Global Generative AI in Autonomous Vehicles Market By Vehicle Type (Passenger Vehicles and Commercial Vehicles), By Component (Solution, Services), By Application (Training & data augmentation, Simulation and Testing, Perception Systems Enhancement & Sensing, Localization and Mapping, Safety Verification & Testing, Behavior Prediction & decision making, Others), By End Users (Automotive Manufacturers, Research & Development Organizations), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 114717

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

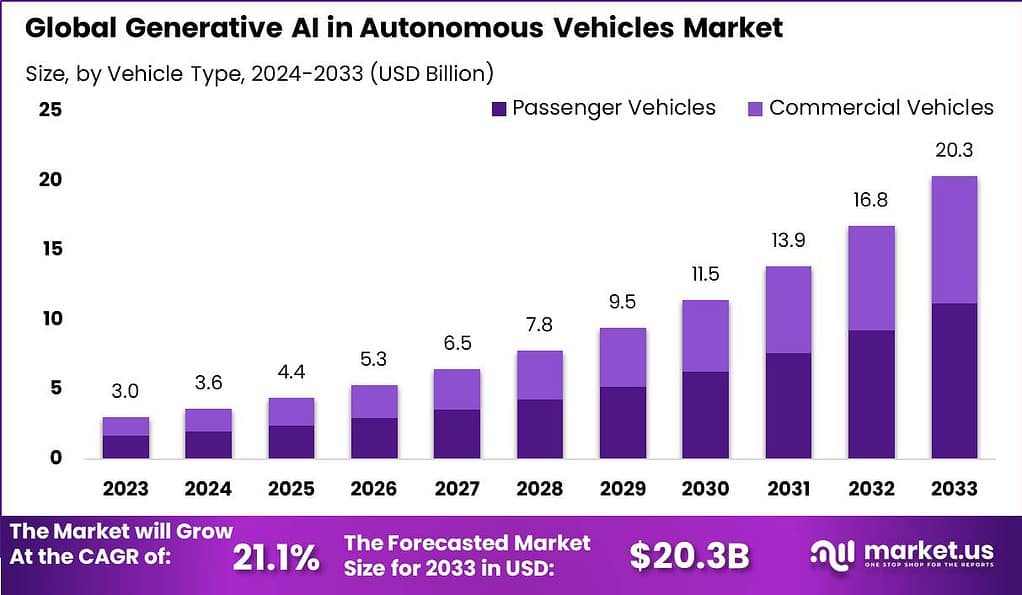

The Global Generative AI in Autonomous Vehicles Market size is expected to be worth around USD 20.3 Billion by 2033, from USD 3.0 Billion in 2023, growing at a CAGR of 21.1% during the forecast period from 2024 to 2033.

Generative AI in autonomous vehicles refers to the application of artificial intelligence technologies that can generate new data or simulations based on learned patterns from vast datasets. This capability is especially crucial for autonomous vehicles, which must navigate an infinite variety of real-world scenarios safely and efficiently. Generative AI enables these vehicles to simulate and predict outcomes in countless situations, improving their decision-making processes.

By leveraging generative models, autonomous vehicles can better understand their environment, anticipate potential hazards, and make informed decisions in real time. This technology facilitates the development of more sophisticated and adaptable autonomous driving systems, enhancing safety, efficiency, and reliability. Generative AI also plays a pivotal role in training and testing autonomous vehicles, allowing for the creation of realistic and diverse driving scenarios that may not be easily captured through real-world data collection alone.

The Generative AI in Autonomous Vehicles Market encompasses the industry and market activities related to the development, distribution, and implementation of generative AI technologies in the autonomous vehicle sector. This market is characterized by rapid growth and innovation, driven by the increasing demand for safer, more efficient autonomous driving solutions.

Key stakeholders include technology companies, automotive manufacturers, and startups, all competing and collaborating to advance the capabilities of autonomous vehicles. The market is fueled by significant investments in R&D, strategic partnerships, and governmental regulations supporting autonomous vehicle adoption.

NVIDIA has firmly established itself as a frontrunner in the development of AI chips and platforms tailored for autonomous vehicles, underscoring its pivotal role in this innovative sector. With an investment exceeding $2 billion in research and development dedicated to automotive AI over the past five years, NVIDIA’s commitment to advancing this technology is evident.

Similarly, Waymo, a subsidiary of Alphabet, has been at the forefront of leveraging generative AI to enhance the capabilities of its autonomous driving systems. By heavily investing in simulation and synthetic data generation techniques, Waymo has dedicated likely more than $2 billion to creating sophisticated environments for the robust training of its self-driving technology. This approach has allowed Waymo to refine and advance its autonomous systems, ensuring higher levels of safety and efficiency.

Key Takeaways

- The Generative AI in Autonomous Vehicles Market is poised for significant expansion, with a forecasted valuation of USD 20.3 Billion by 2033, indicating a staggering CAGR of 21.1% from 2024 to 2033.

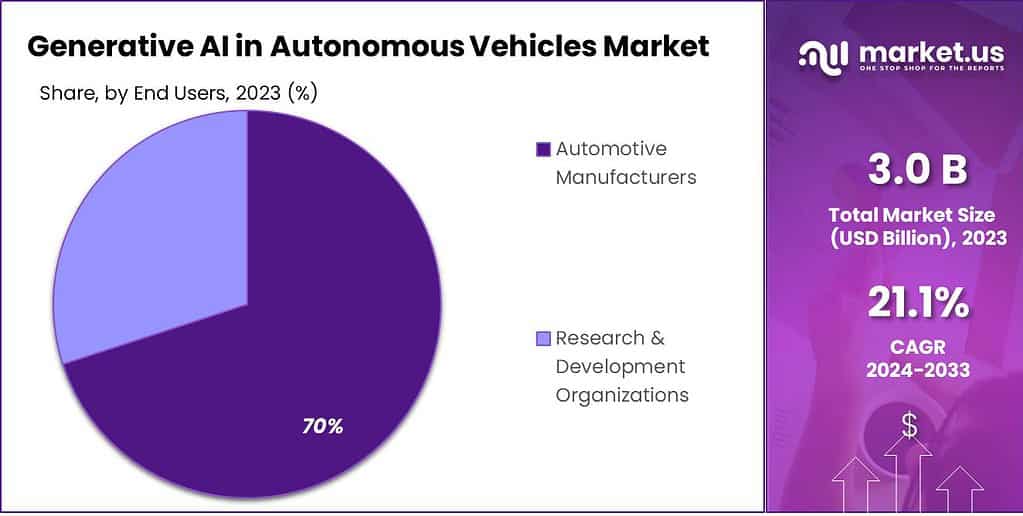

- Automotive manufacturers hold a dominant market position, capturing over 70% share in 2023. Their direct involvement facilitates rapid iteration and improvement of generative AI applications, ensuring technology meets evolving safety requirements and consumer expectations.

- Services, particularly in deployment, maintenance, and optimization of generative AI solutions, held over 73.0% market share in 2023. As autonomous driving technologies evolve, specialized services become increasingly critical for seamless operation and integration of generative AI platforms.

- Training & Data Augmentation segment captured over 25% market share in 2023, highlighting the importance of diverse data in developing and refining autonomous driving technologies. Generative AI’s role in creating realistic, synthetic datasets accelerates development cycles and enhances models’ capabilities.

- Passenger vehicles held over 55% market share in 2023, driven by consumer interest in safer, more autonomous mobility solutions. The integration of generative AI enhances navigation, safety, and personalized driving experiences, reflecting the automotive industry’s response to consumer demand.

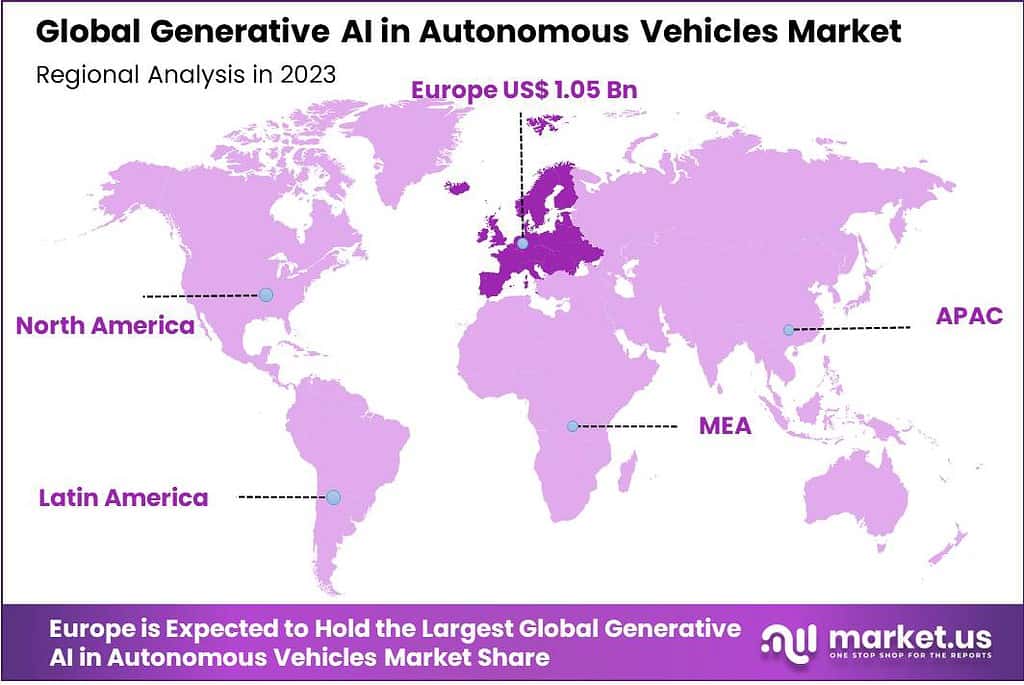

- Europe led the market in 2023, capturing over 35% share, attributed to advanced infrastructure, supportive regulations, and significant investments in research and development. The region’s emphasis on safety and sustainability aligns with generative AI’s potential for optimizing autonomous vehicle performance.

Component Analysis

In 2023, the Services segment held a dominant market position in the Generative AI in Autonomous Vehicles Market, capturing more than a 73.0% share. This significant dominance can be attributed to the essential role that services play in the deployment, maintenance, and optimization of generative AI solutions within the autonomous vehicle sector.

As the complexity of autonomous driving technologies escalates, the need for specialized services that can support these sophisticated systems becomes increasingly critical. These services include but are not limited to, consulting, integration, support, and maintenance, all tailored to ensure the seamless operation of generative AI platforms in autonomous vehicles.

The leading position of the Services segment is further reinforced by the rapid pace of technological advancements in the autonomous vehicle industry. As generative AI technologies evolve, automotive companies and AI developers rely heavily on service providers to navigate the integration of new functionalities and ensure that their systems are up-to-date.

This reliance underscores the value of expert services in mitigating the challenges associated with the adoption of cutting-edge technologies, facilitating a smoother transition towards innovative autonomous driving solutions. Moreover, the customization and scalability offered by service providers are pivotal for the widespread adoption of generative AI in autonomous vehicles.

Organizations often require bespoke solutions that can seamlessly integrate with their existing infrastructure while being capable of scaling to meet future demands. The expertise provided by service segments enables the tailoring of generative AI applications to specific organizational needs, enhancing the effectiveness and efficiency of autonomous driving systems.

Application Analysis

In 2023, the Training & Data Augmentation segment held a dominant market position in the Generative AI in Autonomous Vehicles Market, capturing more than a 25% share. This segment’s leadership underscores the critical importance of high-quality, diverse data in developing and refining autonomous driving technologies.

Training and data augmentation are foundational to the machine learning models at the heart of autonomous vehicles, enabling these systems to learn from varied scenarios and improve over time. Generative AI plays a pivotal role in this process by creating realistic, synthetic data sets that enhance the depth and breadth of training materials available, thus significantly improving the models’ ability to understand and react to complex driving environments.

The dominance of the Training & Data Augmentation segment is further propelled by the challenges associated with collecting real-world driving data. Gathering comprehensive and diverse data sets that cover all possible driving conditions and scenarios is not only time-consuming but also expensive.

Generative AI addresses this bottleneck by generating synthetic data that mimics real-world variability, allowing for the efficient scaling of training processes. This capability is invaluable for accelerating the development cycle of autonomous vehicles, enabling faster iterations and the deployment of more robust and adaptable driving systems.

Moreover, the need for continuous improvement in the perception and decision-making capabilities of autonomous vehicles drives the demand for advanced training and data augmentation solutions. As autonomous vehicles are expected to operate in an ever-changing array of environments, the ability to rapidly update and refine their AI models with new data is crucial. The Training & Data Augmentation segment enables this agility, offering tools that can simulate rare or dangerous scenarios without the risk and cost of real-world testing.

Additionally, regulatory and safety considerations further underscore the importance of this segment. Regulatory bodies and safety standards increasingly require evidence of extensive testing and proven efficacy in varied conditions before autonomous vehicles can be approved for public use.

Training and data augmentation via generative AI provide a path to meet these stringent requirements, by demonstrating that autonomous systems have been exposed to and can handle a comprehensive range of driving scenarios. The strategic importance of training and data augmentation in developing safe, efficient, and reliable autonomous vehicles solidifies this segment’s leading position in the market.

Vehicle Type Analysis

In 2023, the Passenger Vehicles segment held a dominant market position in the Generative AI in Autonomous Vehicles Market, capturing more than a 55% share. This commanding lead is primarily attributed to the escalating consumer interest in autonomous driving technologies for personal use, driven by the promise of enhanced safety, convenience, and efficiency.

The integration of generative AI into passenger vehicles plays a crucial role in this shift, offering advanced capabilities for navigation, safety, and personalized driving experiences. The focus on passenger vehicles reflects the automotive industry’s response to consumer demand for smarter, more autonomous mobility solutions that cater to daily commuting and personal transportation needs.

The leading position of the Passenger Vehicles segment is further bolstered by the rapid pace of technological innovation and adoption in the consumer automotive sector. Automakers are increasingly investing in generative AI to develop sophisticated autonomous driving systems that can learn from a vast array of driving conditions and scenarios, thereby improving their reliability and safety. This investment is supported by consumers’ growing familiarity with and trust in autonomous technologies, alongside their willingness to pay a premium for vehicles equipped with advanced safety and convenience features.

Moreover, regulatory advancements and societal acceptance of autonomous vehicles are more pronounced in the passenger vehicle market. Governments and regulatory bodies worldwide are gradually updating road safety regulations to accommodate and encourage the use of autonomous passenger vehicles, paving the way for their widespread adoption. These regulatory changes, combined with significant advancements in generative AI, are enabling automakers to launch new models equipped with semi-autonomous and fully autonomous capabilities, appealing to a broad consumer base.

End Users Analysis

In 2023, the Automotive Manufacturers segment held a dominant market position in the Generative AI in Autonomous Vehicles Market, capturing more than a 70% share. This significant market share underscores the pivotal role that automotive manufacturers play in driving the adoption and development of autonomous vehicle technologies.

As the primary producers of vehicles, these manufacturers are at the forefront of integrating generative AI into their products, leveraging this technology to enhance safety features, improve navigation systems, and provide innovative driving experiences. Their substantial investment in generative AI technologies reflects a strategic commitment to leading the transition towards fully autonomous driving solutions.

The dominance of the Automotive Manufacturers segment is further reinforced by the intensive research and development efforts undertaken by these entities. Focused on maintaining a competitive edge, automotive manufacturers are investing heavily in generative AI to create more intelligent, efficient, and safer vehicles. This investment not only includes the development of proprietary technologies but also encompasses collaborations with tech companies and startups specializing in AI, demonstrating the industry’s collaborative approach to innovation.

Moreover, the automotive manufacturers’ segment benefits from direct access to end-users, enabling a faster and more efficient feedback loop for refining autonomous driving features. This direct relationship facilitates the rapid iteration and improvement of generative AI applications in vehicles, ensuring that the technology meets the evolving expectations and safety requirements of consumers. Automotive manufacturers’ ability to rapidly prototype, test, and deploy advanced autonomous technologies is a critical factor in their leading market share.

Key Market Segments

By Component

- Solution

- Services

By Application

- Training & data augmentation

- Simulation and Testing

- Perception Systems Enhancement & Sensing

- Localization and Mapping

- Safety Verification & Testing

- Behavior Prediction & decision making

- Others

Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

End Users

- Automotive Manufacturers

- Research & Development Organizations

Driver

Enhanced Perception Capabilities

The driver for generative AI in autonomous vehicles is the need to enhance perception capabilities. Generative AI algorithms can generate synthetic data that helps train autonomous vehicle systems to recognize and interpret various objects, obstacles, and scenarios. This improves the perception capabilities of autonomous vehicles, enabling them to navigate complex environments and make more accurate decisions.Restraint

Computational Complexity

A significant restraint for generative AI in autonomous vehicles is the computational complexity and resource requirements. Generative AI algorithms often require significant computational power and resources to generate and process large amounts of synthetic data. This can pose challenges in real-time applications, where autonomous vehicles need to process data quickly to respond to dynamic environments. The high computational demands may require advanced hardware infrastructure and increase the overall cost and complexity of implementing generative AI in autonomous vehicles.Opportunity

Data Augmentation

An opportunity for generative AI in autonomous vehicles lies in data augmentation. By generating synthetic data, generative AI algorithms can expand the training dataset, enabling more comprehensive and diverse training scenarios. This helps to improve the robustness and generalization of autonomous vehicle systems, making them more capable of handling various real-world situations. Data augmentation through generative AI allows for more extensive training and testing, reducing the reliance on expensive and time-consuming data collection processes.

Challenge

Ethical and Legal Considerations

A challenge in the adoption of generative AI in autonomous vehicles is the ethical and legal considerations associated with the generated data. Generative models may inadvertently introduce biases or inaccuracies in the synthetic data, which could lead to unfair treatment or unsafe decision-making by autonomous vehicles. Ensuring the ethical use and compliance with legal regulations regarding data generation and privacy is a crucial challenge. It requires careful validation, monitoring, and transparency in the generative AI algorithms to address concerns related to bias, privacy, and accountability in autonomous vehicles.Regional Analysis

In 2023, Europe held a dominant market position in the generative AI in autonomous vehicles market, capturing more than a 35% share. The demand for Generative AI in Autonomous Vehicles in Europe was valued at US$ 1.05 billion in 2023 and is anticipated to grow significantly in the forecast period.

The region’s leadership can be attributed to several key factors. Europe has been at the forefront of autonomous vehicle development and is home to several major automotive manufacturers and technology companies investing in generative AI solutions. The presence of a robust research and development ecosystem, coupled with supportive government initiatives and favorable regulations, has fostered innovation in the autonomous vehicle sector.

Additionally, Europe’s advanced infrastructure and well-developed transportation networks provide a conducive environment for testing and deploying autonomous vehicles. The high adoption of generative AI in Europe is further driven by the region’s emphasis on safety and stringent regulations governing autonomous vehicle operations.

Moreover, Europe’s focus on sustainability and reducing carbon emissions aligns with the potential efficiency gains offered by generative AI in optimizing autonomous vehicle performance. As the market progresses, Europe is expected to maintain its dominant position and witness continued growth and advancements in generative AI applications for autonomous vehicles.

North America, following closely, has showcased significant growth in the market, driven by technological leadership and supportive regulatory frameworks. The United States, in particular, has been a hotbed for autonomous vehicle testing and deployment, with Silicon Valley serving as a nexus for advancements in generative AI applications in the automotive sector. The region’s market share is bolstered by substantial investments from both private and public sectors, aiming to accelerate the commercialization of autonomous vehicles.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The generative AI in autonomous vehicles market is characterized by the presence of several key players, each contributing to the technological advancements and market dynamics. These players range from established automotive manufacturers and technology giants to innovative startups focusing on AI and machine learning solutions. A key players analysis sheds light on their strategic initiatives, market positioning, and contributions to the industry’s growth.

Top Market Leaders

- NVIDIA

- OpenAI

- Waymo (Alphabet Inc.)

- Baidu Apollo

- Aptiv

- Aurora

- Motional

- TuSimple

- Zenuity

- AI Motive

- Applied Intuition

- Ridecell

- Perceptive Automata

- DeepMap

- Idriverplus

- Other key players

Recent Developments

1. NVIDIA:

- January 2023: Announced the DRIVE Hyperion 9 platform, featuring advanced AI capabilities for AVs, including potential generative elements for scenario simulation and data augmentation.

- June 2023: Launched the DRIVE Orin SoC with TensorRT 8, specifically designed for AI workloads in vehicles, potentially supporting future generative applications.

- October 2023: Partnered with Mercedes-Benz to develop end-to-end AV solutions, leveraging NVIDIA’s AI hardware and software, which could involve generative components.

2. Waymo (Alphabet Inc.):

- May 2023: Launched Waymo One robotaxi service in Phoenix, Arizona, showcasing significant progress in AV development, potentially utilizing generative models for simulation and data augmentation.

- August 2023: Partnered with Uber to co-develop self-driving truck technology, leveraging their combined expertise in AI and AV systems, which could involve generative components.

- December 2023: Announced plans to expand Waymo One service to other cities in 2024, demonstrating confidence in their AV technology, potentially driven by advancements in generative AI.

Report Scope

Report Features Description Market Value (2023) US$ 3.0 Bn Forecast Revenue (2033) US$ 20.3 Bn CAGR (2024-2033) 21.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Passenger Vehicles and Commercial Vehicles), By Component (Solution, Services), By Application (Training & data augmentation, Simulation and Testing, Perception Systems Enhancement & Sensing, Localization and Mapping, Safety Verification & Testing, Behavior Prediction & decision making, Others), By End Users (Automotive Manufacturers, Research & Development Organizations Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape NVIDIA, OpenAI, Waymo (Alphabet Inc.), Baidu Apollo, Aptiv, Aurora, Motional, TuSimple, Zenuity, AI Motive, Applied Intuition, Ridecell, Perceptive Automata, DeepMap, Idriverplus, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Generative AI in the context of autonomous vehicles?Generative Artificial Intelligence (AI) refers to a subset of AI techniques where machines are trained to generate data, images, or even entire scenarios. In autonomous vehicles, Generative AI plays a crucial role in simulating various driving conditions, enhancing training algorithms, and improving overall safety and reliability.

How big is Generative AI in Autonomous Vehicles Industry?The Global Generative AI in Autonomous Vehicles Market size is expected to be worth around USD 20.3 Billion by 2033, from USD 3.0 Billion in 2023, growing at a CAGR of 21.1% during the forecast period from 2024 to 2033.

Who are the key players in Generative AI in Autonomous Vehicles Market?NVIDIA, OpenAI, Waymo (Alphabet Inc.), Baidu Apollo, Aptiv, Aurora, Motional, TuSimple, Zenuity, AI Motive, Applied Intuition, Ridecell, Perceptive Automata, DeepMap, Idriverplus, Other key players are the major companies operating in the Generative AI in Life Insurance Market.

Which region held the largest Generative AI in Autonomous Vehicles Market share?In 2023, Europe held a dominant market position in the generative AI in autonomous vehicles market, capturing more than a 35% share.

Which vehicle type analysis segment accounted for the largest Generative AI in Autonomous Vehicles Market share?In 2023, the Passenger Vehicles segment held a dominant market position in the Generative AI in Autonomous Vehicles Market, capturing more than a 55% share.

Generative AI in Autonomous Vehicles MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Generative AI in Autonomous Vehicles MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- NVIDIA

- OpenAI

- Waymo (Alphabet Inc.)

- Baidu Apollo

- Aptiv

- Aurora

- Motional

- TuSimple

- Zenuity

- AI Motive

- Applied Intuition

- Ridecell

- Perceptive Automata

- DeepMap

- Idriverplus

- Other key players