The Global Fruit Beverages Market Size, Share, And Business Benefits By Type (Canned and Fresh, Non-carbonated Drinks, Frozen Juices), By Distribution Channel (Hypermarket/Supermarket, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157595

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

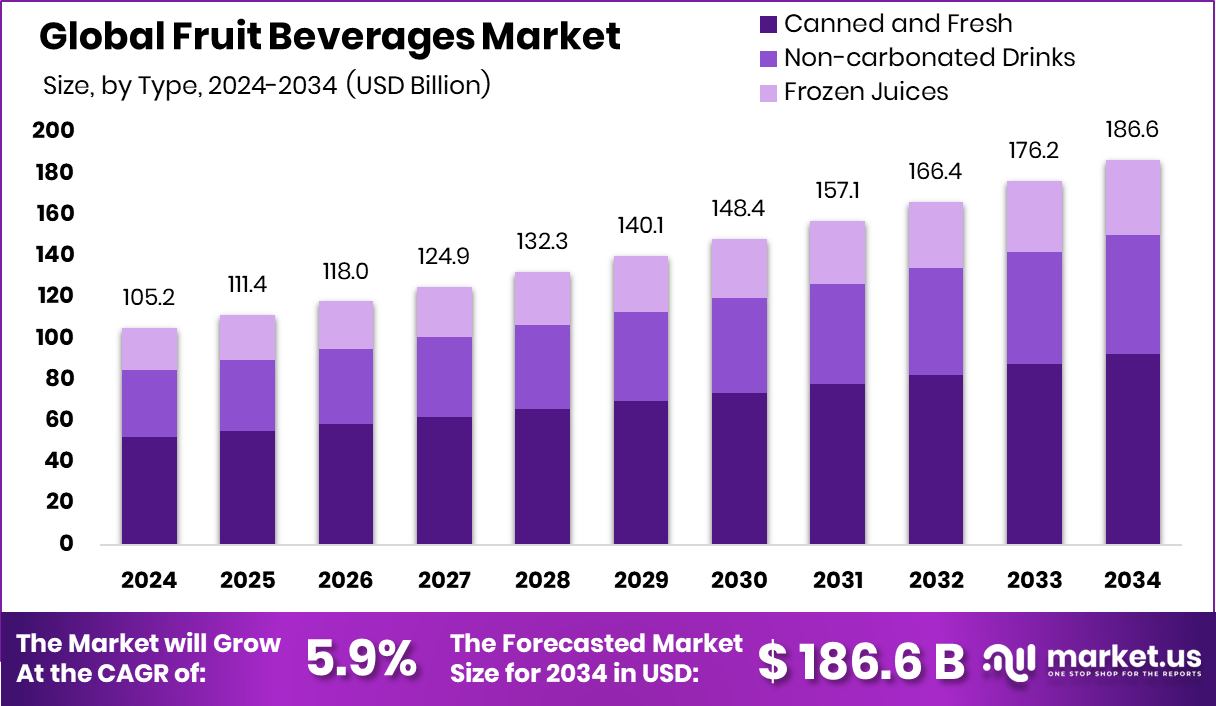

The Global Fruit Beverages Market is expected to be worth around USD 186.6 billion by 2034, up from USD 105.2 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. With a USD 50.8 Bn value, North America commanded a 48.30% market share in Fruit Beverages.

Fruit beverages are drinks made by processing fruits into juices, nectars, smoothies, or flavored drinks, often retaining the natural taste and nutrients of the fruit. They can be fresh, packaged, or concentrated and are widely consumed as a refreshing alternative to carbonated and artificially flavored drinks. According to an industry report, Soda maker Culture Pop successfully raised $21 million to support its growth journey.

The fruit beverages market refers to the global industry that produces, distributes, and sells drinks made from fruits. This market covers a variety of products such as juices, blends, and ready-to-drink options that cater to both health-conscious consumers and those seeking convenience. It is influenced by changing dietary habits, lifestyle choices, and innovation in flavors and packaging. According to an industry report, Beverage startup Rio Innobev has raised Rs 10 crore in funding led by Atomic Capital.

One of the major growth factors is the rising awareness of health and wellness, as consumers shift from sugary sodas to natural, fruit-based options. People are increasingly looking for products with vitamins, minerals, and antioxidants, making fruit beverages a preferred daily choice. According to an industry report, Sparkling water brand Dash secured £8.7 million through its Series A funding round.

The demand for fruit beverages is also driven by urbanization and busy lifestyles. Ready-to-drink fruit juices and smoothies fit perfectly into fast-paced routines, offering nutrition and refreshment without the need for preparation. This has led to higher consumption among young professionals and urban households. According to an industry report, Popular F&B brand Paper Boat obtained $50 million investment from Singapore’s sovereign fund GIC.

Key Takeaways

- The Global Fruit Beverages Market is expected to be worth around USD 186.6 billion by 2034, up from USD 105.2 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- By Type, Canned and Fresh held 49.6% in the Fruit Beverages Market.

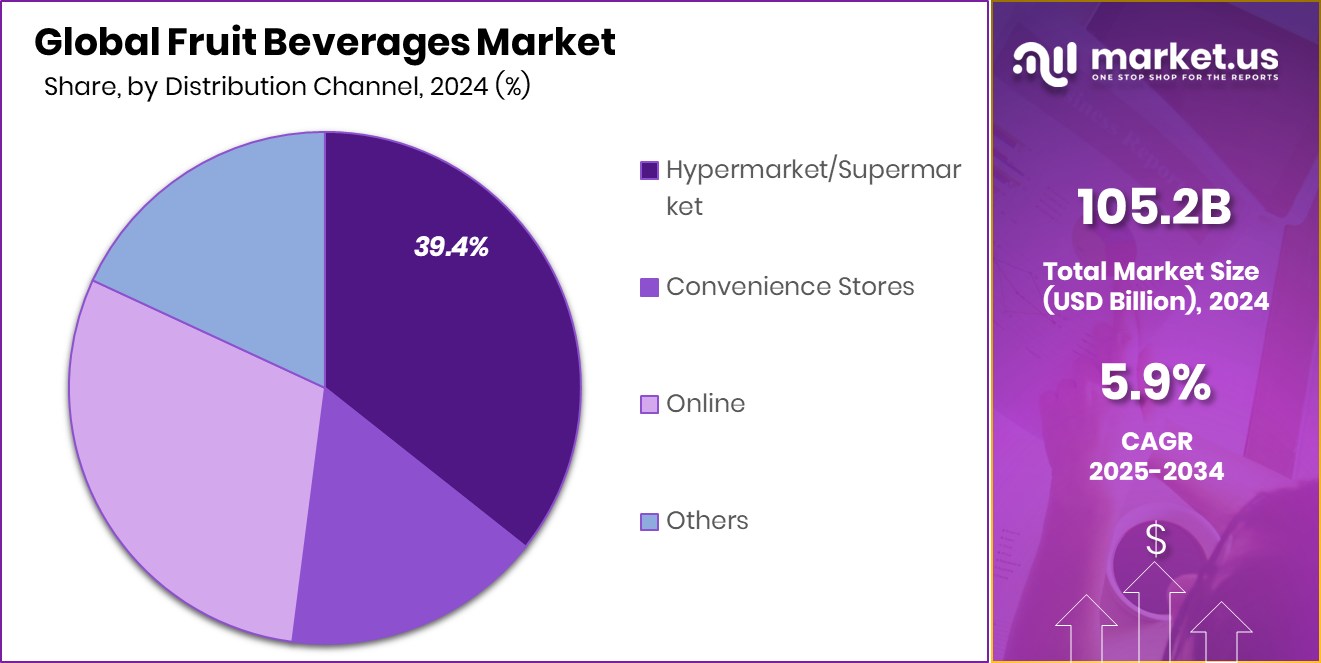

- Hypermarket and Supermarket channels captured 39.4% of the fruit beverages market.

- North America’s 48.30% dominance, worth USD 50.8 Bn, reflects strong consumer preference for healthy beverages.

By Type Analysis

By Type, canned and fresh fruit beverages captured 49.6%, showing strong consumer preference for convenience.

In 2024, Canned and Fresh held a dominant market position in the By Type segment of the Fruit Beverages Market, with a 49.6% share. This strong presence reflects the growing consumer preference for products that balance convenience with freshness. Canned fruit beverages are valued for their long shelf life and easy storage, making them a reliable option for households and retailers.

On the other hand, fresh fruit beverages continue to attract health-conscious buyers who associate freshness with higher nutritional value and natural taste. Together, these categories complement each other by catering to different consumption occasions, such as on-the-go use for canned formats and immediate refreshment for fresh juices.

The dominance of this segment is also supported by advancements in packaging technologies that preserve natural flavors and extend the shelf life of fresh juices without compromising on quality. Moreover, the rising demand for clean-label and minimally processed beverages has boosted confidence in both canned and fresh options.

Consumers in both urban and semi-urban regions are increasingly choosing these beverages as part of their daily diet. The 49.6% share underlines the significant role of this segment in shaping overall industry trends, demonstrating its resilience and adaptability to evolving consumer preferences.

By Distribution Channel Analysis

By Distribution Channel, hypermarkets and supermarkets held 39.4%, highlighting their importance in the fruit beverages market sales.

In 2024, Hypermarket/Supermarket held a dominant market position in the By Distribution Channel segment of the Fruit Beverages Market, with a 49.2% share. This leadership reflects the trust and convenience these large retail formats provide to consumers.

Hypermarkets and supermarkets serve as one-stop destinations, offering a wide variety of fruit beverages under one roof, from canned and packaged juices to freshly processed drinks. Their ability to stock multiple brands, flavors, and packaging sizes caters to diverse consumer preferences, which directly strengthens their role in driving sales volumes.

The dominance of this channel is also supported by promotional strategies, attractive discounts, and bundled offers that encourage bulk buying. In addition, supermarkets often provide a controlled environment that ensures product freshness and quality, which is especially important for fruit beverages. Consumers are also more likely to explore new product launches in these outlets, as in-store displays and sampling opportunities increase visibility and engagement.

With urbanization and rising disposable incomes, shopping habits have shifted towards modern retail formats, making supermarkets and hypermarkets the preferred choice for purchasing fruit beverages. The 49.2% share highlights their central role in shaping consumer access and purchasing behavior, ensuring their continued dominance in this segment.

Key Market Segments

By Type

- Canned and Fresh

- Non-carbonated Drinks

- Frozen Juices

By Distribution Channel

- Hypermarket/Supermarket

- Convenience Stores

- Online

- Others

Driving Factors

Rising Health Awareness Boosts Fruit Beverages Demand

One of the top driving factors for the fruit beverages market is the rising health awareness among consumers. People are increasingly moving away from sugary sodas and artificial soft drinks, instead choosing natural and nutritious options.

Fruit beverages, whether fresh or packaged, are seen as a healthier alternative because they provide vitamins, minerals, and antioxidants that support overall well-being. This shift is especially strong among young adults and families who are becoming more mindful of their daily diets.

Governments and health campaigns promoting reduced sugar intake have also added to this trend. As more people prioritize wellness, the demand for fruit-based drinks continues to rise, making health awareness a key force shaping this market’s growth.

Restraining Factors

High Sugar Content Limits Wider Market Growth

A major restraining factor for the fruit beverages market is the concern over high sugar content in many products. While consumers view fruit drinks as healthier than carbonated sodas, several packaged fruit beverages still contain added sugars or sweeteners to enhance taste and shelf life.

This creates a negative perception among health-conscious buyers who are actively reducing sugar intake to prevent obesity, diabetes, and other lifestyle diseases. Regulatory authorities in many countries are also tightening rules around sugar levels and labeling, which adds further pressure on producers.

As a result, despite strong demand, the growth of this market is limited by these concerns, pushing companies to reformulate products with natural or reduced-sugar alternatives.

Growth Opportunity

Innovation in Natural and Organic Beverages Rising

One of the biggest growth opportunities in the fruit beverages market lies in the rising demand for natural and organic products. Consumers today are looking for drinks made with clean labels, free from artificial colors, flavors, and preservatives.

This shift has opened doors for companies to innovate with organic juices, cold-pressed blends, and beverages sourced from sustainably grown fruits. The premium appeal of organic and natural beverages also allows higher pricing, making it profitable for producers.

Growing awareness about the benefits of chemical-free farming and the popularity of eco-friendly lifestyles further support this opportunity. As consumer trust builds around transparency and authenticity, natural and organic fruit beverages are set to become a fast-expanding segment in the coming years.

Latest Trends

Functional Fruit Beverages with Added Health Benefits

A key trend shaping the fruit beverages market is the growing popularity of functional drinks that go beyond basic refreshment. Consumers are increasingly choosing beverages that not only provide natural fruit flavor but also offer added health benefits such as immunity boosting, energy enhancement, or digestive support.

Companies are introducing fruit juices infused with vitamins, probiotics, and plant-based proteins to meet these evolving preferences. This trend is especially strong among younger consumers who seek convenient options that align with their busy lifestyles while still supporting wellness goals.

The blending of nutrition with taste is redefining the fruit beverage experience, making functional products one of the most innovative and fast-growing areas in the market today.

Regional Analysis

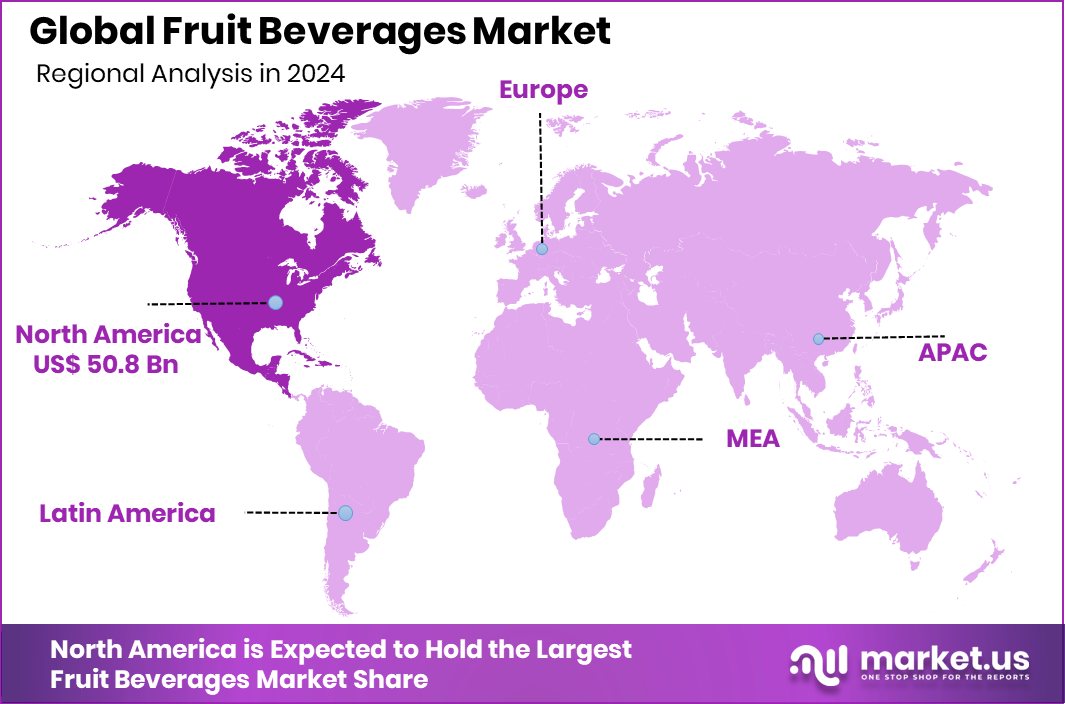

In 2024, North America held a 48.30% share of the Fruit Beverages Market, reaching USD 50.8 Bn.

The Fruit Beverages Market demonstrates significant regional diversity, driven by consumer preferences, lifestyle shifts, and health awareness across the globe. In 2024, North America emerged as the dominating region, holding a substantial 48.30% share valued at USD 50.8 billion.

This leadership is largely supported by the region’s high consumption of natural and functional drinks, as well as a mature retail infrastructure that promotes easy availability of fruit beverages in supermarkets, hypermarkets, and convenience stores.

Health-conscious consumers in the United States and Canada are increasingly opting for fruit-based options over carbonated sodas, which has further accelerated the demand for both fresh and packaged beverages.

Europe represents another important market, where rising interest in organic and clean-label products has shaped consumption trends, especially among younger populations. Asia Pacific is witnessing rapid growth fueled by urbanization, changing dietary habits, and increasing disposable incomes, particularly in emerging economies.

Meanwhile, the Middle East & Africa region is gaining attention due to growing awareness of hydration and wellness, while Latin America benefits from its rich fruit resources that support local beverage production.

Despite this global diversity, North America’s strong share highlights its position as the central hub for innovation and large-scale consumption in the fruit beverages market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Tropicana Products, Inc. continues to hold a trusted reputation in the fruit beverages space with its strong focus on juices that highlight freshness and natural taste. Its brand identity remains closely tied to health and nutrition, appealing to consumers who prioritize vitamins and natural energy in their daily diets.

The Coca-Cola Company, with its expansive global footprint, plays a vital role in pushing innovation across fruit-based beverages. Beyond traditional juices, the company has diversified into flavored drinks, reduced-sugar formats, and functional beverages, aligning with evolving wellness trends. Its wide distribution network ensures unmatched market penetration, especially in North America and Europe.

The Campbell’s Company contributes through its well-recognized portfolio of juice and beverage brands that emphasize quality and authenticity. The company has adapted to consumer demand for convenient, ready-to-drink products while also aligning with clean-label expectations.

Top Key Players in the Market

- Tropicana Products, Inc.

- The Coca‑Cola Company

- The Campbell’s Company

- Langer Juice Company, Inc.

- Ceres Fruit Juices Pty Ltd.

- Industries Lassonde Inc.

- Ocean Spray

- Fresh Del Monte

- Keurig Dr Pepper Inc.

- Danone S.A.

Recent Developments

- In June 2025, Campbell’s introduced a V8 Energy Drink Mix, turning its familiar fruit-forward energy beverage into a convenient, on-the-go powder. You just mix it with water, and it delivers a smooth taste along with 80 mg of natural caffeine from black and green tea. The launch includes three flavors—Pomegranate Blueberry, Peach Mango, and Strawberry Lemonade—and features eye-catching, vibrant packaging

- In February 2025, Coca-Cola entered the wellness segment with its first prebiotic soda, called Simply Pop. Launched under the Simply brand, it features real fruit juice, no added sugar, and contains six grams of prebiotic fiber per can, along with vitamin C and zinc. Flavors include Strawberry, Pineapple Mango, Fruit Punch, Lime, and Citrus Punch. The product targets health-focused Millennials and Gen Z and is available in select stores and via Amazon Fresh.

Report Scope

Report Features Description Market Value (2024) USD 105.2 Billion Forecast Revenue (2034) USD 186.6 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Canned and Fresh, Non-carbonated Drinks, Frozen Juices), By Distribution Channel (Hypermarket/Supermarket, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tropicana Products, Inc., The Coca‑Cola Company, The Campbell’s Company, Langer Juice Company, Inc., Ceres Fruit Juices Pty Ltd., Industries Lassonde Inc., Ocean Spray, Fresh Del Monte, Keurig Dr Pepper Inc., Danone S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fruit Beverages MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Fruit Beverages MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tropicana Products, Inc.

- The Coca‑Cola Company

- The Campbell's Company

- Langer Juice Company, Inc.

- Ceres Fruit Juices Pty Ltd.

- Industries Lassonde Inc.

- Ocean Spray

- Fresh Del Monte

- Keurig Dr Pepper Inc.

- Danone S.A.