Global Animation Market Size, Share, Industry Analysis Report By Product Type (2D Animation, 3D Animation, Stop Motion, Other), By Industry (Direct, Education, Media and Entertainment, Aerospace and Defense, Manufacturing, Automotive, Healthcare, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160938

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- Analysts’ Viewpoint

- Investment and Business Benefits

- US Market Size

- By Product Type: 3D Animation

- By Industry: Media and Entertainment

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

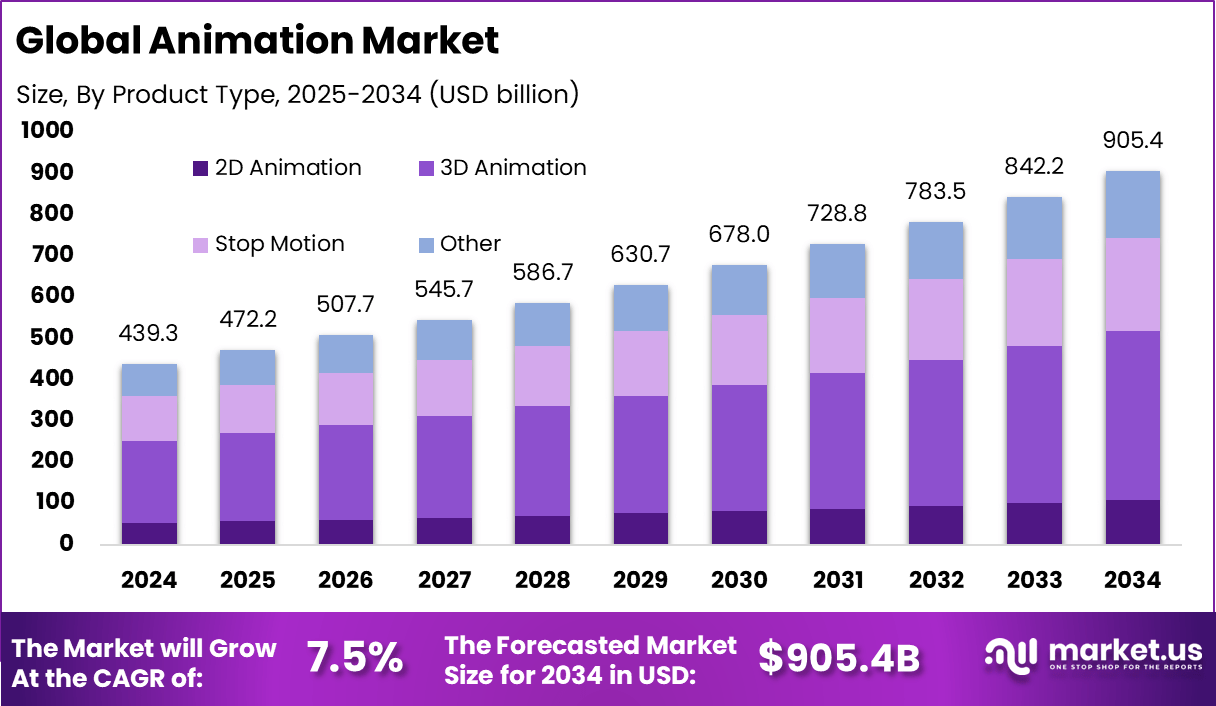

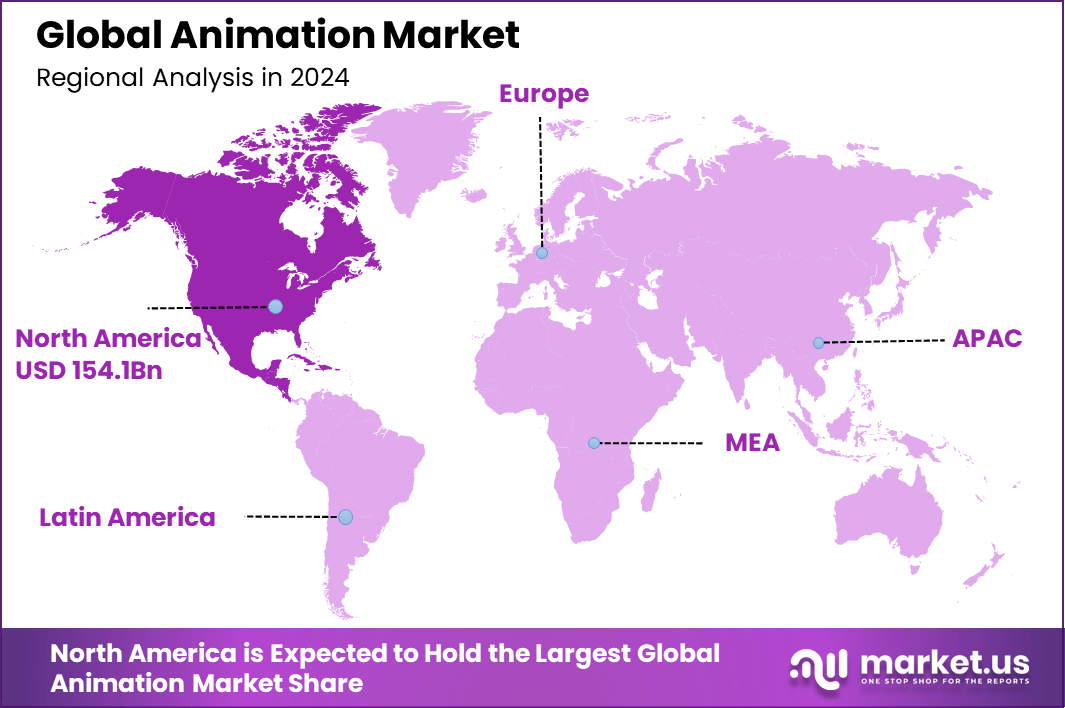

The Global Animation Market generated USD 439.3 billion in 2024 and is predicted to register growth from USD 472.2 billion in 2025 to about USD 905.4 billion by 2034, recording a CAGR of 7.5% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.7% share, holding USD 1.3 Billion revenue.

The Animation Market is expanding rapidly worldwide, driven by technological advances and growing demand for animated content across diverse industries. Animation now plays a vital role not only in entertainment but also in education, advertising, gaming, and virtual experiences. The rise of streaming platforms and digital media channels has pushed animation into mainstream consumption, reaching billions globally.

For instance, In November 2024, the EU launched a three-year plan allocating over €4 million to create a comprehensive report on the animation sector, examining industry challenges, current conditions, and growth strategies. The study aims to provide policymakers and stakeholders with insights to strengthen the EU’s global competitiveness in animation.

According to Freedom Aware. In the United States, over 4,937 animators are employed. Globally, 92% of internet users watch online videos, highlighting animation’s importance in digital content. Videos are 50 times more likely to appear on Google’s first page than text alone. The average person watches 1.5 hours of video daily, making animation essential for engaging audiences.

Different animation styles, including computer-generated (CGI), 3D, and 2D, are increasingly popular, with CGI making up around 85% of the market. Top driving factors include the surge in video streaming platforms that consistently need new, engaging animated content for audiences of all ages. Gaming is another major driver, as animation is critical for character design, story development, and immersive environments.

Demand analysis shows strong growth across multiple animation segments. Kids’ animation remains a cornerstone, especially content focused on educational and social-emotional learning that makes complex concepts accessible and fun. Action-comedy series targeted at children aged 6-11 show high popularity, while content promoting inclusivity and diversity attracts modern audiences.

Additionally, interactive animation experiences are emerging, blending technology and engagement to enhance user participation. Educational sectors drive demand as animated learning tools increase knowledge retention by about 60%, according to studies, and contribute significantly to digital education trends.

Top Market Takeaways

- By product type, 3D animation leads with 45.2%, driven by high demand in movies, gaming, advertising, and immersive media.

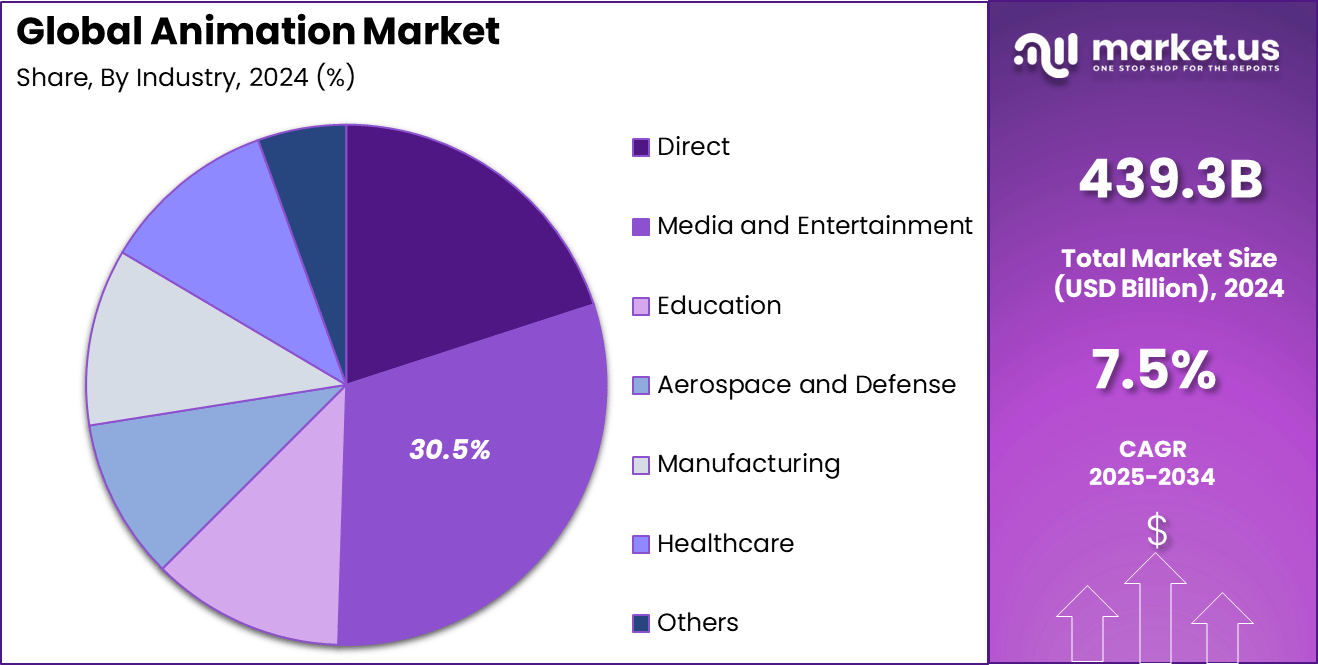

- By industry, media and entertainment dominates with 30.5%, reflecting the sector’s reliance on animation for content creation and visual storytelling.

- North America contributes 35.1%, supported by strong production studios, technological innovation, and streaming platforms.

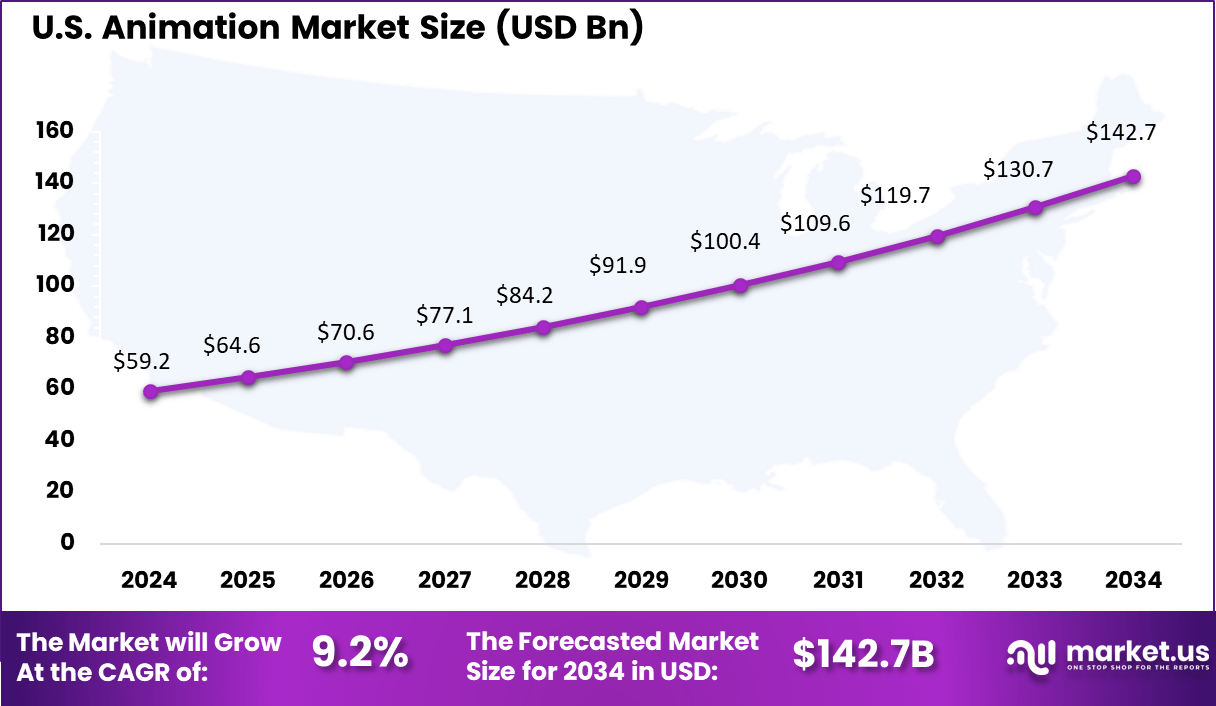

- The US market reached USD 59.27 billion and is expanding at a steady CAGR of 9.2%, underscoring its global leadership in animation production and adoption.

Quick Market Facts

- The Generative AI in Animation Market is witnessing explosive growth, expanding from USD 1.3 billion in 2023 to an estimated USD 28.1 billion by 2033, at a strong CAGR of 36.2%. This rise is fueled by demand for automation in animation design and production efficiency.

- The Animation Software Market remains the largest segment, forecasted to increase from USD 154.8 billion in 2023 to USD 226.9 billion by 2033, growing steadily at 3.9% CAGR. In 2023, North America captured 36.4% share, translating to USD 56.3 billion in revenue, underscoring the region’s leadership in software innovation.

- Outsourcing continues to be a critical driver in global animation workflows. The Animation Outsourcing Market is projected to expand from USD 185.9 billion in 2024 to USD 487 billion by 2034, recording a 10.1% CAGR. North America led in 2024 with 38% share and revenue of USD 70.6 billion, supported by high demand from entertainment and media sectors.

- The Marketing Animation Video Production Market is also on a rapid growth path, forecasted to rise from USD 681.1 million in 2024 to USD 3.36 billion by 2034, reflecting a 17.3% CAGR. With 34.5% share and revenues of USD 234.9 million in 2024, North America was the leading region, driven by brand engagement and digital campaigns.

- In predictive technologies, the Predictive AI Animation Market is expected to grow from USD 499.6 million in 2024 to USD 2.8 billion by 2034, expanding at 18.8% CAGR. North America accounted for 33.5% share in 2024, generating USD 167.3 million in revenue.

- Finally, the EdTech Animation Market demonstrates significant momentum. Valued at USD 110.6 billion in 2024, it is projected to expand from USD 129.1 billion in 2025 to USD 518.2 billion by 2034, at a CAGR of 16.7%. North America again dominated in 2024, with 36.6% share and revenue of USD 40.4 billion, driven by the rapid adoption of animation in digital learning environments.

Analysts’ Viewpoint

Increasing adoption of emerging technologies like Virtual Reality (VR) and Augmented Reality (AR) presents significant opportunities for animation. VR and AR create immersive, interactive environments that animation enables, especially in gaming, education, and healthcare. The U.S. Bureau of Labor Statistics indicates a 21% growth in demand for VR/AR developers from 2021 to 2031, showing the market’s promise.

The increasing consumer base for VR headsets, with several million sold annually, fuels this trend. These technologies help animation studios expand creative possibilities and revenue streams. Key reasons for adopting these advanced animation technologies include enhanced engagement and retention, the ability to simplify complex ideas visually, and the power to create striking, realistic experiences that capture attention.

Animation enables businesses to communicate their offerings more clearly and memorably. Furthermore, animation is cost-effective compared to live-action production, reducing expenses related to sets, actors, and locations. Automated AI techniques in animation production are improving efficiency by about 30%, lowering costs and shortening production times.

Investment and Business Benefits

Investment opportunities in the animation market are diverse and promising. The rapidly growing sectors of kids’ educational content, interactive media, game development, and VR/AR integration provide attractive returns. Governments, notably in Asia, are supporting industry growth through policies, skill development programs, and financial incentives.

The global shift towards digital and streaming consumption creates continuous demand for fresh animated content. Investors can capitalize on the innovation potential of AI-enhanced tools and the expansion in regional markets beyond traditional strongholds. Business benefits of animation include increased audience engagement, improved brand visibility, and better communication of complex ideas.

Animation helps companies standout online by generating visually captivating content that attracts viewer attention. It enhances retention of information, making marketing, training, and educational messages more effective. Moreover, animation content is versatile and can be repurposed across multiple platforms such as social media, advertisements, and internal communications.

US Market Size

The United States, a core part of the North America market, generates significant revenue with a market value of USD 59.27 billion and a CAGR of 9.2%. It remains a powerhouse in animation production, hosting a concentration of major studios and tech companies. The US leads in innovations and content distribution channels, driving continuous market expansion.

Strong demand within film, television, and digital media in the US stimulates investments in 3D animation, visual effects, and interactive experiences. New content delivery methods, including streaming services and gaming platforms, create ongoing opportunities for growth in animated content production and consumption.

North America holds a 35.1% share in the animation market, maintaining its place as a global leader in production capacity and consumption. The region’s strong infrastructure supports a large number of studios and production houses that generate diverse animated content for global audiences. Investment in digital content creation tools and rising consumer demand for streaming and gaming fuel market growth.

Technological innovation also plays a key role in strengthening North America’s position, with widespread adoption of next-gen animation techniques like real-time rendering and AI-driven processes. This region’s animation ecosystem benefits from talent availability and favorable regulations supporting creative industries.

By Product Type: 3D Animation

In 2024, 3D animation leads the market with a 45.2% share, driven by advancements in technology and increasing demand for lifelike visual content. This type of animation is widely used for creating detailed, realistic models and immersive experiences in films, video games, and advertising. The ability to add depth and natural motion sets 3D animation apart, making it favored across industries needing high-quality visuals.

The growing use of virtual reality and augmented reality is also boosting 3D animation adoption, enhancing user engagement through interactive content. The global 3D animation market has shown significant growth, emphasizing its role in creating compelling narratives for entertainment and business applications. This segment continues to expand with the rise of streaming platforms and digital marketing campaigns.

By Industry: Media and Entertainment

In 2024, The media and entertainment industry accounts for 30.5% of the animation market. Animation here enriches storytelling through movies, TV shows, and online streaming services. The rise of animated films and series for both children and adults reflects an increasing appetite for visually creative content. This sector benefits from innovations such as computer-generated imagery (CGI) and motion capture that enhance the quality of productions.

Moreover, the integration of animated elements in advertising, video games, and virtual concerts continues to expand the scope of media and entertainment animation. The demand for high-quality animation drives investment in new tools and talent, fueling further growth. Animation’s role here is not just decorative but central to engaging audiences and creating memorable experiences.

Emerging Trends

One major emerging trend in animation is the use of AI-driven automation tools that reduce production time and costs while maintaining quality. Virtual and augmented reality applications are also gaining ground, offering immersive storytelling experiences that engage audiences more deeply.

The 3D animation segment continues to dominate, with the global 3D animation market expected to nearly double, driven by advancements in real-time rendering and cloud-based collaboration tools. Additionally, more than 65% of marketers plan to increase their animation budgets in the next 18 months, fueling demand for fresh and dynamic animated content.

Growth Factors

The animation industry’s growth is driven by increasing demand for high-quality animated content across entertainment, advertising, education, and gaming. Advancements in AI, cloud technology, and real-time engines enable studios to shorten production timelines and reduce costs without sacrificing quality.

The gaming sector’s need for procedurally generated content and the rise of virtual worlds like the metaverse further propel growth. Consumer desire for personalized and interactive experiences also encourages the adoption of AI in animation production.

Key Market Segments

By Product Type

- 2D Animation

- 3D Animation

- Stop Motion

- Other

By Industry

- Direct

- Media and Entertainment

- Education

- Aerospace and Defense

- Manufacturing

- Healthcare

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing Demand for Animated Content

The animation industry is primarily driven by the ever-increasing demand for animated content across diverse sectors such as entertainment, advertising, gaming, and education. With the rise of streaming platforms like Netflix and Disney+, animated series and films have become a staple offering, attracting global audiences.

The demand extends further into social media and digital marketing, where animation simplifies complex messages and engages consumers more effectively. This growing consumption has catalyzed the industry’s robust growth, enabling studios to invest more confidently in creative storytelling and innovative animation techniques.

Beyond entertainment, the integration of animation into educational tools and healthcare also fuels market expansion. Animated content enhances learning by making complex subjects easier to understand and is used for medical training and patient education. Such broadening utility secures animation’s position as a core element of digital content strategies worldwide, contributing to a projected global market value of approximately $400 billion by 2025.

Restraint Analysis

High Production Costs and Time

A significant restraint facing the animation industry is the high cost and lengthy timelines required for producing quality animated content. Creating detailed animation, especially in 3D, involves sophisticated software, skilled professionals, and extensive post-production work, often stretching over several years for feature films.

These factors add financial burdens, making it challenging for smaller studios and independent creators to compete with large companies that have more resources. Additionally, budget constraints can limit innovation or reduce production quality, impacting market growth potential.

High initial investments and the unpredictability of returns on animated projects make investors cautious. This restraint slows market entry for new players and can delay project releases, impacting the supply of fresh content in a fast-moving, competitive landscape.

Opportunity Analysis

Expansion into Emerging Markets and Technologies

The animation market has promising opportunities in emerging geographic regions and advanced technologies. Countries like India and Japan are leading rapid growth in animation production, driven by increasing internet penetration and cost-efficient outsourcing.

In India, for instance, the animation market is forecasted to grow at an exceptional CAGR exceeding 37% through 2032, fueled by the telecom revolution and mobile connectivity that increase content accessibility. Technology-wise, innovations in AI, virtual reality (VR), and augmented reality (AR) open new frontiers in immersive and interactive animated experiences.

These technologies allow animators to create more realistic, engaging, and personalized content that transcends traditional formats. The rise of short-form animation on mobile and social media platforms also creates viral marketing opportunities, diversifying revenue streams and expanding audience reach globally.

Challenge Analysis

Balancing Quality and Speed in Production

One of the critical challenges for the animation industry is maintaining high-quality output while meeting increasing demand and shrinking production schedules. As audiences expect more sophisticated and visually stunning animation, studios face pressure to accelerate production timelines without compromising quality.

Moreover, the rapidly changing technology landscape demands continuous learning and investment, which not all studios can afford. Smaller players often struggle to keep pace with advancements like AI-assisted animation and real-time rendering. This challenge can widen the gap between leading studios and others, creating disparities in content quality and market competitiveness.

Competitive Analysis

The Animation Market is primarily driven by major software developers and creative studios such as Autodesk Inc., Corel Corporation, and Maxon Computer. These companies provide advanced 2D and 3D animation tools that support industries like film, gaming, advertising, and education. Their platforms enhance animation workflows through AI integration, real-time rendering, and cloud-based collaboration.

Production houses such as Triggerfish Studios, EIAS3D, and Videocaddy contribute significantly to global content creation, offering end-to-end animation services for entertainment and commercial applications. Their capabilities in character design, visual effects, and storytelling continue to strengthen the creative economy and global media exports.

Emerging firms including BRAFTON, WinBizSolutionsIndia, and other key players focus on cost-effective animation outsourcing, motion graphics, and corporate media production. Their growing adoption of digital technologies and remote collaboration tools is expanding accessibility and driving innovation across the animation ecosystem.

Top Key Players in the Market

- SideFX

- Adobe

- Broadcast2World, Inc

- Smith Micro Software, Inc.

- Animation Sharks

- IdeaRocket

- Triggerfish Studios

- EIAS3D

- NewTek, Inc

- BRAFTON

- Corel Corporation

- Autodesk Inc.

- Videocaddy

- Maxon Computer

- WinBizSolutionsIndia

- Others

Recent Developments

- August 2025, SideFX launched Houdini 21, a major upgrade focused on production readiness with over hundreds of new features fully integrated and stable across the CG pipeline. Key highlights include an improved KineFX character rigging system, machine learning enhancements for animation and deformation, and a collaboration plugin with Epic Metahuman. This enhances procedural workflows and boosts efficiency for VFX and game developers.

- September 2025, Adobe unveiled Premiere Pro 25.5 update with more than 90 new effects, transitions, and animations integrated into the software. This upgrade simplifies the creative workflow by embedding effects from their recent acquisition, Film Impact. Enhancements also include smoother GPU-accelerated timeline playback and audio editing improvements, driving user productivity for video and animation creators.

Report Scope

Report Features Description Market Value (2024) USD 439.3 Bn Forecast Revenue (2034) USD 905.4 Bn CAGR(2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (2D Animation, 3D Animation, Stop Motion, Other), By Industry (Direct, Education, Media and Entertainment, Aerospace and Defense, Manufacturing, Automotive, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SideFX, Adobe, Broadcast2World, Inc, Smith Micro Software, Inc., Animation Sharks, IdeaRocket, Triggerfish Studios, EIAS3D, NewTek, Inc, BRAFTON, Corel Corporation, Autodesk Inc., Videocaddy, Maxon Computer, WinBizSolutionsIndia Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SideFX

- Adobe

- Broadcast2World, Inc

- Smith Micro Software, Inc.

- Animation Sharks

- IdeaRocket

- Triggerfish Studios

- EIAS3D

- NewTek, Inc

- BRAFTON

- Corel Corporation

- Autodesk Inc.

- Videocaddy

- Maxon Computer

- WinBizSolutionsIndia

- Others