Global Generative AI in Life Insurance Market By Deployment Model (Cloud-based, On-premise), By Technology (Natural Language Processing (NLP), Machine Learning Algorithms, Deep Learning Models, Other Technologies), By Application (Underwriting and Claims Processing, Personalized Policy Recommendations, Customer Service and Chatbots, Fraud Detection, Risk Management and Predictive Analytics, Natural Language Processing (NLP) for Policy Analysis, Document Processing Automation), By End-User (Life Insurance Companies, Brokers and Agents, Educational Institutions, Reinsurers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 114557

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

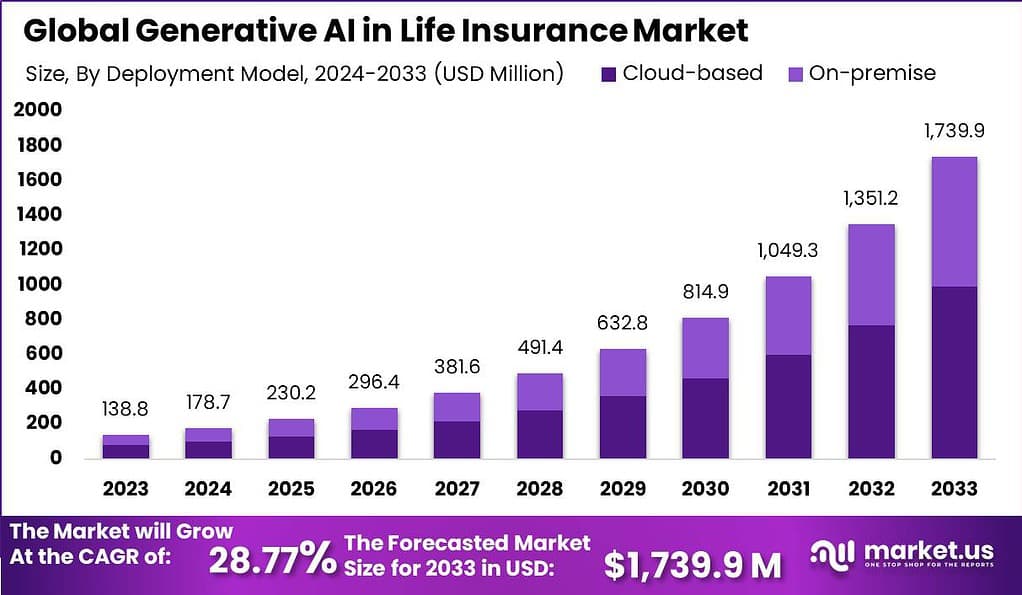

The Global Generative AI in Life Insurance Market size is expected to be worth around USD 1,739.9 Million by 2033, from USD 138.8 Million in 2023, growing at a CAGR of 28.77% during the forecast period from 2024 to 2033.

Generative AI, also known as artificial intelligence, has been making significant strides in various industries, including the life insurance sector. In the context of life insurance, generative AI refers to the use of advanced algorithms and machine learning techniques to generate personalized insights, predictions, and recommendations based on vast amounts of data. This technology has the potential to revolutionize the life insurance industry by enabling more accurate risk assessment, personalized underwriting, and improved customer experiences.

The market for Generative AI in life insurance is witnessing substantial growth, driven by the increasing demand for efficient, data-driven decision-making tools and the continuous pursuit of operational excellence among insurers. This growth can be attributed to the convergence of technological advancements, regulatory support, and shifting consumer expectations towards more customized and responsive insurance solutions.

Analyst Viewpoint

One of the main driving factors is the increasing availability and accessibility of data. With advancements in technology and the proliferation of digital platforms, insurers now have access to vast amounts of data from various sources, including wearable devices, electronic health records, and social media.

Generative AI algorithms can leverage this wealth of data to extract valuable insights, enabling more accurate risk assessment and personalized underwriting. According to Market.us Research predicts that the generative AI market will grow to USD 151.9 Billion over the next 10 years, up from USD 13.9 Billion in 2023.

Additionally, partnerships and collaborations between traditional insurers and technology companies are driving innovation in this space. According to a recent Celent survey, by the end of 2023, half of insurers will have tested generative AI solutions, while over 25% of them are planning to incorporate such solutions into their operations.

Opportunities also arise from the potential to enhance customer experiences and engagement. Generative AI allows insurers to provide personalized recommendations, tailored advice, and proactive alerts to policyholders. This level of customization and engagement can foster stronger relationships with customers, leading to increased satisfaction and loyalty.

Moreover, generative AI can support the development of innovative products and services, such as usage-based insurance or personalized health and wellness programs, creating new revenue streams and market differentiation opportunities.

Key Takeaways

- The Generative AI in Life Insurance Market is projected to reach a value of USD 1,726.7 million by 2033, indicating a notable growth rate of 4.5% during the forecast period.

- Cloud-based solutions dominate the market, capturing over 70% share in 2023, offering scalability, flexibility, enhanced accessibility, cost-effectiveness, and rapid deployment advantages to insurers.

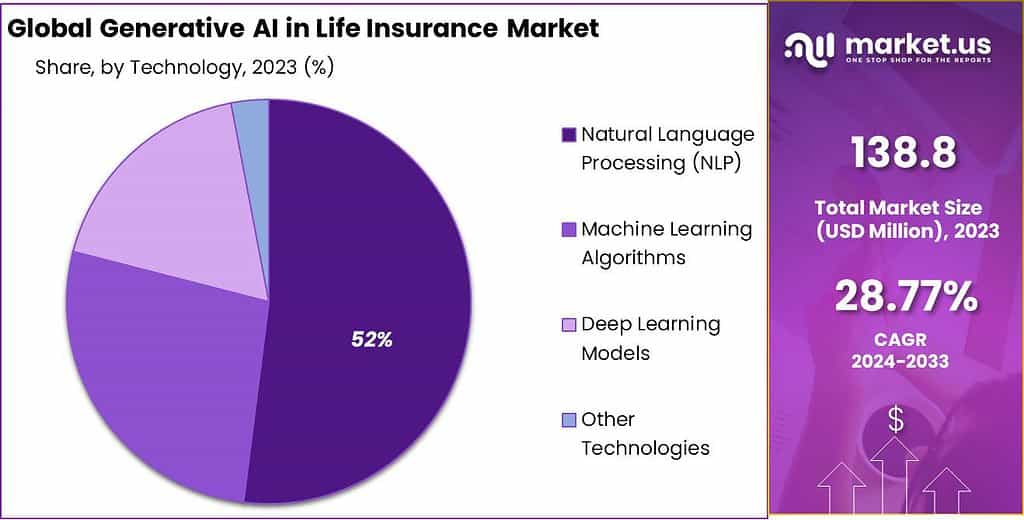

- Natural Language Processing (NLP) emerges as a key technology segment, holding a dominant market position in 2023, with a share of more than 52%. NLP plays a crucial role in transforming customer interactions, streamlining claims processing, and ensuring compliance and fraud detection.

- Personalized Policy Recommendations segment leads the market, capturing over 25% share in 2023, driven by the growing demand for customized insurance products tailored to individual customer needs and preferences.

- Life Insurance Companies segment dominates the market, capturing a significant share of more than 30% in 2023, attributed to leveraging generative AI for accurate risk assessment, personalized underwriting, and enhancing actuarial capabilities.

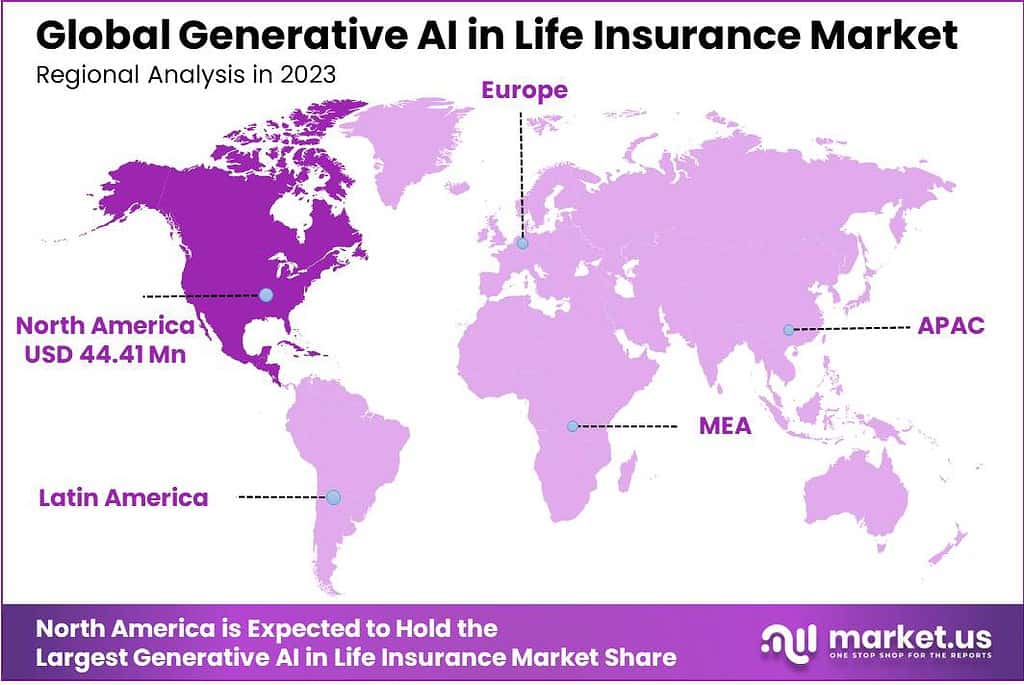

- North America leads the market with a dominant share of over 32% in 2023, owing to a mature and technologically advanced life insurance industry, robust digital infrastructure, and high insurance awareness among the population.

Deployment Model Analysis

In 2023, the Cloud-Based segment held a dominant market position in the Generative AI in Life Insurance market, capturing more than a 70% share.

The Cloud-Based segment’s dominance in the Generative AI in Life Insurance market is primarily due to its ability to provide scalability and flexibility. Insurers can effortlessly adjust their computing resources to meet the fluctuating demands of data processing and AI model training, without the need for substantial upfront investment in physical infrastructure. This adaptability is crucial for deploying generative AI applications that require significant computational power.

Additionally, cloud-based solutions offer enhanced accessibility, enabling life insurance companies to access advanced AI tools and applications from anywhere, at any time. This ubiquitous access facilitates remote work environments and ensures business continuity, a critical factor in today’s increasingly digital and interconnected world.

Cost-effectiveness further solidifies the cloud-based segment’s market position. The pay-as-you-go pricing model eliminates the necessity for large capital expenditures, reducing the financial barrier to entry for leveraging advanced AI technologies. This aspect is particularly attractive to smaller insurers looking to compete with larger entities without incurring prohibitive costs.

The speed of deployment with cloud-based platforms is another significant advantage. These solutions can be rapidly implemented, allowing life insurance companies to quickly benefit from generative AI capabilities. This agility is essential for staying competitive in a fast-evolving industry, where the ability to quickly adapt and innovate can significantly impact market share.

Technology Analysis

In 2023, the Natural Language Processing (NLP) segment held a dominant market position in the Generative AI in Life Insurance market, capturing more than a 52% share. This significant share is largely due to NLP’s pivotal role in transforming customer interactions and streamlining claims processing.

NLP technologies enable the interpretation and understanding of human language, allowing life insurance companies to automate customer service inquiries, policy management, and even initial claims assessments. This automation not only enhances efficiency but also significantly improves customer satisfaction by providing timely and accurate responses to inquiries.

NLP’s ability to extract insights from unstructured data sources, such as social media, emails, and customer feedback, has further cemented its importance in the life insurance sector. These insights are invaluable for insurers, providing a deeper understanding of customer needs, preferences, and risk profiles. By leveraging NLP to analyze this data, life insurance companies can tailor their products and services more effectively, resulting in more personalized customer experiences and improved product offerings.

Moreover, NLP technologies play a crucial role in compliance and fraud detection. They can automatically monitor communications and transactions for patterns that may indicate fraudulent activity, significantly reducing the risk of financial loss. Additionally, NLP can ensure that insurers remain compliant with ever-evolving regulatory requirements by automating the review and analysis of legal and policy documents.

Application Analysis

In 2023, the Personalized Policy Recommendations segment held a dominant market position within the Generative AI in Life Insurance market, capturing more than a 25% share. This leadership position is attributed to the growing demand for customized insurance products tailored to individual customer needs and preferences.

Generative AI technologies, particularly machine learning algorithms and data analytics, play a crucial role in analyzing vast amounts of customer data to offer personalized policy recommendations. This approach not only enhances customer satisfaction by providing them with products that closely match their risk profiles and lifestyle but also improves customer engagement and loyalty.

The success of the Personalized Policy Recommendations segment is further bolstered by the increasing sophistication of predictive analytics. These technologies enable insurers to understand potential future needs of their customers, anticipate life changes, and offer policies that are adaptable to these evolving circumstances. By proactively addressing customer needs, life insurance companies can create a more responsive and customer-focused product offering, distinguishing themselves in a competitive market.

Moreover, personalized policy recommendations are instrumental in optimizing pricing strategies. Generative AI allows for the dynamic pricing of policies based on individual risk assessments, thereby ensuring that customers receive fair and competitive pricing. This personalized approach to pricing not only makes insurance more accessible to a broader audience but also helps insurers manage risk more effectively.

End-User Analysis

In 2023, the Life Insurance Companies segment held a dominant market position in the Generative AI in Life Insurance market, capturing a significant share of more than 30%. This segment’s strong market position can be attributed to several key factors.

Firstly, life insurance companies are the primary providers of life insurance policies, and they play a vital role in underwriting, pricing, and managing risks. Generative AI offers life insurance companies the opportunity to leverage advanced algorithms and machine learning techniques to analyze vast amounts of customer data, including medical records, financial information, and lifestyle data. By harnessing generative AI, life insurance companies can gain valuable insights into customer risk profiles, enabling them to make more accurate underwriting decisions and tailor policies to individual needs.

Moreover, generative AI enables life insurance companies to enhance their actuarial capabilities. Actuaries play a crucial role in assessing and managing risks in the insurance industry. By leveraging generative AI, these professionals can analyze complex data sets, identify patterns, and make more accurate predictions about mortality rates, policyholder behavior, and other critical factors. This empowers life insurance companies to develop more precise pricing models, improve risk management strategies, and enhance overall profitability.

Additionally, generative AI offers life insurance brokers and agents valuable tools to optimize their sales and customer service processes. With access to AI-powered recommendation engines and personalized insights, brokers and agents can provide tailored policy recommendations, pricing options, and risk assessments to potential customers. This enhances the customer experience, fosters trust, and increases the likelihood of policy conversions.

Furthermore, reinsurers, who provide insurance coverage to insurance companies themselves, can leverage generative AI to enhance their risk assessment capabilities. Reinsurers often deal with large volumes of complex data from multiple insurance companies. Generative AI can assist reinsurers in analyzing this data, identifying trends, and evaluating risks across their portfolio. By leveraging these AI-driven insights, reinsurers can make informed decisions on reinsurance pricing, optimize risk transfer strategies, and improve their overall risk management practices.

Key Market Segments

By Deployment Model

- Cloud-based

- On-premise

By Technology

- Natural Language Processing (NLP)

- Machine Learning Algorithms

- Deep Learning Models

Other Technologies

By Application

- Underwriting and Claims Processing

- Personalized Policy Recommendations

- Customer Service and Chatbots

- Fraud Detection

- Risk Management and Predictive Analytics

- Natural Language Processing (NLP) for Policy Analysis

- Document Processing Automation

By End-User

- Life Insurance Companies

- Brokers and Agents

- Educational Institutions

- Reinsurers

Driver

Enhanced Customer Experience and Operational Efficiency

The integration of Generative AI in the life insurance sector significantly enhances customer experience and operational efficiency, serving as a primary driver for its adoption. By automating and optimizing underwriting processes, claims handling, and customer service, insurers can offer faster and more accurate responses to customer inquiries and claims.

Generative AI enables personalized policy recommendations based on individual customer data, leading to higher satisfaction and engagement. The technology’s ability to process and analyze vast amounts of data in real-time helps insurers streamline operations, reduce costs, and improve decision-making, ultimately enhancing profitability and competitive advantage in the market.

Restraint

Data Privacy and Security Concerns

Data privacy and security emerge as significant restraints in the adoption of Generative AI within the life insurance industry. The reliance on vast datasets, including sensitive personal information, raises concerns about data breaches and unauthorized access.

Insurers must navigate complex regulatory environments designed to protect consumer privacy, such as GDPR in Europe and various state-level regulations in the US. Ensuring compliance while leveraging AI capabilities requires substantial investment in cybersecurity measures and data governance frameworks. This challenge can deter some insurers from fully embracing Generative AI technologies, limiting the pace of innovation and adoption in the sector.

Opportunity

Market Penetration in Emerging Economies

Emerging economies present a substantial opportunity for the expansion of Generative AI applications in the life insurance sector. These markets are characterized by a growing middle class, increasing digital literacy, and a relatively untapped customer base for insurance products. Generative AI can enable insurers to efficiently analyze demographic and financial data to tailor products to the needs of these new consumers.

Moreover, digital channels facilitated by AI can overcome traditional barriers to entry, such as distribution network limitations. The ability to offer customized, accessible, and affordable insurance products can drive rapid growth and market penetration in these regions, contributing to the global expansion of life insurance companies.

Challenge

Skill Gap and Integration Complexity

A significant challenge facing the life insurance industry in adopting Generative AI is the skill gap and the complexity of integrating new technologies into existing systems. The development and management of AI solutions require specialized knowledge in data science, machine learning, and cybersecurity, among other areas. The scarcity of talent in these fields can impede the development and deployment of Generative AI applications.

Furthermore, integrating AI technologies with legacy systems poses technical and operational challenges, requiring substantial investment in infrastructure and training. Overcoming these hurdles is essential for insurers to fully realize the benefits of Generative AI, necessitating focused efforts in workforce development and technological upgrades.

Regional Analysis

In 2023, North America held a dominant market position in the Generative AI in Life Insurance market, capturing a significant share of more than 32%. The demand for Generative AI in Life Insurance in North America reached US$ 44.41 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future.

This regional dominance can be attributed to several key factors. North America has a mature and technologically advanced life insurance industry, with a high concentration of established life insurance companies, brokers, and reinsurers. These industry players have been at the forefront of adopting innovative technologies, including generative AI, to enhance their operations, improve risk assessment, and deliver personalized customer experiences. The early adoption of generative AI in North America has given the region a competitive edge in the market.

Furthermore, North America has a robust digital infrastructure and a high level of connectivity. The region’s strong telecommunications networks, data centers, and cloud computing capabilities provide a solid foundation for the implementation of generative AI in the life insurance sector. The availability of reliable and high-speed internet connectivity enables efficient data processing, real-time analytics, and seamless integration of generative AI solutions.

Moreover, North America has a large consumer base and a high level of insurance awareness among its population. This creates a conducive environment for the adoption of generative AI in the life insurance market. Insurers in the region can leverage generative AI to analyze vast amounts of customer data, personalize policy offerings, and provide tailored recommendations to policyholders. This level of customization and personalized engagement resonates well with the North American consumer base, driving the demand for generative AI solutions.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the rapidly evolving Generative AI in the Life Insurance market, the involvement of key players has been instrumental in shaping the industry’s trajectory. The application of generative artificial intelligence (AI) technologies by these organizations is revolutionizing customer service, risk assessment, policy personalization, and claims processing within the sector. This analysis provides an overview of the contributions and strategic positions of notable companies within this space.

IBM Corporation is at the forefront, leveraging its Watson AI to enhance predictive analytics and customer interaction in life insurance. The company’s advanced AI models aid in identifying patterns and insights within large datasets, facilitating more accurate risk assessments and personalized insurance solutions.

Google LLC contributes through its sophisticated AI and machine learning (ML) capabilities, which include natural language processing and data analytics. These technologies enable life insurance companies to improve their customer engagement strategies and operational efficiencies.

Top Market Leaders

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Salesforce

- Amazon Web Services (AWS)

- Cognizant

- Accenture

- Intel Corporation

- Palantir Technologies

- Guidewide

- Insurify

- Lemonade

- Other Key Players

Recent Developments

1. Accenture:

- June 2023: Expanded collaboration with AWS to develop industry-specific and cross-industry solutions for generative AI adoption in life insurance, potentially including underwriting automation, personalized policy recommendations, and claims processing optimization.

- May 2023: Partnered with Google Cloud and Microsoft Azure for a multi-cloud generative AI strategy, encompassing life sciences and other relevant areas.

2. Amazon Web Services (AWS):

- June 2023: Extended collaboration with Accenture, leveraging AWS’s advanced ML and AI technologies for generative AI solutions in life insurance.

3. Microsoft:

- May 2023: Accenture partnership mentioned above also includes leveraging Microsoft Azure and Azure OpenAI Service for life insurance use cases.

Report Scope

Report Features Description Market Value (2023) US$ 138.8 Mn Forecast Revenue (2033) US$ 1,739.9 Mn CAGR (2024-2033) 28.77% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Model (Cloud-based, On-premise), By Technology (Natural Language Processing (NLP), Machine Learning Algorithms, Deep Learning Models, Other Technologies), By Application (Underwriting and Claims Processing, Personalized Policy Recommendations, Customer Service and Chatbots, Fraud Detection, Risk Management and Predictive Analytics, Natural Language Processing (NLP) for Policy Analysis, Document Processing Automation), By End-User (Life Insurance Companies, Brokers and Agents, Reinsurers) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, Google LLC, Microsoft Corporation, Salesforce, Amazon Web Services (AWS), Cognizant, Accenture, Intel Corporation, Palantir Technologies, Guidewide, Insurify, Lemonade, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Generative AI?Generative Artificial Intelligence (AI) refers to a subset of AI technology that focuses on creating new data or content rather than just analyzing existing data. It employs algorithms to generate new information based on patterns and structures learned from existing data.

How big is Generative AI in Life Insurance Market?The Global Generative AI in Life Insurance Market size is expected to be worth around USD 1,739.9 Million by 2033, from USD 138.8 Million in 2023, growing at a CAGR of 28.77% during the forecast period from 2024 to 2033.

How is Generative AI Applied in the Life Insurance Market?In the life insurance market, Generative AI is utilized for various purposes such as risk assessment, customer engagement, product development, and fraud detection. It can generate synthetic data to enhance underwriting processes, personalize customer experiences, create innovative insurance products, and identify fraudulent activities.

Which deployment model type held the largest share in the Generative AI in Life Insurance market?In 2023, the Cloud-Based segment held a dominant market position in the Generative AI in Life Insurance market, capturing more than a 70% share.

Who are the key players in Generative AI in Life Insurance Market?IBM Corporation, Google LLC, Microsoft Corporation, Salesforce, Amazon Web Services (AWS), Cognizant, Accenture, Intel Corporation, Palantir Technologies, Guidewide, Insurify, Lemonade, Other Key Players are the major companies operating in the Generative AI in Life Insurance Market.

Generative AI in Life Insurance MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Generative AI in Life Insurance MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Salesforce

- Amazon Web Services (AWS)

- Cognizant

- Accenture

- Intel Corporation

- Palantir Technologies

- Guidewide

- Insurify

- Lemonade

- Other Key Players