Global Gene Synthesis Market By Method (Solid-Phase Synthesis, Chip-Based Synthesis, and PCR-Based Enzyme Synthesis), By Application (Gene & Cell Therapy Development, Vaccine Development, Disease Diagnosis, and Other Applications), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 14565

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

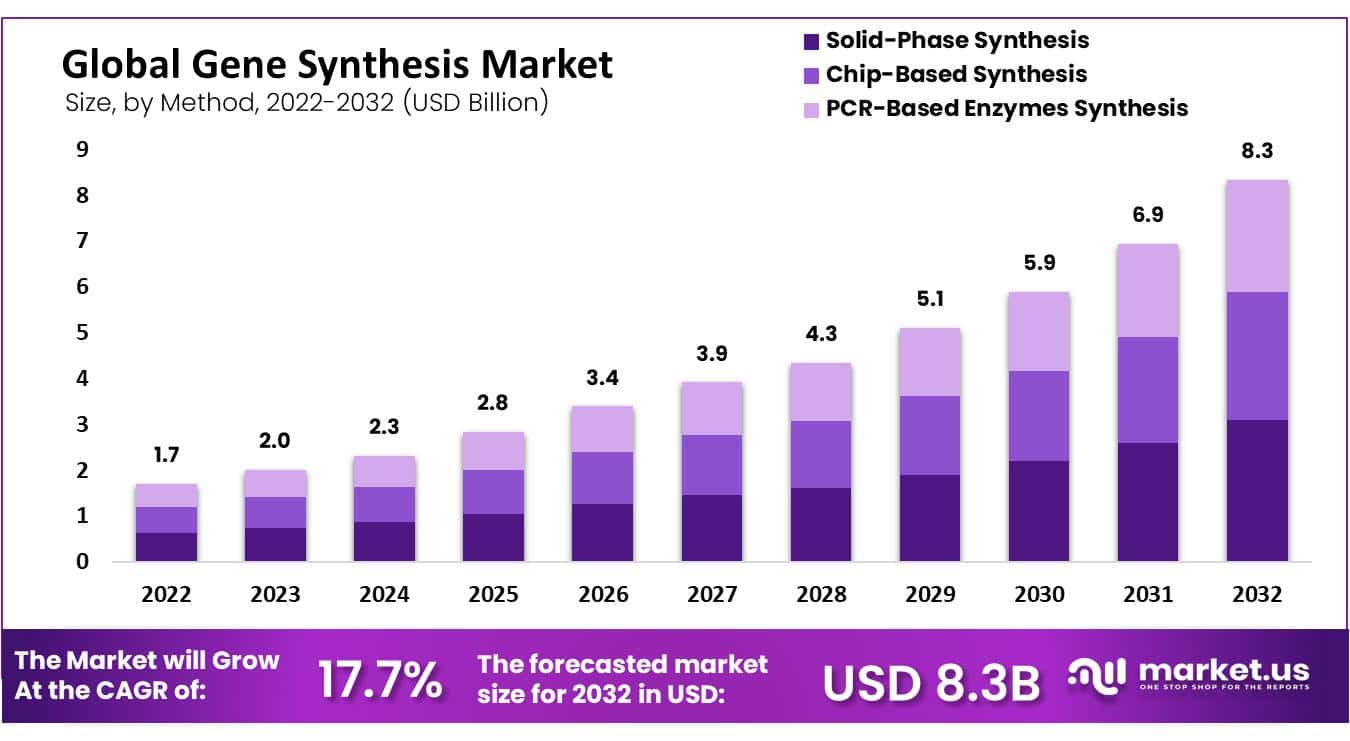

In 2022, the global Gene Synthesis Market accounted for USD 1.7 billion and is expected to reach USD 8.3 Billion in 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 17.7%.

In the realm of DNA-based technology, gene synthesis has gained widespread acceptance, bolstering the gene synthesis market. The future outlook is promising, driven by ongoing research and development in gene synthesis, as well as the emergence of novel therapies and drug innovations.

Immunotherapy, particularly for chronic ailments like cancer and tumors, holds substantial potential, further expanding the gene synthesis industry. Gene therapy, characterized by the direct introduction of genes into a patient’s cells, rather than traditional drug or surgical methods, is gaining traction due to its potential for distinctive and enduring outcomes.

Leveraging synthetic gene constructs and other gene products is poised to accelerate advancements in gene therapy, paving the way for innovative healthcare solutions.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- The number of individuals living with diabetes globally was approximately 537 million in 2021, projected to reach 783 million by 2045.

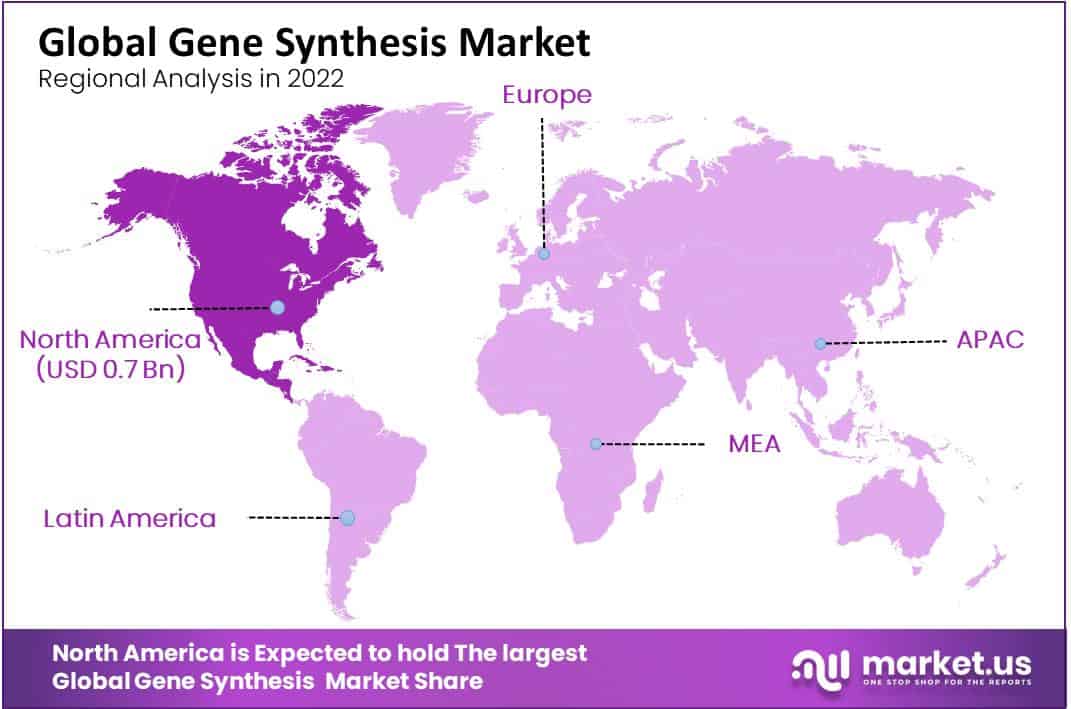

- North America accounted for the highest revenue share of 42% in 2022, with the Asia Pacific expected to witness the fastest growth.

- Key players in the market include Thermo Fisher Scientific, Genewiz, Boster Biological Technology, Twist Bioscience, Proteogenix Inc., Biomatik, Promab Biotechnologies, Genscript, Integrated DNA Technologies, Origene Technologies, and others.

- The solid-phase synthesis method held the largest market share of 38% in gene synthesis.

Gene synthesis is witnessing substantial growth driven by research and development in gene therapy, immunotherapy, and novel therapies. - The rising prevalence of chronic diseases, such as cancer and diabetes, is a significant driver for gene synthesis as it is used for advanced treatments.

- The development of novel therapies and advancements in gene editing technologies like CRISPR-Cas9 are boosting the demand for gene synthesis.

- Ethical and legal issues, cost complexity, and quality control challenges are some of the restraining factors in the gene synthesis market.

- Solid-phase synthesis is the dominant method in gene synthesis, accounting for 38% of the market share.

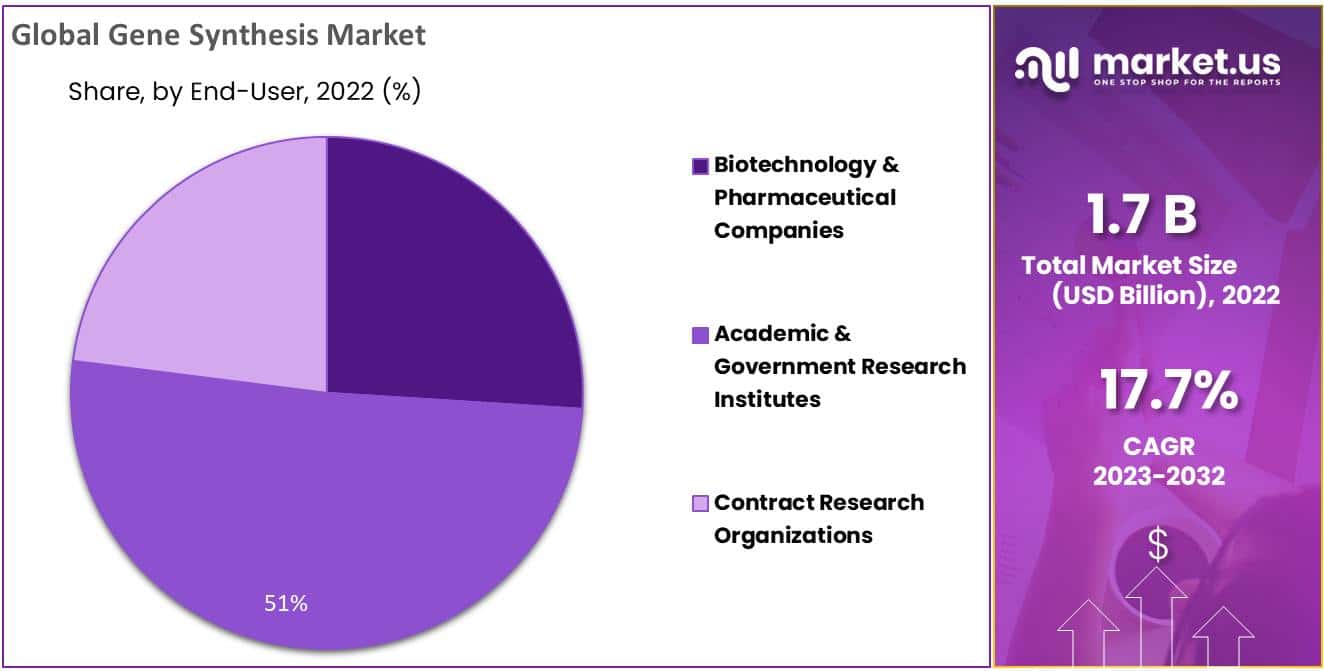

- Academic and government research institutes are the major end-users, contributing to 51% of the market’s revenue

- Increasing government support for gene synthesis and the potential for personalized medicine and gene therapy are creating growth opportunities.

Driving Factors

Rising prevalence of chronic disorders

The rapid expansion of diseases in the majority of the population is due to the changing lifestyles of individuals. This leads to an increase in the number of chronic diseases such as cancer, gastrointestinal disorders, HIV, cardiovascular disorders, and HIV.

Gene synthesis is used for the treatment of chronic diseases with the help of advanced technologies. The genes are produced using biologically developed innovations, and the efficacy and safety of the products are enhanced. The utilization of genes for developing novel vaccines is poised to drive an upsurge in gene synthesis.

Companies are expected to increase their investments significantly, contributing to the market growth. Moreover, growing demand for synthetic genes across various fields, including pharmaceuticals, biotechnology, and academic research is also expected to boost the market growth.

- According to the December 2021 official figures, released by the International Diabetes Federation (IDF), approximately 537 million individuals aged between 20 and 79 were reported to be living with diabetes globally in 2021. The IDF anticipates that this figure is poised to increase significantly, reaching an estimated 783 million individuals by the year 2045.

Development of Novel Therapies

Gene synthesis plays an essential role in creating custom-designed genes that allow researchers and biotech companies to develop novel therapies, vaccines, and genetically modified organisms. The advent of advanced gene editing technologies such as CRISPR-Cas9 has further boosted the need for precise and suitable gene constructs, thereby driving market growth.

Moreover, the expanding applications of synthetic genes in drug discovery and genetic diagnostics, are contributing to the market’s expansion. As the biotechnology and healthcare sectors continue to advance, the demand for gene synthesis services is expected to remain strong.

Restraining Factors

Ethical and Legal Issues

The ethical and legal implications of gene synthesis are particularly relevant in relation to human gene therapy and editing. Misuse or not proper handling of synthetic genes could also lead to serious consequences such as the creation of biological weapons and the spread of dangerous diseases.

Cost and Complexity

Even though the cost of gene synthesis has decreased, they are still relatively expensive. It can be prohibitively expensive for smaller companies and research groups. Moreover, It can be difficult to synthesize long, complex DNA sequences. This requires specialized equipment and expertise. Researchers and companies may be limited in their ability to create certain synthetic genes.

Quality Control

In the gene synthesis industry, quality control is essential to ensuring that synthesized DNA sequences function correctly and are accurate. It can be difficult to maintain high standards, especially when synthesizing longer and complex sequences.

By Method Analysis

The solid phase segment accounted for the largest revenue share of 38% in the gene synthesis market

Based on the method, the market is segmented into solid-phase synthesis, chip-based synthesis, and PCR-based enzyme synthesis. Among these segments, in 2022, the market for gene synthesis was dominated by solid-phase synthesis with a market share of 38% due to a rising adoption rate over the last few years.

The majority of companies that offer commercial gene synthesis services use a solid-phase process. Moreover, time efficiency and cost affordability offered by the solid-phase synthesis method a major factors driving the segment growth.

By Application Analysis

Gene & cell therapy development held the largest market share of 39% in 2022

Based on application, the market for gene synthesis market is divided into gene & cell therapy development, vaccine development, disease diagnosis, and other applications. Among these applications, gene and cell therapy development dominated the market with a revenue share of 39%.

The elevated demand for gene synthesis in the advancement of gene and cell therapy primarily arises from the requirement for customized therapeutic genes, swift prototyping, adherence to safety standards, scalability, and the capability to obtain rare or intricate gene sequences.

Moreover, during the forecast period, the disease diagnosis segment is anticipated to experience the fastest growth. This can be attributed to the significant role that gene synthesis plays in diagnosing rare genetic diseases.

By End-User Analysis

Academic and government research institutes dominated the market with 51% revenue share in 2022

Based on end-user, the market is bifurcated into biotechnology & pharmaceutical companies, academic & government research institutes, and contract research organizations. Among these end-users, the academic and government research institutions accounted for the highest revenue share in the gene synthesis market in 2022.

The segment growth is mainly driven by the growing adoption of gene synthesis in research institutes, coupled with the initiation of important collaborative initiatives. Biotechnology and pharmaceutical companies are also expected to experience significant growth in gene synthesis market during the forecast period.

This is due to the necessity for customized solutions, faster R&D, access to unique genetic sequences, intellectual property protection, scaling production, high-throughput screening, applications in gene therapy and genome editing, and collaborative resource sharing.

Key Market Segments

Based on Method

- Solid-Phase Synthesis

- Chip-Based Synthesis

- PCR-Based Enzyme Synthesis

Based on Application

- Gene & Cell Therapy Development

- Vaccine Development

- Disease Diagnosis

- Other Applications

Based on End User

- Biotechnology & Pharmaceutical Companies

- Academic & Government Research Institutes

- Contract Research Organizations

Growth Opportunity

Increase in government support

Governments worldwide are making substantial investments in research infrastructure, including collaborative facilities and centers offering gene synthesis services. These advanced hubs grant researchers access to advanced equipment, technologies, and gene synthesis expertise, elevating research capabilities and promoting scientific collaboration. This growing government support for gene synthesis is likely expected to propel the market growth, creating lucrative opportunities in the near future.

Personalized medicine and gene therapy.

One prominent opportunity lies in the realm of personalized medicine and gene therapy. Gene synthesis enables the creation of customized gene constructs, opening avenues for precise treatments designed for individual patients. This customization has the potential to revolutionize the healthcare landscape, offering more effective and targeted therapies.

Latest Trends

Advancement in technology

Blockchain technology is under exploration to improve transparency, security, and traceability in gene synthesis. Through blockchain, stakeholders gain the ability to meticulously track and authenticate the source, legitimacy, and unaltered nature of synthesized gene sequences. This ensures confidence in the data and materials utilized in research and development activities. These technological advances are forecasted to propel the market growth in the coming years.

Demand for long DNA sequences

Researchers and companies are highly looking for more complex and longer DNA sequences to develop more advanced biological systems and products. It has led to new platforms and techniques for gene synthesis that can handle long sequences.

Regional Analysis

North America accounted for the highest revenue share in 2022

Based on region, the market for gene synthesis is categorized into North America, Western Europe, Eastern Europe, APAC, Latin America, Middle East & Africa. Among these regions, In 2022, North America held the largest revenue share of 42%.

This is mainly due to the robustness of the biopharmaceutical industry, along with an intensified commitment to R&D, which is poised to drive market expansion in the specified region over the forecast period. Additionally, innovations in areas such as precision medicine, genomics, synthetic biology, pharmaceutical innovation, and industrial biotechnology are likely to contribute favorably to market expansion over the forecast period.

Asia Pacific is projected to grow at the fastest rate during the forecast period

Asia Pacific is likely expected to witness the fastest growth rate over the forecast period owing to increased research for effective therapeutics and the growing interest in synthetic biological research.

Moreover, an, increasing number of diseases and a large patient pool also drive the regional market growth. Improvements in healthcare infrastructure and the entry of new key players are also predicted to surge the market growth in this region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The key players in the market have taken many strategic initiatives, such as entering into partnerships, collaborations, mergers & acquisitions, and geographic expansion to increase their market presence. To strengthen their product offerings, companies are introducing novel products.

For instance, ProteoGenix introduced the XtenCHO Transient CHO Expression System in March 2022. This product accelerates early-stage drug testing by simplifying recombinant protein production.

Market Key Players

- Thermo Fisher Scientific, Inc.

- Genewiz

- Boster Biological Technology

- Twist Bioscience

- Proteogenix Inc.

- Biomatik

- Promab Biotechnologies, Inc.

- Genscript

- Integrated DNA Technologies, Inc.

- Origene Technologies, Inc.

- Other Market Players

Recent Developments

- In 2022 July, OraSure Technologies introduced OmniGene, a product that contains both gut DNA and DNA (OMR-205) by OraSure Technologies.

- In February 2022, Integrated DNA Technologies, Inc. introduced Alt-R HDR donor blocks, allowing researchers to edit the Homology Directed Repair (HDR), genome in order to develop treatments.

Report Scope

Report Features Description Market Value (2022) USD 1.7 Bn Forecast Revenue (2032) USD 8.3 Bn CAGR (2023-2032) 17.7% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Method – Solid-Phase Synthesis, Chip-Based Synthesis, PCR-Based, Enzyme Synthesis; By Application – Gene & Cell Therapy Development, Vaccine Development, Disease Diagnosis and Other Applications; By End-User – Biotechnology & Pharmaceutical Companies, Academic & Government Research Institutes , and Contract Research Organizations Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., Genewiz, Boster Biological Technology Twist Bioscience, Proteogenix Inc., Biomatik, Promab Biotechnologies, Inc., Genscript, Integrated DNA Technologies, Inc., Origene Technologies, Inc. and Other Market Players

Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Gene Synthesis Market Size?In 2022, the global Gene Synthesis market accounted for USD 1.7 billion and is expected to reach USD 8.3 Billion in 2032 Between 2023 and 2032.

What is the CAGR for the Gene Synthesis Market?The Gene Synthesis Market is expected to grow at a CAGR of 17.7% during 2023-2032.Who are the prominent players in the Gene Synthesis Market?Thermo Fisher Scientific, Inc., Genewiz, Boster Biological Technology, Twist Bioscience, Proteogenix Inc., Biomatik, Promab Biotechnologies, Inc., Genscript, Integrated DNA Technologies, Inc., Origene Technologies, Inc., Other Market Players.

-

-

- Thermo Fisher Scientific, Inc.

- Genewiz

- Boster Biological Technology

- Twist Bioscience

- Proteogenix Inc.

- Biomatik

- Promab Biotechnologies, Inc.

- Genscript

- Integrated DNA Technologies, Inc.

- Origene Technologies, Inc.

- Other Market Players