Aesthetic Devices Market By Product Type (Energy-based (Laser-based Device, Radiofrequency (RF) Based Device, Light-based Device, and Ultrasound Device) and Non-energy-based (Dermal Fillers & Aesthetic Threads, Botulinum Toxin, Microdermabrasion, Implants, and Others)), By Application (Body Contouring & Cellulite Reduction, Skin Resurfacing & Tightening, Hair Removal, Breast Augmentation, Facial Aesthetic Procedures, and Othes) and End-user (Hospitals, Home Settings, and Clinics & Beauty Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146075

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

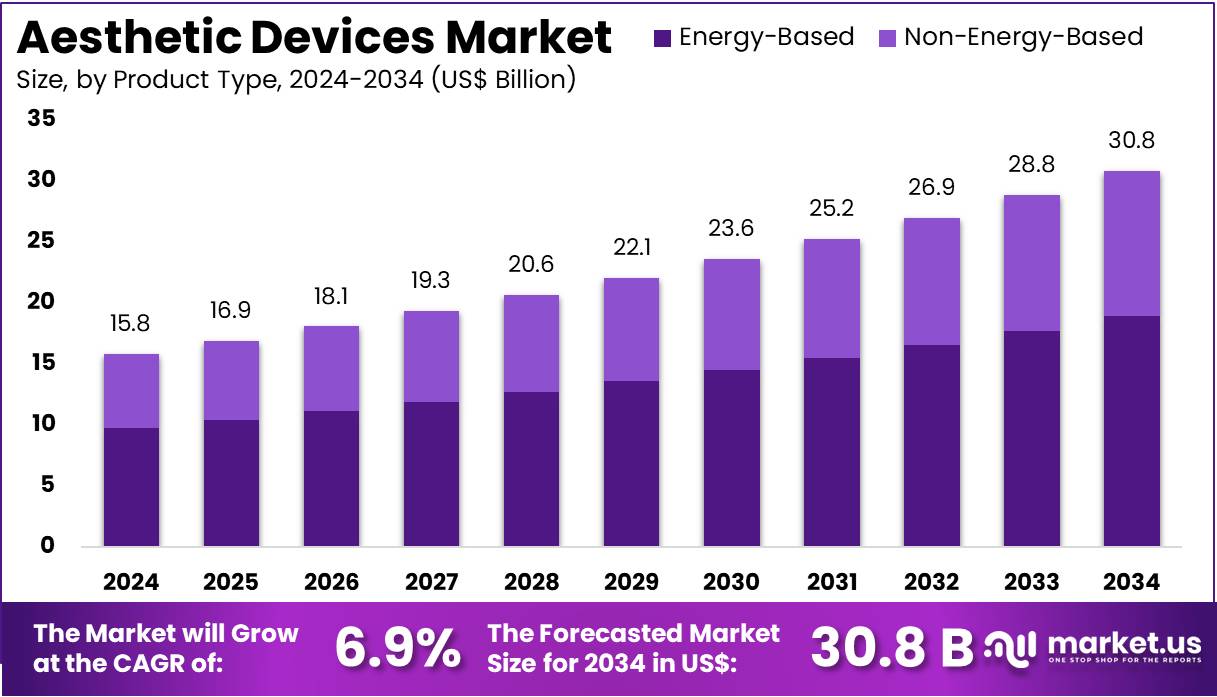

The Aesthetic Devices Market Size is expected to be worth around US$ 30.8 billion by 2034 from US$ 15.8 billion in 2024, growing at a CAGR of 6.9% during the forecast period 2025 to 2034.

Increasing consumer interest in non-invasive aesthetic treatments is driving the growth of the aesthetic devices market. Rising demand for procedures that offer minimal downtime and more natural-looking results is propelling the adoption of devices used for facial rejuvenation, body contouring, and skin tightening. As individuals seek to maintain a youthful appearance without undergoing surgery, the market for aesthetic devices continues to expand, creating new opportunities for growth.

Innovations in laser technologies, radiofrequency devices, and ultrasound-based treatments have contributed to the diversification of available procedures. In October 2023, Naxicap Partners, a private equity firm based in France, acquired Synchrone Group, a prominent provider of medical and aesthetic equipment. This acquisition strengthens Naxicap’s position in the growing aesthetics market, allowing it to broaden its portfolio and enhance its presence in the industry. These trends highlight the growing focus on technology-driven, non-invasive aesthetic solutions that cater to the evolving needs of the beauty and wellness sectors.

Key Takeaways

- In 2024, the market for Aesthetic Devices generated a revenue of US$ 30.8 billion, with a CAGR of 6.9%, and is expected to reach US$ 30.8 billion by the year 2034.

- The product type segment is divided into energy-based and non-energy-based, with energy-based taking the lead in 2024 with a market share of 61.5%.

- Considering application, the market is divided into body contouring & cellulite reduction, skin resurfacing & tightening, hair removal, breast augmentation, facial aesthetic procedures, and others. Among these, body contouring & cellulite reduction held a significant share of 44.8%.

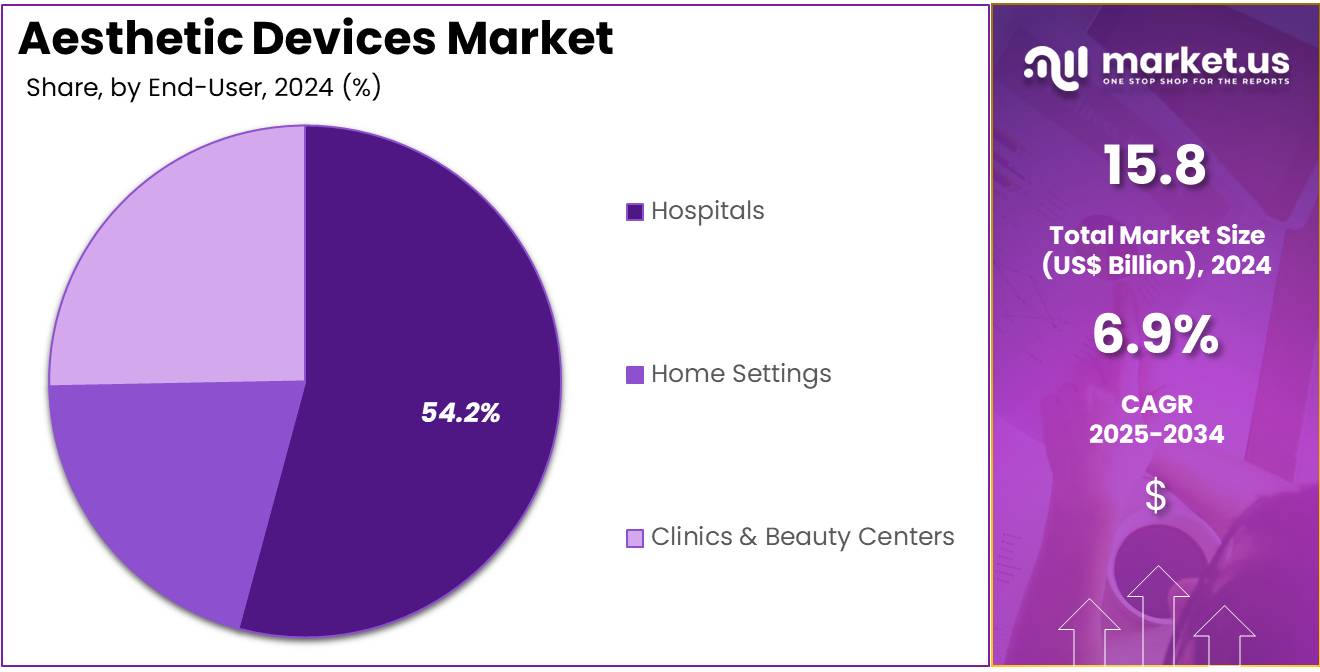

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, home settings, and clinics & beauty centers. The hospitals sector stands out as the dominant player, holding the largest revenue share of 54.2% in the Aesthetic Devices

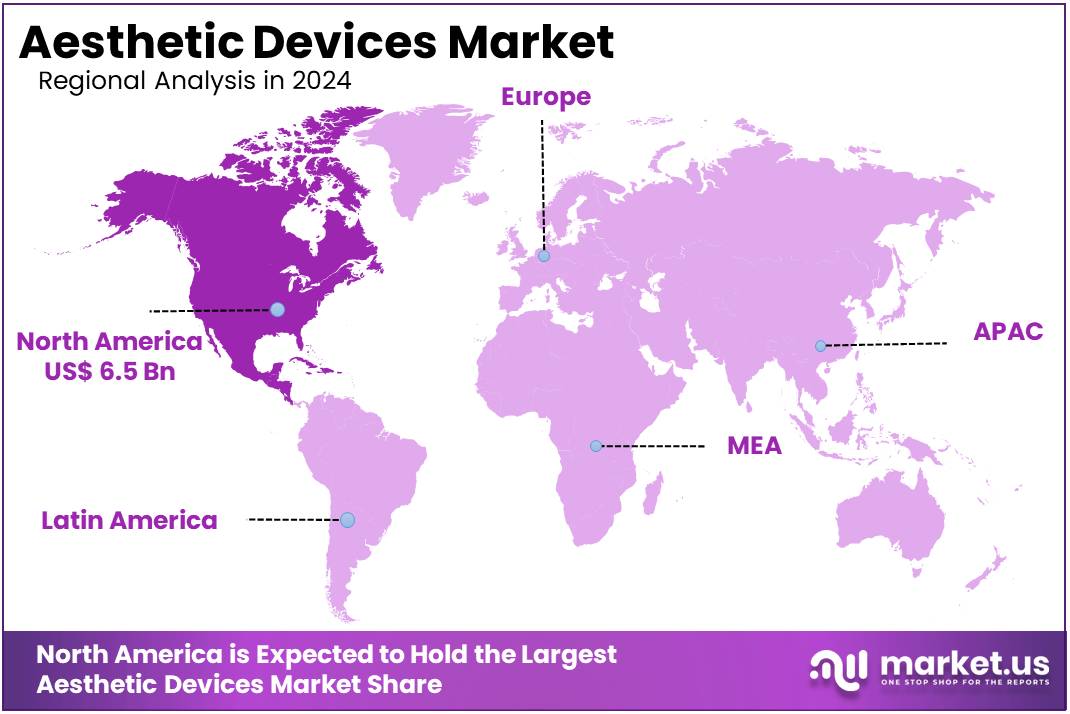

- North America led the market by securing a market share of 41.3% in 2024.

Product Type Analysis

The energy-based segment led in 2024, claiming a market share of 61.5% owing to its wide range of applications, including skin tightening, body contouring, and hair removal. Energy-based devices, such as those using radiofrequency, laser, and ultrasound technologies, offer non-invasive treatments with minimal downtime, which appeals to an increasing number of consumers seeking effective, safe, and convenient aesthetic procedures.

These devices provide precise and controlled energy delivery, ensuring optimal results with fewer side effects. As the demand for minimally invasive procedures grows, this segment is projected to expand further. Additionally, advancements in energy-based technologies, such as improved efficacy and patient safety features, are likely to drive adoption in both professional and home-use markets.

Application Analysis

The body contouring & cellulite reduction held a significant share of 44.8% due to rising consumer interest in non-surgical solutions for body sculpting. Techniques like cryolipolysis and laser-assisted lipolysis have gained popularity as effective ways to reduce stubborn fat deposits and smooth the appearance of cellulite without the need for invasive surgery.

The increasing focus on aesthetics and self-care, particularly among the millennial and Gen Z demographics, is expected to drive demand for these treatments. As more individuals seek to enhance their appearance while avoiding lengthy recovery times, body contouring and cellulite reduction procedures will likely continue to see widespread use, further fueling growth in this segment.

End-User Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 54.2% as hospitals increasingly integrate aesthetic procedures into their offerings. Hospitals have the necessary infrastructure and skilled professionals to provide advanced aesthetic treatments, including energy-based and non-invasive procedures.

As cosmetic treatments become more mainstream and integrated with healthcare, hospitals are expected to adopt a wider range of aesthetic devices to meet patient demand for procedures such as body contouring, skin tightening, and hair removal. The growing awareness of the benefits of non-surgical aesthetic treatments, combined with the advancement of safer and more effective devices, is likely to further enhance hospitals’ role as key end-users in this market.

Key Market Segments

By Product Type

- Energy-based

- Laser-based Device

- Radiofrequency (RF) Based Device

- Light-based Device

- Ultrasound Device

- Non-energy-based

- Dermal Fillers & Aesthetic Threads

- Botulinum Toxin

- Microdermabrasion

- Implants

- Others

By Application

- Body Contouring & Cellulite Reduction

- Skin Resurfacing & Tightening

- Hair Removal

- Breast Augmentation

- Facial Aesthetic Procedures

- Others

By End-user

- Hospitals

- Home Settings

- Clinics & Beauty Centers

Drivers

Technological Advancements are Driving the Market

The aesthetic devices market is experiencing significant growth due to rapid technological advancements, particularly in non-invasive and minimally invasive treatments. Innovations like laser-based devices, radiofrequency systems, and high-intensity focused ultrasound (HIFU) are gaining popularity for their efficacy and reduced downtime.

Companies such as Allergan (AbbVie) and Lumenis have launched advanced platforms, such as the Juvéderm collection and Legend Pro+, which enhance treatment precision. The US Food and Drug Administration (FDA) approved more energy-based aesthetic devices in 2023, reflecting an increasing adoption of advanced treatment options. These developments are expanding the market by attracting both medical professionals and consumers seeking safer, faster solutions for aesthetic treatments.

Restraints

High Treatment Costs are Restraining the Market

The high cost of aesthetic procedures and devices remains a significant barrier for many consumers, limiting market expansion. Advanced treatments like laser resurfacing or body contouring can range from US$ 1,000 to US$ 5,000 per session, making them inaccessible to middle-income demographics. According to the American Society of Plastic Surgeons (ASPS), affordability continues to be a primary concern for many potential patients.

Furthermore, companies like Alma Lasers and Cutera reported slower sales growth in price-sensitive regions such as Latin America and Southeast Asia. The lack of insurance coverage for cosmetic procedures further restricts adoption. While financing options are emerging, the upfront expense remains a deterrent, especially in developing economies.

Opportunities

Rising Medical Tourism is Creating Growth Opportunities

Medical tourism is opening new opportunities for the aesthetic devices market, as patients increasingly seek affordable treatments abroad. Countries like South Korea, Thailand, and Turkey offer high-quality procedures at significantly lower costs than in the US or Western Europe. Leading clinics in these regions are investing in cutting-edge devices from companies like Cynosure and Venus Concept to attract international clients.

South Korea, in particular, has seen a significant number of medical tourists, with aesthetics being one of the top categories. This trend is encouraging device manufacturers to expand their presence in emerging medical hubs, driving global market penetration.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic instability and geopolitical tensions are reshaping the aesthetic devices industry, bringing both positive and negative effects. Inflation and supply chain disruptions have increased production costs, leading companies to raise prices, which may reduce consumer demand in some regions. However, the market is benefiting from rising disposable incomes in emerging economies, where growing middle-class populations are opting for cosmetic enhancements.

Trade restrictions, such as US-China tensions, have delayed device shipments, but local manufacturing efforts are helping to fill this gap with regionally produced alternatives. Currency fluctuations have impacted profitability for multinational firms, yet the thriving medical tourism industry is offsetting some of these challenges. Stricter US FDA oversight ensures higher safety standards, while regulatory harmonization in regions like Europe accelerates approvals. Despite short-term challenges, ongoing technological innovations and expanding global demand will continue to drive long-term growth in this sector.

Latest Trends

At-Home Aesthetic Devices are a Recent Trend

The demand for at-home aesthetic devices is rising, fueled by consumer preference for convenience and privacy. Brands like NuFace, Foreo, and Dr. Dennis Gross are gaining traction with FDA-cleared devices for facial toning and anti-aging. These devices offer cost-effective alternatives to clinical treatments, appealing particularly to younger demographics.

The rise of these home-use devices reflects a shift toward more accessible and personal skincare solutions. However, concerns over the misuse of these devices and lower efficacy compared to professional-grade equipment remain challenges. Despite these issues, the at-home aesthetic devices market is expected to grow as technology improves and becomes more efficient.

Regional Analysis

North America is leading the Aesthetic Devices Market

North America dominated the market with the highest revenue share of 41.3% owing to increasing demand for non-invasive cosmetic procedures, technological advancements, and rising disposable income. The US Food and Drug Administration (FDA) reported a 15% year-over-year increase in approvals for energy-based devices in 2023, accelerating adoption in clinics and medspas.

According to the American Society of Plastic Surgeons (ASPS), over 7.5 million minimally invasive cosmetic procedures were performed in the US in 2023, with laser skin resurfacing and body contouring devices seeing the highest demand. The Centers for Medicare & Medicaid Services (CMS) noted a 12% rise in private healthcare spending on cosmetic treatments between 2022 and 2023, reflecting greater affordability.

Additionally, major industry players like Allergan and Cynosure launched next-generation laser and injectable technologies, further fueling market expansion. The Canadian Medical Association (CMA) also reported a 9% increase in cosmetic procedure volumes in 2023, attributing growth to improved safety profiles of modern devices.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising medical tourism, increasing middle-class spending, and government support for advanced cosmetic technologies. The Chinese National Medical Products Administration (NMPA) approved 20% more aesthetic laser devices in 2023 compared to 2022, signaling rapid industry expansion. In India, the Ministry of Health and Family Welfare recorded a 25% surge in cosmetic procedure licenses issued in 2023, driven by rising demand for skin rejuvenation treatments.

Japan’s Ministry of Health, Labour and Welfare reported a 10% annual increase in dermatological device sales, with a notable shift toward non-surgical solutions. South Korea’s Ministry of Food and Drug Safety (MFDS) noted a 30% rise in approvals for injectable fillers and laser systems in 2023, reinforcing the country’s dominance in beauty innovations. Australia’s Therapeutic Goods Administration (TGA) also observed an 18% growth in aesthetic device registrations, reflecting heightened consumer interest. These trends indicate sustained market momentum across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the aesthetic devices market drive growth through technological innovation, strategic partnerships, and expanding their global presence. They invest in developing advanced technologies, such as energy-based devices like lasers and ultrasound, to enhance treatment efficacy. Collaborations with healthcare providers and research institutions facilitate the integration of new technologies and broaden market reach. Additionally, targeting emerging markets with increasing demand for aesthetic procedures presents significant growth opportunities.

Alma Lasers, headquartered in Caesarea, Israel, is a leading developer and manufacturer of medical and aesthetic lasers and radio-frequency systems. The company offers a comprehensive portfolio of devices for various applications, including skin rejuvenation, body contouring, and hair removal. Alma Lasers emphasizes research and development to deliver innovative solutions that meet the evolving needs of both practitioners and patients. With a strong global presence, the company continues to expand its influence in the aesthetic devices market through strategic partnerships and continuous innovation.

Top Key Players in the Aesthetic Devices Market

- Omni

- Mentor Worldwide LLC

- Medytox

- LUTRONIC INC

- Cynosure

- Cutera

- Candela Medical

- Allergan

Recent Developments

- In August 2023, Allergan and Galderma entered into a strategic partnership to co-develop a new botulinum toxin treatment. Combining Allergan’s leadership in Botox with Galderma’s expertise in dermal fillers, including Restylane, the collaboration aims to create an advanced treatment option that could enhance both aesthetic and therapeutic outcomes.

- In December 2023, Omni Partners acquired Aesthetic Technology Ltd. (ATL), a UK-based company specializing in LED phototherapy for skincare applications. This acquisition is part of Omni’s strategy to expand ATL’s innovative technologies, with a focus on improving its global distribution and advancing skincare treatments.

Report Scope

Report Features Description Market Value (2024) US$ 15.8 billion Forecast Revenue (2034) US$ 30.8 billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Energy-based (Laser-based Device, Radiofrequency (RF) Based Device, Light-based Device, and Ultrasound Device) and Non-energy-based (Dermal Fillers & Aesthetic Threads, Botulinum Toxin, Microdermabrasion, Implants, and Others)), By Application (Body Contouring & Cellulite Reduction, Skin Resurfacing & Tightening, Hair Removal, Breast Augmentation, Facial Aesthetic Procedures, and Othes) and End-user (Hospitals, Home Settings, and Clinics & Beauty Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Omni, Mentor Worldwide LLC, Medytox, LUTRONIC INC, Cynosure, Cutera, Candela Medical, and Allergan. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Omni

- Mentor Worldwide LLC

- Medytox

- LUTRONIC INC

- Cynosure

- Cutera

- Candela Medical

- Allergan