Freeze Drying Equipment Market Report By Product (Bench Top Freeze Dryers , Laboratory Freeze Dryers , Mobile Freeze Dryers , General Purpose Freeze Dryers , Industrial Freeze Dryers , Others ), By Application (Food Processing , Biotechnology , Pharmaceuticals , Surgical Procedures , Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 13114

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

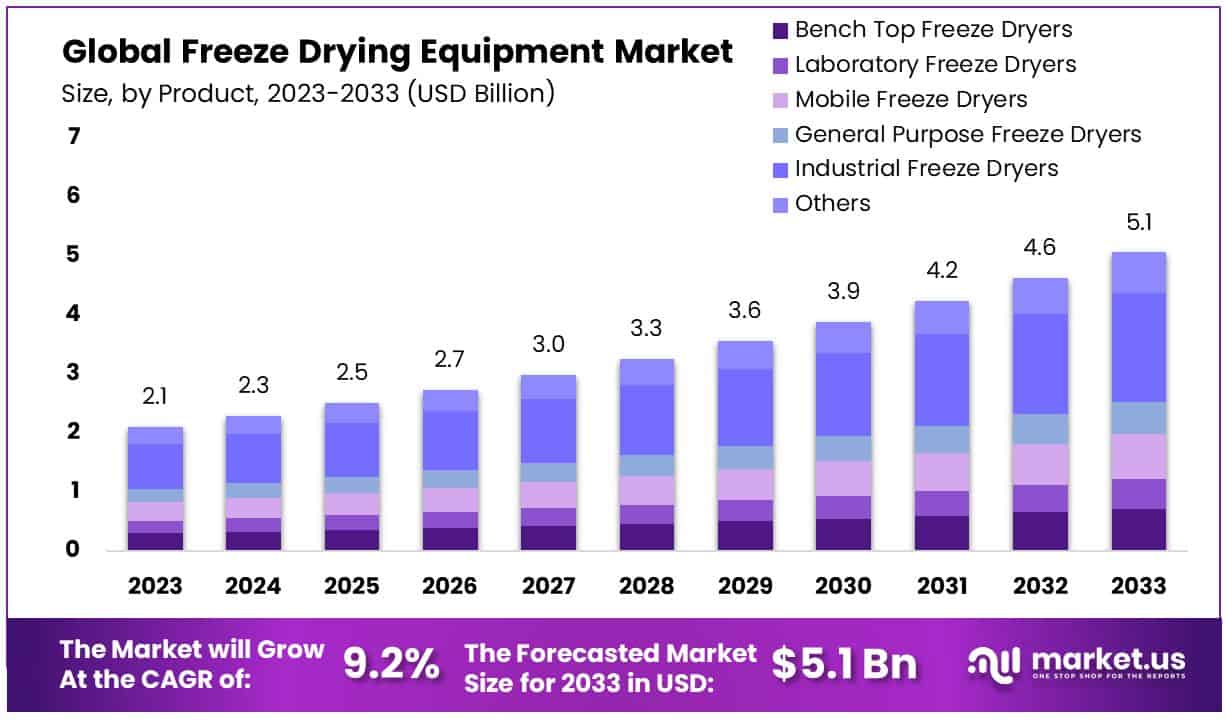

The Global Freeze Drying Equipment Market size is expected to be worth around USD 5.1 Billion by 2033, from USD 2.1 Billion in 2023, growing at a CAGR of 9.20% during the forecast period from 2024 to 2033.

The Freeze Drying Equipment Market encompasses the technology and machinery used to dehydrate products by freezing them and then reducing the surrounding pressure to allow the frozen water in the product to sublimate directly from the ice phase to the gas phase.

This market is experiencing growth due to the rising demand in the pharmaceutical and biotechnology industries, where preserving biological material while maintaining its integrity is crucial. Additionally, the food and beverage sector utilizes freeze drying to extend shelf life and preserve nutritional value. The focus is on developing more energy-efficient, cost-effective, and scalable freeze drying solutions to meet the expanding needs of diverse industries.

The Freeze Drying Equipment Market is strategically positioned at the nexus of significant industrial and economic trends, reflecting the broader dynamics of the pharmaceutical, food, and biotechnology sectors. With North America accounting for 52.3% of global pharmaceutical sales and Europe at 22.4%, the imperative for advanced preservation techniques in these regions becomes evident.

Particularly in the U.S., which represents 43.7% of the global pharmaceutical market in 2023, the demand for freeze drying equipment is bolstered by the critical need for reliable drug preservation and storage solutions that maintain product integrity and efficacy.

This market’s relevance is further magnified by the global agricultural sector’s vast scale, with the production of primary crops reaching 9.5 billion tonnes and agriculture, forestry, and fishing generating a global value added of $3.7 trillion, while employing 873 million people worldwide. The application of freeze drying technology in preserving a portion of this vast output can significantly impact food security, nutritional quality, and the economic viability of food products by extending shelf life and reducing transportation weights.

These significant economic sectors with the technological capabilities of freeze drying equipment underscores a market ripe for growth and innovation. The challenge lies in developing equipment that is not only efficient and cost-effective but also scalable to meet the demands of industries ranging from pharmaceuticals to agriculture.

As such, investments in R&D, a focus on energy efficiency, and the adaptation to emerging market needs are pivotal strategies for companies within this space. The future trajectory of the Freeze Drying Equipment Market is closely tied to global trends in healthcare, food production, and sustainability, promising substantial opportunities for industry leaders and innovators.

Key Takeaways

- Market Value: The Freeze Drying Equipment Market is forecasted to reach USD 5.1 billion by 2033, growing at a CAGR of 9.20% from 2024 to 2033.

- Dominant Segments:

- Product Analysis: Industrial Freeze Dryers lead with a substantial share of 36.5%, catering to pharmaceutical and food industries’ needs for large-scale preservation. Other segments like Bench Top, Laboratory, Mobile, and General Purpose Freeze Dryers also play vital roles, reflecting the diverse applications of freeze-drying technology.

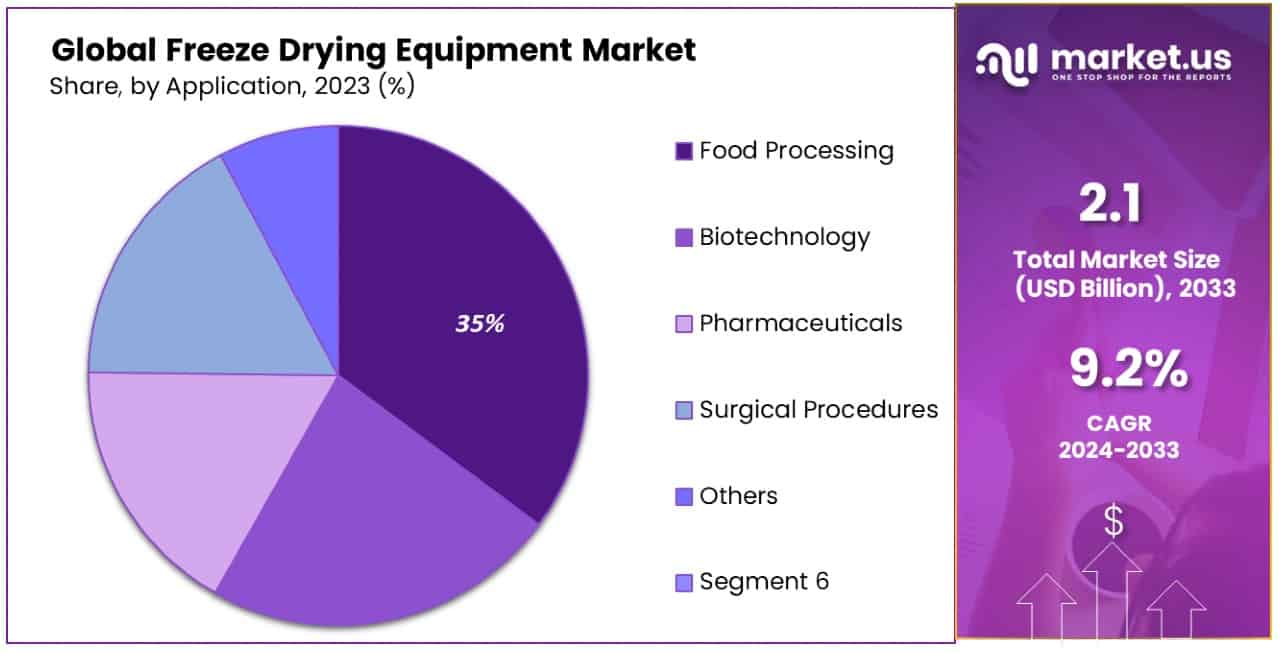

- Application Analysis: Food Processing dominates with a share of 35.2%, driven by consumer demand for preserved foods with retained nutritional value. Biotechnology, Pharmaceuticals, and Surgical Procedures also significantly contribute to the market, showcasing the technology’s versatility across industries.

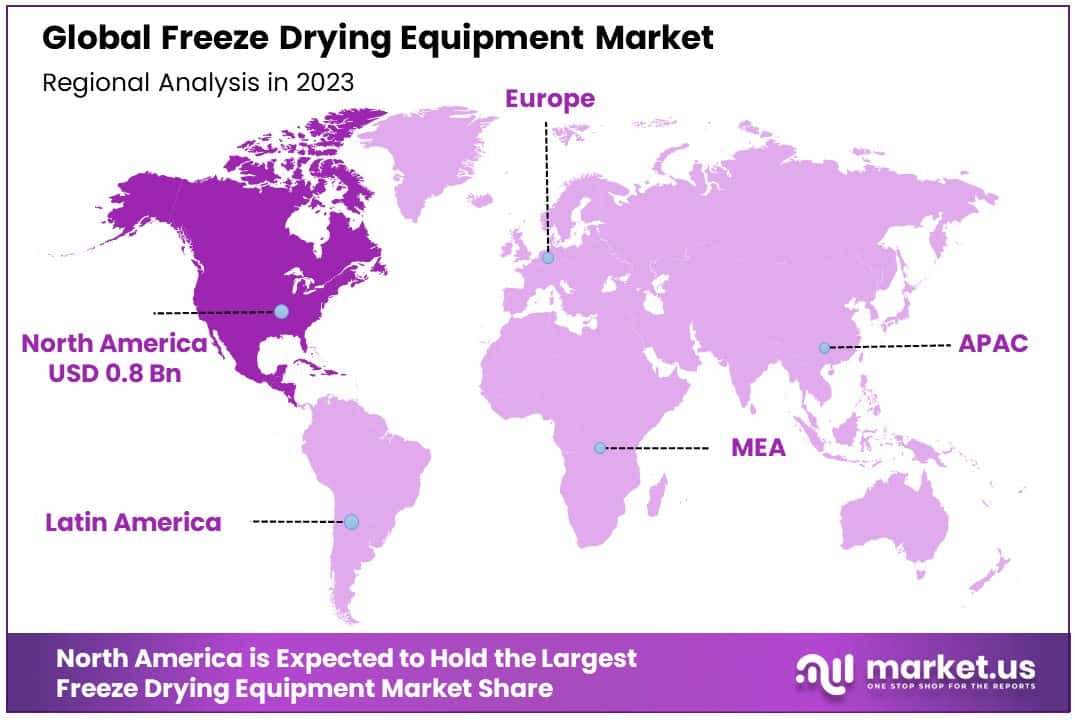

- Regional Dynamics: North America holds the largest market share of 37.1%, driven by robust demand for freeze-drying equipment. Europe follows closely with a 29.5% market share, focusing on pharmaceuticals and biotechnology.

- Analyst Viewpoint: Analysts foresee continued growth in the Freeze Drying Equipment Market, fueled by increasing demand for preserved foods, advancements in pharmaceuticals and biotechnology, and the technology’s adaptability across sectors.

- Growth Opportunities: Opportunities for growth lie in catering to the evolving needs of food processing, pharmaceutical, and biotechnology industries, driving innovation in freeze-drying technology. Expansion into emerging markets, strategic partnerships, and investments in research and development can further propel market growth and technological advancements.

Driving Factors

Increasing Demand from Pharmaceutical and Biotechnology Industries Drives Market Growth

The pharmaceutical and biotechnology sectors are key drivers of the freeze-drying equipment market. This trend is largely due to the critical role freeze-drying plays in preserving heat-sensitive products, such as vaccines, antibiotics, and biopharmaceuticals. The necessity for these products is escalating, propelled by an aging global population and the rising incidence of chronic diseases. Specifically, the COVID-19 pandemic has markedly increased the demand for freeze-dried vaccines.

This surge underscores the indispensability of freeze-drying equipment in responding to global health emergencies and routine medical needs alike. This growth is supported by ongoing investments in healthcare infrastructure and research, amplifying the demand for advanced preservation techniques that ensure the longevity and efficacy of vital pharmaceuticals and biologics.

Adoption of Freeze-Drying in the Food and Beverage Industry Enhances Market Prospects

The food and beverage industry’s embrace of freeze-drying technology has significantly contributed to the expansion of the freeze-drying equipment market. This adoption stems from the technology’s capability to extend the shelf life of food products without compromising their nutritional content or flavor. Freeze-dried items, including fruits, vegetables, and coffee, are increasingly favored for their convenience and durability, catering to the modern consumer’s preference for quality and longevity in food products.

Major corporations such as Nestlé and Starbucks are at the forefront of integrating freeze-drying technology to meet this demand. The market for freeze-dried foods is expected to witness robust growth, with projections indicating a CAGR of approximately 7.4% over the next five years. This trend is reflective of a broader shift towards healthier and more sustainable food consumption patterns, driving innovation and investment in freeze-drying technology across the sector.

Increasing Demand for Lyophilized Products in Cosmetics and Nutraceuticals Promotes Market Growth

The cosmetics and nutraceuticals industries are increasingly incorporating freeze-drying techniques to enhance product stability and shelf life. This method is particularly effective in preserving the potency of cosmetic ingredients like plant extracts and essential oils, thereby maintaining their effectiveness in skincare and personal care products.

In the nutraceutical sector, freeze-dried dietary supplements and probiotics benefit from extended shelf life and preserved bioactivity, making them more appealing to health-conscious consumers. The global market for freeze-dried cosmetic and nutraceutical products is anticipated to grow at a significant pace, with the nutraceuticals segment alone expected to expand at a CAGR of around 6.5% through 2025. This growth is indicative of a larger trend towards natural and long-lasting health and beauty products, further catalyzing the demand for freeze-drying solutions in these industries.

Restraining Factors

High Initial Investment and Operating Costs Restrain Market Growth

The need for substantial initial capital and the presence of ongoing high operating expenses significantly hinder the adoption of freeze-drying technology, especially among small and medium-sized enterprises (SMEs). Freeze-drying equipment is not only expensive to purchase but also to operate, given its energy-intensive nature and the requirement for specialized personnel to manage the process. This financial barrier is particularly prohibitive in markets where cost-efficiency is paramount.

As a result, many companies, especially those with limited budgets, may opt for less expensive preservation methods despite the superior quality and longevity that freeze-drying offers. The high cost associated with freeze-drying equipment can slow market expansion as potential users hesitate or decline to invest in this technology, seeking more affordable alternatives to meet their preservation needs.

Stringent Regulatory Requirements Restrain Market Growth

Stringent regulatory requirements pose significant challenges to the growth of the freeze-drying equipment market, particularly within the pharmaceutical and biotechnology sectors. These industries are governed by rigorous standards that dictate the manufacturing processes and equipment, including compliance with Good Manufacturing Practices (GMP) and stringent validation protocols. Achieving and maintaining compliance requires additional investment in both time and resources, potentially leading to increased costs and delays in the deployment of new freeze-drying technology.

These regulatory hurdles can be daunting for many companies, possibly deterring them from investing in freeze-drying equipment. The need to navigate complex regulatory landscapes adds an extra layer of difficulty to the adoption process, impacting the market’s expansion as companies weigh the benefits of freeze-drying technology against the effort and expense required to comply with these stringent standards.

Product Analysis

Industrial Freeze Dryers Lead Freeze Drying Equipment Market with 36.5% Market Share, Catering to Pharmaceutical and Food Industries

Within the Freeze Drying Equipment Market, the “By Product” segment showcases a varied range of equipment tailored to meet specific needs, from research and development in laboratories to large-scale industrial production. Among these, Industrial Freeze Dryers emerge as the dominant sub-segment, holding a significant market share of 36.5%.

This prominence is attributable to the extensive application of these dryers in the pharmaceutical and food industries, where the demand for preserving large volumes of products without sacrificing quality is paramount. Industrial freeze dryers are engineered to handle substantial quantities, making them indispensable for operations that require the lyophilization of large batches of products, thereby ensuring efficiency and scalability.

The efficiency and scalability provided by industrial freeze dryers cater to the critical requirements of the pharmaceutical industry for the preservation of complex biologicals such as vaccines and antibodies, which are sensitive to heat and require precise moisture removal to maintain efficacy. Additionally, in the food sector, these dryers help in extending the shelf life of products while retaining nutritional values, flavor, and texture, aligning with consumer preferences for high-quality, long-lasting food items.

The other sub-segments, though not as dominant, play crucial roles in the market’s growth. Bench Top Freeze Dryers, Laboratory Freeze Dryers, and Mobile Freeze Dryers are pivotal for research and development purposes, especially in academic and biotechnology sectors, where smaller, more precise drying processes are necessary. General Purpose Freeze Dryers, on the other hand, offer versatility and are used across various sectors for a wide range of applications, including food preservation, pharmaceuticals, and even in technological fields for the lyophilization of electronic components.

Application Analysis

Food Processing Dominates Freeze Drying Equipment Market with 35.2% Market Share, Driven by Demand for Convenient and Nutritious Preserved Foods

In the application segment of the Freeze Drying Equipment Market, Food Processing stands out with a substantial share of 35.2%, underscoring its dominance. This segment’s significant market share is largely due to the increasing consumer demand for preserved foods that retain nutritional value, taste, and texture. Freeze-dried products, such as fruits, vegetables, and ready-to-eat meals, have gained popularity for their extended shelf life and ease of storage, making them ideal for busy lifestyles and emergency food supplies. The technology’s ability to lock in the freshness and nutritional content of food items without the use of preservatives appeals to the growing segment of health-conscious consumers.

The food processing segment’s growth is further fueled by the global trend towards convenience foods and the increasing interest in natural and organic food products. Freeze drying allows for the preservation of these products without diminishing their quality, meeting consumer expectations for healthy and convenient food options. Additionally, the rise in outdoor recreational activities and the need for lightweight, portable food options have contributed to the expansion of the freeze-dried food market.

Other applications such as Biotechnology, Pharmaceuticals, and Surgical Procedures also significantly contribute to the market’s dynamics. The biotechnology and pharmaceutical segments, in particular, rely heavily on freeze-drying equipment for the preservation of biological samples, vaccines, and other pharmaceutical products, where maintaining the integrity and efficacy of these items is crucial. Surgical procedures benefit from freeze-dried products due to their longevity and ease of storage, which are vital for medical supplies and emergency preparedness.

Key Market Segments

By Product

- Bench Top Freeze Dryers

- Laboratory Freeze Dryers

- Mobile Freeze Dryers

- General Purpose Freeze Dryers

- Industrial Freeze Dryers

- Others

By Application

- Food Processing

- Biotechnology

- Pharmaceuticals

- Surgical Procedures

- Others

Growth Opportunities

Development of Portable and Compact Freeze-Drying Equipment Offers Growth Opportunity

The trend towards miniaturization in the freeze-drying equipment market opens up vast opportunities, especially within the pharmaceutical and biotechnology industries. Portable and compact freeze-drying units are becoming increasingly sought after by smaller facilities, research laboratories, and field operations that require the ability to perform lyophilization but are constrained by limited space or the need for mobility. Such developments allow for the on-site processing of samples, facilitating immediate freeze-drying activities in remote locations or small-scale settings.

This adaptability not only broadens the market for freeze-drying equipment but also encourages innovation and customization in product offerings. The introduction of compact units by companies like Millrock Technology, designed for small-scale research applications, exemplifies the industry’s response to this demand. This trend towards portability and compactness is expected to drive market growth by making freeze-drying technology accessible to a wider range of users, fostering expansion in both existing and emerging sectors.

Integration of Internet of Things (IoT) and Automation Offers Growth Opportunity

The incorporation of Internet of Things (IoT) and automation technologies into freeze-drying equipment represents a substantial growth avenue for the industry. By integrating IoT sensors and automated monitoring systems, manufacturers can significantly enhance the efficiency and reliability of freeze-drying processes. Real-time tracking of equipment performance and optimization of freeze-drying cycles can result in reduced operational downtime, enhanced product quality, and lower production costs.

Moreover, the automation of freeze-drying processes reduces the need for manual intervention, thereby minimizing the risk of human error and ensuring consistency in product output. Leading players in the freeze-drying equipment market have started to leverage these technologies, indicating a shift towards more intelligent and self-regulating systems. This technological advancement not only caters to the demand for higher quality and efficiency but also positions the freeze-drying equipment industry at the forefront of innovation, unlocking new potentials for market growth and expansion.

Trending Factors

Sustainability and Energy Efficiency Are Trending Factors

The push towards sustainability and energy efficiency is reshaping the freeze-drying equipment market. This trend reflects a broader industry movement towards reducing energy consumption, minimizing waste, and lowering carbon footprints. As environmental concerns become more central to business operations, companies across sectors are seeking equipment that aligns with these values. Freeze-drying equipment that features energy-efficient designs and eco-friendly operations is increasingly in demand.

Manufacturers responding to this trend, like Labconco with their energy-conserving freeze dryers, are not only meeting market demand but also setting new standards for industry practices. This shift towards sustainability is not just about environmental responsibility; it also offers economic benefits by reducing operational costs, making it a compelling trend for both suppliers and users of freeze-drying technology. As more companies aim to balance performance with sustainability, energy-efficient freeze-drying solutions are poised to become a key market differentiator, driving innovation and competitive advantage.

Single-Use and Disposable Equipment Are Trending Factors

The adoption of single-use and disposable equipment is rapidly becoming a significant trend in the freeze-drying equipment market, especially within the pharmaceutical and biotechnology sectors. This trend is largely driven by the need to enhance operational efficiency, reduce contamination risks, and streamline product changeovers. Single-use systems offer a practical solution to these challenges, eliminating the complexities associated with cleaning and validation processes associated with traditional equipment.

By embracing single-use freeze-drying technologies, companies are catering to a growing market demand for more flexible and efficient manufacturing processes. This trend is indicative of a broader shift towards more agile and responsive production methods in the life sciences industry, where reducing downtime and avoiding cross-contamination are paramount. As the demand for faster, safer, and more efficient production continues to rise, single-use and disposable freeze-drying equipment is set to play a pivotal role in the industry’s future, marking a clear trend towards innovation and adaptability.

Regional Analysis

North America Dominates with 37.1% Market Share

North America holds a significant position in the Freeze Drying Equipment Market, commanding a 37.1% share. This dominance is attributed to several key factors, including advanced research and development facilities, a strong pharmaceutical and biotechnology industry, and increasing demand for preserved food products. The region benefits from a robust infrastructure that supports innovation and the adoption of new technologies. Additionally, the presence of key market players and a regulatory environment that encourages investment in healthcare and biotechnology contribute to North America’s leading position.

The market dynamics in North America are characterized by a high level of technological adoption and a focus on quality and efficiency. The demand for freeze-drying equipment is bolstered by the region’s advanced healthcare sector and its significant investment in research and development activities. This is further supported by the consumer trend towards convenience foods and the increasing awareness of the benefits of freeze-dried products, which include long shelf life and retention of nutritional value.

For other regions:

- Europe: Europe holds a substantial market share, with a strong focus on pharmaceuticals and biotechnology driving demand for freeze-drying equipment. The region’s market share is estimated at 29.5%. Europe’s advanced healthcare system and stringent regulatory standards support the adoption of innovative freeze-drying technologies.

- Asia Pacific: This region is witnessing rapid growth, with a market share of 22.4%. The growth is driven by expanding pharmaceutical and food processing industries in countries like China and India. Investments in healthcare infrastructure and rising consumer demand for quality food products contribute to the growth rate.

- Middle East & Africa: Holding a smaller share of the market at 6.3%, this region’s growth is gradually increasing due to developments in the pharmaceutical and food sectors, alongside improving healthcare infrastructure.

- Latin America: With a market share of 4.7%, Latin America’s freeze-drying equipment market is growing, fueled by the expanding food processing and pharmaceutical industries. Increasing investments in research and development activities are expected to drive market growth in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Freeze Drying Equipment Market, the presence of key players such as SP Industries, Inc., GEA Group AG, Millrock Technology, Inc., and Labconco Corporation, among others, underscores a competitive landscape marked by technological innovation and strategic market positioning.

Companies like Thermo Fisher Scientific Inc. and Azbil Telstar, S.L. are recognized for their significant contributions to advancing freeze-drying technology, offering comprehensive solutions that cater to the pharmaceutical, biotechnological, and food processing industries. IMA Group and HOF Sonderanlagenbau GmbH stand out for their customization capabilities, addressing unique industry requirements.

Meanwhile, entities such as Cuddon Freeze Dry, Biopharma Technology, Martin Christ Gefriertrocknungsanlagen GmbH, and Freezedry Specialities, Inc. bring specialized expertise, enhancing the market’s diversity with niche solutions and services. Collectively, these companies influence the market through their innovation, quality, and service offerings, driving the adoption of freeze-drying equipment across various sectors. Their strategic focus on research and development, coupled with a commitment to sustainability and efficiency, positions them as pivotal in shaping the market’s future direction.

Market Key Players

- SP Industries, Inc.

- GEA Group AG

- Millrock Technology, Inc.

- Labconco Corporation

- Thermo Fisher Scientific Inc.

- Azbil Telstar, S.L.

- IMA Group

- HOF Sonderanlagenbau GmbH

- Cuddon Freeze Dry

- Biopharma Technology

- Martin Christ Gefriertrocknungsanlagen GmbH

- Freezedry Specialities, Inc.

Recent Developments

- On January 2024, Parker Freeze Dry, a division of ProForm Fabrication, completed the relocation to its new 130,000-square-foot facility in Beresford, South Dakota. The fully air-conditioned environment and enhanced equipment aim to increase production capacity and streamline operations for the fabrication and testing of freeze dryers.

- On January 2024, Elementar, a technology leader in elemental analysis, and Martin Christ, a world-leading developer and manufacturer of freeze dryers, announced a collaboration in the Americas region. This partnership focuses on sales, service, and support, combining Elementar’s expertise in elemental analysis with Martin Christ’s innovative freeze drying technology.

- On August 2023, GSK announced an investment exceeding €250 million ($272 million) to establish a new unit for freeze-drying vaccines at its Wavre campus in Belgium. This significant investment is part of GSK’s strategy to enhance its vaccine manufacturing capabilities and support the production of freeze-dried vaccines, including the newly launched RSV shot Arexvy.

Report Scope

Report Features Description Market Value (2023) USD 2.1 Billion Forecast Revenue (2033) USD 5.1 Billion CAGR (2024-2033) 9.20% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Bench Top Freeze Dryers , Laboratory Freeze Dryers , Mobile Freeze Dryers , General Purpose Freeze Dryers , Industrial Freeze Dryers , Others ), By Application (Food Processing , Biotechnology , Pharmaceuticals , Surgical Procedures , Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape SP Industries, Inc., GEA Group AG, Millrock Technology, Inc., Labconco Corporation , Thermo Fisher Scientific Inc., Azbil Telstar, S.L. , IMA Group, HOF Sonderanlagenbau GmbH, Cuddon Freeze Dry, Biopharma Technology, Martin Christ Gefriertrocknungsanlagen GmbH, Freezedry Specialities, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected size of the Global Freeze Drying Equipment Market by 2033?The Global Freeze Drying Equipment Market is expected to reach a value of around USD 5.1 Billion by 2033, growing from USD 2.1 Billion in 2023, at a CAGR of 9.20% during the forecast period from 2024 to 2033.

What are the dominant segments within the Freeze Drying Equipment Market?Industrial Freeze Dryers lead with a substantial share of 36.5%, catering to pharmaceutical and food industries' needs for large-scale preservation. Other segments include Bench Top, Laboratory, Mobile, and General Purpose Freeze Dryers.

What are the key drivers of growth in the Freeze Drying Equipment Market?The increasing demand from pharmaceutical and biotechnology industries, adoption of freeze-drying in the food and beverage industry, and rising demand for lyophilized products in cosmetics and nutraceuticals are key drivers of market growth.

Which regions dominate the Freeze Drying Equipment Market?North America holds the largest market share of 37.1%, followed by Europe with 29.5%. Asia Pacific, Middle East & Africa, and Latin America also contribute to the market's growth.

Freeze Drying Equipment MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Freeze Drying Equipment MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- GEA Group

- Labconco Corporation

- Azbil Corporation

- Tofflon Science and Technology Co. Ltd