Global Agricultural Pumps Market Size, Share, Growth Analysis By Type (Rotodynamic Pumps, Centrifugal Pumps, Axial Flow, Mixed Flow, Positive Displacement Pumps, Rotary Pumps, Reciprocating Pumps), By Power Source (Electricity Grid-Connection, Diesel/Petrol, Solar), By Head Size (Up to 6 Meter, 6-10 Meter, Above 10 Meter), By Power Output (Upto 4 HP, 4 HP to 30 HP, Above 30), By Application (Irrigation, Drainage, Water Transfer, Fertigation, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158003

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

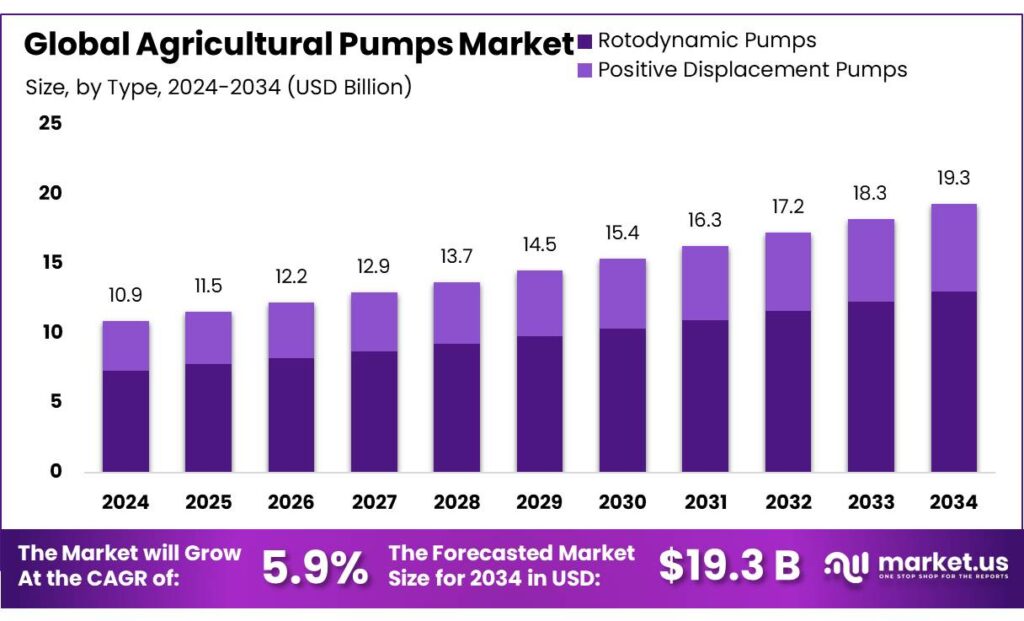

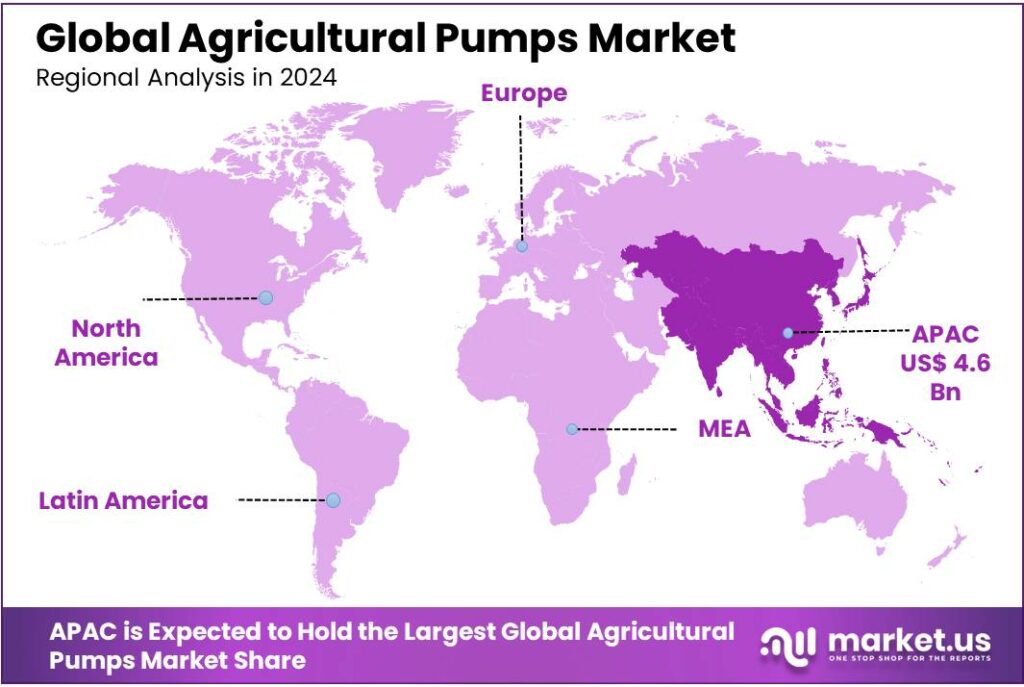

The Global Agricultural Pumps Market size is expected to be worth around USD 19.3 Billion by 2034, from USD 10.9 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 42.6% share, holding USD 4.6 Billion in revenue.

Agricultural pumps play a pivotal role in modern farming by ensuring efficient water supply for irrigation, livestock, and aquaculture. These pumps range from surface pumps and submersible pumps to centrifugal and mono-block pumps, catering to various scales of agricultural operations. India, being an agrarian economy, heavily relies on these pumps to sustain crop productivity, particularly in regions dependent on rainfall.

- According to the Ministry of Agriculture & Farmers Welfare, irrigation covers nearly 64.3 million hectares, representing around 48% of net sown area, highlighting the critical role of pumps in meeting water requirements for agriculture.

The industrial scenario for agricultural pumps in India is influenced by both domestic demand and government support. According to the Ministry of Agriculture and Farmers Welfare, India has over 26 million agricultural pumps installed nationwide, which irrigate roughly 35% of the total cropped area. These pumps are essential in meeting irrigation needs during dry periods and supplement rainfall-dependent cultivation. The National Electric Mobility Mission and rural electrification schemes under the Saubhagya initiative have enabled better access to electricity in rural areas, which indirectly supports the use of electric agricultural pumps in irrigation systems.

Several government initiatives are actively driving the growth of the agricultural pump sector. The Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) focuses on enhancing water-use efficiency through micro-irrigation systems, including drip and sprinkler systems, which heavily rely on pump technology. Under PMKSY, the government aims to cover 70 million hectares of cultivable land with micro-irrigation systems by 2025, requiring a corresponding deployment of over 2 million agricultural pumps to facilitate uniform water distribution.

Driving factors for the growth of agricultural pumps include rising demand for food due to population growth, increasing water scarcity, and the need to enhance crop productivity. The Food and Agriculture Organization (FAO) highlights that irrigation efficiency can increase crop yields by 20-30%, making pumps an indispensable investment for Indian farmers. Technological advancements such as solar-powered pumps are also gaining traction, with India installing more than 400,000 solar pumps under the Kisan Urja Suraksha evam Utthaan Mahabhiyan (KUSUM) scheme, promoting sustainable irrigation while reducing dependence on diesel-based systems.

Key Takeaways

- Agricultural Pumps Market size is expected to be worth around USD 19.3 Billion by 2034, from USD 10.9 Billion in 2024, growing at a CAGR of 5.9%.

- Rotodynamic Pumps held a dominant market position in the Agricultural Pumps Market, capturing more than a 67.4% share.

- Electricity Grid-Connection held a dominant market position in the Agricultural Pumps Market, capturing more than a 48.2% share.

- 6–10 Meter held a dominant market position in the Agricultural Pumps Market, capturing more than a 44.9% share.

- 4 HP to 30 HP held a dominant market position in the Agricultural Pumps Market, capturing more than a 56.3% share.

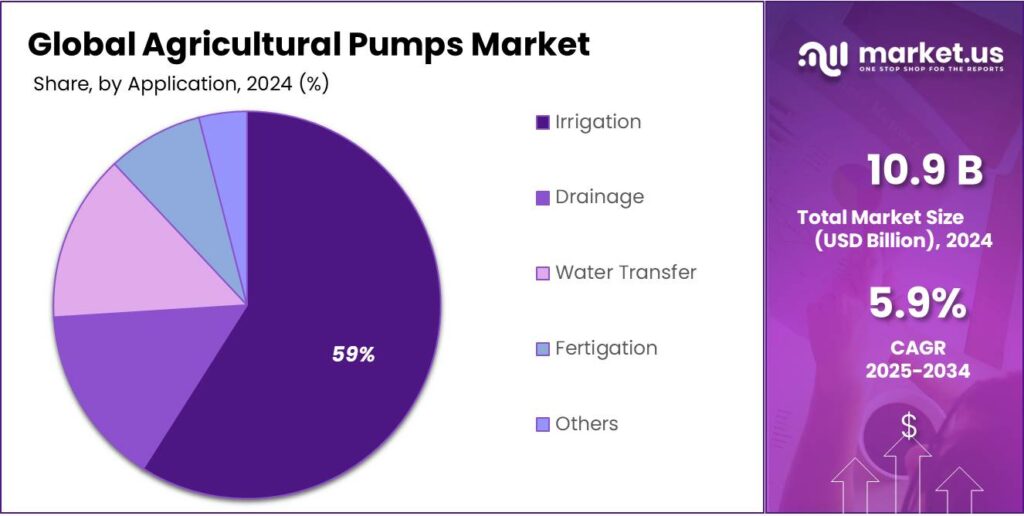

- Irrigation held a dominant market position in the Agricultural Pumps Market, capturing more than a 59.8% share.

- Asia Pacific emerged as the leading region in the global Agricultural Pumps Market, capturing 42.6% of the total share and reaching a value of USD 4.6 billion.

By Type Analysis

Rotodynamic Pumps dominate the Agricultural Pumps Market with 67.4% share in 2024 due to high efficiency and wide application.

In 2024, Rotodynamic Pumps held a dominant market position in the Agricultural Pumps Market, capturing more than a 67.4% share. Their popularity comes from their ability to deliver high efficiency and consistent performance across diverse irrigation needs. Farmers prefer these pumps because they can handle large volumes of water at relatively low maintenance costs, making them suitable for extensive agricultural lands. The versatility of rotodynamic pumps allows them to be used in both small-scale and large-scale farming operations.

The adoption of these pumps is further supported by advancements in pump design, which enhance energy efficiency and reduce operational costs. In many regions, the demand for effective irrigation systems continues to rise due to increasing water stress and the need to optimize crop production. Rotodynamic pumps, with their reliability and cost-effectiveness, have emerged as the preferred solution. Moving into 2025, their share is expected to remain strong, supported by government subsidies for efficient irrigation systems and the ongoing mechanization of agriculture. Their balance of affordability, durability, and large-scale suitability ensures they stay the leading choice among farmers worldwide.

By Power Source Analysis

Electricity Grid-Connection dominates Agricultural Pumps Market with 48.2% share in 2024 due to reliable power access.

In 2024, Electricity Grid-Connection held a dominant market position in the Agricultural Pumps Market, capturing more than a 48.2% share. This leadership is largely driven by the availability of reliable and continuous power supply in agricultural regions, allowing farmers to operate pumps efficiently for irrigation. Grid-connected pumps are cost-effective in the long term, as they reduce the dependency on fuel and minimize operational expenses compared to diesel-powered alternatives.

The popularity of electricity grid-connected pumps is also supported by government initiatives promoting rural electrification and subsidies for energy-efficient agricultural equipment. Farmers prefer these pumps because of their ability to deliver consistent performance and handle high-capacity water requirements, particularly for large-scale farming.

By Head Size Analysis

6–10 Meter Head Size dominates Agricultural Pumps Market with 44.9% share in 2024 due to suitability for medium irrigation needs.

In 2024, 6–10 Meter held a dominant market position in the Agricultural Pumps Market, capturing more than a 44.9% share. This range is widely preferred by farmers because it is ideal for irrigating medium-depth fields and supports diverse crops. Pumps with a head size of 6–10 meters balance efficiency and performance, ensuring adequate water flow without excessive energy consumption, making them a practical choice for small to mid-sized farms.

Their popularity is also supported by the fact that most farmlands do not require extremely high lift systems but still demand reliable water distribution. These pumps are cost-effective, easy to install, and suitable for a variety of irrigation methods, including flood and sprinkler systems.

By Power Output Analysis

4 HP to 30 HP dominates Agricultural Pumps Market with 56.3% share in 2024 due to flexibility and wide adoption.

In 2024, 4 HP to 30 HP held a dominant market position in the Agricultural Pumps Market, capturing more than a 56.3% share. This category is highly preferred because it offers the right balance of power and efficiency for a wide range of irrigation needs. Pumps in this range are suitable for both small and large farms, capable of lifting water from wells, rivers, and reservoirs to irrigate diverse crops efficiently.

Farmers rely on this segment as it provides sufficient horsepower to handle medium to large water volumes while keeping operational costs under control. These pumps are versatile, used in flood irrigation, drip systems, and sprinkler setups, making them adaptable to changing farming practices. Additionally, the durability and easy availability of pumps in this power range make them a practical choice for agricultural communities worldwide.

By Application Analysis

Irrigation dominates Agricultural Pumps Market with 59.8% share in 2024 due to its critical role in farming practices.

In 2024, Irrigation held a dominant market position in the Agricultural Pumps Market, capturing more than a 59.8% share. The segment’s strength comes from the fact that irrigation is the most crucial application of pumps in agriculture, ensuring consistent water supply to crops across varying climatic and soil conditions. Farmers heavily depend on these pumps to optimize crop yields, especially in regions with limited rainfall or seasonal water shortages.

The wide adoption of pumps for irrigation is supported by the rising global demand for food production, where efficient water management has become a necessity. Pumps used for irrigation provide flexibility to farmers by enabling the use of surface water, groundwater, and reservoirs, ensuring a reliable source of water throughout the crop cycle. This makes irrigation pumps an indispensable tool in both small-scale and large-scale farming operations.

Key Market Segments

By Type

- Rotodynamic Pumps

- Centrifugal Pumps

- Axial Flow

- Mixed Flow

- Positive Displacement Pumps

- Rotary Pumps

- Reciprocating Pumps

By Power Source

- Electricity Grid-Connection

- Diesel/Petrol

- Solar

By Head Size

- Up to 6 Meter

- 6-10 Meter

- Above 10 Meter

By Power Output

- Upto 4 HP

- 4 HP to 30 HP

- Above 30

By Application

- Irrigation

- Drainage

- Water Transfer

- Fertigation

- Others

Emerging Trends

Integration of Smart Irrigation and IoT-Enabled Agricultural Pumps

A prominent trend shaping the agricultural pumps market in India is the integration of smart irrigation systems with IoT-enabled pumps. Farmers are increasingly seeking solutions that provide real-time monitoring of water usage, soil moisture levels, and pump performance to optimize irrigation efficiency. The Ministry of Agriculture & Farmers Welfare emphasizes the importance of precision farming and water-use efficiency, noting that over 48% of India’s net sown area, equivalent to around 64.3 million hectares, depends on irrigation. IoT-enabled pumps allow farmers to make informed decisions, reducing water wastage and improving crop productivity.

Smart irrigation pumps are particularly gaining traction in states with high-value crops such as Punjab, Maharashtra, and Andhra Pradesh.

- According to NABARD data, in 2023-24, more than 50,000 pump sets were connected to micro-irrigation systems using sensors and automation technologies, improving water-use efficiency by 20-30%. These systems enable precise control over water distribution, ensuring crops receive the exact amount of water needed at the right time.

Government initiatives are supporting this trend through subsidy programs and technical assistance. Under the Pradhan Mantri Krishi Sinchai Yojana (PMKSY), farmers receive financial aid to install micro-irrigation systems, including drip and sprinkler technologies integrated with automated pumps. In 2023, approximately INR 4,500 crore was allocated under PMKSY to promote water-efficient irrigation infrastructure. This funding has encouraged small and marginal farmers to adopt IoT-based irrigation pumps, bridging the technology gap and facilitating sustainable farming practices.

Drivers

Government Support and Subsidies Boosting Adoption of Agricultural Pumps

One of the most important factors driving the growth of agricultural pumps in India is the strong government support through subsidies and schemes aimed at modernizing irrigation infrastructure. Efficient water management is a critical concern for Indian agriculture, where nearly 48% of the net sown area relies on irrigation. To address this, the government has introduced programs that incentivize farmers to adopt energy-efficient and modern pump technologies.

The Pradhan Mantri Krishi Sinchai Yojana (PMKSY), launched in 2015, focuses on improving irrigation coverage and water-use efficiency. Under the “Har Khet Ko Pani” component, the government provides financial assistance for the installation of pump sets, including submersible and centrifugal pumps. In 2024, an allocation of INR 4,500 crore was dedicated to procurement of high-efficiency pump sets and the creation of irrigation infrastructure, covering both smallholder and marginal farmers. This financial backing has made it possible for farmers in semi-arid regions such as Maharashtra, Rajasthan, and Karnataka to access reliable irrigation solutions, boosting agricultural productivity.

The adoption of solar-powered pumps is another key aspect driving demand. The Ministry of New and Renewable Energy (MNRE) allocated INR 1,000 crore in 2023 to encourage solar irrigation systems. These pumps reduce reliance on diesel and electricity, offering both cost savings and environmental benefits. In states like Punjab and Andhra Pradesh, over 50,000 solar pumps have been installed in the past two years, contributing to more sustainable irrigation practices and reducing the energy footprint of farming operations.

NABARD also plays a significant role in supporting agricultural pump adoption through refinancing programs. During 2023-24, more than 120,000 pump sets were financed under NABARD-supported irrigation projects, with an emphasis on improving water-use efficiency by 25-30%. This financing not only eases the upfront cost for farmers but also encourages the replacement of outdated, inefficient diesel pumps with modern, high-efficiency alternatives.

Restraints

High Energy Costs and Limited Access to Reliable Power

A significant factor restraining the growth of agricultural pumps in India is the high energy cost associated with operating them and the limited availability of reliable electricity in many rural areas. While pumps are essential for ensuring timely irrigation and improving crop yields, their operational costs can be a major burden for small and marginal farmers.

- According to the Central Electricity Authority (CEA), India’s rural electrification still faces intermittent supply issues in several states, with nearly 15% of rural households reporting frequent power outages impacting agricultural operations. Such instability directly affects the use of electric pumps, forcing farmers to rely on less efficient diesel pumps that incur higher fuel costs.

Diesel pumps, commonly used in regions with unreliable electricity, consume significant quantities of fuel, making irrigation expensive. The Ministry of Petroleum and Natural Gas reported that in 2023, the average diesel consumption for agricultural pumps in India reached approximately 3.6 billion liters annually, representing a substantial recurring cost for farmers. Rising global crude oil prices further exacerbate the situation, directly increasing the operational costs of diesel pumps. This financial pressure limits the adoption of newer, more efficient pumps, particularly among small-scale farmers who often operate on tight margins.

Even though government initiatives such as the Pradhan Mantri Krishi Sinchai Yojana (PMKSY) and the MNRE-supported solar pump programs aim to provide energy-efficient alternatives, the scale of adoption remains constrained. In 2023, only around 50,000 solar pumps were installed nationwide, which is relatively low compared to the estimated 12 million pump sets in active agricultural use across the country. Factors such as high initial investment, lack of awareness, and maintenance challenges restrict farmers from fully transitioning to these modern, energy-efficient solutions.

Opportunity

Adoption of Solar-Powered and Energy-Efficient Pumps

A major growth opportunity for the agricultural pumps sector in India lies in the adoption of solar-powered and energy-efficient pumps. As the country faces increasing water scarcity and rising energy costs, farmers are looking for sustainable alternatives that reduce dependence on grid electricity and diesel fuel.

- According to the Ministry of New and Renewable Energy (MNRE), India had installed over 1.3 lakh solar irrigation pumps by the end of 2023, with plans to scale this number to 5 lakh pumps by 2025 under the solar pump program. These pumps offer an eco-friendly solution while significantly lowering operational costs, making them attractive to both small and large-scale farmers.

The government’s support through subsidy programs is a critical driver of this growth opportunity. Under the PMKSY and MNRE schemes, farmers receive up to 90% subsidy on solar-powered pumps, depending on the capacity and region. In 2023 alone, subsidies worth approximately INR 900 crore were disbursed to farmers for installing solar pumps across Maharashtra, Andhra Pradesh, and Rajasthan. Such financial incentives not only reduce the initial capital barrier but also accelerate adoption, enabling farmers to transition from diesel pumps that cost upwards of INR 25,000 annually in fuel expenses for medium-sized farms.

In addition to cost savings, solar and energy-efficient pumps provide a reliable irrigation solution. According to NABARD data, more than 120,000 pump sets installed through its refinance programs during 2023-24 showed a 25-30% improvement in water-use efficiency compared to conventional pumps. This efficiency ensures optimal crop yields and supports the government’s goal under the National Water Mission to improve agricultural water productivity by 20% by 2030.

Moreover, technological advancements are further boosting the appeal of energy-efficient pumps. Many modern pumps now feature IoT-enabled monitoring systems that allow farmers to optimize irrigation schedules, track water consumption, and predict maintenance needs. States like Punjab, Haryana, and Tamil Nadu, where high-value crops such as vegetables and fruits dominate, are witnessing early adoption of these smart pump solutions. This integration of technology not only enhances water-use efficiency but also contributes to energy conservation, aligning with national sustainability goals.

Regional Insights

Asia Pacific leads the Agricultural Pumps Market with 42.6% share in 2024, valued at USD 4.6 billion.

In 2024, Asia Pacific emerged as the leading region in the global Agricultural Pumps Market, capturing 42.6% of the total share and reaching a value of USD 4.6 billion. The region’s dominance is mainly driven by its vast agricultural base, rapid mechanization of farming practices, and government-backed irrigation schemes. Countries like India, China, and Indonesia are key contributors, where agriculture continues to be the backbone of the economy, employing a large share of the population.

Government initiatives such as subsidies on pump purchases, electrification of rural areas, and schemes supporting solar-powered irrigation pumps have further strengthened the adoption rate in Asia Pacific. For instance, India’s push under programs like PM-KUSUM to deploy solar pumps has been instrumental in shifting farmers towards sustainable solutions. China, with its extensive rice and wheat cultivation, continues to invest heavily in modern irrigation technologies, contributing significantly to market growth.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Grundfos posted revenues of about EUR 4.5 billion, though the company saw a 2.4% dip in overall sales compared to 2023. It is headquartered in Denmark and is widely respected for its energy-efficient pump designs, especially in water supply, irrigation, and sensitive farming regions. Grundfos invests heavily in R&D and has introduced smart control systems that reduce power usage and improve reliability. Its strong brand, global presence, and sustainability focus make it a key player in agricultural pump solutions.

Ingersoll-Rand serves many sectors, including agriculture, with a range of fluid handling, precision pumps, and dosing equipment. In 2024, the firm expanded into sustainable agriculture by acquiring Dosatron International, which specializes in water-powered dosing pumps among other solutions. This added roughly US$90 million upfront (with extra earnouts) and gave IR access to new end-markets like hydroponics and nutrient delivery. Their broad technology base—covering liquid transfer, controls, and precision pumps—helps them serve diverse agricultural needs.

In 2024, Flowserve reported a full-year revenue of about US$4.558 billion, up from 2023. Its Pumps Division is central to its business: sales in the fourth quarter of 2024 from this segment were approximately US$794.9 million, with strong bookings growth. Flowserve supplies pumps for irrigation, water infrastructure, and industrial farming systems, and is known for durability, variety in pump types (centrifugal, submersible, etc.), and strong aftermarket/support services. Its growth is supported by infrastructure investments globally and demand for efficient water delivery.

Top Key Players Outlook

- Grundfos Holding A/S

- Ingersoll-Rand

- Flowserve Corporation

- Sulzer Ltd.

- Pentair

- ITT, INC.

- Schlumberger Limited

- EBARA International Corporation

- The Weir Group PLC

Recent Industry Developments

In 2024, Grundfos realised revenues of approximately EUR 4.5 billion, although this represented a decline of about 2.4% versus the previous year.

In 2024, Sulzer achieved operational profitability of 12.4%, showing improvements in manufacturing efficiency and cost control, especially in its Flow division.

Report Scope

Report Features Description Market Value (2024) USD 10.9 Bn Forecast Revenue (2034) USD 19.3 Bn CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Rotodynamic Pumps, Centrifugal Pumps, Axial Flow, Mixed Flow, Positive Displacement Pumps, Rotary Pumps, Reciprocating Pumps), By Power Source (Electricity Grid-Connection, Diesel/Petrol, Solar), By Head Size (Up to 6 Meter, 6-10 Meter, Above 10 Meter), By Power Output (Upto 4 HP, 4 HP to 30 HP, Above 30), By Application (Irrigation, Drainage, Water Transfer, Fertigation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Grundfos Holding A/S, Ingersoll-Rand, Flowserve Corporation, Sulzer Ltd., Pentair, ITT, INC., Schlumberger Limited, EBARA International Corporation, The Weir Group PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Grundfos Holding A/S

- Ingersoll-Rand

- Flowserve Corporation

- Sulzer Ltd.

- Pentair

- ITT, INC.

- Schlumberger Limited

- EBARA International Corporation

- The Weir Group PLC