Global Floor Coating Market By Product(Epoxy, Polyaspartic, Polyurethane, Acrylic, Methyl Methacrylate), By Component(Single Component, Double Component, Triple Component, Others), By Application(Concrete, Wood, Terrazzo, Others, By End-Use, Residential, Industrial, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 37128

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

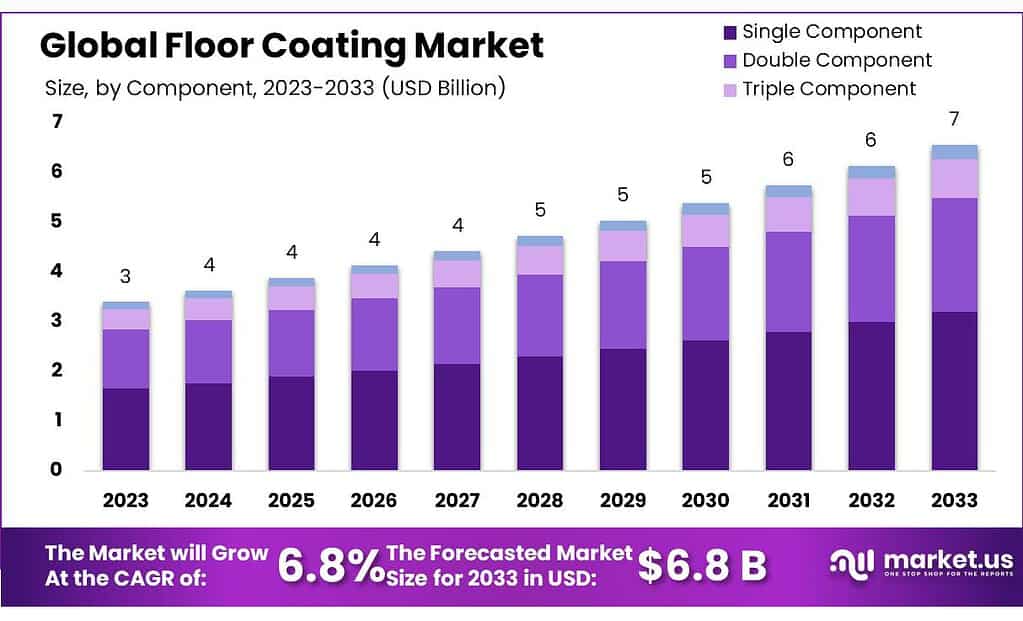

The Floor Coatings Market size is expected to be worth around USD 7 billion by 2033, from USD 3 billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2023 to 2033.

Market growth is being driven by the growing construction industry, which in turn has benefited from the increased use of flooring coatings in residential, industrial, and commercial applications.

The coating protects floors from moisture and stains as well as cracks. It provides a smooth, durable, long-lasting, and high-performance surface that is resistant to heavy loads. Floor coatings are suitable for use in warehouses as well as hospitals, manufacturing facility, industrial plants, showrooms, stores, and commercial & retail shops, garages, and aircraft hangars. Globally, the growth factor in construction activities has contributed significantly to the increase in demand for the floor coatings market.

Key Takeaways

- Market Growth: The Floor Coatings Market is projected to grow from USD 3 billion in 2023 to approximately USD 7 billion by 2033, showing a robust Compound Annual Growth Rate (CAGR) of 6.8%.

- Product Varieties: Different types of coatings cater to specific needs—epoxy for durability, polyaspartic for rapid installation, polyurethane for versatility, acrylic for UV resistance, and methyl methacrylate for fast curing in extreme conditions.

- Component Preferences: Single-component coatings hold a larger market share (over 48%) due to their ease of use. Double-component coatings follow at about 38%, offering enhanced durability.

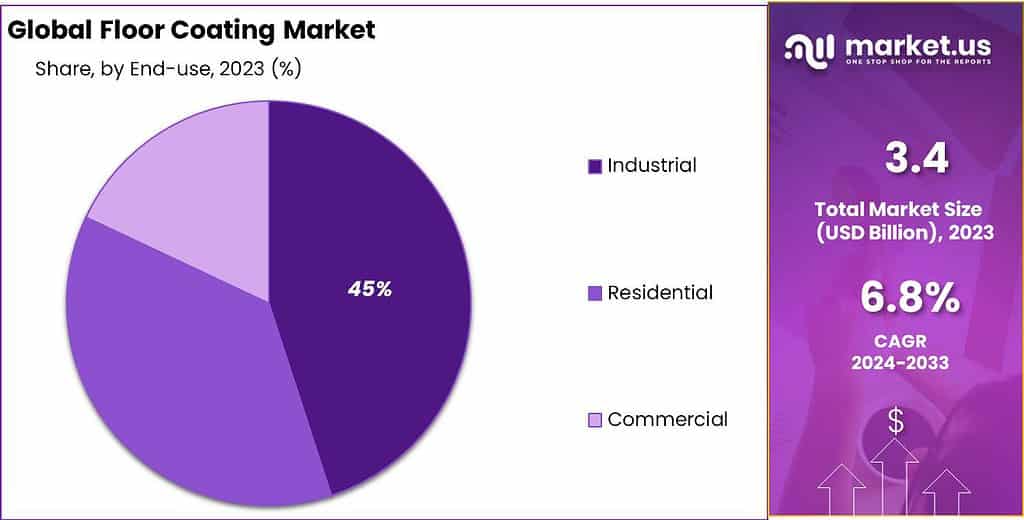

- Application Domains: Industrial sectors lead the market (45%) due to the necessity for durable, protective solutions. Residential and commercial sectors focus on aesthetics and functionality.

- Market Drivers & Restraints: The rising demand for eco-friendly coatings drives innovation, while challenges like improper surface preparation and moisture content in concrete impact coating effectiveness.

- Opportunities & Challenges: Opportunities exist in sustainable coatings, technological advancements, emphasis on quality, and market expansion. Challenges include surface preparation, moisture issues, and application techniques.

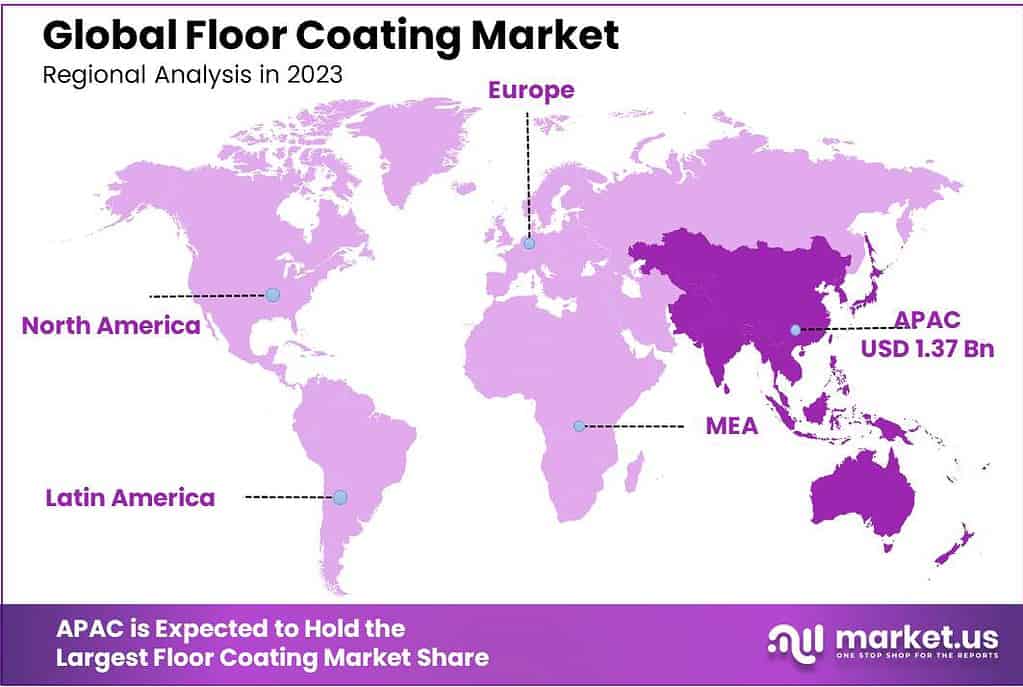

- Regional Dynamics: APAC leads the market due to rising demand from residential, industrial, and commercial sectors, with China leading in revenue and volume.

- Key Market Players: BASF SE, Akzo Nobel N.V., and Sherwin-Williams, among others, drive market competitiveness through product quality, technology, and strategic partnerships.

Product Analysis

Epoxy: Known for its durability and strong adhesion, epoxy coatings are commonly used in industrial and commercial settings due to their resistance to chemicals and heavy traffic.

Polyaspartic: These coatings offer rapid curing times, allowing for quick installation and use. They’re often preferred for areas requiring a fast turnaround, like retail spaces or busy commercial floors.

Polyurethane: Renowned for their excellent abrasion resistance and flexibility, polyurethane coatings are suitable for various applications, including wood floors, concrete, and even sports floors.

Acrylic: Acrylic coatings provide a protective layer with good UV resistance, making them suitable for outdoor surfaces or areas exposed to sunlight.

Methyl Methacrylate: These coatings are valued for their fast curing times and resilience in extreme temperatures, making them ideal for outdoor and high-traffic areas.

Each type of floor coating has its distinct advantages, catering to specific requirements in terms of durability, curing time, resistance to chemicals, UV stability, and suitability for various environments. These coatings play a pivotal role in protecting floors while enhancing their aesthetic appeal in diverse residential, commercial, and industrial spaces.

Component Analysis

Single-component Coatings: These coatings held a significant market position in 2023, capturing over 48% of the market share. Pre-mixed solutions are made up and ready to go straight out of their container, making them popular due to their convenience and easy of application, making them the go-to option for many users.

Double-component Coatings: Following closely, double-component coatings held a substantial share of about 38%. These coatings require mixing two components before application. They offer enhanced performance and durability compared to single-component coatings, making them favorable for applications that require more resilience and strength.

Triple-component Coatings and Others: These variations covered the remaining segment of the market. They cater to specific and specialized applications that demand unique formulations or attributes beyond the conventional single or double-component coatings.

The dominance of Single-component coatings indicates their popularity due to their user-friendly nature, while Double-component coatings, though slightly behind in market share, offer advanced performance benefits, showcasing a balance between convenience and higher durability in the Floor Coatings landscape.

Application Analysis

Floor coatings are specialty materials designed to protect and enhance floors in various settings. Floor coatings offer many advantages, such as durability, improved appearance and increased resistance against stains and damage. Below are a few key facts about floor coatings:

Protective Layer: Floor coatings serve as a protective barrier, safeguarding surfaces they cover from scratches, stains, chemicals and general wear and tear.

Enhance Durability: These surfaces significantly extend the durability of any floor surface, making it more resistant to heavy traffic, impacts, and harsh environmental conditions.

Aesthetic Appeal: Floor coatings come in various colors and finishes to enhance their aesthetic appeal while meeting individual design preferences.

Ease of Maintenance: Coated floors are easier to keep clean and maintain. Their coating provides greater resistance against dirt, stains, and moisture damage, simplifying upkeep while prolonging its lifecycle.

Floor coatings like this one are used in homes, offices, stores, warehouses, factories and garages across multiple industries and spaces – including homes. Their purpose is to preserve strong floors that look their best while being easily cleanable – an essential factor when it comes to construction and maintenance tasks across numerous environments and fields.

End-user Analysis

Industrial Sector: In 2023, this sector held a dominant position, capturing more than 45.0% of the market share. Industrial spaces rely significantly on floor coatings to protect floors from heavy machinery, chemicals, and abrasion. These coatings are crucial for maintaining durability and safety in factories, warehouses, and manufacturing facilities.

Residential Sector: While a smaller segment in the market, the residential sector utilizes floor coatings primarily to enhance the appearance and durability of floors in homes. These coatings offer aesthetic appeal while ensuring that floors withstand everyday wear and tear.

Commercial Sector: This sector, covering spaces like offices, retail stores, and public areas, contributed to the remaining market share. Floor coatings in commercial spaces serve a dual purpose of providing attractive flooring options while ensuring safety and longevity, meeting the demands of high-traffic areas.

The dominance of the Industrial sector signifies the substantial demand for floor coatings in heavy-use environments seeking durable and protective flooring solutions. Meanwhile, the Residential and Commercial sectors contribute with their needs for visually appealing and functional floor coatings tailored to their specific requirements.

Key Market Segments

By Product

- Polyurethane

- Acrylic

- Polyaspartic

- Methyl Methacrylate

- Epoxy

By Component

- Double Component

- Single Component

- Triple Component

- Other Components

By Application

- Terrazzo

- Concrete

- Wood

- Other Applications

By End-User

- Residential Sector

- Commercial Sector

- Industrial Sector

Drivers

The demand for eco-friendly concrete floor coatings is rising due to increased consumer preference for sustainable options. People want coatings with lower VOC (volatile organic compound) levels and reduced odor to support eco-friendly practices.

As sustainability becomes a standard in construction, coating technologies need to adapt to these requirements. Polyurethane coatings are gaining popularity because they can last longer, use recycled materials, and meet green building regulations. These coatings protect concrete, offer quick return-to-service times, and demonstrate long-term effectiveness.

Additionally, limits on VOCs and indoor air pollutants have increased the demand for polyurethane coatings as they are considered safer for the environment compared to traditional solvent-based coatings. Some solvent-based coatings may pose disposal challenges due to harmful additives, while sustainable coatings are free from such components, making disposal easier and potentially reducing costs. These durable coatings allow contractors to offer sustainable solutions while maintaining quality and aesthetics.

The current concrete coating products provide ease of application, durability, low VOC levels, and a glossy finish while meeting environmental standards. For instance, DSM’s bio-based self-matting resin, Decovery SP-2022 XP, has been successfully incorporated into products introduced by coating formulators Ciranova and Arboritec AB at Domotex 2020. These advancements in eco-friendly coatings align with the growing demand for sustainable and high-quality flooring solutions.

Restraints

The improper preparation of surfaces before applying coatings can cause significant issues. When coatings detach from the concrete base, problems like flaking, cracking, and bubbling occur. This not only reduces the coating’s ability to protect the concrete, leading to corrosion but also affects the appearance and safety of the surface. In coating failures, around 80% of the issues arise from improper surface preparation, 15% from application problems, and 5% from the materials used.

Moisture content in concrete is a major cause of coating failures, where water vapor moves through the concrete due to changes in temperature and humidity. To ensure effective coating, the surface must be thoroughly cleaned by methods like diamond grinding or sand-blasting to remove contaminants like oils, debris, or loose materials that can affect adhesion.

Applying coatings with the right thickness and techniques is crucial. If coatings are too thin, their properties weaken, making them prone to cracks and degradation. Epoxy coatings, for instance, must be mixed accurately; otherwise, defects may occur, reducing longevity and resistance to weight, and sometimes resulting in complete coating loss in extreme cases. Proper surface preparation and correct application methods are essential to prevent coating failures and ensure the durability of the coated surface.

Opportunities

Growing Demand for Sustainable Coatings: There’s an increasing preference for eco-friendly and sustainable floor coatings due to rising environmental awareness. Manufacturers developing coatings with lower VOCs and improved environmental credentials are likely to seize market opportunities.

Advancements in Technology: Ongoing advancements in coating technology offer opportunities for innovative products. For instance, developments in self-matting resins and bio-based materials present chances to create high-performance, environmentally friendly coatings that meet consumer demands.

Increased Emphasis on Quality and Durability: Consumers seek durable coatings that offer longevity and quality performance. Opportunities lie in the development of coatings that withstand wear and tear, ensuring a longer lifespan for floors, especially in high-traffic areas.

Focus on Health and Safety Standards: Coatings that prioritize health and safety, such as those with antimicrobial properties or easier cleaning features, are sought after. Manufacturers can capitalize on this demand by creating coatings that promote cleaner and safer environments.

Market Expansion and Partnerships: Opportunities exist in exploring new markets and forming strategic partnerships. Expanding into regions with growing construction and industrial activities, as well as collaborating with key industry players, can open doors for increased market presence and growth.

Challenges

Surface Preparation Issues: Improper surface preparation before applying coatings can lead to adhesion problems, causing coatings to flake, crack, or bubble. Around 80% of coating failures arise due to inadequate surface preparation, affecting the coating’s performance.

Moisture Content in Concrete: Moisture within concrete substrates can cause issues in coatings. Water vapor rising to the surface due to changes in temperature and humidity can lead to coating failures, affecting their durability and performance.

Application Techniques and Thickness: Coatings need to be applied at proper thicknesses using correct application techniques. If coatings are too thin, their properties are compromised, making them susceptible to cracking and degradation.

Material Mixing and Defects: Certain coatings, like epoxy, require accurate mixing ratios. If mixed improperly, these coatings may suffer defects, reducing their durability, weight resistance, and, in extreme cases, resulting in complete coating loss.

Geopolitical and Recession Impact Analysis

Geopolitical Impact

Global Energy Security: Geopolitical tensions can disrupt the global energy landscape, impacting the Floor Coatings Market. Disputes over energy resources and supply routes can influence the availability of raw materials used in floor coatings, potentially leading to supply chain disruptions and fluctuations in pricing.

International Collaboration: Geopolitical stability or instability can affect international collaborations within the floor coatings industry. Positive geopolitical relations encourage knowledge sharing and joint projects, fostering technological advancements. Conversely, conflicts may hinder such collaborations, slowing down innovation and market growth.

Trade Policies and Export Restrictions: Changes in trade policies and export limitations on essential materials for floor coatings, such as specific chemicals or additives, can affect their availability and pricing. Restrictions may disrupt supply chains, impacting the competitiveness of floor coating products in the market.

Energy Independence: Geopolitical considerations drive countries to seek energy independence, which can indirectly impact the Floor Coatings Market. Investments in domestic manufacturing and sourcing of raw materials for coatings production could shift market dynamics and availability based on geopolitical strategies.

Recession Impact

Research and Development Funding: Economic downturns often trigger reductions in research and development (R&D) funding for the floor coatings industry. Both public and private sectors may cut back on investments in floor coating-related R&D projects, potentially slowing down innovation and advancements in coating technologies.

Infrastructure Investment: During recessions, investments in infrastructure related to floor coatings, such as manufacturing facilities or distribution networks, might face delays or reduced funding. This delay or scaling down of projects could impact the growth of the floor coatings market.

Demand Fluctuations: Economic downturns can cause fluctuations in the demand for floor coatings, particularly in sectors like construction and renovation. Reduced construction activities and shifts in consumer spending behaviors can influence the demand for floor coatings, affecting market dynamics.

Global Supply Chain Challenges: Recessions can disrupt global supply chains for floor coatings, impacting the availability of essential components and raw materials. Challenges in sourcing materials or equipment can lead to delays in projects and hinder market growth within the floor coatings industry.

Regional Market Analysis

Asia Pacific (APAC) had the largest revenue share at over 41% in 2023, ahead of Europe. This region is expected to hold a large share of overall market revenue over the forecast period due to the rising product demand from the residential, industrial, and commercial sectors.

China led the Asia Pacific region in terms of revenue and volume. The market key trends are expected to experience substantial growth due to rising demand for green building products in countries such as Australia, India, China, and New Zealand over the forecast.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- Latin America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The market is expected to see a fiercely competitive landscape in the next few years, as key players will be constantly expanding their product offerings and geographical reach globally. Companies compete based on product quality and technology used in floor coating production. Major players compete based on their ability to develop applications.

To reduce the risk of expansion into new markets, they form strategic partnerships with regional competitors. BASF SE is one of the major players in this market. They are increasing their market offerings by investing in research and developing activities. BASF SE opened a new research facility in Dubai Science Park, UAE, for the development of materials. This includes protective coatings. Repair mortars. waterproofing membranes. sealants. decorative flooring materials. This was to promote product economic development in the company and serve the growing GCC construction industry.

Key Market Players

- Akzo Nobel N.V.

- Axalta Coating System

- BASF SE

- Kansai Paint Co

- PPG Industries

- RPM International

- Sherwin-Williams

- Other Key Players

Recent Development

March 2023, BASF SE announced that it has started the production of its first bio-based polyol, Sovermol which is designed for applications like flooring coating, waterpipe coating, adhesive, and putty applications. The production facility was started at Mangalore, India to serve the growing market in the Asia-Pacific

April 2023, Dur-A-Flex Inc., a manufacturer of high-performance, resinous flooring and wall systems proudly launches a breathable epoxy flooring system: Vent-E. This revolutionary new formulation was specifically designed to provide additional protection to concrete floors that surpass the threshold for moisture and salt content of most epoxy coatings.

In May 2023, Sika AG completed the acquisition of MBCC Group. Through this acquisition, Sika AG has expanded its portfolio of decorative floor coatings.

Report Scope

Report Features Description Market Value (2023) USD 3 Bn Forecast Revenue (2033) USD 7 Bn CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Epoxy, Polyaspartic, Polyurethane, Acrylic, Methyl Methacrylate), By Component(Single Component, Double Component, Triple Component, Others), By Application(Concrete, Wood, Terrazzo, Others, By End-Use, Residential, Industrial, Commercial) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Akzo Nobel N.V., Axalta Coating System, BASF SE, Kansai Paint Co, PPG Industries, RPM International, Sherwin-Williams, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are floor coatings, and where are they commonly used?Floor coatings are protective layers applied to surfaces to enhance durability and aesthetics. They find extensive use in industrial, commercial, and residential settings like warehouses, factories, hospitals, and homes.

What factors drive the growth of the floor coatings market?The market growth is propelled by rising construction activities, increased emphasis on aesthetics and durability, industrial expansion, and advancements in coating technologies that offer eco-friendly and sustainable solutions.

Which regions or industries contribute significantly to the floor coatings market?Major contributors include regions with substantial construction and industrial activities such as North America, Asia Pacific, and Europe. Industries like manufacturing, healthcare, automotive, and retail significantly impact the market.

-

-

- Akzo Nobel N.V.

- BASF SE

- Kansai Paint Co. Ltd.

- RPM International, Inc.

- Sherwin-Williams Company

- Axalta Coating Systems Ltd.

- Apurva India Ltd.

- Covestro Group

- DAW Group

- Henkel AG

- Asian Paints PPG Pvt. Ltd.

- Asian Paints Ltd.

- Cipy Polyurethanes Pvt. Ltd.

- Sika AG

- Maris Polymers

- NIPSEA Group

- PPG Industries, Inc.

- Ardex Group

- RPM International, Inc.

- Valspar

- Dupont

- Diamond Paints

- Valspar

- Sacal

- Nippon Paint

- Michelman

- Huarun (Valspar)

- Zhanchen Coating

- Sankeshu

- Carpoly Chemical

- Maydos

- Pre-Tex

- Northwest Yongxinpaint&Coatings

- Sanxia Painting

- Super Quality Chemical

- Other Key Players