Global Algae Products Market Size, Share, And Industry Analysis Report By Source (Macroalgae, Microalgae, Blue-Green), By Form (Dry, Liquid), By Type (Lipids, Carotenoids, Carrageenan, Alginates, Algal Proteins), By Application (Food and Beverages, Dietary Supplements, Animal Feed, Cosmetics and Personal Care Products, Pharmaceuticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169370

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

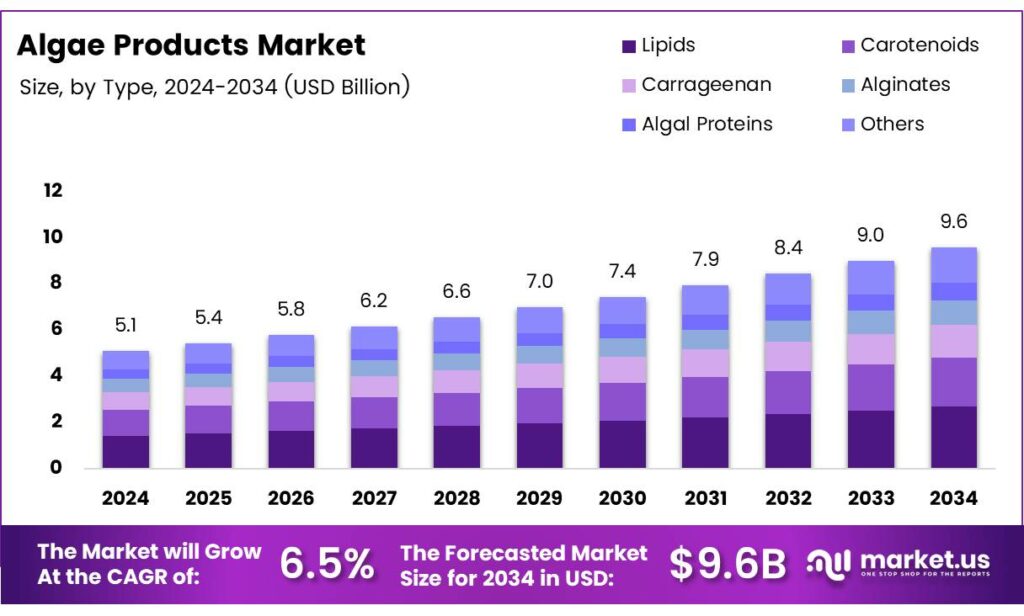

The Global Algae Products Market size is expected to be worth around USD 9.6 billion by 2034, from USD 5.1 billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

The algae products industry covers biomass-derived ingredients used across food, feed, nutraceuticals, cosmetics, pharmaceuticals, biofertilizers, and sustainable materials. Algae products include proteins, lipids, pigments, hydrocolloids, and functional extracts. Consequently, this market connects climate efficiency with supply security, purity control, and scalable fermentation or cultivation economics.

Algae deliver concentrated nutrition and functional performance using limited land and water. Moreover, microalgae and macroalgae offer rapid biomass cycles supporting year-round output stability. Therefore, businesses value algae for clean-label positioning, traceability, and formulation flexibility across protein enrichment, natural colourants, omega oils, and texture modifiers.

- Long-term growth drivers reflect structural food and climate pressures. According to the Food and Agriculture Organisation, the global population is projected to reach 9 billion by 2050, increasing food demand by 70%. Consequently, algae emerge as scalable nutrition sources that reduce dependence on arable land and freshwater.

Scientific efficiency strengthens this case. Including NASA-referenced studies, algae account for nearly 50% of Earth’s photosynthesis, converting sunlight into biomass faster than terrestrial crops. Therefore, producers benefit from higher productivity per area with predictable, controllable yields.

Climate performance metrics further support market expansion. One acre of algae can absorb up to 2.7 tons of CO₂ daily, while requiring about 1.87 kilograms of CO₂ per kilogram of algae biomass produced. Hence, algae products align commercial growth with decarbonization goals, strengthening long-term market opportunity.

Key Takeaways

- The Global Algae Products Market is projected to grow from USD 5.1 billion in 2024 to USD 9.6 billion by 2034, registering a 6.5% CAGR during 2025–2034.

- Macroalgae lead the market by source with a dominant share of 56.2% in 2024, driven by large-scale cultivation and broad food and industrial usage.

- Dry algae products account for the largest share at 69.3% due to longer shelf life and ease of storage, and transportation.

- Lipids hold the leading position with a market share of 23.4%, supported by rising demand for omega-rich ingredients.

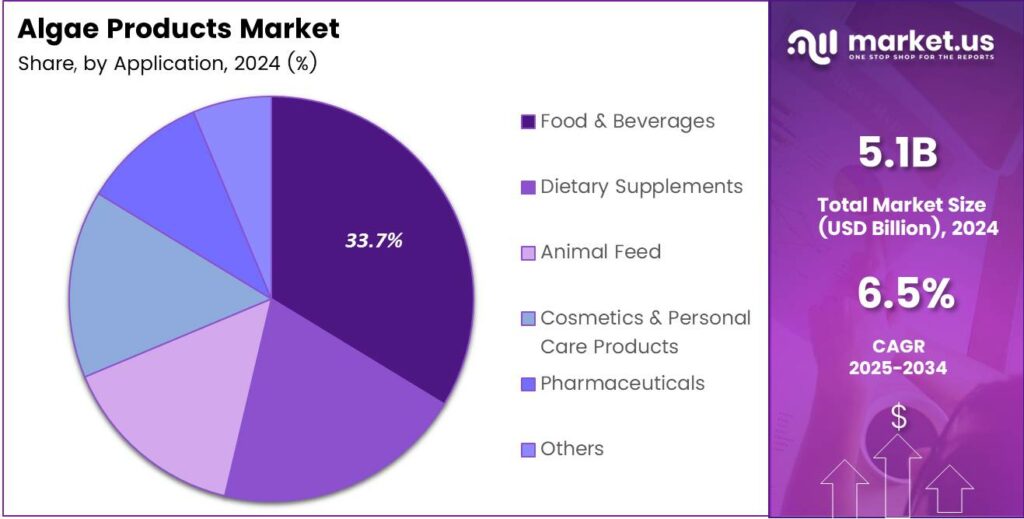

- Food and Beverages dominate application-wise, capturing 33.7% of the total market in 2024, driven by clean-label and functional nutrition trends.

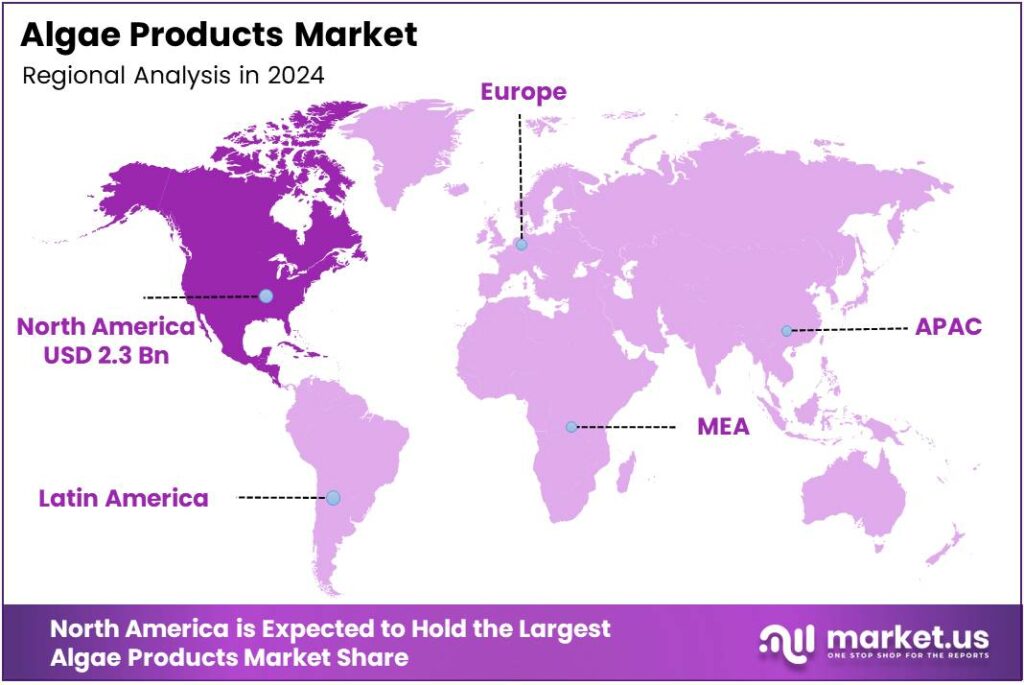

- North America is the leading regional market, holding a 45.7% share and valued at USD 2.3 billion in 2024.

By Source Analysis

Macroalgae dominate with 56.2% due to their large-scale cultivation, high biomass yield, and strong acceptance across food, feed, and industrial applications.

In 2024, Macroalgae held a dominant market position in the By Source Analysis segment of the Algae Products Market, with a 56.2% share. This leadership is driven by easy coastal farming, faster growth cycles, and broad usability. Moreover, macroalgae support stable supply chains for food ingredients and hydrocolloids.

Microalgae play a vital supporting role, mainly used in nutraceuticals and functional foods. It offers higher nutrient density and controlled indoor cultivation advantages. However, relatively higher processing costs and infrastructure needs limit its overall share compared to macroalgae.

Blue-Green algae, often used for pigments and supplements, continues to see focused demand. Its role remains niche, supported by antioxidant and protein-rich properties. Still, scalability challenges and regional production constraints impact wider adoption.

By Form Analysis

Dry dominates with 69.3% due to longer shelf life, easier transportation, and suitability for large-scale food and feed processing.

In 2024, Dry held a dominant market position in the By Form Analysis segment of the Algae Products Market, with a 69.3% share. This dominance reflects its storage stability, reduced microbial risk, and strong compatibility with powders and blended formulations.

The dry form is widely preferred by manufacturers due to cost efficiency and simplified logistics. Moreover, drying allows algae products to retain core nutrients while enabling flexible use across food, supplements, and animal nutrition sectors. Liquid algae products serve applications requiring immediate bioavailability and easy mixing.

These forms are gaining gradual interest in beverages and cosmetics. However, limited shelf life and higher transportation costs restrict faster expansion. Despite slower growth, liquid forms remain important for specialized formulations. Their role continues to support innovation-driven demand, particularly where functional performance outweighs storage efficiency.

By Type Analysis

Lipids dominate with 23.4% due to rising demand for omega-rich ingredients in nutrition, feed, and bio-based applications.

In 2024, Lipids held a dominant market position in the By Type Analysis segment of the Algae Products Market, with a 23.4% share. Growth is driven by increasing use in dietary supplements, functional foods, and sustainable lipid alternatives.

Carotenoids remain important due to their coloring and antioxidant properties. They are widely used in food products and personal care applications. However, production complexity keeps their market share moderate. Carrageenan and alginates are essential for texturizing and stabilizing applications.

Their presence is strong in food processing and industrial uses, supported by consistent demand for natural hydrocolloids. Algal proteins and other types address emerging plant-based nutrition needs. While demand is growing, these segments continue to evolve as production technologies improve and costs gradually reduce.

By Application Analysis

Food and Beverages dominate with 33.7% due to strong demand for natural, functional, and clean-label ingredients.

In 2024, Food and Beverages held a dominant market position in the By Application Analysis segment of the Algae Products Market, with a 33.7% share. Consumers increasingly prefer algae for its nutritional value and natural origin. Dietary supplements represent a growing application, supported by wellness trends and rising interest in plant-based nutrients. Algae-based capsules and powders are gaining steady traction among health-focused consumers.

Animal feed applications benefit from algae’s protein and lipid content, improving feed efficiency and nutritional balance. Adoption remains steady as producers seek sustainable feed ingredients. Cosmetics, pharmaceuticals, and other applications contribute incremental demand. These segments focus on bioactive compounds and functional benefits, supporting diversified growth across the overall market.

Key Market Segments

By Source

- Macroalgae

- Microalgae

- Blue-Green

- Others

By Form

- Dry

- Liquid

By Type

- Lipids

- Carotenoids

- Carrageenan

- Alginates

- Algal Proteins

- Others

By Application

- Food and Beverages

- Dietary Supplements

- Animal Feed

- Cosmetics and Personal Care Products

- Pharmaceuticals

- Others

Emerging Trends

Shift Toward Plant-Based and Eco-Friendly Products Shapes Market Trends

A clear trend in the algae products market is the shift toward plant-based lifestyles. More consumers are reducing animal-based foods and choosing algae as a natural protein source. This trend supports steady demand across food and supplement categories. Clean-label and transparency trends also influence the market.

- Global average protein intake still falls below recommended levels in over 30% of low- and middle-income countries, creating interest in dense, natural protein sources such as algae. Algae stand out because some species contain over 60% protein by dry weight, while also providing iron, iodine, and omega-3 fatty acids.

Consumers want to know where ingredients come from and how they are produced. Algae brands highlighting sustainable sourcing gain stronger trust and preference. Innovation in product formats is another trend. Algae are now available in gummies, ready drinks, and flavored powders, improving taste and convenience. These formats attract first-time users and younger consumers.

Drivers

Rising Demand for Natural and Sustainable Nutrition Drives Algae Products Market Growth

Growing interest in natural, plant-based nutrition is a major driver for algae products. Consumers are looking for clean-label foods with simple ingredients, and algae fit this need well. Products such as spirulina and chlorella are rich in protein, vitamins, and minerals, making them popular in daily diets. Health-conscious consumers prefer algae because they support immune function, digestion, and energy levels.

- The FAO reports that agriculture uses around 70% of global freshwater withdrawals, while climate stress is reducing crop yields in many regions. Algae grow without soil and require significantly less freshwater, making them attractive to food manufacturers seeking stable supply sources.

Algae are also widely used in dietary supplements. Busy lifestyles have increased demand for easy-to-use nutritional sources, and algae powders and tablets are easy to consume. This trend supports steady market growth. In addition, algae-derived ingredients are used in functional foods and beverages, helping brands offer added health benefits.

Restraints

High Production Costs Limit Widespread Adoption of Algae Products

Despite strong demand, high production costs remain a key restraint in the algae products market. Growing algae requires controlled conditions, specific nutrients, and regular monitoring. These factors increase operating expenses, especially for small and mid-sized producers. As a result, algae products are often priced higher than conventional ingredients.

- After harvesting, algae need drying, extraction, and purification to meet quality standards. These steps require advanced equipment and skilled labor, adding to the final product cost. This limits affordability in price-sensitive markets. The International Energy Agency, energy can account for up to 40% of total operating costs in controlled algae cultivation systems such as photobioreactors.

Limited consumer awareness also restricts growth in some regions. Many consumers still lack a clear understanding of algae benefits, leading to hesitation in adoption. Without proper education, algae-based foods may struggle to reach mainstream acceptance.

Growth Factors

Expanding Functional Food and Feed Applications Create New Growth Opportunities

The expanding functional food sector presents strong growth opportunities for algae products. Food companies are actively adding algae ingredients to snacks, beverages, and ready-to-eat meals. Algae help enhance nutritional value without major formulation changes, making them attractive to manufacturers.

Animal feed is another high-potential area. Algae improve feed quality and support animal health, especially in aquaculture and poultry farming. As demand for high-quality protein rises, algae-based feed ingredients are gaining attention. The cosmetics and personal care industry also offers opportunities.

Algae extracts are used in skincare products for hydration, anti-aging, and skin repair benefits. Natural beauty trends support this growing use. Emerging markets present long-term growth potential. As income levels rise and health awareness improves, demand for nutrient-rich products increases. Local algae cultivation projects can reduce costs and improve access.

Regional Analysis

North America Dominates the Algae Products Market with a Market Share of 45.7%, Valued at USD 2.3 billion

North America holds the leading position in the global algae products market due to strong demand from the food, dietary supplement, and animal nutrition sectors. In 2024, the region accounted for a dominant 45.7% share, reaching a value of USD 2.3 billion, supported by high awareness of plant-based nutrition and clean-label ingredients. Regulatory support for sustainable protein sources and continued investment in algae-based research further strengthen market adoption.

Europe represents a stable and steadily growing market for algae products, driven by strong sustainability goals and a preference for natural ingredients. The region shows increasing use of algae in organic foods, cosmetics, and nutraceuticals, supported by strict regulations favoring eco-friendly raw materials. Consumer interest in vegan diets and low-carbon food sources continues to support long-term growth.

Asia Pacific is emerging as a high-growth region for algae products, supported by large population levels and traditional consumption of algae-based foods. Demand is rising across food processing, aquaculture feed, and dietary supplements, especially in coastal economies. Expanding middle-class income levels and awareness of algae’s nutritional benefits are encouraging wider adoption. The region also benefits from favorable climatic conditions for algae cultivation.

The Middle East and Africa region is gradually expanding in the algae products market, mainly due to increasing interest in sustainable food sources and water-efficient crops. Algae-based solutions are gaining attention for animal feed and nutrition security in arid regions. Government-backed food resilience initiatives and pilot-scale algae cultivation projects support early-stage market growth. However, commercialization remains at a developing stage.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, ACCEL Carrageenan Corporation continues to strengthen its position in the hydrocolloid-based algae products space, particularly for food, dairy, and processed meat applications. The company benefits from established supply chains in key seaweed-growing regions and focuses on consistent quality and functional performance, which makes it a preferred partner for formulators seeking texture, stability, and clean-label positioning in both mature and emerging markets.

Algatechnologies Ltd remains a reference player in high-value microalgae ingredients, especially for astaxanthin and other premium nutraceutical applications. In 2024, the company’s strategy revolves around capacity optimization, advanced cultivation technologies, and strong branding around science-backed health benefits, positioning it well in the fast-growing segments of healthy aging, sports nutrition, and eye-health supplements.

Algenol is an important innovation-driven participant, focusing on utilizing algae for biofuels, carbon capture, and related industrial applications. In 2024, its value lies less in sheer volume and more in technology platforms, IP, and pilot-to-commercial pathways that demonstrate how algae can contribute to decarbonization, circular carbon utilization, and energy diversification strategies for governments and large industrial customers.

Archer-Daniels-Midland Company brings scale, global reach, and integrated agricultural supply chains to the algae products market in 2024. Leveraging its capabilities in ingredients, processing, and formulation support, the company is well placed to embed algae-derived components into food, feed, and specialty ingredient portfolios, while aligning them with macro trends around alternative proteins, sustainability, and value-added nutrition for both human and animal markets.

Top Key Players in the Market

- ACCEL Carrageenan Corporation

- Algatechnologies Ltd

- Algenol

- Archer-Daniels-Midland Company

- BASF SE

- Caldic B.V.

- Cargill Incorporated

- Cellana Inc

- Corbion N.V.

- Cyanotech Corporation

- DuPont de Nemours Inc

- DSM Firmenich

- TBK Manufacturing Corporation

Recent Developments

- In 2025, Algenol’s platform for integrating CO₂ utilization with the co-production of biofuels and valuable pigments from cyanobacteria was recognized by the U.S. Environmental Protection Agency (EPA) as a model for scalable biorefineries, highlighting its potential in carbon capture and sustainable fuel production from algae.

- In 2025, BASF incorporated Chlorella vulgaris microalgae extracts into moisturizers and anti-aging creams, leveraging their antioxidant and polyunsaturated fatty acid content for skin rejuvenation, hydration, and wrinkle reduction, as validated in clinical skincare trials. This positions BASF as a key player in eco-friendly cosmetics.

Report Scope

Report Features Description Market Value (2024) USD 5.1 billion Forecast Revenue (2034) USD 9.6 billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Macroalgae, Microalgae, Blue-Green, Others), By Form (Dry, Liquid), By Type (Lipids, Carotenoids, Carrageenan, Alginates, Algal Proteins, Others), By Application (Food and Beverages, Dietary Supplements, Animal Feed, Cosmetics and Personal Care Products, Pharmaceuticals, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ACCEL Carrageenan Corporation, Algatechnologies Ltd, Algenol, Archer-Daniels-Midland Company, BASF SE, Caldic B.V., Cargill Incorporated, Cellana Inc, Corbion N.V., Cyanotech Corporation, DuPont de Nemours Inc, DSM Firmenich, TBK Manufacturing Corporation Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- ACCEL Carrageenan Corporation

- Algatechnologies Ltd

- Algenol

- Archer-Daniels-Midland Company

- BASF SE

- Caldic B.V.

- Cargill Incorporated

- Cellana Inc

- Corbion N.V.

- Cyanotech Corporation

- DuPont de Nemours Inc

- DSM Firmenich

- TBK Manufacturing Corporation