Global Alkaline Fuel Cells Market Size, Share Analysis Report By Type (Static Alkaline Fuel Cells, Mobile/Portable Alkaline Fuel Cells), By Power Output (Up to 5 kW, 5 to 50 kW, Above 50 kW), By Application (Military and Defense, Spacecraft and Launch Systems, Backup and Remote Power, Portable Electronics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165109

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

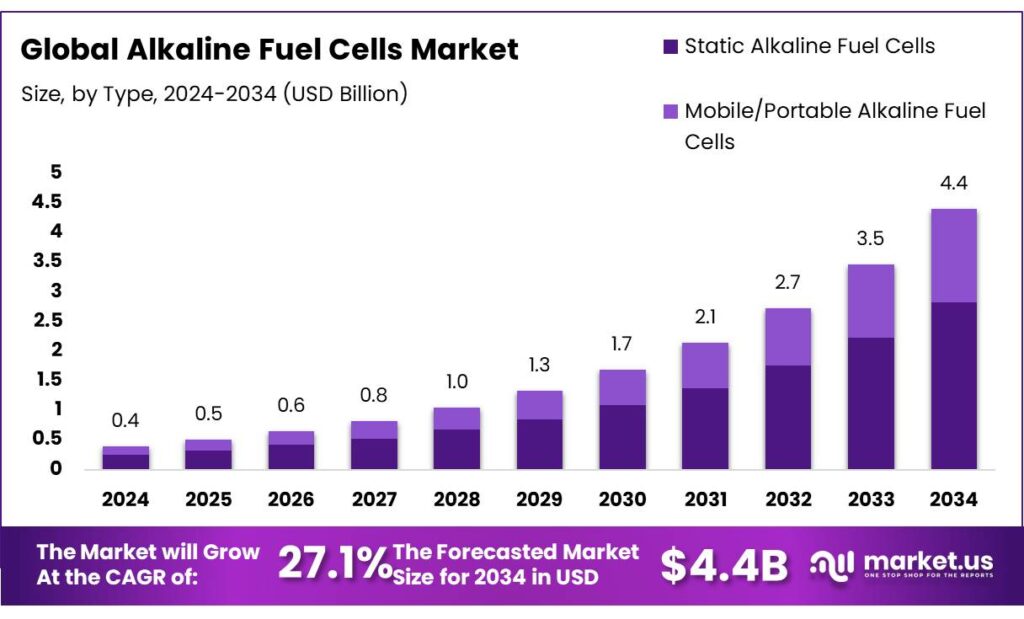

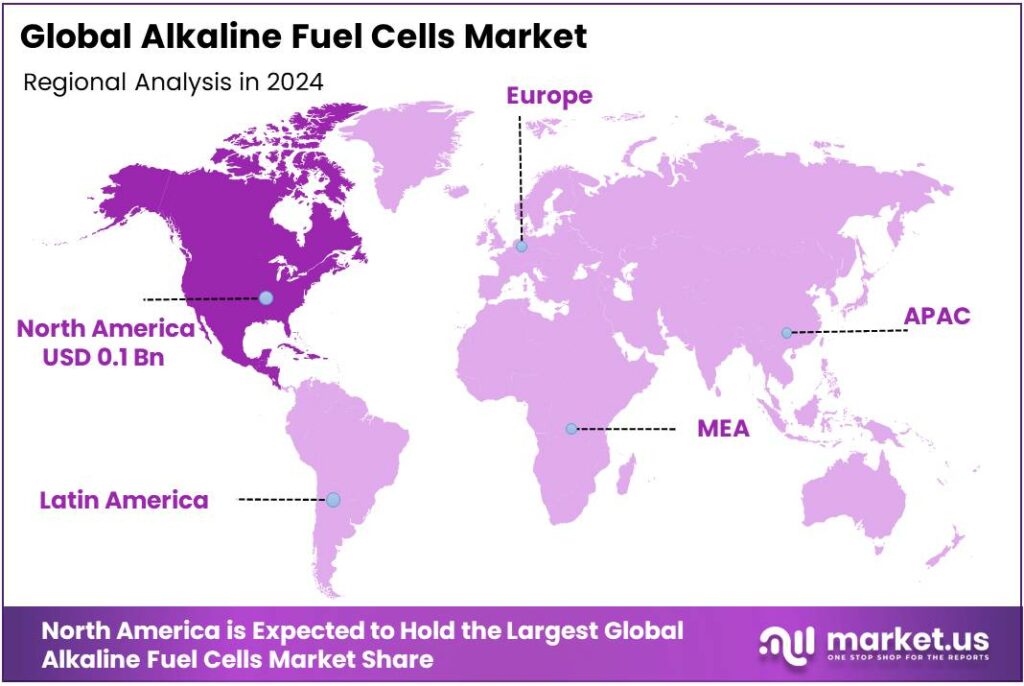

The Global Alkaline Fuel Cells Market size is expected to be worth around USD 4.4 Billion by 2034, from USD 0.4 Billion in 2024, growing at a CAGR of 27.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 46.9% share, holding USD 0.1 Billion in revenue.

Alkaline fuel cells (AFCs) use an alkaline electrolyte and can employ non-precious catalysts. They earned their stripes in the U.S. space program and have demonstrated electrical efficiencies above 60% in space applications. A core technical constraint is CO₂ sensitivity, which can degrade performance unless the inlet gas is well-scrubbed—an engineering consideration for industrial rollouts.

The industrial backdrop is increasingly favorable as hydrogen ecosystems scale. Global hydrogen demand reached ~97 Mt in 2023 and is tracking toward ~100 Mt in 2024, sustaining investment in production, logistics, and end-use technologies that AFCs can tap. Meanwhile, fuel-cell bus fleets—proxies for hydrogen infrastructure maturity—grew more than 75% in the U.S. in 2023, while total full-size zero-emission buses reached 6,147, indicating accelerating hydrogen deployment corridors.

Policy targets are a key demand and cost lever. The EU aims to produce 10 Mt and import 10 Mt of renewable hydrogen by 2030 and initially targeted 40 GW of renewable electrolyzers—ambitions that set direction for industrial decarbonization but face execution scrutiny from auditors. The UK targets up to 10 GW of low-carbon hydrogen production capacity by 2030, with at least half electrolytic, creating a pipeline for clean hydrogen use in off-grid power and construction sites where AFC generators can replace diesel. Such goals expand bankable demand and local supply, tightening project economics for alkaline systems.

In the European Union, the REPowerEU package targets 10 Mt of domestic renewable hydrogen production and 10 Mt of imports by 2030, supported by ~40 GW of electrolyzers—an upstream supply signal for AFC adoption in industry and maritime power. India’s National Green Hydrogen Mission aims for 5 MMT per year by 2030, with analyses indicating ~100–125 GW of additional renewable capacity to meet that target; the government also anticipates ₹8 lakh crore+ in investment and significant job creation—conditions that can localize AFC manufacturing and deployment.

On the supply side, AFC OEMs are translating R&D into fieldable products. In 2024, AFC Energy reported first power from a 200 kW S+ series H-Power generator—its highest-rated unit—targeting construction and temporary power segments traditionally served by diesel. The company also disclosed a 16% reduction in hydrogen consumption for its updated 30 kW generator versus the prior model, alongside capital-cost reductions per kW—concrete steps that narrow total cost of ownership and improve competitiveness against incumbent gensets.

Key Takeaways

- Alkaline Fuel Cells Market size is expected to be worth around USD 4.4 Billion by 2034, from USD 0.4 Billion in 2024, growing at a CAGR of 27.1%.

- Static Alkaline Fuel Cells held a dominant market position, capturing more than a 64.3% share of the overall alkaline fuel cell market.

- 5 to 50 kW held a dominant market position, capturing more than a 49.2% share of the global alkaline fuel cell market.

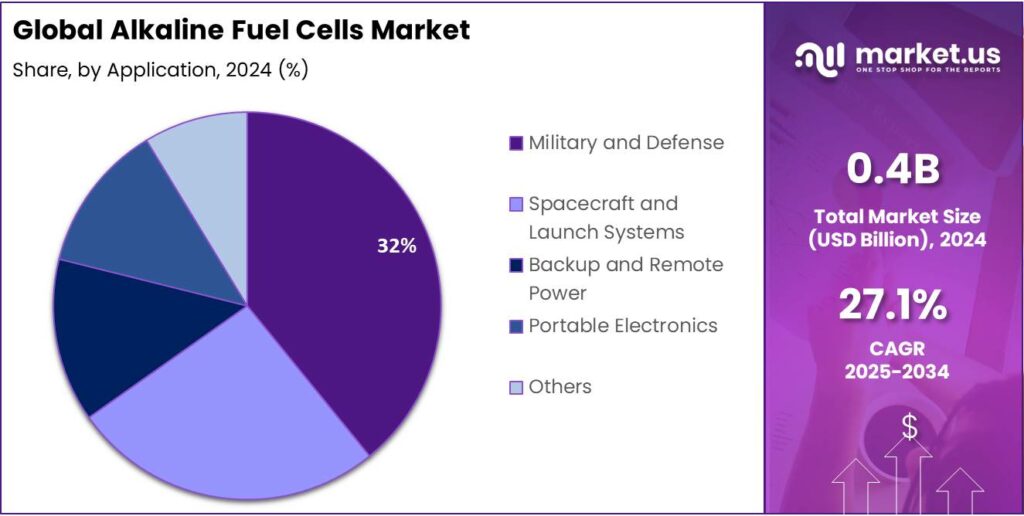

- Military and Defense held a dominant market position, capturing more than a 31.5% share of the global alkaline fuel cell market.

- North America held a dominant position in the global alkaline fuel cells (AFC) market, accounting for more than 46.9% of the total share and valued at approximately USD 0.1 billion.

By Type Analysis

Static Alkaline Fuel Cells lead with 64.3% market share due to their stable performance and reliability.

In 2024, Static Alkaline Fuel Cells held a dominant market position, capturing more than a 64.3% share of the overall alkaline fuel cell market. The strong performance of this segment is attributed to its ability to deliver consistent and efficient power output for stationary and industrial applications. These fuel cells are widely used in backup power systems, remote area energy supply, and combined heat and power (CHP) units, where reliability and long operational life are essential.

During 2025, the demand for static alkaline fuel cells is projected to continue rising as industries focus on decarbonizing power generation and enhancing energy efficiency. Growing emphasis on clean hydrogen infrastructure and government-backed renewable energy programs has further strengthened the adoption of static AFC systems. Their compatibility with existing hydrogen distribution frameworks and high electrical efficiency—often exceeding 60%—make them an attractive choice for grid-independent and mission-critical applications.

By Power Output Analysis

5 to 50 kW Alkaline Fuel Cells dominate with 49.2% share owing to their versatility and efficient mid-range power output.

In 2024, 5 to 50 kW held a dominant market position, capturing more than a 49.2% share of the global alkaline fuel cell market. This power range has become the preferred choice for medium-scale applications such as commercial buildings, telecom towers, and remote industrial operations where steady and efficient electricity generation is essential. The segment’s strength lies in its ability to balance performance and cost while offering a compact design suitable for both stationary and mobile systems.

By 2025, the demand for 5 to 50 kW alkaline fuel cells is expected to rise further as industries and small businesses increasingly adopt clean energy technologies to reduce carbon footprints. Government-led hydrogen initiatives and incentive programs aimed at accelerating low-emission energy adoption are likely to support this expansion. The segment is also gaining momentum in backup and distributed power generation due to its ability to provide uninterrupted energy supply and low maintenance requirements.

By Application Analysis

Military and Defense lead with 31.5% share driven by demand for reliable and portable power solutions.

In 2024, Military and Defense held a dominant market position, capturing more than a 31.5% share of the global alkaline fuel cell market. This strong position is primarily due to the growing need for compact, efficient, and long-lasting power sources for field operations, surveillance systems, and unmanned vehicles. Alkaline fuel cells are valued in defense applications for their ability to provide silent, low-emission, and high-energy-density power, making them ideal for both stationary and mobile military platforms.

By 2025, the military and defense sector is expected to further expand its use of alkaline fuel cells as part of broader modernization and decarbonization initiatives. Many defense organizations are transitioning toward hydrogen-based technologies to reduce logistic challenges associated with conventional fuel systems. Additionally, the integration of AFCs in next-generation defense infrastructure—such as portable communication units, underwater systems, and tactical vehicles—is gaining traction.

Key Market Segments

By Type

- Static Alkaline Fuel Cells

- Mobile/Portable Alkaline Fuel Cells

By Power Output

- Up to 5 kW

- 5 to 50 kW

- Above 50 kW

By Application

- Military and Defense

- Spacecraft and Launch Systems

- Backup and Remote Power

- Portable Electronics

- Others

Emerging Trends

Alkaline fuel cells are pivoting to membrane-based designs and hybrid gensets for zero-emission temporary power

A clear trend in alkaline fuel cells (AFCs) is the move away from liquid KOH systems toward alkaline (anion) exchange membrane fuel cells (AEMFCs) and their use in hybrid battery–fuel-cell generator sets for construction sites, ports, events, and telecom backup. The membrane architecture reduces carbonate fouling risk and enables compact, modular stacks that start quickly and run quietly—essential for places that must cut diesel without sacrificing reliability.

Public-sector programs are reinforcing this shift by expanding clean-hydrogen supply and demonstration budgets, which makes membrane AFC options more bankable for rental fleets and off-grid users. Technical roadmaps from national labs prioritise durability, CO₂ tolerance, and low/PGM-free electrodes, signalling where suppliers are investing to industrialise AEMFC stacks.

What makes this practical now is the hydrogen context. The International Energy Agency (IEA) reports installed electrolysers reached ~1.4 GW by end-2023, nearly double 2022, and could approach ~5 GW by end-2024. Manufacturers also scaled to ~25 GW/yr of electrolyser output by 2023. Even if only ~4% of 2030 project announcements are at final investment decision (FID), the committed base is growing, giving developers greater confidence that hydrogen for temporary power will be available near job sites and ports. These numbers matter because hybrid battery–AEMFC gensets need predictable hydrogen to displace diesel at scale.

Policy is pushing in the same direction. In the United States, the Department of Energy’s Regional Clean Hydrogen Hubs (H2Hubs) program dedicates $7 billion to seven hubs, plus up to $1 billion in demand-side support to lock in offtake—precisely the kind of assurance rental power providers seek before switching platforms. Hubs create local fuel availability, lower delivered-hydrogen risk, and open room for membrane AFC systems that pair with batteries for silent nights and low-emission logistics.

Real-world adoption experience also helps. Japan’s long-running ENE-FARM program shows how stationary fuel-cell ecosystems scale when utilities and service networks mature. More than 450,000 residential fuel-cell units were in use by September 2022, and a 2024 manufacturer tally counted ~503,000 units nationwide (FY2024.3). While most are PEM systems, the installation, maintenance, and gas-supply know-how lowers friction for other fuel-cell formats—AEMFCs included—especially in distributed power and backup roles where quiet operation and high efficiency are valued.

Drivers

Accelerating Clean Hydrogen Supply Chain and Infrastructure

When hydrogen is produced from fossil fuels, it currently causes around 830 million tonnes of CO₂ emissions annually, with only about 130 million tonnes captured. This high-carbon figure highlights the urgent need for low-carbon hydrogen production to align with clean-energy goals. In India, for example, the government’s “Green Hydrogen” initiative notes that hydrogen produced by electrolysis is now ≈60% less expensive than in 2010, thanks to falling electrolyser costs and increasing renewables supply. As hydrogen becomes cleaner and cheaper, fuel-cell systems that rely on it (including AFCs) become far more practical and cost-effective.

For AFCs specifically, the low-temperature operation (<100 °C) and relatively mature chemistry mean they can effectively make use of hydrogen from renewable-electrolysis sources, which are becoming more prevalent. With clean hydrogen production increasing, the “plug-and-play” nature of AFCs becomes more attractive in non-mobility sectors where hydrogen purity and CO₂-challenge issues can be managed more easily than in high-CO₂ environments. This ties directly into the hydrogen supply-chain growth: as more hydrogen is produced and distributed, more applications become viable, creating a virtuous cycle.

On a practical level, the Indian government’s “Green Hydrogen Policy” envisages a domestic electrolyser market of around 20 GW by 2030 in one scenario, with broader demand to reach 226 GW by 2050. While these are not AFC-specific numbers, they indicate the scale of hydrogen-growth which underpins all fuel-cell technologies. For AFCs, this means that end-users—such as small manufacturing units, remote utilities, and construction-site power providers—can increasingly count on hydrogen availability and steady pricing over time.

In more human terms, imagine a rural telecom tower now powered 24/7 by a fuel-cell system rather than a noisy diesel generator: the hum of combustion goes away; the smell of exhaust disappears; the operators worry less about fuel-truck logistics or price swings. This becomes feasible only when hydrogen supply is reliable and affordable. That shift—from fuel-logistics worries to seamless hydrogen-feed power—is made possible precisely by the growing hydrogen infrastructure and policy support.

Restraints

CO₂ Sensitivity and Hydrogen/Air Purity Requirements

A major brake on wider alkaline fuel cell (AFC) adoption is their strong sensitivity to carbon dioxide (CO₂), which drives costly gas-clean-up and operating constraints. In alkaline electrolytes (e.g., KOH), CO₂ reacts to form carbonates (K₂CO₃), lowering ionic conductivity and slowing electrode kinetics—effects directly linked to power loss. Laboratory studies show normalized power density drops as K₂CO₃ builds up in flowing-electrolyte AFCs, quantifying how carbonate formation degrades stack performance over time.

The problem is made harder by today’s air: atmospheric CO₂ is no longer a minor impurity. NOAA reports the annual average CO₂ concentration in 2024 at ~424.6 ppm, with monthly values around 423 ppm—levels high enough that “air-breathing” AFCs must scrub CO₂ or switch to oxygen, adding equipment, maintenance, and energy penalties.

These chemistry and quality realities cascade into system design. AFCs frequently need CO₂-free oxidant to avoid rapid electrolyte carbonation; delivering bottled oxygen or installing air-scrubbers raises capex and operating burden versus technologies that can tolerate air. DOE/NETL references describe how conversion of KOH to K₂CO₃ impairs anode reaction rates and increases ohmic losses, a fundamental mechanism behind performance fade when AFCs face CO₂ ingress.

Hydrogen supply uncertainty compounds the restraint. The IEA notes installed water-electrolyser capacity reached ~1.4 GW by end-2023 and could hit ~5 GW by end-2024, but only ~4% of announced projects to 2030 are at final investment decision (FID) or under construction—a gap that keeps low-carbon hydrogen volumes tight and prices volatile in many regions. For AFC operators who also need higher-purity hydrogen, this supply immaturity raises delivered-fuel costs and risk.

Policy support is growing but uneven, which matters for purity infrastructure. The IEA’s 2024/2025 tracking shows governments revising hydrogen ambitions and timelines as projects stall; outlooks for low-emissions hydrogen in 2030 were cut by nearly 25% versus prior expectations, highlighting execution headwinds in permitting, financing, and supply chains. Where hubs, pipelines, and quality standards are not yet in place, AFC deployments face longer lead times or must resort to localized gas processing to meet CO₂ specs.

Opportunity

Zero-emission temporary & off-grid power (construction, ports, telecom)

A major growth opening for alkaline fuel cells (AFCs) is replacing diesel generators in temporary and off-grid power—construction sites, port berths, outdoor events, and telecom towers. These locations need quiet, reliable power and face tightening emissions rules. Europe’s Stage V standards for non-road mobile machinery (NRMM) are among the toughest worldwide, pushing contractors to cleaner options; AFCs, running on clean hydrogen, can meet power needs without onsite exhaust.

Telecom is a vivid example. India’s sector has long relied on diesel sets for thousands of towers. A TRAI-referenced analysis estimates ~8,760 litres of diesel per tower per year (assuming 8 hours/day operation) and ~10 million tonnes of CO₂ annually from tower diesel use—costly, noisy, and polluting loads that AFCs can displace with clean hydrogen where grid power is weak. The shift improves local air quality and reduces fuel-logistics risks for operators.

Ports are another near-term beachhead. While ships at berth increasingly adopt shore-power, many terminals still run diesel for yard equipment and temporary power. The European Environment Agency reports maritime transport contributed ~24% of EU NOₓ and ~24% of SOₓ emissions in 2018, underscoring the air-quality gains from displacing diesel with fuel-cells in port operations and events near harbours. As the IMO’s 2023 GHG Strategy pushes toward net-zero for international shipping “by or around 2050,” zero-emission ground power will be in higher demand—AFCs fit well for quiet, low-temperature operation.

The opportunity strengthens as clean-hydrogen supply scales. The IEA notes installed electrolyser capacity reached ~1.4 GW at end-2023, nearly double 2022, with manufacturing capacity at ~25 GW/yr by end-2023 and rising—expanding access to low-emissions hydrogen that pairs well with AFCs for stationary/portable generators. Announced projects with FID now stand at ~20 GW of electrolysers globally, a tangible base for regional fuel availability that can feed construction and port micro-hubs.

Regional Insights

North America leads the Alkaline Fuel Cells market with 46.9% share valued at USD 0.1 billion, supported by strong R&D and hydrogen infrastructure growth.

In 2024, North America held a dominant position in the global alkaline fuel cells (AFC) market, accounting for more than 46.9% of the total share and valued at approximately USD 0.1 billion. The region’s leadership is driven by substantial government support, technological innovation, and the increasing adoption of hydrogen-based energy systems. The United States and Canada have emerged as key contributors, with strong funding programs and national hydrogen strategies aimed at reducing carbon emissions and enhancing energy security.

The U.S. Department of Energy (DOE) has prioritized fuel cell and hydrogen research through its Hydrogen and Fuel Cell Technologies Office (HFTO), which invested over USD 200 million in 2024 to accelerate fuel cell system deployment and infrastructure development.

The North American market has also benefited from the growing demand for clean and efficient power solutions in defense, aerospace, and industrial sectors. The U.S. military’s adoption of AFC technology for field operations and backup systems has strengthened domestic manufacturing and innovation capacity. Moreover, several pilot hydrogen projects and demonstration programs across California, Texas, and British Columbia are supporting commercialization pathways for alkaline fuel cells.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AFC Energy plc: Based in the UK, AFC Energy commercialises alkaline fuel-cell systems targeting off-grid and temporary-power markets, particularly to replace diesel generators with hydrogen-based units. It recently delivered a 200 kW H-Power generator and launched the Hy-5 ammonia-cracking module producing up to 500 kg hydrogen/day.

FuelCell Energy Inc.: A US-based fuel-cell company focusing on large-scale power plants, combined heat & power (CHP) and hydrogen production. It holds over 450 patents and supplies megawatt-class solutions for utilities and industry globally.

Plug Power Inc.: An American hydrogen-and-fuel-cell firm offering integrated systems for material handling, stationary power and mobility. It reports over a billion runtime hours of fuel-cell use and is expanding its green-hydrogen manufacturing footprint across the US.

Ballard Power Systems: A Canadian leader in fuel-cell technology, Ballard has developed 14 generations of stacks and nine generations of systems, supplying heavy-duty transport, material handling, and stationary power markets.

Top Key Players Outlook

- AFC Energy plc

- GenCell Ltd.

- Elcogen AS

- FuelCell Energy Inc.

- Plug Power Inc.

- Ballard Power Systems

- Ceres Power Holdings

- PHMatter LLC

- Apollo Energy Systems

- Next Hydrogen Solutions

Recent Industry Developments

Ballard Power Systems, headquartered in Burnaby, Canada, is a leader in fuel-cell engines for heavy-duty mobility and stationary power. In 2024 the company reported revenue of US$69.7 million, down 32% from 2023.

In 2024, GenCell secured a contract worth US$4.9 million to supply dozens of its fuel-cell backup systems to a major European telecom operator for 72-hour power resilience at remote sites.

Report Scope

Report Features Description Market Value (2024) USD 0.4 Bn Forecast Revenue (2034) USD 4.4 Bn CAGR (2025-2034) 27.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Static Alkaline Fuel Cells, Mobile/Portable Alkaline Fuel Cells), By Power Output (Up to 5 kW, 5 to 50 kW, Above 50 kW), By Application (Military and Defense, Spacecraft and Launch Systems, Backup and Remote Power, Portable Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AFC Energy plc, GenCell Ltd., Elcogen AS, FuelCell Energy Inc., Plug Power Inc., Ballard Power Systems, Ceres Power Holdings, PHMatter LLC, Apollo Energy Systems, Next Hydrogen Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AFC Energy plc

- GenCell Ltd.

- Elcogen AS

- FuelCell Energy Inc.

- Plug Power Inc.

- Ballard Power Systems

- Ceres Power Holdings

- PHMatter LLC

- Apollo Energy Systems

- Next Hydrogen Solutions