Global Glass Bottles and Containers Market Size, Share, Growth Analysis By Product (Glass Bottles, Glass Jars, Glass Vials), By Type (Transparent Glass, Opaque Glass), By End-user (Beverages, Food, Cosmetics and Personal Care, Pharmaceuticals, Others), By Beverages (Beer, Wine, Spirits, Juices, Carbonated Drinks (CSDs), Dairy Product Based Drinks, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156186

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

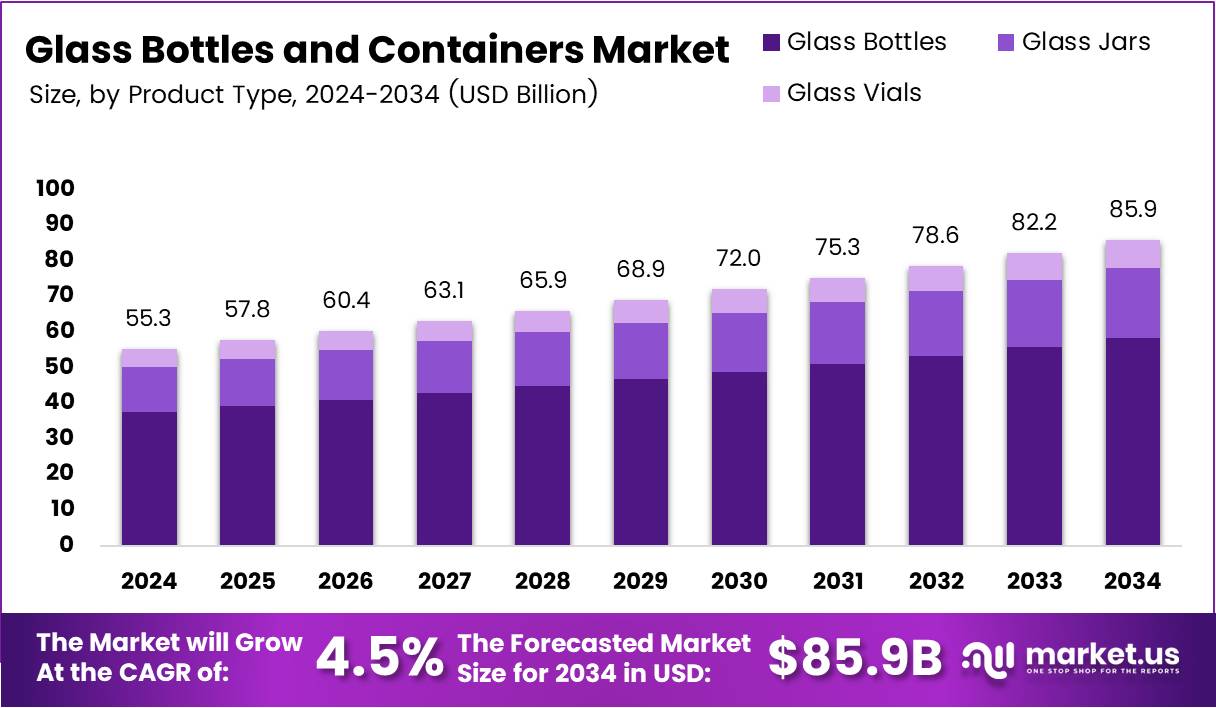

The Global Glass Bottles and Containers Market size is expected to be worth around USD 85.9 Billion by 2034, from USD 55.3 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The Glass Bottles and Containers Market is a dynamic industry that plays a crucial role in packaging, especially for food, beverages, cosmetics, and pharmaceuticals. The increasing demand for eco-friendly alternatives to plastic packaging is a primary driver of market growth. Glass is known for its non-toxicity, recyclability, and ability to preserve product quality.

The growth of the market is significantly supported by rising consumer preferences for sustainable packaging. Glass bottles and containers are perceived as premium products due to their durability and environmental benefits. Moreover, increased consumer awareness about the environmental impact of plastic has contributed to a shift towards glass packaging in various industries.

Governments worldwide are also encouraging the shift toward more sustainable packaging through favorable regulations and investments. In several countries, authorities are implementing policies that support the use of recyclable and reusable packaging materials. As a result, glass packaging has gained momentum due to its compliance with these regulations, further boosting market growth.

Additionally, companies are responding to the rising demand for eco-friendly packaging by expanding their glass container offerings. The market is seeing significant innovations in glass container design and production processes to meet the demand for more sustainable solutions. This opens up new opportunities for both established players and emerging startups.

According to a 2024 survey by the Glass Packaging Institute, 92% of respondents would feel positively toward a company offering more glass packaging due to its lower environmental impact. This indicates a strong consumer preference for sustainability, which is likely to drive the adoption of glass bottles and containers.

In Europe, a survey revealed that 76% of Europeans consider glass the most environmentally friendly packaging material, favoring its higher recyclability over alternatives. This growing consumer sentiment toward glass as a more sustainable option is creating a favorable environment for market expansion.

Key Takeaways

- The Global Glass Bottles and Containers Market is projected to reach USD 85.9 Billion by 2034, growing at a CAGR of 4.5% from 2025 to 2034.

- In 2024, Glass Bottles held a dominant market position in the By Product Type Analysis segment, with a 67.9% share.

- Transparent Glass dominated the By Type Analysis segment in 2024, holding an 82.8% share.

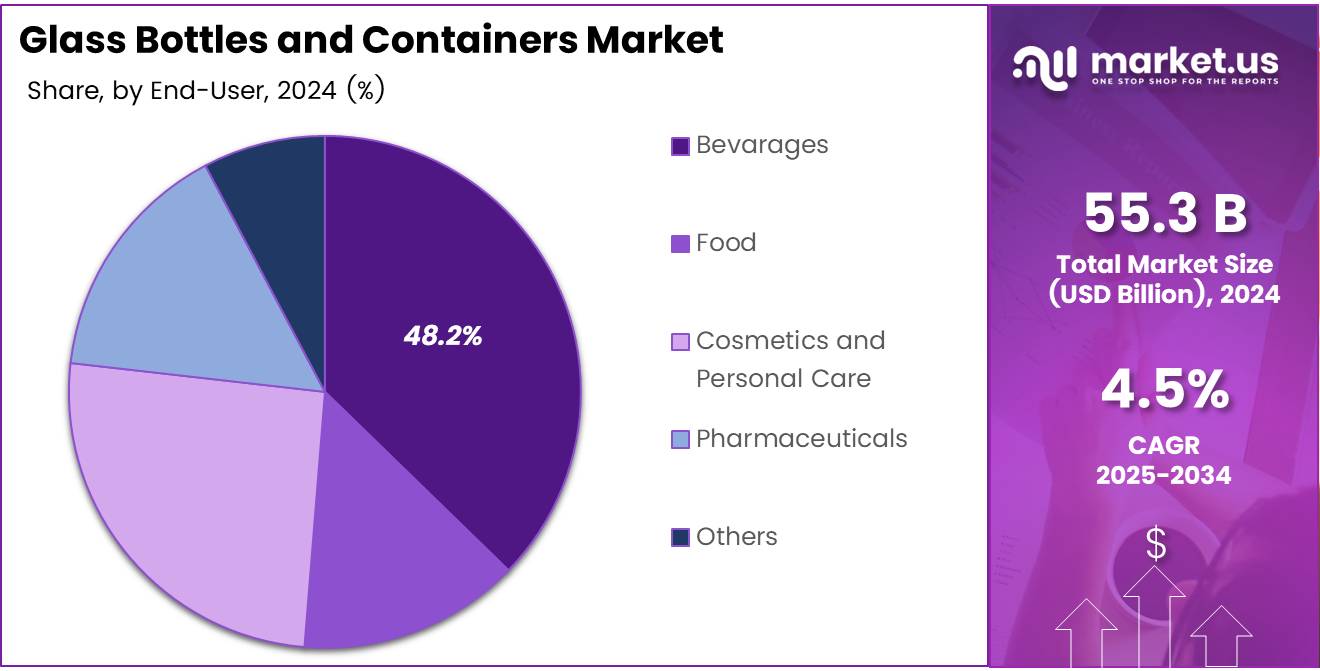

- Beverages held the leading position in the By End-user Analysis segment in 2024, with a 48.2% share.

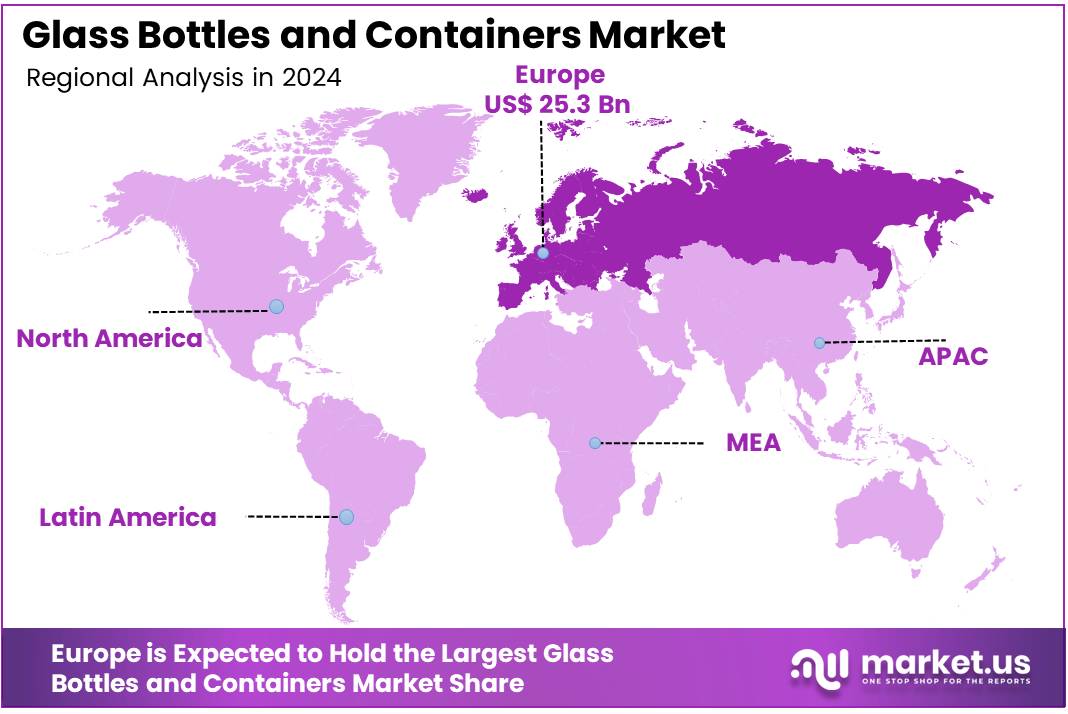

- Europe led the global market in 2024, capturing 45.8% of the market, valued at USD 25.3 Billion.

Product Type Analysis

Glass Bottles dominate with 67.9% due to their versatile applications and consumer preference.

In 2024, Glass Bottles held a dominant market position in By Product Type Analysis segment of Glass Bottles and Containers Market, with a 67.9% share. This substantial market leadership reflects the widespread adoption of glass bottles across multiple industries, particularly in beverages, pharmaceuticals, and personal care sectors.

Glass bottles maintain their competitive edge through superior product preservation qualities and recyclability features. Their ability to maintain product integrity while offering premium packaging aesthetics makes them the preferred choice for brand manufacturers. The segment benefits from increasing consumer awareness about sustainable packaging solutions.

Glass Jars represent the secondary segment, gaining traction in food preservation and specialty packaging applications. Their popularity stems from household storage needs and artisanal food products. Glass Vials occupy a specialized niche, primarily serving pharmaceutical and laboratory applications where precision and contamination prevention are critical factors.

The dominance of glass bottles is expected to continue as manufacturers invest in lightweight designs and enhanced durability features. Consumer preference for premium packaging experiences further reinforces this segment’s market position.

Type Analysis

Transparent Glass dominates with 82.8% due to its visual appeal and product visibility advantages.

In 2024, Transparent Glass held a dominant market position in By Type Analysis segment of Glass Bottles and Containers Market, with a 82.8% share. This overwhelming market preference demonstrates consumer and manufacturer inclination toward packaging that showcases product quality and builds trust through visibility.

Transparent glass containers offer unparalleled product presentation capabilities, allowing consumers to assess product quality, color, and quantity before purchase. This transparency factor becomes particularly crucial in premium beverage segments, cosmetics, and pharmaceutical applications where visual confirmation enhances consumer confidence.

The segment’s dominance is reinforced by manufacturing cost advantages and broader application versatility. Transparent glass requires fewer additives during production, resulting in more efficient manufacturing processes. Additionally, its universal appeal across diverse product categories makes it the go-to choice for manufacturers seeking standardized packaging solutions.

Opaque Glass serves specialized applications where light protection is essential, such as certain pharmaceutical formulations and light-sensitive beverages. However, its market share remains limited due to restricted application scope and higher production complexities associated with opacity-achieving additives.

End-user Analysis

Beverages dominate with 48.2% due to growing consumption patterns and premium packaging demands.

In 2024, Beverages held a dominant market position in By End-user Analysis segment of Glass Bottles and Containers Market, with a 48.2% share. This significant market leadership reflects the beverage industry’s continued reliance on glass packaging for premium product positioning and consumer appeal.

The beverages segment encompasses alcoholic drinks, premium juices, craft sodas, and specialty water brands that prioritize glass packaging for its superior taste preservation and premium brand image. Glass bottles effectively maintain beverage flavor profiles while offering complete recyclability, aligning with sustainability trends.

Food applications represent substantial growth potential, particularly in preserves, sauces, and gourmet products where glass containers provide excellent barrier properties. Cosmetics and Personal Care segments increasingly adopt glass packaging for luxury positioning and eco-friendly brand messaging.

Pharmaceuticals utilize glass containers for their chemical inertness and sterile packaging capabilities, ensuring product stability and safety. The Others category includes industrial applications, laboratory uses, and specialty packaging requirements.

The beverages segment’s dominance is expected to strengthen as craft beverage markets expand and consumers increasingly associate glass packaging with product quality and environmental responsibility.

Key Market Segments

By Product

- Glass Bottles

- Glass Jars

- Glass Vials

By Type

- Transparent Glass

- Opaque Glass

By End-user

- Bevarages

- Beer

- Wine

- Spirits

- Juices

- Carbonated Drinks (CSDs)

- Dairy Product Based Drinks

- Others

- Food

- Cosmetics and Personal Care

- Pharmaceuticals

- Others

Drivers

Increasing Consumer Preference for Eco-Friendly Packaging Drives Market Growth

The glass bottles and containers market is experiencing strong growth due to several key factors. Consumer awareness about environmental issues is pushing demand for eco-friendly packaging solutions. Glass containers are 100% recyclable and don’t release harmful chemicals, making them attractive to environmentally conscious buyers.

Premium brands are increasingly choosing sustainable packaging to meet consumer expectations. Glass offers a premium look and feel that enhances product value, especially for high-end beverages, cosmetics, and gourmet foods. This trend is driving manufacturers to invest more in glass packaging solutions.

The food and beverage industry continues expanding globally, creating steady demand for glass containers. From wine bottles to baby food jars, glass packaging ensures product safety and maintains taste quality. The pharmaceutical sector also relies on glass for drug storage due to its inert properties that don’t interact with medicines.

The cosmetics industry is another major growth driver. Luxury skincare and perfume brands prefer glass packaging for its elegant appearance and ability to preserve product integrity. This sector’s expansion, particularly in emerging markets, is boosting glass container demand significantly.

Restraints

Fragility and Risk of Breakage During Handling Restrains Market Growth

Despite its advantages, the glass bottles and containers market faces several challenges that limit its growth potential. The primary concern is glass fragility, which creates handling and transportation difficulties. Broken glass poses safety risks and leads to product loss, making companies hesitant to choose glass over more durable alternatives.

Stringent recycling regulations create compliance burdens for manufacturers. While glass is recyclable, the collection, sorting, and processing systems require significant investment. Companies must navigate complex waste management rules that vary by region, adding operational costs and complexity.

Competition from alternative materials poses a significant threat. Plastic containers are lighter, cheaper, and more durable than glass. Metal cans offer similar durability with better portability. These alternatives often provide cost advantages that attract price-sensitive customers, especially in mass-market segments.

The higher production costs of glass compared to alternatives also restrict market expansion. Energy-intensive manufacturing processes and expensive raw materials make glass packaging more costly. Transportation costs are higher due to glass weight, further impacting the total cost of ownership for businesses choosing glass containers.

Growth Factors

Rising Demand for Personalized and Custom-Designed Glass Containers Creates Growth Opportunities

The glass bottles and containers market presents significant growth opportunities across multiple sectors. Personalized packaging is becoming increasingly popular, with brands seeking unique glass designs to differentiate their products. Custom shapes, colors, and embossed logos help create memorable brand experiences that drive consumer loyalty.

The organic and natural products market is expanding rapidly, creating new opportunities for glass packaging. Health-conscious consumers associate glass containers with purity and quality, making them ideal for organic foods, natural cosmetics, and herbal supplements. This market segment values sustainability and product integrity over cost considerations.

Emerging markets offer substantial growth potential due to rapid urbanization and rising disposable incomes. Countries in Asia, Africa, and Latin America are experiencing increased demand for packaged goods, creating opportunities for glass container manufacturers. Growing middle-class populations in these regions are driving demand for premium packaged products.

The craft beverage industry represents another significant opportunity. Craft beer, artisanal spirits, and specialty wines often use distinctive glass bottles to convey premium quality and authenticity. This trend toward local, small-batch products creates demand for specialized glass packaging solutions.

Emerging Trends

Adoption of Lightweight Glass Packaging for Cost Reduction Drives Market Trends

Current trends in the glass bottles and containers market focus on innovation and sustainability. Lightweight glass packaging is gaining popularity as manufacturers seek to reduce transportation costs and environmental impact. Advanced manufacturing techniques allow producing stronger glass with less material, maintaining durability while cutting weight.

Smart packaging technologies are being integrated into glass containers. QR codes and NFC chips embedded in labels or caps enable interactive consumer experiences. Brands use these technologies for authentication, product information, and marketing campaigns, adding value beyond traditional packaging functions.

The shift toward refillable and reusable glass containers reflects growing environmental consciousness. Beverage companies are introducing deposit systems and refill programs to encourage container reuse. This trend reduces waste and appeals to sustainability-focused consumers willing to participate in circular economy initiatives.

Carbon footprint reduction in glass production is becoming a priority. Manufacturers are investing in energy-efficient furnaces, renewable energy sources, and recycled glass content to minimize environmental impact. These efforts help glass compete with alternative materials by improving its sustainability profile and reducing production costs.

Regional Analysis

Europe Dominates the Glass Bottles and Containers Market with a Market Share of 45.8%, Valued at USD 25.3 Billion

Europe leads the global Glass Bottles and Containers market, holding a dominant share of 45.8%, valued at USD 25.3 Billion. The region’s strong growth is attributed to increasing demand for sustainable packaging solutions, particularly within the beverage and food industries. Moreover, stringent environmental regulations and consumer preference for eco-friendly packaging are expected to drive further growth in the region.

North America Glass Bottles and Containers Market Trends

North America is another key region in the Glass Bottles and Containers market, accounting for a significant portion of the market share. The demand for high-quality glass packaging is rising, particularly in the food and beverage sector, due to its premium appeal and sustainability. The region’s market is expected to continue to expand as consumers increasingly opt for products that feature environmentally friendly packaging.

Asia Pacific Glass Bottles and Containers Market Insights

Asia Pacific is projected to experience substantial growth in the Glass Bottles and Containers market. The region is seeing a surge in manufacturing capacity and demand driven by rapid urbanization and the rise in disposable income. The demand for beverages and personal care products is a major driver, with glass containers being highly sought after for their preservation qualities and aesthetic appeal.

Middle East and Africa Glass Bottles and Containers Market Trends

The Middle East and Africa region is witnessing moderate growth in the Glass Bottles and Containers market. Increasing demand for luxury and high-end products is fueling the demand for glass packaging in personal care and cosmetics, as well as the food and beverage sectors. However, regional growth is slightly limited by the economic volatility and competition from cheaper alternatives.

Latin America Glass Bottles and Containers Market Overview

Latin America’s Glass Bottles and Containers market is expected to grow at a steady pace, driven by the increasing adoption of glass packaging in food and beverage sectors. The region’s consumer base is increasingly leaning towards products that are considered environmentally sustainable, giving glass packaging a competitive edge over plastic alternatives. The growth prospects are also supported by expanding urban populations in key markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Glass Bottles and Containers Company Insights

In 2024, O-I Glass, Inc. continues to maintain a strong presence in the global Glass Bottles and Containers Market with its extensive manufacturing capabilities and commitment to sustainable packaging solutions. The company’s focus on innovation in design and production processes has enabled it to cater to a wide range of industries, from beverages to cosmetics.

Vidrala SA has been making significant strides in the European glass packaging market by emphasizing eco-friendly production methods. Its continuous investment in advanced glass-forming technology and efficient energy use has solidified its competitive edge, making it a key player in the market.

Ardagh Group S.A., a major player in the glass packaging industry, is expected to continue its strong market position by capitalizing on its global reach and diverse portfolio. The company’s innovative designs and dedication to reducing environmental impact through recycling initiatives have reinforced its reputation in both the food and beverage sectors.

Vetropack Holding SA stands out for its focus on producing high-quality glass containers for premium sectors such as food, beverages, and pharmaceuticals. The company’s commitment to sustainable practices and investment in energy-efficient manufacturing processes supports its competitive standing in the European and international markets.

Top Key Players in the Market

- O-I Glass, Inc.

- Vidrala SA

- Ardagh Group S.A.

- Vetropack Holding SA

- PGP Glass Private Limited

- Verallia SA

- Wiegand-glas GmbH

- Stoelzle Oberglas GmbH

- Gaasch Packaging

Recent Developments

- In February 2025, Pulpex raised $78 million to scale production of its paper-based bottles, aiming to expand its sustainable packaging solutions and meet the growing demand for eco-friendly alternatives in the beverage and consumer goods markets.

- In August 2025, Ciner Glass secured $583.1 million to build a new container glass facility in Belgium, which will enhance the company’s manufacturing capacity and help address the rising demand for glass packaging across Europe.

- In February 2024, Arglass secured $230 million for glass furnace investment, strengthening its production capabilities and improving energy efficiency in glass bottle manufacturing to support a growing market for high-quality packaging solutions.

- In June 2024, a $60 million capital injection provided significant support to a Tanzanian glass bottle company, enabling the firm to expand its production capacity and support local industries with high-quality glass packaging for food and beverages.

Report Scope

Report Features Description Market Value (2024) USD 55.3 Billion Forecast Revenue (2034) USD 85.9 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Glass Bottles, Glass Jars, Glass Vials), By Type (Transparent Glass, Opaque Glass), By End-user (Beverages, Food, Cosmetics and Personal Care, Pharmaceuticals, Others), By Beverages (Beer, Wine, Spirits, Juices, Carbonated Drinks (CSDs), Dairy Product Based Drinks, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape O-I Glass, Inc., Vidrala SA, Ardagh Group S.A., Vetropack Holding SA, PGP Glass Private Limited, Verallia SA, Wiegand-glas GmbH, Stoelzle Oberglas GmbH, Gaasch Packaging Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Glass Bottles and Containers MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Glass Bottles and Containers MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- O-I Glass, Inc.

- Vidrala SA

- Ardagh Group S.A.

- Vetropack Holding SA

- PGP Glass Private Limited

- Verallia SA

- Wiegand-glas GmbH

- Stoelzle Oberglas GmbH

- Gaasch Packaging