Global DNA-based Skin Care Products Market Size, Share, Growth Analysis By Product (Creams, Serums, Cleansers , Others), By Age Group (Adults, Teens and Young Adults, Seniors), By Application (Collagen Production, Sun Defense , Improved Antioxidants, Inflammation Regulation), By End-User (Wellness Clinics, Salons, Personal Use), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145897

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

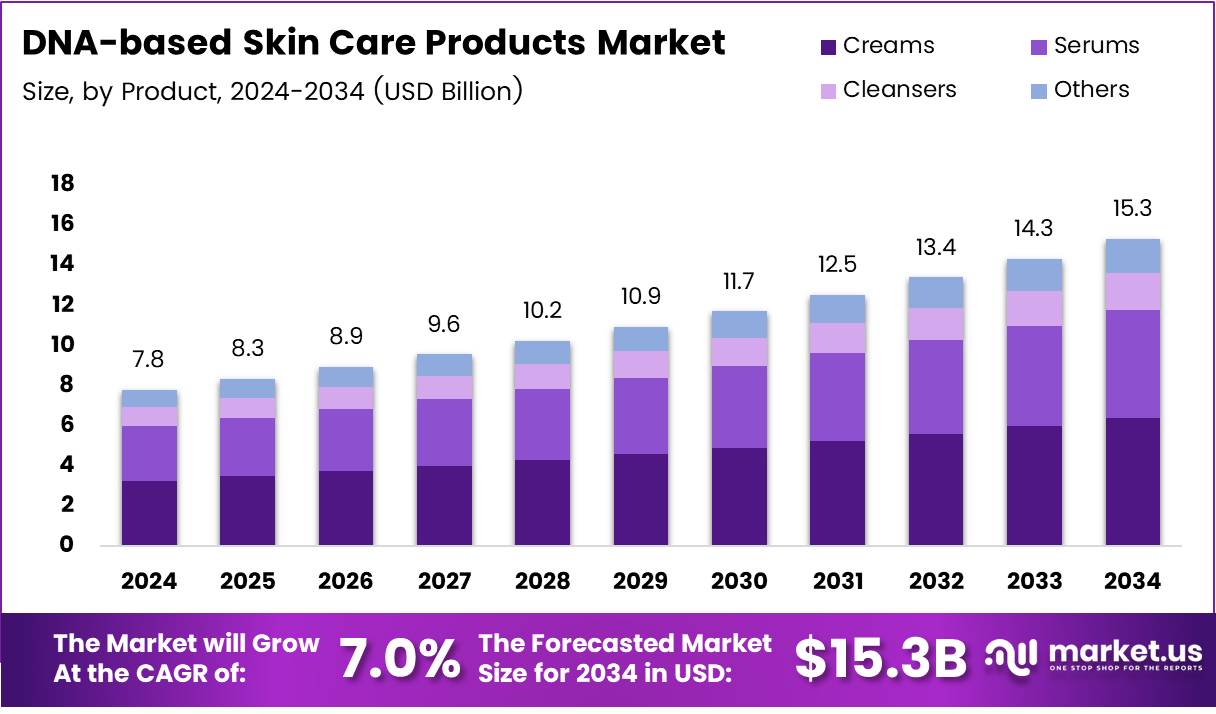

The Global DNA-based Skin Care Products Market size is expected to be worth around USD 15.3 Billion by 2034, from USD 7.8 Billion in 2024, growing at a CAGR of 7% during the forecast period from 2025 to 2034.

The DNA-based skin care products market refers to a specialized segment within the skincare industry that utilizes genetic testing to create personalized skincare regimens. These products are tailored to an individual’s unique genetic profile, addressing specific skin concerns such as aging, pigmentation, elasticity, and sensitivity. By combining biotechnology and dermatological science, this approach enables targeted solutions that offer higher efficacy compared to traditional, one-size-fits-all products.

DNA-based skin care products represent a cutting-edge advancement in personalized wellness. The growing consumer shift toward health-conscious and scientifically backed solutions is driving demand for products that align with individual needs. These solutions empower consumers to make informed decisions based on their genetic predispositions.

The availability of at-home genetic testing kits and the rise of digital health platforms are making this personalization more accessible than ever. This innovation not only enhances customer experience but also strengthens brand loyalty through tailored engagement.

The DNA-based skincare market is evolving rapidly, supported by both technological progress and rising consumer expectations. With the beauty industry generating over $650 billion in global revenue according to Exploding Topics, the market potential for such high-precision products is substantial.

Personalized skincare has become a key growth lever in this space. Furthermore, increasing concerns around skin health—highlighted by over 9,500 daily skin cancer diagnoses in the U.S. according to SkinCancer.org—are motivating consumers to seek more proactive and preventive care solutions. This shift is creating a new layer of demand for science-backed, health-oriented beauty products.

The DNA-based skincare market is entering a high-growth phase with expanding opportunities across both luxury and mass-market segments. In 2024, 72% of global skincare revenue came from non-luxury products, and 28% from luxury according to industry report, indicating broad consumer interest.

Innovation is being fueled by collaborations between biotech firms and skincare brands, while government support for genetic research indirectly benefits product development. Several countries are investing in genomic science, providing a foundation for more sophisticated skincare solutions. On the regulatory front, increasing scrutiny around genetic data usage and consumer privacy is expected. Clear regulatory frameworks will be essential to build trust and ensure responsible market practices as the segment matures.

Key Takeaways

- Global DNA-based Skin Care Products Market is expected to reach USD 15.3 billion by 2034, growing at a CAGR of 7% from 2025 to 2034.

- Creams held a dominant position in the market with a 47.3% share in 2024 due to their versatility and consumer acceptance.

- Adults represented 52.1% of the market share in 2024, driven by increasing awareness and demand for personalized skincare.

- Collagen Production led the application segment with a 34.6% share in 2024, driven by anti-aging and skin rejuvenation needs.

- Wellness Clinics dominated the end-user segment with a 51.1% share in 2024, due to personalized DNA-based skincare treatments.

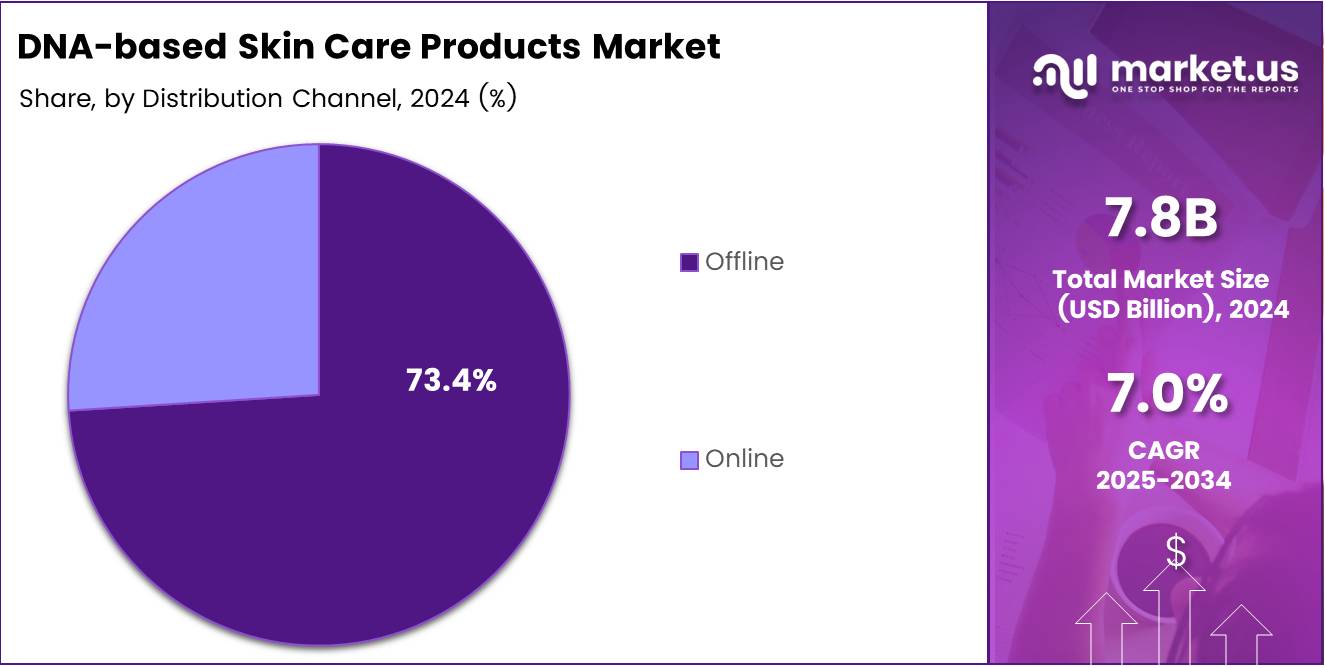

- Offline retail accounted for 73.4% of the market share in 2024, as consumers prefer in-store experiences.

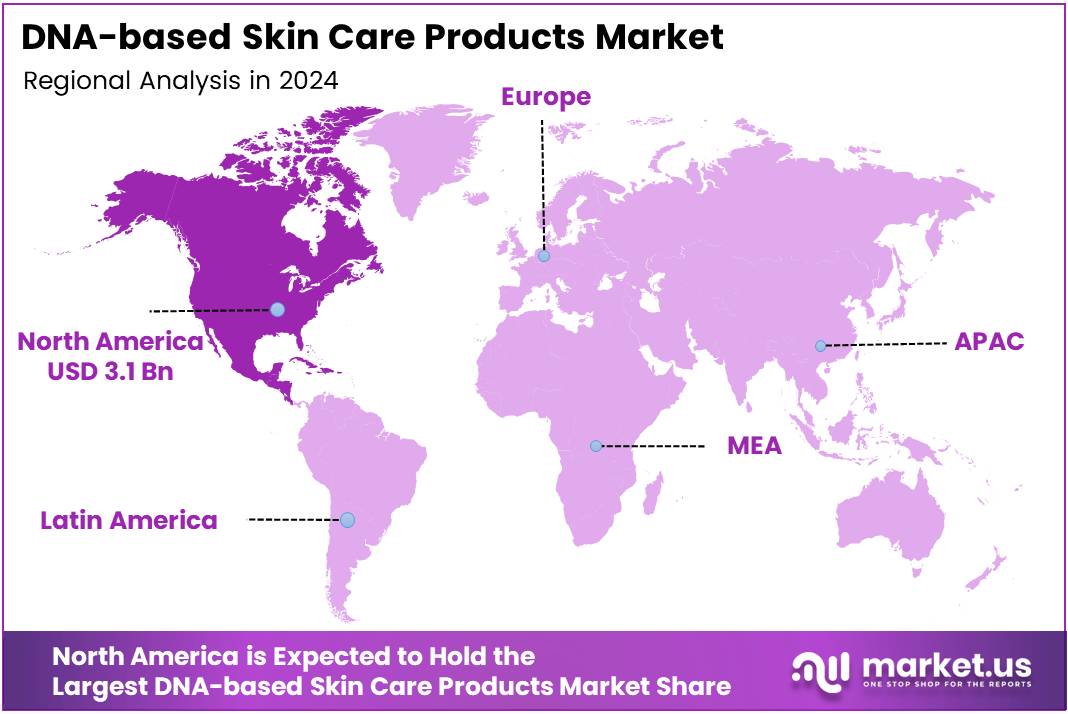

- North America holds the largest regional share at 39.7%, valued at USD 3.1 billion in 2024, due to rising demand for personalized skincare.

Product Analysis

Creams Lead the DNA-based Skin Care Products Market with a 47.3% Share in 2024

In 2024, Creams held a dominant market position in the By Product Analysis segment of the DNA-based Skin Care Products Market, with a 47.3% share. This strong market presence can be attributed to the versatility and wide consumer acceptance of creams. They offer deep hydration, anti-aging benefits, and can address various skin concerns, making them a preferred choice for daily skincare routines.

Following creams, serums have gained significant traction due to their targeted treatment benefits. While they make up a smaller portion of the market, they are expected to grow rapidly, driven by their concentrated formulas that cater to specific skin needs.

Cleansers, essential for every skincare routine, The growing awareness of the importance of skin health and hygiene continues to support the demand for quality cleansers in DNA-based skincare lines.

Other products, including masks and exfoliators. These products serve niche needs and are expected to see incremental growth as consumers increasingly look for comprehensive skincare regimens that incorporate advanced, DNA-based formulations.

Group Analysis

Adults Lead the DNA-based Skin Care Products Market in 2024 with a 52.1% Share

In 2024, Adults held a dominant market position in the By Age Group Analysis segment of the DNA-based Skin Care Products Market, with a 52.1% share. This age group’s significant share is attributed to a growing awareness of skin health and the increasing demand for advanced, personalized skincare solutions. Adults are more likely to invest in high-quality products that promise long-term skin benefits, such as DNA-based formulas that target aging, pigmentation, and environmental stress.

Teens and Young Adults make up a smaller portion of the market, but their presence is still notable, driven by increasing interest in skincare from an early age. This group often gravitates towards products that promise clear, healthy skin with minimal effort. While their market share is not as large as adults, the rise of social media and skincare influencers has accelerated the popularity of DNA-based products among this demographic.

Seniors, on the other hand, are also contributing to the growing market. With their focus on anti-aging and skin rejuvenation, seniors have a strong preference for DNA-based products. Their market share continues to grow as the demand for skin care solutions that specifically target age-related concerns increases. However, their share remains lower compared to adults, with a smaller but steady upward trend.

Application Analysis

Collagen Production Leads the DNA-based Skin Care Products Market with 34.6% Share in 2024

In 2024, Collagen Production held a dominant market position in the By Application Analysis segment of the DNA-based Skin Care Products Market, with a 34.6% share. Collagen, being a key protein responsible for skin elasticity and hydration, continues to drive demand as consumers prioritize anti-aging solutions and skin rejuvenation.

Sun Defense, another prominent segment, is gaining traction as skin care products infused with DNA-based technology offer enhanced protection against harmful UV rays. The growing awareness about the importance of sun protection in skin care is anticipated to push Sun Defense’s market share higher in the coming years.

The Improved Antioxidants segment is expected to witness significant growth as well. With DNA-based formulations, these antioxidants work at a deeper level, protecting the skin from oxidative stress and environmental damage, which resonates with consumers seeking healthier skin solutions.

Inflammation Regulation is another crucial segment contributing to the DNA-based skin care market. Products targeting inflammation regulation address common skin concerns such as acne, redness, and irritation, providing a more targeted and effective approach to skin health.

Overall, the market’s continued focus on innovation and personalized skincare solutions positions these segments for sustained growth in the future.

End-User Analysis

Wellness Clinics Lead with 51.1% Market Share in DNA-based Skin Care Products (2024)

In 2024, Wellness Clinics held a dominant market position in the By End-User Analysis segment of the DNA-based skin care products market, with a 51.1% share. This is largely due to the growing popularity of personalized skin care treatments, where DNA analysis plays a crucial role in providing targeted solutions. Wellness clinics have become go-to destinations for customers seeking customized skincare regimes based on their genetic makeup, leading to the segment’s significant share.

On the other hand, the Salons segment has also shown substantial growth, capturing a considerable portion of the market. While not as dominant as wellness clinics, salons continue to serve as key players by offering DNA-based skincare services, appealing to customers looking for professional treatments without the need for clinic visits.

Lastly, Personal Use products have seen steady demand, with many consumers opting for DNA-based skincare solutions for home use. Although this segment trails behind wellness clinics and salons, the increasing awareness of personalized skincare products is gradually driving growth in this category.

Overall, wellness clinics continue to lead the market, but the segments of salons and personal use are expected to grow as DNA-based skincare gains broader consumer appeal.

Distribution Channel Analysis

Offline dominates with 73.4% market share in Distribution Channel of DNA-based Skin Care Products in 2024

In 2024, the Offline segment held a dominant market position in the DNA-based Skin Care Products Market, accounting for an impressive 73.4% share. This dominance can be attributed to the widespread availability of products in physical retail stores, where customers prefer the tactile experience of testing products before purchasing. Traditional beauty counters, drugstores, and department stores remain key channels for consumers to engage with and buy skin care products.

The Online segment, although growing rapidly, still lags behind with a smaller share of the market. Despite the increasing convenience of e-commerce platforms, many consumers continue to value the immediate access and personal interaction that offline shopping provides. However, online sales are steadily gaining traction, driven by advancements in digital marketing, subscription models, and the growing demand for doorstep delivery.

Both distribution channels cater to different customer preferences. While offline shopping excels in personalized experiences and instant gratification, the online channel benefits from a broader reach and ease of comparison shopping. As the market evolves, the interplay between these channels is expected to shift, with online sales potentially capturing a larger share over time.

Key Market Segments

By Product

- Creams

- Serums

- Cleansers

- Others

By Age Group

- Adults

- Teens and Young Adults

- Seniors

By Application

- Collagen Production

- Sun Defense

- Improved Antioxidants

- Inflammation Regulation

By End-User

- Wellness Clinics

- Salons

- Personal Use

By Distribution Channel

- Offline

- Online

Drivers

Consumer Interest in Personalized Skincare Fuels Market Expansion

The DNA-based skincare products market is experiencing significant growth, driven primarily by the increasing demand for personalized skincare solutions. Consumers are showing a keen interest in skincare regimens that are specifically tailored to their unique genetic profiles. This surge in consumer preference for customized skincare options is a major factor propelling the market forward.

Additionally, advancements in genomic and biotechnological fields have made DNA analysis more accessible and cost-effective. These technological strides are enabling cosmetic companies to develop products that are finely tuned to the genetic needs of individuals, enhancing both effectiveness and consumer satisfaction.

Moreover, there is a growing awareness among consumers about the importance of skin health and preventive care. More people are now proactive about using personalized diagnostics to prevent skin issues before they arise, rather than addressing them post-development. This shift towards preventive skincare is further amplifying the demand for DNA-based skincare products, as they offer targeted treatments and preventive solutions based on thorough genetic understanding. Together, these drivers are shaping a robust market trajectory for DNA-based skincare solutions, marked by innovation and consumer-centric approaches.

Restraints

High Cost of DNA Testing and Custom Products Limits Widespread Adoption

As an analyst observing the DNA-based skincare products market, one major restraint is the high cost associated with DNA testing and the development of personalized skincare solutions. These products rely heavily on advanced genomic analysis, which requires sophisticated technology and skilled professionals. This makes the entire process expensive, both for companies producing these products and for consumers looking to use them.

Due to these costs, DNA-based skincare is often positioned as a luxury service, limiting its accessibility to a small, affluent consumer base. Mass-market penetration remains low, as most consumers are not willing or able to pay the premium price for personalized skincare when more affordable alternatives exist.

Another restraint is the limited consumer awareness, particularly in emerging markets. In many regions, people are still not familiar with the concept of using their genetic information to tailor skincare routines. This lack of awareness translates into low demand and slower market growth in these areas.

Educational efforts and marketing campaigns are needed to help consumers understand the benefits of DNA-based skincare, but such efforts require time and resources, further delaying adoption. Additionally, there may be cultural and privacy concerns around sharing genetic information, which can act as another psychological barrier.

Growth Factors

Expanding into New Markets Boosts DNA-Based Skin Care Product Sales

The DNA-based skin care products market is poised for substantial growth, driven by several key opportunities. One of the most significant growth drivers is the expansion into emerging economies such as those in Asia-Pacific, Latin America, and the Middle East. These regions hold vast untapped potential due to increasing disposable incomes, growing awareness about personalized skin care, and a burgeoning middle class keen on innovative beauty solutions.

Another promising avenue is the integration of DNA-based skin care products with digital platforms and mobile applications. By leveraging artificial intelligence, companies can offer more personalized skincare advice based on DNA insights, which could significantly boost user engagement and customer loyalty. This digital approach not only enhances the consumer experience but also provides brands with valuable data to further refine their products.

Furthermore, developing subscription-based personalized skincare kits presents a lucrative recurring revenue model. Such kits cater to the ongoing demand for customized skin care regimes, providing consumers with a convenient, tailored solution that evolves with their skin’s needs over time.

This model ensures steady income for brands and fosters long-term customer relationships, enhancing both satisfaction and brand loyalty. This combination of geographical expansion, digital integration, and innovative business models positions the DNA-based skin care products market on a trajectory of robust growth and profitability.

Emerging Trends

Rise of At-Home DNA Testing Kits is Powering Consumer Interest in DNA-Based Skincare

The growing popularity of at-home DNA testing kits is making it easier for people to explore personalized skincare based on their unique genetics. These kits allow users to collect their DNA samples at home without needing a clinical setup, making it a convenient and private option. This ease of use is helping to boost demand for DNA-based skincare products, especially among tech-savvy and health-conscious consumers.

Another key trend shaping the market is the influence of celebrities and social media influencers. When well-known public figures promote DNA-based skincare routines or products, it creates buzz and builds trust. Their endorsements often encourage followers to try out these advanced products themselves, driving market adoption.

Moreover, the clean beauty movement is blending well with genomic science. Today’s consumers not only want safe and natural skincare products, but they also look for products backed by real science. DNA-based skincare meets this need by offering customized solutions with clearly listed ingredients that are chosen based on genetic factors. This combination of clean beauty and advanced genomics is especially appealing to younger consumers who value both transparency and innovation.

Together, these factors are creating a strong foundation for growth in the DNA-based skincare market. The industry is moving toward more personalized, science-backed, and influencer-driven solutions that meet the modern consumer’s desire for both results and convenience.

Regional Analysis

North America Leads the DNA-based Skin Care Products Market with 39.7% Share, Valued at USD 3.1 Billion

The DNA-based skin care products market is witnessing significant growth across various regions, with North America holding the largest market share. Dominating the global market with 39.7%, North America, particularly the United States, is valued at USD 3.1 billion.

This surge in demand can be attributed to increasing consumer awareness about advanced skincare solutions, alongside a rising preference for personalized skincare products. Additionally, the presence of prominent players in the region and the growing adoption of anti-aging solutions are contributing factors to the dominance of North America in the market.

Regional Mentions:

Europe follows closely with a strong market presence, owing to its advanced skincare culture and the increasing number of beauty-conscious consumers. The European market is projected to grow steadily, driven by demand from countries such as Germany, France, and the UK, where there is a strong inclination toward innovative and premium skincare products. The growing trend of wellness and self-care in Europe further propels the adoption of DNA-based skincare solutions.

The Asia Pacific region is expected to experience the highest growth rate over the forecast period, with countries like Japan, China, and South Korea at the forefront of this trend. The rising middle-class population and an increasing focus on health and wellness in these countries are key factors that drive the market. Moreover, the demand for skincare solutions that address specific concerns, such as pigmentation and aging, is fueling the popularity of DNA-based skincare products in this region.

The Middle East & Africa and Latin America regions are also witnessing growing interest in DNA-based skincare, although at a slower pace compared to North America and Europe. As the awareness of personalized skincare solutions increases in these regions, the market is expected to expand steadily over the coming years. However, the overall market share of these regions remains relatively small.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global DNA-based skin care products market is experiencing significant growth, driven by advancements in genetic research and personalized wellness. Key players in this sector are leveraging genetic insights to offer tailored skincare solutions, enhancing consumer engagement and market expansion.

IMAGENE LABS PTE. LTD. stands out with its enterprise-grade, cloud-based genetic analytics platform. By employing machine learning and comparing user gene data against ethnically relevant reference datasets, Imagene Labs delivers precise wellness assessments. Their collaborations with prominent fitness, beauty, nutrition, and healthcare brands highlight their influence in the personalized skincare domain.

Caligenix, Inc. offers personalized skincare solutions through advanced genetic analysis. Their platform provides tailored product recommendations based on individual genetic profiles, integrating AI-driven insights to enhance skincare routines. This blend of beauty and biotechnology positions Caligenix as a leader in optimizing skin health.

EpigenCare Inc. is renowned for its personalized skincare testing, utilizing epigenetic analysis to assess skin quality. Their SKINTELLI test evaluates epigenetic markers, guiding consumers toward products that align with their skin’s current condition. This approach exemplifies the shift toward individualized skincare regimens.

Anake, a Singapore-based company, introduced a DNA-based skincare service that analyzes genetic markers to help customers identify products best suited to their skin. This innovative service is expected to drive market growth, particularly in the Asia Pacific region.

MapMyGenome launched BeautyMap™, a DNA-based test that provides personalized skin and hair care recommendations based on genetic makeup. This product helps consumers make informed decisions about their beauty regimens.

Other notable contributors, including SKINSHIFT, DNA Skin Institute, Evergreen Life Ltd., LifeNome Inc., and RGR Pharma Ltd., are also shaping the market. Each company brings unique genetic insights and personalized solutions to the skincare market, creating a future where skincare is increasingly customized, data-driven, and aligned with individual genetic profiles.

In summary, these companies are at the forefront of integrating genetic science with skincare, offering personalized solutions that cater to individual needs. Their innovations are enhancing consumer experiences and driving the evolution of the global DNA-based skincare products market.

Top Key Players in the Market

- IMAGENE LABS PTE. LTD.

- EpigenCare Inc.

- Caligenix, Inc.

- SKINSHIFT

- DNA Skin Institute

- Evergreen Life Ltd.

- Anake

- LifeNome Inc.

- RGR Pharma Ltd.

- Mapmygenome

Recent Developments

- In February 2025, Level Zero Health secured €6.6 million in funding for the development of the world’s first continuous hormone monitoring device, a groundbreaking innovation in healthcare technology.

- In May 2024, Three Ships Beauty raised $2.5 million to support the growth and expansion of its clean, natural beauty products, furthering its mission to revolutionize skincare.

- In February 2025, a healthtech start-up successfully raised £5.5 million to advance its innovative hormone monitoring device, marking a significant step forward in personalized healthcare solutions.

Report Scope

Report Features Description Market Value (2024) USD 7.8 Billion Forecast Revenue (2034) USD 15.3 Billion CAGR (2025-2034) 7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Creams, Serums, Cleansers , Others), By Age Group (Adults, Teens and Young Adults, Seniors), By Application (Collagen Production, Sun Defense , Improved Antioxidants, Inflammation Regulation), By End-User (Wellness Clinics, Salons, Personal Use), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IMAGENE LABS PTE. LTD., EpigenCare Inc., Caligenix, Inc., SKINSHIFT, DNA Skin Institute, Evergreen Life Ltd., Anake, LifeNome Inc., RGR Pharma Ltd., Mapmygenome Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  DNA-based Skin Care Products MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

DNA-based Skin Care Products MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IMAGENE LABS PTE. LTD.

- EpigenCare Inc.

- Caligenix, Inc.

- SKINSHIFT

- DNA Skin Institute

- Evergreen Life Ltd.

- Anake

- LifeNome Inc.

- RGR Pharma Ltd.

- Mapmygenome