Foundry Chemicals Market Report By Product Type (Binders & Resins, Coatings, Fluxes, Additives, Others), By Application (Cast Iron, Steel, Aluminium, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121551

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

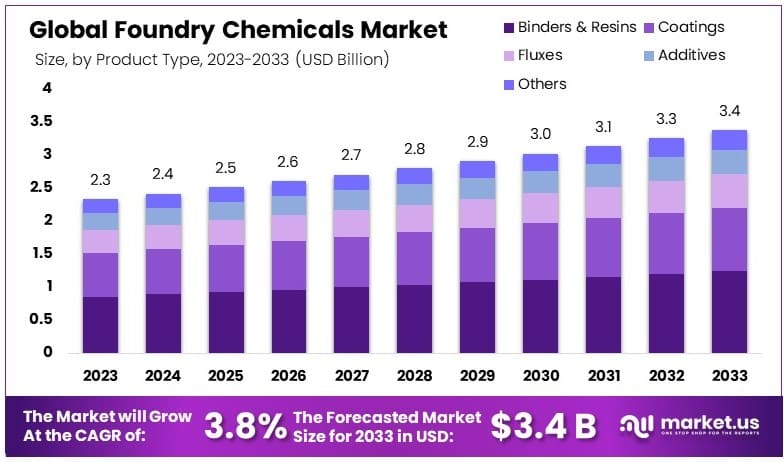

The Global Foundry Chemicals Market size is expected to be worth around USD 3.4 Billion by 2033, from USD 2.3 Billion in 2023, growing at a CAGR of 3.8% during the forecast period from 2024 to 2033.

The foundry chemicals market involves the sale of essential chemicals used in metal casting processes. These chemicals include binders, coatings, additives, and parting agents, which enhance the quality and efficiency of cast metal products.

This market serves industries such as automotive, aerospace, machinery, and construction, where precision and durability are crucial. The demand for foundry chemicals is linked to the manufacturing sector’s expansion and technological enhancements in metal casting techniques, focusing on environmental sustainability and operational efficiency.

The Foundry Chemicals Market is experiencing a phase of steady growth, fueled by increasing industrial activities and technological advancements in metal casting processes. Foundry chemicals are pivotal in enhancing the quality and efficiency of the metal casting industry, which serves a critical function across various sectors including automotive, aerospace, and construction.

A closer analysis reveals that the market’s expansion is closely linked to the rising demand for high-quality castings in the automotive and aerospace sectors. These industries require precise and durable components, which in turn drives the demand for superior foundry chemicals that can ensure optimal mold and core performance during metal casting.

Moreover, environmental considerations are becoming increasingly significant. The market is witnessing a shift towards more sustainable and eco-friendly chemicals, which not only meet regulatory standards but also appeal to a growing segment of environmentally conscious consumers. This shift is prompting manufacturers to innovate and develop products that reduce emissions and waste, thereby contributing to the market’s growth.

Furthermore, the adoption of new technologies such as 3D printing in foundries is opening up novel applications for foundry chemicals, enhancing their market prospects. As the foundry industry continues to evolve, the demand for specialized chemicals that can accommodate these advanced technologies is expected to rise.

In conclusion, the Foundry Chemicals Market is set on a growth trajectory, driven by technological innovations and a push towards sustainability. Market participants would benefit from investing in R&D to cater to the technological and environmental demands of the future, ensuring sustained growth in this dynamic market.

Key Takeaways

- Market Value: The Foundry Chemicals Market was valued at $2.3 billion in 2023 and is expected to reach $3.4 billion by 2033, with a CAGR of 3.8%.

- Product Type Analysis: Binders & Resins dominated with 36.8%; they are essential for improving mold strength and casting quality.

- Application Analysis: Cast Iron led with 38.5%; it is significant due to its extensive use in automotive and industrial machinery.

- Dominant Region: APAC dominated with 42.1%; driven by the large-scale manufacturing and automotive industries in the region.

- High Growth Region: North America shows promising growth; technological advancements and investments in the foundry industry boost demand.

- Analyst Viewpoint: The market is moderately competitive with steady growth. Future trends indicate increased use of eco-friendly chemicals and technological innovations.

- Growth Opportunities: Key players can focus on sustainable product development, expanding in emerging markets, and enhancing product performance to gain a competitive edge.

Driving Factors

Rising Demand from Automotive Industry Drives Market Growth

The automotive industry remains a key consumer of foundry chemicals, driven by the increasing production of vehicles globally. Foundry chemicals play a crucial role in the casting process, ensuring the quality and durability of automotive metals. As the demand for vehicles continues to grow, particularly in emerging economies, the need for foundry chemicals will subsequently rise.

Automakers like Toyota, Volkswagen, and General Motors rely heavily on foundry operations to produce engine blocks, cylinder heads, and other critical components. The quality of these parts is heavily dependent on the efficient use of foundry chemicals during the casting process.

The interaction between automotive production and foundry chemical usage is synergistic. As vehicle manufacturers ramp up production to meet consumer demand, the foundry industry must innovate and scale up its chemical solutions to maintain quality and efficiency. Additionally, advancements in automotive technologies, such as electric vehicles (EVs), which require lightweight yet durable components, further bolster the need for specialized foundry chemicals. Thus, the automotive sector’s growth directly amplifies the expansion of the foundry chemicals market.

Advancements in Foundry Technology Drive Market Growth

Continuous advancements in foundry technology have led to the development of new and improved foundry chemicals. These advanced chemicals offer enhanced performance, increased efficiency, and better environmental compliance. As foundries strive to improve their processes and meet stringent quality standards, the adoption of these advanced foundry chemicals is expected to drive market growth.

The development of new binder systems, insulating materials, and refractory coatings has enabled foundries to improve their casting processes, reduce defects, and enhance the overall quality of their products. For instance, the introduction of eco-friendly binder systems has reduced harmful emissions, aligning with global environmental regulations.

These technological advancements interact with other market drivers, such as the automotive and construction industries, by providing more efficient and sustainable solutions. As foundries adopt these technologies, they can produce higher quality cast components more efficiently, meeting the rising demands from various end-use industries. Consequently, the continuous improvement in foundry technology significantly contributes to the expansion of the foundry chemicals market.

Growth in Construction and Infrastructure Development Drives Market Growth

The construction and infrastructure sectors are significant consumers of foundry products, such as pipes, fittings, and structural components. As governments around the world invest in infrastructure projects and urbanization continues, the demand for foundry products, and consequently, foundry chemicals, is expected to increase.

The construction of bridges, high-rise buildings, and transportation infrastructure requires the use of high-quality cast components, which are produced using foundry processes and foundry chemicals. Global infrastructure investment is projected to reach $94 trillion by 2040, with significant contributions from developing countries, driving the demand for foundry chemicals.

The interplay between infrastructure development and the foundry chemicals market is significant. As construction projects scale up, the need for durable and reliable cast components grows, directly boosting the demand for foundry chemicals. Furthermore, advancements in foundry technologies that improve product quality and reduce environmental impact further align with the stringent requirements of modern infrastructure projects, reinforcing the growth trajectory of the foundry chemicals market.

Restraining Factors

Environmental Regulations and Concerns Restrain Market Growth

The foundry industry faces stringent environmental regulations due to emissions, waste generation, and pollution concerns. Certain foundry chemicals contain hazardous substances, leading to increased scrutiny and stricter regulations. This can hinder market growth as manufacturers may need to invest in alternative, environmentally friendly solutions.

For instance, the use of organic binders and core washing chemicals has come under scrutiny for their impact on air quality and water pollution. Regulations like the EU’s REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) require manufacturers to limit the use of harmful substances. Compliance with these regulations can be costly and time-consuming, discouraging the use of traditional foundry chemicals. As a result, foundries may shift towards eco-friendly alternatives, which can be more expensive and less effective, thus restraining market growth.

Volatility in Raw Material Prices Restrains Market Growth

Foundry chemicals rely on various raw materials, including minerals, metals, and organic compounds. Fluctuations in the prices of these raw materials can significantly impact the cost of production for foundry chemicals, affecting their affordability and profitability for manufacturers and end-users.

For example, the price volatility of bentonite, a key component in foundry sand binders, can lead to increased production costs for foundry chemical manufacturers. The cost of bentonite fluctuated by over 20% in the past year, directly impacting the pricing of foundry chemicals. This price instability makes it difficult for manufacturers to maintain consistent pricing, potentially reducing demand and hampering market growth. End-users may seek cheaper alternatives or reduce their consumption, further restraining the market.

Product Type Analysis

Binders & Resins dominate with 36.8% due to their critical role in improving the quality and durability of castings.

Binders and resins represent the most significant sub-segment in the foundry chemicals market, accounting for 36.8% of the sector. This predominance can be attributed to the essential function these chemicals serve in the foundry process, where they are used to enhance the integrity and finish of metal castings. Binders and resins are critical for creating molds and cores in metal casting, as well as iron casting as they help in binding the sand particles together to form a stable mold. This is crucial for producing high-precision and quality castings required in various industrial applications, including automotive, aerospace, and heavy machinery.

The demand for high-quality castings in these industries drives the continued growth and innovation within this sub-segment. Technological advancements in binder and resin formulations have led to the development of products that offer improved environmental compliance, reduced emissions, and better recyclability, aligning with the global push towards sustainability. This has not only sustained but also enhanced their market position.

The other product types within the foundry chemicals market, such as coatings, fluxes, additives, and others, also play significant roles. Coatings, for example, protect the mold and enhance the surface finish of the final product, while fluxes are used to purify metals during the melting process. Additives are integral for modifying properties of the metal during the casting process to achieve desired characteristics. Although binders and resins dominate the market, the combined utility of these other segments supports the overall growth and innovation in foundry chemicals, ensuring comprehensive solutions that cater to a broad spectrum of foundry needs.

Application Analysis

Cast Iron dominates with 38.5% due to its extensive use in automotive and construction applications.

The application of foundry chemicals in cast iron casting dominates the market, with a 38.5% share, reflecting the extensive use of cast iron in various end-use industries such as automotive, construction, and heavy machinery. Cast iron is favored for its excellent fluidity, castability, and machinability, alongside significant cost-effectiveness, which makes it a preferred material for manufacturing complex and heavy-duty parts. In the automotive sector, cast iron is used extensively to produce engine blocks, cylinder heads, and brake parts, where durability and performance are paramount.

This segment’s dominance is further bolstered by the continuous advancements in automotive technologies and the expanding infrastructure projects worldwide, which increase the demand for cast iron parts. Furthermore, the development of new alloys and improvement in the metallurgical properties of cast iron through the use of advanced foundry chemicals have enhanced the quality and performance of the final products, thereby supporting the growth of this application segment.

Other application segments, such as steel, aluminum, and others, also contribute significantly to the foundry chemicals market. Steel, known for its strength and versatility, is crucial in industries requiring high structural integrity, while aluminum is favored for its lightweight properties in sectors like aerospace and transportation. The growth of these segments is similarly driven by technological innovations and growing industrial demands. Although cast iron leads, the integration and development across all metal types highlight the foundry chemical industry’s role in meeting diverse industrial requirements and adapting to changing market dynamics.

Key Market Segments

By Product Type

- Binders & Resins

- Coatings

- Fluxes

- Additives

- Others

By Application

- Cast Iron

- Steel

- Aluminium

- Others

Growth Opportunities

Increasing Focus on Lightweight Materials Offers Growth Opportunity

The automotive and aerospace industries are increasingly focusing on lightweight materials to improve fuel efficiency and reduce emissions. Foundry chemicals are essential in producing lightweight metal alloys and advanced casting processes. This trend presents significant growth opportunities for foundry chemical manufacturers to develop specialized products for these materials.

The demand for aluminum and magnesium alloy castings in the automotive industry, for instance, has driven the development of specialized foundry chemicals. These chemicals enable foundries to produce high-quality components while meeting weight reduction targets. This growth is fueled by stringent emission regulations and the push towards electric vehicles. Consequently, the increasing focus on lightweight materials provides a substantial opportunity for foundry chemical manufacturers to innovate and expand their product offerings.

Development of Sustainable and Eco-friendly Foundry Chemicals Offers Growth Opportunity

With an increasing emphasis on sustainability and environmental responsibility, there is a growing demand for eco-friendly foundry chemicals that comply with stringent regulations. Manufacturers that can develop and offer sustainable foundry chemical solutions will gain a competitive edge in the market.

The development of water-based and biodegradable core binders, release agents, and other foundry chemicals has gained traction as foundries aim to reduce their environmental impact. These sustainable solutions help foundries comply with regulations such as the EU’s REACH and the US EPA standards. The market for eco-friendly foundry chemicals is expected to grow at a CAGR of 6.2% from 2023 to 2028, driven by increasing regulatory pressure and growing consumer awareness of environmental issues. Thus, the shift towards sustainable foundry chemicals offers manufacturers a significant growth opportunity to lead in an environmentally conscious market.

Trending Factors

Growth in Emerging Markets Are Trending Factors

Emerging economies, such as India, China, and Southeast Asian countries, are experiencing rapid industrialization and infrastructure development. This growth presents significant opportunities for the foundry chemicals market as foundries in these regions require high-quality and cost-effective foundry chemical solutions to meet the increasing demand for cast components.

The construction boom in countries like India and China has led to a surge in demand for foundry products such as pipes, fittings, and construction machinery components. This drives the need for foundry chemicals in these regions. For example, the Indian construction industry is projected to grow at a CAGR of 7.1% from 2023 to 2033, creating substantial demand for foundry chemicals. The rapid industrial growth in these emerging markets positions them as key areas for market expansion, making them trending factors in the foundry chemicals market.

Customized Foundry Chemical Solutions Are Trending Factors

As foundries strive to differentiate themselves and cater to specific customer requirements, there is a growing demand for customized foundry chemical solutions tailored to their unique processes and applications. Manufacturers that can offer tailored solutions and technical support will have a competitive advantage in the market.

A foundry specializing in high-precision aerospace components, for instance, may require customized foundry chemicals and binders to meet stringent quality standards. This presents an opportunity for foundry chemical manufacturers to develop specialized solutions. The need for specialized, high-quality cast components in industries like aerospace and automotive drives this trend, making customized solutions a significant factor in the foundry chemicals market.

Regional Analysis

APAC Dominates with 42.1% Market Share

The Asia-Pacific (APAC) region holds a dominant position in the foundry chemicals market with a 42.1% market share, valued at $0.98 billion. This dominance is driven by rapid industrialization and urbanization in countries like China and India. The growing automotive and construction industries in these countries significantly contribute to the high demand for foundry chemicals. Additionally, APAC’s cost-effective production capabilities and abundant availability of raw materials further enhance its market position.

Regional characteristics such as a large manufacturing base and supportive government policies positively influence the industry’s performance in APAC. The presence of numerous foundries and automotive manufacturing plants in the region boosts the demand for high-quality foundry chemicals. Moreover, the increasing focus on sustainable practices and the development of eco-friendly foundry chemicals align with global environmental regulations, further driving market growth in the region.

North America

North America holds a 25.3% market share in the foundry chemicals market. The region’s growth is driven by technological advancements and a strong automotive sector. The market is expected to grow at a CAGR of 4.2% from 2023 to 2028, supported by increased investments in sustainable foundry chemicals and innovative casting processes.

Europe

Europe accounts for 20.7% of the market share in the foundry chemicals industry. The region benefits from a well-established automotive industry and stringent environmental regulations. Europe’s market is projected to grow at a CAGR of 3.8% from 2023 to 2028, driven by the demand for eco-friendly foundry chemicals and advanced manufacturing technologies.

Middle East & Africa

The Middle East & Africa region has a 6.5% market share in the foundry chemicals market. The growth in this region is attributed to increasing infrastructure projects and industrialization. The market is expected to grow at a CAGR of 4.9% from 2023 to 2028, driven by the expansion of construction activities and the adoption of advanced foundry technologies.

Latin America

Latin America holds a 5.4% market share in the foundry chemicals market. The region’s growth is fueled by the automotive and construction industries. The market is projected to grow at a CAGR of 4.4% from 2023 to 2028, supported by increasing investments in industrial projects and the development of sustainable foundry chemicals.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Foundry Chemicals Market is influenced by several key players who drive innovation and market growth. Companies such as Vesuvius and ASK Chemicals hold significant market positions due to their extensive product portfolios and global reach. These companies focus on developing advanced foundry chemicals that improve casting efficiency and quality. Their strategic positioning allows them to cater to various industries, including automotive and construction, enhancing their market influence.

HÜTTENES-ALBERTUS Chemische Werke GmbH and Hüttenes-Albertus International are known for their strong R&D capabilities, enabling them to introduce eco-friendly and high-performance foundry chemicals. Imerys and IVP Limited contribute to the market with their expertise in mineral-based solutions and innovative products that meet stringent environmental regulations.

Asahi Yukizai Corporation and SQ Group leverage their regional strengths and advanced manufacturing techniques to supply high-quality foundry chemicals globally. General Chemical Corp. and KAO Chemicals are key players that emphasize sustainable solutions and customer-centric approaches, strengthening their market presence.

Fincast Foundry Flux Co. and Mazzon SpA are notable for their specialized products that cater to specific foundry needs, enhancing their strategic positioning within the market. Other key players continuously innovate and adapt to market trends, ensuring they remain competitive in the evolving foundry chemicals market.

Overall, the combined efforts of these companies drive the growth and development of the foundry chemicals market, with each player contributing through strategic initiatives, innovative products, and a strong focus on sustainability.

Market Key Players

- Vesuvius

- ASK Chemicals

- HÜTTENES-ALBERTUS Chemische Werke GmbH

- Imerys

- IVP Limited

- Asahi Yukizai Corporation

- SQ Group

- General Chemical Corp.

- Hüttenes-Albertus International

- KAO Chemicals

- Fincast Foundry Flux Co.

- Mazzon SpA

- Other Key Players

Recent Developments

- May 2024: Torishima Pump has renovated its in-house foundry to enhance production efficiency and quality. The renovation includes the installation of new equipment and the implementation of advanced manufacturing technologies to improve the foundry’s overall performance.

- January 2024: Ask Chemicals has unveiled a revolutionary feeding system at the IFEX tradeshow, designed to improve the efficiency and accuracy of chemical feeding in foundries. The system aims to reduce waste and enhance overall production quality.

Report Scope

Report Features Description Market Value (2023) USD 2.3 Billion Forecast Revenue (2033) USD 3.4 Billion CAGR (2024-2033) 3.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Binders & Resins, Coatings, Fluxes, Additives, Others), By Application (Cast Iron, Steel, Aluminium, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Vesuvius, ASK Chemicals, HÜTTENES-ALBERTUS Chemische Werke GmbH, Imerys, IVP Limited, Asahi Yukizai Corporation, SQ Group, General Chemical Corp., Hüttenes-Albertus International, KAO Chemicals, Fincast Foundry Flux Co., Mazzon SpA, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size of the Global Foundry Chemicals Market by 2033?The Global Foundry Chemicals Market is expected to reach USD 3.4 billion by 2033. The market is anticipated to grow at a CAGR of 3.8% during the forecast period.

Which industries primarily drive the demand for foundry chemicals?The automotive, aerospace, machinery, and construction industries are the primary drivers of demand for foundry chemicals.

Which region holds the largest share of the foundry chemicals market?The Asia-Pacific (APAC) region holds the largest market share at 42.1%, driven by large-scale manufacturing and automotive industries.

Who are some of the key players in the foundry chemicals market?Key players include Vesuvius, ASK Chemicals, HÜTTENES-ALBERTUS Chemische Werke GmbH, Imerys, and Asahi Yukizai Corporation.

-

-

- Vesuvius

- ASK Chemicals

- HÜTTENES-ALBERTUS Chemische Werke GmbH

- Imerys

- IVP Limited

- Asahi Yukizai Corporation

- SQ Group

- General Chemical Corp.

- Hüttenes-Albertus International

- KAO Chemicals

- Fincast Foundry Flux Co.

- Mazzon SpA

- Other Key Players