Germany Anti-Aging Products Market Size, Share, Growth Analysis By Product (Facial Serum, Moisturizer, Creams, & Lotions, Eye Care Products, Facial Cleanser & Exfoliators, Facial Masks & Peels, Sunscreen & Sun Protection, Others), By Distribution Channel (Supermarkets & Hypermarkets, Pharmacy/Drugstores, Specialty Beauty Stores, Online/E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158153

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

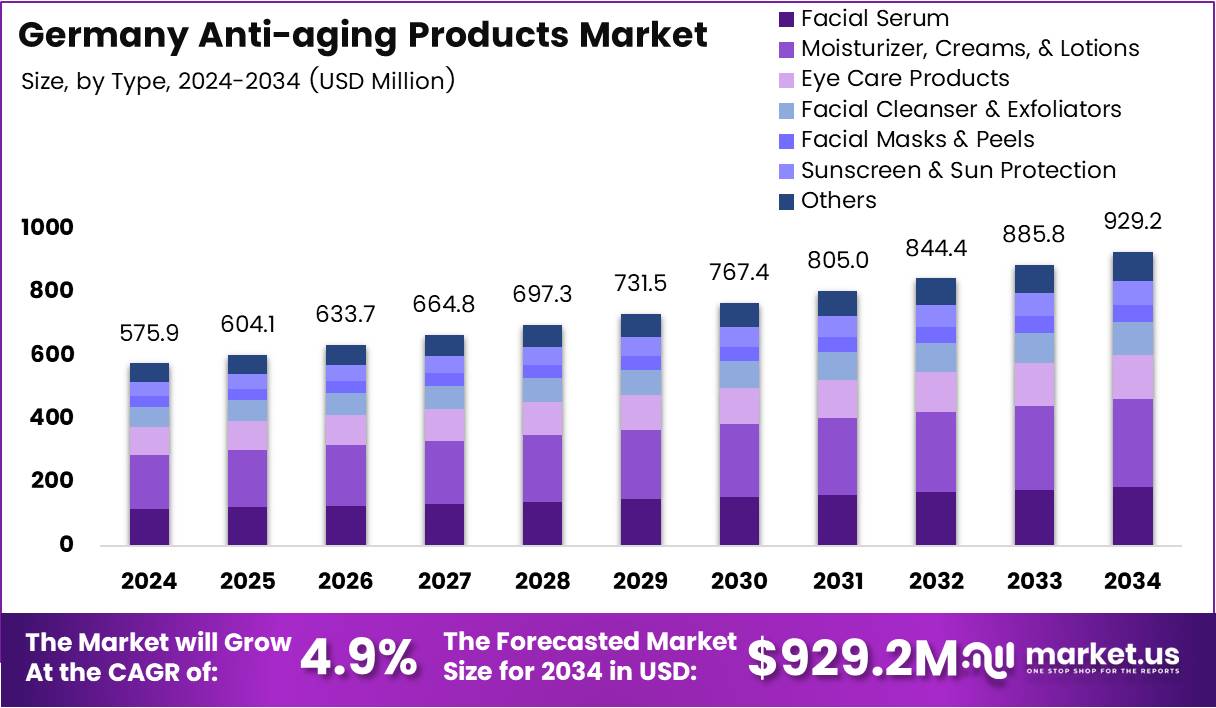

The Germany Anti-Aging Products Market size is expected to be worth around USD 929.2 Million by 2034, from USD 575.9 Million in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

Germany’s anti-aging products market represents a rapidly evolving segment of the broader beauty and personal care industry. The market is shaped by rising consumer awareness, demographic shifts, and higher spending on skincare solutions. With an aging population seeking preventive and corrective products, companies are focusing on innovation and active ingredient development to drive growth.

Demand is primarily driven by shifting lifestyle preferences, where German consumers prioritize high-quality formulations and dermatology-backed solutions. The market sees strong traction for serums, moisturizers, and nutraceutical-based offerings. International and domestic brands continue to leverage advanced R&D and marketing strategies to establish a firm presence across urban and semi-urban areas.

Government regulations on cosmetic safety and sustainable formulations are reinforcing market credibility and consumer trust. Stringent guidelines for labeling, safety testing, and ingredient transparency ensure that only high-quality products are available. These regulatory frameworks create opportunities for established players to introduce clinically tested, eco-friendly, and compliant anti-aging solutions.

Opportunities also lie in technology-enabled skincare, with digital diagnostics and AI-driven skin assessments influencing consumer buying behavior. Moreover, growing interest in natural and plant-based formulations is opening new pathways for manufacturers. German consumers increasingly favor products that combine anti-aging effectiveness with sustainability and ethical sourcing.

The domestic retail environment is highly supportive, with strong distribution across drugstores, specialty outlets, and online platforms. E-commerce adoption has significantly increased, enabling global brands to penetrate deeper into the market. As online shopping expands, personalization and subscription-based product delivery models are expected to gain momentum in the coming years.

According to survey data, Germany stood as Europe’s largest cosmetics market in 2024, recording retail sales of €16.9 billion, highlighting strong baseline demand for skincare and anti-aging products. Furthermore, the beauty and household sector reported a 3.6% increase, reaching €34.6 billion, with domestic sales rising by 7.1%, reflecting consumer resilience in personal care spending.

These statistics reinforce the strength of Germany’s anti-aging products market, underpinned by robust consumer demand, regulatory support, and continuous innovation. With rising focus on wellness, sustainability, and advanced skincare solutions, the market is projected to remain one of Europe’s most promising growth avenues for global and domestic players alike.

Key Takeaways

- The Germany Anti-Aging Products Market is projected to reach USD 929.2 Million by 2034, up from USD 575.9 Million in 2024, growing at a CAGR of 4.9%.

- Moisturizer, Creams, & Lotions lead the market with a 27.8% share in 2024 due to their popularity in hydration and wrinkle prevention.

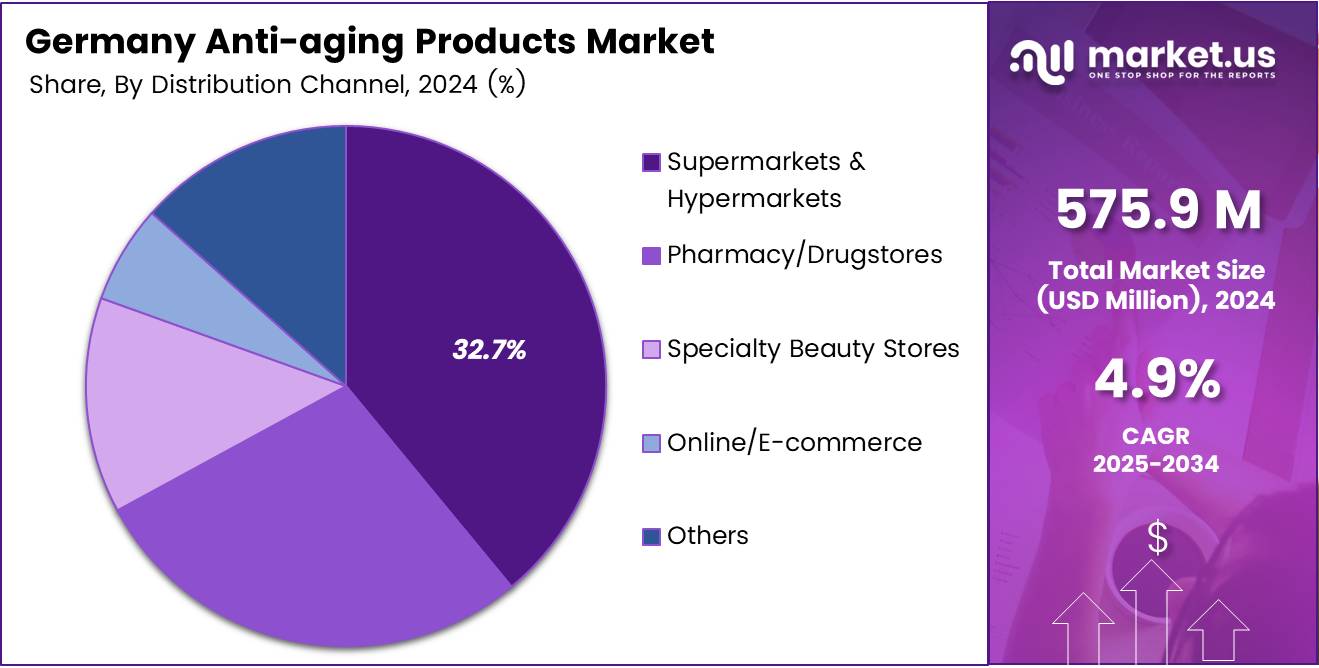

- Supermarkets & Hypermarkets dominate the distribution segment, holding a 32.7% share in 2024, driven by accessibility and promotions.

Product Analysis

Moisturizer, Creams, & Lotions dominate with 27.8% due to their essential role in daily anti-aging skincare routines.

In 2024, Moisturizer, Creams, & Lotions held a dominant market position in the Germany Anti-Aging Products Market, capturing a share of 27.8%. Their widespread adoption stems from daily use among consumers seeking hydration and wrinkle prevention, driving consistent demand across all age groups.

Facial Serum is gaining strong traction in Germany as consumers shift toward concentrated formulations offering targeted results. Increasing demand for serums with active ingredients such as hyaluronic acid and retinol reflects consumer preference for science-backed anti-aging solutions.

Eye Care Products represent a growing category, as German consumers focus on addressing fine lines, puffiness, and dark circles. Rising screen exposure and lifestyle-driven stress factors further accelerate the need for specialized anti-aging eye formulations.

Facial Cleanser & Exfoliators continue to strengthen their position, as exfoliation plays a key role in improving skin renewal. Demand is particularly strong for products with natural and dermatologically tested formulations, aligning with Germany’s clean beauty trend.

Facial Masks & Peels are evolving as premium, occasional-use products in anti-aging routines. Innovation in sheet masks and peel-based formulations contributes to growing adoption among urban consumers seeking quick results.

Sunscreen & Sun Protection remain indispensable within the German market, supported by government and dermatological campaigns on UV-induced skin aging. Growing awareness of preventive skincare sustains this category’s demand.

Others, including niche products, continue to find relevance through innovative formulations, though their market share remains comparatively smaller.

Distribution Channel Analysis

Supermarkets & Hypermarkets dominate with 32.7% due to their wide accessibility and diverse anti-aging product offerings.

In 2024, Supermarkets & Hypermarkets held a leading position in the Germany Anti-Aging Products Market, accounting for 32.7% of distribution. Their dominance is reinforced by easy accessibility, diverse product ranges, and frequent discount-driven promotions attracting cost-conscious German consumers.

Pharmacy/Drugstores represent another strong distribution channel, particularly valued for trusted brands and dermatologist-recommended products. German consumers often associate pharmacies with higher product reliability, strengthening this channel’s importance in anti-aging product sales.

Specialty Beauty Stores play a crucial role in driving premium product adoption. These stores offer personalized consultations and exclusive high-end brands, appealing to consumers willing to invest more in specialized anti-aging care.

Online/E-commerce continues to expand rapidly in Germany, fueled by convenience, price comparisons, and a growing preference for direct-to-consumer beauty brands. Younger demographics, in particular, are increasingly adopting digital channels for purchasing anti-aging products.

Others, including departmental stores and local retailers, contribute to market distribution but command a relatively smaller share. They remain important in rural or localized markets where digital penetration and specialty stores are limited.

Key Market Segments

By Product

- Facial Serum

- Moisturizer, Creams, & Lotions

- Eye Care Products

- Facial Cleanser & Exfoliators

- Facial Masks & Peels

- Sunscreen & Sun Protection

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Pharmacy/Drugstores

- Specialty Beauty Stores

- Online/E-commerce

- Others

Drivers

Rising Consumer Awareness of Preventive Skincare and Anti-Aging Routines Drives Market Growth

German consumers are increasingly aware of preventive skincare, which is driving strong demand for anti-aging products. This awareness is not limited to older demographics but is extending to younger age groups who are beginning routines earlier. As a result, the market is expected to expand steadily in the coming years.

Germany’s strong pharmaceutical and cosmeceutical base supports innovation in anti-aging products. Companies are investing in advanced formulations, often blending dermatological expertise with cosmetic applications. This mix of science and beauty is anticipated to attract consumers seeking credible, effective, and medically backed anti-aging solutions.

Demand for natural and organic formulations is also shaping market growth. Consumers are increasingly choosing products free from harsh chemicals and focused on botanical or sustainable ingredients. This aligns with Germany’s broader sustainability culture, making natural anti-aging products an attractive segment for manufacturers and retailers.

The rise of e-commerce and digital beauty consultations is further accelerating market expansion. Online platforms are enabling easier product discovery, virtual skin consultations, and personalized shopping experiences. With German consumers valuing convenience, digital channels are projected to be a major driver of future sales in anti-aging skincare.

Restraints

Stringent Regulatory Framework under EU Cosmetic Safety Standards Restrains Market Growth

The German anti-aging products market is constrained by strict EU regulations on cosmetic safety and product approvals. Compliance with these standards increases development time and costs, limiting the ability of smaller companies to launch innovative products quickly in the competitive market.

Consumer skepticism about product efficacy remains another restraint. Many buyers question whether anti-aging products deliver visible results, leading to hesitancy in adoption. This skepticism is particularly strong among cost-conscious consumers who prefer to invest in proven dermatological treatments over premium cosmetic claims.

Alternative wellness and holistic aging approaches are also diverting consumer spending. Growing interest in nutrition, fitness, and lifestyle-based anti-aging solutions reduces dependency on topical skincare products. This shift creates competitive pressure for brands to justify their value proposition with stronger scientific backing.

Market growth is further slowed by price sensitivity. With premium anti-aging products positioned at higher price points, many consumers remain cautious about regular purchases. This creates challenges in expanding market penetration beyond affluent demographics and slows overall adoption in the German market.

Growth Factors

Expansion of Personalized and DNA-Based Anti-Aging Solutions Creates Growth Opportunities

Personalized skincare solutions are opening new avenues for growth in Germany. DNA-based testing and personalized regimens are attracting health-conscious consumers seeking treatments designed specifically for their skin biology, offering brands opportunities to differentiate in a competitive market.

The integration of AI-driven skin diagnostics is another opportunity. Digital tools are enabling consumers to receive customized product recommendations and monitor skin improvements. Such innovations are expected to enhance trust and engagement, especially as tech-driven personalization resonates strongly with younger demographics.

Sustainability-driven innovation in packaging presents further potential. German consumers are highly responsive to eco-friendly packaging, and brands adopting recyclable or biodegradable materials are likely to strengthen market appeal. This focus aligns with the country’s broader environmental goals and consumer expectations.

The male grooming segment is also emerging as a high-growth opportunity. Increasing awareness among men about skincare and anti-aging routines is leading to rising demand for gender-specific products. This shift allows companies to expand their consumer base and capture untapped market potential.

Emerging Trends

Popularity of Multifunctional Anti-Aging Products Combines Skincare and Wellness as a Key Trend

German consumers are embracing multifunctional anti-aging products that combine skincare with wellness benefits. Products offering hydration, sun protection, and anti-aging effects in a single solution are gaining traction for their convenience and efficiency in daily routines.

The rise in vegan and cruelty-free cosmetics is another strong trend. Ethical consumerism is deeply embedded in German society, and brands emphasizing cruelty-free testing and plant-based formulations are expected to see higher adoption across younger, conscious buyers.

Minimally invasive anti-aging treatments, such as fillers and non-surgical skin procedures, are growing in popularity. Clinics offering safe and quick treatments appeal to consumers seeking faster results, creating synergy between the medical aesthetics and skincare markets in Germany.

Social media and influencer-led marketing are also reshaping product discovery. Beauty influencers and dermatologists on digital platforms are creating strong brand awareness. This trend is anticipated to further boost demand for innovative and aspirational anti-aging products across multiple consumer segments.

Key Germany Anti-Aging Products Company Insights

In 2024, the Germany Anti-Aging Products Market remained highly competitive, with major players driving innovation and consumer trust through diverse strategies.

Beiersdorf AG maintained a dominant presence due to its flagship brand Nivea, which benefits from deep consumer loyalty and strong distribution networks across Germany. Its focus on scientifically backed formulations continues to reinforce credibility in the anti-aging skincare category.

Dr. Hauschka gained traction by positioning itself in the premium natural cosmetics segment. Its reliance on organic formulations and sustainable sourcing resonates well with German consumers who increasingly favor natural and clean-label beauty solutions. This niche positioning allows it to compete effectively against larger multinational brands.

L’Oréal Group sustained its leadership through aggressive investments in product innovation and R&D. Its strong portfolio across mass and luxury segments, combined with advanced dermatological expertise, positions the company as a major force in Germany’s anti-aging market. Its ability to adapt global innovations to local consumer demands strengthens its competitive edge.

Estée Lauder capitalized on its luxury and prestige positioning, appealing to consumers seeking premium anti-aging solutions. Its high-end brands, including Clinique and Estée Lauder’s own range, enjoy strong retail and e-commerce presence in Germany. The company’s emphasis on innovation in serums and personalized skincare has supported consistent demand among affluent consumers.

Together, these four companies highlight a market defined by a blend of mass-market accessibility, natural formulations, scientific research, and luxury appeal, shaping Germany’s anti-aging products landscape in 2024.

Top Key Players in the Market

- Beiersdorf AG

- Dr. Hauschka

- L’Oréal Group

- Estée Lauder

- Börlind GmbH

- ROYAL FERN GmbH

- Weleda

- Naturkosmetik GmbH & Co. KG

- Dr. Barbara Sturm

- Dr. Rimpler GmbH

Recent Developments

- In Aug 2025, Beiersdorf AG launched NIVEA Cellular Epigenetics Rejuvenating Serum (2025), featuring Epicelline®, a groundbreaking ingredient aimed at rejuvenating skin cells at a genetic level for enhanced anti-aging benefits.

- In Jan 2024, Bridgepoint acquired the Anti-Aging Brand Roc Skincare, expanding its portfolio in the fast-growing skincare market and enhancing its presence in the premium anti-aging segment.

- In Jul 2024, LORIENCE Groupe announced the acquisition of the BIOTULIN brand, a strategic move to strengthen its position in the anti-aging and skincare market, with BIOTULIN known for its innovative, plant-based anti-aging solutions.

Report Scope

Report Features Description Market Value (2024) USD 575.9 Million Forecast Revenue (2034) USD 929.2 Million CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Facial Serum, Moisturizer, Creams, & Lotions, Eye Care Products, Facial Cleanser & Exfoliators, Facial Masks & Peels, Sunscreen & Sun Protection, Others), By Distribution Channel (Supermarkets & Hypermarkets, Pharmacy/Drugstores, Specialty Beauty Stores, Online/E-commerce, Others) Competitive Landscape Beiersdorf AG, Dr. Hauschka, L’Oréal Group, Estée Lauder, Börlind GmbH, ROYAL FERN GmbH, Weleda, Naturkosmetik GmbH & Co. KG, Dr. Barbara Sturm, Dr. Rimpler GmbH. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Germany Anti-Aging Products MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Germany Anti-Aging Products MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Beiersdorf AG

- Dr. Hauschka

- L'Oréal Group

- Estée Lauder

- Börlind GmbH

- ROYAL FERN GmbH

- Weleda

- Naturkosmetik GmbH & Co. KG

- Dr. Barbara Sturm

- Dr. Rimpler GmbH