising awareness of early aging signs, especially among people over 30, further fueled their adoption. Serums also gained traction due to their fast absorption and high concentration of active ingredients. Urban consumers favored serums for their brightening and firming effects.

Injectables like botulinum toxins and dermal fillers showed rapid growth in recent years. These products are popular for providing quick, minimally invasive results. The increasing number of aesthetic clinics has supported this demand. Anti-aging shampoos and hair oils also became more popular. These products target hair thinning and graying. Additionally, consumer focus on scalp care contributed to this segment’s rise. At-home devices, such as LED tools and microcurrent machines, saw higher adoption due to convenience and innovation.

Treatment Type Analysis

In 2024, the Topical Treatments section held a dominant market position in the Treatment Type segment of the Anti-Aging Market, and captured more than a 42.5% share. This dominance is due to the high demand for easy-to-use and non-invasive skincare options. Products like anti-aging creams, serums, and lotions are preferred for daily use. Their wide availability in both online and offline stores has helped increase sales. Ingredients such as retinol and hyaluronic acid are key drivers in this segment’s growth.

Injectables followed closely as the second-largest treatment type. These include botulinum toxins and dermal fillers, which are known for their quick and visible results. Their growing popularity, especially among individuals over 35, is supported by the rise of aesthetic clinics. Many consumers are drawn to these procedures for wrinkle reduction and skin volume restoration. Their minimally invasive nature and short downtime also contribute to their rising use in urban and semi-urban regions.

Laser and surgical treatments also showed steady market performance. Laser options like CO₂ and IPL devices are gaining attention for wrinkle removal and pigmentation correction. These methods offer more targeted results with limited recovery. On the other hand, surgical treatments appeal to a smaller group seeking long-term results. These include facelifts and skin tightening procedures. The “Others” category—such as ultrasound and radiofrequency therapies—is growing steadily as well, fueled by interest in modern, non-invasive solutions.

Gender Analysis

In 2024, the Women Section held a dominant market position in the Gender Segment of the Anti-Aging Market, and captured more than a 68.9% share. This dominance was mainly due to high product usage and early skincare adoption among women. Most women begin anti-aging routines earlier, using products such as creams, serums, and moisturizers. Awareness about aging signs is stronger in this group. Moreover, demand is boosted by the wide variety of products specifically designed for women’s skin.

A third-party analysis shows that women tend to follow consistent skincare habits. These include regular application of anti-aging products and more frequent visits to dermatologists. The influence of beauty trends and social media has further strengthened the focus on youthfulness. Additionally, cultural factors and rising disposable income among working women have supported steady growth. Product marketing efforts also focus heavily on female consumers, helping to maintain their leading market share.

On the other hand, the Men Section is showing gradual but steady progress. Skincare awareness among men is increasing. Many men now seek products that target wrinkles, dullness, and under-eye aging. Lightweight and multi-functional skincare products are gaining popularity in this segment. Changing grooming habits and lifestyle improvements have contributed to this rise. The market is likely to see stronger male participation in the coming years, supported by product innovation and shifting social norms.

Distribution Channel Analysis

In 2024, the Retail Section held a dominant market position in the Distribution Channel Segment of the Anti-Aging Market, and captured more than a 36.5% share. This segment maintained its lead due to the strong presence of supermarkets, beauty chains, and department stores. These outlets provided immediate access to products and allowed consumers to physically evaluate items before purchase. In-store promotions and expert advice also boosted customer confidence. The ability to engage with products directly remained a key advantage for retail locations.

The E-commerce channel emerged as the second most preferred option for anti-aging product distribution. Increased internet access and mobile usage contributed to this trend. Consumers appreciated the convenience, variety, and competitive pricing offered online. Shopping habits formed during pandemic restrictions also influenced continued online purchases. According to the International Telecommunication Union (ITU), over 5.4 billion people used the internet in 2023. This broad connectivity supported rapid growth in digital sales for skincare and wellness products across global markets.

Pharmacies and drugstores served as trusted points for medically oriented anti-aging solutions. Consumers seeking clinically tested products preferred these locations. Spas and dermatology clinics offered advanced treatments and premium skincare. These channels targeted a specific audience focused on personalized services. The Others segment, including health stores and direct sales, catered to niche demands. Growth in natural and holistic skincare helped expand their presence. Despite their smaller share, these channels contributed to a diversified and evolving distribution structure.

Key Market Segments

By Product Type

- Moisturizers

- Anti-Wrinkle Creams

- Serums

- Anti-Aging Shampoos

- Hair Oils & Serums

- Injectables

- Devices

By Treatment Type

- Topical Treatments

- Injectables

- Laser Treatments

- Surgical Procedures

- Others

By Gender

- Women

- Men

By Distribution Channel

- Retail

- E-commerce

- Pharmacies/Drugstores

- Spas & Dermatology Clinics

- Others

Drivers

Rising Global Aging Population Fueling Demand for Anti-Aging Products

The steady rise in the global elderly population is a major factor driving the growth of the anti-aging market. According to the World Health Organization (WHO), the number of individuals aged 60 and above stood at nearly 1.0 billion in 2019. This figure increased to approximately 1.1 billion by 2023 and is projected to reach 1.4 billion by 2030. By 2050, it is expected to double to 2.1 billion. This demographic shift is significantly boosting demand for anti-aging solutions, including skincare, supplements, and aesthetic treatments.

As people live longer, there is a rising focus on maintaining physical appearance and skin health. The growing population aged 60 years and above seeks products that reduce wrinkles, improve skin texture, and restore skin elasticity. This demand is encouraging the development of advanced anti-aging formulations. The aging population is more likely to invest in products with proven efficacy, creating a strong market pull for clinically supported solutions. This trend is fostering innovation and premiumization in the anti-aging product segment.

The demographic transition is particularly significant in high-income and aging economies. For example, in 2024, the WHO European Region reported that individuals aged 65 and above now outnumber those under the age of 15. This demographic tipping point highlights a shift in consumer needs and spending priorities. As a result, the anti-aging market is receiving increased attention from skincare and wellness companies aiming to cater to an aging yet active consumer base seeking preventive and corrective skin treatments.

Furthermore, the share of individuals aged 65 and over constituted around 10% of the global population in 2023. This proportion is projected to rise to 16% by 2050. The growing elderly population presents a vast, underserved market with long-term potential. The increase in life expectancy and heightened health awareness are influencing consumer behaviors. As a result, demand for anti-aging interventions is growing across both developed and emerging markets, driving the expansion of product offerings and service delivery in this sector.

Restraints

High Cost of Advanced Anti-Aging Treatments

The high cost of advanced anti-aging procedures acts as a major restraint on market expansion. Treatments such as laser therapies and cosmetic surgeries often require significant financial investment. For instance, non-ablative facial laser procedures cost around US $1,450 per session, while ablative treatments may reach US $2,500. These prices place such solutions beyond the reach of a large segment of the global population. The cost barrier discourages early adoption, particularly among younger consumers or those with moderate aging concerns.

Injectable treatments, including botulinum toxins and dermal fillers, are also associated with substantial costs. Typically, a single session can range from US $400 to US $1,000, depending on the treatment area and brand. In some premium clinics or high-income urban centers, costs may even exceed US $2,000. Despite the visible and fast-acting results these procedures offer, the financial burden restricts access to a smaller, affluent consumer group. This limits market penetration across broader income demographics.

Low- and middle-income countries face pronounced accessibility challenges due to these high costs. Even where awareness and demand for anti-aging solutions exist, affordability remains a key hurdle. Limited insurance coverage and lack of government support for aesthetic treatments further restrict access. As a result, many consumers in emerging economies are either turning to less effective alternatives or postponing treatments. This economic divide continues to constrain the global growth potential of the anti-aging market.

Opportunities

Rising Demand for Natural and Organic Anti-Aging Products

The growing preference for natural and organic ingredients in skincare is creating significant opportunities in the anti-aging market. Consumers are increasingly seeking chemical-free, plant-based, and sustainably sourced products that align with their health and environmental values. This shift in consumer behavior is driven by rising awareness of harmful effects linked to synthetic compounds and a growing demand for transparency in product labeling. As a result, brands offering herbal creams, botanical serums, and organic supplements are gaining strong traction across multiple regions.

Clean beauty trends are reshaping the competitive landscape, especially in developed markets. In countries such as the United States, Germany, and Japan, consumers are showing a clear inclination toward anti-aging products that promote skin health without harsh chemicals. The demand is further reinforced by increased adoption among younger demographics who prioritize both efficacy and eco-consciousness. This has led to a surge in product innovations using ingredients like green tea, aloe vera, vitamin C, and hyaluronic acid derived from natural sources.

Additionally, regulatory support and eco-label certifications are enhancing consumer trust in organic skincare. Products labeled as cruelty-free, vegan, or certified organic are witnessing higher adoption, especially in e-commerce and specialty retail channels. Manufacturers investing in sustainable sourcing, biodegradable packaging, and transparent supply chains are well-positioned to benefit. This rising demand for natural solutions is expected to expand rapidly, creating long-term growth prospects for companies embracing the clean beauty movement within the anti-aging sector.

Trends

Rise of AI-Driven Personalized Anti-Aging Skincare

Technology is transforming the anti-aging skincare industry. The use of artificial intelligence (AI) and advanced skin diagnostics is enabling brands to offer customized solutions. These innovations allow for precise analysis of skin type, tone, texture, and condition. As a result, products and treatment regimens are tailored to individual needs. This shift is improving product efficacy and consumer satisfaction. Companies are increasingly investing in AI tools and smart devices to meet rising demand for personalized skincare experiences that go beyond the traditional one-size-fits-all approach.

Genetic profiling and lifestyle analysis are being integrated into skincare routines. By evaluating genetic predispositions, environmental exposure, and user behavior, AI platforms can recommend anti-aging products with greater accuracy. Digital consultations and app-based skin evaluations are also streamlining access to tailored skincare. This is especially appealing to tech-savvy consumers who seek convenience without compromising results. The trend is driving innovation in both product development and consumer interaction, creating strong growth opportunities for tech-forward skincare brands.

Increased demand for personalized skincare is also boosting brand engagement. Consumers are more likely to trust and continue using products designed specifically for their unique skin profiles. This has led to a surge in subscription-based and direct-to-consumer models. Furthermore, AI-based platforms generate valuable data insights that support continuous product refinement. As digital adoption grows across all age groups, especially among the aging population, the personalized skincare trend is expected to remain a key driver in the anti-aging market.

Regional Analysis

In 2024, Asia Pacific held a dominant market position, capturing more than a 43.5% share and holds US$ 33.87 Billion market value for the year. The strong performance was mainly due to increasing consumer awareness of skincare and grooming. Countries like China, Japan, South Korea, and India showed fast lifestyle changes and urban growth. These trends supported demand for anti-aging products. Additionally, a growing middle class with higher disposable income pushed growth in premium skincare and beauty treatments.

The region also witnessed a rise in its aging population, especially in Japan, where over 30% of people are 65 or older. This shift led to more purchases of anti-wrinkle creams, injectables, and supplements. In South Korea and China, social acceptance of cosmetic procedures contributed to growing demand. Technological innovation also helped, with countries like Japan and South Korea launching new products using ingredients such as retinoids, peptides, and natural extracts.

Furthermore, access to dermatology clinics, medical spas, and online beauty platforms has improved. Consumers in urban areas now easily find local and global skincare options. Digital media and e-commerce have increased product visibility and adoption. Government campaigns promoting healthy aging in countries like Singapore and Australia have further encouraged early use of skincare. Overall, economic, cultural, and health-related factors are expected to maintain Asia Pacific’s leadership in the anti-aging market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Global Anti-Aging Market is moderately consolidated and led by several multinational corporations. These companies drive industry growth through innovation, acquisitions, and broad global networks. Product advancements and strategic branding are key tools used to gain market share. L’Oréal Group is a leading player, with brands like L’Oréal Paris, Vichy, and SkinCeuticals. Its strong R&D focus and trusted active ingredients, including hyaluronic acid and retinol, support its market dominance. Global reach and premium positioning further enhance its leadership across skincare and dermocosmetic segments.

Estée Lauder Companies Inc. holds a strong position with its luxury skincare offerings. Its brands—Estée Lauder, La Mer, and Clinique—are popular across North America, Europe, and Asia. These lines focus on visible results in skin firmness, hydration, and wrinkle reduction. The company relies on dermatologist partnerships and scientific product development. Estée Lauder’s digital strategies and high brand loyalty enhance its market performance. Procter & Gamble follows with its mass-market appeal through Olay, known for accessible pricing and clinically proven results.

Unilever targets aging concerns through brands like Pond’s, Dove, and Dermalogica. These products address dullness, fine lines, and sagging. Its key strengths include wide retail availability and sustainability-driven product lines. The company also promotes inclusivity and affordable skincare. Shiseido Co., Ltd. is a leader in Asia Pacific and expanding globally. Its premium brands like Elixir and Clé de Peau Beauté combine traditional beauty rituals with scientific skincare. Shiseido’s innovation in cellular aging and skin renewal further strengthens its presence.

Johnson & Johnson focuses on the clinical skincare segment through Neutrogena and RoC. These brands offer cost-effective, dermatologist-recommended products. The company leverages strong scientific backing and continuous innovation. Other important players include Beiersdorf AG (NIVEA), Amorepacific, LVMH (Guerlain), and Revlon. These firms use region-specific branding and emphasize organic, vegan, or botanical solutions. Niche players attract younger consumers, adding diversity to the market. Overall, brand strength, innovation, and global access are key to staying competitive in the evolving anti-aging sector.

Market Key Players

- L’Oréal Group

- Estée Lauder Companies Inc.

- Procter & Gamble Co.

- Unilever

- Shiseido Co. Ltd.

- Johnson & Johnson

- Coty Inc.

- Beiersdorf AG

- Avon Products Inc.

- Amorepacific Corporation

- Algenist

- Neutrogena Corporation (a Johnson & Johnson brand)

- Murad Inc.

- Rodan + Fields

- Olay (Procter & Gamble)

- La Mer (Estée Lauder)

- Kiehl’s (L’Oréal)

- Himalaya Wellness

- Dermalogica

- Others

Recent Developments

- In August 2024: L’Oréal acquired a 10% minority stake in Swiss dermatology firm Galderma, signaling its strategic re‑entry into the medical‑aesthetics market, notably anti‑wrinkle injectables and fillers. Concurrently, both companies signed an R&D agreement to co‑develop next‑generation dermatological and anti‑ageing technologies.

- In June 2024: Estée Lauder finalized its full acquisition of DECIEM Beauty Group for approximately US $1.7 billion, acquiring the remaining ~ $860 M stake it did not already own. This strategic move bolsters ELC’s skincare portfolio, notably its popular “The Ordinary” brand, recognized for ingredient-forward, affordable anti‑aging serums and peptides.

- In spring 2024: Olay Body collaborated with personalization platform Wantable on a limited-edition “Power Edit” collection. This partnership promoted Olay’s Super Serum Body Wash, reinforcing the company’s anti‑aging skincare innovation with an integrated lifestyle appeal. The marketing campaign included full-size serum body wash with curated style items, targeting consumers seeking seamless beauty and fashion integration.

Report Scope

Report Features Description Market Value (2024) US$ 77.9 Billion Forecast Revenue (2034) US$ 159.0 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Moisturizers, Anti-Wrinkle Creams, Serums, Anti-Aging Shampoos, Hair Oils & Serums, Injectables, Devices), By Treatment Type (Topical Treatments, Injectables, Laser Treatments, Surgical Procedures, Others), By Gender (Women, Men), By Distribution Channel (Retail, E-commerce, Pharmacies/Drugstores, Spas & Dermatology Clinics, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape L’Oréal Group, Estée Lauder Companies Inc., Procter & Gamble Co., Unilever, Shiseido Co. Ltd., Johnson & Johnson, Coty Inc., Beiersdorf AG, Avon Products Inc., Amorepacific Corporation, Algenist, Neutrogena Corporation (a Johnson & Johnson brand), Murad Inc., Rodan + Fields, Olay (Procter & Gamble), La Mer (Estée Lauder), Kiehl’s (L’Oréal), Himalaya Wellness, Dermalogica, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- L'Oréal Group

- Estée Lauder Companies Inc.

- Procter & Gamble Co.

- Unilever

- Shiseido Co. Ltd.

- Johnson & Johnson

- Coty Inc.

- Beiersdorf AG

- Avon Products Inc.

- Amorepacific Corporation

- Algenist

- Neutrogena Corporation (a Johnson & Johnson brand)

- Murad Inc.

- Rodan + Fields

- Olay (Procter & Gamble)

- La Mer (Estée Lauder)

- Kiehl’s (L’Oréal)

- Himalaya Wellness

- Dermalogica

- Others