Global Food Coating Market by Type (Sugars & Syrups, Cocoa & Chocolates, Fats & Oils, Spices & Seasonings, Flours, Batter & Crumbs), By Form (Dry and Liquid), By Application (Meat & Poultry Products, Confectionery Products, Bakery Products, Ready to Eat Cereals, Fruits & vegetables, Snacks), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 104988

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

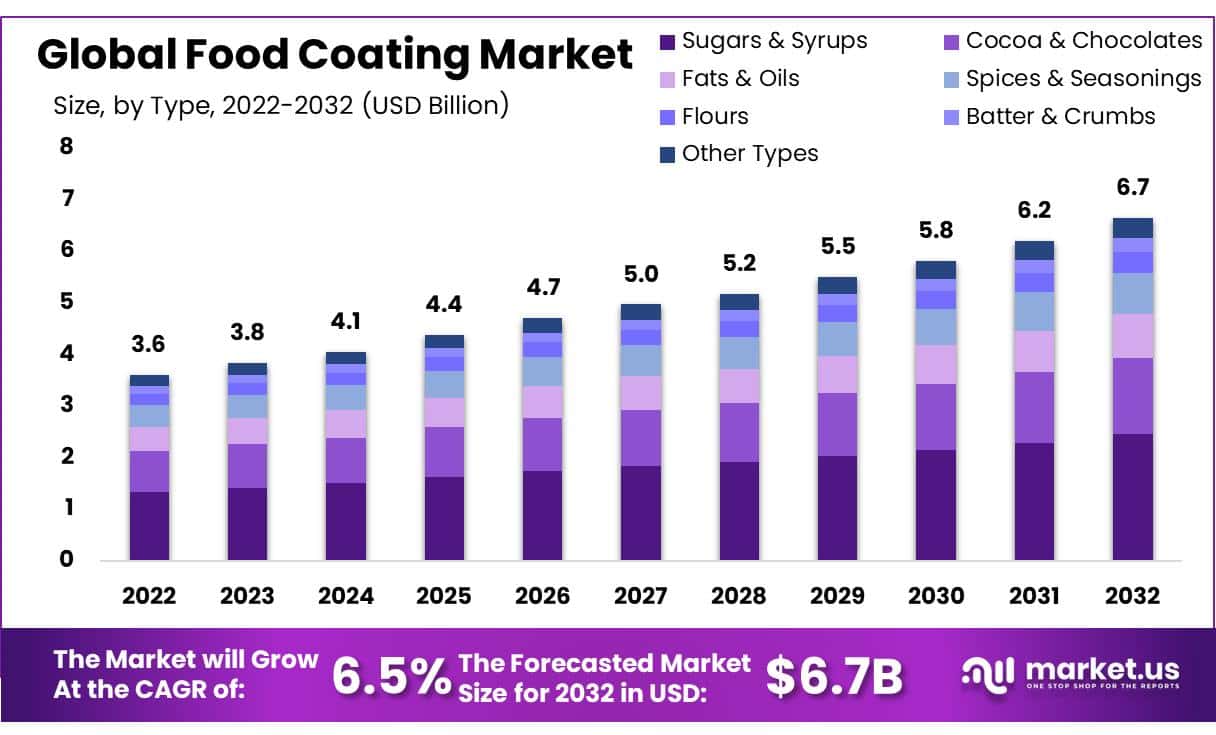

The global Food Coating market is valued at USD 3.6 Billion in 2022 and is expected to reach USD 6.7 Billion in 2032. It is expected to grow at a CAGR of 6.5% between 2023 and 2032.

Food coating is a process of applying a layer of various ingredients onto food products to improve their taste, texture, and presentation. These coatings are applied to various foods, such as meat and poultry, seafood, vegetables, snacks, and bakery products. Each category requires specialized coating solutions to achieve the desired taste, texture, and appearance.

Moreover, ingredients such as flour, batters, marinades, spices, oils, fats, sugars, and even chocolate are used for coating. The food coating market has steadily grown due to increased urbanization, changing lifestyles, and rising disposable incomes. Consumers are seeking new food experiences, which has led to the growth of coated food products across the globe.

In addition, with the growing demand for convenience foods and the rising trend of gourmet dining experiences, the food coating market has seen consistent growth.

Actual Numbers Might Vary in the Final Report

Key Takeaways

Market Growth and Outlook: The Food Coating Market was valued at USD 3.6 billion in 2022 and is projected to reach USD 6.7 billion by 2032, representing a robust Compound Annual Growth Rate (CAGR) of 6.5% during the period from 2023 to 2032.

2. Types of Coatings: Food coatings encompass a range of ingredients, including sugars & syrups, cocoa & chocolates, fats & oils, spices & seasonings, flours, batter & crumbs, and other types. Sugars & syrups are the dominant segment, accounting for 32.6% of the market share in 2022, with a projected CAGR of 8.3% from 2023 to 2032. Cocoa & chocolates represent the second most dominant segment due to their distinctive flavors, appealing aesthetics, and wide use in various food products.

3. Forms of Coating: Food coatings are categorized into dry and liquid forms. Dry coatings are versatile and widely used across various food products, making them a dominant segment in 2022. Liquid coatings, including oils, fats, emulsifiers, and flavorings, are valued for providing a uniform and consistent layer on food products, making them suitable for items requiring specific appearances or flavor infusions.

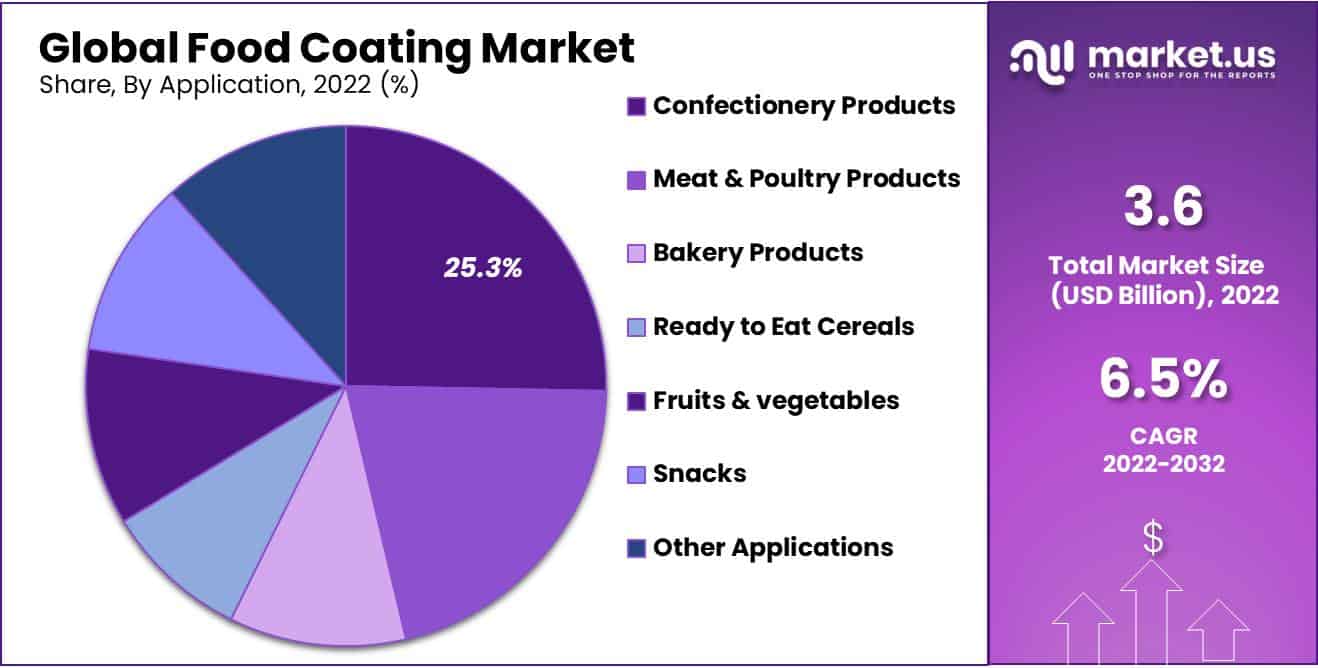

4. Applications: The food coating market caters to a variety of applications, including meat & poultry products, confectionery products, bakery products, ready-to-eat cereals, fruits & vegetables, snacks, and others. Confectionery products, such as chocolates, candies, and sweets, are the most dominant segment, accounting for 25.3% of the market share in 2022, driven by their appeal and unique taste experience. Meat & poultry products, known for their crispy texture when coated, represent the second most dominant segment in the market.

5. Driving Factors: Evolving consumer tastes and the expansion of the food service sector, including quick-service restaurants (QSRs) and fast-food chains, are driving the growth of the food coating market. Consumers seek fresh flavors, textures, and appearances, leading to the demand for coated food items. QSRs rely heavily on coated products to design menus catering to a broad consumer audience, contributing to the market’s expansion.

6. Restraining Factors: Volatile raw material costs, including commodities like flour, starches, fats, and oils, can significantly impact production costs and restrict market growth. Increasing health concerns among consumers, particularly regarding high-calorie and high-fat coatings, are driving the demand for healthier alternatives, limiting the market.

7. Growth Opportunities: The market can capitalize on the growing demand for unique flavors and textures by developing coatings with diverse taste sensations. The rising demand for convenience foods aligns with coatings that enhance texture, taste, and appearance, creating growth opportunities.

8. Trending Factors: Consumers are seeking coatings made from simple, transparent ingredients, avoiding artificial additives, colors, and preservatives. Coatings featuring ethnic and exotic flavors are becoming popular, offering consumers new taste experiences.

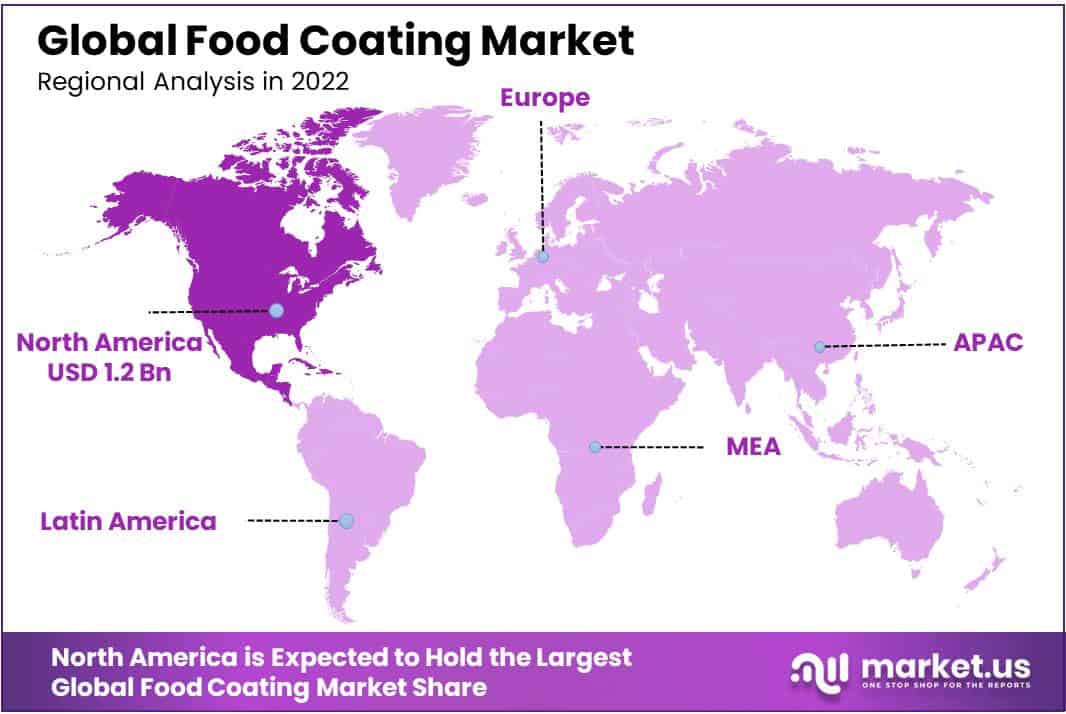

9. Regional Analysis: North America is the most lucrative global food coating market. In 2022, it held a revenue share of 33.7% and is expected to register a CAGR of 6.4% during the forecast period. Asia Pacific is the fastest-growing region in the market due to the rapid growth of the food & beverage industry, rising disposable incomes, and urbanization.

10. Key Players: The food coating market is highly fragmented, with major established companies operating in the market. Key players include Archer Daniels Midland Company, Cargill Incorporated, DuPont de Nemours, Inc., Kerry Group, Tate & Lyle PLC, and others.

By Type Analysis

Sugars and syrups Are Accountable for the Majority Market Share in the Global Food Coating Market Due to Their Functional Versatility

By nature, the food coating market can be divided into sugars & syrups, cocoa & chocolates, fats & oils, spices & seasonings, flours, batter & crumbs, and other types. Among these, the sugars & syrups segment is dominant, with a market share of 32.6% in 2022 and a projected CAGR of 8.3% from 2023 to 2032.

This can be attributed to factors such as being widely used in food coating due to their versatile nature and ability to provide a range of functionalities, including sweetness, texture enhancement, and browning. They are commonly used in bakery products, confectioneries, and even certain savory applications, making them an integral part of the food coating.

The cocoa & chocolates segment is the second most dominant in the food coating market. The reasons behind this segment’s significant presence are noteworthy. Cocoa and chocolates are sought-after components in food coating due to their distinctive flavors, appealing aesthetics, and the universally loved taste they impart.

This makes them preferred for products such as baked goods, desserts, and snack items. Additionally, cocoa and chocolates’ ability to provide visual and sensory appeal enhances their demand in the market. The fats & oils segment holds a significant share of the food coating market because of their use in various applications, including fried foods, bakery products, and snack items.

Form Analysis

Dry Coatings Holds Significant Market Share Due To Convenience, Shelf Life, And Application Ease

Based on form, the market is segmented into dry and liquid. Among these, the dry food coating segment accounted for a significant share in 2022 due to its versatility and wide applications across various food products. Dry coatings are used in several food items, including snacks, confectioneries, ready-to-eat meals, and baked goods.

This broad applicability has increased demand for dry food coatings, contributing to its dominance. The liquid coatings include oils, fats, emulsifiers, and flavorings. Liquid coatings are valued for providing a uniform and consistent layer on food products, making them suitable for products that require a glossy appearance or a specific flavor infusion.

Application Analysis

Confectionery Products Are the Most Lucrative Segment Because Growing Health-Conscious Trend.

Based on applications, the market is divided into meat & poultry products, confectionery products, bakery products, ready-to-eat cereals, fruits & vegetables, snacks, and other applications. Among these, the confectionery products segment was the most dominant in the market, with a market share of 25.3% in the global food coating market in 2022.

This is attributed to the global affection for chocolates, candies, and other sweets. These products are coated to enhance texture, taste, and shelf life. Coatings ingredients used in confectionery products ranging from sugary glazes to chocolate layers, offer an appealing visual allure and a unique taste experience, making confectionery items irresistible to many consumers.

The meat and poultry Products segment is the second most dominant segment in the food coating market. The reasons behind its prominence are multifaceted. When cooked, meat and poultry products often undergo coating processes to preserve freshness, enhance flavor, and improve their crispy texture.

Key Market Segments

Based on Type

- Sugars & Syrups

- Cocoa & Chocolates

- Fats & Oils

- Spices & Seasonings

- Flours

- Batter & Crumbs

- Other Types

Based on Form

- Dry

- Liquid

Based on Application

- Meat & Poultry Products

- Confectionery Products

- Bakery Products

- Ready to Eat Cereals

- Fruits & vegetables

- Snacks

- Other Applications

Driving Factors

Evolving Consumer Tastes and Foodservice Expansion Driving the Growth of the Global Food Coating Market

The global food coating market is rising due to evolving consumer preferences and a desire for unique food experiences. Consumers are increasingly looking for fresh flavors, textures, and appearances, which has sparked interest in coated food items. This trend is visible in the demand for products such as crispy snacks, breaded proteins, and confectionery items, which focus on offering distinct taste sensations and visually appealing choices.

Furthermore, the expansion of the food service sector, which includes the rapid growth of quick-service restaurants (QSRs) and fast-food chains, is driving the food coating market. These establishments heavily rely on coated products to design menus that cater to a broad consumer audience. With the continued growth of QSR outlets worldwide, there’s a constant requirement for coated foods that add value and can be prepared efficiently, contributing to the market’s expansion.

Restraining Factors

Volatile Raw Material Costs and Increasing Health Concerns among Consumers are Challenges in the Food Coating Market

The global food coating market heavily relies on various raw materials such as flour, starches, fats, and oils. Volatile prices of these commodities can significantly impact the overall production cost of food coatings. Fluctuations in agricultural production, geopolitical factors, and supply chain disruptions can lead to sudden and unpredictable increases in raw material costs.

Additionally, growing health concerns among consumers, including those related to high-calorie, high-fat coatings, have led to a demand for healthier alternatives. This growing consumer preference for healthier food choices restricts the food coating market.

Growth Opportunities

Innovative Texture and Flavors and Rise in Demand for Convenience Foods Presents Lucrative Opportunities

The global food coating market can capitalize on the growing demand for unique flavor profiles and varied textures. Consumers are increasingly drawn to new culinary experiences and diverse taste sensations.

This presents an opportunity for food coating manufacturers to develop coatings that incorporate a wide range of flavors, seasonings, and textures, enhancing the overall sensory appeal of food products. In addition, rising demand for convenient foods.

Busy consumer lifestyles drive preference for ready-to-eat and simple-to-make foods. Coatings enhance texture, taste, and appearance, increasing consumer appeal. Moreover, increasing health consciousness drives a preference for healthier foods, creating growth opportunities.

Manufacturers are expected to develop coatings that cater to health-conscious consumers by focusing on reduced oil absorption, lower fat content, and cleaner ingredient profiles. Natural and organic coatings tap into this trend, attracting those desiring healthier choices.

Trending Factors

Rising Demand for Natural and Organic Food Coating Triggers Innovation in Ingredient Diversity and Health Benefits

In recent years, consumers have become more health-conscious, preferring healthier food coatings. Manufacturers are responding by creating coatings with lower fat content, reduced calorie levels, and limited use of artificial additives. This trend stems from a growing demand for foods that fit dietary preferences and offer nutritional advantages, all while maintaining the expected taste and texture.

Moreover, the food coating market is experiencing a surge in demand for coatings featuring ethnic and exotic flavors.

These coatings incorporate a range of spices, seasonings, and herbs from various cuisines, catering to adventurous consumers looking for new taste experiences. This trend introduces an element of excitement to traditional coated foods, aligning with consumers’ evolving preferences.

In Addition, consumers are now looking for coatings made from simple, transparent ingredients, avoiding artificial colors, flavors, and preservatives.

Regional Analysis

North America’s Food Coating Market Driven by a High Demand for Convenience Foods, A Well-Established Food Processing Industry

North America is the most lucrative global food coating market. The North American market held a 33.7% revenue share in 2022 and is expected to register a CAGR of 6.4% during the forecast period. This dominance results from various factors, such as the high demand for convenience food, the well-established food processing industry, and the growing trend towards healthy and natural food ingredients.

Asia Pacific region is the fastest-growing region in the food coating market, with a projected CAGR of 7.1% during the forecasted period. APAC is witnessing rapid growth in the food & beverage industry. The rising disposable income of consumers and continued urbanization in Asian countries such as Japan, India, and China is expected to boost the growth of the food coating market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The food coating market is highly fragmented, with major established companies operating in the market. This market is influenced by the ongoing R&D efforts of major players, evolving consumer preferences, and global food trends.

Market Key Players

- Archer Daniels Midland Company

- Cargill Incorporated

- DuPont de Nemours, Inc.

- Kerry Group

- Tate & Lyle PLC

- PGP International, Inc.

- Ashland Inc.

- Döhler Group

- AGRANA Beteiligungs-AG

- Ingredion Incorporated

- AgroFresh Solutions, Inc.,

- Other Key Players

Recent Developments

- In June 2023, CSM Ingredients announced the United States entry of its Hi-Food unit. Headquartered in Parma, Hi-Food specializes in researching, developing, and producing natural value-added ingredients for the food industry.

- In April 2021, AgroFresh Solutions, Inc., a global leader in producing freshness solutions, announced the launch of VitaFresh Botanicals – Life Ultra, a plant-based, edible coating to keep produce fresh and reduce food loss and waste.

Report Scope

Report Features Description Market Value (2022) USD 3.6 Bn Forecast Revenue (2032) USD 6.7 Bn CAGR (2023-2032) 6.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Sugars & Syrups, Cocoa & Chocolates, Fats & Oils, Spices & Seasonings, Flours, Batter & Crumbs, and Other Types), By Form (Dry and Liquid), By Application (Meat & Poultry Products, Confectionery Products, Bakery Products, Ready to Eat Cereals, Fruits & vegetables, Snacks and Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Archer Daniels Midland Company, Cargill Incorporated, DuPont de Nemours, Inc., Kerry Group, Tate & Lyle PLC, PGP International, Inc., Ashland Inc., Döhler Group, AGRANA Beteiligungs-AG, Ingredion Incorporated, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the food coating market?The food coating market refers to the industry segment involved in the production and distribution of various types of coatings that are applied to food products. These coatings serve several purposes, including enhancing texture, flavor, appearance, and shelf life.

What are some benefits of using food coatings market?Using food coatings can improve the overall eating experience by adding crunchiness, flavor, and visual appeal. They can also help in even cooking, reducing oil absorption, and extending shelf life.

What is the value of the Food Coating Market?In 2022, the global Food Coating Market was valued at USD 3.6 billion, And will reach USD 6.7 billion.

-

-

- Archer Daniels Midland Company

- Cargill Incorporated

- DuPont de Nemours, Inc.

- Kerry Group

- Tate & Lyle PLC

- PGP International, Inc.

- Ashland Inc.

- Döhler Group

- AGRANA Beteiligungs-AG

- Ingredion Incorporated

- AgroFresh Solutions, Inc.,

- Other Key Players