Global Generic Oncology Drugs Market By Molecule (Type, Small molecule, Large molecule) By Drug Class (Alkylating agents, Antimetabolites, Antibiotics (cytotoxic), Anti-cancer hormones, Targeted therapy, Others) By Route of Administration (Oral, Parenteral, Topical, Transdermal) By Target Indication (Breast cancer, Lung cancer, Colorectal cancer, Prostate cancer, Liver cancer, Kidney cancer, Cervical cancer, Others) By Distribution Channel (Hospital pharmacies, Retail pharmacies, Online pharmacies) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166487

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

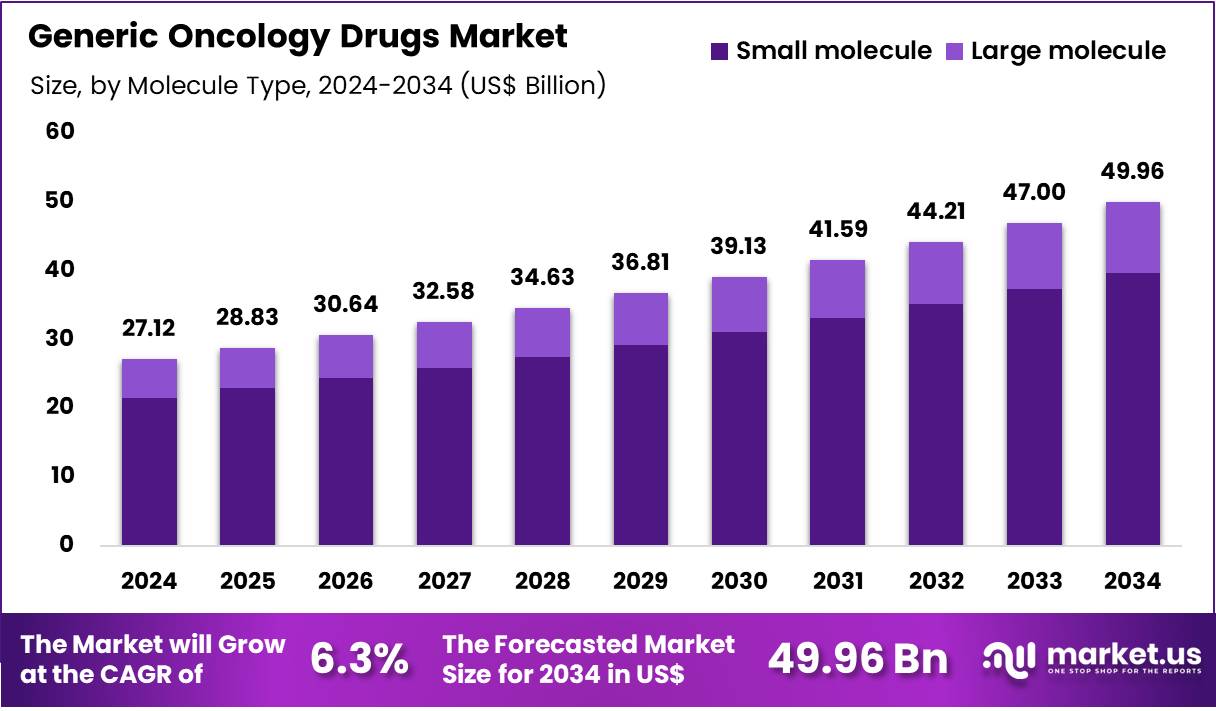

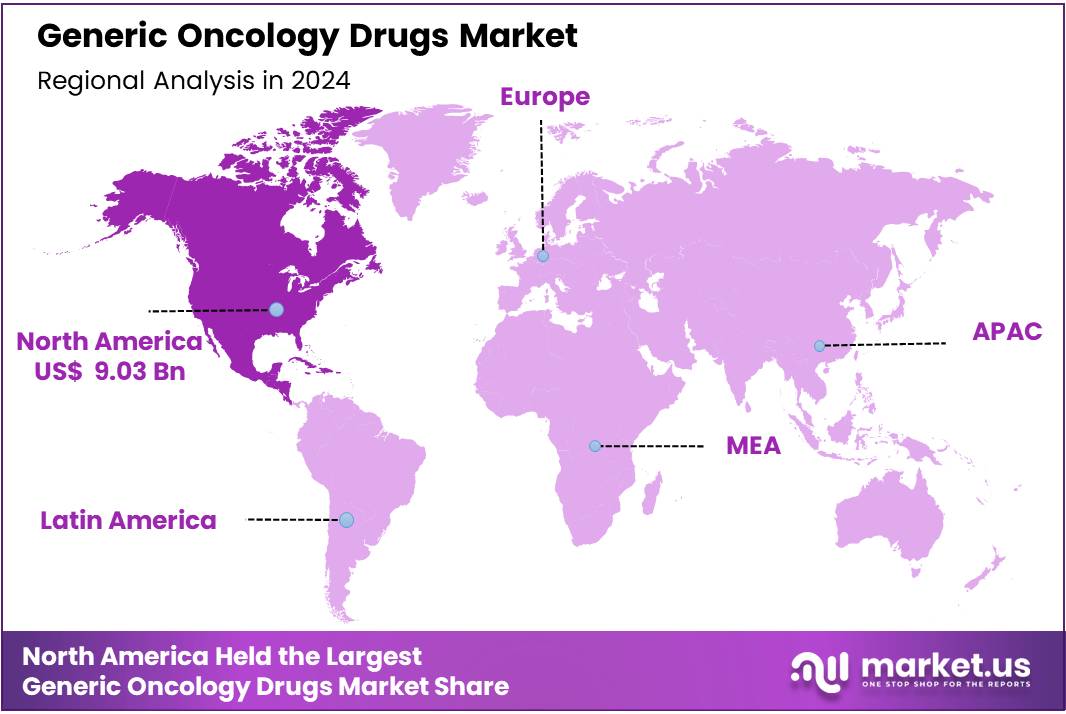

Global Generic Oncology Drugs Market size is expected to be worth around US$ 49.96 Billion by 2034 from US$ 27.12 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 33.3% share with a revenue of US$ 9.3 Billion.

The growth of the generic oncology drugs market is being driven by rising cancer incidence, expanding treatment demand, and increasing pressure on healthcare budgets. Global cancer cases were estimated at 20 million in 2022, with 9.7 million deaths, and the number of new cases is projected to exceed 35 million by 2050, representing a 77% increase. This surge is linked to ageing populations, lifestyle-related risk factors, and population expansion.

As more patients are diagnosed and treated earlier, demand for systemic therapies has risen, and a significant share of this growth is being met by lower-cost generic oncology medicines. Incidence growth is strongest in low- and middle-income countries, where treatment access depends heavily on affordability. Data from global cancer observatories indicate rising incidence across Asia, Latin America, and Africa, and in these settings, generics often represent the only viable route to scaling up care.

This rapid increase has intensified pressure on public payers and households. In OECD countries, governments and compulsory insurance schemes finance around 58% of retail drug spending, and in some European markets, the share exceeds 80%. Out-of-pocket spending remains substantial; in the United States, it reached USD 98 billion in 2024, rising 25% in five years. These financial pressures strengthen the case for generic substitution and cost-containment policies.

The market is also expanding due to ongoing patent expiries. As exclusivity ends for widely used chemotherapies and small-molecule targeted agents, multiple generic entrants drive down prices and shift volumes from branded products. WHO’s Essential Medicines List, which now includes 64 cancer medicines covering 224 indications, plays an influential role in promoting the uptake of effective and affordable generic oncology drugs, especially in LMICs. Pooled procurement initiatives have reported savings ranging from 23% to 99% on cancer medicines, with the largest reductions achieved through generics.

Biosimilars complement this trend by lowering the cost of biological oncology treatments. Their share of biologic medicine volume increased from 1% in 2013 to 22% by 2023 across 25 countries, reflecting stronger policy support and maturing regulatory pathways. Although supply chain fragility and shortages of low-margin injectables remain concerns, policy measures such as multi-winner tenders and minimum price floors are being considered to stabilize supply.

Overall, the market is expanding as rising incidence, economic pressures, patent expiries, supportive policies, and affordability needs converge to strengthen demand for generic oncology drugs globally.

Key Takeaways

- Market Size: Global Generic Oncology Drugs Market size is expected to be worth around US$ 49.96 Billion by 2034 from US$ 27.12 Billion in 2024.

- Market Growth: The market growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

- Molecule Type Analysis: In 2024, the small-molecule segment accounted for an estimated 79.5% share of the total market, and this leadership has been supported by several structural factors.

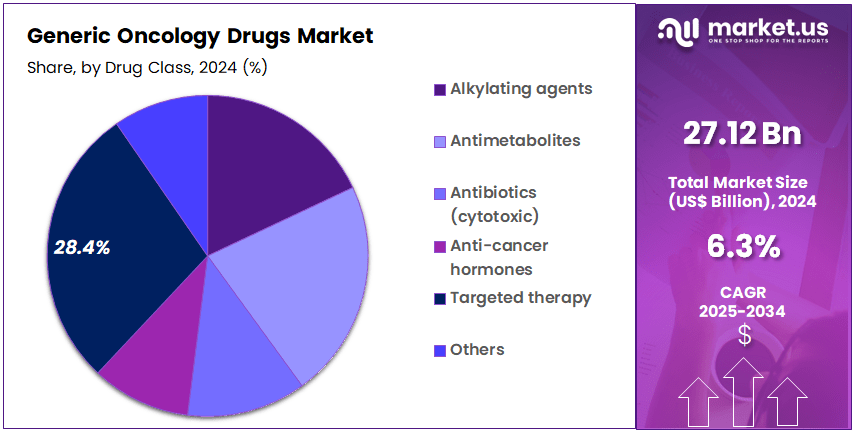

- Drug Class Analysis: In 2024, targeted therapy generics held the leading position with an estimated 28.4% share.

- Route of Administration Analysis: Parenteral therapy has been observed to dominate the market, accounting for 49.8% of the total share in 2024.

- Target Indication Analysis: In 2024, the breast cancer segment has been reported to dominate the overall market, accounting for 49.8% of total revenue share.

- Distribution Channel Analysis: Hospital pharmacies accounted for an estimated 61.2% share of the global market in 2024.

- Regional Analysis: In 2024, North America led the market, achieving over 33.3% share with a revenue of US$ 9.3 Billion.

Molecule Type Analysis

The global generic oncology drugs market has been categorized by molecule type into small molecules and large molecules, with small-molecule generics maintaining a dominant position. In 2024, the small-molecule segment accounted for an estimated 79.5% share of the total market, and this leadership has been supported by several structural factors.

Broad utilization in chemotherapy regimens, ease of manufacturing, and lower development complexity have contributed to the widespread adoption of these molecules. The market expansion of oral anticancer generics and the expiration of patents for several high-volume targeted therapies have further strengthened segment growth. Cost advantages and extensive availability across retail and hospital pharmacies have reinforced the segment’s prominence.

The large-molecule segment, which includes biosimilar monoclonal antibodies and other biologics, has been witnessing steady acceleration. The growth of this segment can be attributed to the rising shift toward immuno-oncology and targeted biologic therapies.

Increased regulatory approvals for biosimilars and supportive reimbursement pathways have encouraged wider uptake. Although large molecules currently hold a smaller share, their contribution is expected to rise as more blockbuster biologics lose exclusivity and biosimilar penetration improves across major healthcare markets.

Drug Class Analysis

The drug class segmented into targeted therapies, alkylating agents, antimetabolites, cytotoxic antibiotics, anti-cancer hormones, and other drug classes. In 2024, targeted therapy generics held the leading position with an estimated 28.4% share, driven by the growing availability of low-cost generics for high-value targeted oncology products.

The dominance of this segment has been supported by increasing adoption of precision medicine, strong uptake of oral targeted agents, and a rising number of patent expirations for kinase inhibitors and other targeted drug classes. Broader clinical acceptance and favorable therapeutic outcomes have strengthened market penetration.

Alkylating agents continue to represent a key traditional drug class due to their extensive use in hematologic and solid tumor treatment protocols. The sustained demand for cyclophosphamide, ifosfamide, and related generics has ensured stable market performance. Antimetabolites, used widely in breast, colorectal, and hematologic cancers, have remained another significant segment owing to strong utilization rates in combination regimens.

Cytotoxic antibiotics, although declining in use, continue to serve critical roles in specific malignancies. Anti-cancer hormones have maintained consistent demand, particularly in hormone-responsive breast and prostate cancers. The others category, comprising miscellaneous cytotoxic and supportive agents, contributes additional volume, supported by broad therapeutic applicability across oncology care.

Route of Administration

The route of administration segments devided into parenteral, oral, topical, and transdermal formulations. The distribution of these therapies reflects clinical preferences, drug stability considerations, and patient compliance requirements.

Parenteral therapy has been observed to dominate the market, accounting for 49.8% of the total share in 2024. This leading position can be attributed to the widespread use of injectable chemotherapeutic agents, which require controlled dosing, rapid onset of action, and reliable bioavailability. Many cytotoxic and targeted molecules are chemically unsuitable for oral delivery, reinforcing the dominance of parenteral formulations in oncology care.

The oral segment continues to experience steady adoption. Growth has been supported by the increasing availability of small-molecule generics, patient preference for at-home administration, and improved treatment adherence. Topical formulations maintain a smaller share, primarily being utilized for localized conditions such as cutaneous lymphomas or chemotherapy-induced dermatologic manifestations. Transdermal delivery represents a niche segment, with applications focused on supportive care and palliative symptom management rather than primary cancer therapy.

Overall, the route-of-administration landscape is shaped by clinical effectiveness, patient convenience, and the expanding availability of cost-effective generic oncology medicines.

Target Indication Analysis

The Target Indication segmentation based on major cancer indications, and a strong concentration of demand has been observed across high-prevalence cancer types. In 2024, the breast cancer segment has been reported to dominate the overall market, accounting for 49.8% of total revenue share. This dominance can be attributed to the high global incidence rate, wider availability of approved generics, and the increased transition of leading biologics and chemotherapies toward generic competition. The demand is further supported by strong adoption in developing regions, where cost-effective treatment options remain essential.

The lung cancer segment continues to represent a significant proportion of generic oncology drug utilization due to the high patient burden and continued patent expiries of several cytotoxic and targeted therapies. Colorectal and prostate cancer segments contribute steadily to market expansion, supported by stable diagnosis rates and treatment standardization.

Liver and kidney cancer indications are projected to witness moderate growth as generic penetration increases across targeted and immunotherapy-associated regimens. Cervical cancer and other smaller indication groups maintain consistent demand, primarily driven by affordability needs in low- and middle-income countries. Overall, rising cancer prevalence and increasing generic availability are expected to sustain indication-wise market diversification.

Distribution Channel Analysis

The distribution structure of generic oncology drugs is characterized by a strong reliance on institutional channels, reflecting the clinical complexity and urgency associated with cancer therapy. Hospital pharmacies accounted for an estimated 61.2% share of the global market in 2024, and this dominance has been supported by the high volume of oncology prescriptions managed within inpatient and specialized cancer care settings.

The administration of chemotherapy, targeted therapies, and supportive medicines is often centralized in hospitals, ensuring controlled dispensing, adherence monitoring, and continuous patient evaluation. As a result, a stable demand base has been created for hospital-based distribution.

Retail pharmacies represent a secondary yet significant channel, serving patients requiring ongoing oral oncology regimens and post-treatment medications. Their share has been driven by rising outpatient care and improved access to cost-effective generic formulations. Growth in this segment has also been supported by increasing integration of pharmacy benefit managers and insurance providers.

Online pharmacies have exhibited gradual expansion as digital health adoption increases. Their growth has been facilitated by home-delivery services, competitive pricing, and improved prescription validation processes. Although the segment remains smaller, its trajectory is expected to strengthen as tele-oncology and remote patient management become more widely utilized.

Key Market Segments

By Molecule Type

- Small molecule

- Large molecule

By Drug Class

- Alkylating agents

- Antimetabolites

- Antibiotics (cytotoxic)

- Anti-cancer hormones

- Targeted therapy

- Others

By Route of Administration

- Oral

- Parenteral

- Topical

- Transdermal

By Target Indication

- Breast cancer

- Lung cancer

- Colorectal cancer

- Prostate cancer

- Liver cancer

- Kidney cancer

- Cervical cancer

- Others

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Driving Factors

Rising cancer incidence and treatment need

The global burden of cancer is increasing significantly, with an estimated 20 million new cases and 9.7 million deaths in 2022 according to the World Health Organization (WHO). This growing incidence of oncology patients places sustained pressure on health-systems to provide effective therapies.In that context, generic oncology drugs offer a lower-cost alternative to branded treatments, enabling greater access for larger patient populations; this cost advantage constitutes a clear driver for the market. A recent peer-reviewed article noted that generics and biosimilars in oncology “have emerged as essential strategies to reduce costs and improve access to effective therapies.”

Trending Factors

Regulatory and policy support for generic substitution

Regulatory agencies are actively facilitating the approval and uptake of generic drugs, including in oncology. For example, the U.S. Food & Drug Administration (FDA) notes that generic drugs must demonstrate same active ingredient, strength, route, and bio-equivalence as the brand counterpart.Additionally, the FDA’s Office of Generic Drugs clarifies that generics account for more than 90 % of prescriptions and are held to the same quality standards as branded drugs. This evolving regulatory context is trending toward broader generics adoption in oncology, enabling faster market entry once patents expire and accelerating cost-containment efforts in oncology therapeutics.

Restraining Factors

Quality concerns and supply-chain risks for oncology generics

While generics are cost-effective, challenges remain in ensuring consistent quality, safety and stable supply especially in the oncology context. A peer-reviewed article on drug-shortages in oncology highlighted that generics (particularly older injectable oncology drugs) face supply disruption, which poses a risk to patient treatment continuity.In addition, although generics are approved based on equivalence data, some clinicians remain cautious about switching in high-risk oncology settings, which can restrain uptake and slow market growth.

Opportunity

Improved access in emerging markets and cost containment frameworks

Emerging regions with rising cancer incidence and constrained healthcare budgets represent significant opportunity zones for generic oncology therapies. The WHO projects that cancer incidence will expand disproportionately in low- and middle-income countries, thereby increasing demand for affordable treatments.Moreover, health-systems globally are under growing cost-containment pressure (given the rising spend on oncology medicines, as noted by industry trackers) which opens the door for generics to substitute for branded therapies. This combination of rising need and cost-drive frameworks creates favourable conditions for generics to capture increased share in oncology treatment protocols.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 33.3% share and holds US$ 9.3 Billion market value for the year.

The dominance of North America can be attributed to strong healthcare infrastructure. The region benefits from high adoption of oncology therapeutics. A large diagnosed patient pool supports sustained demand for generic oncology drugs. The burden of cancer continues to rise across the United States and Canada. This trend supports consistent utilization of cost-effective treatment options.

Favorable reimbursement systems further strengthen the regional position. Generic products are widely preferred due to lower treatment costs. The shift toward value-based care has encouraged hospitals and clinics to reduce overall therapy expenditure. This has increased the penetration of generic oncology medicines in major treatment centers.

Regulatory efficiency also plays an essential role. The presence of streamlined approval pathways has accelerated product availability. The structure of speed-to-market advantages has increased the number of approved generics for critical oncology indications. This has improved access for patients and expanded commercial opportunities for manufacturers.

Higher healthcare spending per capita contributes to stronger uptake. Advanced diagnostic rates result in early detection of multiple cancer types. Early diagnosis increases the need for long-term drug regimens. This has created sustained demand for affordable therapeutic options.

Technological progress in manufacturing supports regional growth. The presence of large-scale production facilities ensures stable supply. The operational capacity of leading manufacturers has supported uninterrupted availability across key distribution channels.

Overall, North America is expected to maintain its leadership. Its stable regulatory landscape, robust healthcare systems, and strong economic environment continue to support market expansion for generic oncology drugs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

A diversified competitive landscape has been observed in the generic oncology drugs market, characterized by a mix of established manufacturers and emerging producers. The market structure has been shaped by extensive product portfolios, strong regulatory compliance capabilities, and broad geographic reach. Competition has been intensified by frequent patent expirations, which have enabled multiple entrants to introduce cost-effective therapeutic alternatives.

Robust manufacturing capacity, adherence to stringent quality standards, and effective supply-chain networks have been identified as key differentiators. The growth of the market has been supported by strategic investments in biosimilar development, process optimization, and expansion into high-incidence cancer segments. Pricing pressures and evolving reimbursement policies have driven continuous efficiency improvements.

Overall, the competitive environment remains dynamic, with sustained emphasis on affordability, accessibility, and technological advancement to strengthen positioning within global oncology treatment pathways.

Market Key Players

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Cipla Ltd.

- Lupin Ltd.

- Hikma Pharmaceuticals PLC

- Viatris Inc.

- Johnson & Johnson

- Takeda Pharmaceutical Company Limited

- Sanofi S.A.

- GlaxoSmithKline plc

- Eli Lilly and Company

- Bayer AG

- AbbVie Inc.

- Aurobindo Pharma Limited

- Other key players

Recent Developments

- Teva Pharmaceutical Industries Ltd. (Teva) Oct 2024: Teva and mAbxience expanded their strategic partnership to include an additional oncology biosimilar candidate, strengthening Teva’s cost-effective oncology access strategy.

- Sun Pharmaceutical Industries Ltd. Mar 2025: Sun Pharma agreed to acquire Checkpoint Therapeutics, Inc., a US immunotherapy/targeted-oncology company with FDA-approved cosibelimab (Unloxcyt) for skin cancer, enlarging its oncology specialty offering.

- Cipla Ltd. Apr 2025: Cipla received US FDA final approval for its generic version of albumin-bound paclitaxel (the branded product Abraxane) for multiple solid tumour indications.

- Takeda Pharmaceutical Company Limited Apr 2025: Takeda announced that Phase 3 clinical data from its oncology pipeline (hematologic, thoracic & gastrointestinal cancers) will be presented at ASCO 2025, reinforcing its research focus in oncology.

Report Scope

Report Features Description Market Value (2024) US$ 27.12 Billion Forecast Revenue (2034) US$ 49.96 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Molecule (Type, Small molecule, Large molecule) By Drug Class (Alkylating agents, Antimetabolites, Antibiotics (cytotoxic), Anti-cancer hormones, Targeted therapy, Others) By Route of Administration (Oral, Parenteral, Topical, Transdermal) By Target Indication (Breast cancer, Lung cancer, Colorectal cancer, Prostate cancer, Liver cancer, Kidney cancer, Cervical cancer, Others) By Distribution Channel (Hospital pharmacies, Retail pharmacies, Online pharmacies) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Cipla Ltd., Lupin Ltd., Hikma Pharmaceuticals PLC, Viatris Inc., Johnson & Johnson, Takeda Pharmaceutical Company Limited, Sanofi S.A., GlaxoSmithKline plc, Eli Lilly and Company, Bayer AG, AbbVie Inc., Aurobindo Pharma Limited, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Generic Oncology Drugs MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Generic Oncology Drugs MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Cipla Ltd.

- Lupin Ltd.

- Hikma Pharmaceuticals PLC

- Viatris Inc.

- Johnson & Johnson

- Takeda Pharmaceutical Company Limited

- Sanofi S.A.

- GlaxoSmithKline plc

- Eli Lilly and Company

- Bayer AG

- AbbVie Inc.

- Aurobindo Pharma Limited

- Other key players