Global Agricultural Tractor Market Size, Share, Growth Analysis By Engine Power (Less than 40 HP, 41 to 100 HP, More than 100 HP), By Operation Type (Manual Tractors, Autonomous Tractors), By Driveline (2WD, 4WD), By Propulsion (ICE, Electric) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157685

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

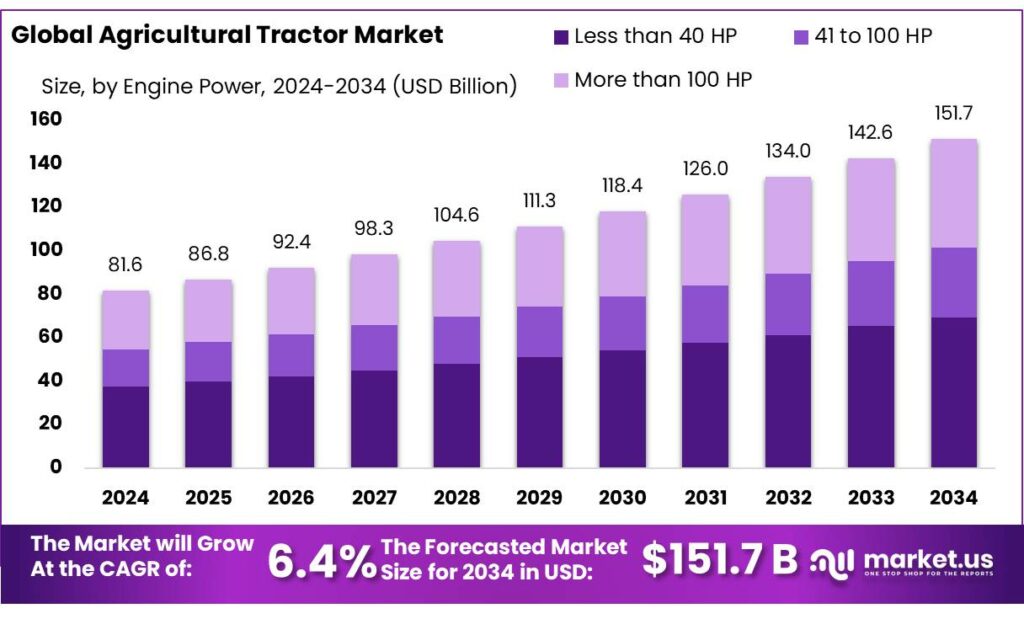

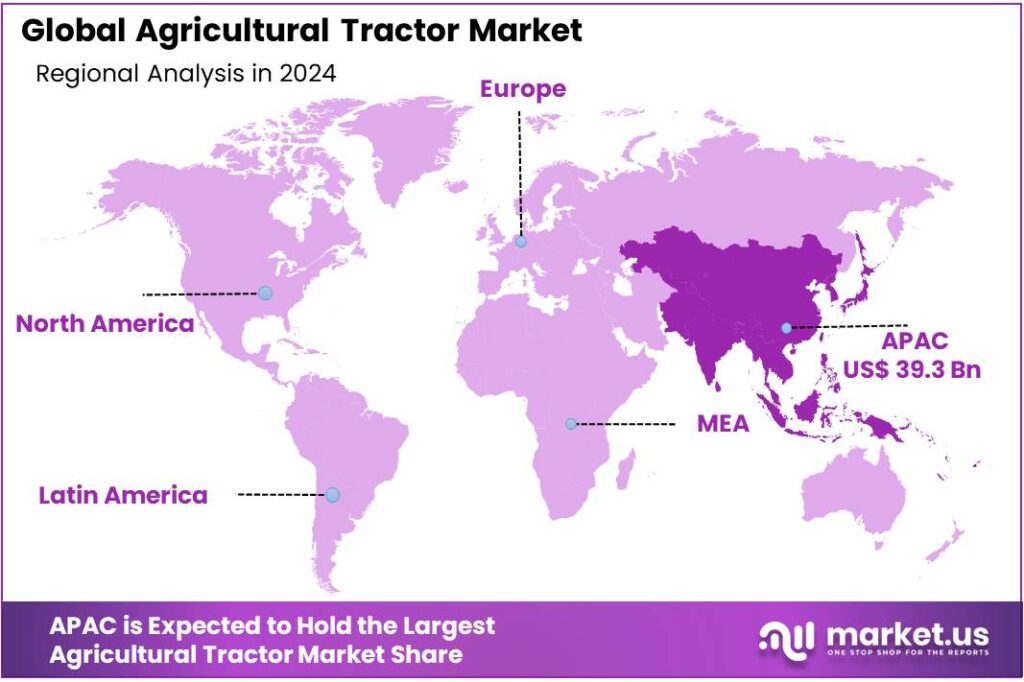

The Global Agricultural Tractor Market size is expected to be worth around USD 151.7 Billion by 2034, from USD 81.6 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific held a dominant market position, capturing more than a 48.20% share, holding USD 39.3 Billion in revenue.

The agricultural tractor industry in India is a cornerstone of the nation’s agrarian economy, pivotal for enhancing productivity and ensuring food security. As of 2025, India stands as the world’s largest producer and consumer of tractors, with annual sales reaching approximately 10 lakh units, marking a significant milestone in mechanization. This surge is attributed to factors such as rising labor costs, the necessity for timely sowing and harvesting, and a growing emphasis on sustainable farming practices.

Government support plays a crucial role in this expansion. The Ministry of Agriculture and Farmers Welfare allocated INR 1,27,470 crore to the agriculture sector in the interim budget for FY2024-25, with a focus on mechanization and infrastructure development.

Additionally, the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) scheme provides direct income support to farmers, enhancing their purchasing power for agricultural equipment. State-level initiatives further bolster this support; for instance, the Maharashtra government’s ‘MahaAgri-AI Policy 2025-2029’ allocates INR 500 crore over five years to integrate artificial intelligence and modern technologies into agriculture.

The tractor market in India is characterized by a dominance of indigenous Original Equipment Manufacturers (OEMs), including Mahindra & Mahindra, TAFE, and Escorts Kubota. These companies have been at the forefront of innovation, introducing technologically advanced tractors equipped with GPS guidance systems and precision farming tools. The 30–50 HP segment holds the highest market share, driven by its versatility and suitability for various farming operations.

Government schemes such as the Sub-Mission on Agricultural Mechanization (SMAM) have been instrumental in promoting farm mechanization. Between 2014–15 and 2020–21, the Indian government allocated ₹4,556.93 crore under SMAM, facilitating the distribution of over 13 lakh agricultural machines and the establishment of more than 27,500 Custom Hiring Centres (CHCs). In 2021–22, the budget allocation for SMAM was increased to ₹1,050 crore, reflecting the government’s commitment to enhancing farm mechanization

Key Takeaways

- Agricultural Tractor Market size is expected to be worth around USD 151.7 Billion by 2034, from USD 81.6 Billion in 2024, growing at a CAGR of 6.4%.

- Less than 40 horsepower (HP) held a dominant market position in India, capturing more than a 45.8% share.

- Manual tractors held a dominant market position in India, capturing more than a 94.6% share.

- 2WD (two-wheel drive) tractors held a dominant market position in India, capturing more than a 74.3% share.

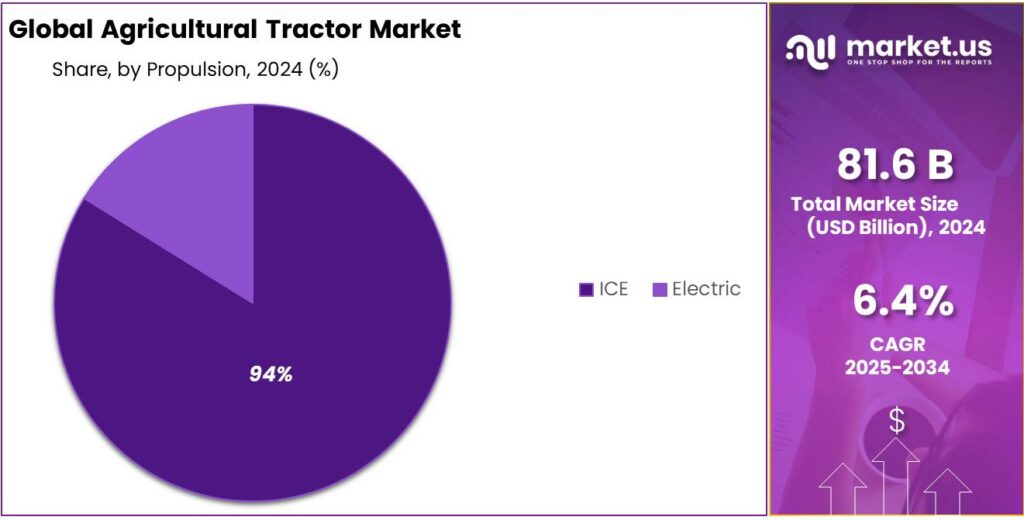

- Internal combustion engine (ICE) tractors held a dominant market position in India, capturing more than a 94.5% share.

- Asia-Pacific region dominated the global agricultural tractor market, capturing a substantial 48.20% share, equivalent to approximately USD 39.3 billion.

By Engine Power Analysis

Less than 40 HP Tractors: Leading the Market with 45.8% Share

In 2024, tractors with engine power less than 40 horsepower (HP) held a dominant market position in India, capturing more than a 45.8% share. This segment’s popularity is primarily driven by the widespread prevalence of small and fragmented landholdings, particularly in states like Uttar Pradesh, Bihar, and Odisha. These compact tractors are well-suited for various agricultural tasks such as plowing, sowing, and hauling, making them indispensable for small-scale farmers.

The affordability and versatility of less than 40 HP tractors have made them the preferred choice for many farmers. Their ability to perform a wide range of tasks efficiently at a lower cost has contributed to their significant market share. Additionally, government initiatives like the Sub-Mission on Agricultural Mechanization (SMAM) have provided subsidies and support, further encouraging the adoption of these tractors among small and marginal farmers.

By Operation Type Analysis

Manual Tractors: Dominating with Over 94.6% Market Share

In 2024, manual tractors held a dominant market position in India, capturing more than a 94.6% share. This overwhelming preference is primarily due to their affordability, simplicity, and widespread availability, making them the go-to choice for small and marginal farmers across the country.

The manual tractor segment’s dominance can be attributed to several factors. Firstly, manual tractors are cost-effective, both in terms of initial investment and maintenance, making them accessible to a larger segment of the farming community. Secondly, the simplicity of manual tractors ensures ease of use and repair, which is crucial in rural areas where technical expertise may be limited. Additionally, the extensive dealer network and availability of spare parts contribute to their widespread adoption.

By Driveline Analysis

2WD Tractors: Dominating with Over 74.3% Market Share

In 2024, 2WD (two-wheel drive) tractors held a dominant market position in India, capturing more than a 74.3% share. This widespread adoption is primarily due to their affordability, fuel efficiency, and suitability for small to medium-sized farms, which constitute a significant portion of India’s agricultural landscape.

The preference for 2WD tractors is evident in the sales figures. In the fiscal year 2024-25, India recorded its highest-ever annual tractor sales at 10 lakh units, with the majority being 2WD models. This surge is attributed to factors such as increased farm mechanization, government subsidies, and favorable monsoon conditions that boosted agricultural productivity.

By Propulsion Analysis

ICE-Powered Tractors: Dominating with Over 94.5% Market Share

In 2024, internal combustion engine (ICE) tractors held a dominant market position in India, capturing more than a 94.5% share. This widespread adoption is primarily due to their affordability, reliability, and suitability for various agricultural tasks across diverse terrains.

The preference for ICE tractors is evident in the sales figures. In the fiscal year 2024-25, India recorded its highest-ever annual tractor sales at 10 lakh units, with the majority being ICE-powered models. This surge is attributed to factors such as increased farm mechanization, government subsidies, and favorable monsoon conditions that boosted agricultural productivity.

For instance, in Uttar Pradesh, tractor ownership increased by over 62% from 2016-17 to 2024-25, largely driven by the availability of subsidies covering nearly 50% of the cost for tractor-operated equipment.

Key Market Segments

By Engine Power

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

By Operation Type

- Manual Tractors

- Autonomous Tractors

By Driveline

- 2WD

- 4WD

By Propulsion

- ICE

- Electric

Emerging Trends

Government Support for Agricultural Mechanization

The Indian government’s commitment to enhancing agricultural productivity is evident through various initiatives aimed at promoting farm mechanization. These efforts are designed to make modern farming equipment more accessible and affordable for farmers, thereby improving efficiency and sustainability in agriculture.

One of the key programs in this regard is the Sub-Mission on Agricultural Mechanization (SMAM). Under SMAM, the government provides financial assistance to farmers for the purchase of agricultural machinery. For instance, in the financial year 2022–23, the government allocated ₹1,051 crore under SMAM, facilitating the distribution of over 13 lakh agricultural machines and the establishment of more than 27,500 Custom Hiring Centres (CHCs) across the country.

Additionally, state governments have introduced their own initiatives to support farm mechanization. For example, the Maharashtra government approved a ₹500 crore plan to integrate artificial intelligence and modern technologies into agriculture, aiming to improve crop monitoring and overall farm productivity.

These government initiatives have not only made tractors more accessible to farmers but have also encouraged the adoption of advanced farming techniques. By reducing the financial burden and providing training and support, these programs have empowered farmers to enhance their productivity and contribute to the country’s agricultural growth.

Drivers

Government Initiatives Driving Agricultural Tractor Adoption in India

The Indian government’s proactive approach to agricultural mechanization has significantly influenced the growth of the tractor market. Through various schemes and policies, the government has facilitated easier access to modern farming equipment, thereby enhancing productivity and efficiency in agriculture.

One of the pivotal initiatives is the Sub-Mission on Agricultural Mechanization (SMAM), implemented by the Ministry of Agriculture and Farmers Welfare. This scheme aims to promote farm mechanization in the country, particularly among small and marginal farmers. Under SMAM, financial assistance of 40–50% of the cost of machinery is provided, making it more affordable for farmers to acquire equipment like tractors and harvesters. In the financial year 2022–23, the government disbursed ₹1,051 crore under this scheme, facilitating the distribution of over 13 lakh agricultural machines and the establishment of more than 27,500 Custom Hiring Centres (CHCs) across the country.

Additionally, state governments have introduced their own initiatives to support farm mechanization. For instance, the Maharashtra government approved a ₹500 crore plan to integrate artificial intelligence and modern technologies into agriculture, aiming to improve crop monitoring and overall farm productivity. Similarly, Uttar Pradesh’s “Viksit UP @ 2047” vision outlines plans to make the state a global leader in agriculture by 2047, focusing on modern storage, processing infrastructure, and promoting sustainable practices.

Restraints

High Upfront Costs: A Major Barrier to Tractor Adoption in India

One of the most significant challenges hindering the widespread adoption of agricultural tractors in India is the high upfront cost associated with purchasing new machinery. This financial barrier is particularly pronounced among small and marginal farmers, who constitute over 80% of the farming community in the country. These farmers often operate on landholdings less than 2 hectares, making the investment in a new tractor economically unfeasible.

The average price of a mid-range tractor in India ranges between ₹6 lakh and ₹9 lakh in 2024. Even with government subsidies and financing options, the initial expense remains a significant hurdle. For instance, the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) scheme provides direct income support to farmers, but the amount is insufficient to cover the cost of a tractor. Additionally, the interest rates on loans for agricultural equipment can be as high as 12–15% annually, further increasing the financial burden on farmers.

To address this issue, the government has introduced various schemes aimed at making tractors more affordable. For example, the Sub-Mission on Agricultural Mechanization (SMAM) offers financial assistance for the purchase of agricultural machinery. However, the coverage and impact of these schemes are limited, and many farmers are still unable to afford the necessary equipment.

In response to these challenges, there has been a growing interest in the used tractor market. Used tractors can cost 30–50% less than new ones, making them a more accessible option for many farmers. The average price of a used farm tractor in India ranges between ₹2.5 lakh and ₹6 lakh, depending on the model, brand, and hours of usage.

Opportunity

Growth Opportunity: Adoption of Electric Tractors in India

One of the most promising growth opportunities for the agricultural tractor market in India is the adoption of electric tractors. This shift is driven by a combination of environmental concerns, economic benefits, and supportive government initiatives.

The Indian government has recognized the potential of electric vehicles, including tractors, in reducing carbon emissions and promoting sustainable agriculture. Initiatives like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme provide subsidies for the purchase of electric tractors, making them more accessible to farmers. Additionally, state-level policies are being introduced to encourage the use of electric tractors, further accelerating their adoption.

Electric tractors offer several advantages over traditional diesel-powered models. They are more cost-effective in the long run due to lower operating and maintenance costs. For instance, electric tractors eliminate the need for fuel, which can be a significant expense for farmers. Moreover, electric tractors produce less noise and air pollution, contributing to a healthier farming environment.

The adoption of electric tractors also aligns with global trends towards sustainable farming practices. As international markets increasingly demand environmentally friendly products, Indian farmers adopting electric tractors can gain a competitive edge by meeting these global standards.

Regional Insights

Asia-Pacific Agricultural Tractor Market: Leading with 48.20% Share, Valued at $39.3 Billion

In 2024, the Asia-Pacific region dominated the global agricultural tractor market, capturing a substantial 48.20% share, equivalent to approximately USD 39.3 billion in market value. This commanding position underscores the region’s pivotal role in global agricultural mechanization.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AGCO Corp., a global leader in agricultural equipment, offers a wide range of tractors and farm machinery under brands such as Massey Ferguson, Fendt, and Valtra. Known for its innovation, AGCO focuses on enhancing agricultural productivity through advanced technology like precision farming. With a global footprint, AGCO continues to grow its presence in key markets like North America, Europe, and Asia-Pacific, positioning itself as a dominant player in the agricultural tractor market.

Deere & Company, widely recognized by its John Deere brand, is one of the largest manufacturers of agricultural machinery. It is a key player in the global agricultural tractor market, known for its durable, efficient, and high-tech tractors. Deere’s focus on smart farming solutions, like precision agriculture and autonomous systems, has made it a market leader. The company’s strong dealer network and extensive support services solidify its position in North America, Europe, and emerging markets.

CLAAS KGaA mbH is a leading manufacturer of agricultural equipment, specializing in high-quality tractors and harvesting machinery. The company is recognized for its advanced engineering, efficiency, and innovation, particularly in the area of intelligent farm machinery. CLAAS offers a wide range of products designed to meet the needs of modern agriculture, from small-scale operations to large farms. The company has a strong presence in Europe and is expanding its footprint in other global markets, making significant strides in the tractor market.

Top Key Players Outlook

- AGCO Corp.

- CNH Industrial N.V.

- Deere & Company

- CLAAS KGaAmbH

- Escorts Ltd.

- Sonalika

- YanmarCo., Ltd.

- KubotaCorp.

- Mahindra & Mahindra Ltd.

- Tractors and Farm Equipment Ltd.

Recent Industry Developments

In 2024, AGCO Corporation, a prominent player in the agricultural machinery sector, reported net sales of approximately $11.7 billion, marking a 19.1% decline from the previous year’s $14.4 billion.

In the 2024, CLAAS KGaA mbH, a leading German manufacturer of agricultural machinery, reported net sales of €4.997 billion, a 19% decrease from €6.144 billion in 2023.

Report Scope

Report Features Description Market Value (2024) USD 81.6 Bn Forecast Revenue (2034) USD 151.7 Bn CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Engine Power (Less than 40 HP, 41 to 100 HP, More than 100 HP), By Operation Type (Manual Tractors, Autonomous Tractors), By Driveline (2WD, 4WD), By Propulsion (ICE, Electric) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AGCO Corp., CNH Industrial N.V., Deere & Company, CLAAS KGaAmbH, Escorts Ltd., Sonalika, YanmarCo., Ltd., KubotaCorp., Mahindra & Mahindra Ltd., Tractors and Farm Equipment Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agricultural Tractor MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Agricultural Tractor MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AGCO Corp.

- CNH Industrial N.V.

- Deere & Company

- CLAAS KGaAmbH

- Escorts Ltd.

- Sonalika

- YanmarCo., Ltd.

- KubotaCorp.

- Mahindra & Mahindra Ltd.

- Tractors and Farm Equipment Ltd.