Global Algaecides Market Size, Share, And Business Benefits By Type (Copper Sulfate, Chelated Copper, Quaternary Ammonium Compounds, Peroxyacetic Acid and Hydrogen Dioxide, Dyes and Colorants, Others), By Mode of Action (Non-Selective, Selective), By Form (Liquid, Granular Crystal, Pellet), By Application (Surface Water Treatment, Aquaculture, Sports and Recreational Centers, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157706

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

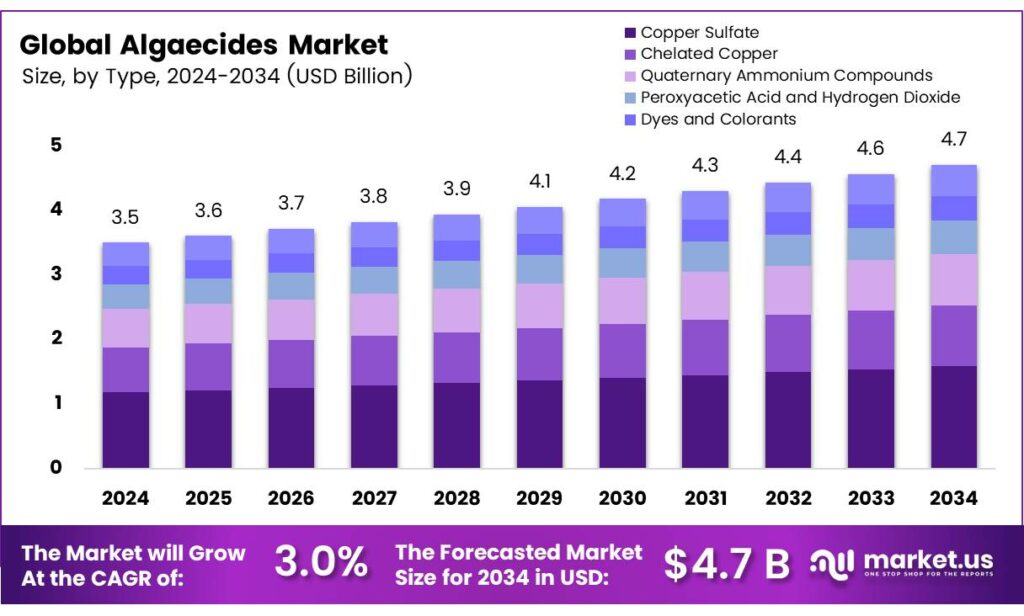

The Global Algaecides Market size is expected to be worth around USD 4.7 billion by 2034, from USD 3.5 billion in 2024, growing at a CAGR of 3.0% during the forecast period from 2025 to 2034.

The Algaecides market plays a critical role in water treatment, agriculture, aquaculture, and industrial applications, where controlling algae growth is vital for maintaining water quality, ecosystem balance, and operational efficiency. Algaecides are widely adopted in municipal water treatment plants, irrigation systems, aquaculture ponds, and industrial reservoirs to prevent algae proliferation that can disrupt filtration systems, affect crop irrigation, and damage aquatic environments.

Fungal plant diseases remain the leading cause of crop loss worldwide, with thousands of fungal pathogens threatening global agriculture. To counter this, chemical and biological fungicides are widely used to suppress or destroy fungal infections. In the United States alone, more than 50,000 tons of fungicide are applied annually, with over half of this usage concentrated on grape and tomato crops.

Fungal plant diseases remain the leading cause of crop loss worldwide, with thousands of fungal pathogens threatening global agriculture. To counter this, chemical and biological fungicides are widely used to suppress or destroy fungal infections. In the United States alone, more than 50,000 tons of fungicide are applied annually, with over half of this usage concentrated on grape and tomato crops.Production of fruits such as eastern apples, southern peaches, and California grapes relies almost entirely on fungicide applications, making them indispensable in modern agricultural systems. With 70% of global freshwater consumption directed toward agriculture, the demand for effective algae control solutions has increased to ensure smooth irrigation and improved crop yields. In addition, aquaculture, which contributes more than 50% of global fish consumption, requires constant monitoring of water quality, making algaecides indispensable in this sector.

Fungicides are typically categorized by their site of application. Foliar fungicides are sprayed on the green parts of plants, where they form a protective barrier against pathogens. Soil fungicides are applied directly to the soil, acting either as fumigants or by being absorbed into the plant root system. Dressing fungicides are applied to seeds or harvested crops to prevent fungal infestation during storage or germination.

Key Takeaways

- The Global Algaecides Market is projected to grow from USD 3.5 billion in 2024 to USD 4.7 billion by 2034 at a CAGR of 3.0%.

- Copper Sulfate led the market in 2024 with a 33.7% share due to its effectiveness in controlling algae across various applications.

- Liquid algaecides dominated the market in 2024, with a 56.8% share, due to their ease of application and fast results.

- Non-selective algaecides held a 67.9% share in 2024, valued for their ability to effectively target a diverse range of algae species.

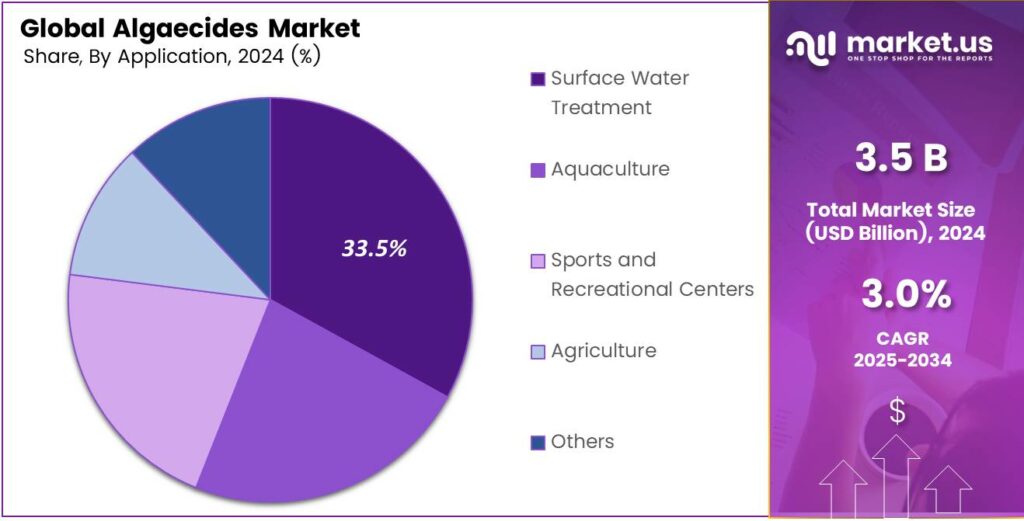

- Surface water treatment accounted for a 33.5% share in 2024, driven by the need to manage algal blooms in natural water bodies.

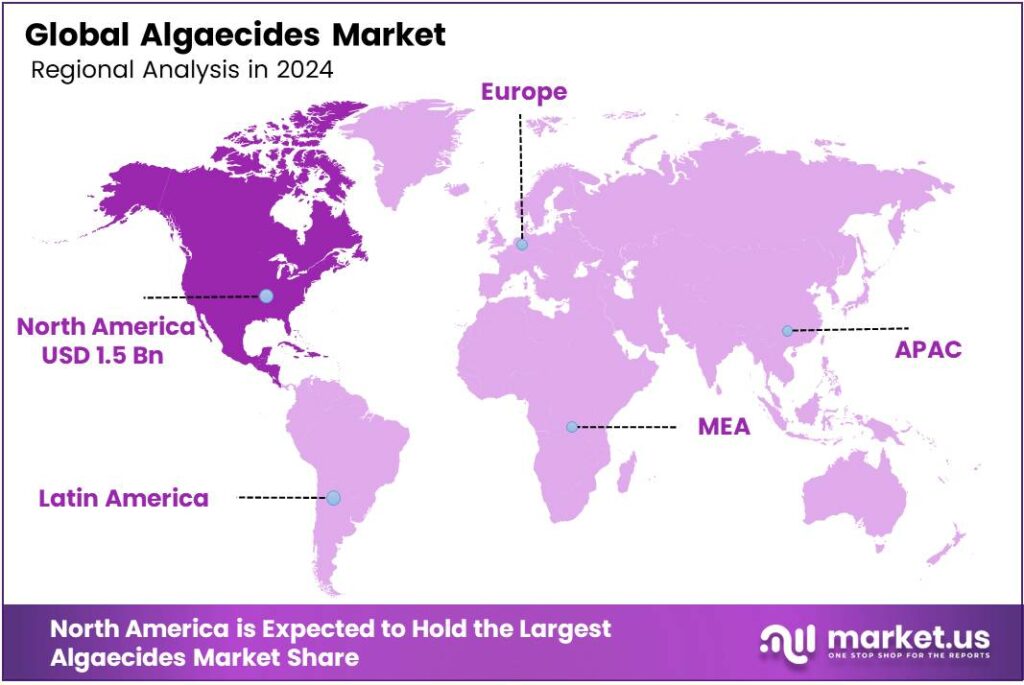

- North America led the global market in 2024 with a 43.7% share, valued at USD 1.5 billion, due to advanced agriculture and water management practices.

Analyst Viewpoint

The Algaecides Market presents a compelling opportunity as global demand for clean water and sustainable agriculture grows. With increasing algal blooms due to climate change and nutrient runoff, industries like aquaculture, municipal water treatment, and farming are leaning heavily on algaecides to maintain water quality.

The push for eco-friendly solutions, like biodegradable and bio-based algaecides, is opening doors for innovation-driven companies, particularly in regions like North America and Asia-Pacific, where water management is a priority. For instance, the rise in aquaculture production fuels demand for safe, effective algae control.

Investors could find strong potential in firms developing peroxide-based or plant-derived algaecides, as these align with growing consumer and regulatory preferences for sustainability. However, the market’s growth isn’t without hurdles. Price competition from traditional chemicals like copper sulfate and volatile raw material costs could squeeze margins for smaller players.

By Type

Copper Sulfate Leads with 33.7% Market Share

In 2024, Copper Sulfate held a dominant market position, capturing more than a 33.7% share in the global algaecides market. Its strong demand is mainly due to its effectiveness in controlling algae in agricultural irrigation systems, aquaculture ponds, and natural water bodies.

Farmers and water management authorities have long relied on copper sulfate as a cost-effective and proven solution for maintaining water quality and reducing harmful algal blooms. The compound’s ability to act quickly against different algae types makes it a preferred choice, particularly in regions with recurring algae infestations.

Copper Sulfate is expected to maintain its dominance as industries continue to seek efficient solutions for managing algae in both commercial and municipal applications. With rising concerns over water safety and the protection of aquatic life, regulatory bodies are increasingly supporting controlled usage of copper-based products.

By Mode of Action

Non-Selective Dominates with 67.9% Share

In 2024, Non-Selective held a dominant market position, capturing more than a 67.9% share in the global algaecides market. The preference for non-selective products comes from their ability to target and eliminate a wide range of algae species at once, making them highly effective for large-scale applications.

Water treatment facilities, aquaculture farms, and agricultural irrigation systems often rely on non-selective algaecides to maintain clean water sources and prevent rapid algae spread. Their broad-spectrum action helps reduce maintenance costs and ensures quick results, which has made them the most widely used type in both industrial and commercial water management practices.

The strong demand for non-selective algaecides is expected to continue as water safety regulations tighten and the need for effective algae control grows worldwide. Increasing challenges from harmful algal blooms in lakes, reservoirs, and aquaculture ponds further boost reliance on these solutions.

By Form

Liquid Form Leads with 56.8% Share

In 2024, Liquid held a dominant market position, capturing more than a 56.8% share in the global algaecides market. The liquid form is highly preferred because it is easy to apply, mixes well in water, and provides fast results. Farmers, aquaculture operators, and municipal water treatment facilities often choose liquid algaecides since they ensure even distribution across ponds, lakes, reservoirs, and irrigation systems.

This convenience and effectiveness make liquid formulations the first choice for large-scale applications, especially where quick algae control is needed. The liquid segment is expected to maintain its strong hold as demand for efficient and user-friendly solutions continues to rise. With increasing concerns over harmful algal blooms affecting both drinking water and aquatic life, liquid algaecides are projected to remain in high demand.

Their compatibility with advanced spraying and pumping equipment further supports their widespread use in both agricultural and urban water management. As a result, the liquid form will continue to dominate the algaecides market, sustaining its majority share and driving consistent growth across global regions.

By Application

Surface Water Treatment Holds 33.5% Share

In 2024, Surface Water Treatment held a dominant market position, capturing more than a 33.5% share in the global algaecides market. This segment is driven by the growing need to manage harmful algal blooms in lakes, rivers, reservoirs, and other natural water bodies that serve as vital sources for drinking water and irrigation.

Municipal authorities and environmental agencies increasingly depend on algaecides to ensure water safety, protect aquatic ecosystems, and maintain recreational water quality. The ability of algaecides to control algae growth effectively in open water systems has made surface water treatment a leading area of application.

Demand for algaecides in surface water treatment is expected to rise further as climate change, nutrient pollution, and rising temperatures continue to intensify algae proliferation. Communities around the world are placing greater emphasis on sustainable water management, and algaecides are set to play a central role in safeguarding public health and aquatic resources.

Key Market Segments

By Type

- Copper Sulfate

- Chelated Copper

- Quaternary Ammonium Compounds

- Peroxyacetic Acid and Hydrogen Dioxide

- Dyes and Colorants

- Others

By Mode of Action

- Non-Selective

- Selective

By Form

- Liquid

- Granular Crystal

- Pellet

By Application

- Surface Water Treatment

- Aquaculture

- Sports and Recreational Centers

- Agriculture

- Others

Drivers

Clean Water Laws Spark Demand for Algaecides

One of the biggest driving forces behind algaecide use today is stronger water-quality rules set by governments. For instance, in the U.S., agencies like the Environmental Protection Agency enforce tighter limits on nutrient pollution, especially nitrogen and phosphorus, which fuel harmful algal blooms.

When lakes or reservoirs show elevated nutrient levels, local authorities often turn to algaecides to quickly bring algae levels down and ensure drinking water is safe and ecosystems stay balanced. Putting it plainly: when governments step up regulations around clean water, communities feel pressure to act and fast.

Algaecides provide a familiar, reliable option. They help managers meet safety standards and manage outbreaks before they spiral out of control. Since regulators demand safe, algae-free water in our reservoirs, rivers, and lakes, the push from legislation becomes a natural engine behind steady growth in algaecide use. The numbers I shared reflect just how much this kind of regulatory attention can move the needle for these products.

Restraints

Toxicity to Aquatic Life is a Key Constraint

When copper-based algaecides enter lakes or rivers, they don’t just target algae; they can affect fish, plants, and other water creatures in gentle but troubling ways. That’s why regulators have introduced strict limits to protect ecosystems. California’s water authorities use a formula to determine how much copper is too much. They apply a Chronic Criterion for dissolved copper, based on water hardness, plus a hard cap of 3.1 µg/L when treating saltwater bodies.

These tiny numbers, just a few micrograms per liter, sound almost invisible. Yet they can make a world of difference. If algaecide applications push copper levels above those thresholds, regulators can intervene. They may require more monitoring, demand changes in how and when the algaecide is applied, or even pause applications altogether.

From another trusted source, a 2010 EPA proposal listed specific annual application amounts of copper, like no more than 2.74 lbs of metallic copper per acre foot, which equals about 1 ppm for whole-water-body treatments, spaced over the active algae-growing months. This precision ensures that treatments are effective yet respectful of environmental health.

Opportunity

Rising Incidence of Harmful Algal Blooms Fuels Demand for Algaecides

Algae are living things that thrive when conditions are just right: plenty of food, warm water, and gentle light. But when they bloom too much, especially the harmful kind, they disrupt ecosystems, harm people, and shake local economies. NOAA keeps a close watch on these harmful algal blooms (HABs).

Every year, they cost regions like the U.S. tens of millions. In fact, the U.S. seafood and tourism industries lose around USD 82 million each year because of HABs. And some events are truly devastating. Florida’s 2018 red tide, for instance, racked up a staggering USD 2.7 billion in total economic damage.

When harm to fisheries, tourism, and public health grows, people and governments begin to look for solutions. That’s where algaecides step in. These treatments help control blooms before they get out of hand. In effect, every dollar lost to a bloom makes the case stronger for investing in prevention, and that’s fuel for the algaecide market.

Trends

Shift Toward Eco-Friendly Natural and Biocontrol Algaecides

In algaecide development, away from only relying on harsh chemicals and toward using nature’s own solutions. One of the most hopeful emerging trends is the rise of plant-based and microbial algaecides, safe, natural, and kinder to the water and its tender inhabitants. Spotlighted a plant-based algaecide named C7X1, which works against harmful algae strains like Microcystis and Pseudo-nitzschia.

It’s effective at low parts-per-million doses, and it slows down photosynthesis without spraying traditional chemicals like copper or hydrogen peroxide that can linger and harm other life in the water hydrogen peroxide that can linger and harm other life in the water. That kind of precision and gentleness matters, especially when communities and ecosystems feel fragile.

Regional Analysis

North America leads with a 43.7% share and a USD 1.5 Billion market value.

In 2024, North America emerged as the dominant regional market for algaecides, securing a substantial 43.7% share, valued at approximately USD 1.5 billion. The region’s strong presence is primarily driven by its advanced agricultural practices, high awareness of water quality management, and significant investment in aquaculture.

The U.S. leads consumption, supported by extensive applications in surface water treatment, irrigation systems, and recreational water bodies. With growing concerns about harmful algal blooms, government initiatives and regulatory frameworks have further encouraged the adoption of algaecides across municipal and private sectors.

The demand in North America is also fueled by the rising need for effective water treatment solutions to ensure safe drinking water and to maintain ecological balance in lakes, ponds, and rivers. The Environmental Protection Agency (EPA) and local authorities have been actively monitoring algal bloom occurrences, prompting higher reliance on algaecides to mitigate their impact.

The fish farming sector increasingly depends on water treatment chemicals to maintain healthy aquatic environments, directly boosting algaecide usage. With growing investments in water resource management and the increasing risk of climate change-related algal outbreaks, North America is expected to sustain its leadership position over the coming years, continuing to capture the largest share of the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Airmax Inc. is a significant player in the algaecides market, recognized for its innovative pond and lake management solutions. The company specializes in EPA-registered products that effectively control a wide range of algal blooms, from planktonic to filamentous types. Airmax’s strength lies in its integrated approach, combining algaecides with aeration systems and water quality treatments to promote long-term aquatic health.

BASF SE is a global chemical giant and a leading force in the algaecides market. Leveraging its vast R&D capabilities, BASF develops advanced active ingredients and formulated products known for their efficacy and reliability. Their algaecides are widely used in industrial water treatment, aquaculture, and agriculture to manage harmful algal blooms and protect water systems.

UPL Limited is a major global agrichemical company with a substantial presence in the algaecides segment. Offering a broad portfolio of crop protection solutions, UPL provides effective algaecidal products designed for agricultural and industrial water treatment applications. Their strength is derived from a powerful worldwide distribution network and a strategy focused on sustainable food systems.

Top Key Players in the Market

- Airmax Inc.

- BASF SE

- UPL Limited

- Oreq Corporation

- BioSafe Systems LLC

- Waterco Limited

- Nufarm Limited

- SePRO Corporation

- Phoenix Products Co.

- Kemira

Recent Developments

- In 2024, Airmax Inc. continues to focus on eco-friendly pond management solutions. Their algaecide products, such as Airmax WipeOut and Airmax Algae Defense, are marketed for controlling a broad spectrum of algae in ponds and lakes. Recent updates emphasize enhanced formulations for faster algae control with minimal environmental impact.

- In 2024, BASF announced enhancements to its Magnafloc and Alclar product lines, which, while primarily flocculants, are often used in conjunction with algaecides to improve water clarity in industrial settings. BASF’s commitment to reducing chemical runoff in agricultural water systems which includes algaecide applications.

Report Scope

Report Features Description Market Value (2024) USD 3.5 Billion Forecast Revenue (2034) USD 4.7 Billion CAGR (2025-2034) 3.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Copper Sulfate, Chelated Copper, Quaternary Ammonium Compounds, Peroxyacetic Acid and Hydrogen Dioxide, Dyes and Colorants, Others), By Mode of Action (Non-Selective, Selective), By Form (Liquid, Granular Crystal, Pellet), By Application (Surface Water Treatment, Aquaculture, Sports and Recreational Centers, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Airmax Inc.

- BASF SE

- UPL Limited

- Oreq Corporation

- BioSafe Systems LLC

- Waterco Limited

- Nufarm Limited

- SePRO Corporation

- Phoenix Products Co.

- Kemira