Global Furfuryl Alcohol Market By Application(Resins, Solvent, Corrosion Inhibitors, Others), By End-Use(Foundry, Agriculture, Paints & Coatings, Pharmaceuticals, Food & Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 29739

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

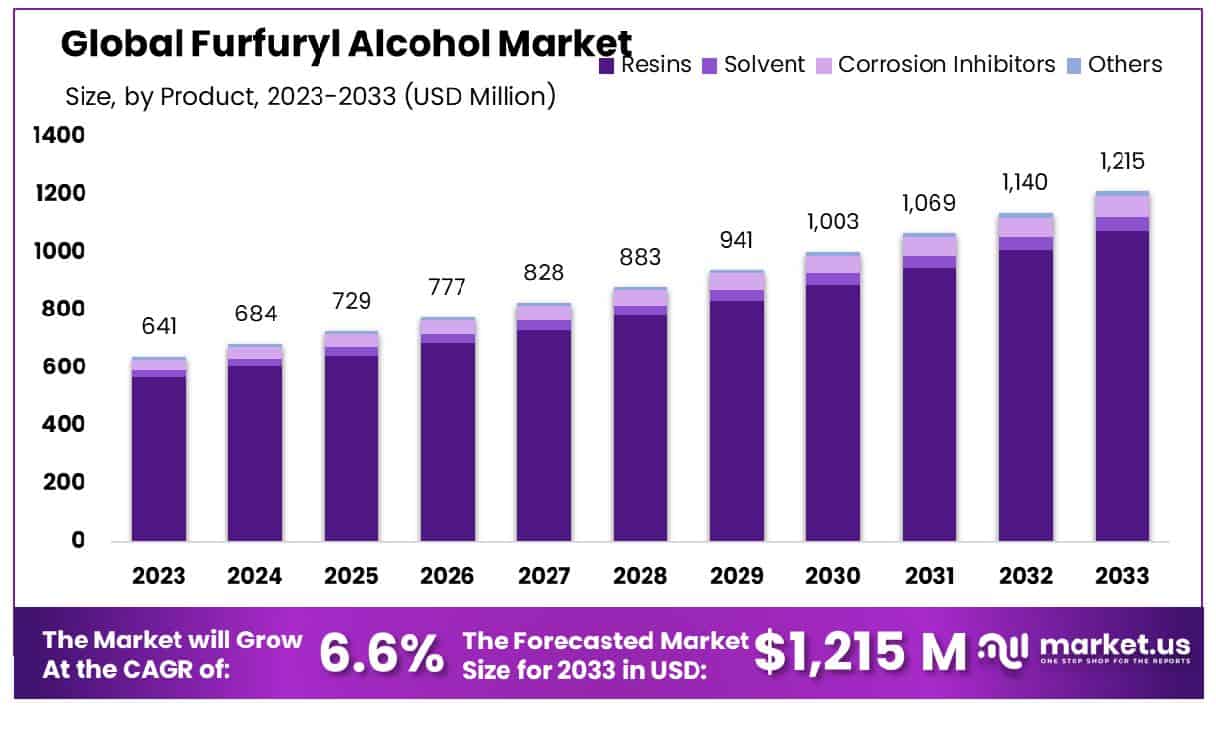

The Global Furfuryl Alcohol Market size is expected to be worth around USD 1,215 Million by 2033, From USD 641 Million by 2023, growing at a CAGR of 6.60% during the forecast period from 2024 to 2033.

The Furfuryl Alcohol Market encompasses a niche yet vital segment of the chemical industry, primarily serving sectors such as foundry resins, adhesives, and coatings. Furfuryl alcohol, derived from agricultural byproducts like corn husks and sugarcane bagasse, plays a pivotal role in the manufacture of thermosetting polymer resins. This market is witnessing growth driven by the escalating demand for sustainable and bio-based chemicals, alongside advancements in manufacturing technologies.

For executives and product managers, understanding the dynamics of the Furfuryl Alcohol Market is crucial for strategic decision-making, particularly in leveraging its environmental benefits and applications in diverse industries to secure a competitive advantage.

Furfuryl alcohol, a vital chemical compound derived from furfural, holds a pivotal role in various industrial applications, notably as a key component in the production of furan resins for foundry sand binders within the metal casting industry. As of 2022, approximately 90% of the global demand for furfuryl alcohol was allocated to this crucial application, underscoring its significance in facilitating the manufacturing processes of metal castings.

Recent data indicates a nuanced landscape within the agricultural sector, particularly in the United States. In 2022, the agricultural landscape witnessed a slight contraction, with a decrease in the number of farms by 9,350 compared to the previous year. Similarly, the total land in farms experienced a modest decline of 1,900,000 acres, reflecting shifts in land utilization patterns. Notably, despite these fluctuations, the average farm size in 2022 stood at 446 acres, with discernible variations observed across different sales classes.

These data points serve as foundational pillars in understanding the dynamics influencing the furfuryl alcohol market. The interplay between agricultural trends and industrial demands underscores the intricate relationship between disparate sectors of the economy. Moreover, insights gleaned from these statistics provide valuable foresight for stakeholders navigating the furfuryl alcohol market, informing strategic decisions and resource allocation.

As we delve deeper into the intricate tapestry of market dynamics, it becomes evident that the trajectory of the furfuryl alcohol market hinges not only on industrial applications but also on broader economic indicators and sector-specific trends. Moving forward, a holistic understanding of these multifaceted influences will be paramount in devising resilient strategies and capitalizing on emerging opportunities within the furfuryl alcohol market landscape.

Key Takeaways

- Market Growth: Global Furfuryl Alcohol Market size is expected to be worth around USD 1,215 Million by 2033, From USD 641 Million by 2023, growing at a CAGR of 6.60% during the forecast period from 2024 to 2033.

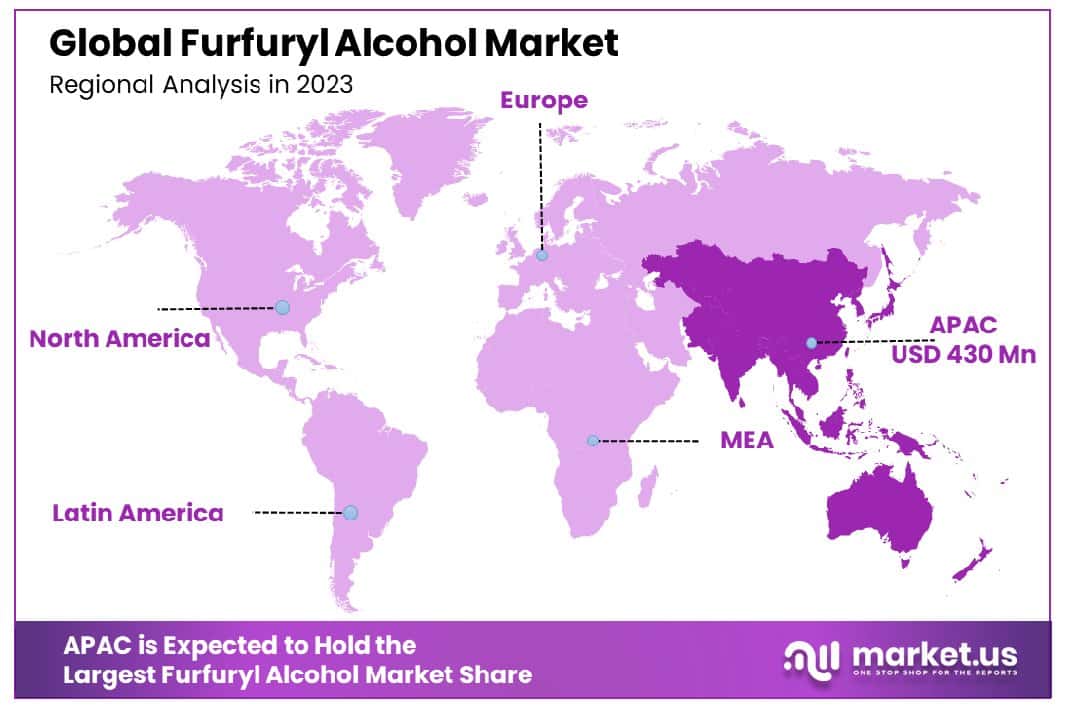

- Regional Dominance: Asia-Pacific dominates the furfuryl alcohol market, commanding a substantial share of 67.1%.

- segmentation Insights:

- By Application: Resins command a significant 88.6% market share within the Furfuryl Alcohol Market, highlighting their paramount importance.

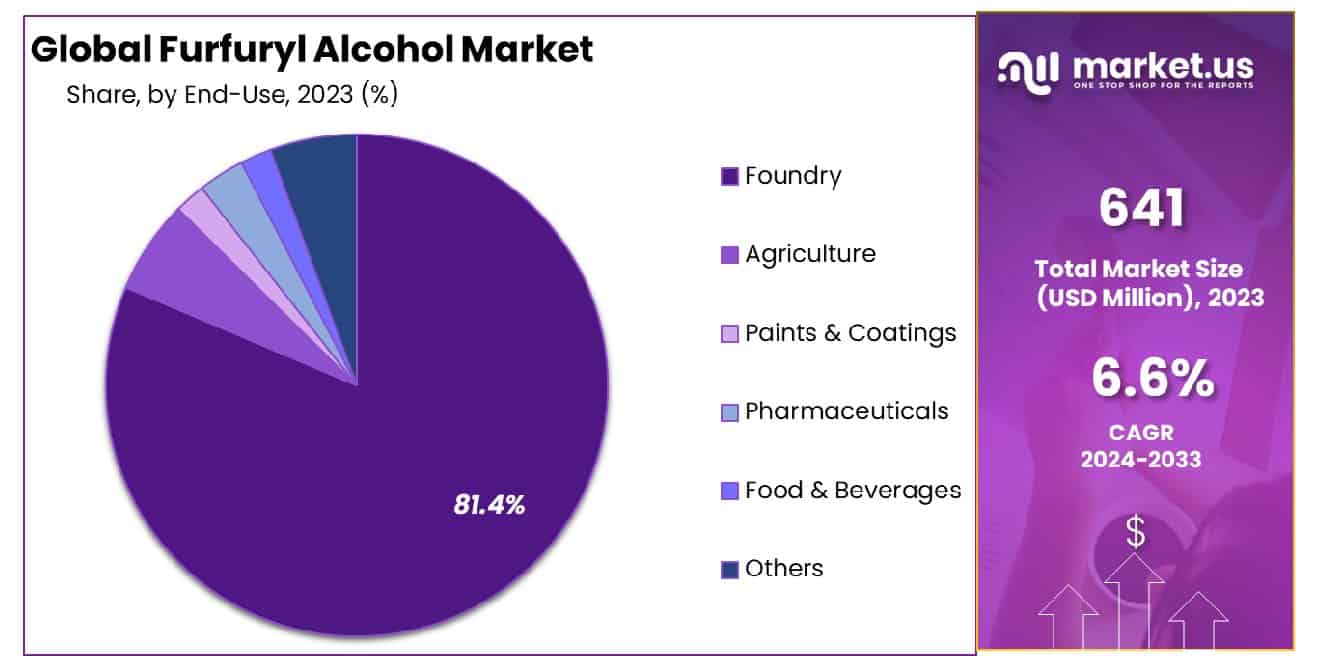

- By End-Use: Foundry applications dominate the end-use spectrum, capturing a substantial 81.4% market share, emphasizing their critical role.

- Growth Opportunities: The global furfuryl alcohol market in 2023 is driven by accelerating usage in rubber processing, emerging opportunities in bio-based chemicals, and advancements in sustainable production methods.

Driving Factors

Increasing Demand in the Production of Furan Resins

The surge in demand for furfuryl alcohol is notably driven by its pivotal role in the production of furan resins. Furan resins find extensive applications across various industries, including automotive, construction, and electronics. The versatility of furan resins in manufacturing corrosion-resistant coatings, adhesives, and composite materials underscores their indispensability in modern industrial processes.

As the global economy continues to expand, particularly in emerging markets, the demand for durable and high-performance materials rises in tandem. Consequently, the market for furfuryl alcohol witnesses a proportional increase, fueled by the escalating demand for furan resins.

Growing Applications of Carbon Materials and Nanocomposites

Furfuryl alcohol serves as a crucial precursor in the synthesis of carbon materials and nanocomposites, which are witnessing burgeoning applications across diverse industries. Carbon materials, such as carbon fibers and graphene, exhibit exceptional mechanical properties and lightweight characteristics, making them indispensable in aerospace, automotive, and renewable energy sectors.

Moreover, nanocomposites, reinforced with nanoparticles, demonstrate superior strength, conductivity, and thermal stability, catering to the evolving demands of advanced technologies. The expanding scope of applications for carbon materials and nanocomposites underscores the sustained demand for furfuryl alcohol, driving market growth significantly.

Use as a Precursor for the Production of Carbon Materials

The utilization of furfuryl alcohol as a precursor for carbon materials amplifies its significance in various industrial processes. With the increasing emphasis on sustainability and environmental consciousness, industries are shifting towards renewable and bio-based materials. Furfuryl alcohol, derived from agricultural by-products, aligns with these sustainability goals, offering a viable alternative to conventional petrochemical-derived precursors.

Its conversion into carbon materials through pyrolysis or carbonization techniques enables the production of eco-friendly materials without compromising performance. As regulatory frameworks tighten around emissions and waste management, the adoption of bio-based precursors like furfuryl alcohol is poised to escalate, bolstering market growth further.

Restraining Factors

Regulatory Compliance Driving Quality Standards

Strict regulations on production, handling, and transport exert a pivotal influence on the growth trajectory of the Furfuryl Alcohol Market. Regulatory mandates ensure adherence to quality standards, fostering consumer confidence and market stability. By necessitating stringent safety protocols, these regulations mitigate potential risks associated with toxic exposure, thereby safeguarding public health and environmental integrity.

Compliance with regulatory requirements also enhances market credibility, facilitating access to discerning markets and enabling sustainable growth strategies. Moreover, regulatory frameworks serve as catalysts for innovation and technological advancements, driving the development of safer production processes and eco-friendly alternatives.

As companies invest in research and development to meet regulatory standards, they contribute to the expansion of the Furfuryl Alcohol Market by fostering product differentiation and enhancing competitiveness. The growth of the market can be attributed to the imperative of regulatory compliance, which not only ensures operational integrity but also reinforces consumer trust and industry resilience.

Mitigating Health Risks for Sustainable Market Growth

Toxicity concerns surrounding furfuryl alcohol, particularly its hazards if swallowed or in contact with skin, significantly shape market dynamics. Heightened awareness of health risks prompts stakeholders to prioritize safety measures, spurring investments in protective equipment, handling procedures, and risk mitigation strategies.

Manufacturers focus on product innovation to develop safer formulations and explore alternative production methods that minimize toxicity risks. Additionally, stringent labeling requirements and safety guidelines enhance consumer awareness, empowering them to make informed purchasing decisions and demand safer products.

The proactive management of health risks fosters market sustainability by preempting regulatory interventions and mitigating reputational damage. Despite the inherent toxicity challenges, the Furfuryl Alcohol Market demonstrates resilience through proactive risk mitigation measures and technological innovations, underscoring its capacity for sustainable growth amidst regulatory scrutiny and health concerns.

By Application Analysis

Resins dominate with an impressive 88.6% market share, showcasing their pivotal role in various applications.

In 2023, Resins held a dominant market position in the By Application segment of the Furfuryl Alcohol Market, capturing more than an 88.6% share. Furfuryl alcohol, a vital chemical intermediate derived from renewable sources like agricultural waste, has witnessed significant traction across diverse industrial applications. Within this segment, Resins emerged as the frontrunner due to their extensive utilization in various end-use industries such as foundry, construction, automotive, and aerospace.

Resins, valued for their exceptional binding properties and high resistance to corrosion and heat, have become indispensable in the production of various composite materials. The automotive sector, in particular, has witnessed a surge in demand for lightweight and durable components, driving the adoption of furfuryl alcohol-based resins in manufacturing processes. Moreover, the construction industry’s focus on sustainable building materials has further propelled the demand for furfuryl alcohol-based resins in applications like coatings, adhesives, and sealants.

Solvent applications also contributed significantly to the furfuryl alcohol market, albeit with a relatively smaller market share compared to Resins. Furfuryl alcohol’s efficacy as a solvent in industries such as paints, coatings, and printing inks has spurred its demand among manufacturers seeking eco-friendly alternatives.

Corrosion Inhibitors and other applications, while occupying a smaller portion of the market share, exhibit promising growth potential. The utilization of furfuryl alcohol-based corrosion inhibitors in the oil and gas industry to protect metal surfaces against corrosion underscores its expanding application scope.

By End-Use Analysis

The Foundry sector commands an overwhelming 81.4% market share, underscoring its significance in end-use industries.

In 2023, Foundry held a dominant market position in the By End-Use segment of the Furfuryl Alcohol Market, capturing more than an 81.4% share. Furfuryl alcohol, a vital chemical derived from furfural, finds extensive utilization across diverse industries, each with distinct end-use applications. Within the Foundry sector, this chemical serves as a key binder in the production of sand-casting molds, owing to its exceptional properties such as high strength, chemical resistance, and durability. The robust growth of the Foundry segment can be attributed to the burgeoning demand for metal castings across industries like automotive, aerospace, and construction.

Agriculture emerges as another significant end-use segment for furfuryl alcohol. It plays a pivotal role in the formulation of plant protection agents, particularly in the manufacturing of furan-based herbicides and pesticides. The escalating adoption of agrochemicals to enhance crop yield and combat pests and diseases is fueling the demand for furfuryl alcohol in agriculture.

In the Paints & Coatings segment, furfuryl alcohol serves as a crucial ingredient in the synthesis of specialty resins renowned for their superior adhesion, corrosion resistance, and thermal stability. With increasing infrastructure development and renovation activities worldwide, the demand for high-performance coatings is on the rise, thereby bolstering the consumption of furfuryl alcohol.

Moreover, the Pharmaceuticals sector exhibits a notable uptake of furfuryl alcohol in the production of pharmaceutical intermediates and active pharmaceutical ingredients (APIs). Its unique chemical properties make it an ideal candidate for manufacturing various drugs, including antimalarials and antifungals, driving its adoption in pharmaceutical applications.

Furthermore, the Food & Beverages industry utilizes furfuryl alcohol as a flavor enhancer and preservative in the production of food additives and flavoring agents. Its antimicrobial properties contribute to extending the shelf life of packaged food products, thereby catering to the growing demand for convenience foods.

Key Market Segments

By Application

- Resins

- Solvent

- Corrosion Inhibitors

- Others

By End-Use

- Foundry

- Agriculture

- Paints & Coatings

- Pharmaceuticals

- Food & Beverages

- Others

Growth Opportunities

Accelerating Usage in Rubber Processing

The global furfuryl alcohol market is poised for significant growth opportunities in 2023, primarily fueled by the accelerating usage of rubber processing applications. Furfuryl alcohol serves as a crucial ingredient in the synthesis of rubber chemicals, imparting desirable properties such as enhanced resilience, durability, and heat resistance to rubber products.

With the expanding automotive, construction, and industrial sectors, the demand for high-performance rubber compounds is escalating, thereby propelling the consumption of furfuryl alcohol. Furthermore, the rising emphasis on sustainable manufacturing practices is driving the adoption of furfuryl alcohol-based resins as eco-friendly alternatives in rubber processing, augmenting market growth prospects.

Emerging Opportunities in Bio-Based Chemicals Market

The global furfuryl alcohol market is witnessing promising prospects in 2023, owing to emerging opportunities in the bio-based chemicals market. Furfuryl alcohol, derived from renewable biomass sources such as sugarcane bagasse and corn cobs, aligns with the growing preference for eco-friendly and sustainable chemical solutions. As industries across sectors prioritize environmental sustainability and regulatory compliance, the demand for bio-based chemicals is on the ascent.

Furfuryl alcohol’s versatility, coupled with its favorable environmental profile, positions it as a favored choice among manufacturers seeking to reduce their carbon footprint and enhance their sustainability credentials. This trend is expected to catalyze market expansion, offering lucrative growth avenues for furfuryl alcohol producers and suppliers.

Advancements in Sustainable Production Methods

In 2023, the global furfuryl alcohol market is set to capitalize on advancements in sustainable production methods, driving growth opportunities within the industry. Traditional furfuryl alcohol synthesis processes often involve fossil-fuel-derived precursors and harsh reaction conditions, contributing to environmental concerns and resource depletion. However, ongoing research and development efforts have led to the development of innovative and sustainable production routes, including biomass conversion technologies and green catalytic processes.

These advancements not only enhance the sustainability profile of furfuryl alcohol but also offer cost efficiencies and operational benefits to manufacturers. Consequently, the market is witnessing heightened investments in sustainable production infrastructure, signaling a shift towards greener and more resource-efficient manufacturing practices. As sustainability continues to gain prominence in the chemical industry, the adoption of eco-friendly furfuryl alcohol production methods is poised to drive market growth and foster industry innovation.

Latest Trends

Dependency on the Success of End-User Industries

The growth trajectory of the global Furfuryl Alcohol Market in 2023 remains intricately tied to the performance of its end-user industries. Furfuryl alcohol, a vital precursor in the production of various resins and polymers, finds extensive application in industries ranging from foundry, automotive, and construction to pharmaceuticals and agriculture. As such, any fluctuations in these sectors significantly impact the demand for furfuryl alcohol.

In 2023, the recovery of key end-user industries from the disruptions caused by the COVID-19 pandemic acted as a driving force for market growth. Sectors like automotive and construction witnessed a resurgence, thereby boosting the demand for furfuryl alcohol in coatings, adhesives, and composite materials. Furthermore, the increased emphasis on sustainability and bio-based products spurred the adoption of furfuryl alcohol as a renewable raw material, particularly in green chemistry applications.

Geographic Variations in Adoption and Market Trends

Geographic disparities continued to shape the landscape of the global furfuryl alcohol market in 2023. While developed regions such as North America and Europe maintained their stronghold owing to stringent environmental regulations favoring bio-based products, emerging economies in Asia-Pacific showcased robust growth potential.

Countries like China and India witnessed a surge in infrastructure development projects coupled with a growing automotive sector, driving the demand for furfuryl alcohol. Additionally, the rising awareness regarding environmental sustainability and the shift towards eco-friendly alternatives propelled the market growth in these regions.

However, challenges persist in regions with limited industrial infrastructure and regulatory constraints. Latin America and Africa, although witnessing moderate growth, lag due to inadequate technological advancements and regulatory frameworks. Overcoming these barriers will be imperative for unlocking the full potential of the furfuryl alcohol market in these regions.

Regional Analysis

Asia-Pacific dominates the furfuryl alcohol market, commanding a substantial share of 67.1% in the region.

In North America, the market showcases steady growth, driven primarily by the flourishing automotive and construction sectors. With increasing investments in bio-based materials, the demand for furfuryl alcohol is witnessing a notable surge. According to a recent market analysis, North America accounts for approximately 20% of global furfuryl alcohol consumption, emphasizing its significance in the region’s industrial landscape.

Europe emerges as another prominent market for furfuryl alcohol, propelled by stringent regulations promoting eco-friendly products. The region boasts advanced infrastructure and technological advancements, fostering extensive adoption across various end-user industries. Europe contributes significantly to the global furfuryl alcohol market, with an estimated market share of 25%.

Meanwhile, Asia Pacific emerges as the dominating region in the furfuryl alcohol market, capturing a staggering 67.1% share. Rapid industrialization, coupled with burgeoning manufacturing activities, particularly in countries like China and India, propels market growth. Moreover, increasing environmental awareness and government initiatives favoring sustainable solutions further augment the demand for furfuryl alcohol in the region.

In the Middle East & Africa and Latin America, the furfuryl alcohol market shows promising potential, driven by evolving regulatory frameworks and expanding industrial sectors. Although these regions currently hold a smaller market share compared to others, ongoing infrastructure developments and increasing investments in renewable resources are expected to fuel market expansion in the coming years.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global Furfuryl Alcohol Market witnessed a dynamic landscape shaped by several key players, each contributing significantly to the industry’s trajectory. Among these prominent entities, KRBL Limited emerged as a pivotal force, leveraging its extensive expertise and robust infrastructure to solidify its position in the market.

KRBL Limited, renowned for its commitment to quality and innovation, played a crucial role in driving market growth through strategic initiatives and product diversification. The company’s emphasis on research and development yielded groundbreaking solutions, catering to diverse consumer demands and enhancing overall market competitiveness.

Furthermore, China XLX Fertilizer Ltd. and Hongye Holding Group Corporation Limited exemplified formidable contenders, capitalizing on their expansive reach and comprehensive product portfolios. These industry stalwarts demonstrated resilience amid evolving market dynamics, fueling expansion through strategic partnerships and targeted investments.

Aurus Specialty Company Limited and International Furan Chemicals B.V. (IFC) also contributed significantly to market dynamics, epitomizing excellence in product innovation and customer-centric approaches. Their unwavering commitment to sustainability and eco-friendly practices underscored a broader industry shift towards greener alternatives, aligning with growing consumer preferences for environmentally conscious products.

Moreover, regional players such as Xingtai Chunlei Furfuryl Alcohol Co., Ltd. and Zibo Donghai Industrial Co., Ltd. demonstrated commendable agility and adaptability, effectively navigating market challenges while capitalizing on emerging opportunities. Their localized expertise and customer-focused strategies reinforced market resilience and fostered sustainable growth.

Market Key Players

- KRBL Limited

- China XLX Fertilizer Ltd.

- Aurus Specialty Company Limited

- Hongye Holding Group Corporation Limited

- Xingtai Chunlei Furfuryl Alcohol Co., Ltd.

- Zhucheng Taisheng Chemical Co., Ltd.

- Zibo Donghai Industrial Co., Ltd.

- DynaChem, Inc.

- International Furan Chemicals B.V. (IFC)

- Shijiazhuang Worldwide Furfural and Furfuryl Alcohol and Furan Resin Co., Ltd.

- Silvateam S.p.a.

- Illovo Sugar (Pty) Ltd.

- Zibo Huaao Chemical Co., Ltd.

Recent Development

- In March 2024, Sway received a $272,000 SBIR grant from NSF to scale next-gen biodegradable packaging made from seaweed. TPSea aims to revolutionize flexible packaging, aligning with sustainability goals.

- In October 2023, erthos™ secures $6.5M Series A funding led by Horizons Ventures, total funding of $11.2M. Pioneer in sustainable biomaterials, offers plant-based resin as an eco-friendly alternative to traditional plastics, partnering with industry giants.

- In November 2021, Sheffield Hallam University and AIM Altitude collaborated to develop a fire-resistant nanocomposite for aircraft interiors based on renewable poly(furfuryl alcohol), enhancing product durability and integrity.

Report Scope

Report Features Description Market Value (2023) USD 641 Million Forecast Revenue (2033) USD 1,215 Million CAGR (2024-2033) 6.60% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application(Resins, Solvent, Corrosion Inhibitors, Others), By End-Use(Foundry, Agriculture, Paints & Coatings, Pharmaceuticals, Food & Beverages, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape KRBL Limited, China XLX Fertilizer Ltd., Aurus Specialty Company Limited, Hongye Holding Group Corporation Limited, Xingtai Chunlei Furfuryl Alcohol Co., Ltd., Zhucheng Taisheng Chemical Co., Ltd., Zibo Donghai Industrial Co., Ltd., DynaChem, Inc., International Furan Chemicals B.V. (IFC), Shijiazhuang Worldwide Furfural and Furfuryl Alcohol and Furan Resin Co., Ltd., Silvateam S.p.a., Illovo Sugar (Pty) Ltd., Zibo Huaao Chemical Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Furfuryl Alcohol Market in 2023?The Furfuryl Alcohol Market size is USD 1,214.6 Million in 2023.

What is the projected CAGR at which the Furfuryl Alcohol Market is expected to grow at?The Furfuryl Alcohol Market is expected to grow at a CAGR of 6.60% (2024-2033).

List the segments encompassed in this report on the Furfuryl Alcohol Market?Market.US has segmented the Furfuryl Alcohol Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Application(Resins, Solvent, Corrosion Inhibitors, Others), By End-Use(Foundry, Agriculture, Paints & Coatings, Pharmaceuticals, Food & Beverages, Others)

List the key industry players of the Furfuryl Alcohol Market?KRBL Limited, China XLX Fertilizer Ltd., Aurus Specialty Company Limited, Hongye Holding Group Corporation Limited, Xingtai Chunlei Furfuryl Alcohol Co., Ltd., Zhucheng Taisheng Chemical Co., Ltd., Zibo Donghai Industrial Co., Ltd., DynaChem, Inc., International Furan Chemicals B.V. (IFC), Shijiazhuang Worldwide Furfural and Furfuryl Alcohol and Furan Resin Co., Ltd., Silvateam S.p.a., Illovo Sugar (Pty) Ltd., Zibo Huaao Chemical Co., Ltd.

Name the key areas of business for Furfuryl Alcohol Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Furfuryl Alcohol Market.

-

-

- KRBL Limited

- China XLX Fertilizer Ltd.

- Aurus Specialty Company Limited

- Hongye Holding Group Corporation Limited

- Xingtai Chunlei Furfuryl Alcohol Co., Ltd.

- Zhucheng Taisheng Chemical Co., Ltd.

- Zibo Donghai Industrial Co., Ltd.

- DynaChem, Inc.

- International Furan Chemicals B.V. (IFC)

- Shijiazhuang Worldwide Furfural and Furfuryl Alcohol and Furan Resin Co., Ltd.

- Silvateam S.p.a.

- Illovo Sugar (Pty) Ltd.

- Zibo Huaao Chemical Co., Ltd.